FALSE000127790200012779022023-10-262023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported): | October 26, 2023 |

| | |

MVB Financial Corp. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| West Virginia | 001-38314 | 20-0034461 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

301 Virginia Avenue, Fairmont, WV | 26554-2777 |

| (Address of principal executive offices) | (Zip Code) |

| | |

(304) 363-4800 |

| (Registrant's telephone number, including area code) |

|

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, $1.00 par value | | MVBF | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 26, 2023, MVB Financial Corp. issued a press release announcing its financial results for the quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, is hereby furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press release of MVB Financial Corp. dated October 26, 2023

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| MVB Financial Corp. |

| By: | /s/ Donald T. Robinson |

| | Donald T. Robinson

President and Chief Financial Officer |

Date: October 26, 2023

N E W S R E L E A S E

MVB Financial Corp. Announces Third Quarter 2023 Results

(FAIRMONT, WV) October 26, 2023 – MVB Financial Corp. (NASDAQ: MVBF) (“MVB Financial,” “MVB” or the “Company”), the holding company for MVB Bank, Inc. ("MVB Bank"), today announced financial results for the third quarter of 2023, with reported net income of $3.9 million, or $0.30 basic and $0.29 diluted earnings per share.

Third Quarter 2023 Highlights As Compared to Second Quarter 2023

Balance sheet deposits increased 2.7%, or $80.0M.

Noninterest bearing deposits increased 10.8%, or $106.3M, and represent 36% of deposits.

Balance sheet loan to deposit ratio of 74.7%, compared to 78.1%.

Nonperforming loans decreased 22.4%, or $3.1M.

Net interest margin improved by 10 bps, to 3.87%.

From Larry F. Mazza, Chief Executive Officer, MVB Financial:

“While market conditions remained volatile during the third quarter, team MVB built upon our already strong foundation. We continued to optimize our earnings power and grew low-cost deposits and reduced higher-cost funding, further optimizing our deposit mix, improving our strong liquidity position, and with asset yields continuing to reprice higher, drove improvement in our net interest margin. Additionally, although our cost of funds continued to move higher, this quarter marked the slowest pace of increase since the second quarter of 2022. Our loan pipelines continued to build, and we believe our balance sheet is well-positioned for the road ahead. At quarter-end, MVB had no outstanding FHLB or other short-term borrowings, no held to maturity investment securities and a limited concentration of CRE loans and office exposure. Since the industry disruption in March of this year, we took additional steps to enhance our risk management and compliance infrastructure in anticipation of changing industry requirements. These elevated costs have weighed on our earnings in the short-term, but leave us well positioned to drive growth and improve profitability, while maintaining our foundational strength in the long run.”

THIRD QUARTER 2023 HIGHLIGHTS

•Strong core deposit growth and a favorable shift in deposit mix.

•Total deposits increased 2.7%, or $80.0 million, to $3.04 billion, compared to the prior quarter-end, primarily reflecting strong growth in noninterest bearing (“NIB”) deposits, and increases due to payment relationships, gaming and seasonal considerations, partially offset by a decline in brokered deposits. Relative to the prior year, total deposits increased 12.7%, or $341.9 million.

•Total off-balance sheet deposits were steady at $1.11 billion as compared to $1.06 billion at the prior quarter-end. Off-balance sheet deposit networks are utilized to generate fee income, enhance capital efficiency and manage liquidity and concentration risk.

•NIB deposits increased 10.8%, or $106.3 million, to $1.09 billion, and represented 36.0% of total deposits, as compared to 33.4% of total deposits at the prior quarter-end.

•Certificate of deposit (“CD”) balances, which include brokered deposits, declined 11.1%, or $78.1 million, to $622.5 million, reflecting the Company’s decision to reduce higher-cost deposit funding.

•Net interest margin expansion drives improvement in net interest income.

•Net interest income on a fully tax-equivalent basis, a non-GAAP financial measure, increased 0.9%, or $0.3 million, to $30.1 million relative to the prior quarter, reflecting net interest margin expansion, partially offset by a decline in total average earning asset balances.

•Net interest margin on a fully tax-equivalent basis, a non-GAAP financial measure, was 3.90%, up 10 basis points from the prior quarter, primarily reflecting higher loan yields and a favorable shift in the mix of earning assets and deposit funding. Total cost of funds was 2.43%, compared to 2.26% for the prior quarter, representing the slowest pace of increase in the Company’s cost of funds since the second quarter of 2022.

•Average earning asset balances decreased 2.8% during the third quarter of 2023, reflecting lower average loan balances and a decline in investment securities, partially offset by higher interest-bearing balances with banks. Average total loan balances declined 4.0%, reflecting lower commercial, real estate and consumer balances, including the sale certain of subprime automobile loans during the third quarter of 2023.

•The loan to deposit ratio was 74.7% as of September 30, 2023, compared to 78.1% as of June 30, 2023 and 91.6% as of September 30, 2022.

•Measures of foundational strength were generally stable.

•The Community Bank Leverage Ratio, Tier 1 Risk-Based Capital Ratio and MVB Bank’s Total Risk-Based Capital Ratio were 10.4%, 14.0%, and 14.8%, respectively, compared to 10.0%, 13.8%, and 14.9%, respectively, at the prior quarter end.

•Tangible book value per share, a non-U.S. GAAP measure discussed below, declined 1.1% to $21.08, relative to the prior quarter-end, and increased 8.77% from the year-ago period.

•Nonperforming loans declined $3.1 million, or 22.4%, to $10.6 million, or 0.5% of total loans, from to $13.6 million, or 0.6% of total loans, at the prior quarter end. Criticized loans as a percentage of total loans were 6.1%, as compared to 3.1% at the prior quarter end. The increase is driven primarily by addition of one loan relationship, which is secured by a financial institution’s stock and all loan payments are current. Net charge-offs were $5.9 million, or 1.0% of total loans on an annualized basis, for the third quarter of 2023, compared to $1.2 million, or 0.2%, for the prior quarter. The increase from prior quarter is primarily related to a single charge-off related to a commercial client in the energy industry.

•The release of allowance for credit losses totaled $0.2 million, compared to $4.2 million for the prior quarter. The net reserve release for the quarter reflected the aforementioned sale of subprime automobile loans, partially offset by the impact of increases in criticized loans and charge-offs. The allowance for credit losses was 1.1% of total loans, as compared to 1.3% as of the prior quarter-end, reflecting the changes in loan portfolio composition noted above.

•Expenses trend higher on actions taken to enhance regulatory and compliance infrastructure in response to industry events earlier this year; fees lower, primarily due to seasonal factors.

•Noninterest expense increased 1.5% to $30.7 million relative to the prior quarter, primarily reflecting higher professional fees and other operating costs related to recent actions taken in response to the market events in March 2023 and to enhance risk management and compliance-related infrastructure. Noninterest expenses other than professional fees declined 4.9% from the prior quarter.

•Total noninterest income was $5.8 million for the third quarter of 2023, as compared to $6.4 million for the prior quarter, primarily reflecting a decline in payment card and service charge income due mostly to seasonal considerations, as well as a decline in equity method investments income.

INCOME STATEMENT

Net interest income on a tax-equivalent basis totaled $30.1 million for the third quarter of 2023. This reflected an increase of $0.3 million, or 0.9%, from the second quarter of 2023 and was consistent as compared to the third quarter of 2022. The increase in net interest income compared to the second quarter of 2023 reflected a higher net interest margin, partially offset by a decline in total average earning asset balances.

Interest income increased $1.3 million, or 2.8%, from the second quarter of 2023 and increased $14.4 million, or 42.5%, from the third quarter of 2022. The tax-equivalent yield on loans was 7.0% for the third quarter of 2023, compared to 6.7% for the second quarter of 2023 and 5.3% for the third quarter of 2022. Higher loan yields compared to the second quarter of 2023 generally reflect the beneficial impact of higher interest rates on earning asset yields, while higher loan yields compared to the third quarter of 2022 reflect the cumulative impact of loans booked at higher yields than the prevailing portfolio yield in the prior year.

Interest expense increased $1.0 million, or 5.8%, from the second quarter of 2023 and increased $14.4 million from the third quarter of 2022. The cost of funds was 2.43% for the third quarter of 2023, up from 2.26% for the second quarter of 2023 and 0.59% for the third quarter of 2022. The increase from the prior quarter primarily reflected the impact of higher interest rates, including an increase in rates paid on money market checking deposits. The increase in cost of funds compared to the prior year period reflects the impact of increased time deposits in 2023 in response to market conditions, higher interest rates and the senior term loan, which was entered into during October 2022.

On a tax-equivalent basis, net interest margin for the third quarter of 2023 was 3.90%, an increase of 10 basis points versus the second quarter of 2023 and a decrease of 35 basis points versus the third quarter of 2022. See the table below for a reconciliation between net interest margin and net interest margin on a fully tax-equivalent basis, a non-GAAP measure. The increase in net interest margin from the second quarter of 2023 primarily reflected higher loan yields and a favorable shift in the mix of earning assets and deposit funding. Contraction in net interest margin from the third quarter of 2022 primarily reflected higher funding costs and an unfavorable shift in the mix of earning assets (loan balances declined, while lower yielding cash balances increased), partially offset by higher interest rates on loans.

Noninterest income totaled $5.8 million for the third quarter of 2023, a decrease of $0.6 million from the second quarter of 2023 and an increase of $0.3 million from the third quarter of 2022. The decrease compared to the prior quarter is primarily driven by declines of $2.6 million in equity method investment income from our mortgage companies, $0.7 million in payment card and service charge income and $0.4 million in other

operating income. These decreases were partially offset by increases of $0.3 million in compliance and consulting income and $0.3 million in gain on sale of equity securities. Additionally, the second quarter of 2023 included losses of $1.0 million in acquisition and divestiture activity and $1.0 million in sale of loans, without comparable losses in the third quarter of 2023.

The $0.3 million increase in noninterest income from the third quarter of 2022 was primarily driven by increases of $0.8 million in other operating income, $0.3 million in compliance consulting income, $0.3 million in holding gain on equity securities, $0.3 million in equity method investment income and $0.2 million in gain on sale of equity securities. These increases were partially offset by declines of $1.0 million in gain on sale of loans, $0.5 million in payment and card service charge income, $0.1 million in insurance and investment services income.

Noninterest expense totaled $30.7 million for the third quarter of 2023, an increase of $0.4 million, or 1.5%, from the second quarter of 2023 and an increase of $2.5 million, or 9.0%, from the third quarter of 2022, primarily reflecting higher professional fees of $1.7 million, or 43.9%, and $1.8 million, or 45.3%, as compared to the second quarter of 2023 and the third quarter of 2022, respectively. Salaries and employee benefits expense increased $0.3 million, or 1.7%, and $0.1 million, or 0.7%, as compared to the second quarter of 2023 and the third quarter of 2022, respectively.

BALANCE SHEET

Loans totaled $2.27 billion at September 30, 2023, a decrease of $42.0 million, or 1.8%, and $201.0 million, or 8.1%, as compared to June 30, 2023 and September 30, 2022, respectively. The decline in loan balances compared to the prior quarters primarily reflects amortization of the loan portfolio and slower origination as the pipeline continues to build, in addition to the sale of $15.9 million of subprime automobile loans during the third quarter of 2023 and the sale of $20.4 million of subprime automobile loans during the second quarter of 2023. Loans held-for-sale, which represent MVB Bank’s government guaranteed lending growth vehicle, were $7.6 million as of September 30, 2023, compared to $7.0 million at June 30, 2023 and $20.0 million at September 30, 2022.

Deposits totaled $3.04 billion as of September 30, 2023, an increase of $80.0 million, or 2.7%, from June 30, 2023, and an increase of $341.9 million, or 12.7%, from September 30, 2022. NIB deposits totaled $1.09 billion as of September 30, 2023, an increase of $106.3 million, or 10.8%, from June 30, 2023 and a decrease of $317.9 million, or 22.5%, from September 30, 2022. The increase in total deposit balances compared to June 30, 2023 primarily reflects the increase in noninterest-bearing deposits, payment relationships, gaming and seasonal considerations, partially offset by a decrease in brokered deposits. The increase relative to

September 30, 2022, reflects higher CDs and brokered deposits, partially offset by a decrease in NIB deposits driven by the highly-competitive deposit environment, higher interest rates and the utilization of off-balance sheet deposit networks to generate fee income, enhance capital efficiency and manage liquidity and concentration risk.

CAPITAL

The Community Bank Leverage Ratio was 10.4% as of September 30, 2023, compared to 10.0% as of June 30, 2023 and 11.1% as of September 30, 2022.

The tangible common equity ratio, a non-GAAP financial measure, was 7.8% of as of September 30, 2023, compared to 8.1% as of June 30, 2023 and 7.6% as of as of September 30, 2022. See the reconciliation of the tangible common equity ratio to its most directly comparable U.S. GAAP financial measure later in this release.

The Company issued a quarterly cash dividend of $0.17 per share for the third quarter of 2023, consistent with the second quarter of 2023 and the third quarter of 2022.

ASSET QUALITY

Nonperforming loans totaled $10.6 million, or 0.5% of total loans, as of September 30, 2023, as compared to $13.6 million, or 0.6% of total loans, as of June 30, 2023, and $22.4 million, or 0.9% of total loans, as of September 30, 2022. Criticized loans as a percentage of total loans were 6.1%, compared to 3.1% as of June 30, 2023 and 3.4% as of September 30, 2022.

Net charge-offs were $5.9 million, or 1.0% of total loans, for the third quarter of 2023, compared to $1.2 million, or 0.2% of total loans, for the second quarter of 2023 and $1.3 million, or 0.2% of total loans, for the third quarter of 2022.

The release of allowance for credit losses totaled $0.2 million compared to $4.2 million for the prior quarter. The Company sold $15.9 million and $20.4 million of subprime automobile loans during the quarters ended September 30, 2023 and June 30, 2023, respectively, and released the reserves associated with those loans, resulting in the net allowance releases. The allowance for credit losses was 1.1% of total loans at September 30, 2023, as compared to 1.3% at June 30, 2023 and 1.1% at September 30, 2022. The decline in the allowance ratio compared to the prior quarter largely reflects the aforementioned changes in loan portfolio composition.

About MVB Financial Corp.

MVB Financial, the holding company of MVB Bank, is publicly traded on The Nasdaq Capital Market® (“Nasdaq”) under the ticker “MVBF.”

MVB is a financial holding company headquartered in Fairmont, West Virginia. Through its subsidiary, MVB Bank, and MVB Bank’s subsidiaries, MVB Financial provides financial services to individuals and corporate clients in the Mid-Atlantic region and beyond.

Nasdaq is a leading global provider of trading, clearing, exchange technology, listing, information and public company services.

For more information about MVB, please visit ir.mvbbanking.com.

Forward-looking Statements

MVB Financial has made forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, in this press release that are intended to be covered by the protections provided under the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations about the future and are subject to risks and uncertainties. Forward-looking statements include, without limitation, information concerning possible or assumed future results of operations of the Company and its subsidiaries. Forward-looking statements can be identified by the use of words such as “may,” “could,” “should,” “would,” “will,” “plans,” “believes,” “estimates,” “expects,” “anticipates,” “intends,” “continues” or the negative of those terms or similar expressions. Note that many factors could affect the future financial results of the Company and its subsidiaries, both individually and collectively, and could cause those results to differ materially from those expressed in forward-looking statements. Therefore, undue reliance should not be placed upon any forward-looking statements. Those factors include but are not limited to: market, economic, operational, liquidity and credit risk; changes in market interest rates; impacts related to or resulting from recent turmoil in the banking industry; inability to achieve anticipated synergies and successfully integrate recent mergers and acquisitions; inability to successfully execute business plans, including strategies related to investments in Fintech companies; competition; unforeseen events, such as pandemics or natural disasters, and any governmental or societal responses thereto; changes in economic, business and political conditions; changes in demand for loan products and deposit flow; operational risks and risk management failures; and government regulation and supervision. Additional factors that may cause actual results to differ materially from those described in the forward-looking statements can be found in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2022, as well as its other filings with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. Except as required by law, the Company disclaims any obligation to update, revise or correct any forward-looking statements.

Accounting standards require the consideration of subsequent events occurring after the balance sheet date for matters that require adjustment to, or disclosure in, the consolidated financial statements. The review period for subsequent events extends up to and including the filing date of a public company’s financial statements when filed with the SEC. Accordingly, the consolidated financial information in this announcement is subject to change.

Questions or comments concerning this earnings release should be directed to:

MVB Financial Corp.

Donald T. Robinson, President and Chief Financial Officer

(304) 598-3500

drobinson@mvbbanking.com

Amy Baker, VP, Corporate Communications and Marketing

(844) 682-2265

abaker@mvbbanking.com

Non-U.S. GAAP Financial Measures

This document contains supplemental financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). Management uses these non-U.S. GAAP measures in its analysis of the Company’s performance. These measures should not be considered a substitute for U.S. GAAP basis measures nor should they be viewed as a substitute for operating results determined in accordance with U.S. GAAP. Management believes the presentation of non-U.S. GAAP financial measures that exclude the impact of specified items provide useful supplemental information that is essential to a proper understanding of the Company’s financial condition and results. Non-U.S. GAAP measures are not formally defined under U.S. GAAP, and other entities may use calculation methods that differ from those used by us. As a complement to U.S. GAAP financial measures, our management believes these non-U.S. GAAP financial measures assist investors in comparing the financial condition and results of operations of financial institutions due to the industry prevalence of such non-U.S. GAAP measures. See the tables below for a reconciliation of these non-U.S. GAAP measures to the most directly comparable U.S. GAAP financial measures.

MVB Financial Corp.

Financial Highlights

Consolidated Statements of Income

(Unaudited) (Dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarterly | | Year-to-Date |

| | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | Third Quarter | | Second Quarter | | Third Quarter | | |

| Interest income | | $ | 48,325 | | | $ | 47,031 | | | $ | 33,903 | | | $ | 140,119 | | | $ | 85,255 | |

| Interest expense | | 18,460 | | | 17,449 | | | 4,057 | | | 47,943 | | | 6,901 | |

| Net interest income | | 29,865 | | | 29,582 | | | 29,846 | | | 92,176 | | | 78,354 | |

| Provision (release of allowance) for credit losses | | (159) | | | (4,235) | | | 5,120 | | | 182 | | | 11,500 | |

| Net interest income after provision (release of allowance) for credit losses | | 30,024 | | | 33,817 | | | 24,726 | | | 91,994 | | | 66,854 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total noninterest income | | 5,791 | | | 6,419 | | | 5,467 | | | 15,277 | | | 24,130 | |

| | | | | | | | | | |

| Noninterest expense: | | | | | | | | | | |

| Salaries and employee benefits | | 16,016 | | | 15,746 | | | 15,905 | | | 48,508 | | | 48,217 | |

| Other expense | | 14,709 | | | 14,536 | | | 12,271 | | | 40,816 | | | 35,188 | |

| Total noninterest expenses | | 30,725 | | | 30,282 | | | 28,176 | | | 89,324 | | | 83,405 | |

| | | | | | | | | | |

| Income before income taxes | | 5,090 | | | 9,954 | | | 2,017 | | | 17,947 | | | 7,579 | |

| Income taxes | | 1,218 | | | 1,956 | | | 184 | | | 3,639 | | | 1,563 | |

| Net income from continuing operations before noncontrolling interest | | 3,872 | | | 7,998 | | | 1,833 | | | 14,308 | | | 6,016 | |

| Income from discontinued operations, before income taxes | | — | | | — | | | 935 | | | 11,831 | | | 2,599 | |

| Income taxes - discontinued operations | | — | | | — | | | 213 | | | 3,049 | | | 598 | |

| Net income from discontinued operations | | — | | | — | | | 722 | | | 8,782 | | | 2,001 | |

| Net (income) loss attributable to noncontrolling interest | | (5) | | | 114 | | | 163 | | | 231 | | | 521 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net income available to common shareholders | | $ | 3,867 | | | $ | 8,112 | | | $ | 2,718 | | | $ | 23,321 | | | $ | 8,538 | |

| | | | | | | | | | |

| Earnings per share from continuing operations - basic | | $ | 0.30 | | | $ | 0.64 | | | $ | 0.16 | | | $ | 1.15 | | | $ | 0.54 | |

| Earnings per share from discontinued operations - basic | | $ | — | | | $ | — | | | $ | 0.06 | | | $ | 0.69 | | | $ | 0.16 | |

| Earnings per share - basic | | $ | 0.30 | | | $ | 0.64 | | | $ | 0.22 | | | $ | 1.84 | | | $ | 0.70 | |

| Earnings per share from continuing operations - diluted | | $ | 0.29 | | | $ | 0.63 | | | $ | 0.16 | | | $ | 1.12 | | | $ | 0.51 | |

| Earnings per share from discontinued operations - diluted | | $ | — | | | $ | — | | | $ | 0.05 | | | $ | 0.67 | | | $ | 0.15 | |

| Earnings per share - diluted | | $ | 0.29 | | | $ | 0.63 | | | $ | 0.21 | | | $ | 1.79 | | | $ | 0.66 | |

Noninterest Income

(Unaudited) (Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarterly | | Year-to-Date |

| | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | Third Quarter | | Second Quarter | | Third Quarter | | |

| Card acquiring income | | $ | 845 | | | $ | 788 | | | $ | 560 | | | $ | 2,255 | | | $ | 2,293 | |

| Service charges on deposits | | 490 | | | 1,060 | | | 889 | | | 2,676 | | | 2,734 | |

| Interchange income | | 1,517 | | | 1,655 | | | 1,864 | | | 5,034 | | | 4,943 | |

| Total payment card and service charge income | | 2,852 | | | 3,503 | | | 3,313 | | | 9,965 | | | 9,970 | |

| | | | | | | | | | |

| Equity method investments income (loss) | | (750) | | | 1,873 | | | (1,021) | | | (70) | | | 666 | |

| Compliance and consulting income | | 1,314 | | | 996 | | | 966 | | | 3,326 | | | 3,380 | |

| Gain (loss) on sale of loans | | 330 | | | (989) | | | 1,298 | | | (1,015) | | | 3,786 | |

| Investment portfolio gains (losses) | | 244 | | | (134) | | | (217) | | | (1,734) | | | 2,322 | |

| Loss on acquisition and divestiture activity | | — | | | (986) | | | — | | | (986) | | | — | |

| Other noninterest income | | 1,801 | | | 2,156 | | | 1,128 | | | 5,791 | | | 4,006 | |

| | | | | | | | | | |

| Total noninterest income | | $ | 5,791 | | | $ | 6,419 | | | $ | 5,467 | | | $ | 15,277 | | | $ | 24,130 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Condensed Consolidated Balance Sheets

(Unaudited) (Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | | June 30, 2023 | | | | September 30, 2022 |

| Cash and cash equivalents | | $ | 587,100 | | | $ | 455,835 | | | | | $ | 79,946 | |

| | | | | | | | |

| Securities available-for-sale, at fair value | | 311,537 | | | 329,137 | | | | | 366,742 | |

| Equity securities | | 40,835 | | | 41,082 | | | | | 34,101 | |

| Loans held-for-sale | | 7,603 | | | 7,009 | | | | | 19,977 | |

| Loans receivable | | 2,270,433 | | | 2,312,387 | | | | | 2,471,395 | |

| Less: Allowance for credit losses | | (24,276) | | | (30,294) | | | | | (26,515) | |

| Loans receivable, net | | 2,246,157 | | | 2,282,093 | | | | | 2,444,880 | |

| Premises and equipment, net | | 21,468 | | | 22,407 | | | | | 24,639 | |

| Assets from discontinued operations | | — | | | — | | | | | 4,818 | |

| Goodwill | | 2,838 | | | 2,838 | | | | | 2,838 | |

| | | | | | | | |

| Other assets | | 220,045 | | | 211,446 | | | | | 161,981 | |

| Total assets | | $ | 3,437,583 | | | $ | 3,351,847 | | | | | $ | 3,139,922 | |

| | | | | | | | |

| Noninterest-bearing deposits | | $ | 1,093,903 | | | $ | 987,555 | | | | | $ | 1,411,772 | |

| Interest-bearing deposits | | 1,944,986 | | | 1,971,384 | | | | | 1,285,186 | |

| | | | | | | | |

| FHLB and other borrowings | | — | | | — | | | | | 73,328 | |

| Senior term loan | | 8,473 | | | 8,835 | | | | | — | |

| Subordinated debt | | 73,478 | | | 73,414 | | | | | 73,222 | |

| Liabilities from discontinued operations | | — | | | — | | | | | 5,647 | |

| Other liabilities | | 45,374 | | | 36,362 | | | | | 46,407 | |

| Stockholders' equity | | 271,369 | | | 274,297 | | | | | 244,360 | |

| Total liabilities and stockholders' equity | | $ | 3,437,583 | | | $ | 3,351,847 | | | | | $ | 3,139,922 | |

Reportable Segments

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 | | CoRe Banking | | Mortgage Banking | | | | | | Financial Holding Company | | Other | | Intercompany Eliminations | | Consolidated |

| (Dollars in thousands) | | | | | | | | |

| Interest income | | $ | 48,268 | | | $ | 103 | | | | | | | $ | 2 | | | $ | — | | | $ | (48) | | | $ | 48,325 | |

| Interest expense | | 17,454 | | | — | | | | | | | 1,000 | | | 54 | | | (48) | | | 18,460 | |

| Net interest income (expense) | | 30,814 | | | 103 | | | | | | | (998) | | | (54) | | | — | | | 29,865 | |

| Release of allowance for credit losses | | (159) | | | — | | | | | | | — | | | — | | | — | | | (159) | |

| Net interest income (expense) after release of allowance for credit losses | | 30,973 | | | 103 | | | | | | | (998) | | | (54) | | | — | | | 30,024 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Noninterest income | | 4,980 | | | (742) | | | | | | | 2,576 | | | 3,099 | | | (4,122) | | | 5,791 | |

| | | | | | | | | | | | | | | | |

| Noninterest Expenses: | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | 9,787 | | | — | | | | | | | 4,129 | | | 2,100 | | | — | | | 16,016 | |

| Other expenses | | 14,701 | | | 13 | | | | | | | 1,992 | | | 2,125 | | | (4,122) | | | 14,709 | |

| Total noninterest expenses | | 24,488 | | | 13 | | | | | | | 6,121 | | | 4,225 | | | (4,122) | | | 30,725 | |

| | | | | | | | | | | | | | | | |

| Income (loss) before income taxes | | 11,465 | | | (652) | | | | | | | (4,543) | | | (1,180) | | | — | | | 5,090 | |

| Income taxes | | 2,628 | | | (153) | | | | | | | (978) | | | (279) | | | — | | | 1,218 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net income (loss) | | 8,837 | | | (499) | | | | | | | (3,565) | | | (901) | | | — | | | 3,872 | |

| Net income attributable to noncontrolling interest | | — | | | — | | | | | | | — | | | (5) | | | — | | | (5) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net income (loss) available to common shareholders | | $ | 8,837 | | | $ | (499) | | | | | | | $ | (3,565) | | | $ | (906) | | | $ | — | | | $ | 3,867 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 | | CoRe Banking | | Mortgage Banking | | | | | | Financial Holding Company | | Other | | Intercompany Eliminations | | Consolidated |

| (Dollars in thousands) | | | | | | | | |

| Interest income | | $ | 46,929 | | | $ | 105 | | | | | | | $ | 3 | | | $ | 6 | | | $ | (12) | | | $ | 47,031 | |

| Interest expense | | 16,439 | | | — | | | | | | | 999 | | | 23 | | | (12) | | | 17,449 | |

| Net interest income (expense) | | 30,490 | | | 105 | | | | | | | (996) | | | (17) | | | — | | | 29,582 | |

| Provision for credit losses | | (4,235) | | | — | | | | | | | — | | | — | | | — | | | (4,235) | |

| Net interest income (expense) after provision for credit losses | | 34,725 | | | 105 | | | | | | | (996) | | | (17) | | | — | | | 33,817 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Noninterest income | | 4,113 | | | 1,872 | | | | | | | 3,116 | | | 1,051 | | | (3,733) | | | 6,419 | |

| | | | | | | | | | | | | | | | |

| Noninterest Expenses: | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | 9,053 | | | 7 | | | | | | | 4,623 | | | 2,063 | | | — | | | 15,746 | |

| Other expenses | | 14,148 | | | 18 | | | | | | | 2,163 | | | 1,940 | | | (3,733) | | | 14,536 | |

| Total noninterest expenses | | 23,201 | | | 25 | | | | | | | 6,786 | | | 4,003 | | | (3,733) | | | 30,282 | |

| | | | | | | | | | | | | | | | |

| Income (loss) before income taxes | | 15,637 | | | 1,952 | | | | | | | (4,666) | | | (2,969) | | | — | | | 9,954 | |

| Income taxes | | 3,237 | | | 643 | | | | | | | (1,207) | | | (717) | | | — | | | 1,956 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net income (loss) | | 12,400 | | | 1,309 | | | | | | | (3,459) | | | (2,252) | | | — | | | 7,998 | |

| Net loss attributable to noncontrolling interest | | — | | | — | | | | | | | — | | | 114 | | | — | | | 114 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net income (loss) available to common shareholders | | $ | 12,400 | | | $ | 1,309 | | | | | | | $ | (3,459) | | | $ | (2,138) | | | $ | — | | | $ | 8,112 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 | | CoRe Banking | | Mortgage Banking | | | | | | Financial Holding Company | | Other | | Intercompany Eliminations | | Consolidated |

| (Dollars in thousands) | | | | | | | | |

| Interest income | | $ | 33,777 | | | $ | 103 | | | | | | | $ | 33 | | | $ | — | | | $ | (10) | | | $ | 33,903 | |

| Interest expense | | 3,286 | | | — | | | | | | | 771 | | | 10 | | | (10) | | | 4,057 | |

| Net interest income (expense) | | 30,491 | | | 103 | | | | | | | (738) | | | (10) | | | — | | | 29,846 | |

| Provision for credit losses | | 5,120 | | | — | | | | | | | — | | | — | | | — | | | 5,120 | |

| Net interest income (expense) after provision for credit losses | | 25,371 | | | 103 | | | | | | | (738) | | | (10) | | | — | | | 24,726 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Noninterest income | | 5,356 | | | (817) | | | | | | | 2,366 | | | 1,370 | | | (2,808) | | | 5,467 | |

| | | | | | | | | | | | | | | | |

| Noninterest Expenses: | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | 9,354 | | | 8 | | | | | | | 4,274 | | | 2,269 | | | — | | | 15,905 | |

| Other expenses | | 11,523 | | | 25 | | | | | | | 1,810 | | | 1,722 | | | (2,808) | | | 12,272 | |

| Total noninterest expenses | | 20,877 | | | 33 | | | | | | | 6,084 | | | 3,991 | | | (2,808) | | | 28,177 | |

| | | | | | | | | | | | | | | | |

| Income (loss) before income taxes | | 9,850 | | | (747) | | | | | | | (4,456) | | | (2,631) | | | — | | | 2,016 | |

| Income taxes | | 1,817 | | | (192) | | | | | | | (840) | | | (601) | | | — | | | 184 | |

| Net income (loss) from continuing operations | | 8,033 | | | (555) | | | | | | | (3,616) | | | (2,030) | | | — | | | 1,832 | |

| Income from discontinued operations, before income taxes | | — | | | — | | | | | | | — | | | 936 | | | — | | | 936 | |

| Income tax expense - discontinued operations | | — | | | — | | | | | | | — | | | 213 | | | — | | | 213 | |

| Net income from discontinued operations | | — | | | — | | | | | | | — | | | 723 | | | — | | | 723 | |

| Net income (loss) | | 8,033 | | | (555) | | | | | | | (3,616) | | | (1,307) | | | — | | | 2,555 | |

| Net loss attributable to noncontrolling interest | | — | | | — | | | | | | | — | | | 163 | | | — | | | 163 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net income (loss) available to common shareholders | | $ | 8,033 | | | $ | (555) | | | | | | | $ | (3,616) | | | $ | (1,144) | | | $ | — | | | $ | 2,718 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 | | CoRe Banking | | Mortgage Banking | | | | | | Financial Holding Company | | Other | | Intercompany Eliminations | | Consolidated |

| (Dollars in thousands) | | | | | | | | |

| Interest income | | $ | 139,859 | | | $ | 313 | | | | | | | $ | 38 | | | $ | — | | | $ | (91) | | | $ | 140,119 | |

| Interest expense | | 44,934 | | | — | | | | | | | 2,992 | | | 108 | | | (91) | | | 47,943 | |

| Net interest income (expense) | | 94,925 | | | 313 | | | | | | | (2,954) | | | (108) | | | — | | | 92,176 | |

| Provision for credit losses | | 182 | | | — | | | | | | | — | | | — | | | — | | | 182 | |

| Net interest income (expense) after provision for credit losses | | 94,743 | | | 313 | | | | | | | (2,954) | | | (108) | | | — | | | 91,994 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Noninterest income | | 12,111 | | | (56) | | | | | | | 8,102 | | | 5,934 | | | (10,814) | | | 15,277 | |

| | | | | | | | | | | | | | | | |

| Noninterest Expenses: | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | 27,891 | | | 7 | | | | | | | 13,702 | | | 6,908 | | | — | | | 48,508 | |

| Other expenses | | 39,903 | | | 65 | | | | | | | 6,072 | | | 5,590 | | | (10,814) | | | 40,816 | |

| Total noninterest expenses | | 67,794 | | | 72 | | | | | | | 19,774 | | | 12,498 | | | (10,814) | | | 89,324 | |

| | | | | | | | | | | | | | | | |

| Income (loss) before income taxes | | 39,060 | | | 185 | | | | | | | (14,626) | | | (6,672) | | | — | | | 17,947 | |

| Income taxes | | 8,380 | | | (14) | | | | | | | (3,127) | | | (1,600) | | | — | | | 3,639 | |

| Net income (loss) from continuing operations | | 30,680 | | | 199 | | | | | | | (11,499) | | | (5,072) | | | — | | | 14,308 | |

| Income from discontinued operations, before income taxes | | — | | | — | | | | | | | — | | | 11,831 | | | — | | | 11,831 | |

| Income taxes - discontinued operations | | — | | | — | | | | | | | — | | | 3,049 | | | — | | | 3,049 | |

| Net income from discontinued operations | | — | | | — | | | | | | | — | | | 8,782 | | | — | | | 8,782 | |

| Net income (loss) | | 30,680 | | | 199 | | | | | | | (11,499) | | | 3,710 | | | — | | | 23,090 | |

| Net loss attributable to noncontrolling interest | | — | | | — | | | | | | | — | | | 231 | | | — | | | 231 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net income (loss) available to common shareholders | | $ | 30,680 | | | $ | 199 | | | | | | | $ | (11,499) | | | $ | 3,941 | | | $ | — | | | $ | 23,321 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 | | CoRe Banking | | Mortgage Banking | | | | | | Financial Holding Company | | Other | | Intercompany Eliminations | | Consolidated |

| (Dollars in thousands) | | | | | | | | |

| Interest income | | $ | 84,858 | | | $ | 309 | | | | | | | $ | 113 | | | $ | — | | | $ | (25) | | | $ | 85,255 | |

| Interest expense | | 4,617 | | | — | | | | | | | 2,284 | | | 25 | | | (25) | | | 6,901 | |

| Net interest income (expense) | | 80,241 | | | 309 | | | | | | | (2,171) | | | (25) | | | — | | | 78,354 | |

| Provision for credit losses | | 11,500 | | | — | | | | | | | — | | | — | | | — | | | 11,500 | |

| Net interest income (expense) after provision for credit losses | | 68,741 | | | 309 | | | | | | | (2,171) | | | (25) | | | — | | | 66,854 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Noninterest income | | 19,347 | | | 1,193 | | | | | | | 8,265 | | | 4,490 | | | (9,165) | | | 24,130 | |

| | | | | | | | | | | | | | | | |

| Noninterest Expenses: | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | 28,810 | | | 8 | | | | | | | 12,769 | | | 6,630 | | | — | | | 48,217 | |

| Other expenses | | 33,484 | | | 119 | | | | | | | 6,262 | | | 4,489 | | | (9,165) | | | 35,189 | |

| Total noninterest expenses | | 62,294 | | | 127 | | | | | | | 19,031 | | | 11,119 | | | (9,165) | | | 83,406 | |

| | | | | | | | | | | | | | | | |

| Income (loss) before income taxes | | 25,794 | | | 1,375 | | | | | | | (12,937) | | | (6,654) | | | — | | | 7,578 | |

| Income taxes | | 5,219 | | | 356 | | | | | | | (2,524) | | | (1,488) | | | — | | | 1,563 | |

| Net income (loss) from continuing operations | | 20,575 | | | 1,019 | | | | | | | (10,413) | | | (5,166) | | | — | | | 6,015 | |

| Income from discontinued operations, before income taxes | | — | | | — | | | | | | | — | | | 2,600 | | | — | | | 2,600 | |

| Income tax expense - discontinued operations | | — | | | — | | | | | | | — | | | 598 | | | — | | | 598 | |

| Net income from discontinued operations | | — | | | — | | | | | | | — | | | 2,002 | | | — | | | 2,002 | |

| Net income (loss) | | 20,575 | | | 1,019 | | | | | | | (10,413) | | | (3,164) | | | — | | | 8,017 | |

| Net loss attributable to noncontrolling interest | | — | | | — | | | | | | | — | | | 521 | | | — | | | 521 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net income (loss) available to common shareholders | | $ | 20,575 | | | $ | 1,019 | | | | | | | $ | (10,413) | | | $ | (2,643) | | | $ | — | | | $ | 8,538 | |

Average Balances and Interest Rates

(Unaudited) (Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Three Months Ended | | Three Months Ended |

| | September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| | Average

Balance | | Interest

Income/

Expense | | Yield/

Cost | | Average

Balance | | Interest

Income/

Expense | | Yield/

Cost | | Average

Balance | | Interest

Income/

Expense | | Yield/

Cost |

| Assets | | | | | | | | | | | | | | | | | | |

| Interest-bearing balances with banks | | $ | 483,158 | | | $ | 6,404 | | | 5.26 | % | | $ | 444,600 | | | $ | 5,542 | | | 5.00 | % | | $ | 32,552 | | | $ | 111 | | | 1.35 | % |

| CDs with banks | | — | | | — | | | — | | | — | | | — | | | — | | | 232 | | | 2 | | | 3.42 | |

| Investment securities: | | | | | | | | | | | | | | | | | | |

| Taxable | | 206,340 | | | 1,056 | | | 2.03 | | | 220,687 | | | 1,229 | | | 2.23 | | | 231,953 | | | 897 | | | 1.53 | |

Tax-exempt 1 | | 107,490 | | | 1,016 | | | 3.75 | | | 123,497 | | | 1,147 | | | 3.73 | | | 144,719 | | | 1,346 | | | 3.69 | |

Loans and loans held-for-sale: 2 | | | | | | | | | | | | | | | | | | |

Commercial 3 | | 1,593,875 | | | 31,348 | | | 7.80 | | | 1,635,438 | | | 30,534 | | | 7.49 | | | 1,687,383 | | | 22,898 | | | 5.38 | |

Tax-exempt 1 | | 3,678 | | | 40 | | | 4.31 | | | 3,822 | | | 42 | | | 4.41 | | | 4,498 | | | 51 | | | 4.50 | |

| Real estate | | 573,579 | | | 6,351 | | | 4.39 | | | 593,767 | | | 5,691 | | | 3.84 | | | 579,685 | | | 4,707 | | | 3.22 | |

| Consumer | | 95,032 | | | 2,331 | | | 9.73 | | | 128,113 | | | 3,096 | | | 9.69 | | | 129,464 | | | 4,183 | | | 12.82 | |

| Total loans | | 2,266,164 | | | 40,070 | | | 7.02 | | | 2,361,140 | | | 39,363 | | | 6.69 | | | 2,401,030 | | | 31,839 | | | 5.26 | |

| Total earning assets | | 3,063,152 | | | 48,546 | | | 6.29 | | | 3,149,924 | | | 47,281 | | | 6.02 | | | 2,810,486 | | | 34,195 | | | 4.83 | |

| Less: Allowance for credit losses | | (29,693) | | | | | | | (35,143) | | | | | | | (23,083) | | | | | |

| Cash and due from banks | | 6,686 | | | | | | | 5,756 | | | | | | | 5,399 | | | | | |

| Other assets | | 281,504 | | | | | | | 289,161 | | | | | | | 227,337 | | | | | |

| Total assets | | $ | 3,321,649 | | | | | | | $ | 3,409,698 | | | | | | | $ | 3,020,139 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | | | | | | | |

| NOW | | $ | 674,745 | | | $ | 4,970 | | | 2.92 | % | | $ | 682,277 | | | $ | 4,816 | | | 2.83 | % | | $ | 734,271 | | | $ | 1,394 | | | 0.75 | % |

| Money market checking | | 537,592 | | | 3,294 | | | 2.43 | | | 615,962 | | | 2,439 | | | 1.59 | | | 258,527 | | | 422 | | | 0.65 | |

| Savings | | 72,206 | | | 438 | | | 2.41 | | | 72,289 | | | 351 | | | 1.95 | | | 71,370 | | | 153 | | | 0.85 | |

| IRAs | | 6,788 | | | 56 | | | 3.27 | | | 6,401 | | | 45 | | | 2.82 | | | 6,132 | | | 17 | | | 1.10 | |

| CDs | | 664,281 | | | 8,702 | | | 5.20 | | | 662,753 | | | 8,799 | | | 5.33 | | | 202,299 | | | 988 | | | 1.94 | |

| Repurchase agreements and federal funds sold | | 4,911 | | | — | | | — | | | 5,428 | | | — | | | — | | | 10,627 | | | 1 | | | 0.04 | |

| FHLB and other borrowings | | 278 | | | — | | | — | | | 158 | | | — | | | — | | | 48,058 | | | 311 | | | 2.57 | |

| Senior term loan | | 8,751 | | | 191 | | | 8.66 | | | 9,351 | | | 198 | | | 8.49 | | | — | | | — | | | — | |

| Subordinated debt | | 73,446 | | | 809 | | | 4.37 | | | 73,382 | | | 801 | | | 4.38 | | | 73,190 | | | 771 | | | 4.18 | |

| Total interest-bearing liabilities | | 2,042,998 | | | 18,460 | | | 3.58 | | | 2,128,001 | | | 17,449 | | | 3.29 | | | 1,404,474 | | | 4,057 | | | 1.15 | |

| Noninterest-bearing demand deposits | | 975,164 | | | | | | | 971,436 | | | | | | | 1,321,982 | | | | | |

| Other liabilities | | 38,021 | | | | | | | 38,842 | | | | | | | 37,019 | | | | | |

| Total liabilities | | 3,056,183 | | | | | | | 3,138,279 | | | | | | | 2,763,475 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Stockholders’ equity | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Common stock | | 13,570 | | | | | | | 13,533 | | | | | | | 13,086 | | | | | |

| Paid-in capital | | 159,050 | | | | | | | 158,601 | | | | | | | 145,877 | | | | | |

| Treasury stock | | (16,741) | | | | | | | (16,741) | | | | | | | (16,741) | | | | | |

| Retained earnings | | 146,504 | | | | | | | 148,600 | | | | | | | 144,816 | | | | | |

| Accumulated other comprehensive loss | | (36,865) | | | | | | | (32,714) | | | | | | | (30,915) | | | | | |

| Total stockholders’ equity attributable to parent | | 265,518 | | | | | | | 271,279 | | | | | | | 256,123 | | | | | |

| Noncontrolling interest | | (52) | | | | | | | 140 | | | | | | | 541 | | | | | |

| Total stockholders’ equity | | 265,466 | | | | | | | 271,419 | | | | | | | 256,664 | | | | | |

| Total liabilities and stockholders’ equity | | $ | 3,321,649 | | | | | | | $ | 3,409,698 | | | | | | | $ | 3,020,139 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net interest spread (tax-equivalent) | | | | | | 2.71 | % | | | | | | 2.73 | % | | | | | | 3.68 | % |

Net interest income and margin (tax-equivalent)1 | | | | $ | 30,086 | | | 3.90 | % | | | | $ | 29,832 | | | 3.80 | % | | | | $ | 30,138 | | | 4.25 | % |

| Less: Tax-equivalent adjustments | | | | $ | (221) | | | | | | | $ | (250) | | | | | | | $ | (292) | | | |

| Net interest spread | | | | | | 2.68 | % | | | | | | 2.70 | % | | | | | | 3.64 | % |

| Net interest income and margin | | | | $ | 29,865 | | | 3.87 | % | | | | $ | 29,582 | | | 3.77 | % | | | | $ | 29,846 | | | 4.21 | % |

1 In order to make pre-tax income and resultant yields on tax-exempt loans and investment securities comparable to those on taxable loans and investment securities, a tax-equivalent adjustment has been computed using a Federal tax rate of 21% for the periods presented, which is a non-GAAP financial measure. See the reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure included in the tables on page 19.2 Non-accrual loans are included in total loan balances, lowering the effective yield for the portfolio in the aggregate.

3 MVB Bank’s PPP loans totaling $3.0 million, $4.5 million and $20.1 million are included in this amount as of September 30, 2023, June 30, 2023 and September 30, 2022, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended | | Nine Months Ended |

| | September 30, 2023 | | September 30, 2022 |

| | Average

Balance | | Interest

Income/

Expense | | Yield/

Cost | | Average

Balance | | Interest

Income/

Expense | | Yield/

Cost |

| Assets | | | | | | | | | | | | |

| Interest-bearing balances with banks | | $ | 405,012 | | | $ | 15,099 | | | 4.98 | % | | $ | 273,184 | | | $ | 630 | | | 0.31 | % |

| CDs with banks | | — | | | — | | | — | | | 1,381 | | | 24 | | | 2.32 | |

| Investment securities: | | | | | | | | | | | | |

| Taxable | | 221,089 | | | 4,133 | | | 2.50 | | | 237,188 | | | 2,383 | | | 1.34 | |

Tax-exempt 1 | | 122,818 | | | 3,471 | | | 3.78 | | | 140,377 | | | 3,824 | | | 3.64 | |

Loans and loans held-for-sale: 2 | | | | | | | | | | | | |

Commercial 3 | | 1,616,510 | | | 90,413 | | | 7.48 | | | 1,569,161 | | | 59,899 | | | 5.10 | |

Tax-exempt 1 | | 3,813 | | | 125 | | | 4.38 | | | 4,829 | | | 156 | | | 4.32 | |

| Real estate | | 596,070 | | | 18,343 | | | 4.11 | | | 438,380 | | | 9,722 | | | 2.97 | |

| Consumer | | 120,075 | | | 9,290 | | | 10.34 | | | 91,092 | | | 9,454 | | | 13.88 | |

| Total loans | | 2,336,468 | | | 118,171 | | | 6.76 | | | 2,103,462 | | | 79,231 | | | 5.04 | |

| Total earning assets | | 3,085,387 | | | 140,874 | | | 6.10 | | | 2,755,592 | | | 86,092 | | | 4.18 | |

| Less: Allowance for credit losses | | (31,656) | | | | | | | (20,468) | | | | | |

| Cash and due from banks | | 4,252 | | | | | | | 5,680 | | | | | |

| Other assets | | 303,233 | | | | | | | 237,637 | | | | | |

| Total assets | | $ | 3,361,216 | | | | | | | $ | 2,978,441 | | | | | |

| | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | |

| NOW | | $ | 717,527 | | | $ | 14,448 | | | 2.69 | % | | $ | 678,991 | | | $ | 1,844 | | | 0.36 | % |

| Money market checking | | 455,463 | | | 6,661 | | | 1.96 | | | 367,608 | | | 807 | | | 0.29 | |

| Savings | | 79,187 | | | 1,430 | | | 2.41 | | | 49,714 | | | 155 | | | 0.42 | |

| IRAs | | 6,448 | | | 128 | | | 2.65 | | | 6,271 | | | 52 | | | 1.11 | |

| CDs | | 572,078 | | | 21,396 | | | 5.00 | | | 122,095 | | | 1,433 | | | 1.57 | |

| Repurchase agreements and federal funds sold | | 5,974 | | | — | | | — | | | 11,334 | | | 4 | | | 0.05 | |

| FHLB and other borrowings | | 23,449 | | | 888 | | | 5.06 | | | 16,966 | | | 322 | | | 2.54 | |

| Senior term loan | | 9,285 | | | 583 | | | 8.39 | | | — | | | — | | | — | |

| Subordinated debt | | 73,383 | | | 2,409 | | | 4.39 | | | 73,126 | | | 2,284 | | | 4.18 | |

| Total interest-bearing liabilities | | 1,942,794 | | | 47,943 | | | 3.30 | | | 1,326,105 | | | 6,901 | | | 0.70 | |

| Noninterest-bearing demand deposits | | 1,107,712 | | | | | | | 1,350,533 | | | | | |

| Other liabilities | | 37,987 | | | | | | | 41,379 | | | | | |

| Total liabilities | | 3,088,493 | | | | | | | 2,718,017 | | | | | |

| | | | | | | | | | | | |

| Stockholders’ equity | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Common stock | | 13,525 | | | | | | | 13,276 | | | | | |

| Paid-in capital | | 157,034 | | | | | | | 144,903 | | | | | |

| Treasury stock | | (16,741) | | | | | | | (16,741) | | | | | |

| Retained earnings | | 153,769 | | | | | | | 140,174 | | | | | |

| Accumulated other comprehensive income loss | | (34,980) | | | | | | | (21,905) | | | | | |

| Total stockholders’ equity attributable to parent | | 272,607 | | | | | | | 259,707 | | | | | |

| Noncontrolling interest | | 116 | | | | | | | 717 | | | | | |

| Total stockholders’ equity | | 272,723 | | | | | | | 260,424 | | | | | |

| Total liabilities and stockholders’ equity | | $ | 3,361,216 | | | | | | | $ | 2,978,441 | | | | | |

| | | | | | | | | | | | |

| Net interest spread (tax-equivalent) | | | | | | 2.80 | % | | | | | | 3.48 | % |

Net interest income and margin (tax-equivalent)1 | | | | $ | 92,931 | | | 4.03 | % | | | | $ | 79,191 | | | 3.84 | % |

| Less: Tax-equivalent adjustments | | | | $ | (755) | | | | | | | $ | (837) | | | |

| Net interest spread | | | | | | 2.77 | % | | | | | | 3.44 | % |

| Net interest income and margin | | | | $ | 92,176 | | | 3.99 | % | | | | $ | 78,354 | | | 3.80 | % |

1 In order to make pre-tax income and resultant yields on tax-exempt loans and investment securities comparable to those on taxable loans and investment securities, a tax-equivalent adjustment has been computed using a Federal tax rate of 21% for the periods presented, which is a non-GAAP financial measure. See the reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure included in the tables on page 19.2 Non-accrual loans are included in total loan balances, lowering the effective yield for the portfolio in the aggregate.

3 MVB Bank’s PPP loans totaling $3.0 million and $20.1 million are included in this amount as of September 30, 2023 and September 30, 2022, respectively.

Selected Financial Data

(Unaudited) (Dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarterly | | Year-to-Date |

| | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| | Third Quarter | | Second Quarter | | Third Quarter | | |

| Earnings and Per Share Data: | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net income | | $ | 3,867 | | | $ | 8,112 | | | $ | 2,718 | | | $ | 23,321 | | | $ | 8,538 | |

| Earnings per share from continuing operations - basic | | $ | 0.30 | | | $ | 0.64 | | | $ | 0.16 | | | $ | 1.15 | | | $ | 0.54 | |

| Earnings per share from discontinued operations - basic | | $ | — | | | $ | — | | | $ | 0.06 | | | $ | 0.69 | | | $ | 0.16 | |

| Earnings per share - basic | | $ | 0.30 | | | $ | 0.64 | | | $ | 0.22 | | | $ | 1.84 | | | $ | 0.70 | |

| Earnings per share from continuing operations - diluted | | $ | 0.29 | | | $ | 0.63 | | | $ | 0.16 | | | $ | 1.12 | | | $ | 0.51 | |

| Earnings per share from discontinued operations - diluted | | $ | — | | | $ | — | | | $ | 0.05 | | | $ | 0.67 | | | $ | 0.15 | |

| Earnings per share - diluted | | $ | 0.29 | | | $ | 0.63 | | | $ | 0.21 | | | $ | 1.79 | | | $ | 0.66 | |

| Cash dividends paid per common share | | $ | 0.17 | | | $ | 0.17 | | | $ | 0.17 | | | $ | 0.51 | | | $ | 0.51 | |

| Book value per common share | | $ | 21.33 | | | $ | 21.57 | | | $ | 19.85 | | | $ | 21.33 | | | $ | 19.85 | |

Tangible book value per common share 1 | | $ | 21.08 | | | $ | 21.31 | | | $ | 19.38 | | | $ | 21.08 | | | $ | 19.38 | |

| Weighted-average shares outstanding - basic | | 12,722,010 | | | 12,689,669 | | | 12,238,505 | | | 12,678,708 | | | 12,170,028 | |

| Weighted-average shares outstanding - diluted | | 13,116,629 | | | 12,915,294 | | | 12,854,951 | | | 13,012,834 | | | 12,852,574 | |

| | | | | | | | | | |

| Performance Ratios: | | | | | | | | | | |

Return on average assets 2 | | 0.5 | % | | 1.0 | % | | 0.4 | % | | 0.9 | % | | 0.4 | % |

Return on average equity 2 | | 5.8 | % | | 12.0 | % | | 4.2 | % | | 11.4 | % | | 4.4 | % |

Net interest margin 3 4 | | 3.90 | % | | 3.80 | % | | 4.25 | % | | 4.03 | % | | 3.84 | % |

Efficiency ratio 5 10 | | 86.2 | % | | 84.1 | % | | 78.8 | % | | 75.4 | % | | 80.4 | % |

Overhead ratio 2 6 | | 3.7 | % | | 3.6 | % | | 4.0 | % | | 3.5 | % | | 4.0 | % |

| Equity to assets | | 7.9 | % | | 8.2 | % | | 7.8 | % | | 7.9 | % | | 7.8 | % |

| | | | | | | | | | |

| Asset Quality Data and Ratios: | | | | | | | | | | |

| Charge-offs | | $ | 8,064 | | | $ | 3,700 | | | $ | 3,653 | | | $ | 16,611 | | | $ | 7,305 | |

| Recoveries | | $ | 2,205 | | | $ | 2,468 | | | $ | 2,313 | | | $ | 7,842 | | | $ | 4,054 | |

Net loan charge-offs to total loans 2 7 | | 1.0 | % | | 0.2 | % | | 0.2 | % | | 0.5 | % | | 0.2 | % |

| Allowance for credit losses | | $ | 24,276 | | | $ | 30,294 | | | $ | 26,515 | | | $ | 24,276 | | | $ | 26,515 | |

Allowance for credit losses to total loans 8 | | 1.07 | % | | 1.31 | % | | 1.07 | % | 1.07 | % | 1.07 | % | | 1.07 | % |

| Nonperforming loans | | $ | 10,593 | | | $ | 13,646 | | | $ | 22,350 | | | $ | 10,593 | | | $ | 22,350 | |

| Nonperforming loans to total loans | | 0.5 | % | | 0.6 | % | | 0.9 | % | | 0.5 | % | | 0.9 | % |

| | | | | | | | | | |

Mortgage Company Equity Method Investees Production Data9: | | | | | | | | | | |

| Mortgage pipeline | | $ | 643,578 | | | $ | 748,756 | | | $ | 792,388 | | | $ | 643,578 | | | $ | 792,388 | |

| Loans originated | | $ | 1,131,963 | | | $ | 1,167,596 | | | $ | 606,805 | | | $ | 3,299,253 | | | $ | 2,713,508 | |

| Loans closed | | $ | 786,885 | | | $ | 820,665 | | | $ | 615,585 | | | $ | 2,282,768 | | | $ | 2,239,732 | |

| Loans sold | | $ | 605,296 | | | $ | 786,469 | | | $ | 619,059 | | | $ | 1,827,019 | | | $ | 1,999,706 | |

1 Common equity less total goodwill and intangibles per common share, a non-U.S. GAAP measure. See the reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure included in the tables on page 19.

2 Annualized for the quarterly periods presented.

3 Net interest income as a percentage of average interest-earning assets.

4 Presented on a fully tax-equivalent basis, a non-GAAP financial measure.

5 Noninterest expense as a percentage of net interest income and noninterest income, a non-U.S. GAAP measure.

6 Noninterest expense as a percentage of average assets, a non-U.S. GAAP measure.

7 Charge-offs, less recoveries.

8 Excludes loans held-for-sale.

9 Information is related to Intercoastal Mortgage Company, LLC and Warp Speed Holdings LLC, entities in which MVB has an ownership interest that are accounted for as equity method investments.

10 Includes net income from discontinued operations.

Non-GAAP Reconciliation: Net Interest Margin on a Full Tax-Equivalent Basis

The following table reconciles, for the periods shown below, net interest margin on a fully tax-equivalent basis:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| (Dollars in thousands) | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Net interest margin - U.S. GAAP basis | | | | | | | | | | |

| Net interest income | | $ | 29,865 | | | $ | 29,582 | | | $ | 29,846 | | | $ | 92,176 | | | $ | 78,354 | |

| Average interest-earning assets | | $ | 3,063,152 | | | $ | 3,149,924 | | | $ | 2,810,486 | | | 3,085,387 | | | 2,755,592 | |

| Net interest margin | | 3.87 | % | | 3.77 | % | | 4.21 | % | | 3.99 | % | | 3.80 | % |

| | | | | | | | | | |

| Net interest margin - non-U.S. GAAP basis | | | | | | | | | | |

| Net interest income | | $ | 29,865 | | | $ | 29,582 | | | $ | 29,846 | | | $ | 92,176 | | | $ | 78,354 | |

| Impact of fully tax-equivalent adjustment | | 221 | | | 250 | | | 292 | | | 755 | | | 837 | |

| Net interest income on a fully tax-equivalent basis | | $ | 30,086 | | | $ | 29,832 | | | $ | 30,138 | | | 92,931 | | | 79,191 | |

| Average interest-earning assets | | $ | 3,063,152 | | | $ | 3,149,924 | | | $ | 2,810,486 | | | $ | 3,085,387 | | | $ | 2,755,592 | |

| Net interest margin on a fully tax-equivalent basis | | 3.90 | % | | 3.80 | % | | 4.25 | % | | 4.03 | % | | 3.84 | % |

Non-U.S. GAAP Reconciliation: Tangible Book Value per Common Share and Tangible Common Equity Ratio

(Unaudited) (Dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| Tangible Book Value per Common Share | | | | | | |

| Goodwill | | $ | 2,838 | | | $ | 2,838 | | | $ | 3,988 | |

| Intangibles | | 375 | | | 397 | | | 1,806 | |

| Total intangibles | | $ | 3,213 | | | 3,235 | | | 5,794 | |

| | | | | | |

| Total equity attributable to parent | | $ | 271,416 | | | 274,349 | | | 243,913 | |

| | | | | | |

| Less: Total intangibles | | (3,213) | | | (3,235) | | | (5,794) | |

| Tangible common equity | | $ | 268,203 | | | $ | 271,114 | | | $ | 238,119 | |

| | | | | | |

| Tangible common equity | | $ | 268,203 | | | $ | 271,114 | | | $ | 238,119 | |

| Common shares outstanding (000s) | | 12,726 | | | 12,720 | | | 12,287 | |

| Tangible book value per common share | | $ | 21.08 | | | $ | 21.31 | | | $ | 19.38 | |

| | | | | | |

| Tangible Common Equity Ratio | | | | | | |

| Total assets | | $ | 3,437,583 | | | $ | 3,351,847 | | | $ | 3,139,922 | |

| Less: Total intangibles | | (3,213) | | | (3,235) | | | (5,794) | |

| Tangible assets | | $ | 3,434,370 | | | $ | 3,348,612 | | | $ | 3,134,128 | |

| | | | | | |

| Tangible assets | | $ | 3,434,370 | | | $ | 3,348,612 | | | $ | 3,134,128 | |

| Tangible common equity | | $ | 268,203 | | | $ | 271,114 | | | $ | 238,119 | |

| Tangible common equity ratio | | 7.8 | % | | 8.1 | % | | 7.6 | % |

###

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.3

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

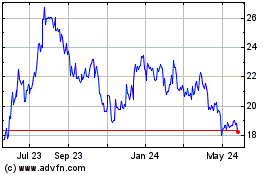

MVB Financial (NASDAQ:MVBF)

Historical Stock Chart

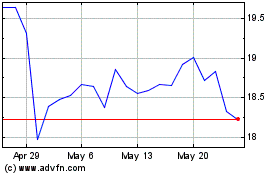

From Apr 2024 to May 2024

MVB Financial (NASDAQ:MVBF)

Historical Stock Chart

From May 2023 to May 2024