NewAmsterdam Pharma Reports Full Year 2022 Financial Results and Provides Corporate Update

31 March 2023 - 11:00PM

NewAmsterdam Pharma Company N.V. (Nasdaq: NAMS or “NewAmsterdam” or

the “Company”), a clinical-stage company focused on the research

and development of transformative oral therapies for major

cardiometabolic diseases, today announced its financial results for

the full year ended December 31, 2022 and provided a corporate

update.

“2022 was a transformative year for NewAmsterdam, and we are

thrilled to have achieved significant corporate and clinical

milestones that have propelled our company forward. From securing a

major pharmaceutical partner to support potential commercialization

efforts in Europe, to going public through a successful deSPAC and

concurrent oversubscribed PIPE financing, we have fortified our

position as a leader in the cardiometabolic space,” said Michael

Davidson, M.D., Chief Executive Officer of NewAmsterdam. “Our

positive topline data readout in the ROSE2 Phase 2 clinical trial,

the initiation of a Phase 2 dose-finding study in Japanese

patients, and the advancement of our three pivotal Phase 3

BROOKLYN, BROADWAY and PREVAIL trials underscore our commitment to

developing innovative treatments for patients worldwide. With the

capital we believe is needed to support our clinical operations

through completion of these pivotal trials, we are confident in our

ability to unlock the full potential of obicetrapib and deliver

value to the millions of people in need of an effective and

convenient LDL-C lowering therapy.”

Fourth Quarter and Recent Business

Highlights:

Clinical Pipeline Updates

NewAmsterdam is developing obicetrapib, an oral, low-dose and

once-daily CETP inhibitor, as the preferred low-density lipoprotein

cholesterol (“LDL-C”) lowering therapy to be used as an adjunct to

maximally tolerated statin therapy for high-risk cardiovascular

disease patients. The Company is currently conducting three pivotal

Phase 3 clinical trials of obicetrapib: BROOKLYN, evaluating the

effect of obicetrapib on LDL-C levels in patients with heterozygous

familial hypercholesterolemia (“HeFH”) as an adjunct to maximally

tolerated lipid-lowering therapy; BROADWAY, evaluating the effect

of obicetrapib on top of maximally tolerated lipid-lowering therapy

in patients with established atherosclerotic cardiovascular disease

(“ASCVD”); and PREVAIL, a cardiovascular outcomes trial in patients

with a history of ASCVD with inadequately controlled LDL-C despite

treatment with maximally tolerated lipid-modifying therapies.

- In January 2023, NewAmsterdam announced topline results from

ROSE2, a Phase 2 clinical trial evaluating obicetrapib in

combination with ezetimibe as an adjunct to high-intensity statin

therapy. ROSE2 achieved its primary efficacy endpoint: patients

treated with the combination of obicetrapib and ezetimibe achieved

a median reduction in LDL-C of 59%, as compared to patients treated

with placebo, who achieved a median reduction in LDL-C of 6% (p<

0.0001). Overall, the combination of obicetrapib and ezetimibe was

observed to be well-tolerated, with a safety profile observed to be

comparable to placebo.

- In October 2022, NewAmsterdam initiated a Phase 2 dose-finding

study of obicetrapib as an adjunct to stable statin therapy in

Japanese patients with dyslipidemia. The trial is expected to

enroll 108 adult participants and is being conducted at hospitals

and clinics across Japan.

Corporate Highlights

- In February 2023, NewAmsterdam appointed John W. Smither to its

Board of Directors. Mr. Smither also serves as chair of the

Company’s Audit Committee.

- In November 2022, NewAmsterdam completed its going public

business combination with Frazier Lifesciences Acquisition

Corporation (“FLAC”), a special purpose acquisition company

sponsored by an affiliate of Frazier Healthcare Partners. Proceeds

from this transaction were approximately $328 million, prior to

deducting transaction and other expenses, comprising approximately

$93 million in funds from the former FLAC trust account and

approximately $235 million from the concurrent, oversubscribed PIPE

financing, which was co-led by Frazier Healthcare Partners and Bain

Capital Life Sciences. After deducting transaction fees and other

expenses, total proceeds from this transaction were approximately

$306 million. Following the close of this transaction, James

Topper, M.D., Ph.D., Managing Partner at Frazier Healthcare

Partners and former Chairman of the Board of Directors and Chief

Executive Officer of FLAC, and Nicholas Downing, M.D., Principal at

Bain Capital Life Sciences, joined NewAmsterdam’s Board of

Directors.

Upcoming Potential Milestones

NewAmsterdam expects to achieve the following upcoming

milestones:

- Present full data from the Phase 2 ROSE2 clinical trial testing

the combination of obicetrapib and ezetimibe at the National Lipid

Association (NLA) Scientific Sessions, June 1-4, 2023 in Atlanta,

GA.

- Select a formulation for Phase 3 fixed-dose combination of

obicetrapib and ezetimibe in the second half of 2023.

- Complete enrollment in the Phase 3 BROOKLYN obicetrapib

monotherapy trial in mid-2023 and announce topline data in the

second half of 2024.

- Complete enrollment in the Phase 3 BROADWAY obicetrapib

monotherapy trial in mid-2023 and announce topline data in the

second half of 2024.

- Announce topline results from the Phase 2 obicetrapib

monotherapy dose-finding study in Japanese patients in the second

half of 2023.

- Complete enrollment in the Phase 3 PREVAIL obicetrapib

monotherapy trial in the second half of 2023 and announce topline

data in the second half of 2026.

- Announce topline data from Phase 2a Alzheimer’s biomarker

study, intended to study whether CETP inhibition results in

increased ApoA1 levels in cerebrospinal fluid of early mild

cognitive impairment Alzheimer’s patients carrying at least one

copy of the ApoE4 -carrying gene, in the second half of 2023.

Full Year 2022 Financial Results

- Cash Position: As of December 31, 2022,

NewAmsterdam had cash of €439 million, compared to €53 million

as of December 31, 2021. The increase in cash was primarily due to

the receipt of Menarini’s upfront payment in July 2022, in addition

to receipt of proceeds from NewAmsterdam’s business combination

with FLAC and concurrent, oversubscribed PIPE financing in November

2022.

- Revenue: NewAmsterdam recognized €98 million

of revenue in 2022. This amount represents a portion of the €115M

July 2022 upfront payment received from Menarini.

- Research and Development Expenses: Research

and development expenses were €82 million for the full year 2022,

compared to €25 million for the full year 2021. The increase in

research and development expenses for the full year 2022 was

primarily due to additional costs associated with the Company’s

ongoing clinical trials to advance obicetrapib.

- Selling, General and Administrative Expenses:

Selling, general and administrative expenses were €22 million for

the full year 2022, compared to €5 million for the full year 2021.

The increase in selling, general and administrative expenses for

the full year 2022 was primarily due to additional personnel costs,

legal and finance costs, and commission and transaction costs

incurred related to the closing of the going public business

combination and the execution of the Menarini license

agreement.

- Net Loss: Net loss was €78 million for the

full year 2022, or €0.96 per share, compared to a net loss of €29

million, or €1.19 per share, for the same period in 2021.

Financial Guidance: Based on its current

operating and development plans, NewAmsterdam believes that its

existing cash, cash equivalents and available-for-sale securities

will fund operations through 2026, beyond the readout of its three

ongoing Phase 3 trials, BROADWAY, BROOKLYN and PREVAIL.

About NewAmsterdam

NewAmsterdam Pharma (Nasdaq: NAMS) is a clinical-stage

biopharmaceutical company whose mission is to improve patient care

in populations with cardiometabolic diseases where currently

approved therapies have not been sufficiently successful or well

tolerated. NewAmsterdam is investigating obicetrapib, an oral,

low-dose and once-daily CETP inhibitor, as the preferred LDL-C

lowering therapy to be used as an adjunct to maximally-tolerated

statin therapy for high-risk cardiovascular disease (“CVD”)

patients. Results from NewAmsterdam Pharma’s ROSE Phase 2b trial

(presented at AHA Scientific Sessions in 2021) included

observations that patients receiving obicetrapib 10 mg experienced

a median reduction in LDL-C of 51% versus baseline in patients on

high-intensity statin therapy (vs. a 7% reduction in the placebo

arm). In addition, topline results from NewAmsterdam Pharma’s ROSE2

trial evaluating the combination of 10 mg obicetrapib and 10 mg

ezetimibe demonstrated a median reduction in LDL-C levels of 59%

versus baseline in patients on high-intensity statin therapy (vs. a

6% reduction in the placebo arm). Based in the Netherlands,

NewAmsterdam recently completed a business combination with FLAC, a

special purpose acquisition company sponsored by an affiliate of

Frazier Healthcare Partners. Proceeds from this transaction were

approximately $328 million, prior to deducting transaction

expenses. In June 2022, NewAmsterdam Pharma entered into an

exclusive licensing agreement with the Menarini Group for the

commercialization of obicetrapib in Europe, while retaining all

rights to commercialize obicetrapib, if approved, in the rest of

the world, as well as rights to develop certain forms of

obicetrapib for other diseases such as Alzheimer’s disease. For

more information, please visit: www.newamsterdampharma.com.

Forward-Looking StatementsCertain statements

included in this document that are not historical facts are

forward-looking statements for purposes of the safe harbor

provisions under the United States Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally are

accompanied by words such as “believe,” “may,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “expect,” “should,” “would,”

“plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook”

and similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These

forward-looking statements include, but are not limited to,

statements regarding the Company’s business and strategic plans,

cash runway, the therapeutic and curative potential of the

Company’s product candidate, the Company’s clinical trials and the

timing for enrolling patients, the timing and forums for announcing

data and the achievement and timing of regulatory approvals. These

statements are based on various assumptions, whether or not

identified in this document, and on the current expectations of the

Company’s management and are not predictions of actual performance.

These forward-looking statements are provided for illustrative

purposes only and are not intended to serve as and must not be

relied on as a guarantee, an assurance, a prediction, or a

definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict and may differ

from assumptions. Many actual events and circumstances are beyond

the control of the Company. These forward-looking statements are

subject to a number of risks and uncertainties, including changes

in domestic and foreign business, market, financial, political, and

legal conditions; risks relating to the uncertainty of the

projected financial information with respect to the Company; risks

related to the approval of the Company’s product candidate and the

timing of expected regulatory and business milestones; ability to

negotiate definitive contractual arrangements with potential

customers; the impact of competitive product candidates; ability to

obtain sufficient supply of materials; the impact of COVID-19;

global economic and political conditions, including the

Russia-Ukraine conflict; the effects of competition on the

Company’s future business; and those factors described in the

Company’s public filings with the U.S. Securities and Exchange

Commission. Additional risks related to the Company’s business

include, but are not limited to: uncertainty regarding outcomes of

the Company’s ongoing clinical trials, particularly as they relate

to regulatory review and potential approval for its product

candidate; risks associated with the Company’s efforts to

commercialize a product candidate; the Company’s ability to

negotiate and enter into definitive agreements on favorable terms,

if at all; the impact of competing product candidates on the

Company’s business; intellectual property related claims; the

Company’s ability to attract and retain qualified personnel;

ability to continue to source the raw materials for its product

candidate. If any of these risks materialize or the Company’s

assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. There

may be additional risks that the Company does not presently know or

that the Company currently believes are immaterial that could also

cause actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements

reflect the Company’s expectations, plans, or forecasts of future

events and views as of the date of this document and are qualified

in their entirety by reference to the cautionary statements herein.

The Company anticipates that subsequent events and developments may

cause the Company’s assessments to change. These forward-looking

statements should not be relied upon as representing the Company’s

assessment as of any date subsequent to the date of this

communication. Accordingly, undue reliance should not be placed

upon the forward-looking statements. Neither the Company nor any of

its affiliates undertakes any obligation to update these

forward-looking statements, except as may be required by law.

|

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

| |

|

As at December 31, |

|

| |

|

2022 |

|

|

2021 |

|

| (In thousands of Euro) |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

Intangible assets |

|

|

83,160 |

|

|

|

— |

|

|

Property, plant and equipment |

|

|

144 |

|

|

|

190 |

|

|

Loan receivable |

|

|

— |

|

|

|

718 |

|

|

Long term prepaid expenses |

|

|

146 |

|

|

|

— |

|

|

Total non-current assets |

|

|

83,450 |

|

|

|

908 |

|

|

Current assets |

|

|

|

|

|

|

|

Prepayments and other receivables |

|

|

9,611 |

|

|

|

5,782 |

|

|

Cash |

|

|

438,522 |

|

|

|

53,092 |

|

|

Total current assets |

|

|

448,133 |

|

|

|

58,874 |

|

|

Total assets |

|

|

531,583 |

|

|

|

59,782 |

|

|

Equity and liabilities |

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

Share capital |

|

|

599,191 |

|

|

|

83,876 |

|

|

Other reserves |

|

|

4,691 |

|

|

|

591 |

|

|

Accumulated loss |

|

|

(119,361 |

) |

|

|

(34,676 |

) |

|

Total equity |

|

|

484,521 |

|

|

|

49,791 |

|

|

Non-current liabilities |

|

|

|

|

|

|

|

Deferred revenue |

|

|

4,492 |

|

|

|

— |

|

|

Lease liability |

|

|

56 |

|

|

|

111 |

|

|

Derivative earnout liability |

|

|

7,053 |

|

|

|

— |

|

|

Total non-current liabilities |

|

|

11,601 |

|

|

|

111 |

|

|

Current liabilities |

|

|

|

|

|

|

|

Trade and other payables |

|

|

18,503 |

|

|

|

9,827 |

|

|

Deferred revenue |

|

|

13,008 |

|

|

|

— |

|

|

Lease liability |

|

|

62 |

|

|

|

53 |

|

|

Derivative warrant liabilities |

|

|

3,888 |

|

|

|

— |

|

|

Total current liabilities |

|

|

35,461 |

|

|

|

9,880 |

|

|

Total equity and liabilities |

|

|

531,583 |

|

|

|

59,782 |

|

|

CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND COMPREHENSIVE

LOSS |

| |

|

For the year ended December 31, |

|

| |

|

2022 |

|

|

2021 |

|

|

2020 |

|

| (In thousands of Euro, except

per share amounts) |

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

97,500 |

|

|

|

— |

|

|

|

— |

|

|

Research and development expenses |

|

|

(82,230 |

) |

|

|

(25,032 |

) |

|

|

(4,045 |

) |

|

Selling, general and administrative expenses |

|

|

(22,230 |

) |

|

|

(4,803 |

) |

|

|

(1,384 |

) |

|

Share listing expense |

|

|

(60,600 |

) |

|

|

— |

|

|

|

— |

|

|

Total operating expenses |

|

|

(165,060 |

) |

|

|

(29,835 |

) |

|

|

(5,429 |

) |

|

Operating loss |

|

|

(67,560 |

) |

|

|

(29,835 |

) |

|

|

(5,429 |

) |

|

Finance income |

|

|

11 |

|

|

|

9 |

|

|

|

- |

|

|

Finance expense |

|

|

(271 |

) |

|

|

(216 |

) |

|

|

(344 |

) |

|

Fair value change – earnout and warrants |

|

|

(976 |

) |

|

|

— |

|

|

|

— |

|

|

Foreign exchange gains/(losses) |

|

|

(9,256 |

) |

|

|

1,443 |

|

|

|

24 |

|

|

Loss before tax |

|

|

(78,052 |

) |

|

|

(28,599 |

) |

|

|

(5,749 |

) |

|

Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Loss for the year |

|

|

(78,052 |

) |

|

|

(28,599 |

) |

|

|

(5,749 |

) |

|

Other comprehensive loss, net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total comprehensive loss for the year, net of

tax |

|

|

(78,052 |

) |

|

|

(28,599 |

) |

|

|

(5,749 |

) |

|

Net loss per share (in Euro) |

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

€ |

(0.96 |

) |

|

€ |

(1.19 |

) |

|

€ |

(0.54 |

) |

Media Contact

Spectrum Science on behalf of NewAmsterdamBryan BlatsteinP:

917-714-2609bblatstein@spectrumscience.com

Investor Contact

Stern Investor Relations on behalf of NewAmsterdamHannah

DeresiewiczP: 1 212-362-1200hannah.deresiewicz@sternir.com

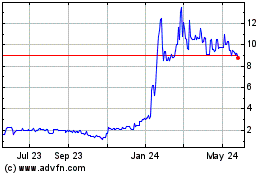

NewAmsterdam Pharma Comp... (NASDAQ:NAMSW)

Historical Stock Chart

From Oct 2024 to Nov 2024

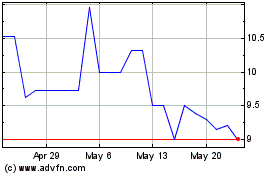

NewAmsterdam Pharma Comp... (NASDAQ:NAMSW)

Historical Stock Chart

From Nov 2023 to Nov 2024