false000140170800014017082024-02-042024-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_______________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 04, 2024

_______________________________

NanoString Technologies, Inc.

(Exact name of registrant as specified in its charter)

________________________________

| | | | | | | | |

| Delaware | 001-35980 | 20-0094687 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

530 Fairview Avenue North

Seattle, Washington 98109

(Address of principal executive offices, including zip code)

(206) 378-6266

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | NSTG | The NASDAQ Stock Market LLC |

| | (The NASDAQ Global Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act). ¨

Item 1.03. Bankruptcy or Receivership.

Chapter 11 Filing

On February 4, 2024, NanoString Technologies, Inc. (the “Company”), NanoString Technologies International, Inc., NanoString Technologies Germany GmbH and NanoString Netherlands B.V. (collectively with the Company, the “Debtors”) filed voluntary petitions for relief (the “Bankruptcy Petitions”) under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (such court, the “Court” and such cases, the “Cases”). The Debtors are concurrently filing a motion with the Court seeking joint administration of the Cases under the caption In re NanoString Technologies, Inc., et al. The Debtors will continue to operate their businesses as “debtors-in-possession” under the jurisdiction of the Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Court. The Debtors are concurrently filing various “first day” motions with the Bankruptcy Court requesting customary relief that will enable them to transition into chapter 11 and uphold their commitments to stakeholders during the process without material disruption to their ordinary course operations.

In connection with this process, the Company has reached an agreement in principle with certain of its incumbent lenders to provide it with at least $40 million in new capital in the form of Debtor in Possession (DIP) financing. Upon approval of the Court, this financing facility is expected to provide sufficient liquidity to operate the Company's business during the pendency of the Cases.

The Company has engaged Perella Weinberg Partners to advise on its strategic options, including the potential sale of the Company or its product lines in connection with the Cases. The Company has received and is currently evaluating multiple preliminary indications of interests with respect to a potential sale of one or more of its assets. Any of those sales would be subject to review and approval by the Court and compliance with Court-approved bidding procedures.

Item 2.04 Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement.

The filing of the Bankruptcy Petitions described in Item 1.03 above constitutes an event of default that accelerated the Company’s obligations under the following debt instruments (the “Debt Instruments”):

•Indenture, dated as of March 9, 2023, by and among the Company and U.S. Bank Trust Company, National Association (as successor in interest to U.S. Bank National Association), as Trustee, governing the 2.625% Convertible Senior Notes which mature on March 1, 2025; and

•Indenture, dated as of November 7, 2023, by and among the Company, as issuer, the guarantor parties thereto, and U.S. Bank Trust Company, National Association, as trustee and collateral agent, governing the 6.95% Senior Secured Notes due 2026.

The Debt Instruments provide that upon the filing of the Bankruptcy Petitions, the principal and interest due under the Debt Instruments shall automatically become due and payable. Any efforts to enforce such payment obligations under the Debt Instruments are automatically stayed as a result of the Bankruptcy Petitions, and the creditors’ rights of enforcement in respect of the Debt Instruments are subject to the applicable provisions of the Bankruptcy Code.

Item 8.01 Other Events.

On February 4, 2024, the Company issued a press release announcing the filing of the Cases. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

Cautionary Statements Regarding Trading in the Company’s Securities

The Company’s securityholders are cautioned that trading in the Company’s securities during the pendency of the Cases is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders thereof in the Cases. Accordingly, the Company urges extreme caution with respect to existing and future investments in its securities.

Cautionary Note Regarding Forward-Looking Statements

This Form 8-K includes statements that are, or may be deemed, “forward-looking statements.” In some cases, these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or, in each case, their negative or other variations thereon or comparable terminology, although not all forward-looking statements contain these words. These forward-looking statements reflect the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and

liquidity and the development of the industry in which we operate may differ materially from the forward-looking statements contained herein. Any forward-looking statements that we make in this Form 8-K speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this Form 8-K or to reflect the occurrence of unanticipated events. The Company’s forward-looking statements in this Form 8-K include, but are not limited to, statements about the Company’s plans to sell its assets pursuant to chapter 11 of the U.S. Bankruptcy Code; the Company’s plans to obtain DIP financing; the Company’s intention to continue operations during the Cases; the Company’s belief that the 363 sale process will be in the best interest of the Company and its stakeholders; and other statements regarding the Company’s strategy and future operations, performance and prospects among others. These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects. There can be no assurance that future developments affecting the Company will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the Company’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the risks associated with the potential adverse impact of the Cases on the Company’s liquidity and results of operations; changes in the Company’s ability to meet its financial obligations during the Cases and to maintain contracts that are critical to its operations; the outcome and timing of the Cases and any potential asset sale; the effect of the filing of the Cases and any potential asset sale on the Company’s relationships with vendors, regulatory authorities, employees and other third parties; possible proceedings that may be brought by third parties in connection with the Cases or the potential asset sale; uncertainty regarding obtaining Court approval of a sale of the Company’s assets or other conditions to the potential asset sale; and the timing or amount of any distributions, if any, to the Company’s stakeholders.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | The cover page from NanoString Technologies, Inc.’s Current Report on Form 8-K is formatted in iXBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | NanoString Technologies, Inc. |

| | | |

| Date: | February 5, 2024 | By: | /s/ R. Bradley Gray |

| | | R. Bradley Gray |

| | | President and Chief Executive Officer |

Exhibit 99.1

NANOSTRING TAKES STEPS TO RESTRUCTURE ITS BUSINESS AND PROTECT ITS MISSION TO

MAP THE UNIVERSE OF BIOLOGY

Initiates Voluntary Chapter 11 Restructuring Proceedings with Additional $40 Million in Financing

Secured from Existing Noteholders to Facilitate Process

Continuing to Serve Life Sciences Researchers Worldwide

Seattle, February 4, 2024 – (BUSINESS WIRE) -- NanoString Technologies, Inc. (NASDAQ:NSTG) (“NanoString” or “the Company”), a leading provider of life science tools for discovery and translational research, today announced that steps are being taken to protect its business, customers, employees and its mission to “Map the Universe of Biology.” With support from key creditors, NanoString and certain of its subsidiaries have voluntarily initiated a chapter 11 restructuring proceeding in the United States Bankruptcy Court for the District of Delaware. Coincident with this proceeding, NanoString is exploring strategic alternatives in support of the Company’s mission and for the benefit of its stakeholders, including the potential sale of the company or product lines.

“The unexpected outcome of the November GeoMx patent litigation trial in Delaware and the unusually large magnitude of the damages awarded by the jury have forced us to take proactive steps to protect our stakeholders, customers and employees,” said Brad Gray, President and CEO of NanoString. “NanoString has powerful product platforms, strong relationships with our customers throughout the scientific community, an enviable workforce, and conviction in the integrity of our innovation process. We believe chapter 11 protection will provide us with the necessary breathing room to continue to serve our customers while we address our litigation and the related financial challenges.”

Patent Litigation with Competitor Seeking to Control Life Science Research

Patent litigation is common among companies operating in life sciences and is sometimes initiated for the purpose of minimizing or eliminating competition unfairly. NanoString is currently the primary target of an extensive litigation campaign being conducted by 10x Genomics, Inc. (10x). Since May 2021, 10x has brought multiple infringement lawsuits against NanoString in the United States and the European Union, with respect to NanoString’s GeoMx® Digital Spatial Profiler (DSP) and CosMx™ Spatial Molecular Imager (SMI) product lines. 10x is engaging in its litigation campaign with the apparent goal of shrinking the competitive landscape for different spatial biology platforms to the detriment of the public good. In one case, 10x acquired patents from a defunct company for the apparent purpose of generating litigation with NanoString. In another case, the court granted NanoString’s motion to add counterclaims for antitrust and unfair competition violations, as well as the affirmative defense of “unclean hands” by the plaintiffs.

NanoString is confident in the fidelity of its innovation and product development process, and believes it has strong legal defenses and counterclaims and that the GeoMx DSP and CosMx SMI offer unique propositions to the scientific community. Nonetheless, the Company has faced unfavorable initial rulings that have impacted its business trajectory and financial position. While the Company believes that it has strong grounds for appeals, these initial litigation outcomes, including the cost burdens associated with continued engagement in extensive litigation with a large well-funded competitor, have siphoned resources from innovation and customer support activities and placed a significant strain on the Company’s business and financial resources.

Restructuring Process Provides Safe Haven and Cash Infusion

As a result of the combined near-term impact of these litigation proceedings, today, NanoString elected to commence a court-supervised restructuring process. This process importantly allows the Company to:

•Continue to operate its business, support its workforce, and serve its customers, including customers that either own or are considering the purchase of an nCounter®, GeoMx DSP or CosMx SMI system.

•Stay all ongoing patent litigation against the Company worldwide.

•Explore strategic alternatives including a potential sale of all or part of the Company’s business to new owners who will continue the Company’s mission. The Company has received and is currently evaluating multiple preliminary indications of interest as part of this process.

In connection with this process, NanoString has reached an agreement in principle with certain of our incumbent lenders to provide us with at least $40 million in new capital in the form of Debtor in Possession (DIP) financing. Upon approval of the Bankruptcy Court, this financing facility is expected to provide sufficient liquidity to operate the Company’s business during the pendency of the cases.

NanoString to Continue to Serve Researchers Worldwide

NanoString will continue to serve researchers across its installed base of over 1,500 nCounter, GeoMx DSP, and CosMx SMI platforms. NanoString’s current management team, Board of Directors and employees will continue to operate the business and serve customers following the filing.

As part of the restructuring process, the Company will file customary “First Day” motions to allow it to maintain normal operations. NanoString expects and intends to pay vendors under customary terms for goods and services received on or after the filing date, and to pay its employees in the usual manner and to continue their primary benefits without disruption.

Additional Information About the Court-Supervised Restructuring Process

Additional information regarding the Company’s court-supervised process, including court filings and other information, is available on a separate website administrated by the Company’s claims agent, Kroll, at https://cases.ra.kroll.com/NanoString.

The Company is represented by Willkie Farr & Gallagher LLP as counsel, AlixPartners LLP as restructuring advisor and Perella Weinberg Partners L.P. as restructuring investment banker.

About NanoString

NanoString Technologies, a leader in spatial biology, offers an ecosystem of innovative discovery and translational research solutions, empowering our customers to map the universe of biology. The GeoMx® Digital Spatial Profiler is a flexible and consistent solution combining the power of whole tissue imaging with gene expression and protein data for spatial whole transcriptomics and proteomics. The CosMx™ Spatial Molecular Imager is a single-cell imaging platform powered by spatial multiomics enabling researchers to map single cells in their native environments to extract deep biological insights and novel discoveries from one experiment. The AtoMx™ Spatial Informatics Platform is a cloud-based informatics solution with advanced analytics and global collaboration capabilities, enabling powerful spatial biology insights anytime, anywhere. At the foundation of our research tools is our nCounter® Analysis System, which offers a secure way to easily profile the expression of hundreds of genes, proteins, miRNAs, or copy number variations, simultaneously with high sensitivity and precision. For more information, please visit www.nanostring.com.

Forward-Looking Statements

This press release includes statements that are, or may be deemed, “forward-looking statements.” In some cases, these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should,” “approximately” or, in each case, their negative or other variations thereon or comparable terminology, although not all forward-looking statements contain these words. These forward-looking statements reflect the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. We caution you that forward-looking statements are not guarantees of future

performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained herein. Any forward-looking statements that we make in this press release speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events. NanoString’s forward-looking statements in this press release include, but are not limited to, statements about NanoString’s plans to sell its assets pursuant to chapter 11 of the U.S. Bankruptcy Code; NanoString’s intention to continue operations during the chapter 11 case; NanoString’s belief that the sale process will be in the best interest of NanoString and its stakeholders; NanoString’s beliefs about the outcome of litigation; and other statements regarding NanoString’s strategy and future operations, performance and prospects, among others. These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects. There can be no assurance that future developments affecting NanoString will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond NanoString’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the risks associated with the potential adverse impact of the chapter 11 filings on NanoString’s liquidity and results of operations; changes in NanoString’s ability to meet its financial obligations during the chapter 11 process and to maintain contracts that are critical to its operations; the outcome and timing of the chapter 11 process and any potential asset sale; the effect of the chapter 11 filings and any potential asset sale on NanoString’s relationships with vendors, regulatory authorities, employees and other third parties; possible proceedings that may be brought by third parties in connection with the chapter 11 process or the potential asset sale; uncertainty regarding obtaining Bankruptcy Court approval of a sale of NanoString’s assets or other conditions to the potential asset sale; and the timing or amount of any distributions, if any, to NanoString’s stakeholders.

NanoString, NanoString Technologies, the NanoString logo, CosMx, GeoMx, AtoMx and nCounter are trademarks or registered trademarks of NanoString Technologies, Inc. in various jurisdictions.

Investor Relations and Communications

ir@nanostring.com

(888) 358-6266

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

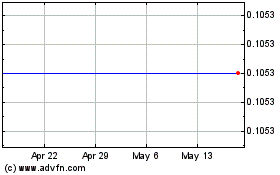

NanoString Technologies (NASDAQ:NSTG)

Historical Stock Chart

From Apr 2024 to May 2024

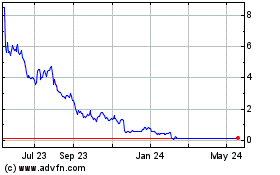

NanoString Technologies (NASDAQ:NSTG)

Historical Stock Chart

From May 2023 to May 2024