Wells Fargo 22nd Annual Utilities Symposium New York | December 6, 2023 8-K December 06, 2023

2 Forward Looking Statements Forward Looking Statements During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date hereof unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s most recent Form 10-K and 10-Q along with other public filings with the SEC. NorthWestern Corporation dba: NorthWestern Energy Ticker: NWE (Nasdaq) www.northwesternenergy.com Corporate Office 3010 West 69th Street Sioux Falls, SD 57108 (605) 978-2900 Investor Relations Officer Travis Meyer 605-978-2967 travis.meyer@northwestern.com O’Dell Creek - Madison River Valley - Montana Recognized by Newsweek as one of “America’s Most Responsible Companies”

3 Mission Working together to deliver safe, reliable and affordable energy solutions. Vision Enriching lives through a safe and sustainable energy future. Values Safety Excellence Respect Value Integrity Community Environment NorthWestern Energy

4 Company Overview

• Pending Montana electric and natural gas rate review to reduce regulatory lag, aid earnings and cash flow and improve balance sheet strength • History of consistent annual dividend growth NWE - An Investment for the Long Term 5 • 100% pure electric & natural gas utility business with over 100 years of operating history • Solid economic indicators in service territory • Diverse electric supply portfolio ~55% hydro, wind & solar Pure Electric & Gas Utility Solid Utility Foundation Earnings & Cash Flow Attractive Future Growth Prospects Financial Goals & Metrics Best Practices Corporate Governance • Residential electric & gas rates below national average • Solid system reliability • Low leaks per 100 miles of pipe • Solid JD Power Overall Customer Satisfaction scores • Disciplined maintenance capital investment program focus on reliability, capacity, asset life and compliance • Further opportunity for energy supply investment to meet significant capacity shortfalls • Target 4%-6% EPS growth plus dividend yield to provide competitive total return • Target dividend long-term payout ratio of 60%-70% • Target debt to capitalization ratio of 50%-55% with liquidity of $100 million or greater 5th Best Governance Score Recognized as one of America’s Greatest Workplaces

About NorthWestern 6 Montana Operations Electric 398,200 customers 25,131 miles – transmission & distribution lines 882 MW maximum capacity owned power generation Natural Gas 209,100 customers 7,334 miles of transmission and distribution pipeline 17.75 Bcf of gas storage capacity Own 35.1 Bcf of proven natural gas reserves Nebraska Operations Natural Gas 43,000 customers 821 miles of distribution pipeline Data as of 12/31/2022 South Dakota Operations Electric 64,700 customers 3,650 miles – transmission & distribution lines 446 MW nameplate owned power generation Natural Gas 49,200 customers 1,779 miles of transmission and distribution pipeline

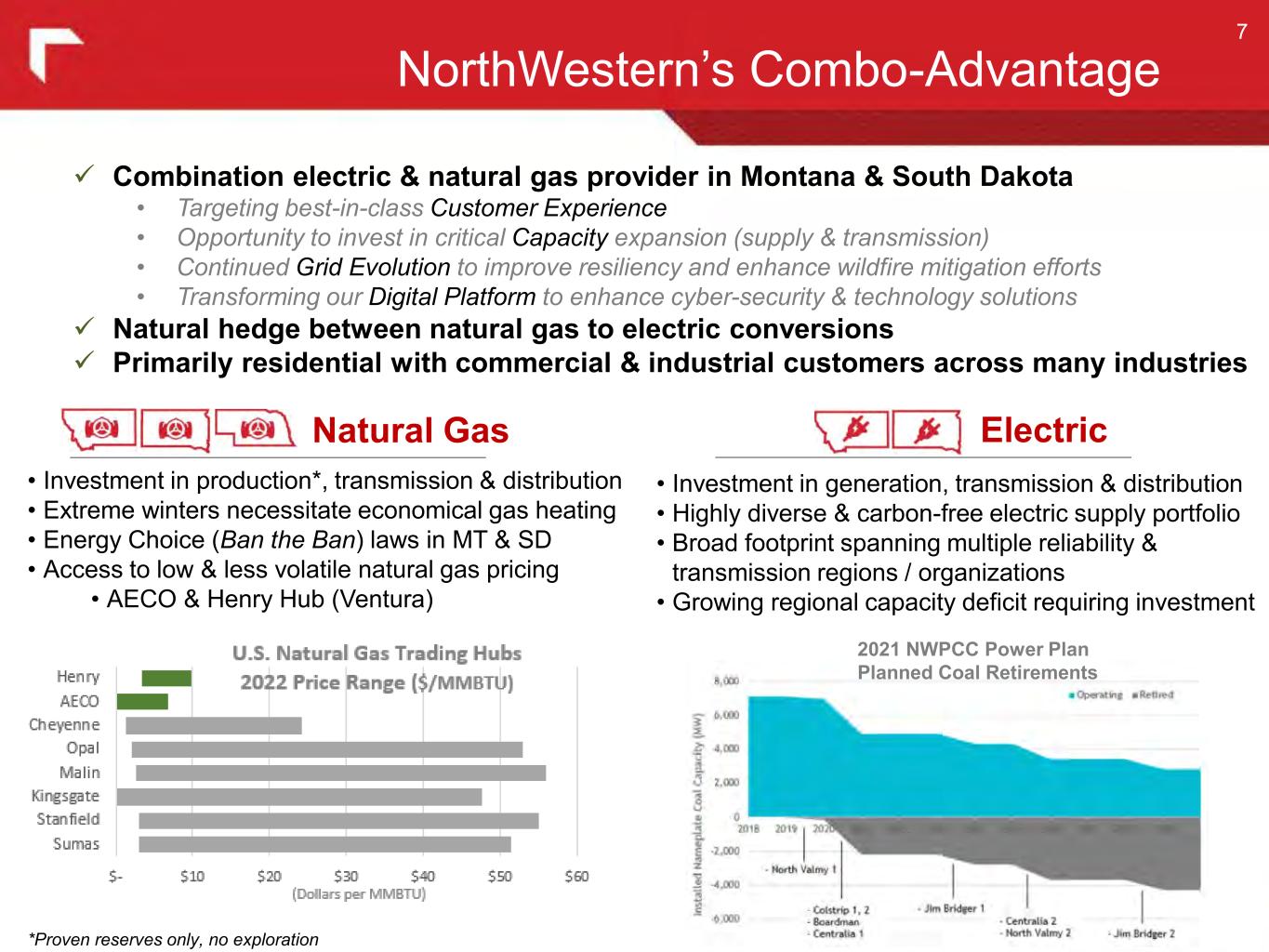

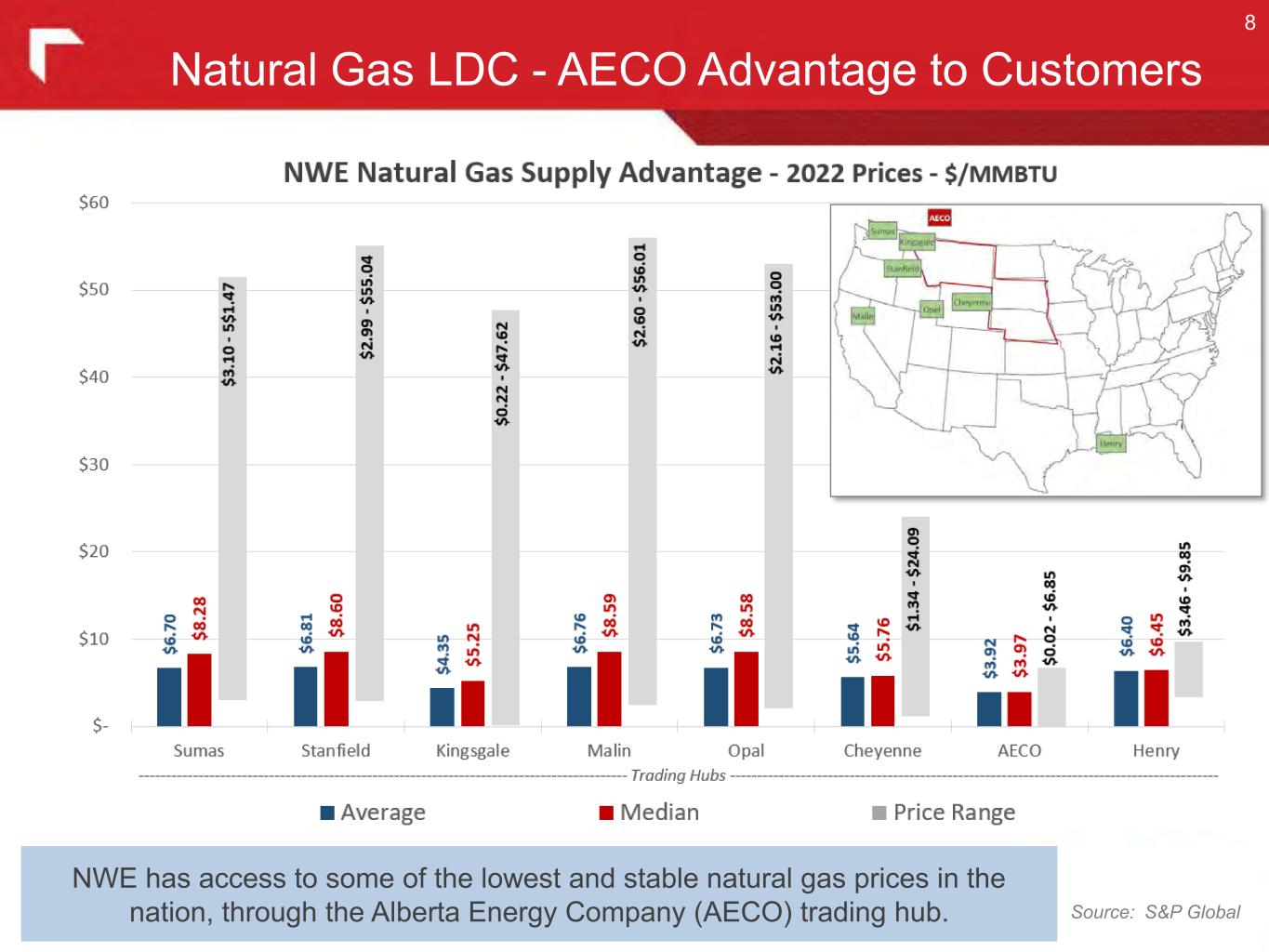

Combination electric & natural gas provider in Montana & South Dakota • Targeting best-in-class Customer Experience • Opportunity to invest in critical Capacity expansion (supply & transmission) • Continued Grid Evolution to improve resiliency and enhance wildfire mitigation efforts • Transforming our Digital Platform to enhance cyber-security & technology solutions Natural hedge between natural gas to electric conversions Primarily residential with commercial & industrial customers across many industries NorthWestern’s Combo-Advantage 7 • Investment in production*, transmission & distribution • Extreme winters necessitate economical gas heating • Energy Choice (Ban the Ban) laws in MT & SD • Access to low & less volatile natural gas pricing • AECO & Henry Hub (Ventura) *Proven reserves only, no exploration • Investment in generation, transmission & distribution • Highly diverse & carbon-free electric supply portfolio • Broad footprint spanning multiple reliability & transmission regions / organizations • Growing regional capacity deficit requiring investment ElectricNatural Gas 2021 NWPCC Power Plan Planned Coal Retirements

Natural Gas LDC - AECO Advantage to Customers 8 NWE has access to some of the lowest and stable natural gas prices in the nation, through the Alberta Energy Company (AECO) trading hub. Source: S&P Global

Montana Enhanced Wildfire Mitigation Plan 9 Reduction of Ignition Potential System and Environmental Monitoring Enhanced Vegetation Maintenance Enriched Public Communication and Outreach Filed in August 2022 with Montana general rate review Approved settlement provides for deferral of fire mitigation operating expense of up to approximately $95 million over a five- year period for future recovery Key elements of the plan, driven by risk analysis include: Situational Awareness Operational Practice System Preparedness Vegetation Management Public Communication Our operational practice includes situationally performing power shutdowns and adjusting system operating protocols during periods of heightened wildfire risk. Power shutdown considerations include environmental conditions, system performance and mitigating any potential impacts of an outage to customers and emergency services.

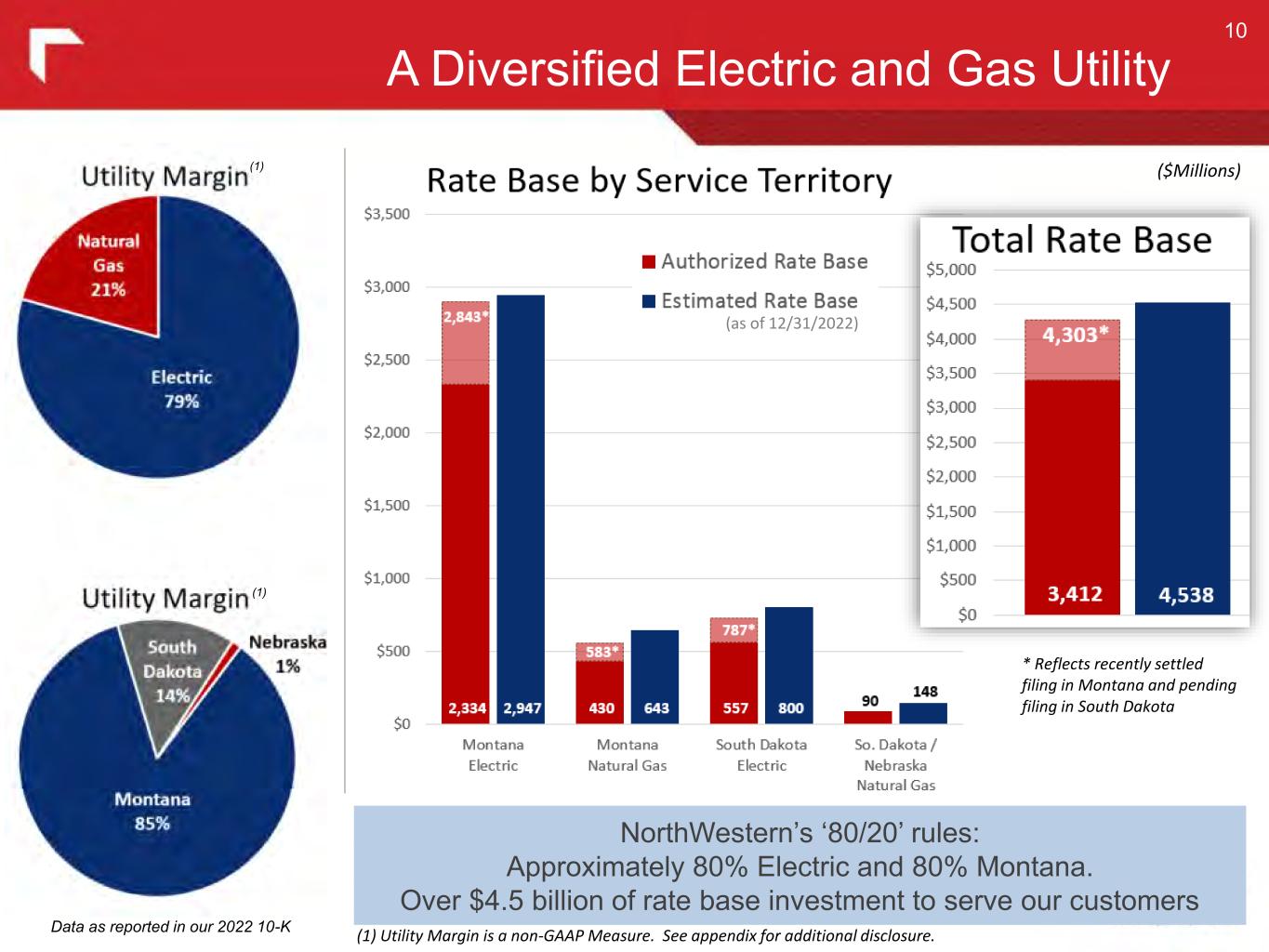

A Diversified Electric and Gas Utility 10 NorthWestern’s ‘80/20’ rules: Approximately 80% Electric and 80% Montana. Over $4.5 billion of rate base investment to serve our customers Data as reported in our 2022 10-K (1) Utility Margin is a non-GAAP Measure. See appendix for additional disclosure. (1) (1) * Reflects recently settled filing in Montana and pending filing in South Dakota ($Millions) (as of 12/31/2022)

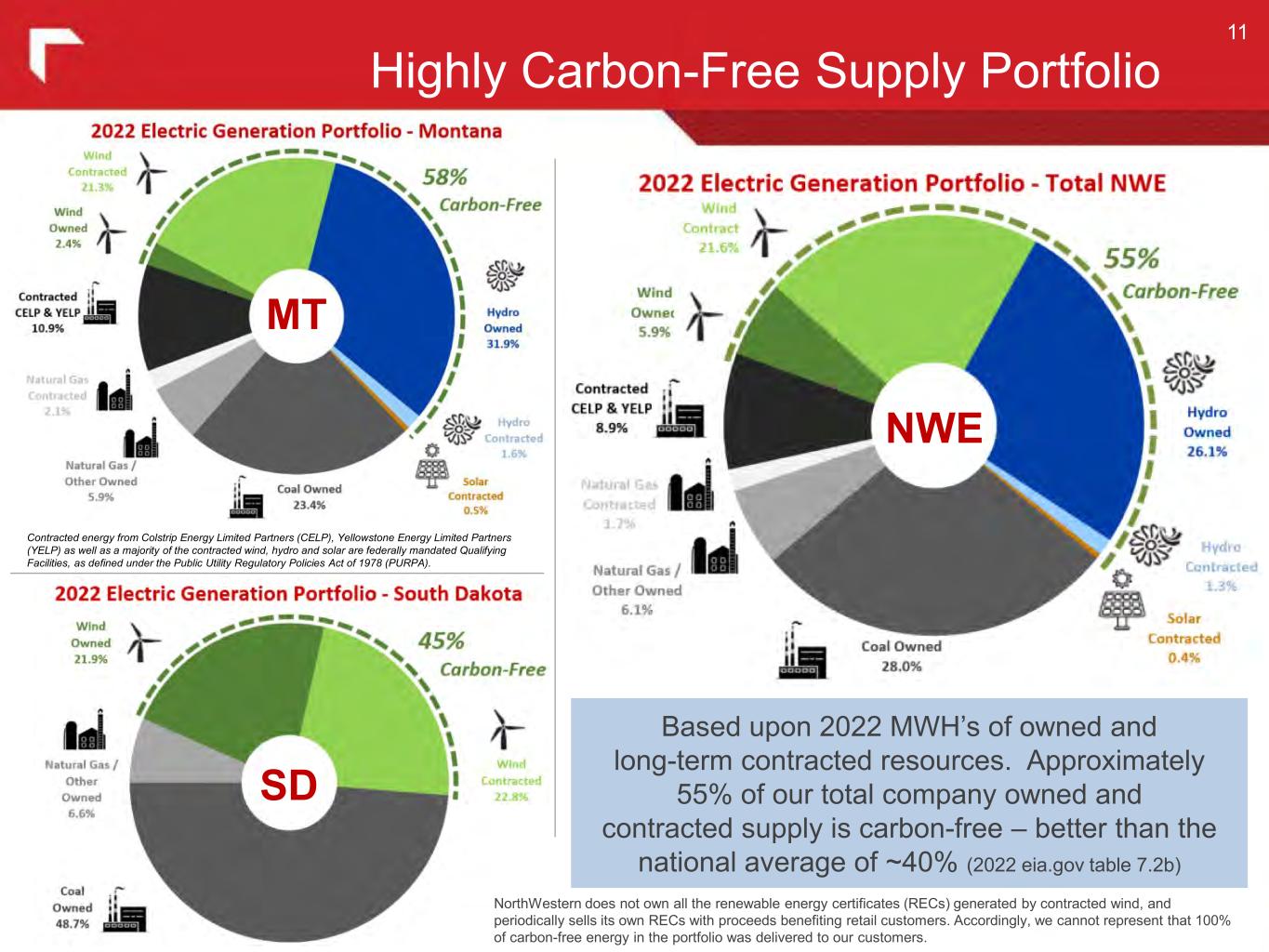

11 Highly Carbon-Free Supply Portfolio Based upon 2022 MWH’s of owned and long-term contracted resources. Approximately 55% of our total company owned and contracted supply is carbon-free – better than the national average of ~40% (2022 eia.gov table 7.2b) NorthWestern does not own all the renewable energy certificates (RECs) generated by contracted wind, and periodically sells its own RECs with proceeds benefiting retail customers. Accordingly, we cannot represent that 100% of carbon-free energy in the portfolio was delivered to our customers. Contracted energy from Colstrip Energy Limited Partners (CELP), Yellowstone Energy Limited Partners (YELP) as well as a majority of the contracted wind, hydro and solar are federally mandated Qualifying Facilities, as defined under the Public Utility Regulatory Policies Act of 1978 (PURPA). MT SD NWE

Strong Utility Foundation 12 Solid and generally improving JD Power Overall Customer Satisfaction Scores Residential electric and natural gas rates below national average * Solid electric system reliability Better than average natural gas leaks per mile * NE bills temporarily impacted by ongoing recovery of the February 2021 prolonged cold weather event that resulted in extreme price excursion for purchased power and natural gas.

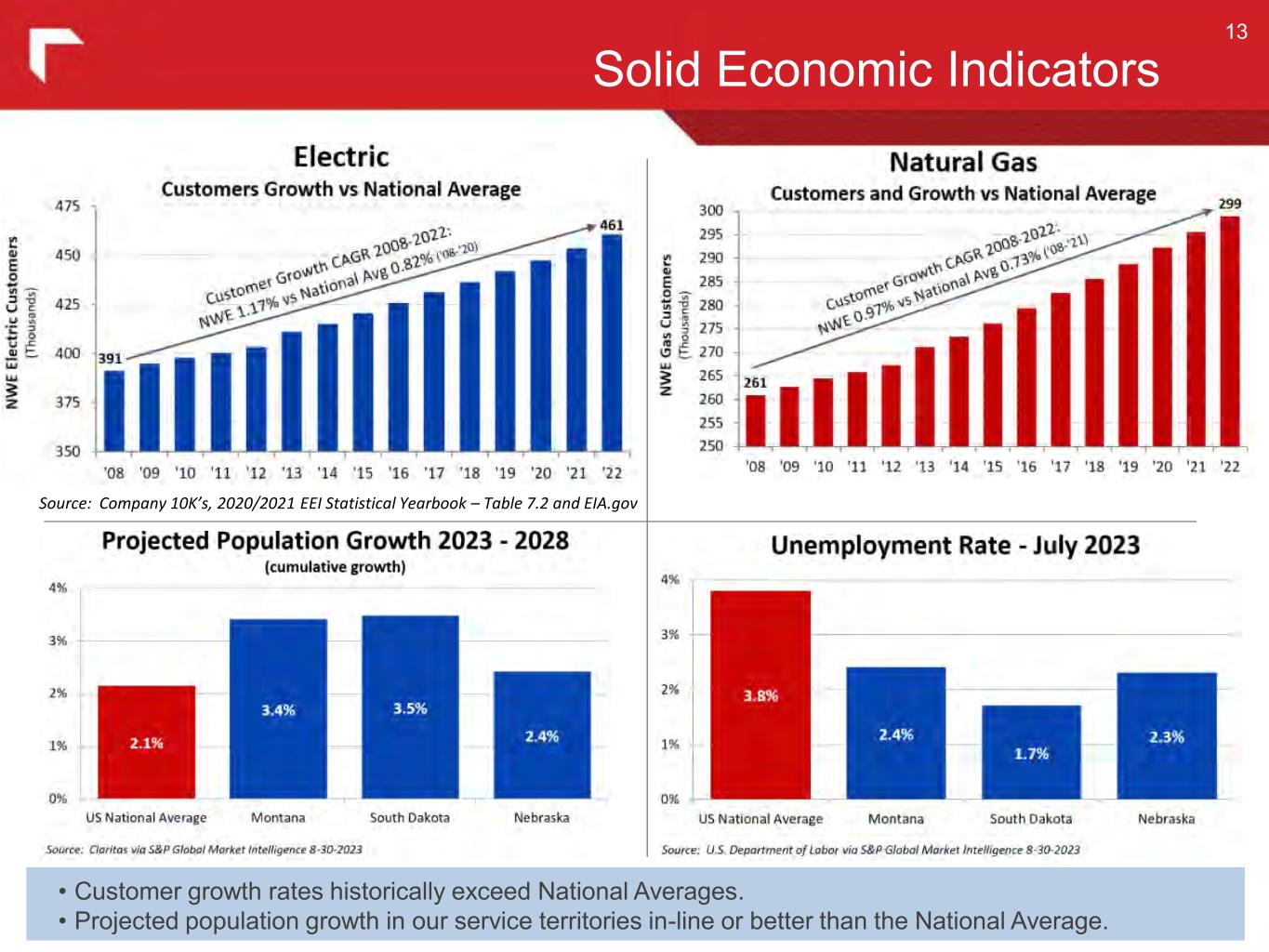

Solid Economic Indicators 13 • Customer growth rates historically exceed National Averages. • Projected population growth in our service territories in-line or better than the National Average. Source: NorthWestern customer growth - 2008-2016 Forms 10-K Unemployment Rate: US Department of Labor via SNL Database 2/21/17 Electric: EEI Statistical Yearbook (published December 2015, table 7.2) Natural Gas: EIA.gov (Data table "Number of Natural Gas Consumers") Source: Company 10K’s, 2020/2021 EEI Statistical Yearbook – Table 7.2 and EIA.gov

Corporate Sustainability 14 Environmental Social Governance These eight publications provide valuable insight into NorthWestern Energy’s Environmental, Social and Governance (ESG) Sustainability practices. Sustainability Report includes Sustainability Accounting Standards Board (SASB) and Task Force on Climate-Related Financial Disclosures (TCFD) aligned reporting.

EO Best Practices Governance 15 America’s Most Responsible Companies Recognized by Newsweek as one of the most responsible companies in 2023. One of only eleven EEI member utilities selected. Board of Directors Executive Team5th Best Score Among 50 Publicly Traded North American Utility and Power Companies by Moody’s Investment Services for Best Governance Practices Diverse Leadership 2022 CEO Pay Ratio to Average Employee Salary NWE 26:1 U.S. Utilities 12 Member Peer Average Group Average 66:1 40:1 Performance- Based Pay to Peers 76% Recent Governance Recognition America’s Greatest Workplaces Recognized by Newsweek as one of America’s greatest workplaces in 2023. 20 / 20 – Women on Boards Recognized for gender diversity on its board of directors by 2022 Women on Boards. Currently four of the company’s ten directors are female. Edison Electric Institute Emergency Response Award recipient Recognized for our restoration response for both the May 2022 derecho in South Dakota and the historic flooding in Montana & Yellowstone National Park in June 2022.

16 Financial & Regulatory Update

Strong Outlook & 2024 Earnings Guidance 17 This guidance range is based upon, but not limited to, the following major assumptions: • Final approval of all material aspects of the Montana general rate review settlement agreement • Constructive outcomes in our current South Dakota rate review and regulatory proceedings • Normal weather in our service territories • An effective income tax rate of approximately 4%-5% for 2023 and 12%-14% for 2024; and • Diluted average shares outstanding of approximately 60.4 million in 2023 and 61.3 million in 2024. Non-GAAP EPS guidance 2023: $3.00 - $3.10 2024: $3.42 - $3.62 Long-term (5 Year) expected growth rates • EPS growth of 4% to 6% (from 3% to 6%) from 2022 base year of $3.18 Non-GAAP • Rate base growth of 4% - 6% (from 4% to 5%) from 2022 base year $4.54 billion. • Continued focus on earned returns driven by financial and operational execution No equity expected to fund the current 5-year capital plan • $510 million capital plan for 2023 on target • $2.4 billion infrastructure investment plan for ‘23–’27 sized to be self-funded • Any equity needs would be driven by opportunities incremental to the plan Targeting FFO > 14% by end of 2024 and beyond Annual dividend growth expected to be below earnings growth until we return to a payout ratio within our targeted 60% to 70%

Earnings Bridge to 2024 18 This guidance range is based upon, but not limited to, the following major assumptions: • Final approval of all material aspects of the Montana general rate review settlement agreement • Constructive outcomes in our current South Dakota rate review and regulatory proceedings • Normal weather in our service territories • An effective income tax rate of approximately 4%-5% for 2023 and 12%- 14% for 2024; and • Diluted average shares outstanding of approximately 60.4 million in 2023 and 61.3 million in 2024. See Detailed Earnings Bridge to 2024 slide in the Appendix for additional information

Disciplined Electric O&M Program 19 Source: FERC Form 1 Reports - 2022 expenses and company filings through S&P Global IQ Electric Non-Fuel O&M excludes fuel and steam costs for power generation, water costs for hydro operations and purchased power cost unless identified in company disclosures, electric employees are allocated by electric rate base weighting to total rate base Per Customer… Per Employee… Per Rate Base… NorthWestern has best-in-class expense efficiency among our regional peers.

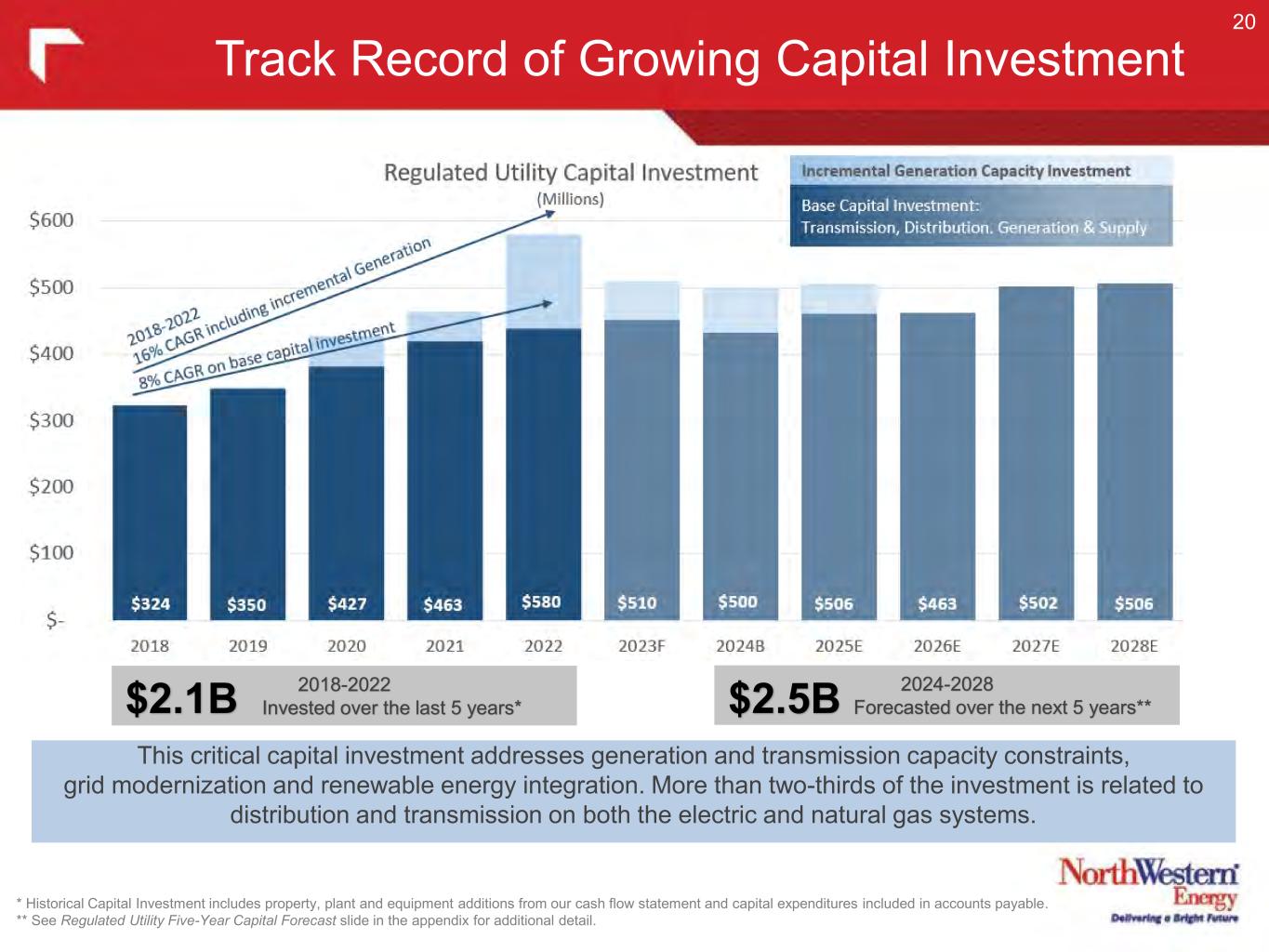

Track Record of Growing Capital Investment 2018-2022 Invested over the last 5 years* * Historical Capital Investment includes property, plant and equipment additions from our cash flow statement and capital expenditures included in accounts payable. ** See Regulated Utility Five-Year Capital Forecast slide in the appendix for additional detail. 20 This critical capital investment addresses generation and transmission capacity constraints, grid modernization and renewable energy integration. More than two-thirds of the investment is related to distribution and transmission on both the electric and natural gas systems. 2024-2028 Forecasted over the next 5 years**$2.1B $2.5B

Highly Executable Pipeline of Capital Investment 21 Nearly $2.5 billion of low-risk capital investment forecasted over the next five years is expected to drive annualized rate base growth of approximately 4% - 6%. We expect to finance this capital with a combination of cash flows from operations and first mortgage bonds (equity funding is not anticipated). Financing plans are subject to change and intended to protect our current credit ratings (targeting a 14%-15% FFO to Debt ratio). Capital Opportunities not currently included in the Projections FERC Transmission Incremental generating capacity (subject to successful resource procurement bids) Qualifying Facility and / or Power Purchase Agreement buyouts Electrification supporting economic development

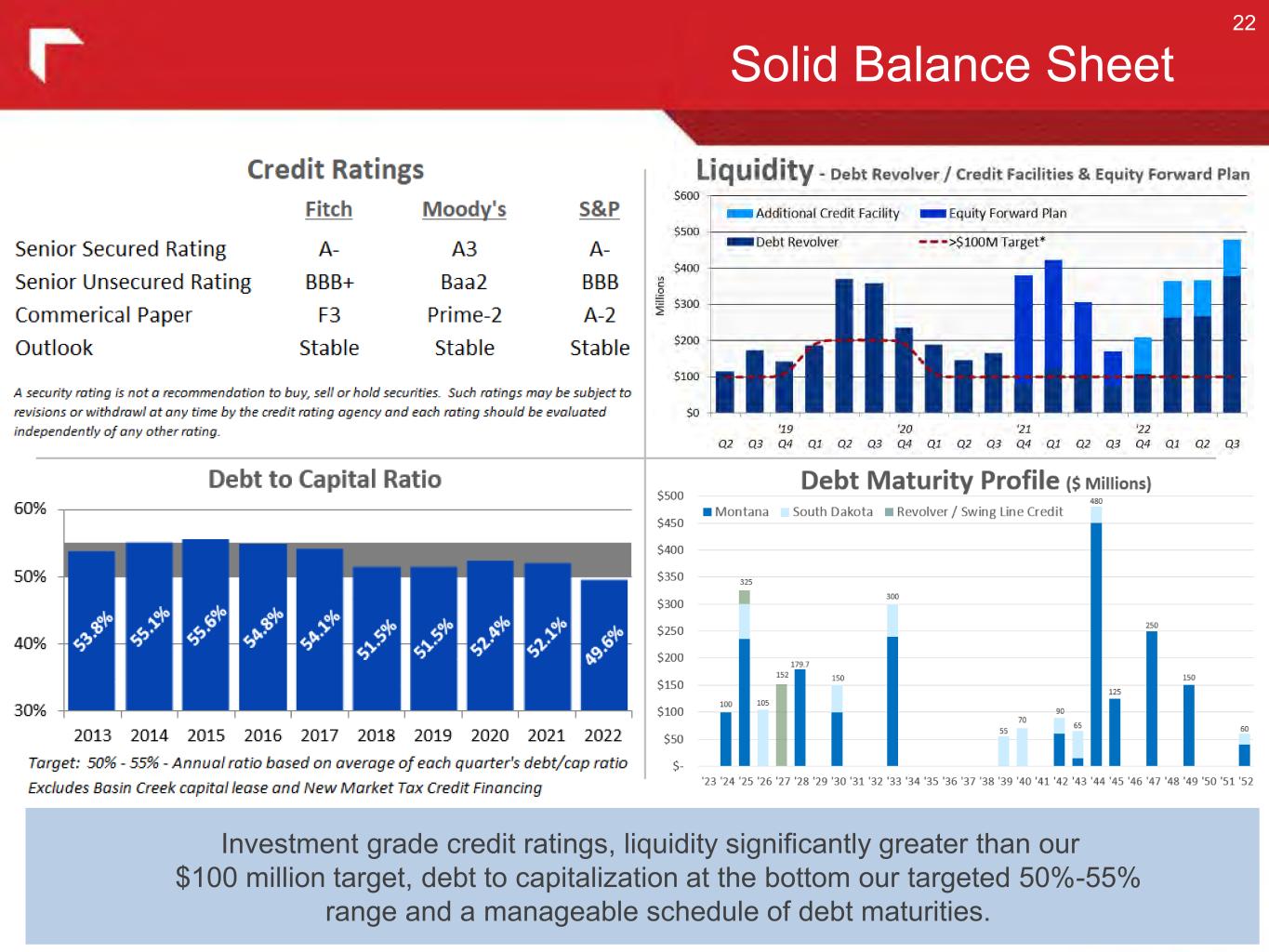

Solid Balance Sheet 22 Investment grade credit ratings, liquidity significantly greater than our $100 million target, debt to capitalization at the bottom our targeted 50%-55% range and a manageable schedule of debt maturities.

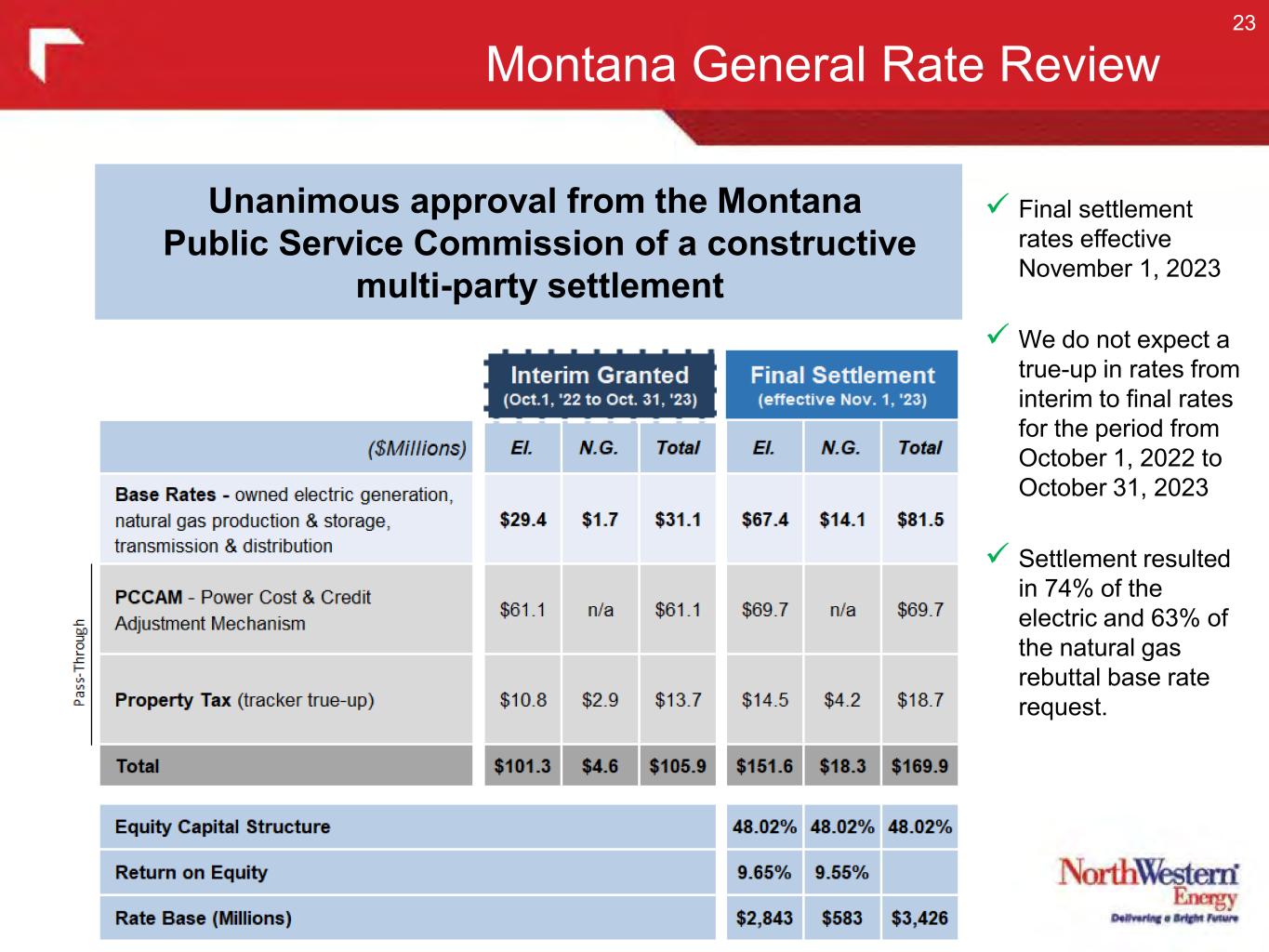

Final settlement rates effective November 1, 2023 We do not expect a true-up in rates from interim to final rates for the period from October 1, 2022 to October 31, 2023 Settlement resulted in 74% of the electric and 63% of the natural gas rebuttal base rate request. Montana General Rate Review 23 Unanimous approval from the Montana Public Service Commission of a constructive multi-party settlement

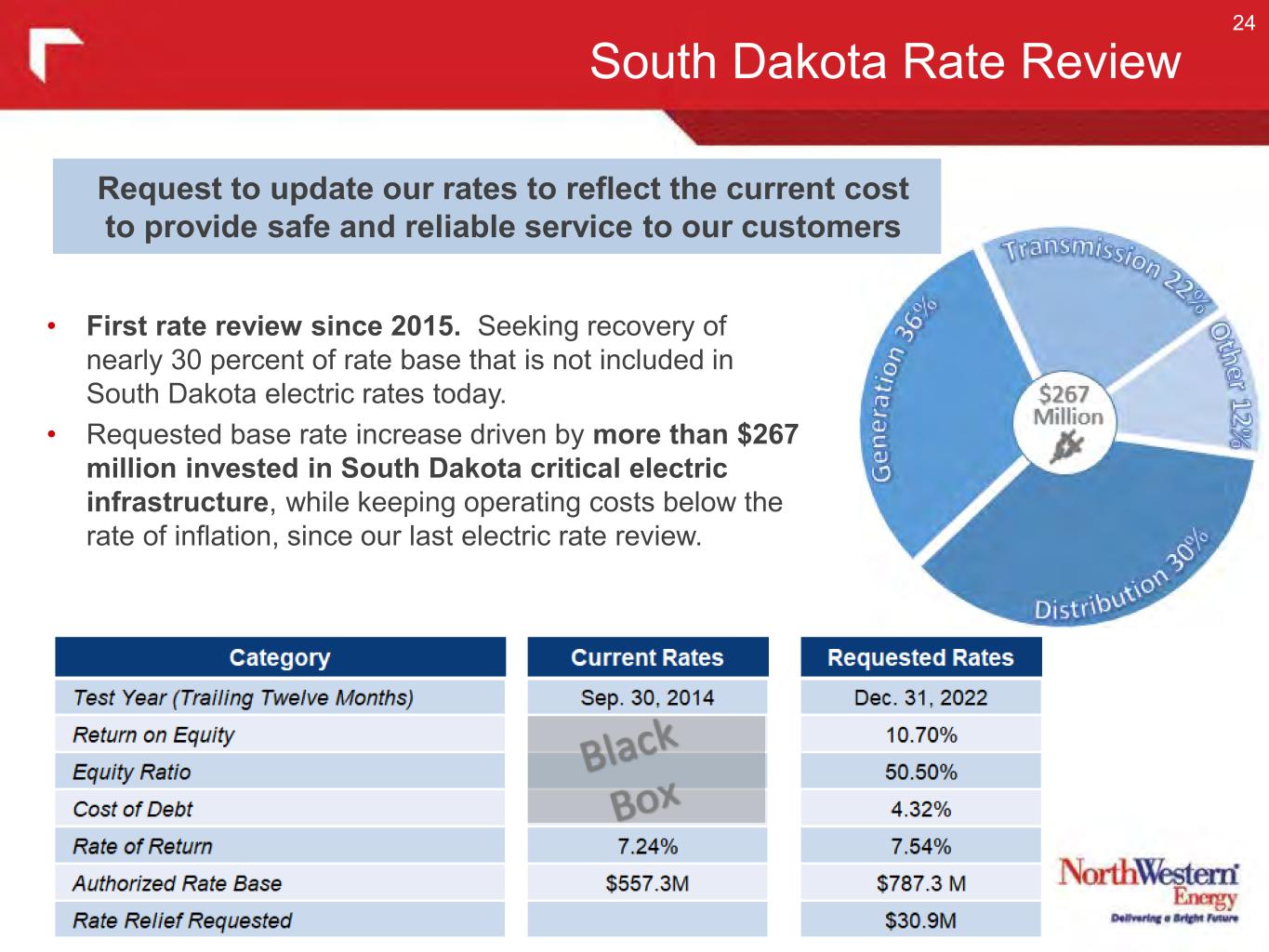

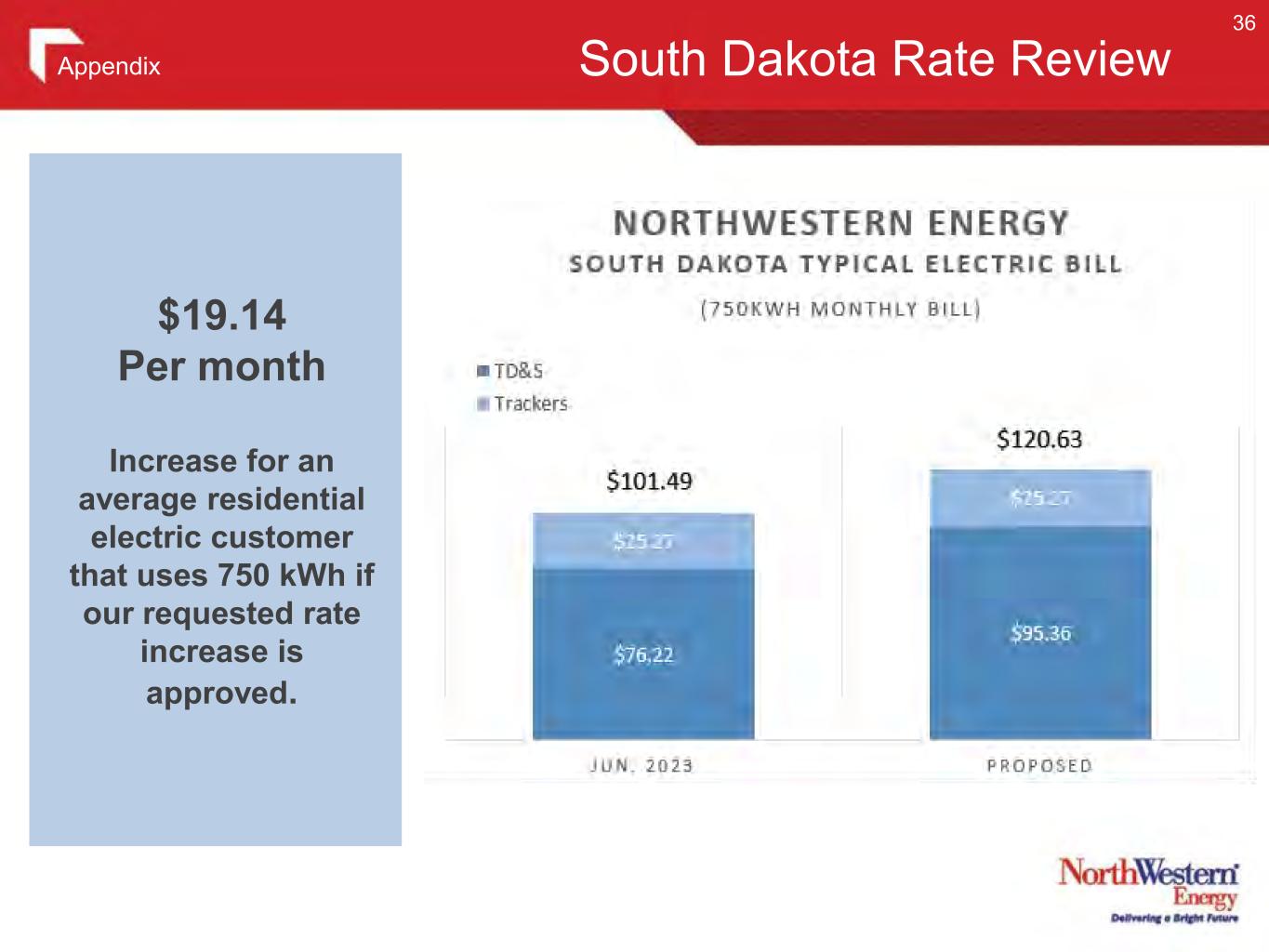

South Dakota Rate Review 24 • First rate review since 2015. Seeking recovery of nearly 30 percent of rate base that is not included in South Dakota electric rates today. • Requested base rate increase driven by more than $267 million invested in South Dakota critical electric infrastructure, while keeping operating costs below the rate of inflation, since our last electric rate review. Request to update our rates to reflect the current cost to provide safe and reliable service to our customers

South Dakota Rate Review 25 Infrastructure investment drives nearly 99%* of the requested base rate adjustment * $19.0 million Cost of Capital plus $17.2 million Infrastructure Investment as a percent of $36.6 million Total Change in Cost of Service.

Holding Company Reorganization 26

Supply Update 27 Montana: • 175 MW Yellowstone County Generating Station Construction began in April 2022 with costs of approximately $275 million with $217.5 million invested to date (thru 9/30/23). Current schedule anticipates commercial operation during third quarter 2024* • Anticipated acquisition of 222 MW of Colstrip capacity from Avista on 12/31/2025 for $0 transfer price. Integrated Resource Plans South Dakota: Filed in September 2022, the plan identifies 43 megawatts as retire and replace candidates. Montana: Filed in April 2023, the plan evaluates alternatives to reliably and affordably meet customer needs over a 20 year horizon. With the anticipated addition of YCGS and Avista’s transfer of Colstrip, the plan anticipates resource adequacy into 2029. The recently completed 58-megawatt Bob Glanzer Generating Station in Huron, South Dakota, provides on-demand resources to support the variability of wind and solar projects coming onto our system and the grid in our region and help serve our customers during extended periods of peak demand. * On October 21, 2021, the Montana Environmental Information Center (MEIC) and the Sierra Club filed a lawsuit in Montana State Court, against the Montana Department of Environmental Quality (MDEQ) and NorthWestern, alleging that the environmental analysis conducted by MDEQ prior to issuance of the Yellowstone County Generating Station's air quality construction permit was inadequate. The Montana District Court judge held oral argument on June 20, 2022. On April 4, 2023, the Montana District Court issued an order finding MDEQ's environmental analysis was deficient in not addressing exterior lighting and greenhouse gases. The Court remanded it back to MDEQ to address the deficiencies and vacated the air quality permit pending that remand. As a result of the vacatur of the permit, we were required to stop construction. On April 14, 2023, following entry of final judgment, we filed a Motion to Stay the order vacating the air quality permit pending appeal. On April 17, 2023, we filed a notice of appeal with the Montana Supreme Court. On June 8, 2023 the Montana District Court Judge issued a Stay Pending Appeal allowing construction to resume. This lawsuit, as well as additional legal challenges related to the Yellowstone County Generating Station, could delay the project timing and increase costs. At this time, we still expect the plan to be operational in the second half of 2024.

Conclusion 28 Pure Electric & Gas Utility Solid Utility Foundation Best Practices Corporate Governance Attractive Future Growth Prospects Improving Earnings & Cash Flows (rate reviews pending)

29

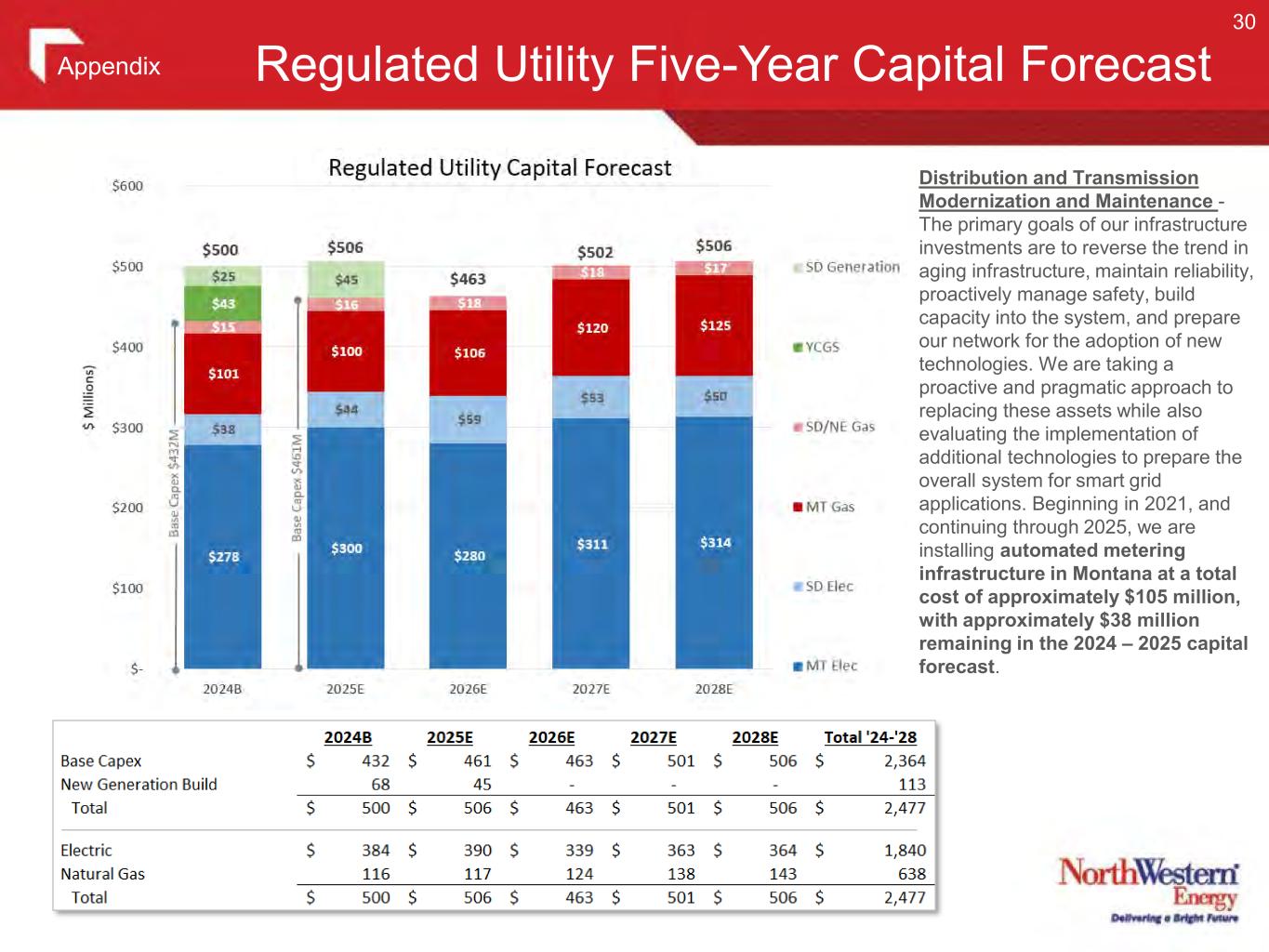

Regulated Utility Five-Year Capital Forecast 30 Distribution and Transmission Modernization and Maintenance - The primary goals of our infrastructure investments are to reverse the trend in aging infrastructure, maintain reliability, proactively manage safety, build capacity into the system, and prepare our network for the adoption of new technologies. We are taking a proactive and pragmatic approach to replacing these assets while also evaluating the implementation of additional technologies to prepare the overall system for smart grid applications. Beginning in 2021, and continuing through 2025, we are installing automated metering infrastructure in Montana at a total cost of approximately $105 million, with approximately $38 million remaining in the 2024 – 2025 capital forecast. Appendix

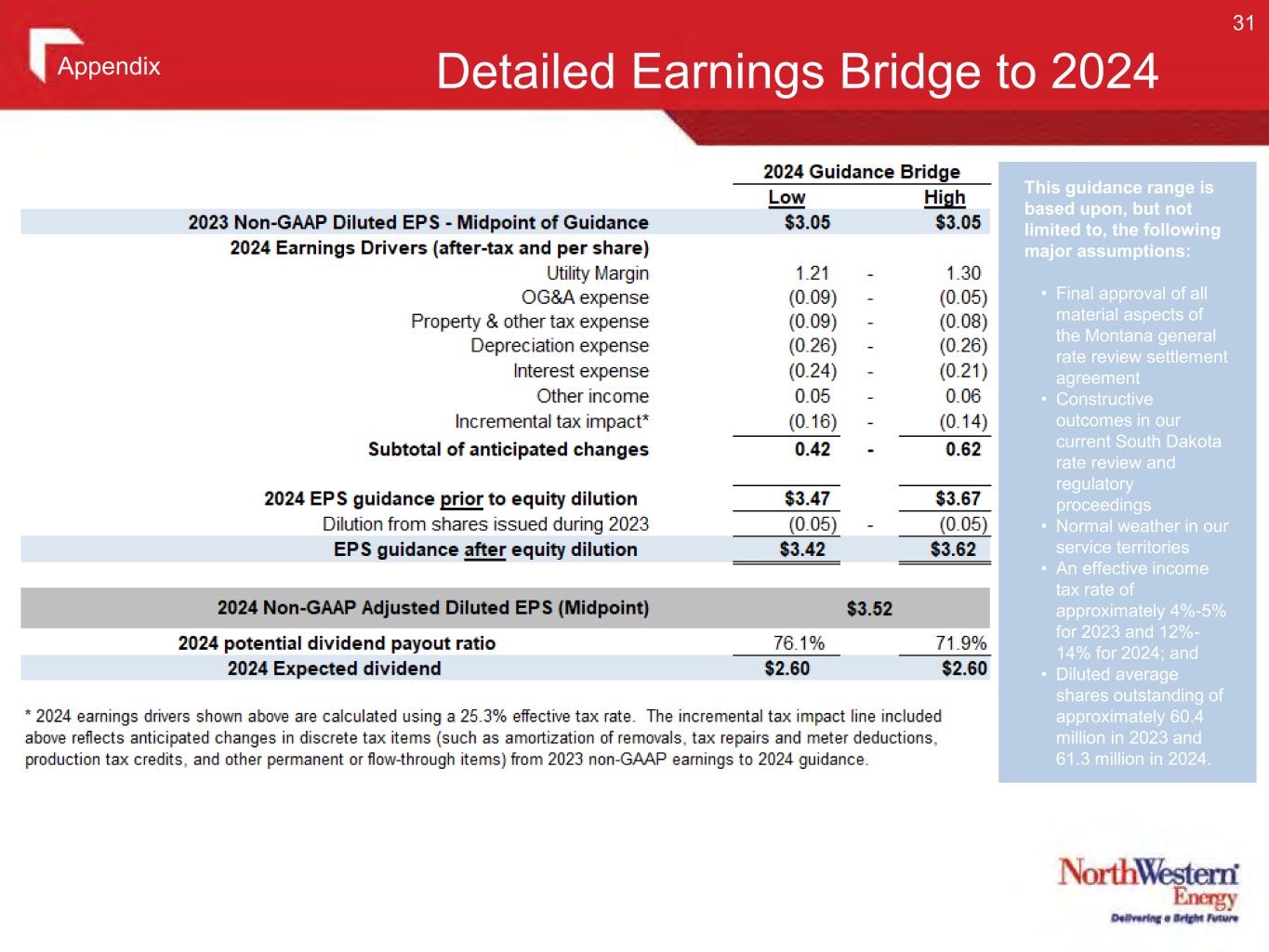

Detailed Earnings Bridge to 2024 31 This guidance range is based upon, but not limited to, the following major assumptions: • Final approval of all material aspects of the Montana general rate review settlement agreement • Constructive outcomes in our current South Dakota rate review and regulatory proceedings • Normal weather in our service territories • An effective income tax rate of approximately 4%-5% for 2023 and 12%- 14% for 2024; and • Diluted average shares outstanding of approximately 60.4 million in 2023 and 61.3 million in 2024. Appendix

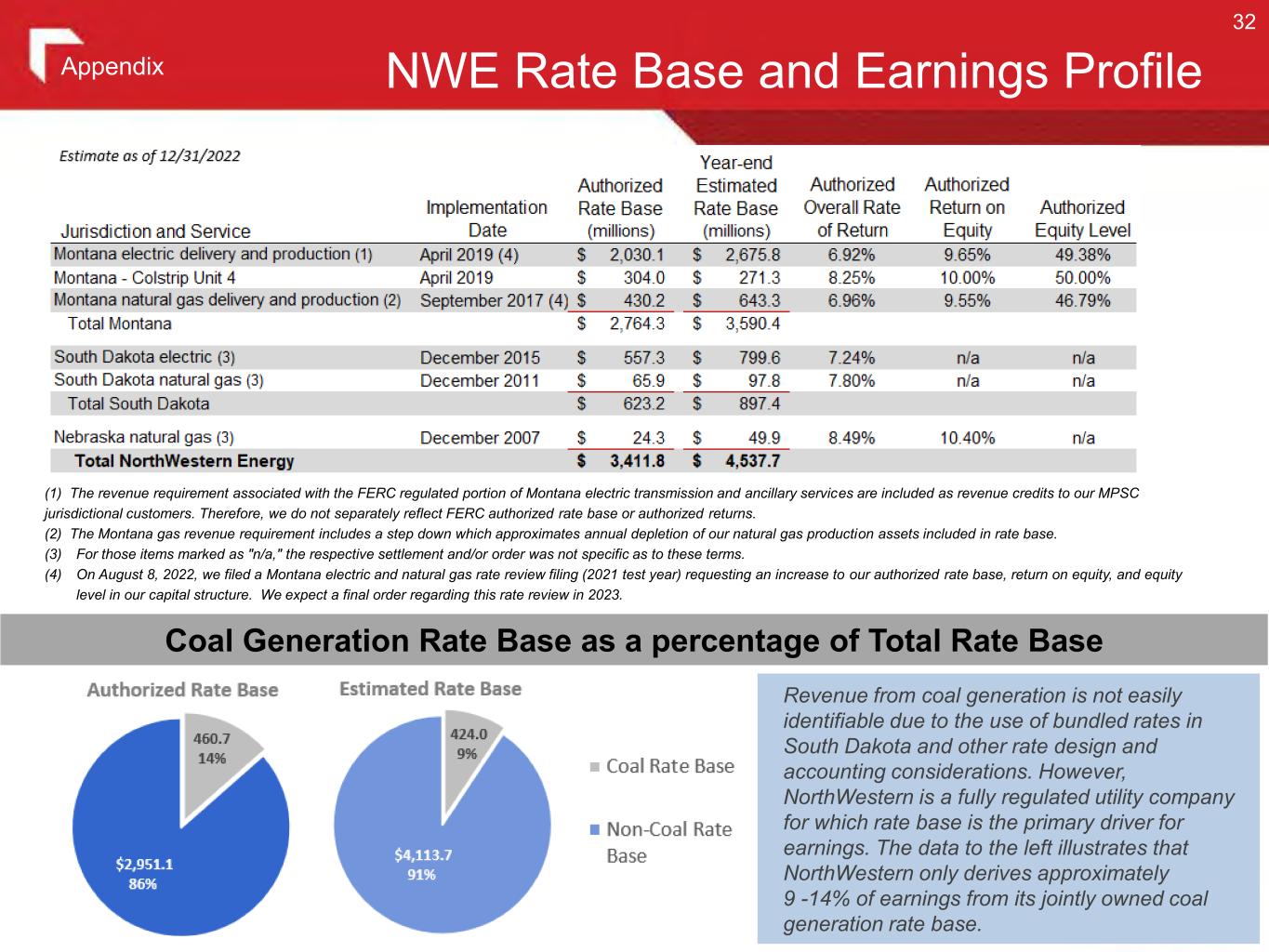

NWE Rate Base and Earnings Profile Coal Generation Rate Base as a percentage of Total Rate Base (1) The revenue requirement associated with the FERC regulated portion of Montana electric transmission and ancillary services are included as revenue credits to our MPSC jurisdictional customers. Therefore, we do not separately reflect FERC authorized rate base or authorized returns. (2) The Montana gas revenue requirement includes a step down which approximates annual depletion of our natural gas production assets included in rate base. (3) For those items marked as "n/a," the respective settlement and/or order was not specific as to these terms. (4) On August 8, 2022, we filed a Montana electric and natural gas rate review filing (2021 test year) requesting an increase to our authorized rate base, return on equity, and equity level in our capital structure. We expect a final order regarding this rate review in 2023. Revenue from coal generation is not easily identifiable due to the use of bundled rates in South Dakota and other rate design and accounting considerations. However, NorthWestern is a fully regulated utility company for which rate base is the primary driver for earnings. The data to the left illustrates that NorthWestern only derives approximately 9 -14% of earnings from its jointly owned coal generation rate base. 32 Appendix

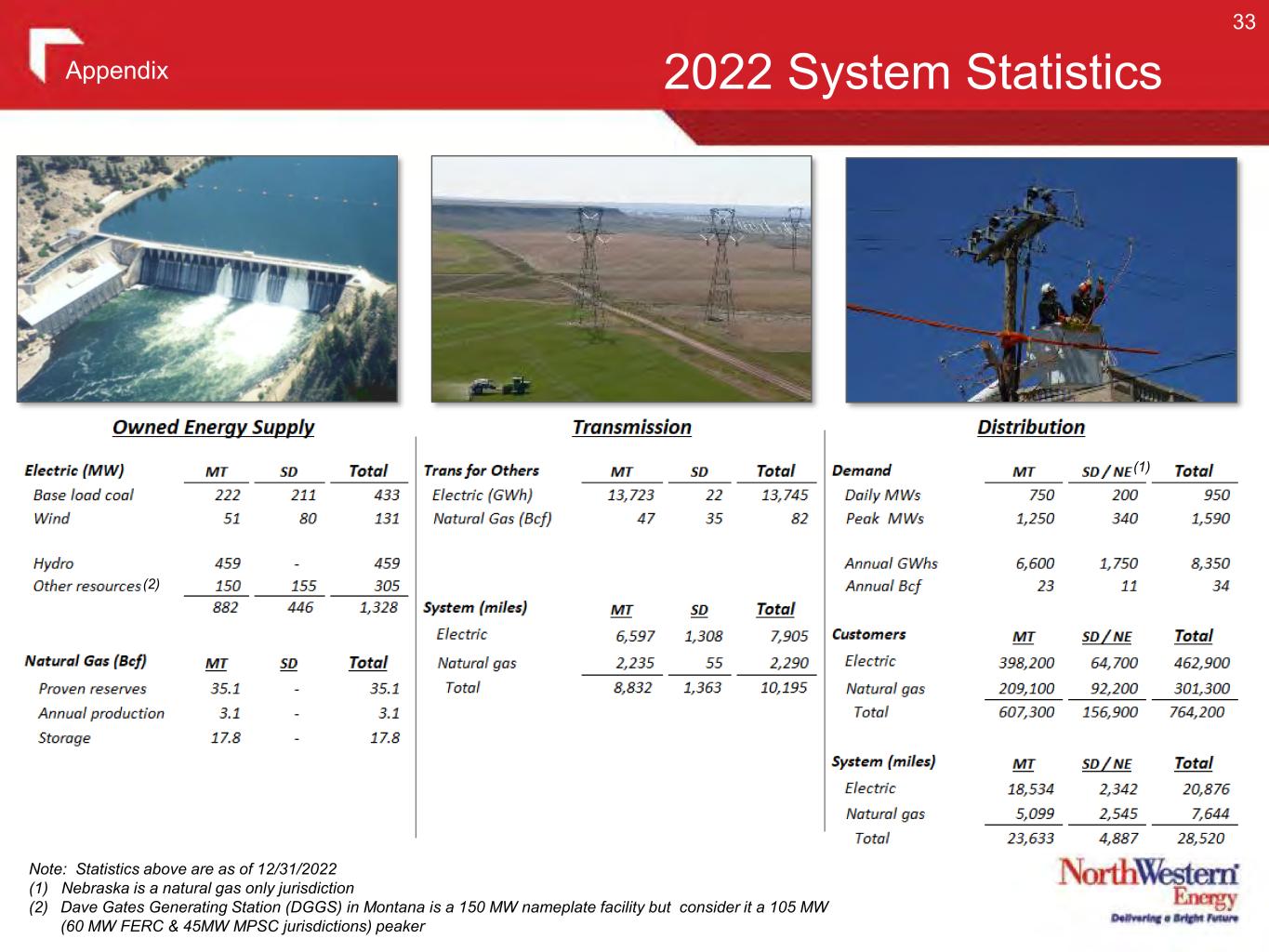

2022 System Statistics Note: Statistics above are as of 12/31/2022 (1) Nebraska is a natural gas only jurisdiction (2) Dave Gates Generating Station (DGGS) in Montana is a 150 MW nameplate facility but consider it a 105 MW (60 MW FERC & 45MW MPSC jurisdictions) peaker (1) (2) 33 Appendix

Transmission System Update 34 Electric Transmission: • In June 2021, we joined the Western Energy Imbalance Market (WEIM). This real-time, within-hour energy market will provide the company’s Montana customers with economically efficient energy to resolve imbalances and variations in load and generation on our Montana system. • Continue planned retirements of generating resources in Montana in conjunction with increasing demand is placing more stress on the transmission system (two record peaks in the last three seasons). As a result, we are experiencing less available transmission capacity throughout the system. • Continued investment is critical to address aging infrastructure, capacity concerns, reliability and compliance requirements. Gas Transmission: • Continued investment is critical to address aging infrastructure, capacity concerns, reliability and compliance (including the Pipeline and Hazardous Materials Safety Administration proposed rules). • Three primary factors leading to the need for additional investment to address: • Overall reliability and capacity on the gas transmission system to withstand single large contingencies and to address the decline in on-system gas production; • The need to provide additional capacity for existing gas-fired electric generation (given expected growing dependence); and • The need to serve new gas-fired capacity generation in South Dakota. Significant investment needs identified for transmission reliability, capacity and gas / electric interdependence. WEIM Participants Appendix

35 Rate Reviews Appendix

South Dakota Rate Review 36 $19.14 Per month Increase for an average residential electric customer that uses 750 kWh if our requested rate increase is approved. Appendix

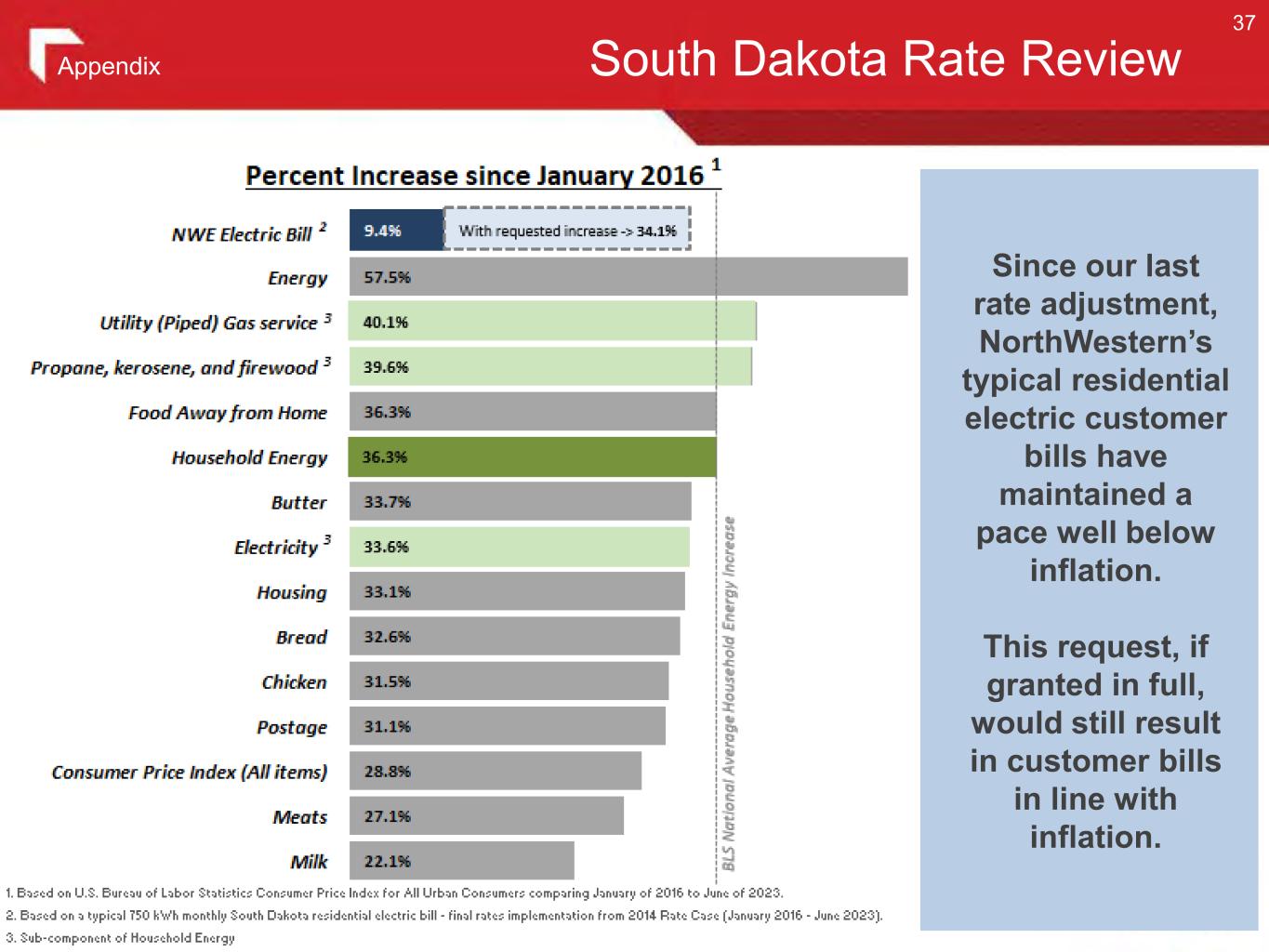

South Dakota Rate Review 37 Since our last rate adjustment, NorthWestern’s typical residential electric customer bills have maintained a pace well below inflation. This request, if granted in full, would still result in customer bills in line with inflation. Appendix

Montana Rate Review 38 Appendix Reliable, Sustainable and still Affordable service for our customers. While still significant – the resulting increase in customer bills, from current rates, amounts to pennies a day (Electric: $8.24 per month or 27 cents per day | Natural Gas $3.94 per month or 13 cents per day)

Appendix 39 Colstrip Transfer Agreement

Colstrip Transaction Overview NorthWestern Energy executed an agreement with Avista Corporation (Exit Agreement) for the transfer of Avista’s ownership interests in Colstrip Units 3 and 4. • Effective date of transfer: December 31, 2025 • Generating capacity: 222 MW (bringing our total ownership to 444 MW) • Transfer price: $0.00 • NorthWestern will be responsible for operational and capital costs beginning January 1, 2026. • The agreement does not require approval by the Montana Public Service Commission (MPSC). We expect to work with the MPSC in a future docket for cost recovery in 2026. • NorthWestern will have the right to exercise Avista’s vote with respect to capital expenditures1 between now and 2025 with Avista responsible for its pro rata share2. • Avista will retain its existing environmental and decommissioning obligations through life of plant. • Under the Colstrip Ownership & Operating Agreement, each of the owners will have a 90-day period in which to evaluate the transaction between NorthWestern and Avista to determine whether to exercise their respective right of first refusal. • We expect to file our Montana Integrated Resource Plan during the first quarter 2023. This transaction is expected to satisfy our capacity needs in Montana for at least the next 5 years. 1. Avista retains the vote related to remediation activities. 2. Avista bears its current project share (15%) costs through 2025, other than “Enhancement Work Costs” for which it bears a time-based pro-rata share. Enhancement Work Costs are costs that are not performed on a least-costs basis or are intended to extend the life of the facility beyond 2025. See the Exit Agreement for additional detail. 40 Appendix

Colstrip Transfer 41 Reliable Existing resource, ready to serve our Montana customers. Avoids lengthy planning, permitting and construction of a new facility that would stretch in-service beyond 2026. Reduces reliance on imported power and volatile markets, providing increased energy independence. In-state and on-system asset mitigating the transmission constraints we experience importing capacity. Adds critical long-duration, 24/7 on-demand generation necessary for balancing our existing portfolio. Affordable 222 MW of capacity with no upfront capital costs and stable operating costs going forward. o Equivalent new build would cost in excess of $500 million. o Incremental operating costs are known and reasonable. Resulting variable generation costs represent a 90%+ discount to market prices incurred during December’s polar vortex. In addition to no upfront capital, low and stably priced mine-mouth coal supply costs. Sustainable We remain committed to our net zero goal by 2050. This additional capacity, with a remaining life of up to 20 years, helps bridge the interim gap and will likely lead to less carbon post 2040. Yellowstone County Generating Station is potentially our last natural gas resource addition in Montana. Partners are committed to evaluate non-carbon long-duration alternative resources for the site. Keeps the existing plant open and retains its highly skilled jobs vital to the Colstrip community. Protects existing ownership interests with an ultimate goal of majority ownership of Unit 4. NorthWestern Energy executed an agreement with Avista Corporation for the transfer of Avista’s ownership interests in Colstrip Units 3 & 4. • Effective date of transfer: 12/31/2025 • Generating capacity: 222 MW • Transfer price: $0.00 Appendix

Why Colstrip? Reduces Risk We are in a supply capacity crisis due to lack of resource adequacy, with approx. 40% of our customers’ peak needs on the market. This transaction will reduce our need to import expensive capacity during critical times. Establishes clarity regarding operations past 2025 Washington state legislation deadline. Reduces PCCAM risk sharing for customers and shareholders. Bill Headroom Stable pricing reduces impact of market volatility and high energy prices on customers. Aligned with ‘All of the Above’ energy transition in Montana Supports our generating portfolio that is nearly 60% carbon-free today. Provides future opportunity at the site while supporting economic development in Montana. Agreement considers the appropriate balance of reliability, affordability and sustainability. 42 Appendix

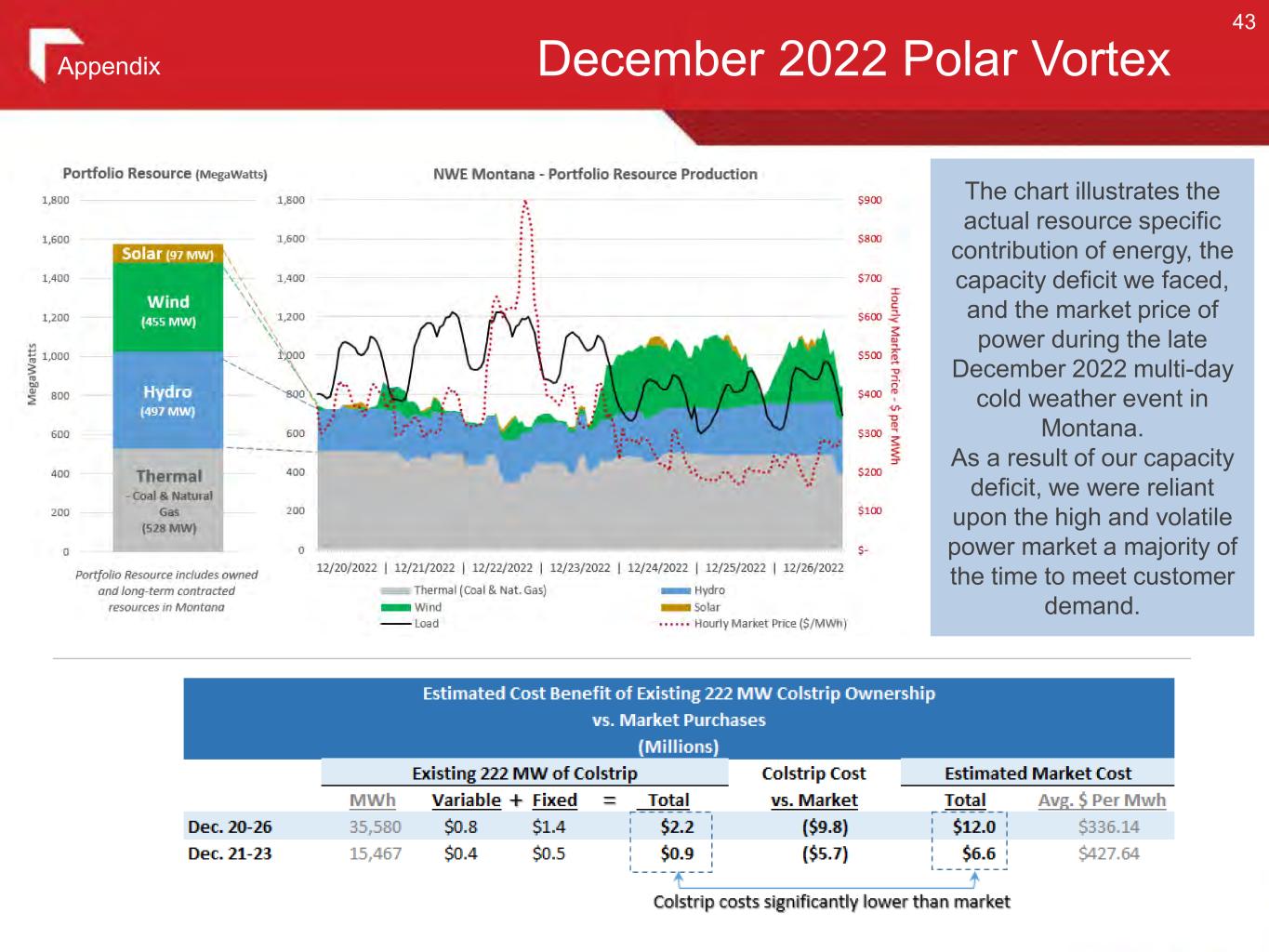

December 2022 Polar Vortex 43 The chart illustrates the actual resource specific contribution of energy, the capacity deficit we faced, and the market price of power during the late December 2022 multi-day cold weather event in Montana. As a result of our capacity deficit, we were reliant upon the high and volatile power market a majority of the time to meet customer demand. Appendix

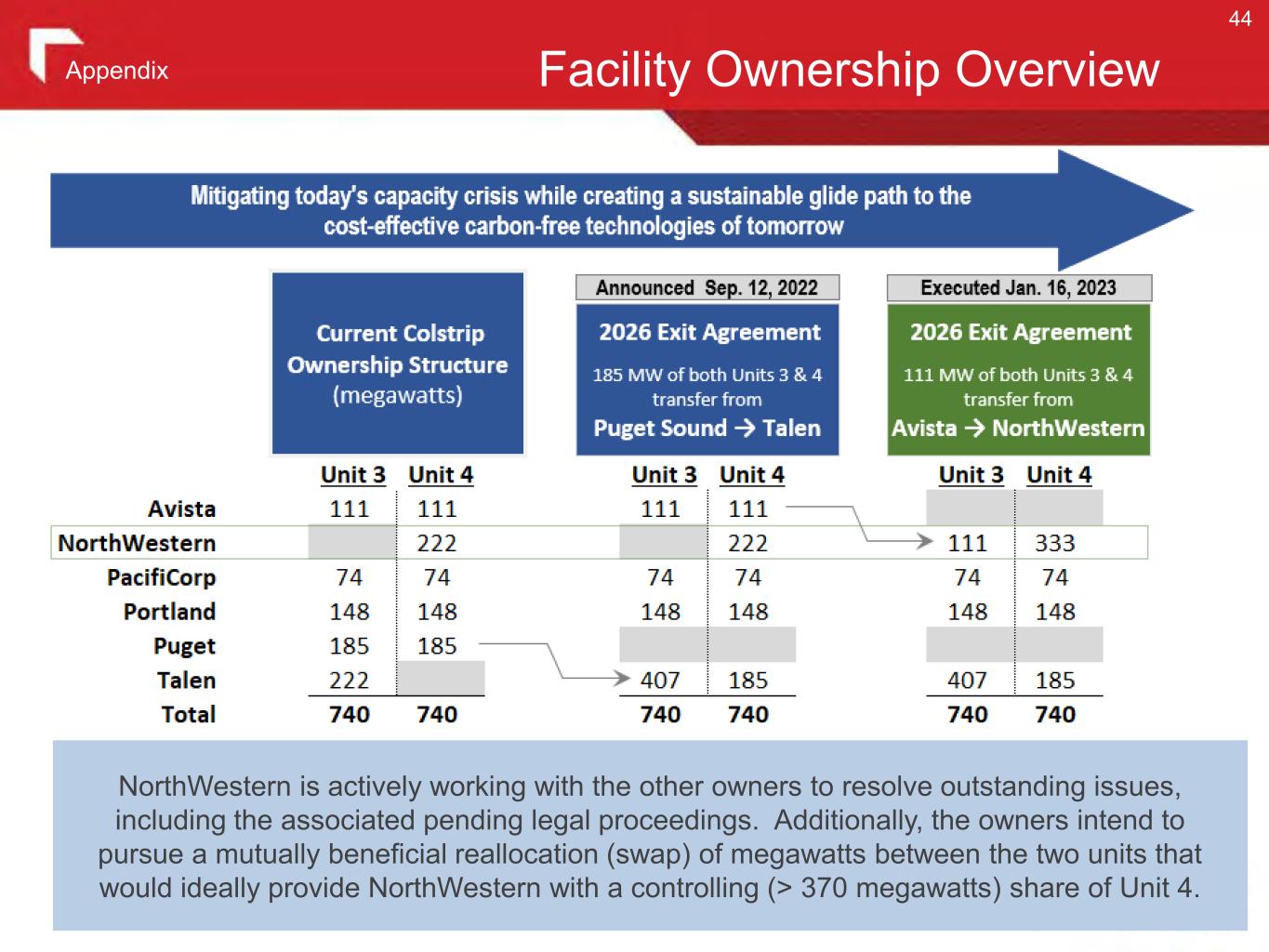

Facility Ownership Overview NorthWestern is actively working with the other owners to resolve outstanding issues, including the associated pending legal proceedings. Additionally, the owners intend to pursue a mutually beneficial reallocation (swap) of megawatts between the two units that would ideally provide NorthWestern with a controlling (> 370 megawatts) share of Unit 4. 44 Appendix

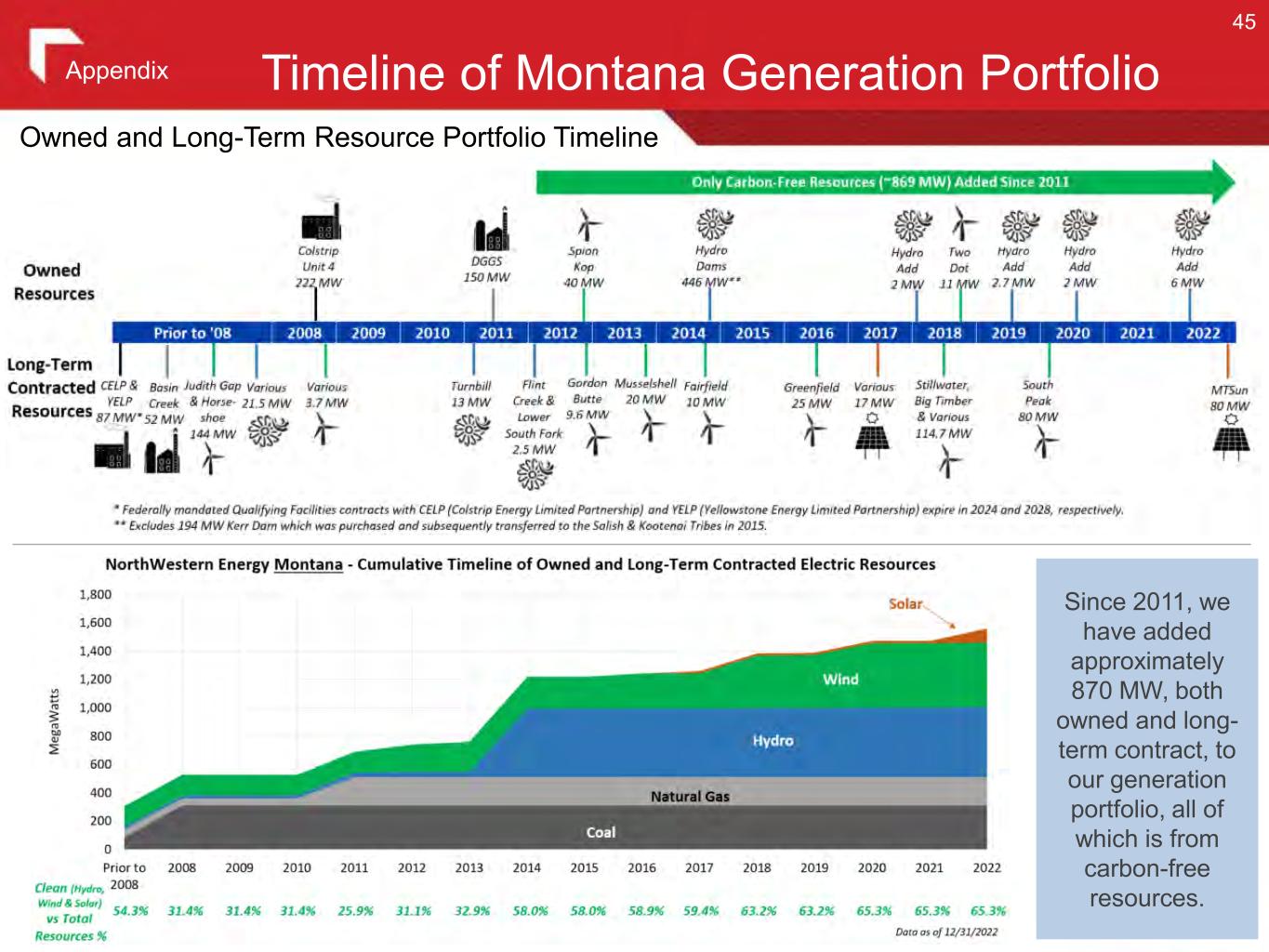

Timeline of Montana Generation Portfolio Since 2011, we have added approximately 870 MW, both owned and long- term contract, to our generation portfolio, all of which is from carbon-free resources. Owned and Long-Term Resource Portfolio Timeline 45 Appendix

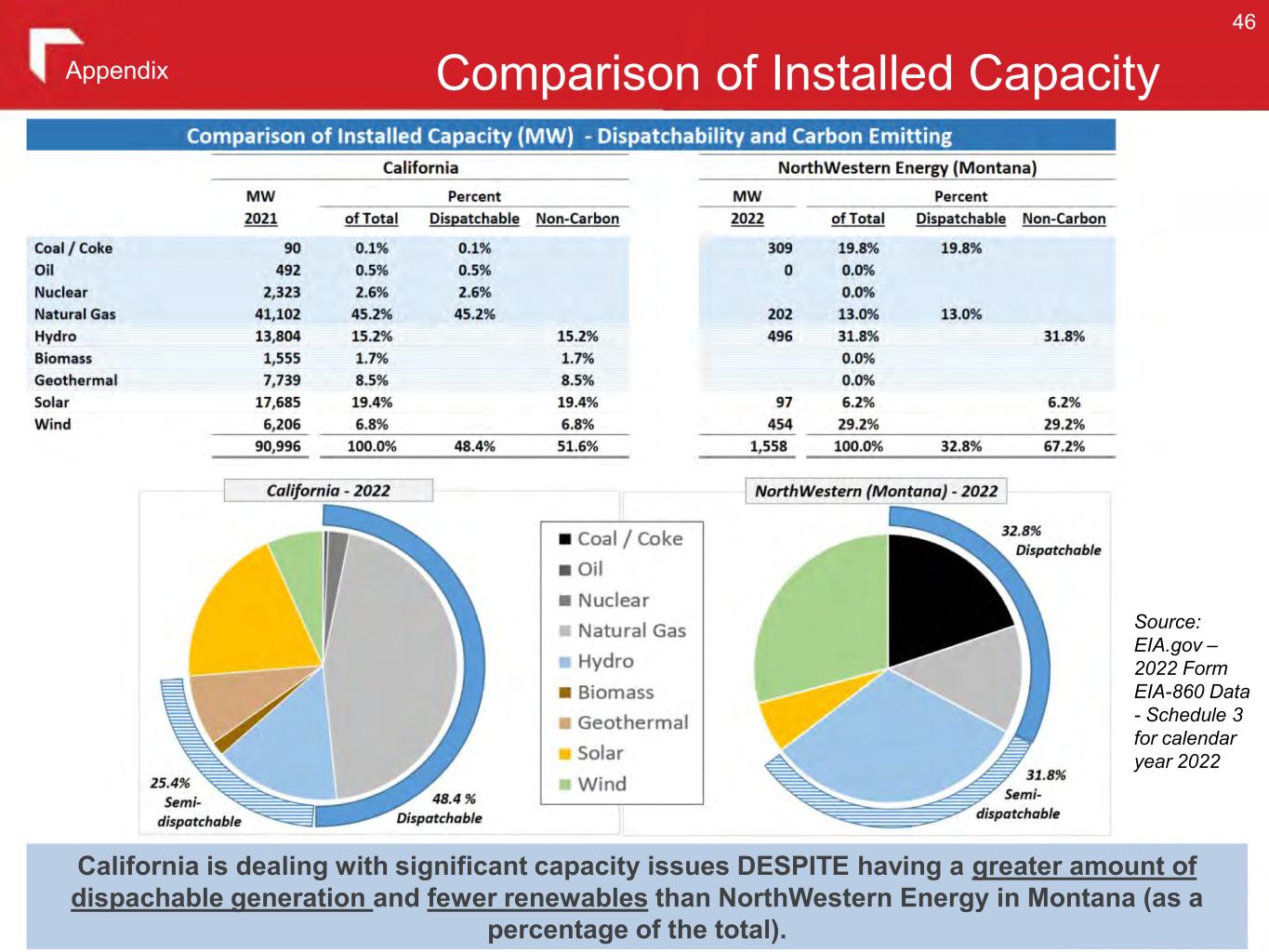

Comparison of Installed Capacity California is dealing with significant capacity issues DESPITE having a greater amount of dispachable generation and fewer renewables than NorthWestern Energy in Montana (as a percentage of the total). Source: EIA.gov – 2022 Form EIA-860 Data - Schedule 3 for calendar year 2022 46 Appendix

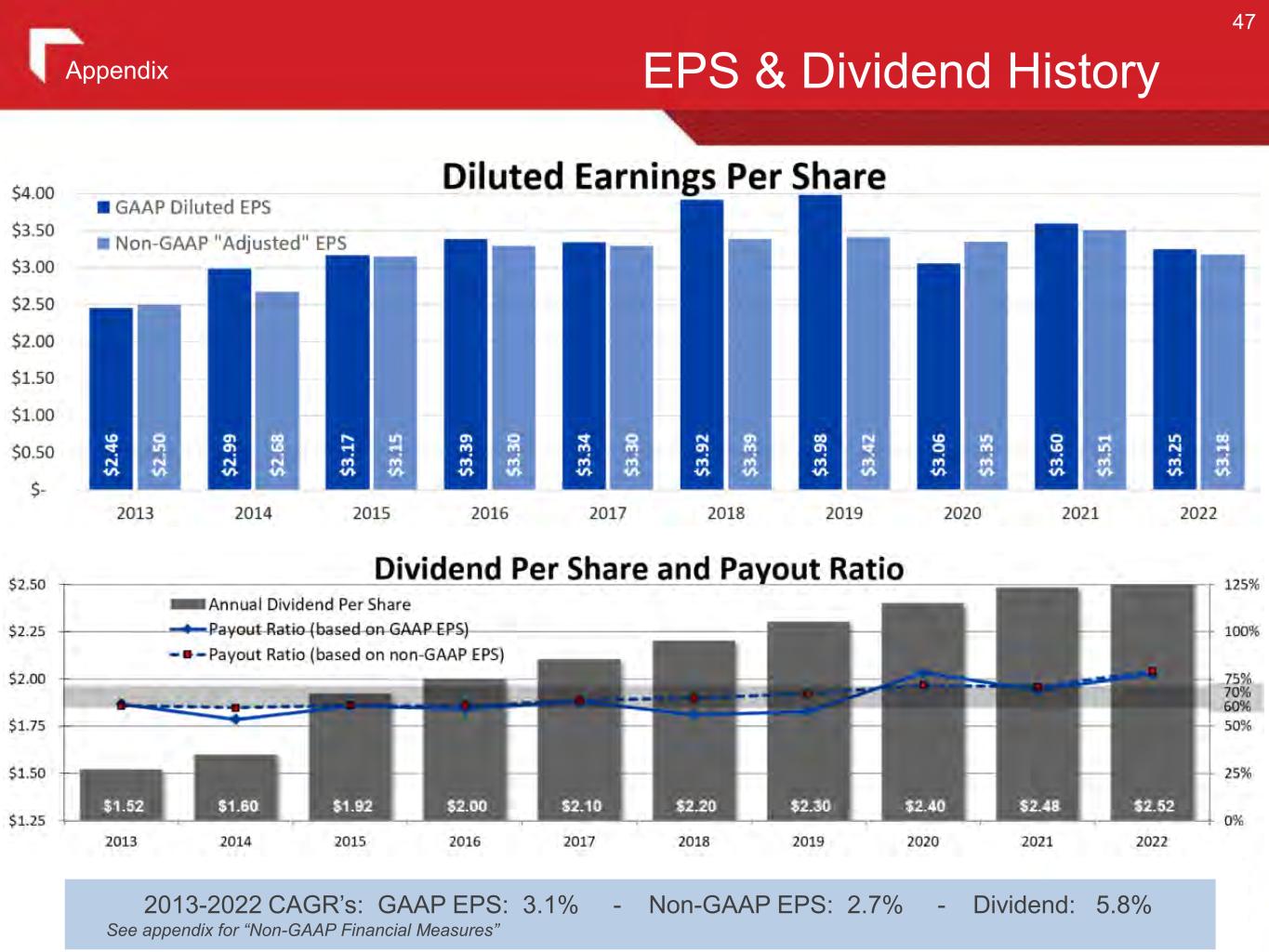

EPS & Dividend History 2013-2022 CAGR’s: GAAP EPS: 3.1% - Non-GAAP EPS: 2.7% - Dividend: 5.8% See appendix for “Non-GAAP Financial Measures” $2.60 - $2.75 $3.10 - $3.30 $3. 0-$3.40 $3.30-$3.50 47 Appendix

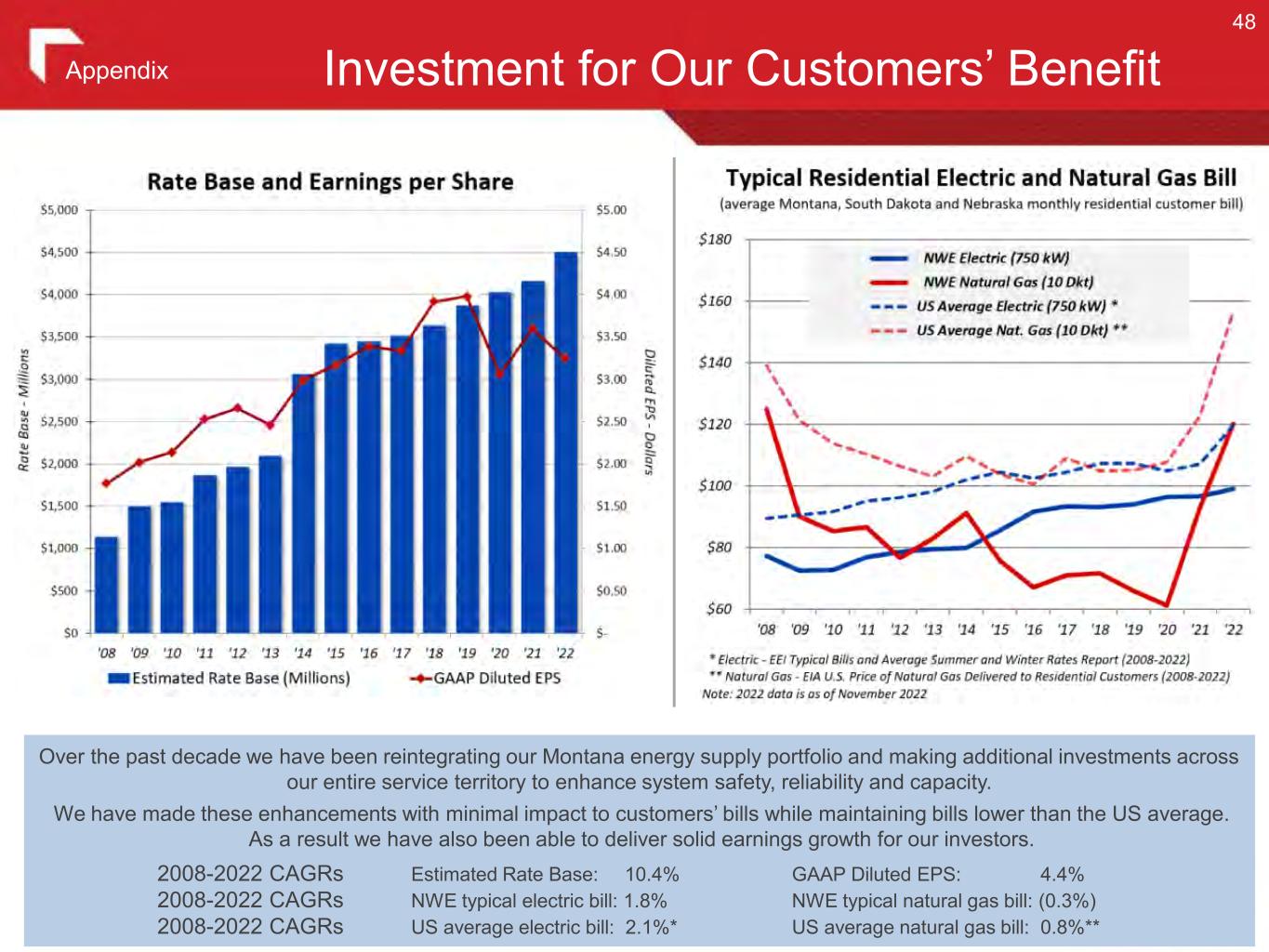

Investment for Our Customers’ Benefit Over the past decade we have been reintegrating our Montana energy supply portfolio and making additional investments across our entire service territory to enhance system safety, reliability and capacity. We have made these enhancements with minimal impact to customers’ bills while maintaining bills lower than the US average. As a result we have also been able to deliver solid earnings growth for our investors. 2008-2022 CAGRs Estimated Rate Base: 10.4% GAAP Diluted EPS: 4.4% 2008-2022 CAGRs NWE typical electric bill: 1.8% NWE typical natural gas bill: (0.3%) 2008-2022 CAGRs US average electric bill: 2.1%* US average natural gas bill: 0.8%** 48 Appendix

Experienced & Engaged Board of Directors 49 Appendix Britt E. Ide • Nominating & Governance, HR • Independent • Since April 2017 Anthony T. Clark • Nominating & Governance., HR • Independent • Since Dec. 2016 Dana J. Dykhouse • Chairman • Independent • Since Jan. 2009 Jan R. Horsfall • SETO (chair), Audit • Independent • Since April 2015 Brian B. Bird • President & Chief Executive Officer • Non-independent • Since January 2023 Jeff W. Yingling • Nominating & Governance (Chair), Audit • Independent • Since October 2019 Linda G. Sullivan • Audit (Chair), SETO • Independent • Since April 2017 Mahvash Yazdi • HR (Chair), SETO • Independent • Since December 2019 Kent T. Larson • SETO, Audit • Independent • Since July 2022 Sherina M. Edwards • Nominating & Governance, HR • Independent • Since April 2023

Strong Executive Team 50 Appendix Brian B. Bird • President & Chief Executive Officer • Current position since 2023 (formerly President & Chief Operating Officer ’21-’22 and Chief Financial Officer ’03-’21) Crystal D. Lail • Vice President and Chief Financial Officer • Current position since 2021 (formerly VP and Chief Accounting Officer ’20-’21) Michael R. Cashell • Vice President - Transmission • Current Position since 2011 Cynthia S. Fang • Vice President - Regulatory • Current position since 2023 Shannon M. Heim • Vice President & General Counsel • Current position since 2023 Bobbi L. Schroeppel • Vice President – Customer Care, Communications and Human Resources • Current Position since 2002 Bleau LaFave • Vice President – Asset Management & Business Development • Current position since June 2023 (formerly Director of Long-Term Resources) Jason Merkel • Vice President – Distribution • Current Position since 2022 John D. Hines • Vice President – Supply/Montana Affairs • Current Position since 2011 Jeanne M. Vold • Vice President – Technology • Current Position since 2021 (former Business Technology Officer ’12- ’21)

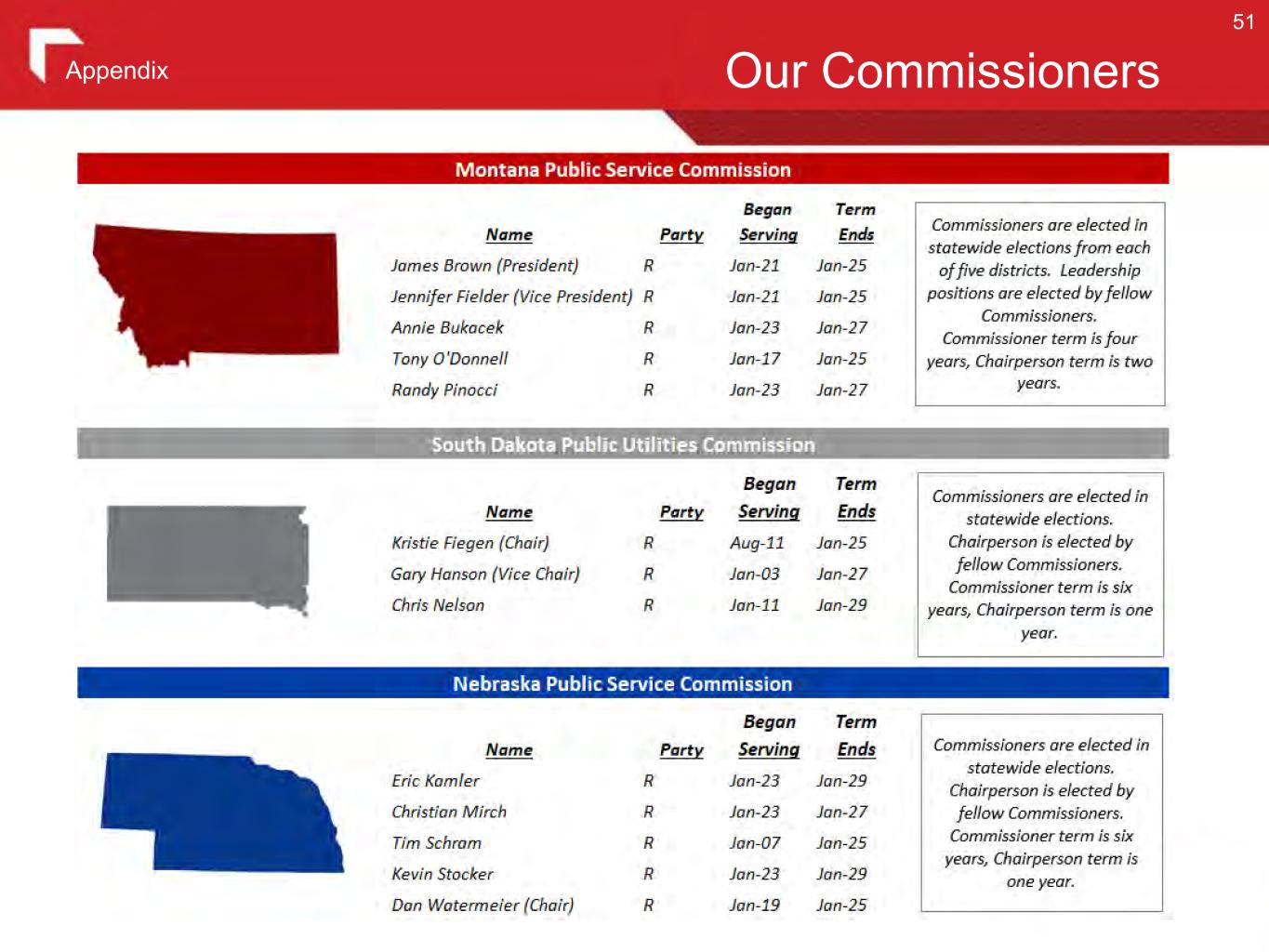

Our Commissioners 51 Appendix

52 Earnings & Other Appendix

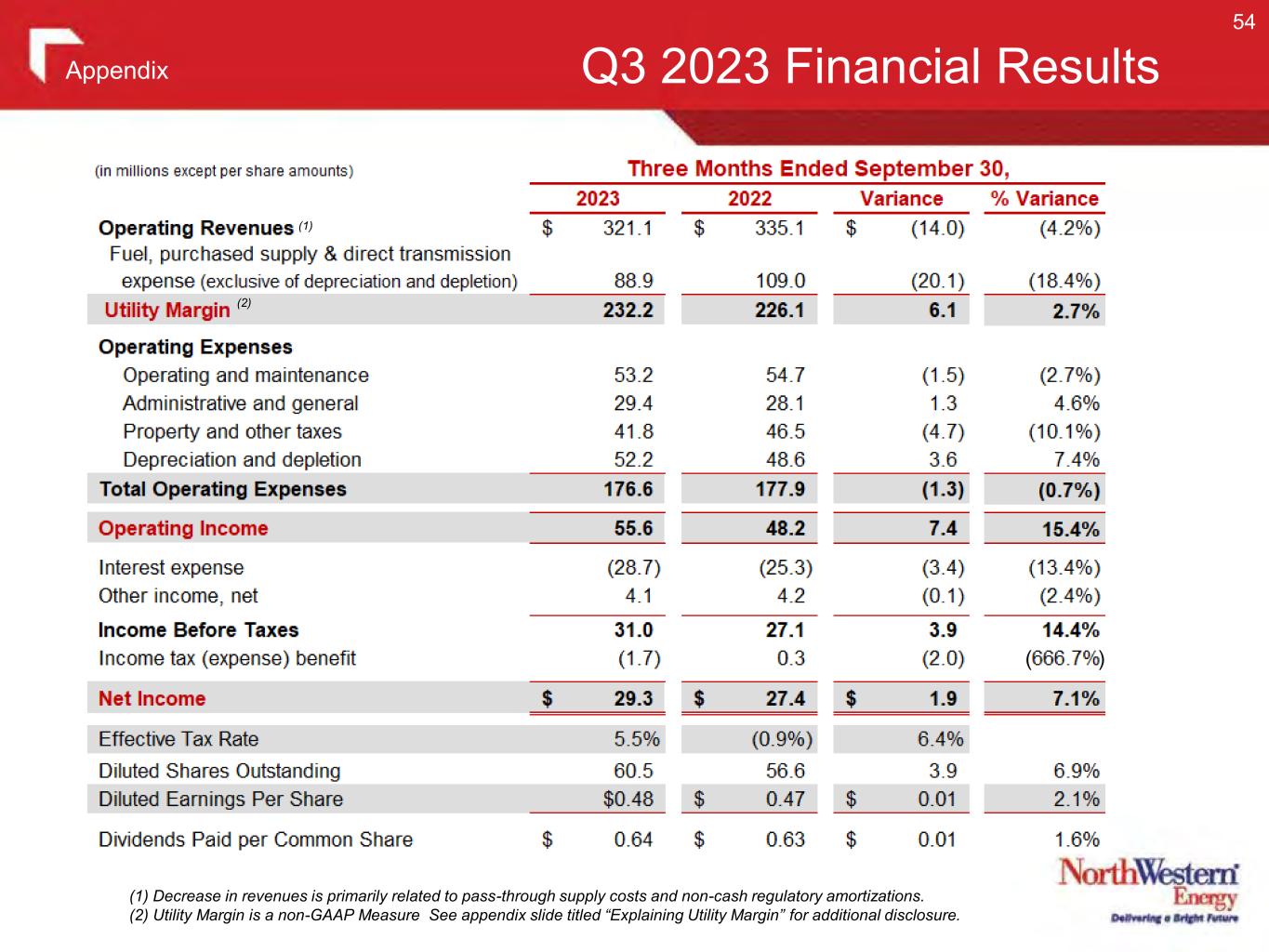

Q3 2023 Financial Results 53 *See slide 56 and “Non-GAAP Financial Measures” slide in the appendix for additional detail on this measure. Appendix Third Quarter Net Income vs Prior Period •GAAP: $1.9 Million or +7.1% •Non-GAAP*: $4.2 Million +16.3% Third Quarter EPS vs Prior Period •GAAP: $0.01 or +2.1% •Non-GAAP*: $0.05 or 11.4%

Q3 2023 Financial Results 54 (1) ( ) Appendix (1) Decrease in revenues is primarily related to pass-through supply costs and non-cash regulatory amortizations. (2) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. (2)

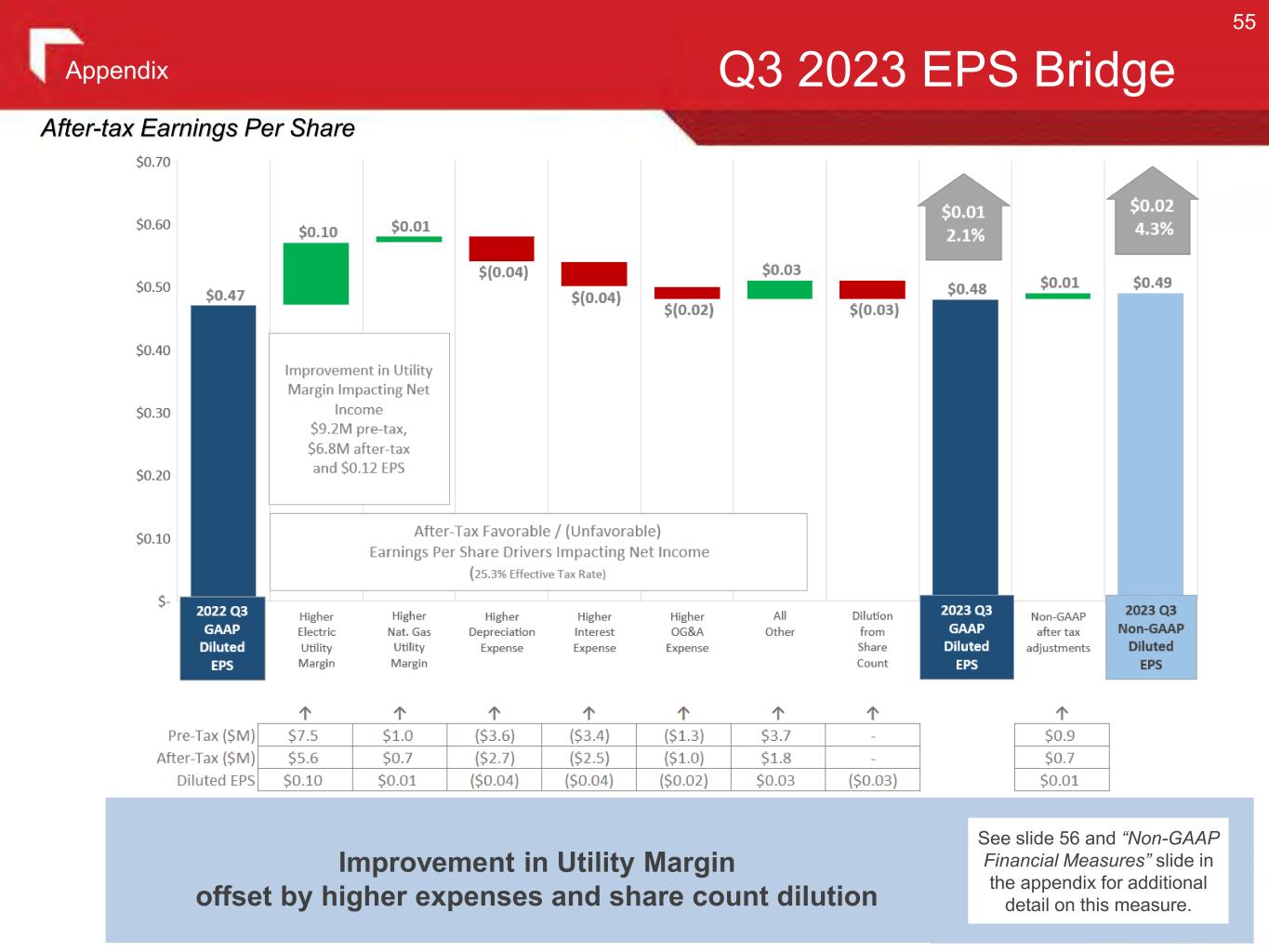

Q3 2023 EPS Bridge After-tax Earnings Per Share 55 Appendix Improvement in Utility Margin offset by higher expenses and share count dilution See slide 56 and “Non-GAAP Financial Measures” slide in the appendix for additional detail on this measure.

Q3 2023 Utility Margin Bridge $8.5 Million or 3.8% increase in Utility Margin due to items that impact Net Income. NOTE: Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. Pre-tax Millions 56 Appendix

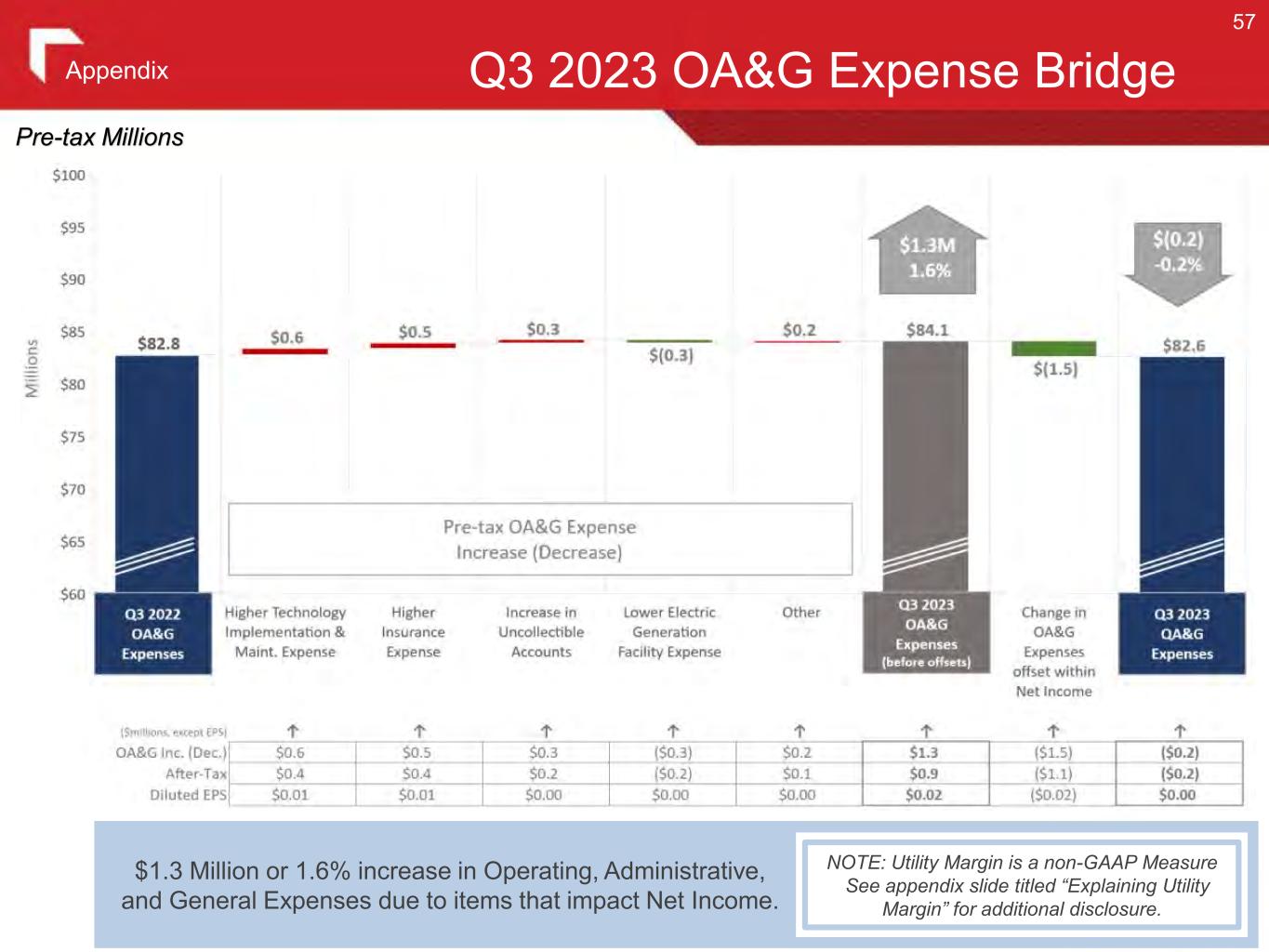

Q3 2023 OA&G Expense Bridge $1.3 Million or 1.6% increase in Operating, Administrative, and General Expenses due to items that impact Net Income. NOTE: Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. Pre-tax Millions 57 Appendix

Q3 2023 Tax Reconciliation 58 Appendix

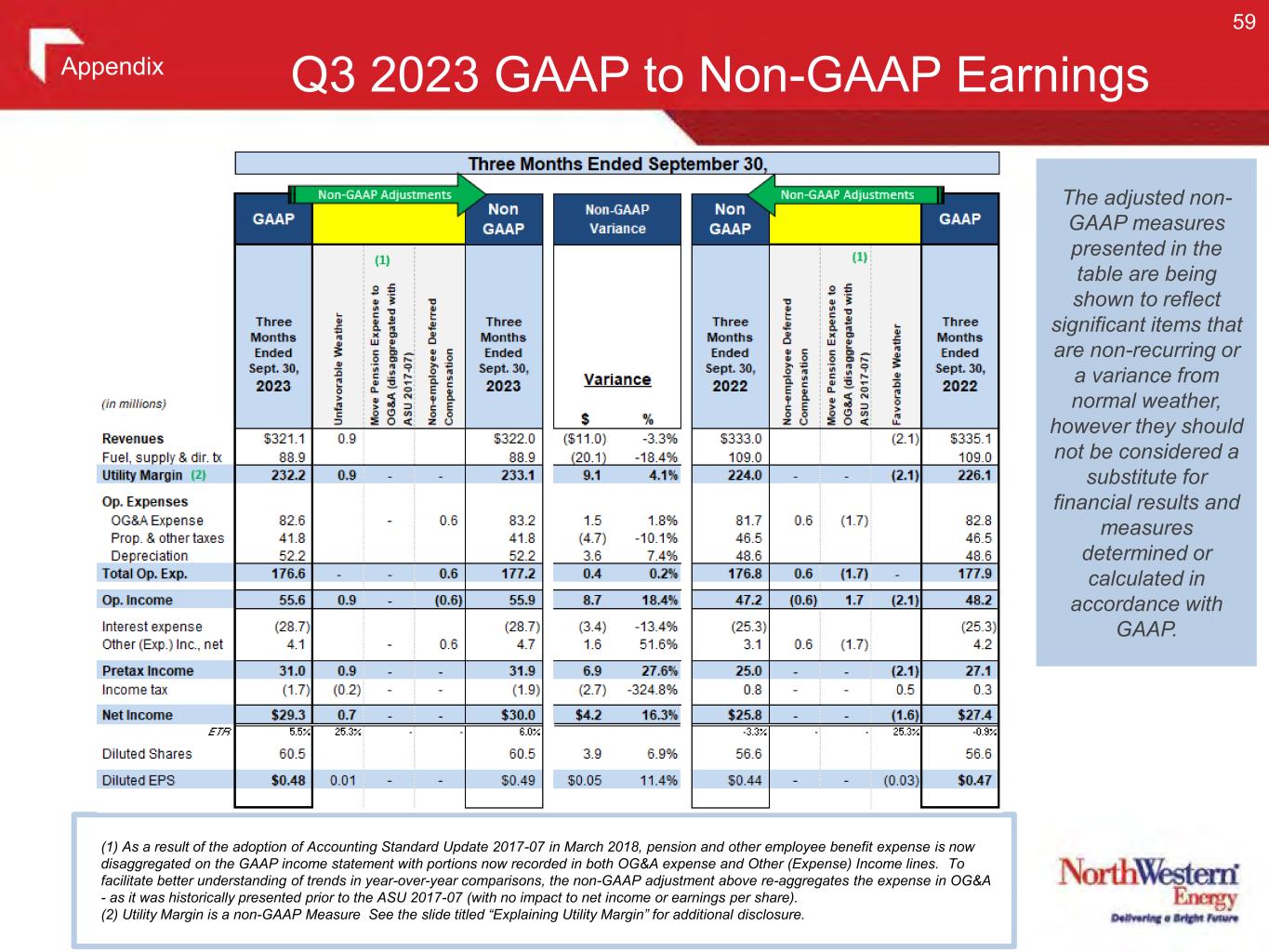

Q3 2023 GAAP to Non-GAAP Earnings The adjusted non- GAAP measures presented in the table are being shown to reflect significant items that are non-recurring or a variance from normal weather, however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. (1) As a result of the adoption of Accounting Standard Update 2017-07 in March 2018, pension and other employee benefit expense is now disaggregated on the GAAP income statement with portions now recorded in both OG&A expense and Other (Expense) Income lines. To facilitate better understanding of trends in year-over-year comparisons, the non-GAAP adjustment above re-aggregates the expense in OG&A - as it was historically presented prior to the ASU 2017-07 (with no impact to net income or earnings per share). (2) Utility Margin is a non-GAAP Measure See the slide titled “Explaining Utility Margin” for additional disclosure. 59 Appendix

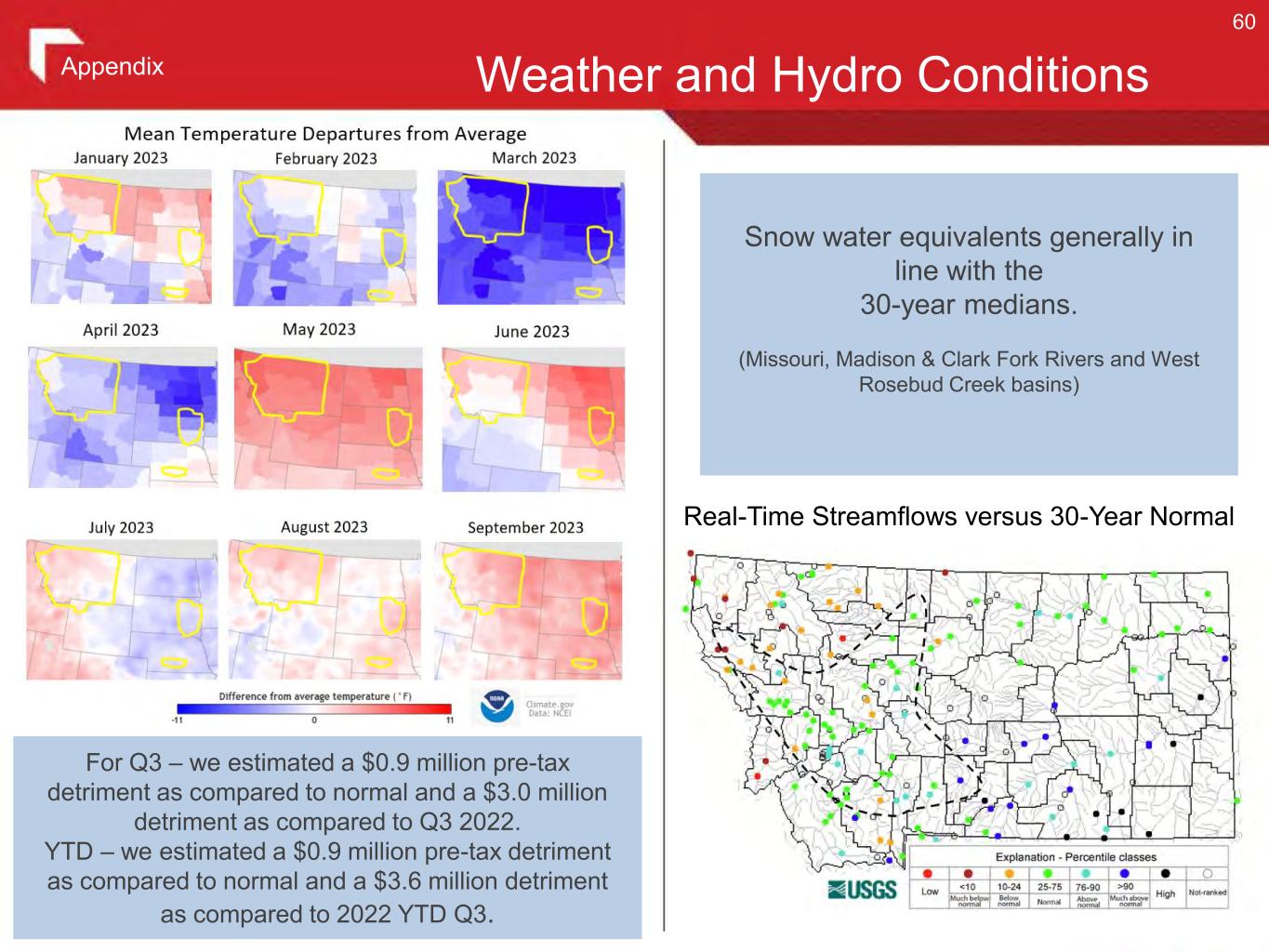

Weather and Hydro Conditions 60 Appendix Snow water equivalents generally in line with the 30-year medians. (Missouri, Madison & Clark Fork Rivers and West Rosebud Creek basins) Real-Time Streamflows versus 30-Year Normal For Q3 – we estimated a $0.9 million pre-tax detriment as compared to normal and a $3.0 million detriment as compared to Q3 2022. YTD – we estimated a $0.9 million pre-tax detriment as compared to normal and a $3.6 million detriment as compared to 2022 YTD Q3.

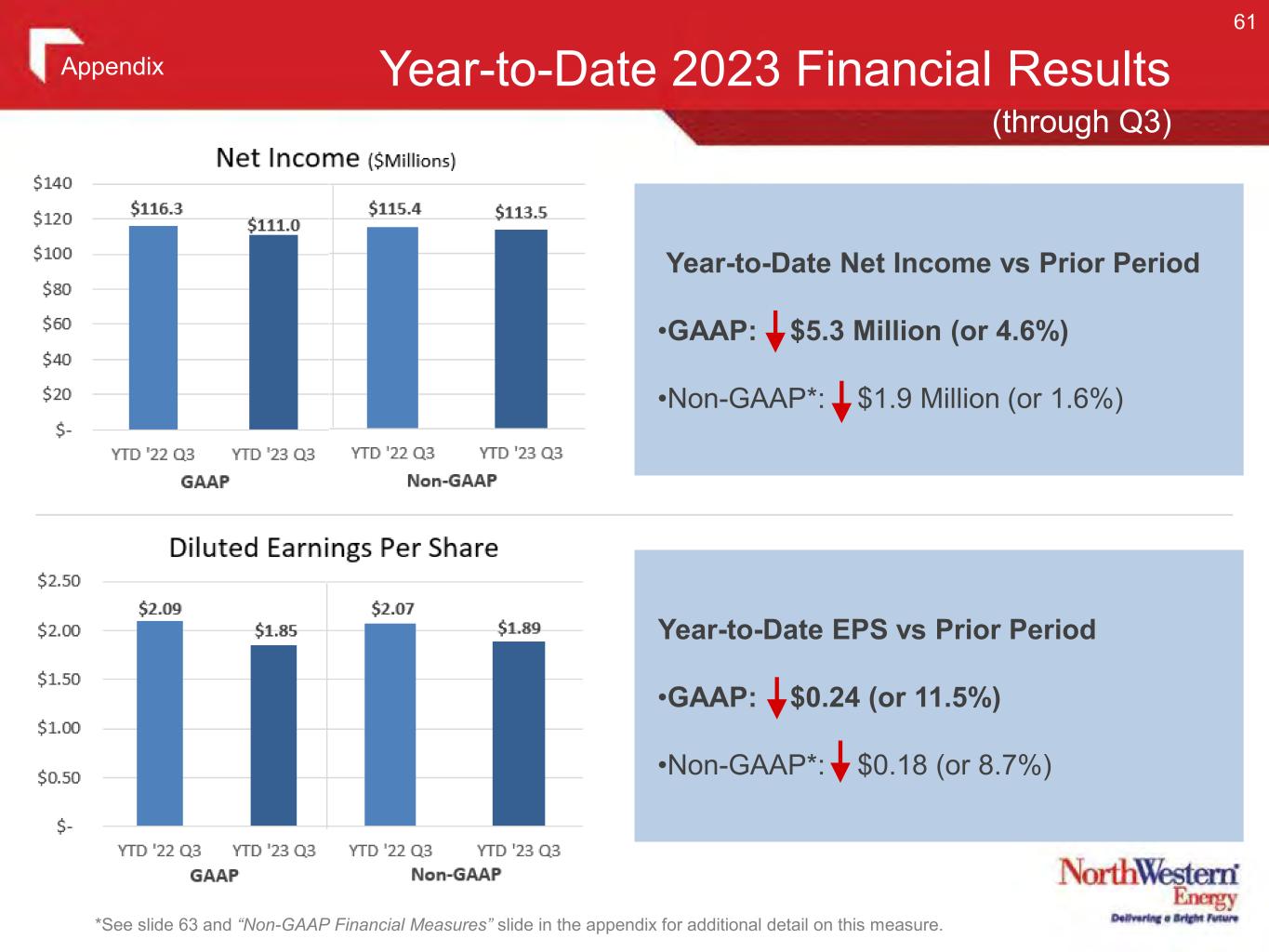

*See slide 63 and “Non-GAAP Financial Measures” slide in the appendix for additional detail on this measure. Year-to-Date 2023 Financial Results 61 (through Q3) Appendix Year-to-Date Net Income vs Prior Period •GAAP: $5.3 Million (or 4.6%) •Non-GAAP*: $1.9 Million (or 1.6%) Year-to-Date EPS vs Prior Period •GAAP: $0.24 (or 11.5%) •Non-GAAP*: $0.18 (or 8.7%)

62 (through Q3) Year-to-Date Financial ResultsAppendix (1) (1) Decrease in revenues is primarily related to pass-through supply costs and non-cash regulatory amortizations. (2) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. (2)

Increase in utility margin due to the following factors: $ 23.4 Montana interim rates 8.3 Lower non-recoverable Montana electric supply costs 4.8 Montana property tax tracker collections 2.0 Higher electric retail volumes 1.8 Higher Montana natural gas transportation (1.0) Lower natural gas retail volumes (1.0) Lower transmission revenue (market conditions & lower transmission rates) (1.1) Other $ 37.2 Change in Utility Margin Impacting Net Income 63 Utility Margin (YTD thru 3rd Quarter) (dollars in millions) Nine Months Ended September 30, 2023 2022 Variance Electric $ 606.1 $ 576.5 $ 29.6 5.1% Natural Gas 138.0 137.0 1.0 0.7% Total Utility Margin $ 744.1 $ 713.5 $ 30.6 4.3% $ (7.7) Lower property taxes recovered in revenue, offset in property & other tax expense (1.4) Lower operating expenses recovered in revenue, offset in O&M expense (0.6) Lower natural gas production taxes recovered in revenue, offset in property & other taxes 3.1 Higher revenue from lower production tax credits, offset in income tax expense $ (6.6) Change in Utility Margin Offset Within Net Income $ 30.6 Increase in Utility Margin (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. (1) Appendix

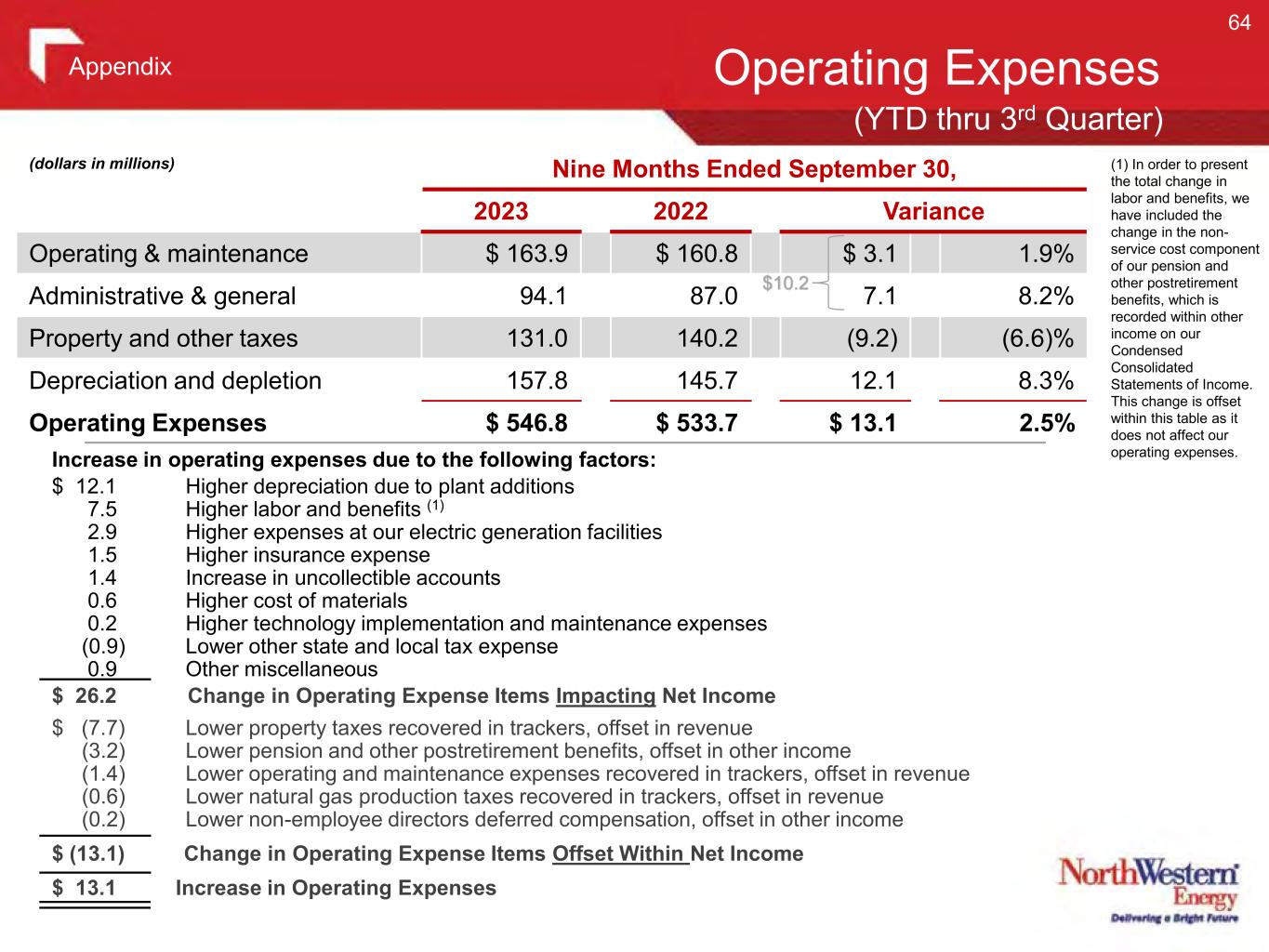

Increase in operating expenses due to the following factors: $ 12.1 Higher depreciation due to plant additions 7.5 Higher labor and benefits (1) 2.9 Higher expenses at our electric generation facilities 1.5 Higher insurance expense 1.4 Increase in uncollectible accounts 0.6 Higher cost of materials 0.2 Higher technology implementation and maintenance expenses (0.9) Lower other state and local tax expense 0.9 Other miscellaneous $ 26.2 Change in Operating Expense Items Impacting Net Income Operating Expenses 64 (YTD thru 3rd Quarter) (dollars in millions) Nine Months Ended September 30, 2023 2022 Variance Operating & maintenance $ 163.9 $ 160.8 $ 3.1 1.9% Administrative & general 94.1 87.0 7.1 8.2% Property and other taxes 131.0 140.2 (9.2) (6.6)% Depreciation and depletion 157.8 145.7 12.1 8.3% Operating Expenses $ 546.8 $ 533.7 $ 13.1 2.5% $ (7.7) Lower property taxes recovered in trackers, offset in revenue (3.2) Lower pension and other postretirement benefits, offset in other income (1.4) Lower operating and maintenance expenses recovered in trackers, offset in revenue (0.6) Lower natural gas production taxes recovered in trackers, offset in revenue (0.2) Lower non-employee directors deferred compensation, offset in other income $ (13.1) Change in Operating Expense Items Offset Within Net Income $ 13.1 Increase in Operating Expenses $10.2 Appendix (1) In order to present the total change in labor and benefits, we have included the change in the non- service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses.

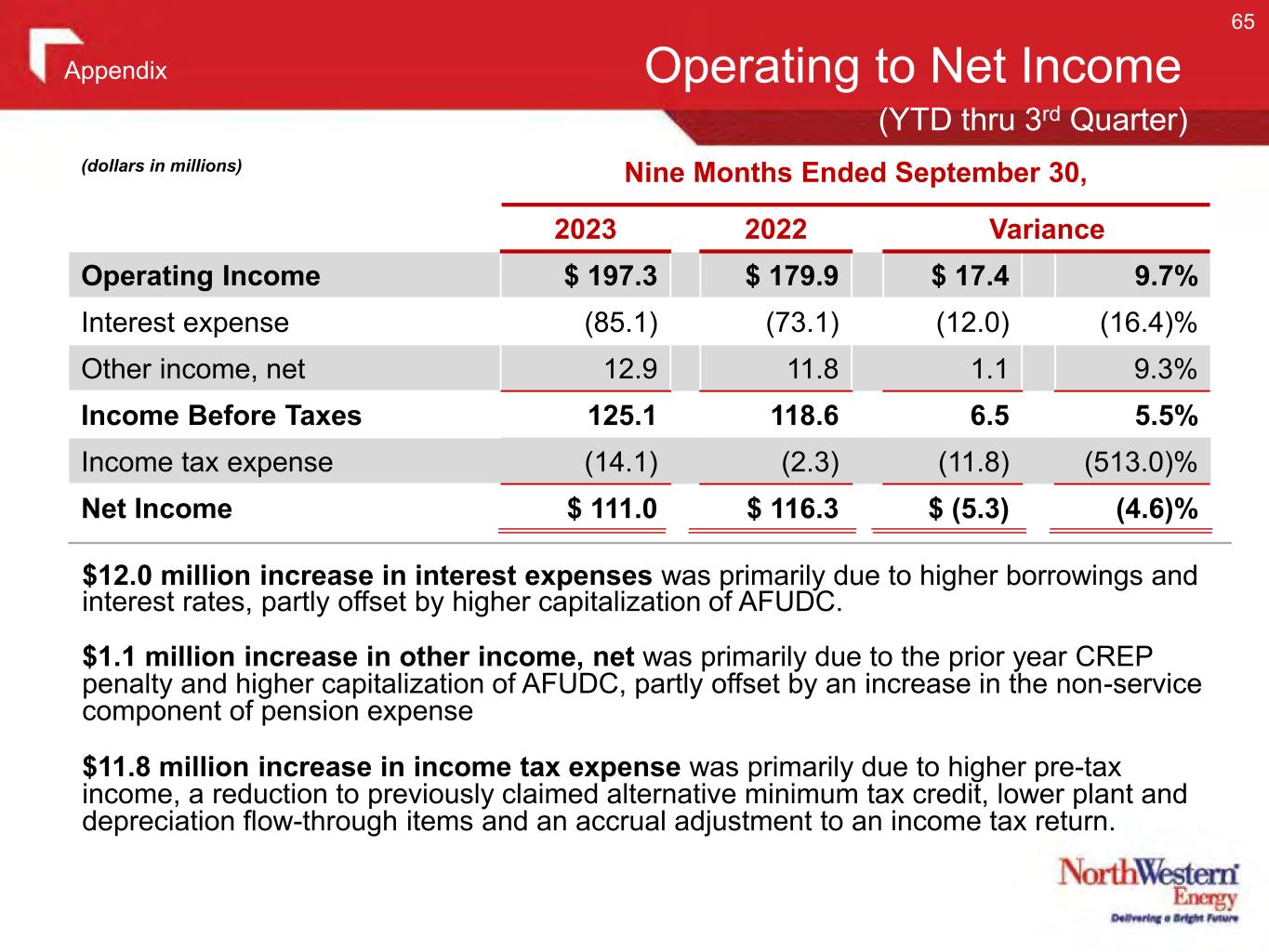

Operating to Net Income 65 (dollars in millions) Nine Months Ended September 30, 2023 2022 Variance Operating Income $ 197.3 $ 179.9 $ 17.4 9.7% Interest expense (85.1) (73.1) (12.0) (16.4)% Other income, net 12.9 11.8 1.1 9.3% Income Before Taxes 125.1 118.6 6.5 5.5% Income tax expense (14.1) (2.3) (11.8) (513.0)% Net Income $ 111.0 $ 116.3 $ (5.3) (4.6)% (YTD thru 3rd Quarter) $12.0 million increase in interest expenses was primarily due to higher borrowings and interest rates, partly offset by higher capitalization of AFUDC. $1.1 million increase in other income, net was primarily due to the prior year CREP penalty and higher capitalization of AFUDC, partly offset by an increase in the non-service component of pension expense $11.8 million increase in income tax expense was primarily due to higher pre-tax income, a reduction to previously claimed alternative minimum tax credit, lower plant and depreciation flow-through items and an accrual adjustment to an income tax return. Appendix

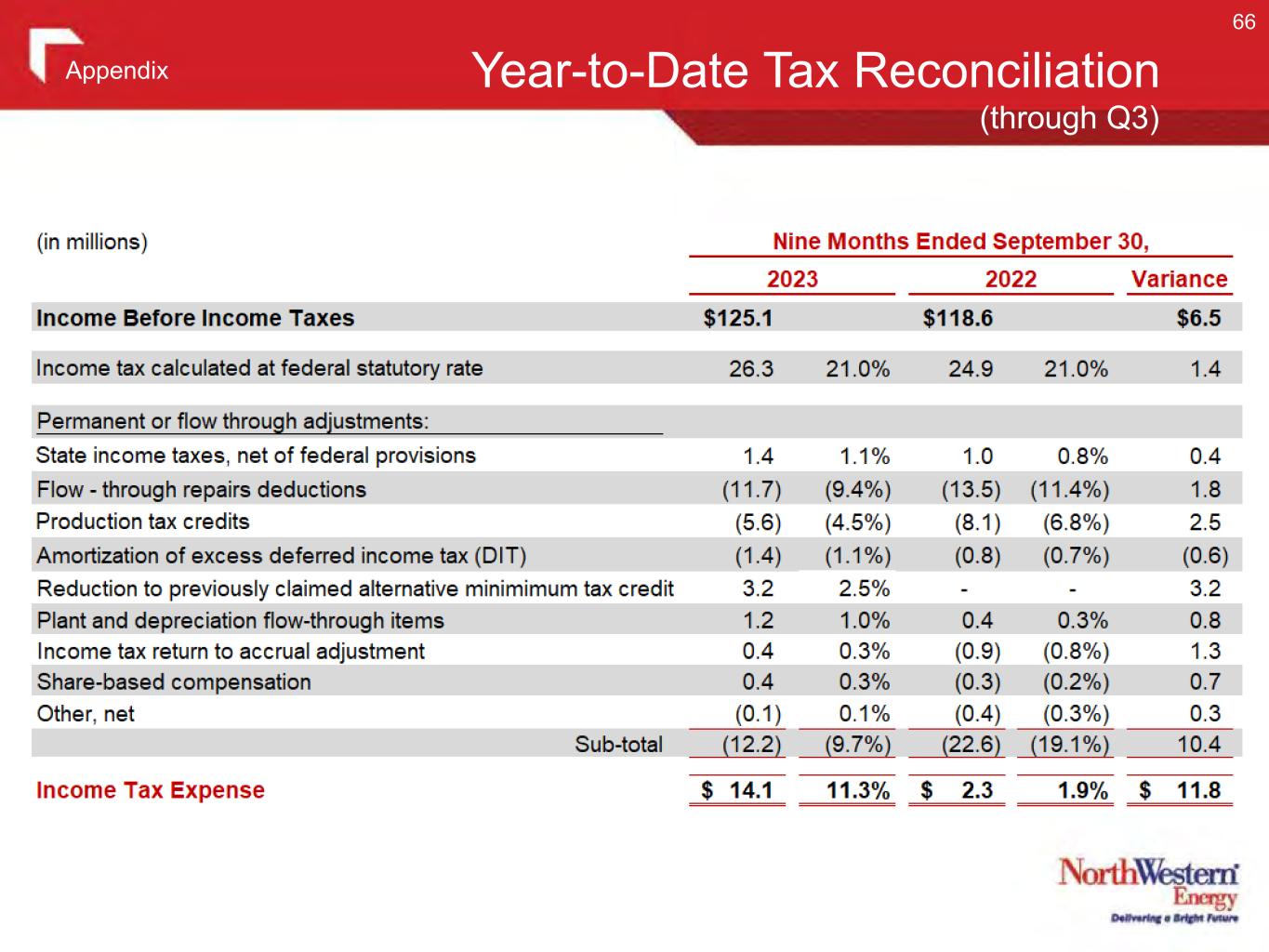

Year-to-Date Tax Reconciliation 66 Appendix (through Q3)

Year-to-Date GAAP to Non-GAAP Earnings (1) As a result of the adoption of Accounting Standard Update 2017-07 in March 2018, pension and other employee benefit expense is now disaggregated on the GAAP income statement with portions now recorded in both OG&A expense and Other (Expense) Income lines. To facilitate better understanding of trends in year-over-year comparisons, the non-GAAP adjustment above re-aggregates the expense in OG&A - as it was historically presented prior to the ASU 2017-07 (with no impact to net income or earnings per share). (2) Utility Margin is a non-GAAP Measure See the slide titled “Explaining Utility Margin” for additional disclosure. The adjusted non-GAAP measures presented in the table are being shown to reflect significant items that are non- recurring or a variance from normal weather, however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. 67 Appendix (through Q3)

Cash Flow 68 Appendix (through Q3) Cash from Operating Activities increased by $117.7 million driven primarily by a $101.6 million increase in collection of energy supply costs from customers and Montana interim rates. Funds from Operations decreased by $4.5 million over prior period. Net Under-Collected Supply Costs (in millions) Beginning (Jan. 1) Ending (Sept. 30) Inflow 2022 $99.1 $101.9 $(2.8) 2023 $115.4 $16.6 $98.8 2023 Improvement (less outflow) $101.6 Financing Activities in 2023 Equity Issuances in 2023 • Issued remaining $73.6 million of common stock under our At-the-Market program in Q2 & Q3. Debt financing in 2023 • Issued $239 million, 5.57% coupon, 10 year Montana FMBs priced in Q1 • Issued $31 million, 5.57% coupon, 10 year South Dakota FMB’s priced in Q1 • Issued $30 million, 5.42% coupon, 10 year, South Dakota FMBs in Q2 • Refinanced $144.7 million, 3.88% coupon, 5 year Pollution Control Revenue Refunding Bonds in Q2 Financing plans (targeting a FFO to Debt ratio > 14%) are expected maintain our current credit ratings and are subject to change.

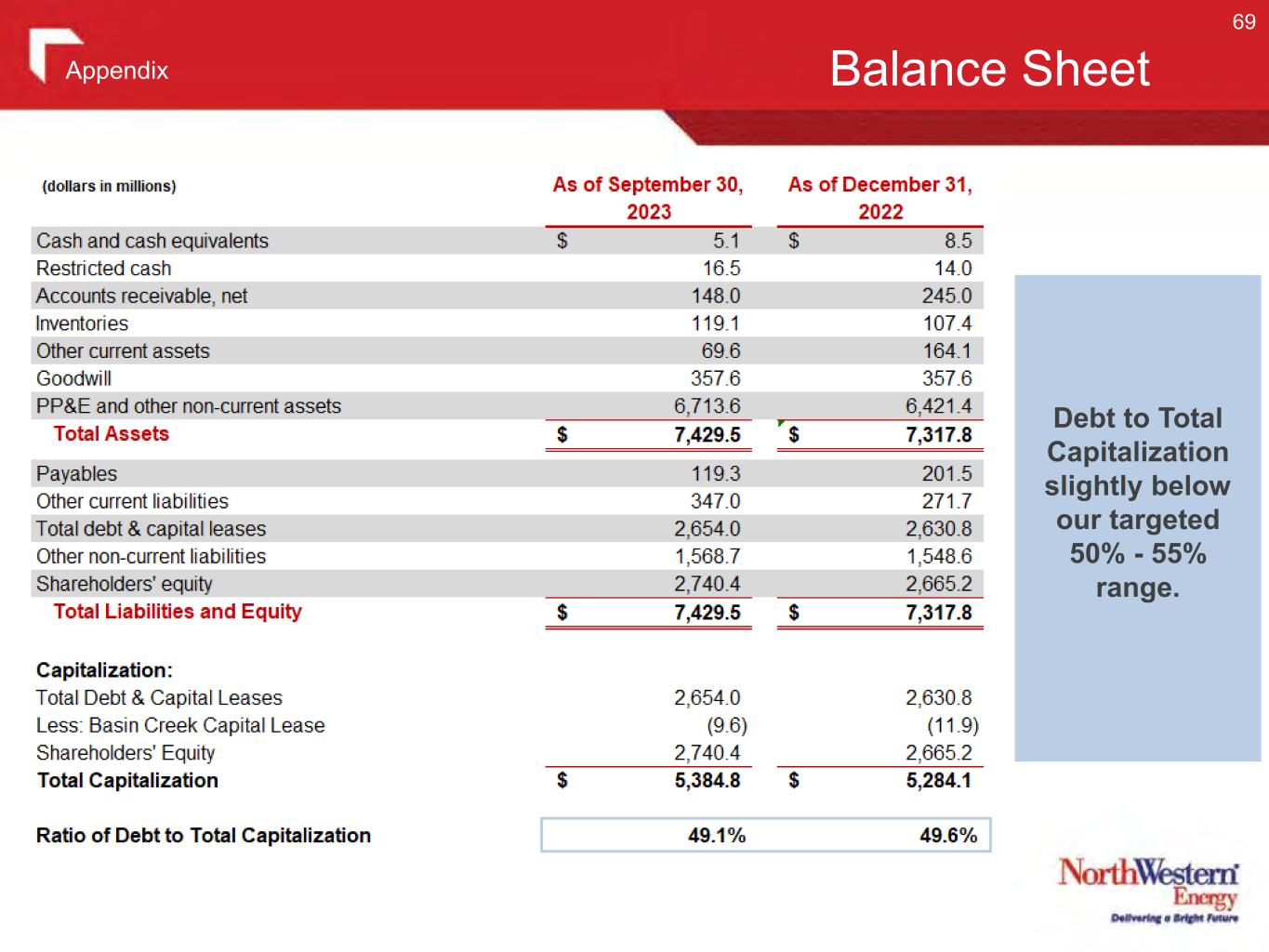

Balance Sheet 69 Appendix Debt to Total Capitalization slightly below our targeted 50% - 55% range.

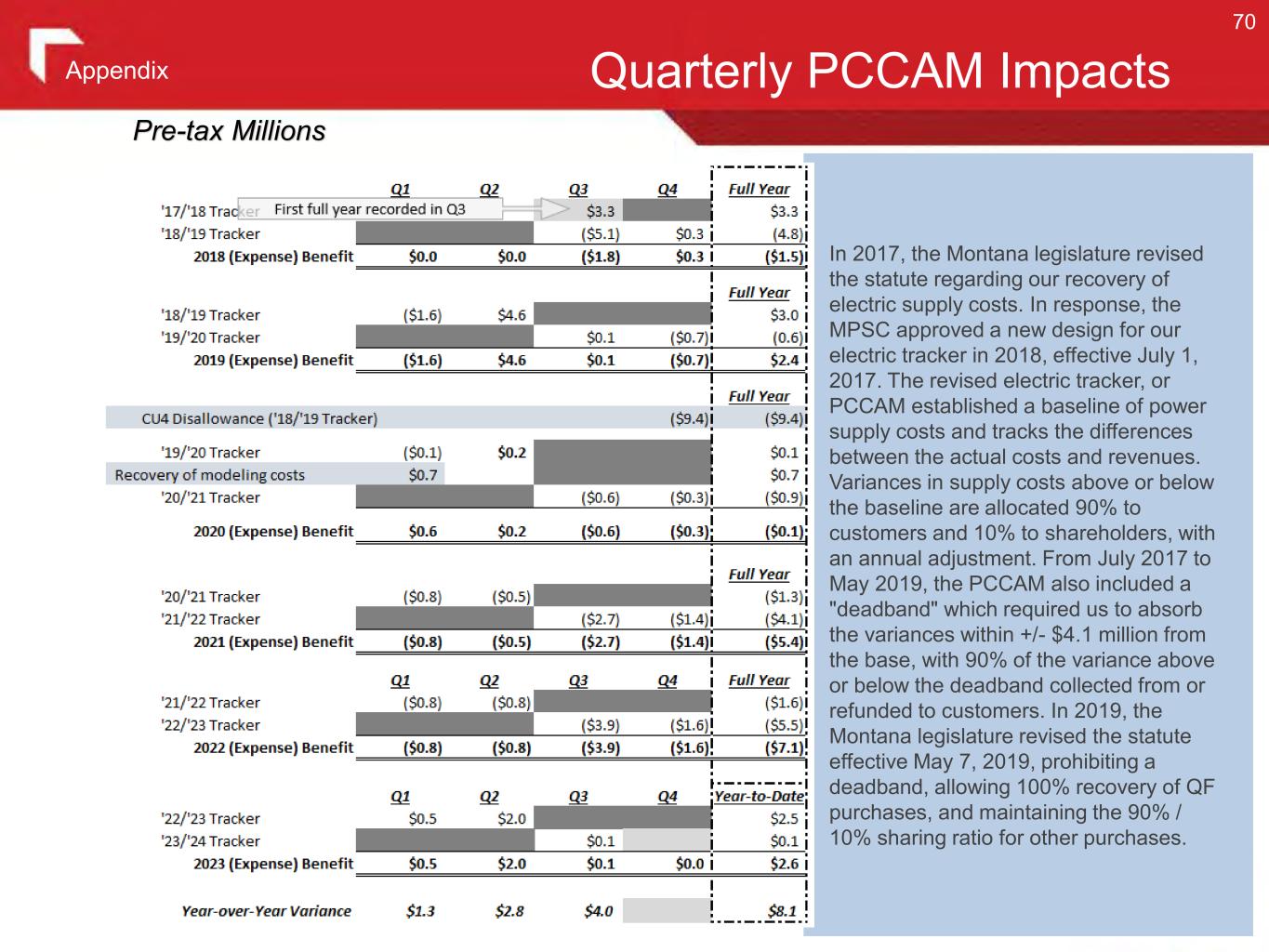

Quarterly PCCAM Impacts Pre-tax Millions In 2017, the Montana legislature revised the statute regarding our recovery of electric supply costs. In response, the MPSC approved a new design for our electric tracker in 2018, effective July 1, 2017. The revised electric tracker, or PCCAM established a baseline of power supply costs and tracks the differences between the actual costs and revenues. Variances in supply costs above or below the baseline are allocated 90% to customers and 10% to shareholders, with an annual adjustment. From July 2017 to May 2019, the PCCAM also included a "deadband" which required us to absorb the variances within +/- $4.1 million from the base, with 90% of the variance above or below the deadband collected from or refunded to customers. In 2019, the Montana legislature revised the statute effective May 7, 2019, prohibiting a deadband, allowing 100% recovery of QF purchases, and maintaining the 90% / 10% sharing ratio for other purchases. 70 Appendix

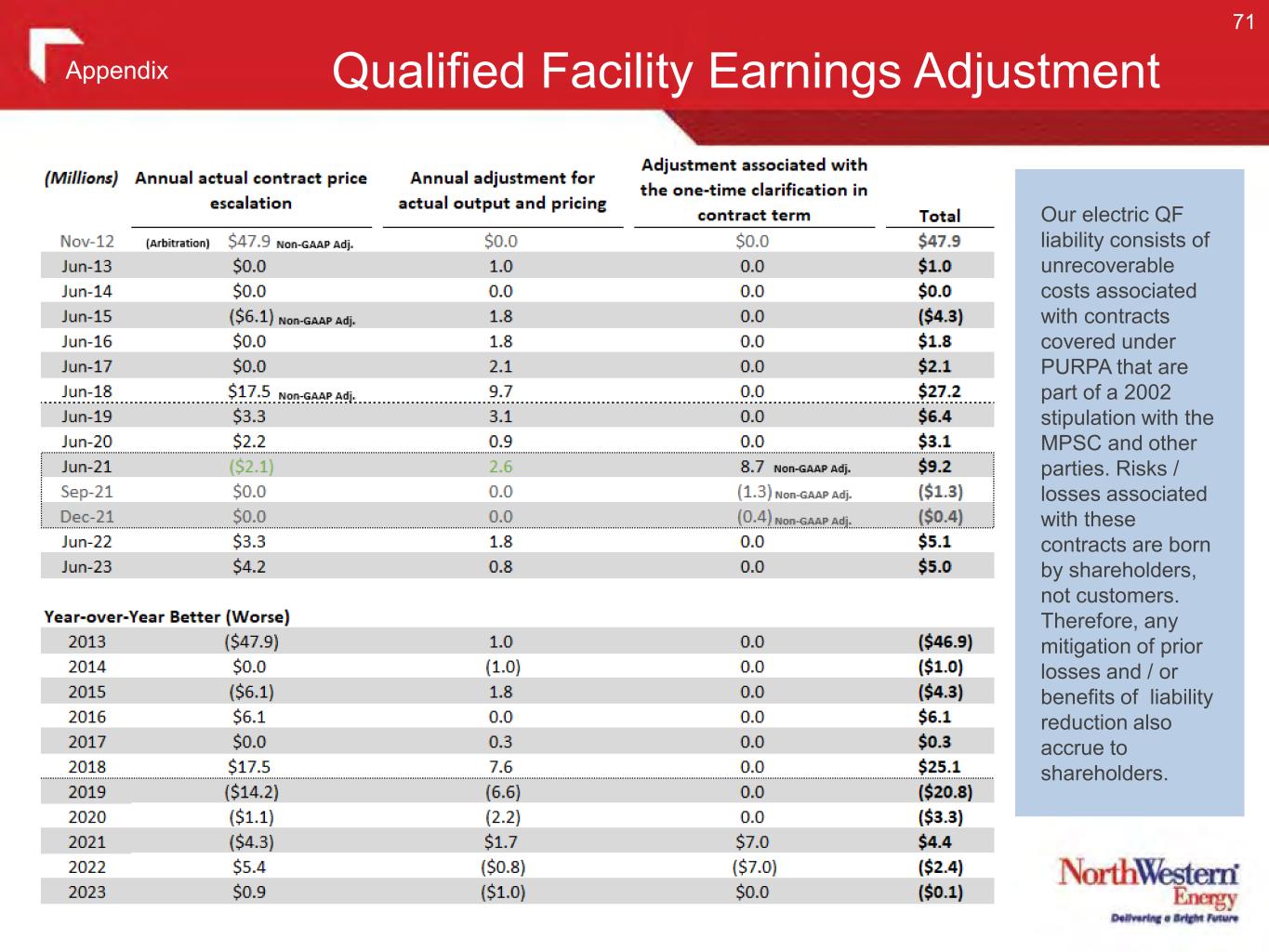

Qualified Facility Earnings Adjustment Our electric QF liability consists of unrecoverable costs associated with contracts covered under PURPA that are part of a 2002 stipulation with the MPSC and other parties. Risks / losses associated with these contracts are born by shareholders, not customers. Therefore, any mitigation of prior losses and / or benefits of liability reduction also accrue to shareholders. 71 Appendix

Non-GAAP Financial Measures (1 of 5) This presentation includes financial information prepared in accordance with GAAP, as well as other financial measures, such as Utility Margin, Adjusted Non-GAAP pretax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. We define Utility Margin as Operating Revenues less fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion) as presented in our Consolidated Statements of Income. This measure differs from the GAAP definition of Gross Margin due to the exclusion of Operating and maintenance, Property and other taxes, and Depreciation and depletion expenses, which are presented separately in our Consolidated Statements of Income. A reconciliation of Utility Margin to Gross Margin, the most directly comparable GAAP measure, is included in this presentation. Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. Management also believes the presentation of Adjusted Non-GAAP pre-tax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS is more representative of normal earnings than GAAP pre-tax income, net income and EPS due to the exclusion (or inclusion) of certain impacts that are not reflective of ongoing earnings. The presentation of these non-GAAP measures is intended to supplement investors' understanding of our financial performance and not to replace other GAAP measures as an indicator of actual operating performance. Our measures may not be comparable to other companies' similarly titled measures. 72 Appendix

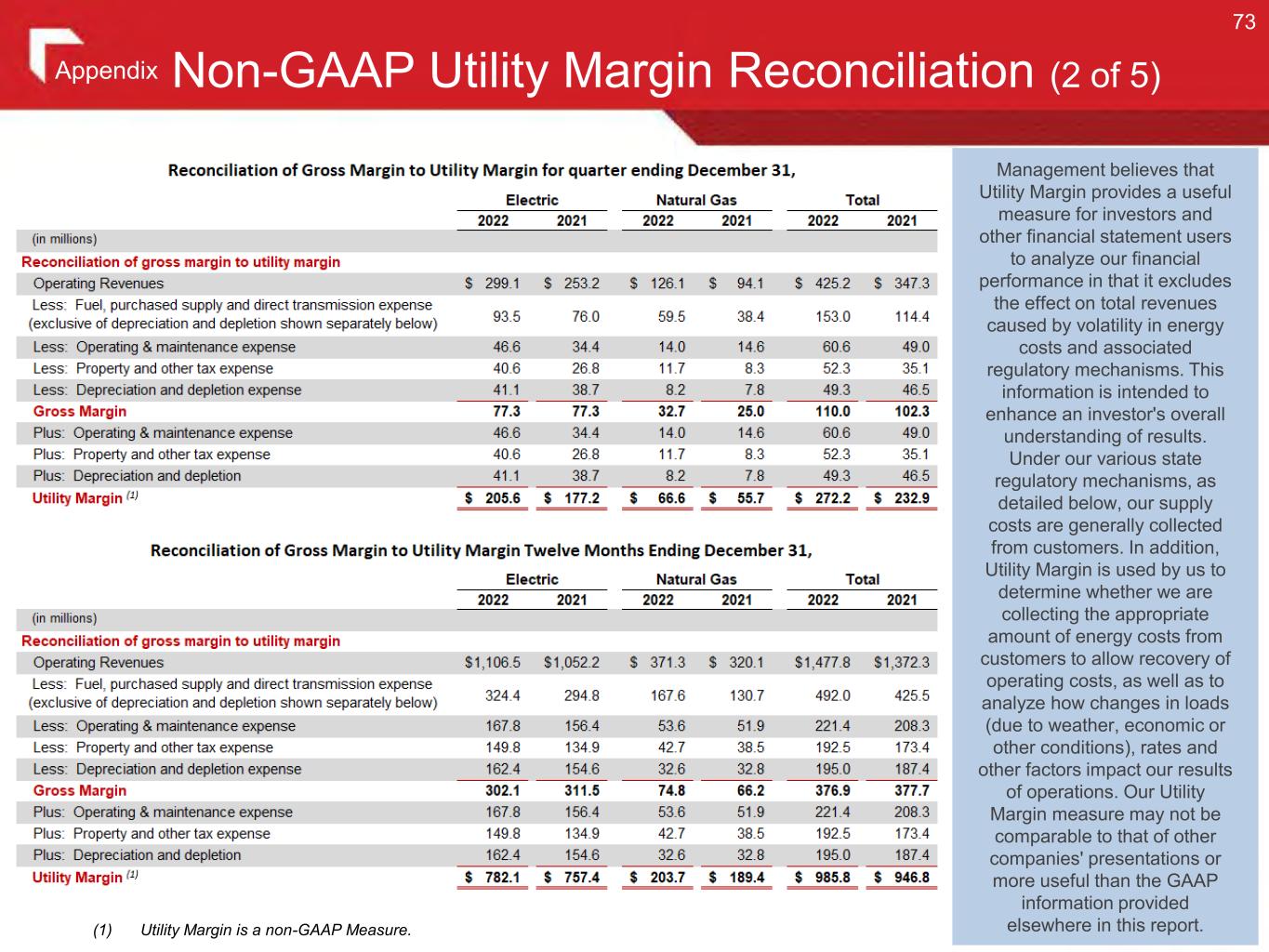

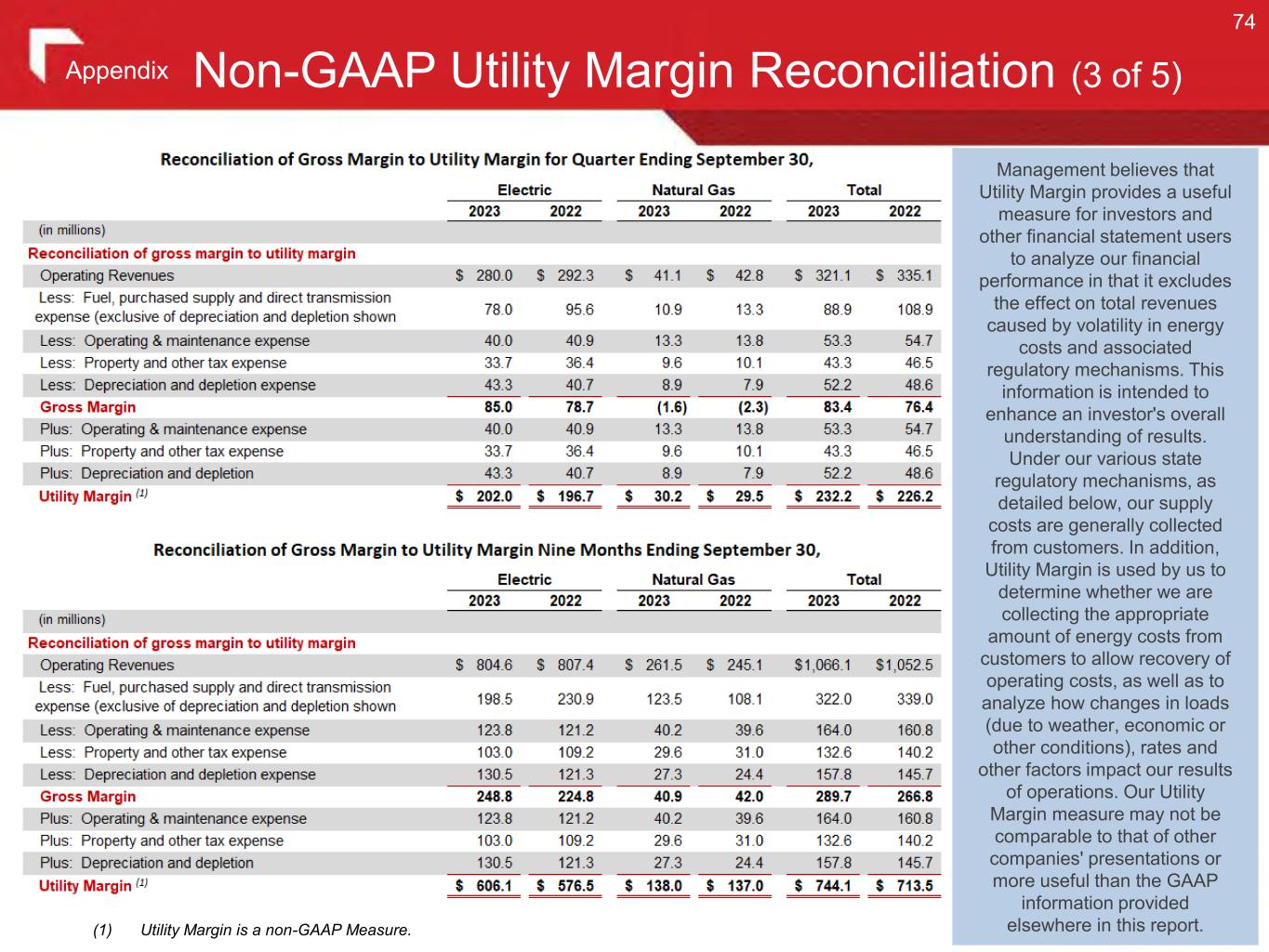

(1) Utility Margin is a non-GAAP Measure. Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. 73 Non-GAAP Utility Margin Reconciliation (2 of 5)Appendix

(1) Utility Margin is a non-GAAP Measure. Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. 74 Non-GAAP Utility Margin Reconciliation (3 of 5)Appendix

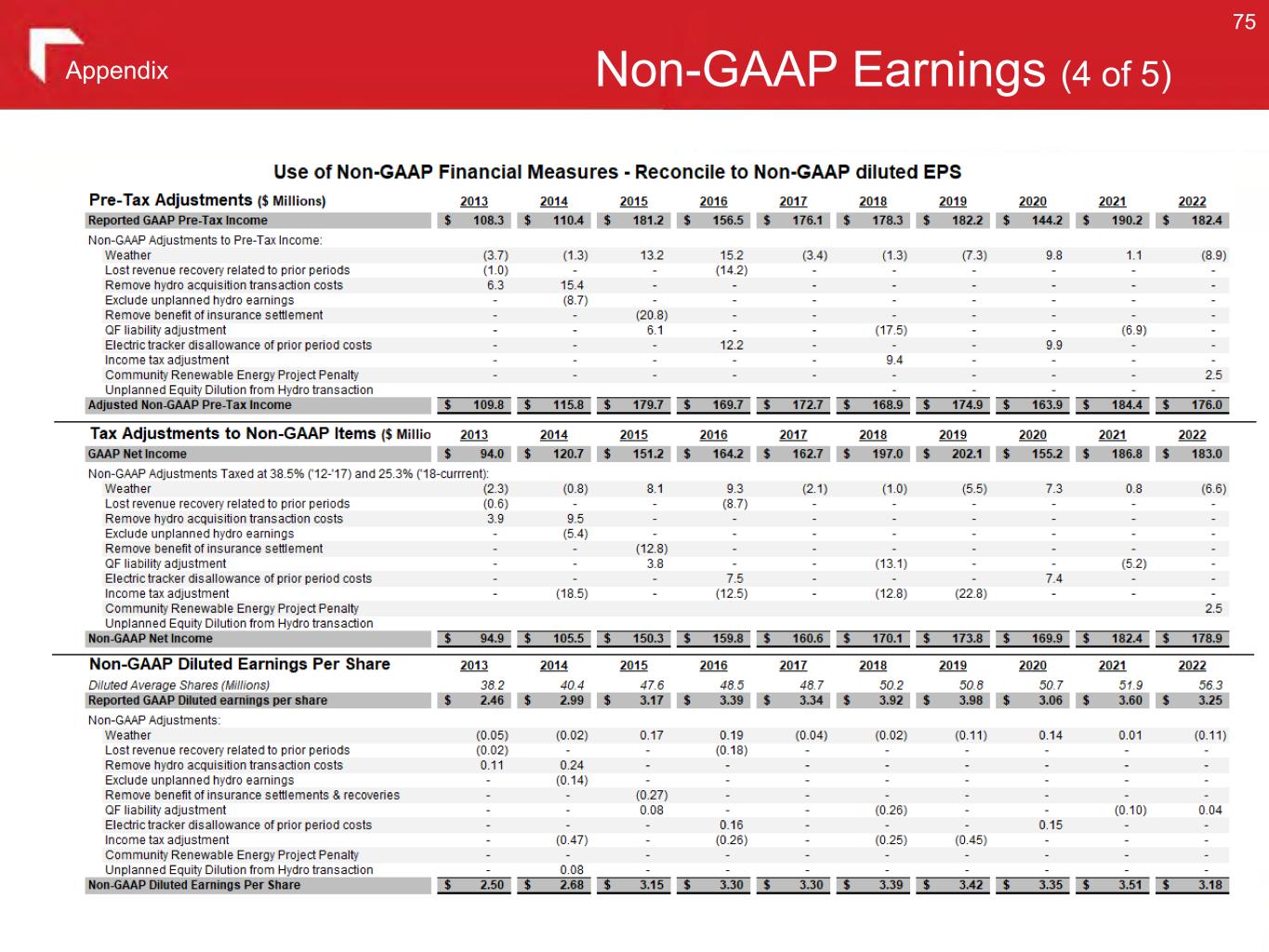

Non-GAAP Earnings (4 of 5) 75 Appendix

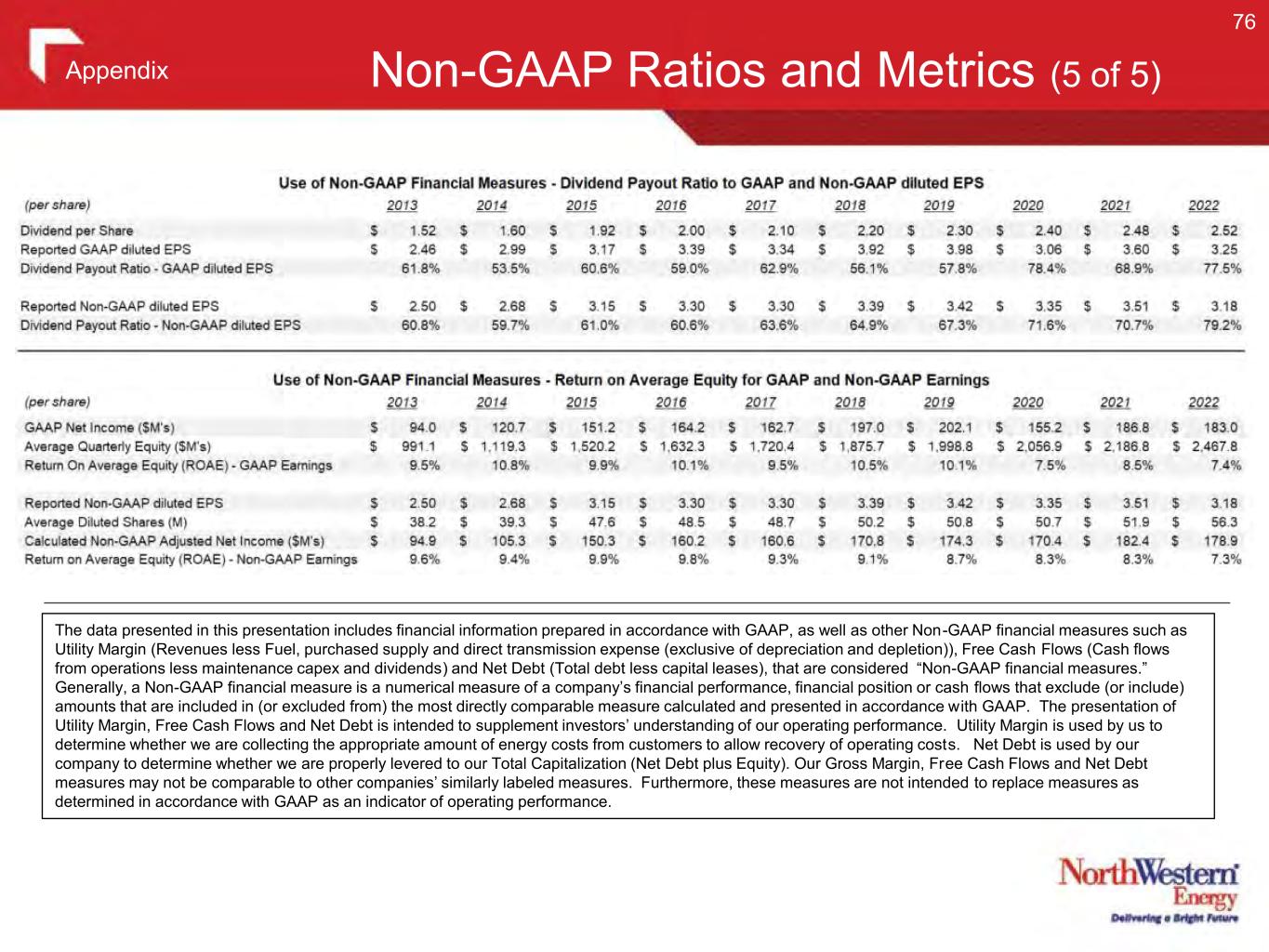

Non-GAAP Ratios and Metrics (5 of 5) The data presented in this presentation includes financial information prepared in accordance with GAAP, as well as other Non-GAAP financial measures such as Utility Margin (Revenues less Fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion)), Free Cash Flows (Cash flows from operations less maintenance capex and dividends) and Net Debt (Total debt less capital leases), that are considered “Non-GAAP financial measures.” Generally, a Non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. The presentation of Utility Margin, Free Cash Flows and Net Debt is intended to supplement investors’ understanding of our operating performance. Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs. Net Debt is used by our company to determine whether we are properly levered to our Total Capitalization (Net Debt plus Equity). Our Gross Margin, Free Cash Flows and Net Debt measures may not be comparable to other companies’ similarly labeled measures. Furthermore, these measures are not intended to replace measures as determined in accordance with GAAP as an indicator of operating performance. 76 Appendix

77