Form 424B3 - Prospectus [Rule 424(b)(3)]

09 January 2025 - 9:20AM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-276853

PROSPECTUS SUPPLEMENT NO. 1

(To Prospectus dated February 15, 2024)

ONDAS HOLDINGS INC.

10,200,000 Shares of Common Stock underlying

Warrants

This prospectus supplement supplements the prospectus dated February

15, 2024, relating to the offer and resale by the selling stockholders identified in this prospectus supplement of up to an aggregate

of 10,200,000 shares of Ondas Holdings Inc. (the “Company”) common stock (“Common Stock”), underlying outstanding

Warrants at an exercise price of $0.89 per share issued to the selling stockholders.

This prospectus supplement is solely being filed to update the Selling

Stockholders table to reflect transfers, including gifts, of the Warrants.

You should read this prospectus supplement, together

with the related prospectus and the additional information described under the headings “Incorporation of Certain Information by

Reference” and “Where You Can Find More Information” carefully before you invest in any of our securities.

Our Common Stock is traded on the NASDAQ Capital

Market (the “Nasdaq”), under the symbol “ONDS.” As of January 7, 2025, the last reported sale price of our Common

Stock on the Nasdaq was $2.65.

This investment involves a high degree of risk.

See “Risk Factors” on page 6 of the prospectus and any similar section contained in the documents that are incorporated by

reference therein.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is January

8, 2025.

The following information is provided to update

the Selling Stockholder table in the prospectus to reflect the transfers, including gifts, of the Warrants.

SELLING STOCKHOLDERS

The following table provides

information about the selling stockholders, listing how many shares of our Common Stock the selling stockholders own on the date of this

prospectus supplement, how many shares may be offered by this prospectus supplement and the prospectus, and the number and percentage

of outstanding shares the selling stockholders will own after the offering, assuming all shares covered by this prospectus supplement

and the prospectus are sold. The information concerning beneficial ownership has been provided by the selling stockholders. Information

concerning the selling stockholders may change from time to time, and any changed information will be set forth if and when required in

prospectus supplements or other appropriate forms permitted to be used by the SEC.

We do not know when or in

what amounts the selling stockholders may offer shares for sale. The selling stockholders may choose not to sell any or all of the shares

offered by this prospectus supplement and the prospectus. Because the selling stockholders may offer all or some of the shares, and because

there are currently no agreements, arrangements or understandings with respect to the sale of any of the shares, we cannot accurately

report the number of the shares that will be held by the selling stockholders after completion of the offering. However, for purposes

of this table, we have assumed that, after completion of the offering, all of the shares covered by this prospectus supplement and the

prospectus will be sold by the selling stockholders.

As of January 6, 2025, 224,819

shares of Common Stock have been issued in connection with the exercise of the Warrants. The number of shares outstanding, and the percentage

of beneficial ownership, post-offering are based on 105,873,300 shares of Common Stock issued and outstanding as of the conclusion of

the offering, calculated on the basis of (i) 95,898,119 shares of Common Stock issued and outstanding as of January 6, 2025 prior

to the offering, which includes 224,819 shares that have been issued pursuant to the exercise of the Warrants, and (ii) assuming the

exercise and sale by the selling stockholders of the remaining 9,975,181 shares of Common Stock underlying the Warrants. For the purposes

of the following table, the number of shares of Common Stock beneficially owned has been determined in accordance with Rule 13d-3 under

the Exchange Act, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under Rule 13d-3,

beneficial ownership includes any shares as to which the selling stockholders have sole or shared voting power or investment power and

also any shares which each selling shareholder, respectively, has the right to acquire within 60 days of the date of this prospectus

through the exercise of any stock option, warrant or other rights.

Selling Stockholder | |

Shares of Common Stock Owned Before the Offering(1) | | |

Shares of Common Stock to be Offered for the Selling Stockholder’s Account(2) | | |

Shares of Common Stock Owned by the Selling Stockholder after the Offering | | |

Percent of Common Stock to be Owned by the Selling Stockholder after the Offering | |

| Stage 1 Growth Fund, LLC Series WAVE | |

| - | | |

| 9,030,000 | | |

| - | | |

| - | |

| The Popolo Family Fund of the Catholic Foundation | |

| - | | |

| 1,000,000 | | |

| - | | |

| - | |

| Inspira Financial Trust, LLC Custodian FBO Philip Rehkemper Roth/IRA xxxxV3660 | |

| - | | |

| 170,000 | | |

| - | | |

| - | |

(1) This column does not include

shares of Common Stock issuable upon exercise of the Warrants.

(2) This

column includes shares of Common Stock issuable upon exercise of the Warrants.

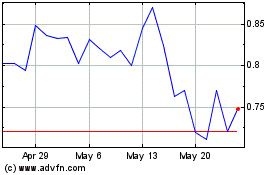

Ondas (NASDAQ:ONDS)

Historical Stock Chart

From Dec 2024 to Jan 2025

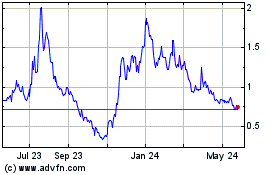

Ondas (NASDAQ:ONDS)

Historical Stock Chart

From Jan 2024 to Jan 2025