Mutual Fund Summary Prospectus (497k)

13 July 2013 - 2:08AM

Edgar (US Regulatory)

SUMMARY PROSPECTUS

OCTOBER

1, 2012, AMENDED AND RESTATED JULY 12, 2013

TIAA-CREF LIFECYCLE 2015 FUND

of the

TIAA-CREF Funds

Class

Ticker

:

Institutional

TCNIX

Retirement

TCLIX

Premier

TCFPX

Before

you invest, you may want to review the Fund’s prospectus, which contains more information about

the Fund and its risks. You can find the Fund’s prospectus and other information about the

Fund online at www.tiaa-cref.org/lc_pro. You can also get this information at no cost by calling 800

223-1200 or by sending an e-mail request to disclosure@tiaa-cref.org. The Fund’s prospectus and

Statement of Additional Information (“SAI”), each dated October 1, 2012, as subsequently supplemented,

and the sections of the Fund’s shareholder report dated May 31, 2012 from “Portfolio of Investments”

through “Notes to Financial Statements,” are incorporated into this Summary Prospectus by reference

and may be obtained free of charge at the website, phone number or e-mail address noted above.

INVESTMENT

OBJECTIVE

The Lifecycle 2015 Fund seeks high total return over time through a combination

of capital appreciation and income.

FEES AND EXPENSES

This table describes the fees and expenses

that you may pay if you buy and hold shares of the Fund.

SHAREHOLDER

FEES

(deducted directly

from gross amount of transaction)

|

|

|

|

|

|

|

|

|

|

Retirement

Class

|

|

Premier

Class

|

|

Institutional

Class

|

|

|

Maximum Sales Charge Imposed on Purchases

(percentage

of offering price)

|

0%

|

|

0%

|

|

0%

|

|

|

Maximum

Deferred Sales Charge

|

0%

|

|

0%

|

|

0%

|

|

|

Maximum

Sales Charge Imposed on Reinvested

Dividends and Other Distributions

|

0%

|

|

0%

|

|

0%

|

|

|

Redemption or Exchange Fee

|

0%

|

|

0%

|

|

0%

|

|

|

Maximum Account Fee

|

0%

|

|

0%

|

|

0%

|

|

TIAA-CREF

Lifecycle 2015 Fund

■

Summary Prospectus

1

ANNUAL FUND OPERATING EXPENSES

(expenses that

you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

|

|

|

|

|

Retirement

Class

|

|

Premier Class

|

|

Institutional

Class

|

|

|

Management

Fees

|

0.10%

|

|

0.10%

|

|

0.10%

|

|

|

Distribution

(Rule 12b-1) Fees

1

|

0.05%

|

|

0.15%

|

|

—

|

|

|

Other

Expenses

|

0.28%

|

|

0.03%

|

|

0.03%

|

|

|

Acquired

Fund Fees and Expenses

2

|

0.42%

|

|

0.42%

|

|

0.42%

|

|

|

Total

Annual Fund Operating Expenses

|

0.85%

|

|

0.70%

|

|

0.55%

|

|

|

Waivers and Expense Reimbursements

3,4

|

(0.18)%

|

|

(0.13)%

|

|

(0.13)%

|

|

|

Total Annual Fund Operating

Expenses After Fee Waiver and/or Expense Reimbursement

|

0.67%

|

|

0.57%

|

|

0.42%

|

|

|

|

|

|

|

|

|

|

|

|

1

|

The Retirement Class of the

Fund has adopted a Distribution (12b-1) Plan that compensates the Fund’s distributor, Teachers Personal

Investors Services, Inc. (“TPIS”), for its expenses in providing distribution, promotional

and/or shareholder services to Retirement Class shares at the annual rate of 0.05% of average daily net

assets attributable to Retirement Class shares. In addition, TPIS has contractually agreed not to seek

payment of this fee under the Plan for Retirement Class shares through September 30, 2013, unless changed

with approval of the Board of Trustees.

|

|

2

|

“Acquired Fund Fees and Expenses” are the Fund’s proportionate amount

of the expenses of any investment companies or pools in which it invests. These expenses are not paid

directly by Fund shareholders. Instead, Fund shareholders bear these expenses indirectly because they

reduce Fund performance. Because “Acquired Fund Fees and Expenses” are included in the chart

above, the Fund’s operating expenses here will not correlate with the expenses included in the Financial

Highlights in this Prospectus and the Fund’s annual report.

|

|

3

|

Under the Fund’s expense reimbursement arrangements, the Fund’s

investment adviser, Teachers Advisors, Inc. (“Advisors”), has contractually agreed to reimburse

the Fund for any Total Annual Fund Operating Expenses (excluding interest, taxes, brokerage commissions

or other transactional expenses, Acquired Fund Fees and Expenses and extraordinary expenses) that exceed:

(i) 0.25% of average daily net assets for Retirement Class shares; (ii) 0.15% of average daily net assets

for Premier Class shares; and (iii) 0.00% of average daily net assets for Institutional Class shares

of the Fund. These expense reimbursement arrangements will continue through at least September 30, 2013,

unless changed with approval of the Board of Trustees.

|

|

4

|

Advisors has contractually agreed to waive the Fund’s Management

Fees equal to, on an annual basis, 0.10%. This waiver will remain in effect through September 30, 2013,

unless changed with approval of the Board of Trustees.

|

Example

This example

is intended to help you compare the cost of investing in shares of the Fund with the cost of investing

in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated

and then redeem all your shares at the end of those periods. The example also assumes that your investment

has a 5% return each year and that the Fund’s operating expenses, before expense reimbursements,

remain the same. The example assumes that the Fund’s fee waiver and/or expense reimbursement agreement

will remain in place through September 30, 2013 but that there will be no waiver or expense reimbursement

agreement in effect thereafter. Although your actual costs may be higher or lower, based on these assumptions

your costs would be:

2

Summary

Prospectus

■

TIAA-CREF Lifecycle

2015 Fund

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement Class

|

|

Premier

Class

|

|

Institutional Class

|

|

|

1 Year

|

$

|

68

|

|

$

|

58

|

|

$

|

43

|

|

|

3

Years

|

$

|

253

|

|

$

|

211

|

|

$

|

163

|

|

|

5

Years

|

$

|

454

|

|

$

|

377

|

|

$

|

294

|

|

|

10 Years

|

$

|

1,032

|

|

$

|

858

|

|

$

|

677

|

|

PORTFOLIO

TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities

(or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which

are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance.

During the fiscal year ended May 31, 2012 the Fund’s portfolio turnover rate was 11% of the average

value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

The Fund is a “fund

of funds” that invests in Institutional Class shares of other funds of the Trust and potentially

in other investment pools or investment products (collectively, the “Underlying Funds”). In

general, the Fund is designed for investors who have an approximate target retirement year in mind, and

the Fund’s investments are adjusted from more aggressive to more conservative over time as the target

retirement year approaches and for approximately seven to ten years afterwards. The Fund invests in Underlying

Funds according to an asset allocation strategy designed for investors retiring or planning to retire

within a few years of 2015.

The Fund expects to allocate approximately 51.60% of its assets

to equity Underlying Funds and 48.40% of its assets to fixed-income Underlying Funds. These allocations

represent targets for equity and fixed-income asset classes. Target allocations will change over time

and actual allocations may vary up to 10% from the targets. The target allocations along the investment

glidepath, illustrated in the chart below, gradually become more conservative, moving to target allocations

of approximately 50% equity/50% fixed-income in the Fund’s target retirement year of 2015 and reaching

the Fund’s final target allocation of approximately 40% equity/60% fixed-income at some point from

2022 to 2025. Within the equity and fixed-income asset classes, the Fund allocates its investments to

particular market sectors (U.S. equity, international equity, fixed-income, short-term fixed-income and

inflation-protected assets) represented by various Underlying Funds. These market sector allocations

may vary by up to 10% from the Fund’s target market sector allocations. The Fund’s current

target market sector allocations for June 30, 2014, which will change over time, are approximately as

follows: U.S. Equity: 36.12%; International Equity: 15.48%; Fixed-Income: 37.20%; Short-Term Fixed-Income:

5.60%; and Inflation-Protected Assets: 5.60%.

TIAA-CREF Lifecycle 2015 Fund

■

Summary

Prospectus

3

The Fund’s target market sector allocations to Underlying Funds may include

the TIAA-CREF Growth & Income Fund, Large-Cap Growth Fund, Large-Cap Value Fund, Mid-Cap Growth Fund,

Mid-Cap Value Fund, Small-Cap Equity Fund, Enhanced Large-Cap Growth Index Fund and Enhanced Large-Cap

Value Index Fund (U.S. Equity); International Equity Fund, International Opportunities Fund, Enhanced

International Equity Index Fund, Global Natural Resources Fund and Emerging Markets Equity Fund (International

Equity); Bond Fund, Bond Plus Fund and High-Yield Fund (Fixed-Income); Short-Term Bond Fund and Money

Market Fund (Short-Term Fixed-Income); and Inflation-Linked Bond Fund (Inflation-Protected Assets).

Additional

or replacement Underlying Funds for each market sector, as well as additional or replacement market sectors,

may be included when making future allocations if Advisors believes that such Underlying Funds and/or

market sectors are appropriate in light of the Fund’s desired levels of risk and potential return

at the particular time. The Fund’s portfolio management team may also add a new market sector if

it believes that will help to achieve the Fund’s investment objective. The relative allocations

among Underlying Funds within a market sector may be changed at any time without notice to shareholders,

and the portfolio management team may use tactical allocation to take advantage of short to intermediate

term opportunities through a combination of positions in Underlying Funds. If 10% or more of a Fund’s

assets are expected to be invested in any Underlying Fund or market sectors not listed above, shareholders

will receive prior notice of such change.

The Fund’s asset class allocations, market

sector allocations within each asset class, and Underlying Fund allocations within each market sector,

as of May 31, 2013, are listed in the chart below. These allocations will change over time.

|

|

|

|

|

|

|

|

Asset Class

|

Allocation

|

Market Sector

|

Allocation

|

Underlying Funds

|

Allocation

|

|

EQUITY

|

53.73%

|

U.S. Equity

|

37.61%

|

l

Large-Cap Value Fund

|

7.19%

|

|

|

|

|

|

l

Enhanced Large-Cap Value Index Fund

|

7.18%

|

|

|

|

|

|

l

Large-Cap

Growth Fund

|

6.66%

|

|

|

|

|

|

l

Enhanced Large-Cap Growth

Index Fund

|

6.65%

|

|

|

|

|

|

l

Growth & Income Fund

|

6.12%

|

|

|

|

|

|

l

Small-Cap Equity Fund

|

2.99%

|

|

|

|

|

|

l

Mid-Cap

Value Fund

|

0.45%

|

|

|

|

|

|

l

Mid-Cap Growth Fund

|

0.37%

|

|

|

|

International Equity

|

16.12%

|

l

International Equity Fund

|

5.53%

|

|

|

|

|

|

l

Enhanced International Equity Index Fund

|

4.41%

|

|

|

|

|

|

l

Emerging

Markets Equity Fund

|

3.64%

|

|

|

|

|

|

l

Global Natural Resources

Fund

|

1.56%

|

|

|

|

|

|

l

International Opportunities Fund

|

0.98%

|

|

FIXED-INCOME

|

46.27%

|

Fixed-Income

|

35.81%

|

l

Bond Fund

|

30.98%

|

|

|

|

|

|

l

High-Yield

Fund

|

3.42%

|

|

|

|

|

|

l

Bond Plus Fund

|

1.41%

|

4

Summary Prospectus

■

TIAA-CREF Lifecycle 2015 Fund

|

|

|

|

|

|

|

|

Asset

Class

|

Allocation

|

Market Sector

|

Allocation

|

Underlying Funds

|

Allocation

|

|

|

|

Short-Term

Fixed-Income

|

5.48%

|

l

Short-Term Bond Fund

|

5.14%

|

|

|

|

|

|

l

Money Market Fund

|

0.34%

|

|

|

|

Inflation-Protected

Assets

|

4.98%

|

l

Inflation-Linked Bond Fund

|

4.98%

|

|

|

|

|

|

|

|

|

Total

|

100.00%

|

|

100.00%

|

|

100.00%

|

The

following chart shows how the investment glidepath for the Fund is expected to gradually move the Fund’s

target allocations over time between the different target market sector allocations. The actual market

sector allocations of the Fund may differ from this chart. The Fund seeks to achieve its final target

market sector allocations approximately seven to ten years following the target date.

The

Fund is designed to accommodate investors who invest in a fund up to their target retirement date, and

plan to make gradual systematic withdrawals in retirement. In addition, investors should note that the

Fund will continue to have a significant level of equity exposure up to, through and after its target

retirement date, and this exposure could cause significant fluctuations in the value of the Fund depending

on the performance of the equity markets generally.

Approximately seven to ten

years after the Fund enters its target retirement year, the Board of Trustees may authorize the merger

of the Fund into the Lifecycle Retirement Income Fund or other similar fund. Fund shareholders will receive

prior notice of any such merger. The Lifecycle Retirement Income Fund is designed to maintain a relatively

stable allocation among the Underlying Funds reflecting the resting point on the glidepath described

in the chart above. More detailed information about the Lifecycle Retirement Income Fund is contained

in the prospectus for that fund.

TIAA-CREF Lifecycle 2015 Fund

■

Summary

Prospectus

5

PRINCIPAL INVESTMENT RISKS

You could lose money over short or long periods by investing in

this Fund. Accordingly, an investment in the Fund or the Underlying Funds typically is subject to the

following principal investment risks:

·

Asset

Allocation Risk

—The risk that the Fund may not achieve its target allocations. In addition,

there is the risk that the asset allocations may not achieve the desired risk-return characteristic or

that the selection of Underlying Funds and the allocations among them will result in the Fund underperforming

other similar funds or cause an investor to lose money.

·

Underlying Funds Risk

—The Fund is exposed to the risks

of the Underlying Funds in which it invests in direct proportion to the amount of assets the Fund allocates

to each Underlying Fund.

·

Equity

Underlying Funds Risks

—The risks of investing in equity Underlying Funds include risks specific

to their investment strategies, such as style risk, capitalization risk, and foreign investment risk,

among others, as well as risks related to the equity markets in general.

·

Fixed-Income Underlying Funds Risks

—The risks of investing

in fixed-income Underlying Funds include credit risk, interest rate risk, and market volatility, liquidity

and valuation risk, among others.

·

Active

Management Risk

—The risk that the strategy, investment selection or trading execution of

Advisors could cause the Fund or an Underlying Fund to underperform its benchmark index or mutual funds

with similar investment objectives.

·

Fund

of Funds Risk

—The ability of the Fund to achieve its investment objective will depend in

part upon the ability of the Underlying Funds to achieve their investment objectives. There can be no

guarantee that any Underlying Fund will achieve its investment objective.

There

can be no assurances that the Fund will achieve its investment objective. You should not consider the

Fund to be a complete investment program. Please see the non-summary portion of the prospectus for more

detailed information about the risks described above, including the risks of the Underlying Funds.

PAST PERFORMANCE

The

following chart and table help illustrate some of the risks of investing in the Fund by showing changes

in the Fund’s performance from year to year. The bar chart shows the annual total returns of the

Retirement Class of the Fund, before taxes, in each full calendar year since inception of the class.

Because the expenses vary across share classes, the performance of the Retirement Class will vary from

the other share classes. Below the bar chart are the best and worst returns for a calendar quarter since

inception of the Retirement Class. The performance table following the bar chart shows the Fund’s

average annual total returns for the Retirement, Institutional and Premier Classes over the one-year,

five-year, ten-year and since-inception periods (where applicable) ended

6

Summary Prospectus

■

TIAA-CREF Lifecycle 2015 Fund

December

31, 2011, and how those returns compare to those of a broad-based securities market index and a composite

index based on the Fund’s target allocations. After-tax performance is shown only for the Retirement

Class shares, and after-tax returns for the other Classes of shares will vary from the after-tax returns

presented for Retirement Class shares.

The returns shown below reflect previous agreements

by Advisors to waive or reimburse the Fund and certain Underlying Funds for certain fees and expenses.

Without these waivers and reimbursements, the returns of the Fund would have been lower. Past performance

of the Fund (before and after taxes) is not necessarily an indication of how it will perform in the future.

The indices listed below are unmanaged, and you cannot invest directly in an index. The returns for the

indices reflect no deduction for fees, expenses or taxes.

For current performance

information of each share class, including performance to the most recent month-end, please visit www.tiaa-cref.org.

ANNUAL

TOTAL RETURNS FOR THE RETIREMENT CLASS SHARES (%)

†

Lifecycle 2015 Fund

†

The year-to-date return

as of the most recent calendar quarter, which ended on June 30, 2012, was 6.13%.

Best quarter: 12.39%, for the quarter ended June 30, 2009. Worst

quarter: -12.97%, for the quarter ended December 31, 2008.

TIAA-CREF Lifecycle 2015 Fund

■

Summary

Prospectus

7

AVERAGE

ANNUAL TOTAL RETURNS

For the Periods Ended December 31, 2011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inception Date

|

|

One Year

|

|

|

Five Years

|

|

|

Since Inception

|

|

|

Retirement Class

|

10/15/04

|

|

|

|

$

|

|

|

$

|

|

|

|

|

Return Before Taxes

|

|

|

0.46

|

%

|

|

1.83

|

%

|

|

4.18

|

%

|

|

|

Return After Taxes on Distributions

|

|

|

–0.54

|

%

|

|

1.06

|

%

|

|

3.30

|

%

|

|

|

Return After Taxes on Distributions and Sale of

|

|

|

|

|

|

|

|

|

|

|

|

|

Fund Shares

|

|

|

0.83

|

%

|

|

1.22

|

%

|

|

3.18

|

%

|

|

Institutional Class

|

1/17/07

|

|

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

0.74

|

%

|

|

2.10

|

%*

|

|

4.37

|

%*

|

|

Premier Class

|

9/30/09

|

|

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

0.65

|

%

|

|

1.89

|

%*

|

|

4.22

|

%*

|

|

Russell 3000

®

Index

|

|

|

|

|

|

|

|

|

|

|

|

(reflects

no deductions for fees, expenses or taxes)

|

|

|

1.03

|

%

|

|

–0.01

|

%

|

|

4.34

|

%

†

|

|

Lifecycle

2015 Fund Composite Index

‡

|

|

|

|

|

|

|

|

|

|

|

|

(reflects no deductions for fees, expenses or

taxes)

|

|

|

2.33

|

%

|

|

2.15

|

%

|

|

4.62

|

%

†

|

|

Current performance of the Fund’s shares may be higher or lower

than that shown above.

|

|

*

|

The performance shown for the Institutional Class and Premier Class that is prior to

their inception dates is based on performance of the Fund’s Retirement Class. The performance for

these periods has not been restated to reflect the lower expenses of the Institutional Class and Premier

Class.

|

|

†

|

Performance is calculated from the inception date of the Retirement

Class.

|

|

‡

|

As of the close of business on December 31, 2011, the Lifecycle

2015 Fund Composite Index consisted of: 41.7% Russell 3000 Index; 35.2% Barclays U.S. Aggregate Bond

Index; 13.9% MSCI EAFE + Emerging Markets Index; 4.6% Barclays U.S. 1–5 Year Government/Credit Bond

Index; and 4.6% Barclays U.S. Treasury Inflation Protected Securities Index (Series-L). The Fund’s

composite benchmark, the components that make up a composite benchmark and the method of calculating

a composite benchmark’s performance may vary over time.

|

|

|

|

After-tax

returns are calculated using the historical highest individual federal marginal income tax rates in effect

during the periods shown and do not reflect the impact of state and local taxes. Actual after-tax returns

depend on the investor’s tax situation and may differ from those shown. The after-tax returns shown

are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(a),

401(k) or 403(b) plans or Individual Retirement Accounts (IRAs). After-tax returns are shown for only

one class, and after-tax returns for other classes will vary.

|

|

|

PORTFOLIO MANAGEMENT

Investment Adviser.

The Fund’s

investment adviser is Teachers Advisors, Inc.

Portfolio Managers.

The following persons manage the Fund on a day-to-day basis:

|

|

|

|

|

|

|

|

|

Name:

|

Hans Erickson, CFA

|

John Cunniff, CFA

|

|

Title:

|

Managing

Director

|

Managing

Director

|

|

Experience on Fund:

|

since

2006

|

since 2006

|

8

Summary Prospectus

■

TIAA-CREF Lifecycle 2015 Fund

PURCHASE AND SALE OF FUND SHARES

Retirement Class and Premier Class shares are

generally available for purchase through employee benefit plans or other types of savings plans or accounts.

Institutional Class shares are available for purchase directly from the Fund by certain eligible investors

or through financial intermediaries.

·

There is no minimum initial or subsequent investment

for Retirement Class shares. Retirement Class shares are primarily offered through employer-sponsored

employee benefit plans.

·

There is a $100 million aggregate plan size and $1 million

initial minimum plan-level investment requirement for Premier Class shares. Premier Class shares are

primarily offered through certain financial intermediaries and employer-sponsored employee benefit plans.

·

The

minimum initial investment is $2 million and the minimum subsequent investment is $1,000 for Institutional

Class shares, unless an investor purchases shares by or through financial intermediaries that have entered

into an appropriate agreement with the Fund or its affiliates.

Redeeming or Exchanging Shares.

You can redeem (sell) or

exchange your shares of the Fund on any business day. Exchanges may be made for shares of the same share

class of other funds offered by the Trust. If your shares are held through a third party, please

contact that entity for applicable redemption or exchange requirements. If your shares are held directly

with the Fund, contact the Fund directly in writing or by telephone.

TAX INFORMATION

The Fund

intends to make distributions to shareholders that may be taxed as ordinary income or capital gains.

Distributions made to tax-exempt shareholders or shareholders who hold Fund shares in a tax-deferred

account are generally not subject to income tax in the current year, but redemptions made from tax-deferred

accounts may be subject to income tax.

PAYMENTS TO BROKER-DEALERS AND OTHER

FINANCIAL INTERMEDIARY COMPENSATION

If

you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund

and/or its related companies may pay the intermediary for the sale of Fund shares and related services

or for other investor services. These payments may create a conflict of interest by influencing

the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment.

Ask your salesperson or visit your financial intermediary’s website for more information.

TIAA-CREF

Lifecycle 2015 Fund

■

Summary Prospectus

9

[This page intentionally left blank.]

[This

page intentionally left blank.]

|

|

|

|

|

|

Printed on paper containing

recycled fiber

|

A11995 (7/13)

|

A11995

(7/13)

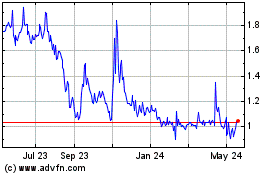

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Dec 2024 to Jan 2025

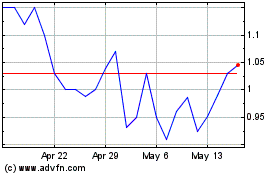

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Jan 2024 to Jan 2025