Oportun Financial Corporation (Nasdaq: OPRT) (“Oportun”, or the

"Company") today reported financial results for the fourth quarter

and full year ended December 31, 2023.

"We executed well during the fourth quarter and

met each of our guidance metrics," said Raul Vazquez, CEO of

Oportun. "Our top-line remained resilient and we completed full

year 2023 with a record $1.1 billion of total revenue, for 11%

growth year-over-year, while continuing to focus on the quality

rather than the quantity of our originations under a tightened

credit posture. We also continued to drive operating efficiencies

and reduced our quarterly operating expenses by 15% year-over-year,

setting our sixth consecutive post-IPO record for Adjusted

Operating Efficiency. We're pleased that the $200 million asset

backed securitization we completed in February was ten times

oversubscribed, indicative of the investment community's strong

confidence in the quality of Oportun's underwriting and its

business model. Committed to enhancing our profitability while

serving our members as a much leaner enterprise, we're ardently

focused on winning in the marketplace with three differentiated

core products: unsecured personal loans, secured personal loans and

savings. Our initial full year 2024 guidance reflects markedly

improved profitability on an adjusted basis, supported by an

additional $30 million in run-rate operating expense savings to be

achieved by 4Q24."

Fourth Quarter and Full Year

2023 Results

|

Metric |

GAAP |

|

Adjusted1 |

|

|

4Q23 |

4Q22 |

FY23 |

FY22 |

|

4Q23 |

4Q22 |

FY23 |

FY22 |

|

Total revenue |

$ |

263 |

|

$ |

262 |

|

$ |

1,057 |

|

$ |

953 |

|

|

|

|

|

|

|

Net income (loss) |

($ |

42 |

) |

$ |

(8.4 |

) |

($ |

180 |

) |

($ |

78 |

) |

|

($ |

21 |

) |

$ |

4.6 |

|

$ |

(124 |

) |

$ |

69 |

|

|

Diluted EPS |

($ |

1.09 |

) |

$ |

(0.25 |

) |

($ |

4.88 |

) |

$ |

(2.37 |

) |

|

($ |

0.54 |

) |

$ |

0.14 |

|

($ |

3.37 |

) |

$ |

2.09 |

|

|

Adjusted EBITDA |

|

|

|

|

|

$ |

6.1 |

|

$ |

(34 |

) |

$ |

1.7 |

|

$ |

(10 |

) |

|

Dollars in millions, except per share amounts. |

|

|

|

|

|

|

|

|

|

1 See the section entitled “About Non-GAAP

Financial Measures” for an explanation of non-GAAP measures, and

the table entitled “Reconciliation of Non-GAAP Financial Measures”

for a reconciliation of non-GAAP to GAAP measures. |

Fourth Quarter

2023

- Members were 2.2 million, an

increase of 18% compared to the prior-year quarter

- Products were 2.4 million, an

increase of 19% compared to the prior-year quarter

- Aggregate Originations were $437

million, down 28% compared to the prior-year quarter

- Portfolio Yield was 32.7%, an

increase of 100 basis points compared to the prior-year

quarter

- Managed Principal Balance at End of

Period was $3.2 billion, down 7% compared to the prior-year

quarter

- Annualized Net Charge-Off Rate of

12.3% as compared to 12.8% for the prior-year quarter

- 30+ Day

Delinquency Rate of 5.9% as compared to 5.6% for the prior-year

quarter

Full Year

2023

- Aggregate Originations were $1.8

billion, down 38% year-over-year

- Portfolio Yield was 32.2%, an

increase of 23 basis points year-over-year

- Managed Principal Balance at End of

Period was $3.2 billion, down 7% year-over-year

- Annualized Net Charge-Off Rate of

12.2% as compared to 10.1% for the prior-year period

Financial and Operating

Results

All figures are as of or for the quarter ended

December 31, 2023, unless otherwise noted.

Operational Drivers

Members – Members as of the end

of the fourth quarter grew to 2.2 million, up 18% from 1.9

million at the end of the prior-year quarter.

Products – Products as of the

end of the fourth quarter grew to 2.4 million, up 19% from 2.0

million at the end of the prior-year quarter.

Originations – Aggregate

Originations for the fourth quarter were $437 million, a decrease

of 28% as compared to $610 million in the prior-year quarter.

Aggregate Originations for the full year 2023 were $1.8 billion, a

decrease of 38% as compared to $2.9 billion in 2022. The decrease

is primarily due to credit tightening actions. The decrease in

number of loans originated was partially offset by growth in

average loan size due to a focus on returning members.

Portfolio Yield – Portfolio

Yield as of the end of fourth quarter was 32.7%, an increase of 100

basis points as compared to 31.7% in the prior-year quarter.

Portfolio Yield for the full year 2023 was 32.2%, an increase of 23

basis points as compared to 32.0% in 2022. Both figures were

primarily attributable to higher pricing on our personal loan

products.

Fourth Quarter 2023 Financial

Results

Revenue – Total revenue for the

fourth quarter was $263 million, essentially flat as compared to

total revenue of $262 million in the prior-year quarter. Total

revenue was flat as increased portfolio yield and higher

non-interest income was offset by a decrease in the Average Daily

Principal Balance. Net Revenue for the fourth quarter was $72

million, a decrease of 50% as compared to Net Revenue of $143

million in the prior-year quarter. Net Revenue declined from the

prior-year quarter due to an unfavorable change in fair value and

increased interest expense, partially offset by improved net

charge-offs.

Operating Expenses and Adjusted

Operating Expenses – For the fourth quarter, total

operating expense was $129 million including $7 million of costs

related to severance, a decrease of 15% as compared to $151 million

in the prior-year quarter. Adjusted Operating Expense, which

excludes stock-based compensation expense and certain non-recurring

charges, decreased 27% year-over-year to $101 million.

Net Income (Loss) and Adjusted Net

Income (Loss) – Net loss was $41.8 million, as compared to

net loss of $8.4 million in the prior-year quarter. Adjusted Net

Loss was $21 million, as compared to Adjusted Net Income of $4.6

million in the prior-year quarter. The decreases in net income

and Adjusted Net Income are attributable to an unfavorable net

change in fair value, and increased interest expense.

Earnings (Loss) Per Share and Adjusted

EPS – GAAP net loss per share, basic and diluted, were

both $1.09 , as compared to basic and diluted loss per share of

$0.25 each in the prior-year quarter. Adjusted loss per share was

$0.54 as compared to adjusted earnings per share of $0.14 in the

prior-year quarter.

Adjusted EBITDA – Adjusted

EBITDA was $6.1 million, up $40 million from the prior year

quarter, driven by a significant reduction in operating

expenses.

Full Year 2023 Financial

Results

Revenue – Total revenue for the

full year was $1.1 billion, an increase of 11% as compared to total

revenue of $953 million in 2022. The increase was primarily due to

increased interest income attributable to a higher Average Daily

Principal Balance and increased non-interest income attributable to

interest earned on our savings product, recently rebranded as "Set

& Save."

Operating Expenses and Adjusted

Operating Expenses – For the full year, total operating

expense was $534 million, a decrease of 25% as compared to $716

million in 2022. Adjusted Operating Expense, which excludes

stock-based compensation expense and certain non-recurring charges,

decreased 17% year-over-year to $452 million, primarily driven by

the Company's reductions in force, decreased marketing spend as we

shifted our strategy to focus efforts on existing and returning

members and other cost savings measures.

Net Income (Loss) and Adjusted Net

Income (Loss) – Net loss was $180 million, as compared to

a net loss of $78 million in 2022. Adjusted Net Loss was $124

million, as compared to Adjusted Net Income of $69 million in

2022. The decreases in net income and Adjusted Net Income are

attributable to non-cash fair value mark-to-market adjustments,

increased charge-offs and interest expense, partially offset by

increased revenues.

Earnings (Loss) Per Share and Adjusted

EPS – GAAP net loss per share, basic and diluted, were

both $4.88 for the full year 2023 as compared to basic and diluted

loss per share of $2.37 each in 2022. Adjusted loss per share was

$3.37 in 2023 as compared to adjusted earnings per share of $2.09

in 2022.

Adjusted EBITDA – Adjusted

EBITDA was $1.7 million, up $12 million from 2022. Adjusted EBITDA

as a percentage of total revenue was 0.2% and (1.1)% for 2023 and

2022, respectively.

Credit and Operating

Metrics

Net Charge-Off Rate – The

Annualized Net Charge-Off Rate for the fourth quarter was 12.3%,

compared to 12.8% for the prior-year quarter, and 12.2% for the

full year 2023, compared to 10.1% for 2022 and 6.8% for 2021.

30+ Day Delinquency Rate – 30+

Day Delinquency Rate was 5.9% at the end of 2023, compared to 5.6%

at the end of 2022. 30+ Day Delinquency Rates are presented on page

11 of the Company's Earnings Presentation available at

investor.oportun.com.

Operating Efficiency and Adjusted

Operating Efficiency – Operating Efficiency for the

fourth quarter was 49% as compared to 58% in the prior-year

quarter. Adjusted Operating Efficiency in the fourth quarter

was 38%, as compared to 52% in the prior-year quarter. For the full

year 2023, Operating Efficiency was 51% as compared to 75% for

2022. Adjusted Operating Efficiency for the full year 2023 was

43%, as compared to 57% for 2022. The improvement in Operating

Efficiency and Adjusted Operating Efficiency reflect the Company's

revenue growing more quickly than operating expenses. Adjusted

Operating Efficiency excludes stock-based compensation expense and

certain non-recurring charges, such as impairment charges, the

Company's retail network optimization expenses, and acquisition and

integration related expenses.

Return on Equity ("ROE") and Adjusted

ROE – ROE for the fourth quarter was (39)%, compared

to (6.1)% in the prior-year quarter. Adjusted ROE for the

fourth quarter was (19)%, compared to 3.3% in the corresponding

prior-year quarter. ROE for the full year 2023 was (38)%, as

compared to (14)% for 2022. Adjusted ROE for the full year

2023 was (26)%, as compared to 12% for 2022.

Other Products

Secured personal loans – As of

December 31, 2023, the Company had a secured personal loan

receivables balance of $117 million, down 1% from $119 million at

the end of 2022, and down 1% quarter-over-quarter.

Credit card receivables – As of

December 31, 2023, the Company had a credit card receivables

balance of $111 million, down 15% from $131 million at the end of

2022, and down 4% quarter-over-quarter.

Funding and Liquidity

As of December 31, 2023, cash and cash

equivalents were $91 million and restricted cash was $115 million.

Cost of Debt was 6.0% for the year ended December 31, 2023, as

compared to 3.7% for the year ended December 31, 2022. Cost of Debt

was 7.1% for the fourth quarter of 2023 as compared to 4.8% for the

prior-year quarter. Debt-to-Equity was 7.2x as of December 31,

2023, as compared to 5.3x as of December 31, 2022. As of December

31, 2023, the Company had $378 million of undrawn capacity on its

existing $600 million personal loan warehouse line. The Company's

personal loan warehouse line is committed through September 2024.

As of December 31, 2023, the Company had $31 million of undrawn

capacity on its existing $100 million credit card warehouse line.

The Company's credit card warehouse line is committed through

December 2024.

On October 20, 2023, the Company borrowed $197

million under a new private structured financing facility with

Castlelake, its affiliates and other investors. The facility has a

two-year revolving period.

On November 2, 2023, the Company entered into a

forward flow whole loan sale agreement with an institutional

investor. Pursuant to the agreement, the Company is expected to

sell up to $70 million of its unsecured personal loan

originations for an initial term of twelve months.

Financial Outlook for First

Quarter and Full Year 2024

Oportun is providing the following guidance for

1Q 2024 and full year 2024 as follows:

|

|

1Q 2024 |

|

Full Year 2024 |

|

Total Revenue |

$233 - $238 M |

|

$975 - $1,000 M |

|

Annualized Net Charge-Off Rate |

12.1% +/- 15 bps |

|

11.9% +/- 50 bps |

|

Adjusted EBITDA1 |

$(14) - $(12) M |

|

$60 - $70 M |

|

|

|

|

|

|

1 See the section entitled “About Non-GAAP

Financial Measures” for an explanation of non-GAAP measures,

including revised Adjusted EBITDA, and the table entitled

“Reconciliation of Forward Looking Non-GAAP Financial Measures” for

a reconciliation of non-GAAP to GAAP measures. |

|

|

Conference Call

As previously announced, Oportun’s management

will host a conference call to discuss fourth quarter 2023 results

at 5:00 p.m. ET (2:00 p.m. PT) today. A live webcast of the

call will be accessible from the Investor Relations page of

Oportun's website at https://investor.oportun.com. The dial-in

number for the conference call is 1-866-604-1698 (toll-free) or

1-201-389-0844 (international). Participants should call in 10

minutes prior to the scheduled start time. Both the call and

webcast are open to the general public. For those unable to listen

to the live broadcast, a webcast replay of the call will be

available at https://investor.oportun.com for one year. An investor

presentation that includes supplemental financial information and

reconciliations of certain non-GAAP measures to their most directly

comparable GAAP measures, will be available on the Investor

Relations page of Oportun's website at https://investor.oportun.com

prior to the start of the conference call.

About Non-GAAP Financial

Measures

This press release presents information about

the Company’s Adjusted Net Income (Loss), Adjusted EPS, Adjusted

EBITDA, Adjusted Operating Efficiency, Adjusted Operating Expense

and Adjusted ROE, which are non-GAAP financial measures provided as

a supplement to the results provided in accordance with accounting

principles generally accepted in the United States of America

(“GAAP”). The Company believes these non-GAAP measures can be

useful measures for period-to-period comparisons of its core

business and provide useful information to investors and others in

understanding and evaluating its operating results. Non-GAAP

financial measures are provided in addition to, and not as a

substitute for, and are not superior to, financial measures

calculated in accordance with GAAP. In addition, the non-GAAP

measures the Company uses, as presented, may not be comparable to

similar measures used by other companies. Reconciliations of

non-GAAP to GAAP measures can be found below.

About Oportun

Oportun (Nasdaq: OPRT) is a mission-driven

fintech that puts its 2.2 million members' financial goals within

reach. With intelligent borrowing, savings, and budgeting

capabilities, Oportun empowers members with the confidence to build

a better financial future. Since inception, Oportun has provided

more than $17.8 billion in responsible and affordable credit, saved

its members more than $2.4 billion in interest and fees, and helped

its members save an average of more than $1,800 annually. For more

information, visit Oportun.com.

Forward-Looking Statements

This press release contains forward-looking

statements. These forward-looking statements are subject to the

safe harbor provisions under the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements other than statements of historical fact

contained in this press release, including statements as to future

performance, results of operations and financial position;

statements related to the effectiveness of the Company’s cost

reduction measures and the impacts on the Company's business; the

anticipated size, timing and effectiveness of operational

efficiencies and expense reductions; strategic options regarding

our credit card portfolio; our planned products and services; the

ability to access diverse sources of capital; the Company's

expectations regarding the sale of certain personal loan

originations; achievement of the Company's strategic priorities and

goals; the Company's expectations regarding macroeconomic

conditions; the Company's profitability and future growth

opportunities; the Company's expectations regarding the effect of

tightening its underwriting standards on credit outcomes and the

effect of fair value mark-to-market adjustments on its loan

portfolio and asset-backed notes; the Company's first quarter and

full year 2024 outlook; the Company's expectations related to

future profitability on an adjusted basis, and the plans and

objectives of management for our future operations, are

forward-looking statements. These statements can be generally

identified by terms such as “expect,” “plan,” “goal,” “target,”

“anticipate,” “assume,” “predict,” “project,” “outlook,”

“continue,” “due,” “may,” “believe,” “seek,” or “estimate” and

similar expressions or the negative versions of these words or

comparable words, as well as future or conditional verbs such as

“will,” “should,” “would,” “likely” and “could.” These statements

involve known and unknown risks, uncertainties, assumptions and

other factors that may cause Oportun’s actual results, performance

or achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Oportun has based these forward-looking

statements on its current expectations and projections about future

events, financial trends and risks and uncertainties that it

believes may affect its business, financial condition and results

of operations. These risks and uncertainties include those risks

described in Oportun's filings with the Securities and Exchange

Commission, including Oportun's most recent annual report on Form

10-K, and include, but are not limited to, Oportun's ability to

retain existing members and attract new members; Oportun's ability

to accurately predict demand for, and develop its financial

products and services; the effectiveness of Oportun's A.I. model;

macroeconomic conditions, including rising inflation and market

interest rates; increases in loan non-payments, delinquencies and

charge-offs; Oportun's ability to increase market share and enter

into new markets; Oportun's ability to realize the benefits from

acquisitions and integrate acquired technologies; the risk of

security breaches or incidents affecting the Company's information

technology systems or those of the Company's third-party vendors or

service providers; Oportun’s ability to successfully offer loans in

additional states; Oportun’s ability to compete successfully with

other companies that are currently in, or may in the future enter,

its industry; changes in Oportun's ability to obtain additional

financing on acceptable terms or at all; and Oportun's potential

need to seek additional strategic alternatives, including

restructuring or refinancing its debt, seeking additional debt or

equity capital, or reducing or delaying its business activities.

These forward-looking statements speak only as of the date on which

they are made and, except to the extent required by federal

securities laws, Oportun disclaims any obligation to update any

forward-looking statement to reflect events or circumstances after

the date on which the statement is made or to reflect the

occurrence of unanticipated events. In light of these risks and

uncertainties, there is no assurance that the events or results

suggested by the forward-looking statements will in fact occur, and

you should not place undue reliance on these forward-looking

statements.

Oportun and the Oportun logo are registered

trademarks of Oportun, Inc.

|

Oportun Financial CorporationCONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (in

millions, except share and per share data, unaudited) |

| |

| |

|

Three Months EndedDecember

31, |

|

Twelve Months

EndedDecember 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

Interest income |

|

$ |

242.2 |

|

|

$ |

244.1 |

|

|

$ |

963.5 |

|

|

$ |

876.1 |

|

|

Non-interest income |

|

|

20.5 |

|

|

|

17.8 |

|

|

|

93.4 |

|

|

|

76.4 |

|

|

Total revenue |

|

|

262.6 |

|

|

|

261.9 |

|

|

|

1,056.9 |

|

|

|

952.5 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

52.0 |

|

|

|

35.6 |

|

|

|

179.4 |

|

|

|

93.0 |

|

|

Net decrease in fair value |

|

|

(138.5 |

) |

|

|

(82.9 |

) |

|

|

(596.8 |

) |

|

|

(218.8 |

) |

|

Net revenue |

|

|

72.1 |

|

|

|

143.4 |

|

|

|

280.7 |

|

|

|

640.7 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Technology and facilities |

|

|

54.8 |

|

|

|

58.0 |

|

|

|

219.4 |

|

|

|

216.1 |

|

|

Sales and marketing |

|

|

18.1 |

|

|

|

21.3 |

|

|

|

75.3 |

|

|

|

110.0 |

|

|

Personnel |

|

|

25.1 |

|

|

|

40.3 |

|

|

|

121.8 |

|

|

|

154.9 |

|

|

Outsourcing and professional fees |

|

|

11.2 |

|

|

|

17.5 |

|

|

|

45.4 |

|

|

|

67.6 |

|

|

General, administrative and other |

|

|

20.2 |

|

|

|

14.1 |

|

|

|

72.4 |

|

|

|

58.8 |

|

|

Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

108.5 |

|

|

Total operating expenses |

|

|

129.4 |

|

|

|

151.4 |

|

|

|

534.3 |

|

|

|

715.9 |

|

| |

|

|

|

|

|

|

|

|

|

Income (loss) before taxes |

|

|

(57.3 |

) |

|

|

(7.9 |

) |

|

|

(253.7 |

) |

|

|

(75.3 |

) |

|

Income tax expense (benefit) |

|

|

(15.5 |

) |

|

|

0.5 |

|

|

|

(73.7 |

) |

|

|

2.5 |

|

|

Net loss |

|

$ |

(41.8 |

) |

|

$ |

(8.4 |

) |

|

$ |

(180.0 |

) |

|

$ |

(77.7 |

) |

| |

|

|

|

|

|

|

|

|

|

Diluted Earnings (Loss) per Common Share |

|

$ |

(1.09 |

) |

|

$ |

(0.25 |

) |

|

$ |

(4.88 |

) |

|

$ |

(2.37 |

) |

|

Diluted Weighted Average Common Shares |

|

|

38,485,406 |

|

|

|

33,231,661 |

|

|

|

36,875,950 |

|

|

|

32,825,772 |

|

Note: Numbers may not foot or cross-foot

due to rounding.

|

Oportun Financial CorporationCONDENSED

CONSOLIDATED BALANCE SHEETS (in millions,

unaudited) |

| |

| |

|

December 31, |

|

December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

Assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

91.2 |

|

|

$ |

98.8 |

|

|

Restricted cash |

|

|

114.8 |

|

|

|

105.0 |

|

|

Loans receivable at fair value |

|

|

2,962.4 |

|

|

|

3,175.4 |

|

|

Capitalized software and other intangibles |

|

|

114.7 |

|

|

|

139.8 |

|

|

Right of use assets - operating |

|

|

21.1 |

|

|

|

30.4 |

|

|

Other assets |

|

|

107.7 |

|

|

|

64.2 |

|

|

Total assets |

|

$ |

3,411.9 |

|

|

$ |

3,613.7 |

|

| |

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

|

Liabilities |

|

|

|

|

|

Secured financing |

|

$ |

290.0 |

|

|

$ |

317.6 |

|

|

Asset-backed notes at fair value |

|

|

1,780.0 |

|

|

|

2,387.7 |

|

|

Asset-backed borrowings at amortized cost |

|

|

581.5 |

|

|

|

— |

|

|

Acquisition and corporate financing |

|

|

258.7 |

|

|

|

222.9 |

|

|

Lease liabilities |

|

|

28.4 |

|

|

|

37.9 |

|

|

Other liabilities |

|

|

68.9 |

|

|

|

100.0 |

|

|

Total liabilities |

|

|

3,007.5 |

|

|

|

3,066.1 |

|

|

Stockholders' equity |

|

|

|

|

|

Common stock |

|

|

— |

|

|

|

— |

|

|

Common stock, additional paid-in capital |

|

|

584.6 |

|

|

|

547.8 |

|

|

Retained earnings (accumulated deficit) |

|

|

(173.8 |

) |

|

|

6.1 |

|

|

Treasury stock |

|

|

(6.3 |

) |

|

|

(6.3 |

) |

|

Total stockholders’ equity |

|

|

404.4 |

|

|

|

547.6 |

|

|

Total liabilities and stockholders' equity |

|

$ |

3,411.9 |

|

|

$ |

3,613.7 |

|

Note: Numbers may not foot or cross-foot

due to rounding.

|

Oportun Financial CorporationCONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (in

millions, unaudited) |

| |

| |

Three Months EndedDecember

31, |

|

Twelve Months

EndedDecember 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

Net loss |

$ |

(41.8 |

) |

|

$ |

(8.4 |

) |

|

$ |

(180.0 |

) |

|

$ |

(77.7 |

) |

|

Adjustments for non-cash items |

|

139.0 |

|

|

|

91.7 |

|

|

|

585.3 |

|

|

|

400.3 |

|

|

Proceeds from sale of loans in excess of originations of loans sold

and held for sale |

|

2.9 |

|

|

|

(0.1 |

) |

|

|

8.5 |

|

|

|

6.1 |

|

|

Changes in balances of operating assets and liabilities |

|

6.2 |

|

|

|

5.3 |

|

|

|

(21.1 |

) |

|

|

(80.7 |

) |

|

Net cash provided by operating activities |

|

106.3 |

|

|

|

88.5 |

|

|

|

392.8 |

|

|

|

247.9 |

|

| |

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

Net loan principal repayments (loan originations) |

|

(91.8 |

) |

|

|

(242.4 |

) |

|

|

(257.5 |

) |

|

|

(1,365.9 |

) |

|

Proceeds from loan sales originated as held for investment |

|

1.3 |

|

|

|

1.3 |

|

|

|

4.1 |

|

|

|

249.3 |

|

|

Capitalization of system development costs |

|

(6.1 |

) |

|

|

(12.1 |

) |

|

|

(31.3 |

) |

|

|

(48.9 |

) |

|

Other, net |

|

(0.2 |

) |

|

|

(2.6 |

) |

|

|

(1.4 |

) |

|

|

(6.0 |

) |

|

Net cash used in investing activities |

|

(96.8 |

) |

|

|

(255.7 |

) |

|

|

(286.2 |

) |

|

|

(1,171.5 |

) |

| |

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

Borrowings |

|

429.4 |

|

|

|

579.2 |

|

|

|

945.5 |

|

|

|

3,234.1 |

|

|

Repayments |

|

(432.1 |

) |

|

|

(480.1 |

) |

|

|

(1,047.1 |

) |

|

|

(2,290.9 |

) |

|

Net stock-based activities |

|

(0.4 |

) |

|

|

(0.4 |

) |

|

|

(2.7 |

) |

|

|

(8.7 |

) |

|

Net cash provided by (used in) financing

activities |

|

(3.1 |

) |

|

|

98.7 |

|

|

|

(104.4 |

) |

|

|

934.5 |

|

| |

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents and

restricted cash |

|

6.4 |

|

|

|

(68.4 |

) |

|

|

2.2 |

|

|

|

10.9 |

|

|

Cash and cash equivalents and restricted cash beginning of

period |

|

199.6 |

|

|

|

272.2 |

|

|

|

203.8 |

|

|

|

193.0 |

|

|

Cash and cash equivalents and restricted cash end of period |

$ |

206.0 |

|

|

$ |

203.8 |

|

|

$ |

206.0 |

|

|

$ |

203.8 |

|

Note: Numbers may not foot or cross-foot

due to rounding.

|

Oportun Financial CorporationCONSOLIDATED

KEY PERFORMANCE METRICS(unaudited) |

| |

| |

|

Three Months EndedDecember

31, |

|

Twelve Months

EndedDecember 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Members (Actuals) |

|

|

2,224,302 |

|

|

|

1,877,260 |

|

|

|

2,224,302 |

|

|

|

1,877,260 |

|

|

Products (Actuals) |

|

|

2,387,745 |

|

|

|

2,006,245 |

|

|

|

2,387,745 |

|

|

|

2,006,245 |

|

|

Aggregate Originations (Millions) |

|

$ |

437.3 |

|

|

$ |

610.4 |

|

|

$ |

1,813.1 |

|

|

$ |

2,922.9 |

|

|

Portfolio Yield (%) |

|

|

32.7 |

% |

|

|

31.7 |

% |

|

|

32.2 |

% |

|

|

32.0 |

% |

|

30+ Day Delinquency Rate (%) |

|

|

5.9 |

% |

|

|

5.6 |

% |

|

|

5.9 |

% |

|

|

5.6 |

% |

|

Annualized Net Charge-Off Rate (%) |

|

|

12.3 |

% |

|

|

12.8 |

% |

|

|

12.2 |

% |

|

|

10.1 |

% |

|

Return on Equity (%) |

|

(39.2 |

)% |

|

(6.1 |

)% |

|

(37.8 |

)% |

|

(13.5 |

)% |

|

Adjusted Return on Equity (%) |

|

(19.3 |

)% |

|

|

3.3 |

% |

|

(26.1 |

)% |

|

|

12.1 |

% |

|

Oportun Financial CorporationOTHER

METRICS(unaudited) |

| |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months EndedDecember

31, |

|

Twelve Months

EndedDecember 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Managed Principal Balance at End of Period (Millions) |

|

$ |

3,182.1 |

|

|

$ |

3,407.0 |

|

|

$ |

3,182.1 |

|

|

$ |

3,407.0 |

|

|

Owned Principal Balance at End of Period (Millions) |

|

$ |

2,904.7 |

|

|

$ |

3,098.6 |

|

|

$ |

2,904.7 |

|

|

$ |

3,098.6 |

|

|

Average Daily Principal Balance (Millions) |

|

$ |

2,940.5 |

|

|

$ |

3,058.3 |

|

|

$ |

2,992.6 |

|

|

$ |

2,740.3 |

|

Note: Numbers may not foot or cross-foot

due to rounding.

|

Oportun Financial CorporationABOUT

NON-GAAP FINANCIAL

MEASURES(unaudited) |

| |

This press release dated March 12, 2024

contains non-GAAP financial measures. The following tables

reconcile the non-GAAP financial measures in this press release to

the most directly comparable financial measures prepared in

accordance with GAAP.

The Company believes that the provision of these

non-GAAP financial measures can provide useful measures for

period-to-period comparisons of Oportun's core business and useful

information to investors and others in understanding and evaluating

its operating results. However, non-GAAP financial measures are not

calculated in accordance with GAAP and should not be considered as

a substitute for, or superior to, measures of financial performance

prepared in accordance with GAAP. These non-GAAP financial measures

do not reflect a comprehensive system of accounting, differ from

GAAP measures with the same names, and may differ from non-GAAP

financial measures with the same or similar names that are used by

other companies.

Adjusted EBITDA The Company

defines Adjusted EBITDA as net income, adjusted to eliminate the

effect of certain items as described below. The Company believes

that Adjusted EBITDA is an important measure because it allows

management, investors and its board of directors to evaluate and

compare operating results, including return on capital and

operating efficiencies, from period to period by making the

adjustments described below. In addition, it provides a useful

measure for period-to-period comparisons of Oportun's business, as

it removes the effect of income taxes, certain non-cash items,

variable charges and timing differences.

- The Company

believes it is useful to exclude the impact of income tax expense,

as reported, because historically it has included irregular income

tax items that do not reflect ongoing business operations.

- The Company

believes it is useful to exclude depreciation and amortization and

stock-based compensation expense because they are non-cash

charges.

- The Company

believes it is useful to exclude the impact of interest expense

associated with the Company's corporate financing facilities, as it

views this expense as related to its capital structure rather than

its funding.

- The Company

excludes the impact of certain non-recurring charges, such as

expenses associated with our workforce optimization, acquisition

and integration related expenses and other non-recurring charges

because it does not believe that these items reflect ongoing

business operations. Other non-recurring charges include litigation

reserve, impairment charges, debt amendment and warrant

amortization costs related to our corporate financing

facilities.

- The Company also

reverses origination fees for Loans Receivable at Fair Value, net.

The Company believes it is beneficial to exclude the uncollected

portion of such origination fees, because such amounts do not

represent cash received.

- The Company also

reverses the fair value mark-to-market adjustment because it is a

non-cash adjustment.

Revised Adjusted EBITDA

Beginning in 2024, we will transition to an

updated definition of Adjusted EBITDA which better represents how

management views the results of operations and makes management

decisions. Reconciliations of non-GAAP to GAAP measures, updated

definitions of reconciling items, and comparative calculations for

2022 and 2023 for Adjusted EBITDA using the new definition can be

found below.

|

Adjusted EBITDA |

Rationale for Change |

|

Interest on Corporate Financing |

We have updated the interest on corporate financing adjustment to

include interest on our acquisition related financing previously

included within the adjustment for acquisition and integration

related expenses. |

|

Depreciation and amortization |

We have updated the adjustment related to depreciation and

amortization to include the amortization of acquired intangibles.

This amortization was previously included within the adjustment for

acquisition and integration related expenses. |

|

Acquisition and integration related expenses |

We have removed the adjustment related to acquisition and

integration related expenses. Interest expense related to our

acquisition related financing has been reclassified to the

adjustment for corporate financing. Amortization of acquired

intangibles has been reclassified to depreciation and

amortization. |

|

Origination fees for loans receivable at fair value, net |

We have removed the adjustment related to origination fees for

loans receivable at fair value, net as we believe this better

aligns with common practices within our industry. |

|

|

|

Adjusted Net IncomeThe Company

defines Adjusted Net Income as net income adjusted to eliminate the

effect of certain items as described below. The Company believes

that Adjusted Net Income is an important measure of operating

performance because it allows management, investors, and the

Company's board of directors to evaluate and compare its operating

results, including return on capital and operating efficiencies,

from period to period, excluding the after-tax impact of non-cash,

stock-based compensation expense and certain non-recurring

charges.

- The Company

believes it is useful to exclude the impact of income tax expense

(benefit), as reported, because historically it has included

irregular income tax items that do not reflect ongoing business

operations. The Company also includes the impact of normalized

income tax expense by applying a normalized statutory tax

rate.

- The Company

believes it is useful to exclude the impact of certain

non-recurring charges, such as expenses associated with our

workforce optimization, acquisition and integration related

expenses and other non-recurring charges because it does not

believe that these items reflect its ongoing business operations.

Other non-recurring charges include litigation reserve, impairment

charges, debt amendment and warrant amortization costs related to

our Corporate Financing facility.

- The Company

believes it is useful to exclude stock-based compensation expense

because it is a non-cash charge.

Revised Adjusted Net Income

(Loss)

Beginning in 2024, we will transition to an

updated definition of Adjusted Net Income (Loss) which better

represents how management views the results of operations and makes

management decisions. Reconciliations of non-GAAP to GAAP measures,

updated definitions of reconciling items, and comparative

calculations for 2022 and 2023 for Adjusted Net Income (Loss) using

the new definitions can be found below.

|

Adjusted Net Income (Loss) |

Rationale for Change |

|

Acquisition and integration related expenses |

We have removed the adjustment related to acquisition and

integration related expenses. Interest expense related to our

acquisition related financing has been reclassified to the

adjustment for Corporate Financing. Amortization of acquired

intangibles has been reclassified to depreciation and

amortization. |

|

Fair value mark-to-market adjustment on Asset-Backed Notes at Fair

Value |

We have added an adjustment to exclude the Fair value

mark-to-market adjustments related to Asset-Backed Notes at Fair

Value. This adjustment aligns with our decision in 2023 to stop

electing the fair value option for new debt financings. By the end

of 2025 nearly all our existing Asset-Backed Notes at Fair Value

will have paid down to zero, so after that there will be no

mark-to-market adjustment for our debt. |

|

|

|

Adjusted Operating Efficiency and

Adjusted Operating ExpenseThe Company defines Adjusted

Operating Efficiency as Adjusted Operating Expense divided by total

revenue. The Company defines Adjusted Operating Expense as total

operating expenses adjusted to exclude stock-based compensation

expense and certain non-recurring charges, such as expenses

associated with our workforce optimization, acquisition and

integration related expenses and other non-recurring charges. Other

non-recurring charges include litigation reserve, impairment

charges, and debt amendment costs related to our Corporate

Financing facility. The Company believes Adjusted Operating

Efficiency is an important measure because it allows management,

investors and Oportun's board of directors to evaluate how

efficiently the Company is managing costs relative to revenue. The

Company believes Adjusted Operating Expense is an important measure

because it allows management, investors and Oportun's board of

directors to evaluate and compare its operating costs from period

to period, excluding the impact of non-cash, stock-based

compensation expense and certain non-recurring charges.

Adjusted Return on EquityThe

Company defines Adjusted Return on Equity (“ROE”) as annualized

Adjusted Net Income divided by average stockholders’ equity.

Average stockholders’ equity is an average of the beginning and

ending stockholders’ equity balance for each period. The Company

believes Adjusted ROE is an important measure because it allows

management, investors and its board of directors to evaluate the

profitability of the business in relation to its stockholders'

equity and how efficiently it generates income from stockholders'

equity.

Adjusted EPSThe Company defines

Adjusted EPS as Adjusted Net Income divided by weighted average

diluted shares outstanding.

|

Oportun Financial

CorporationRECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(in millions, unaudited) |

| |

| |

|

Three Months EndedDecember

31, |

|

Adjusted EBITDA |

|

|

2023 |

|

|

|

2022 |

|

| |

|

Reported |

Revised |

|

Reported |

Revised |

|

Net income (loss) |

|

$ |

(41.8 |

) |

|

$ |

(41.8 |

) |

|

$ |

(8.4 |

) |

|

$ |

(8.4 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

Income tax expense (benefit) |

|

|

(15.5 |

) |

|

|

(15.5 |

) |

|

|

0.5 |

|

|

|

0.5 |

|

|

Interest on corporate financing (1) |

|

|

11.2 |

|

|

|

14.6 |

|

|

|

5.1 |

|

|

|

8.5 |

|

|

Depreciation and amortization |

|

|

10.8 |

|

|

|

13.8 |

|

|

|

9.9 |

|

|

|

12.9 |

|

|

Stock-based compensation expense |

|

|

4.8 |

|

|

|

4.8 |

|

|

|

6.9 |

|

|

|

6.9 |

|

|

Workforce optimization expenses |

|

|

6.8 |

|

|

|

6.8 |

|

|

|

— |

|

|

|

— |

|

|

Acquisition and integration related expenses |

|

|

6.6 |

|

|

|

— |

|

|

|

7.3 |

|

|

|

0.9 |

|

|

Other non-recurring charges (1) |

|

|

10.8 |

|

|

|

10.8 |

|

|

|

— |

|

|

|

— |

|

|

Origination fees for Loans Receivable at Fair Value, net |

|

|

(4.0 |

) |

|

|

— |

|

|

|

(9.1 |

) |

|

|

— |

|

|

Fair value mark-to-market adjustment |

|

|

16.4 |

|

|

|

16.4 |

|

|

|

(45.6 |

) |

|

|

(45.6 |

) |

|

Adjusted EBITDA |

|

$ |

6.1 |

|

|

$ |

9.9 |

|

|

$ |

(33.5 |

) |

|

$ |

(24.4 |

) |

| |

|

|

|

|

|

|

| |

|

Twelve Months

EndedDecember 31, |

|

Adjusted EBITDA |

|

|

2023 |

|

|

|

2022 |

|

| |

|

Reported |

|

Revised |

|

Reported |

|

Revised |

|

Net income (loss) |

|

$ |

(180.0 |

) |

|

$ |

(180.0 |

) |

|

$ |

(77.7 |

) |

|

$ |

(77.7 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Income tax expense (benefit) |

|

|

(73.7 |

) |

|

|

(73.7 |

) |

|

|

2.5 |

|

|

|

2.5 |

|

|

Interest on corporate financing (1) |

|

|

37.7 |

|

|

|

51.8 |

|

|

|

6.0 |

|

|

|

17.6 |

|

|

Depreciation and amortization |

|

|

43.0 |

|

|

|

54.9 |

|

|

|

35.2 |

|

|

|

47.4 |

|

|

Stock-based compensation expense |

|

|

18.0 |

|

|

|

18.0 |

|

|

|

27.6 |

|

|

|

27.6 |

|

|

Workforce optimization expenses |

|

|

22.5 |

|

|

|

22.5 |

|

|

|

1.9 |

|

|

|

1.9 |

|

|

Acquisition and integration related expenses |

|

|

27.6 |

|

|

|

— |

|

|

|

29.7 |

|

|

|

5.8 |

|

|

Other non-recurring charges (1) |

|

|

15.5 |

|

|

|

15.5 |

|

|

|

111.2 |

|

|

|

111.2 |

|

|

Origination fees for Loans Receivable at Fair Value, net |

|

|

(18.5 |

) |

|

|

— |

|

|

|

(26.8 |

) |

|

|

— |

|

|

Fair value mark-to-market adjustment |

|

|

109.5 |

|

|

|

109.5 |

|

|

|

(119.7 |

) |

|

|

(119.7 |

) |

|

Adjusted EBITDA |

|

$ |

1.7 |

|

|

$ |

18.6 |

|

|

$ |

(10.3 |

) |

|

$ |

16.6 |

|

| |

|

Three Months EndedDecember

31, |

|

Adjusted Net Income |

|

|

2023 |

|

|

|

2022 |

|

| |

|

Reported |

|

Revised |

|

Reported |

|

Revised |

|

Net income (loss) |

|

$ |

(41.8 |

) |

|

$ |

(41.8 |

) |

|

$ |

(8.4 |

) |

|

$ |

(8.4 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Income tax expense (benefit) |

|

|

(15.5 |

) |

|

|

(15.5 |

) |

|

|

0.5 |

|

|

|

0.5 |

|

|

Stock-based compensation expense |

|

|

4.8 |

|

|

|

4.8 |

|

|

|

6.9 |

|

|

|

6.9 |

|

|

Workforce optimization expenses |

|

|

6.8 |

|

|

|

6.8 |

|

|

|

— |

|

|

|

— |

|

|

Acquisition and integration related expenses |

|

|

6.6 |

|

|

|

— |

|

|

|

7.3 |

|

|

|

0.9 |

|

|

Other non-recurring charges (1) |

|

|

10.8 |

|

|

|

10.8 |

|

|

|

— |

|

|

|

— |

|

|

Mark-to-market adjustment on ABS notes |

|

|

— |

|

|

|

23.6 |

|

|

|

— |

|

|

|

(21.0 |

) |

|

Adjusted income before taxes |

|

|

(28.3 |

) |

|

|

(11.3 |

) |

|

|

6.3 |

|

|

|

(21.1 |

) |

|

Normalized income tax expense |

|

|

(7.6 |

) |

|

|

(3.0 |

) |

|

|

1.7 |

|

|

|

(5.7 |

) |

|

Adjusted Net Income |

|

$ |

(20.6 |

) |

|

$ |

(8.2 |

) |

|

$ |

4.6 |

|

|

$ |

(15.4 |

) |

| |

|

Twelve Months Ended December 31, |

|

Adjusted Net Income |

|

|

2023 |

|

|

|

2022 |

|

| |

|

Reported |

|

Revised |

|

Reported |

|

Revised |

|

Net income (loss) |

|

$ |

(180.0 |

) |

|

$ |

(180.0 |

) |

|

$ |

(77.7 |

) |

|

$ |

(77.7 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Income tax expense (benefit) |

|

|

(73.7 |

) |

|

|

(73.7 |

) |

|

|

2.5 |

|

|

|

2.5 |

|

|

Stock-based compensation expense |

|

|

18.0 |

|

|

|

18.0 |

|

|

|

27.6 |

|

|

|

27.6 |

|

|

Workforce optimization expenses |

|

|

22.5 |

|

|

|

22.5 |

|

|

|

1.9 |

|

|

|

1.9 |

|

|

Acquisition and integration related expenses |

|

|

27.6 |

|

|

|

— |

|

|

|

29.7 |

|

|

|

5.8 |

|

|

Other non-recurring charges (1) |

|

|

15.5 |

|

|

|

15.5 |

|

|

|

111.2 |

|

|

|

111.2 |

|

|

Mark-to-market adjustment on ABS notes |

|

|

— |

|

|

|

100.0 |

|

|

|

— |

|

|

|

(184.9 |

) |

|

Adjusted income before taxes |

|

|

(170.0 |

) |

|

|

(97.7 |

) |

|

|

95.1 |

|

|

|

(113.6 |

) |

|

Normalized income tax expense |

|

|

(45.9 |

) |

|

|

(26.4 |

) |

|

|

25.7 |

|

|

|

(30.7 |

) |

|

Adjusted Net Income |

|

$ |

(124.1 |

) |

|

$ |

(71.3 |

) |

|

$ |

69.4 |

|

|

$ |

(82.9 |

) |

Note: Numbers may not foot or cross-foot

due to rounding.(1) Certain prior-period financial

information has been reclassified to conform to current period

presentation.

|

Oportun Financial

CorporationRECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(in millions, unaudited) |

| |

| |

|

Three Months EndedDecember

31, |

|

Twelve Months

EndedDecember 31, |

|

Adjusted Operating Efficiency |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Operating Efficiency |

|

|

49.3 |

% |

|

|

57.8 |

% |

|

|

50.6 |

% |

|

|

75.2 |

% |

|

Total Revenue |

|

$ |

262.6 |

|

|

$ |

261.9 |

|

|

$ |

1,056.9 |

|

|

$ |

952.5 |

|

| |

|

|

|

|

|

|

|

|

|

Total Operating Expense |

|

$ |

129.4 |

|

|

$ |

151.4 |

|

|

$ |

534.3 |

|

|

$ |

715.9 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

(4.8 |

) |

|

|

(6.9 |

) |

|

|

(18.0 |

) |

|

|

(27.6 |

) |

|

Workforce optimization expenses |

|

|

(6.8 |

) |

|

|

— |

|

|

|

(22.5 |

) |

|

|

(1.9 |

) |

|

Acquisition and integration related expenses |

|

|

(6.6 |

) |

|

|

(7.3 |

) |

|

|

(27.6 |

) |

|

|

(29.7 |

) |

|

Other non-recurring charges (1) |

|

|

(10.5 |

) |

|

|

— |

|

|

|

(14.4 |

) |

|

|

(111.2 |

) |

|

Total Adjusted Operating Expense |

|

$ |

100.7 |

|

|

$ |

137.2 |

|

|

$ |

451.8 |

|

|

$ |

545.5 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted Operating Efficiency |

|

|

38.4 |

% |

|

|

52.4 |

% |

|

|

42.7 |

% |

|

|

57.3 |

% |

Note: Numbers may not foot or cross-foot

due to rounding.(1) Certain prior-period financial

information has been reclassified to conform to current period

presentation.

|

Oportun Financial

CorporationRECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(in millions, except share and per share

data, unaudited) |

| |

| |

|

Three Months EndedDecember

31, |

|

Twelve Months

EndedDecember 31, |

|

GAAP Earnings (loss) per Share |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net income (loss) |

|

$ |

(41.8 |

) |

|

$ |

(8.4 |

) |

|

$ |

(180.0 |

) |

|

$ |

(77.7 |

) |

|

Net income (loss) attributable to common stockholders |

|

$ |

(41.8 |

) |

|

$ |

(8.4 |

) |

|

$ |

(180.0 |

) |

|

$ |

(77.7 |

) |

| |

|

|

|

|

|

|

|

|

|

Basic weighted-average common shares outstanding |

|

|

38,485,406 |

|

|

|

33,231,661 |

|

|

|

36,875,950 |

|

|

|

32,825,772 |

|

|

Weighted average effect of dilutive securities: |

|

|

|

|

|

|

|

|

|

Stock options |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Restricted stock units |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Diluted weighted-average common shares outstanding |

|

|

38,485,406 |

|

|

|

33,231,661 |

|

|

|

36,875,950 |

|

|

|

32,825,772 |

|

| |

|

|

|

|

|

|

|

|

|

Earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(1.09 |

) |

|

$ |

(0.25 |

) |

|

$ |

(4.88 |

) |

|

$ |

(2.37 |

) |

|

Diluted |

|

$ |

(1.09 |

) |

|

$ |

(0.25 |

) |

|

$ |

(4.88 |

) |

|

$ |

(2.37 |

) |

| |

|

Three Months EndedDecember

31, |

|

Twelve Months

EndedDecember 31, |

|

Adjusted Earnings (loss) Per Share |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Diluted earnings (loss) per share |

|

$ |

(1.09 |

) |

|

$ |

(0.25 |

) |

|

$ |

(4.88 |

) |

|

$ |

(2.37 |

) |

| |

|

|

|

|

|

|

|

|

|

Adjusted Net Income |

|

$ |

(20.6 |

) |

|

$ |

4.6 |

|

|

$ |

(124.1 |

) |

|

$ |

69.4 |

|

| |

|

|

|

|

|

|

|

|

|

Basic weighted-average common shares outstanding |

|

|

38,485,406 |

|

|

|

33,231,661 |

|

|

|

36,875,950 |

|

|

|

32,825,772 |

|

|

Weighted average effect of dilutive securities: |

|

|

|

|

|

|

|

|

|

Stock options |

|

|

— |

|

|

|

29,322 |

|

|

|

— |

|

|

|

252,357 |

|

|

Restricted stock units |

|

|

— |

|

|

|

66,569 |

|

|

|

— |

|

|

|

173,092 |

|

|

Diluted adjusted weighted-average common shares outstanding |

|

|

38,485,406 |

|

|

|

33,327,552 |

|

|

|

36,875,950 |

|

|

|

33,251,221 |

|

| |

|

|

|

|

|

|

|

|

|

Adjusted Earnings (loss) Per Share |

|

$ |

(0.54 |

) |

|

$ |

0.14 |

|

|

$ |

(3.37 |

) |

|

$ |

2.09 |

|

Note: Numbers may not foot or cross-foot

due to rounding.

|

Oportun Financial

CorporationRECONCILIATION OF FORWARD LOOKING

NON-GAAP FINANCIAL MEASURES(in millions,

unaudited) |

| |

| |

|

1Q 2024 |

|

FY 2024 |

|

| |

|

Low |

|

High |

|

Low |

|

High |

|

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

Net (loss)* |

|

$ |

(35.8 |

) |

* |

$ |

(34.2 |

) |

* |

$ |

(54.2 |

) |

* |

$ |

(46.3 |

) |

* |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

Income tax expense (benefit) |

|

|

(14.7 |

) |

|

|

(14.3 |

) |

|

|

(12.9 |

) |

|

|

(10.8 |

) |

|

|

Interest on corporate financing |

|

|

13.4 |

|

|

|

13.4 |

|

|

|

48.7 |

|

|

|

48.7 |

|

|

|

Depreciation and amortization |

|

|

13.3 |

|

|

|

13.3 |

|

|

|

50.9 |

|

|

|

50.9 |

|

|

|

Stock-based compensation expense |

|

|

5.4 |

|

|

|

5.4 |

|

|

|

18.5 |

|

|

|

18.5 |

|

|

|

Workforce optimization expenses |

|

|

0.8 |

|

|

|

0.8 |

|

|

|

0.8 |

|

|

|

0.8 |

|

|

|

Other non-recurring charges |

|

|

3.6 |

|

|

|

3.6 |

|

|

|

8.2 |

|

|

|

8.2 |

|

|

|

Fair value mark-to-market adjustment* |

|

* |

|

* |

|

* |

|

* |

|

|

Adjusted EBITDA |

|

$ |

(14.0 |

) |

|

$ |

(12.0 |

) |

|

$ |

60.0 |

|

|

$ |

70.0 |

|

|

| |

|

|

|

|

|

|

|

|

|

* Due to the uncertainty in macroeconomic

conditions, we are unable to precisely forecast the fair value

mark-to-market adjustments on our loan portfolio and asset-backed

notes. As a result, while we fully expect there to be a fair value

mark-to-market adjustment which could have an impact on GAAP net

income (loss), the net income (loss) number shown above assumes no

change in the fair value mark-to-market adjustment.

Note: Numbers may not foot or cross-foot

due to rounding.

Investor Contact

Dorian Hare

(650) 590-4323

ir@oportun.com

Media Contact

Usher Lieberman

(650) 769-9414

usher.lieberman@oportun.com

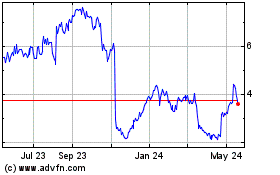

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

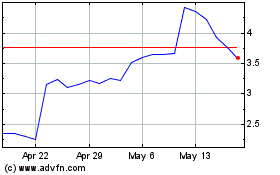

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Jan 2024 to Jan 2025