Oportun Appoints Scott Parker to its Board of Directors in Cooperation with Findell Capital

23 April 2024 - 6:05AM

Oportun (Nasdaq: OPRT) (“Oportun”, or the "Company"), a

mission-driven fintech, today announced the appointment of Scott

Parker as a new independent director and Richard Tambor as an

observer to Oportun's Board of Directors, each effective

immediately. Tambor will stand for election to Oportun's Board of

Directors at Oportun's 2024 annual shareholder meeting later this

year. The appointments are in connection with a cooperation

agreement (the "Agreement") the Company has entered into with

Findell Capital Management LLC (together, with certain of its

affiliates “Findell”). Findell is an investment firm that owns

approximately 7.7% of Oportun’s outstanding common shares.

"Oportun is dedicated to a thoughtful and continuous Board

refreshment process and to identifying candidates who are

established leaders with the right mix of skills, experience and

unique perspectives to complement our Board," said Ginny Lee,

Chair, Oportun Nominating, Governance and Social Responsibility

Committee. "Today's announcement is reflective of Oportun's

commitment to engaging constructively with shareholders. We look

forward to leveraging Scott and Richard's deep knowledge in

consumer finance and risk management to build on our ongoing

momentum and enhance value for shareholders."

“The Board and management team will benefit from Scott and

Richard’s perspectives and contributions as we continue to focus on

disciplined execution and driving profitable, sustainable growth,"

said Raul Vazquez, CEO of Oportun.

“Oportun has taken significant steps to reduce its cost

structure and tighten its underwriting standards in the current

environment, positioning the Company to enhance its profitability

during 2024 and beyond,” said Scott Parker. “I look forward to

partnering with the Board and management team to support the

ongoing execution of Oportun’s strategic initiatives to drive value

for shareholders.”

"We appreciate the constructive engagement with Oportun's Board

and management team and are pleased to have reached an agreement

that adds additional proven leaders to the board room," said Brian

Finn, Managing Member of Findell. "Scott and Rich have held C-suite

roles at the best-in-class operators in the subprime consumer

lending space. They know our Industry well and have helped lead

organizations through various market and economic cycles. We have

confidence that they will do the same at Oportun."

The Agreement contains customary standstill, voting,

non-disparagement, and other provisions. A complete copy of the

Agreement will be filed on Form 8-K with the U.S. Securities and

Exchange Commission.

About Scott ParkerScott Parker currently serves

as Chief Financial Officer of NationsBenefits, LLC, a leading

provider of supplemental benefits and fintech solutions to the

healthcare industry. Previously, Mr. Parker served as Executive

Vice President and Chief Financial Officer of Ryder System, Inc.

(NYSE: R), and as Executive Vice President and Chief Financial

Officer of OneMain Holdings, Inc. (NYSE: OMF). Mr. Parker has also

served as Executive Vice President and Chief Financial Officer of

CIT Group Inc. Mr. Parker currently serves on the Board of

Directors of DailyPay, Inc., as Chairman of its Audit and Risk

Committee. Mr. Parker earned a B.S. in Agricultural Economics from

Cornell University.

About Richard TamborRichard Tambor previously

served as the Executive Vice President and Chief Risk Officer at

OneMain Holdings, Inc. (NYSE: OMF). Prior to OneMain, Mr. Tambor

was the Senior Vice President and Chief Risk Officer of Retail

Financial Services at JPMorgan Chase & Co. Mr. Tambor also

served as the Managing Director at Novantas LLC, and was a Senior

Advisor at Inductis, Inc. Mr. Tambor began his career at American

Express Travel Related Services Co., Inc. (parent organization of

American Express), where he rose to Chief Risk Officer of Small

Business Services and served as President and General Manager of

American Express Business Finance Corp. Mr. Tambor received a B.A.

in Economics from The Hebrew University of Jerusalem, and an M.A.

in Economics from New York University.

About Oportun Oportun (Nasdaq: OPRT) is a

mission-driven fintech that puts its 2.2 million members' financial

goals within reach. With intelligent borrowing, savings, and

budgeting capabilities, Oportun empowers members with the

confidence to build a better financial future. Since inception,

Oportun has provided more than $17.8 billion in responsible and

affordable credit, saved its members more than $2.4 billion in

interest and fees, and helped its members save an average of more

than $1,800 annually. For more information, visit Oportun.com.

Forward-Looking StatementsThis press release

contains forward-looking statements. These forward-looking

statements are subject to the safe harbor provisions under the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements other

than statements of historical fact contained in this press release,

including statements as to future performance, results of

operations and financial position and growth, are forward-looking

statements. These statements can be generally identified by terms

such as “expect,” “plan,” “goal,” “target,” “anticipate,” “assume,”

“predict,” “project,” “outlook,” “continue,” “due,” “may,”

“believe,” “seek,” or “estimate” and similar expressions or the

negative versions of these words or comparable words, as well as

future or conditional verbs such as “will,” “should,” “would,”

“likely” and “could.” These statements involve known and unknown

risks, uncertainties, assumptions and other factors that may cause

Oportun’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Oportun has based these forward-looking statements on

its current expectations and projections about future events,

financial trends and risks and uncertainties that it believes may

affect its business, financial condition and results of operations.

These risks and uncertainties include those risks described in

Oportun's filings with the Securities and Exchange Commission,

including Oportun's most recent annual report on Form 10-K. These

forward-looking statements speak only as of the date on which they

are made and, except to the extent required by federal securities

laws, Oportun disclaims any obligation to update any

forward-looking statement to reflect events or circumstances after

the date on which the statement is made or to reflect the

occurrence of unanticipated events. In light of these risks and

uncertainties, there is no assurance that the events or results

suggested by the forward-looking statements will in fact occur, and

you should not place undue reliance on these forward-looking

statements.

Investor Contact

Dorian Hare

(650) 590-4323

ir@oportun.com

Media Contact

Usher Lieberman

(720) 987-9538

usher.lieberman@oportun.com

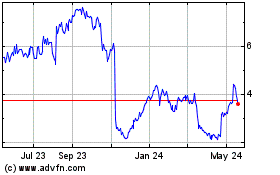

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

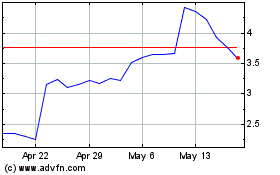

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Jan 2024 to Jan 2025