Palisade Bio Announces Closing of $5 Million Underwritten Public Offering Priced At-Market Under Nasdaq Rules

14 December 2024 - 8:05AM

Palisade Bio, Inc, (Nasdaq: PALI) (“Palisade,” “Palisade Bio” or

the “Company”), a clinical-stage biopharmaceutical company focused

on developing novel therapeutics for autoimmune, inflammatory, and

fibrotic diseases, today announced the closing of its previously

announced underwritten public offering for gross proceeds of

approximately $5 million prior to deducting underwriting

commissions and offering expenses. The offering is comprised of (i)

158,000 Class A Units with each unit consisting of (a) one share of

common stock and (b) one common warrant to purchase one share of

common stock (the “Common Warrants”), and (ii) 3,120,688 Class B

Units with each unit consisting of (a) one prefunded common stock

purchase warrant to purchase one share of common stock (“Prefunded

Warrants”) and (b) one Common Warrant. The price per Class A Unit

is $1.525 and the price per Class B Unit is $1.5249 (collectively,

the “Offering”).

The Common Warrants have an exercise price of

$1.40 per share, are exercisable at issuance, and have a term

expiring five years from issuance.

Ladenburg Thalmann & Co. Inc. acted as sole

bookrunning manager in connection with this Offering.

In addition, the Company has granted the

underwriter a 45-day option to purchase up to 491,803 additional

shares of common stock and/or Common Warrants, solely to cover

over-allotments, if any, at the public offering price less the

underwriting discounts and commissions.

In connection with the Offering, the Company has

elected to reprice approximately one million previously issued

warrants to $1.40 per share.

The gross proceeds from the Offering to the

Company, before deducting underwriting discounts and commissions

and other Offering expenses and excluding any proceeds that may be

received upon the exercise of the Common Warrants and the exercise

of the underwriter’s option to purchase additional shares of common

stock and/or Common Warrants, were approximately $5 million. The

Company currently intends to use the net proceeds of the Offering

primarily to fund our Phase 1 clinical trial of PALI-2108,

pre-clinical studies, research and development, and working

capital.

The securities were offered pursuant to a

registration statement on Form S-1 (File No. 333-282883), which was

declared effective by the United States Securities and Exchange

Commission (“SEC”) on December 12, 2024. The securities may be

offered only by means of a prospectus which forms part of the

effective registration statement. A preliminary prospectus

describing the terms of the Offering has been filed with the SEC

and is available on the SEC’s website located at

http://www.sec.gov. A final prospectus relating to this Offering

was filed by the Company with the SEC. Electronic copies of the

final prospectus relating to the Offering, when available, may also

be obtained by contacting Ladenburg Thalmann & Co. Inc.,

Prospectus Department, 640 Fifth Avenue, 4th Floor, New York, New

York 10019 or by email at prospectus@ladenburg.com.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy, nor will there be

any sales of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such

jurisdiction.

About Palisade Bio

Palisade Bio is a clinical-stage

biopharmaceutical company focused on developing and advancing novel

therapeutics for patients living with autoimmune, inflammatory, and

fibrotic diseases. The Company believes that by using a targeted

approach with its novel therapeutics it will transform the

treatment landscape. For more information, please go

to www.palisadebio.com.

Forward Looking Statements

This communication contains “forward-looking”

statements for purposes of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements include, but are not limited to, statements regarding

the over-allotment option. These forward-looking statements are

based on the Company’s current expectations. Forward-looking

statements involve risks and uncertainties. The Company’s actual

results and the timing of events could differ materially from those

anticipated in such forward-looking statements as a result of these

risks and uncertainties, which include, without limitation, the

intended use of net proceeds from the Offering, the extent of our

cash runway; our ability to successfully develop our licensed

technologies; the timing and outcome of our current and anticipated

applications and studies related to our product candidates;

estimates about the size and growth potential of the markets for

our product candidates, and our ability to serve those markets,

including any potential revenue generated; future regulatory,

judicial, and legislative changes or developments in the United

States (U.S.) and foreign countries and the impact of these

changes; our ability to maintain the Nasdaq listing of our

securities; our ability to build a commercial infrastructure in the

U.S. and other markets; our ability to compete effectively in a

competitive industry; our ability to identify and qualify

manufacturers to provide API and manufacture drug product; our

ability to enter into commercial supply agreements; the success of

competing technologies that are or may become available; our

ability to attract and retain key scientific or management

personnel; the accuracy of our estimates regarding expenses, future

revenues, capital requirements and needs for additional financing;

our ability to obtain funding for our operations; our ability to

attract collaborators and strategic partnerships; and the impact of

any global event on our business, and operations, and supply. Any

statements contained in this communication that are not statements

of historical fact may be deemed to be forward-looking statements.

These forward-looking statements are based upon the Company’s

current expectations. Forward-looking statements involve risks and

uncertainties. The Company’s actual results and the timing of

events could differ materially from those anticipated in such

forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, the Company’s

ability to advance its nonclinical and clinical programs, the

uncertain and time-consuming regulatory approval process; and the

Company’s ability to secure additional financing to fund future

operations and development of its product candidates. Additional

risks and uncertainties can be found in the Company’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2023, filed

with the Securities and Exchange Commission (“SEC”) on March 26,

2024, and the Quarterly Reports on Form 10-Q or other SEC filings

that are filed thereafter, including the Registration Statement on

Form S-1. These forward-looking statements speak only as of the

date hereof, and the Company expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in the Company’s expectations with regard thereto or any change in

events, conditions or circumstances on which any such statements

are based.

Investor Relations Contact

JTC Team, LLCJenene Thomas 908-824-0775PALI@jtcir.com

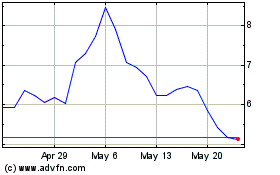

Palisade Bio (NASDAQ:PALI)

Historical Stock Chart

From Jan 2025 to Feb 2025

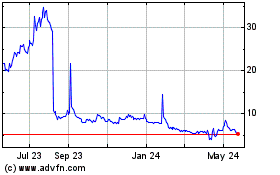

Palisade Bio (NASDAQ:PALI)

Historical Stock Chart

From Feb 2024 to Feb 2025