0001616741

false

FL

0001616741

2023-12-06

2023-12-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December

6, 2023

PATRIOT

TRANSPORTATION HOLDING, INC.

(Exact name of

registrant as specified in its charter)

|

florida

(State or other jurisdiction of incorporation) |

001-36605

(Commission File

Number) |

47-2482414

(IRS Employer

Identification No.) |

|

200 W. FORSYTH STREET, 7TH FLOOR

JACKSONVILLE, FLORIDA

(Address of principal executive offices) |

32202

(Zip Code) |

(904) 858-9100

(Registrant’s telephone number, including area

code)

Not Applicable

(Former name or former address, if changed since last

report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

[ ] Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

PATI |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On December 6, 2023, Patriot Transportation

Holding, Inc. issued a press release announcing results of operations for the fourth quarter and fiscal year ended September 30, 2023.

A copy of the press release is furnished as Exhibit 99.1.

The information in this report

(including the exhibit) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference

into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall

be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

99.1 Press Release dated December 6, 2023

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

PATRIOT TRANSPORTATION HOLDING, INC. |

| |

|

Registrant |

|

|

| |

|

|

|

|

| Date: December 6, 2023 |

|

By: |

/s/Matthew C. McNulty |

|

| |

|

|

Matthew C. McNulty |

|

| |

|

|

Chief Financial Officer |

|

PATRIOT TRANSPORTATION HOLDING, INC./NEWS

Contact: Matt McNulty

Chief Financial Officer 904/858-9100

PATRIOT TRANSPORTATION HOLDING, INC.

ANNOUNCES RESULTS FOR

THE FOURTH QUARTER AND FISCAL YEAR 2023

Patriot Transportation Holding, Inc. (NASDAQ-PATI)

Jacksonville, Florida; December 6, 2023

Fourth Quarter Operating Results

The Company reported net income of $526,000, or $.15

per share for the quarter ended September 30, 2023, compared to $470,000, or $.13 per share in the same quarter last year.

Revenue miles were up 402,000, or 7.7%, over the same

quarter last year. Operating revenues for the quarter were $24,217,000, up $1,335,000 from the same quarter last year due to higher miles,

rate increases, and an improved business mix. Operating revenue per mile was down $.08, or 1.8% due mainly to lower fuel surcharges as

diesel prices have declined since the same quarter last year.

Compensation and benefits increased $895,000, mainly

due to the increase in owner operators. Fuel expense decreased $515,000 due to lower diesel prices in the quarter. Insurance and losses

decreased $81,000 due to lower risk insurance claims offset by increased health insurance claims. Sales, general & administrative

increased $499,000 due mainly to bonus accruals. Corporate expenses included $368,000 of costs related to the pending merger. Gain on

sale of equipment was $274,000 versus $97,000 in the same quarter last year.

As a result, operating profit this quarter was $579,000

compared to $484,000 in the same quarter last year.

Operating Results for Fiscal year 2023

The Company reported net income of $2,673,000, or

$.74 per share for the fiscal year ended September 30, 2023, compared to $7,190,000, or $1.98 per share in the same period last year.

Net income in the fiscal year ended September 30, 2022 included $6,281,000, or $1.73 per share, from one-time gains on real estate net

of income taxes.

Revenue miles were up 579,000, or 2.7%, over the same

period last year. Operating revenues for the period were $94,785,000, up $6,903,000 from the same period last year due to an increase

in miles, rate increases and an improved business mix. Operating revenue per mile was up $.20, or 4.8%.

Compensation and benefits increased $5,587,000, mainly

due to the increases in driver compensation, a $331,000 increase in training pay versus the same period last year and increases in owner

operators. Fuel expense decreased $1,317,000 due to lower diesel prices. Insurance and losses decreased $1,103,000 due to lower risk and

health insurance claims. Depreciation expense was down $127,000 in the period. Sales, general & administrative increased $1,286,000

due

mainly to bonus accruals, increased travel and higher

401(k) match. Corporate expenses were up $204,000 due to $368,000 of costs related to the pending merger. Gain on sale of equipment was

$1,047,000 versus $739,000 in the same period last year.

As a result, operating profit this period was $3,282,000

compared to $9,299,000 in the same period last year. Prior year gain on the sale of land was $8,330,000 due to the sale of our former

terminal location in Tampa, FL. Operating ratio was 96.5 versus 89.4 in the same period last year.

Conference Call

The Company will not hold an earnings conference call

due to the execution of a definitive merger agreement, pursuant to which affiliates of United Petroleum Transports, Inc. propose to acquire

all of the outstanding shares of Patriot common stock for $16.26 per share in cash.

Investors are cautioned that any statements in

this press release which relate to the future are, by their nature, subject to risks and uncertainties that could cause actual results

and events to differ materially from those indicated in such forward-looking statements. These include the satisfaction of the conditions

precedent to complete the proposed merger, disruptions of current plans and operations caused by the announcement and pendency of the

merger, and the response of customers, suppliers, drivers and regulators to the announcement and pendency of the merger as well as general

economic conditions; competitive factors; political, economic, regulatory and climatic conditions; driver availability and cost; the impact

of future regulations regarding the transportation industry; freight demand for petroleum product and levels of construction activity

in the Company's markets; impact of COVID-19; fuel costs; risk insurance markets; pricing; energy costs and technological changes. Additional

information regarding these and other risk factors and uncertainties may be found in the Company’s filings with the Securities and

Exchange Commission.

Patriot Transportation Holding, Inc. is engaged in

the transportation business. The Company’s transportation business is conducted through Florida Rock & Tank Lines, Inc. which

is a Southeastern transportation company engaged in the hauling of liquid and dry bulk commodities.

PATRIOT TRANSPORTATION HOLDING, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(In thousands)

(Unaudited)

| |

|

THREE MONTHS ENDED |

|

TWELVE MONTHS ENDED |

| |

|

SEPTEMBER 30, |

|

SEPTEMBER 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

| Operating revenues |

|

$ |

24,217 |

|

|

|

22,882 |

|

|

|

94,785 |

|

|

|

87,882 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Compensation and benefits |

|

|

10,981 |

|

|

|

10,086 |

|

|

|

43,493 |

|

|

|

37,906 |

|

| Fuel expenses |

|

|

2,930 |

|

|

|

3,445 |

|

|

|

11,971 |

|

|

|

13,288 |

|

| Repairs & tires |

|

|

1,712 |

|

|

|

1,597 |

|

|

|

6,102 |

|

|

|

5,760 |

|

| Other operating |

|

|

825 |

|

|

|

834 |

|

|

|

3,125 |

|

|

|

3,027 |

|

| Insurance and losses |

|

|

1,784 |

|

|

|

1,865 |

|

|

|

7,064 |

|

|

|

8,167 |

|

| Depreciation expense |

|

|

1,477 |

|

|

|

1,291 |

|

|

|

5,410 |

|

|

|

5,537 |

|

| Rents, tags & utilities |

|

|

618 |

|

|

|

618 |

|

|

|

2,578 |

|

|

|

2,650 |

|

| Sales, general & administrative |

|

|

2,860 |

|

|

|

2,361 |

|

|

|

10,592 |

|

|

|

9,306 |

|

| Corporate expenses |

|

|

725 |

|

|

|

398 |

|

|

|

2,215 |

|

|

|

2,011 |

|

| Gain on sale of terminal sites |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(8,330 |

) |

| Gain on disposition of PP&E |

|

|

(274 |

) |

|

|

(97 |

) |

|

|

(1,047 |

) |

|

|

(739 |

) |

| Total cost of operations |

|

|

23,638 |

|

|

|

22,398 |

|

|

|

91,503 |

|

|

|

78,583 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating profit |

|

|

579 |

|

|

|

484 |

|

|

|

3,282 |

|

|

|

9,299 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income and other |

|

|

96 |

|

|

|

45 |

|

|

|

324 |

|

|

|

62 |

|

| Interest expense |

|

|

(5 |

) |

|

|

(5 |

) |

|

|

(18 |

) |

|

|

(18 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

670 |

|

|

|

524 |

|

|

|

3,588 |

|

|

|

9,343 |

|

| Provision for income taxes |

|

|

144 |

|

|

|

54 |

|

|

|

915 |

|

|

|

2,153 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

526 |

|

|

|

470 |

|

|

|

2,673 |

|

|

|

7,190 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on retiree health, net |

|

|

(11) |

|

|

|

(13 |

) |

|

|

(11) |

|

|

|

(13 |

) |

| Unrealized investment gains (losses), net |

|

|

— |

|

|

|

2 |

|

|

|

5 |

|

|

|

(5 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income |

|

$ |

515 |

|

|

|

459 |

|

|

|

2,667 |

|

|

|

7,172 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.15 |

|

|

|

0.13 |

|

|

|

0.76 |

|

|

|

2.08 |

|

| Diluted |

|

$ |

0.15 |

|

|

|

0.13 |

|

|

|

0.74 |

|

|

|

1.98 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Number of shares (in thousands) used in computing: |

|

|

|

|

| -basic earnings per common share |

|

|

3,526 |

|

|

|

3,484 |

|

|

|

3,515 |

|

|

|

3,459 |

|

| -diluted earnings per common share |

|

|

3,624 |

|

|

|

3,510 |

|

|

|

3,594 |

|

|

|

3,623 |

|

PATRIOT TRANSPORTATION HOLDING, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| |

|

|

September 30, |

|

|

September 30, |

| Assets |

|

|

2023 |

|

|

|

2022 |

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

6,429 |

|

|

|

8,302 |

|

|

Accounts receivable (net of allowance for

doubtful accounts of $63 and $68, respectively) |

|

|

6,126 |

|

|

|

5,296 |

|

| Federal and state taxes receivable |

|

|

511 |

|

|

|

— |

|

| Inventory of parts and supplies |

|

|

898 |

|

|

|

1,006 |

|

| Prepaid tires on equipment |

|

|

1,674 |

|

|

|

1,486 |

|

| Prepaid taxes and licenses |

|

|

380 |

|

|

|

378 |

|

| Prepaid insurance |

|

|

3,369 |

|

|

|

3,927 |

|

| Prepaid expenses, other |

|

|

83 |

|

|

|

163 |

|

| Total current assets |

|

|

19,470 |

|

|

|

20,558 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment, at cost |

|

|

77,048 |

|

|

|

72,816 |

|

| Less accumulated depreciation |

|

|

50,708 |

|

|

|

52,567 |

|

| Net property and equipment |

|

|

26,340 |

|

|

|

20,249 |

|

| |

|

|

|

|

|

|

|

|

| Operating lease right-of-use assets |

|

|

2,735 |

|

|

|

2,424 |

|

| Goodwill |

|

|

3,637 |

|

|

|

3,637 |

|

| Intangible assets, net |

|

|

359 |

|

|

|

556 |

|

| Other assets, net |

|

|

126 |

|

|

|

142 |

|

| Total assets |

|

$ |

52,667 |

|

|

|

47,566 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

2,614 |

|

|

|

1,964 |

|

| Federal and state taxes payable |

|

|

— |

|

|

|

594 |

|

| Accrued payroll and benefits |

|

|

4,490 |

|

|

|

3,208 |

|

| Accrued insurance |

|

|

918 |

|

|

|

1,053 |

|

| Accrued liabilities, other |

|

|

382 |

|

|

|

1,010 |

|

| Operating lease liabilities, current portion |

|

|

653 |

|

|

|

884 |

|

| Total current liabilities |

|

|

9,057 |

|

|

|

8,713 |

|

| |

|

|

|

|

|

|

|

|

| Operating lease liabilities, less current portion |

|

|

2,459 |

|

|

|

1,705 |

|

| Deferred income taxes |

|

|

4,715 |

|

|

|

3,631 |

|

| Accrued insurance |

|

|

1,276 |

|

|

|

1,476 |

|

| Other liabilities |

|

|

829 |

|

|

|

854 |

|

| Total liabilities |

|

|

18,336 |

|

|

|

16,379 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Shareholders’ Equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, 5,000,000 shares authorized, of which

250,000 shares are designated Series A Junior

Participating Preferred Stock; $0.01 par value;

None issued and outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, $.10 par value; (25,000,000 shares

authorized; 3,526,489 and 3,484,004 shares issued

and outstanding, respectively) |

|

|

353 |

|

|

|

348 |

|

| Capital in excess of par value |

|

|

40,430 |

|

|

|

39,958 |

|

| Accumulated deficit |

|

|

(6,517 |

) |

|

|

(9,190 |

) |

| Accumulated other comprehensive income, net |

|

|

65 |

|

|

|

71 |

|

| Total shareholders’ equity |

|

|

34,331 |

|

|

|

31,187 |

|

| Total liabilities and shareholders’ equity |

|

$ |

52,667 |

|

|

|

47,566 |

|

v3.23.3

Cover

|

Dec. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 06, 2023

|

| Entity File Number |

001-36605

|

| Entity Registrant Name |

PATRIOT

TRANSPORTATION HOLDING, INC.

|

| Entity Central Index Key |

0001616741

|

| Entity Tax Identification Number |

47-2482414

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

200 W. FORSYTH STREET

|

| Entity Address, Address Line Two |

7TH FLOOR

|

| Entity Address, City or Town |

JACKSONVILLE

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32202

|

| City Area Code |

(904)

|

| Local Phone Number |

858-9100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

PATI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

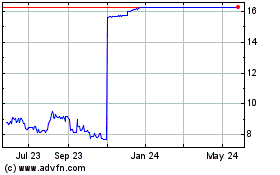

Patriot Transportation (NASDAQ:PATI)

Historical Stock Chart

From Apr 2024 to May 2024

Patriot Transportation (NASDAQ:PATI)

Historical Stock Chart

From May 2023 to May 2024