false

--09-30

2023

FY

Non-accelerated Filer

0001616741

P5Y

P1M6D

P2Y7M6D

0.54

P1Y9M18D

P6Y

P9Y1M3D

P6Y7M5D

P6Y5M30D

P5Y3M18D

P4Y4M24D

P3Y10M24D

P6Y8M11D

P5Y2M12D

P6Y5M30D

P5Y8M11D

P3Y3M19D

P8M12D

P3Y10M24D

P4Y4M24D

P1Y9M18D

0001616741

2022-10-01

2023-09-30

0001616741

2023-12-11

0001616741

2023-03-31

0001616741

2023-09-30

0001616741

2022-09-30

0001616741

2021-10-01

2022-09-30

0001616741

2020-10-01

2021-09-30

0001616741

us-gaap:CommonStockMember

2020-09-30

0001616741

us-gaap:AdditionalPaidInCapitalMember

2020-09-30

0001616741

us-gaap:RetainedEarningsMember

2020-09-30

0001616741

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-09-30

0001616741

2020-09-30

0001616741

us-gaap:CommonStockMember

2021-09-30

0001616741

us-gaap:AdditionalPaidInCapitalMember

2021-09-30

0001616741

us-gaap:RetainedEarningsMember

2021-09-30

0001616741

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-09-30

0001616741

2021-09-30

0001616741

us-gaap:CommonStockMember

2022-09-30

0001616741

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001616741

us-gaap:RetainedEarningsMember

2022-09-30

0001616741

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-09-30

0001616741

us-gaap:CommonStockMember

2020-10-01

2021-09-30

0001616741

us-gaap:AdditionalPaidInCapitalMember

2020-10-01

2021-09-30

0001616741

us-gaap:RetainedEarningsMember

2020-10-01

2021-09-30

0001616741

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-10-01

2021-09-30

0001616741

us-gaap:CommonStockMember

2021-10-01

2022-09-30

0001616741

us-gaap:AdditionalPaidInCapitalMember

2021-10-01

2022-09-30

0001616741

us-gaap:RetainedEarningsMember

2021-10-01

2022-09-30

0001616741

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-10-01

2022-09-30

0001616741

us-gaap:CommonStockMember

2022-10-01

2023-09-30

0001616741

us-gaap:AdditionalPaidInCapitalMember

2022-10-01

2023-09-30

0001616741

us-gaap:RetainedEarningsMember

2022-10-01

2023-09-30

0001616741

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-10-01

2023-09-30

0001616741

us-gaap:CommonStockMember

2023-09-30

0001616741

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001616741

us-gaap:RetainedEarningsMember

2023-09-30

0001616741

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-09-30

0001616741

PATI:PetroleumProductsMember

2023-09-30

0001616741

PATI:OtherProductsMember

2023-09-30

0001616741

us-gaap:BuildingAndBuildingImprovementsMember

2022-10-01

2023-09-30

0001616741

us-gaap:TransportationEquipmentMember

2022-10-01

2023-09-30

0001616741

us-gaap:OtherMachineryAndEquipmentMember

2022-10-01

2023-09-30

0001616741

us-gaap:RevolvingCreditFacilityMember

2021-07-01

2021-07-31

0001616741

us-gaap:RevolvingCreditFacilityMember

2023-09-30

0001616741

us-gaap:RevolvingCreditFacilityMember

2022-10-01

2023-09-30

0001616741

PATI:RevenueEquipmentAndOtherMember

2023-09-30

0001616741

us-gaap:RealEstateMember

2023-09-30

0001616741

us-gaap:DividendPaidMember

2021-10-01

2022-09-30

0001616741

us-gaap:DividendPaidMember

2020-10-01

2021-09-30

0001616741

us-gaap:StockAppreciationRightsSARSMember

2016-12-01

2016-12-31

0001616741

us-gaap:StockAppreciationRightsSARSMember

2021-11-15

0001616741

us-gaap:StockAppreciationRightsSARSMember

2016-12-31

0001616741

us-gaap:StockAppreciationRightsSARSMember

2023-09-30

0001616741

us-gaap:StockAppreciationRightsSARSMember

2022-09-30

0001616741

PATI:DirectorStockAwardMember

2022-10-01

2023-09-30

0001616741

PATI:DirectorStockAwardMember

2023-09-30

0001616741

PATI:DirectorStockAwardMember

2021-10-01

2022-09-30

0001616741

PATI:DirectorStockAwardMember

2022-09-30

0001616741

PATI:AdditionalDirectorStockAwardMember

2021-10-01

2022-09-30

0001616741

PATI:AdditionalDirectorStockAwardMember

2022-09-30

0001616741

PATI:DirectorStockAwardMember

2020-10-01

2021-09-30

0001616741

PATI:DirectorStockAwardMember

2021-09-30

0001616741

us-gaap:EmployeeStockOptionMember

2023-09-30

0001616741

2023-09-29

0001616741

us-gaap:EmployeeStockOptionMember

2022-10-01

2023-09-30

0001616741

us-gaap:EmployeeStockOptionMember

2021-10-01

2022-09-30

0001616741

us-gaap:EmployeeStockOptionMember

2020-10-01

2021-09-30

0001616741

us-gaap:EmployeeStockOptionMember

2020-09-30

0001616741

us-gaap:EmployeeStockOptionMember

2019-10-01

2020-09-30

0001616741

us-gaap:EmployeeStockOptionMember

2021-09-30

0001616741

us-gaap:EmployeeStockOptionMember

2022-09-30

0001616741

PATI:FivePointFourteenToSixPointNinetyFourMember

2023-09-30

0001616741

PATI:FivePointFourteenToSixPointNinetyFourMember

2022-10-01

2023-09-30

0001616741

PATI:SixPointNinetyFiveToNinePointThirtyEightMember

2023-09-30

0001616741

PATI:SixPointNinetyFiveToNinePointThirtyEightMember

2022-10-01

2023-09-30

0001616741

PATI:NinePointThirtyNineToTwelvePointSixtyEightMember

2023-09-30

0001616741

PATI:NinePointThirtyNineToTwelvePointSixtyEightMember

2022-10-01

2023-09-30

0001616741

PATI:TopTenCustomersMember

2022-10-01

2023-09-30

0001616741

PATI:TopCustomersMember

2022-10-01

2023-09-30

0001616741

PATI:TopTenCustpmersMember

2023-09-30

0001616741

PATI:TopTenCustpmersMember

2022-09-30

0001616741

PATI:PensacolaTerminalMember

2021-01-01

2021-03-31

0001616741

PATI:ChattanoogaTerminalMember

2021-04-01

2021-06-30

0001616741

PATI:TampaTerminalMember

2021-10-18

0001616741

PATI:TampaTerminalMember

2021-10-01

2021-12-31

0001616741

us-gaap:CustomerRelationshipsMember

2023-09-30

0001616741

us-gaap:CustomerRelationshipsMember

2022-09-30

0001616741

us-gaap:TrademarksAndTradeNamesMember

2023-09-30

0001616741

us-gaap:TrademarksAndTradeNamesMember

2022-09-30

0001616741

us-gaap:NoncompeteAgreementsMember

2023-09-30

0001616741

us-gaap:NoncompeteAgreementsMember

2022-09-30

0001616741

us-gaap:SubsequentEventMember

2023-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

PATI:Count

xbrli:pure

utr:Y

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 10-K

_________________

| [X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2023. |

|

or

| [_] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Commission File Number: 001-36605

_____________________

PATRIOT TRANSPORTATION HOLDING, INC.

(Exact name of registrant as specified in its charter)

_____________________

| florida |

|

47-2482414 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

| 200 W. Forsyth St., 7th Floor, Jacksonville, Florida |

|

32202 |

| (Address of principal executive offices) |

|

(Zip Code) |

(904) 396-5733

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, $.10 par value |

|

PATI |

|

NASDAQ |

|

Securities registered pursuant to Section

12(g) of the Act: None

_________________

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [_] No [X]

Indicate by check mark if the registrant is

not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [_] No [X]

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes [X] No [_]

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [_]

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [_] |

|

Accelerated filer [_] |

| |

|

|

| Non-accelerated filer [ ] |

Smaller reporting company [X] |

| |

|

|

| Emerging growth company [ ] |

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. [_]

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting fi rm that prepared or

issued its audit report. [_]

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements. [_]

Indicate by check mark whether any of those

error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). [_]

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes [_] No [X]

The number of shares of the registrant’s

common stock outstanding as of December 11, 2023 was 3,553,571. The aggregate market value of the shares of Common Stock held by non-affiliates

of the registrant as of March 31, 2023, the last day of business of our most recently completed second fiscal quarter, was $20,484,376.

Solely for purposes of this calculation, the registrant has assumed that all directors, officers and ten percent (10%) shareholders of

the Company are affiliates of the registrant.

DOCUMENTS INCORPORATED BY REFERENCE

None

PATRIOT TRANSPORTATION HOLDING, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2023

TABLE OF CONTENTS

Preliminary Note Regarding Forward-Looking

Statements.

Certain matters discussed in this report

contain “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the

Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties

that could cause actual results to differ materially from those indicated by such forward-looking statements.

These forward-looking statements are generally

denoted by the use of words such as “anticipate,” “believe,” “expect,” “intend,” “aim,”

“target,” “plan,” “continue,” “estimate,” “project,” “may,” “will,”

“should,” and similar expressions. However, the absence of these words or similar expressions does not mean that a statement

is not forward-looking. These statements reflect management’s current beliefs and are based on information currently available to

management. Forward-looking statements are based upon a number of estimates and assumptions that, while considered reasonable by management,

are inherently subject to known and unknown risks and uncertainties and other factors that could cause actual results to differ materially

from historical results or those anticipated. These factors include, but are not limited to: (a) the satisfaction of the conditions precedent

to the consummation of the proposed merger with affiliates of United Petroleum Transports, Inc. (referred to herein as the “merger”),

including, without limitation, the timely receipt of shareholder approval; (b) uncertainties as to the timing of the merger and the possibility

that the merger may not be completed, including uncertainties regarding the acquiror’s ability to finance the merger; (c) unanticipated

difficulties or expenditures relating to the merger; (d) the occurrence of any event, change or other circumstance that could give rise

to the termination of the merger agreement, including, in circumstances which would require the Company to pay a termination fee; (e)

legal proceedings, judgments or settlements, including those that may be instituted against the Company, the Company’s Board of

Directors, the Company’s executive officers and others following the announcement of the merger; (f) disruptions of current plans

and operations caused by the announcement and pendency of the merger; (g) risks related to disruption of management’s attention

from the Company’s ongoing business operations due to the merger; (h) potential difficulties in employee retention due to the announcement

and pendency of the merger; (i) the response of customers, suppliers, drivers and regulators to the announcement and pendency of the merger;

(j) disruptions in the execution of plans, strategies, goals and objectives of management for future operations caused by the merger;

(k) changes in accounting standards or tax rates, laws or regulations; (l) economic, market, business or geopolitical conditions (including

resulting from the COVID-19 pandemic, inflation, the conflict in Ukraine and related sanctions, or the conflict in the Middle East) or

competition, or changes in such conditions, negatively affecting the Company’s business, operations and financial performance, including

fuel costs; (m) risks that the price of the Company’s common stock may decline significantly if the merger is not completed; (n)

the possibility that the Company could, following the merger, engage in operational or other changes that could result in meaningful appreciation

in its value; (o) the possibility that the Company could, at a later date, engage in unspecified transactions, including restructuring

efforts, special dividends or the sale of some or all of the Company’s assets to one or more as yet unknown purchasers, which could

conceivably produce a higher aggregate value than that available to our shareholders in the merger; (p) freight demand for petroleum products

including the impact of reduced commuting, as well as increased vehicle fuel efficiency and the increased popularity of electric vehicles;

(q) accident severity and frequency; (r) risk insurance markets; (s) driver availability and cost; the impact of future regulations, including

regulations regarding the transportation industry and regulations intended to reduce greenhouse gas emissions; (t) cyber-attacks; (u)

competition in our markets; and (v) interest rates. However, this list is not a complete statement of all potential risks or uncertainties.

These forward-looking statements are made

as of the date hereof based on management’s current expectations, and the Company does not undertake an obligation to update such

statements, whether as a result of new information, future events or otherwise. Additional information regarding these and other risk

factors may be found in the Company’s other filings made from time to time with the Securities and Exchange Commission.

PART I

Item 1. BUSINESS.

Our Business. Our business, conducted through

our wholly owned subsidiary Florida Rock & Tank Lines, Inc., consists of hauling petroleum related products, dry bulk commodities

and liquids. We are one of the largest regional tank truck carriers in North America. We operate terminals in Florida, Georgia, Alabama,

and Tennessee. We do not own any of the products we haul; rather, we act as a third-party carrier to deliver our customers’

products from point A to point B, using predominately Company employees and Company-owned tractors and tank trailers. Approximately 86%

of our business consists of hauling liquid petroleum products (mostly gas and diesel fuel) from large scale fuel storage facilities to

our customers’ retail outlets (e.g. convenience stores, truck stops and fuel depots) where we off-load the product into our customers’

fuel storage tanks for ultimate sale to the retail consumer. The remaining 14% of our business consists of hauling dry bulk commodities

such as cement, lime and various industrial powder products, water and liquid chemicals. As of September 30, 2023, we employed 323 revenue-producing

drivers who operated our fleet of 264 Company tractors, 52 owner operators and 389 trailers from our 17 terminals and 6 satellite locations.

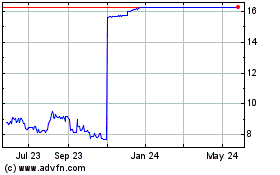

Agreement and Plan of Merger. On November 1,

2023 the Company entered into a merger agreement under which affiliates of United Petroleum Transports, Inc. (“UPT”) will,

subject to the terms and conditions set forth in the merger agreement, acquire all of the outstanding shares of the Company’s common

stock for $16.26 per share in cash (referred to herein as, the “merger”). The transaction, which has been unanimously approved

by the Company’s Board of Directors, is subject to the satisfaction of closing conditions, including the approval of the Company’s

shareholders. UPT has obtained a customary financing commitment from an established lending institution pursuant to which the lender will

provide financing that, together with other available sources, is expected to be sufficient to fund the merger consideration and other

obligations under the merger agreement. Shareholders collectively beneficially owning 26.6% of the voting power of the Company’s

common stock have agreed to vote in favor of the merger, subject to customary exceptions. Upon completion of the transaction, which the

parties expect will occur by late 2023 or early 2024, the Company will become a private company and delist from the NASDAQ Global Select

Market.

Tractors and Trailers. During fiscal 2023,

the Company replaced 72 tractors and 5 trailers. We believe maintaining a modern fleet will result in reduced maintenance expenses, improved

operating efficiencies and enhanced driver recruitment and retention.

Competition. The tank lines transportation

business is extremely competitive and fragmented. We have multiple competitors in each of our markets, consisting of other carriers of

varying sizes as well as our customers’ private fleets. Price, service, and location are the major competitive factors in each local

market. Some of our competitors have greater financial resources and a more expansive geographic footprint than our company. Some of our

competitors periodically reduce their prices to gain business, which may limit our ability to maintain or increase prices, implement new

pricing strategies, or maintain significant growth in our business. Our largest competitors include Kenan Advantage Group, Eagle Transport,

and Penn Tank Lines. We also compete with smaller carriers in most of our markets.

Our industry is characterized by such barriers to

entry as the time and cost required to develop the capabilities necessary to handle hazardous material, the resources required to recruit,

train and retain drivers, substantial industry regulatory and insurance requirements and the significant capital investments required

to build a fleet of equipment, establish a network of terminals and, in recent years, the cost to build and maintain sufficient information

technology resources to allow us to interface with and assist our customers in the day-to-day management of their product inventories.

Our ability to provide superior customer service at

competitive rates and to operate safely and efficiently is important to our success in growing our revenues and increasing profitability.

Our focus is to grow our profitability by executing on our key strategies of (i) increasing our business with existing and new customers,

particularly hypermarket and large convenience store chains, that are willing to compensate us for our ability to provide superior, safe

and reliable service, (ii) expanding our service offerings with respect to dry bulk, liquid and chemical products particularly in markets

where we already operate terminals, (iii) earning the reputation as the preferred employer for tank truck drivers in all the markets in

which we operate and (iv) pursuing strategic acquisitions. Our ability to

execute this strategy depends on continuing our dedicated

commitments to customer service and safety and continuing to recruit and retain qualified drivers.

Customers. Approximately 86% of our business

consists of hauling petroleum related products. Our petroleum clients include major convenience store and hypermarket accounts, fuel wholesalers

and major oil companies. We strive to build long-term relationships with major customers by providing outstanding customer service.

During fiscal 2023, the Company’s ten largest customers accounted for approximately 60.0% of revenue. One of these customers accounted

for 16.9% of revenue. The loss of any one of these customers could have a material adverse effect on the Company’s revenues and

income. Our top 10 accounts have been customers for at least 10 years.

Our dry bulk and chemical customers include large

industrial companies including cement and concrete accounts and product distribution companies. Our customer relationships are long-standing

and have grown over time as a result of consistently high safety and service levels.

In September 2020, we entered into a contract with

a customer to haul spring water in seven food grade trailers. This is the Company’s first venture into the food grade space.

Sales and Marketing. Our marketing activities

are focused on building our relationships with existing customers as well as developing new business opportunities. Our senior management

team has extensive experience in marketing specialized fuels delivery services. In addition, significant portions of our marketing activities

are conducted locally by our regional managers, terminal managers and dispatchers who act as local customer service representatives. These

managers and dispatchers maintain regular contact with customers and are well-positioned to identify the changing transportation needs

of customers in their respective geographic areas. We also actively participate in various trade associations, including the National

Tank Truck Carriers Association, various state trucking and petroleum marketing associations and the Society of Independent Gasoline Marketers

Association.

Environmental Matters. Our activities, which

involve the transportation, storage and disposal of fuels and other hazardous substances and wastes, are subject to various federal, state

and local health and safety laws and regulations relating to the protection of the environment, including, among others, those governing

the transportation, management and disposal of hazardous materials, vehicle emissions, underground and above ground storage tanks and

the cleanup of contaminated sites. Our operations involve risks of fuel spillage or seepage, hazardous waste disposal and other activities

that are potentially damaging to the environment. If we are involved in a spill or other accident involving hazardous substances, or if

we are found to be in violation of or liable under applicable laws or regulations, it could significantly increase our cost of doing business.

Most of our truck terminals are located in industrial

areas, where groundwater or other forms of environmental contamination may have occurred. Under environmental laws, we could be held responsible

for the costs relating to any contamination at those or other of our past or present facilities and at third-party waste disposal sites,

including cleanup costs, fines and penalties and personal injury and property damages. Under some of these laws, such as the Comprehensive

Environmental Response Compensation and Liability Act (also known as the Superfund law) and comparable state statutes, liability for the

entire cost of the cleanup of contaminated sites can be imposed upon any current or former owner or operator, or upon any party who sent

waste to the site, regardless of the lawfulness of any disposal activities or whether a party owned or operated a contaminated property

at the time of the release of hazardous substances. From time to time, we have incurred remedial costs and/or regulatory penalties with

respect to chemical or wastewater spills and releases relating to our facilities or operations, and, notwithstanding the existence of

our environmental management program, we may incur such obligations in the future. The discovery of contamination or the imposition of

additional obligations or liabilities in the future could result in a material adverse effect on our financial condition, results of operations

or our business reputation.

Our operations involve hazardous materials and could

result in significant environmental liabilities and costs. For a discussion of certain risks of our being associated with transporting

hazardous substances see “Risk Factors—Risks Relating to Our Business”

Seasonality. Our business is subject to seasonal

trends common in the refined petroleum products delivery industry. We typically face reduced demand for refined petroleum products delivery

services during the winter months and increased demand during the spring and summer months. Further, operating costs and earnings are

generally adversely affected by inclement weather conditions. These factors generally result in lower operating results during

the first and second fiscal quarters of the year and

cause our operating results to fluctuate from quarter to quarter. Our operating expenses also have been somewhat higher in the winter

months, due primarily to decreased fuel efficiency and increased maintenance costs for tractors and trailers in colder months.

Human Capital. As of September 30, 2023, the

Company employed 466 people. Our industry is experiencing a severe shortage of qualified professional drivers with a tenured safe driving

career. The trend we are seeing is that more and more of the applicants are drivers with little to no experience in the tank truck business,

short driving careers in other lines of trucking, poor safety records and a pattern of job instability in their work history. As a result,

in many markets we serve it is difficult to grow the driver count and, in some cases, to even maintain our historical or desired driver

counts. There are several opportunities available today in our markets that will allow us to execute on our strategy so long as we can

find, hire and retain qualified drivers to meet the demands of these opportunities.

Company Website Access and SEC Filings. The

Company’s website may be accessed at www.patriottrans.com. All of our filings with the

Securities and Exchange Commission (“SEC”) can be accessed free of charge through our website promptly after filing; however,

in the event that the website is inaccessible, we will provide paper copies of our most recent annual report on Form 10-K, the most recent

quarterly report on Form 10-Q, current reports filed or furnished on Form 8-K, and all related amendments, excluding exhibits, free of

charge upon request. These filings are also accessible on the SEC’s website at www.sec.gov.

The content of our website is not incorporated by reference into this Annual Report on Form 10-K or in any other report or document we

file with the SEC, and any references to our website are intended to be inactive textual references only.

General Information. Our stock transfer

agent is American Stock Transfer & Trust Company, 59 Maiden Lane Plaza Level, New York, NY 10038, Telephone: 1-800-937-5449. The Company’s

common stock is listed on the NASDAQ Global Market and trades under the stock symbol “PATI”. Our independent registered public

accounting firm is Hancock Askew & Co. LLP, Jacksonville, Florida. Our legal counsel is Foley & Lardner LLP, Jacksonville, Florida.

Item 1A. RISK FACTORS.

Our future results may be affected by a number of

factors over which we have little or no control. The following issues, uncertainties, and risks, among others, should be considered in

evaluating our business and outlook. Also, note that additional risks not currently identified or known to us could also negatively impact

our business or financial results.

Risks Related to the Merger

Risks related to the merger could materially affect our business, financial

condition, results of operations, cash flows, projected results, and future prospects.

Completion of the merger is subject to a number of

closing conditions, including obtaining the approval of our shareholders and upon UPT’s ability to obtain debt financing (as defined

in the merger agreement). We can provide no assurance that all closing conditions will otherwise be satisfied (or waived, if applicable),

and, even if all closing conditions are satisfied (or waived, if applicable), we can provide no assurance as to the terms, conditions

and timing of such approvals or the timing of the completion of the merger. Many of the conditions to completion of the merger are not

within our control, and we cannot predict when or if these conditions will be satisfied (or waived, if applicable). Any adverse consequence

of the pending merger could be exacerbated by any delays in completion of the merger or termination of the merger agreement.

Each party’s obligation to consummate the merger

is subject to the accuracy of the representations and warranties of the other party (subject to customary materiality qualifications)

and compliance in all material respects with the covenants and agreements contained in the merger agreement as of the closing of the merger,

including, with respect to us, covenants to conduct our business in the ordinary course and to not engage in certain kinds of material

transactions prior to closing. In addition, the merger agreement may be terminated under certain specified circumstances, including, but

not limited to, in connection with a change in the recommendation of our Board to enter into an agreement for a Superior Proposal (as

defined in the merger agreement). As a result, we cannot assure you that the merger will be completed, even if our shareholders approve

the merger, or that, if completed, it will be

exactly on the terms set forth in the merger agreement

or within the expected time frame. In addition, we are subject to the following risks related to the merger:

- legal proceedings,

judgments or settlements, including those that may be instituted against the Company, the Board, the Company’s executive officers

and others following the announcement of the merger;

- disruptions of current

plans and operations caused by the announcement and pendency of the merger;

- disruption of management’s

attention from the Company’s ongoing business operations due to the merger;

- potential difficulties in employee retention

due to the announcement and pendency of the merger;

- the response of customers, suppliers and

drivers to the announcement and pendency of the merger;

- disruptions in the execution of plans, strategies,

goals and objectives of management for future operations caused by the merger; and

- the price of the Company’s common stock price

may decline significantly if the merger is not completed.

The occurrence of any of these events individually

or in combination could affect the Company’s business, financial condition, results of operations, cash flows, projected results,

and future prospects.

Strategic Risks

Our operations and financial results are subject

to the demand for hauling petroleum products in our markets, which is determined by factors outside our control.

We derive approximately 86% of our revenues from the

hauling of petroleum products, including gasoline, diesel fuel and ethanol. The demand for these services is determined by motor fuel

consumption in our markets, which is affected by gasoline prices, general economic conditions, employment levels, remote work, consumer

confidence and spending patterns. Gasoline prices can be highly volatile and are impacted by factors outside

of our control (including production decisions made by oil producing nations).

Developments related to climate

change, fuel efficiency, vehicle manufacturing and increased acceptance of electric vehicles are expected to reduce demand for petroleum

products.

Increasing concern regarding

the impacts of climate change resulting from greenhouse gas emissions has resulted in proposed regulations to improve fuel efficiency

and legislation such as the Inflation Reduction Act that create incentives for the purchase of electric vehicles, as well as legislative

proposals such as carbon taxes and cap and trade programs. Many major automobile manufacturers have plans to increase production of electric

vehicles over time. These factors, together with increasing social consciousness about climate change and consumer acceptance of electric

vehicles, could reduce demand for petroleum products over time.

Human Capital Risks

Our ability to recruit and retain drivers is critical

to our financial results and the ability to grow our business.

Our industry is subject to a shortage of qualified

drivers. This shortage is exacerbated during periods of economic expansion, in which attractive employment opportunities, including in

the construction and manufacturing industries, may offer better compensation and better hours. We suffer from high turnover. We have implemented

driver pay increases to address this shortage in the hopes of reducing turnover, however our efforts to reduce turnover may be unsuccessful.

There is substantial competition for qualified personnel,

particularly drivers, in the trucking industry. Supply chain challenges could continue to reduce the number of eligible drivers in our

markets. This results in temporary under-utilization of our equipment, difficulty in meeting our customers’ demands and increased

compensation levels, each

of which could have a material adverse effect on our

business, results of operations and financial condition. A decrease in quality drivers could lead to an increased frequency in the number

of accidents, potential claims exposure and, indirectly, insurance costs.

Difficulty in attracting qualified drivers limits

our ability to accept or service new business opportunities or could require us to increase the wages we pay in order to attract and retain

drivers. If we are unable to hire qualified drivers to service new or existing business, we may have to temporarily send drivers from

other terminals to those struggling markets, causing us to incur significant costs relating to out-of-town driver pay and expenses.

If our relationship with our employees were to

deteriorate, we may be faced with unionization efforts, labor shortages, disruptions or stoppages, which could adversely affect our business

and reduce our operating margins and income.

Our operations rely heavily on our employees, and

any labor shortage, disruption or stoppage caused by poor relations with our employees, whether as a result of the pending merger or another

reason, could reduce our operating margins and income. None of our employees are subject to collective bargaining agreements, although

unions have traditionally been active in the U.S. trucking industry. Our workforce has been subject to union organization efforts from

time to time, and we could be subject to future unionization efforts as our operations expand. Unionization of our workforce could result

in higher compensation and working condition demands that could increase our operating costs or constrain our operating flexibility. We

believe we are exempt from overtime pay rules under regulations of the Department of Transportation (“DOT”). However, our

operating costs would increase if this exemption were rescinded or if a court determined that we were not exempt from these overtime pay

rules.

If we lose key members of our senior management,

our business may be adversely affected.

Our ability to implement our business strategy successfully

and to operate profitably depends in large part on the continued employment of our senior management team, led by Robert Sandlin, President

and CEO. If Mr. Sandlin or the other members of senior management become unable or unwilling to continue in their present positions, our

business or financial results could be adversely affected.

Operational Risks

We may be adversely affected by fluctuations in

the price and availability of fuel.

We require large amounts of diesel fuel to operate

our tractors. In 2021, 2022 and 2023, cost of fuel (including fuel taxes) represented approximately 11.9%, 15.1%, and 12.6%, respectively,

of our total revenue. The market price for fuel can be extremely volatile and can be affected by a number of economic and political factors.

In addition, changes in federal or state regulations can impact the price of fuel, as well as increase the amount we pay in fuel taxes.

We typically incorporate a fuel surcharge provision

in all customer contracts. The intended effect of that provision is to neutralize the impacts of fluctuations in the price of diesel fuel

on both the Company and our customer. The amount of the fuel surcharge is typically set at the beginning of each month and is based on

the actual price of diesel fuel recorded in the preceding month. This provision produces a lag in the timing of the recovery of the price

move for both the Company and our customer. However, our customers may be able to negotiate contracts that minimize or eliminate our ability

to pass on fuel price increases.

We currently do not hedge our fuel purchases to protect

against fluctuations in fuel prices.

Our operations may also be adversely affected by any

limit on the availability of fuel. Disruptions in the political climate in key oil producing regions in the world, particularly in the

event of wars or other armed conflicts, could severely limit the availability of fuel in the United States. In the event our customers

face significant difficulty in obtaining fuel, our business, results of operations and financial condition would be materially adversely

affected.

We operate in a highly competitive industry, and

competitive pressures may adversely affect our operations and profitability.

The tank lines transportation business is extremely

competitive and fragmented. We compete with many other carriers of varying sizes as well as our customers’ private fleets. Numerous

competitive factors could impair our ability to maintain our current level of revenues and profitability and adversely affect our financial

condition. These factors include the following:

| |

• |

we compete with many other fuels delivery service providers, particularly smaller regional competitors, some of which may have more equipment in, or stronger ties to, the geographic regions in which they operate or other competitive advantages; |

| |

• |

some of our competitors periodically reduce their prices to gain business, which may limit our ability to maintain or increase prices, implement new pricing strategies or maintain significant growth in our business; |

| |

• |

many customers periodically accept bids from multiple carriers, and this process may depress prices or result in the loss of some business to competitors; |

| |

• |

many customers are looking to reduce the number of carriers they use, and in some instances we may not be selected to provide services; |

| |

• |

consolidation in the fuels delivery industry could create other large carriers with greater financial resources than we have and other competitive advantages relating to their size; |

| |

• |

the development of alternative power sources for cars and trucks could reduce demand for gasoline; and |

| |

• |

advances in technology require increased investments to maintain competitiveness, and we may not have the financial resources to invest in technology improvements or our customers may not be willing to accept higher prices to cover the cost of these investments. |

If we are unable to address these competitive pressures,

our operations and profitability may be adversely affected.

Our operations present hazards and risks, which

are not fully covered by insurance. If a significant accident happens, for which we are not fully insured, our operations and financial

results could be adversely affected.

The primary accident risks associated with our business

are:

| |

• |

|

motor-vehicle related bodily injury and property damage; |

| |

• |

|

workers’ compensation claims; |

| |

• |

|

environmental pollution liability claims; |

| |

• |

|

cargo loss and damage; and |

| |

• |

|

general liability claims. |

We currently maintain insurance for:

| |

• |

|

motor-vehicle related bodily injury and property damage claims; |

| |

• |

|

workers’ compensation insurance coverage on our employees; and |

| |

• |

|

general liability claims. |

Our insurance program includes a self-insured deductible

of $250,000 per incident for bodily injury and property damage. The deductible on workers’ compensation is $500,000. In addition,

the Company maintains a minimum of $10 million of insurance coverage which is the largest amount required by any of our customers. The

deductible per incident could adversely affect our profitability, particularly in the event of an increase in the frequency or severity

of incidents. Additionally, we are self-insured for damage to the equipment that we own and lease, as well as for cargo losses and such

self-insurance is not subject to any maximum limitation. In addition, even where we have insurance, our insurance policies may not

provide coverage for certain claims against us or may not be sufficient to cover all possible liabilities.

Our self-insured retentions require us to make estimates

of expected loss amounts and accrue such estimates as expenses. Changes in estimates may materially and adversely affect our financial

results. In addition, our insurance does not cover claims for punitive damages.

We are subject to changing conditions and pricing

in the insurance marketplace that in the future could change dramatically the cost or availability of various types of insurance. To the

extent these costs cannot be passed on to our customers in increased prices, increases in insurance costs could reduce our future profitability

and cash flow.

Moreover, any accident or incident involving us, even

if we are fully insured or not held to be liable, could negatively affect our reputation among customers and the public, thereby making

it more difficult for us to compete effectively, and could significantly affect the cost and availability of insurance in the future.

Because we provide “last mile” fuels delivery services, we generally perform our services in more crowded areas, which increases

the possibility of an accident involving our trucks.

If we fail to develop, integrate or upgrade our

information technology systems, we may lose customers or incur costs beyond our expectations.

We rely heavily on information technology and communications

systems to operate our business and manage our network in an efficient manner. We have equipped our tractors with various mobile communications

systems and electronic logging devices that enable us to monitor our tractors and communicate with our drivers in the field and enable

customers to track the location and monitor the progress of their cargo through the Internet.

Increasingly, we compete for customers based upon

the flexibility and sophistication of our technologies supporting our services. The failure of hardware or software that supports our

information technology systems, the loss of data contained in the systems, or the inability of our customers to access or interact with

our website, could significantly disrupt our operations and cause us to lose customers. If our information technology systems are unable

to handle additional volume for our operations as our business and scope of service grow, our service levels and operating efficiency

will decline. In addition, we expect customers to continue to demand more sophisticated fully integrated information systems. If we fail

to hire and retain qualified personnel to implement and maintain our information technology systems or if we fail to upgrade or replace

these systems to handle increased volumes, meet the demands of our customers and protect against disruptions of our operations, we may

lose customers, which could seriously harm our business.

Our business could be negatively impacted by cyberattacks

targeting our computer and telecommunications systems and infrastructure, or targeting those of our third-party service providers.

Our business, like other companies in our industry,

has become increasingly dependent on digital technologies, including technologies that are managed by third-party service providers on

whom we rely to help us collect, host or process information. Such technologies are integrated into our business operations. Use of the

internet and other public networks for communications, services, and storage, including "cloud" computing, exposes all users

(including our business) to cybersecurity risks.

While we and our third-party service providers commit

resources to the design, implementation, and monitoring of our information systems, there is no guarantee that our security measures will

provide absolute security. Despite these security measures, we may not be able to anticipate, detect, or prevent cyberattacks, particularly

because the methodologies used by attackers change frequently or may not be recognized until launched, and because attackers are increasingly

using techniques designed to circumvent controls and avoid detection. We and our third-party service providers may therefore be vulnerable

to security events that are beyond our control, and we may be the target of cyber-attacks, as well as physical attacks, which could result

in information security breaches and significant disruption to our business.

As cyberattacks continue to evolve, we may be required

to expend significant additional resources to respond to cyberattacks, to continue to modify or enhance our protective measures, or to

investigate and remediate any information.

We operate in a highly regulated industry, and

increased costs of compliance with, or liability for violation of, existing or future regulations could significantly increase our costs

of doing business.

As a motor carrier, we are subject to regulation by

the Federal Motor Carrier Safety Administration (“FMCSA”) and DOT, and by various federal and state agencies. These regulatory

authorities exercise broad powers governing various aspects such as operating authority, safety, hours of service, hazardous materials

transportation, financial reporting and acquisitions. There are additional regulations specifically relating to the trucking industry,

including testing and specification of equipment, product-handling requirements and drug testing of drivers. In 2019, Florida Rock &

Tank Lines, Inc. underwent a compliance review by the FMCSA in which we retained our satisfactory DOT safety rating. Any downgrade in

our DOT safety rating (as a result of new regulations or otherwise) could adversely affect our business.

The trucking industry is subject to possible regulatory

and legislative changes that may affect the economics of the industry by requiring changes in operating practices, emissions or by changing

the demand for common or contract carrier services or the cost of providing trucking services. Possible changes include:

| |

• |

|

increasingly stringent environmental regulations, including changes intended to address climate change; |

| |

• |

|

restrictions, taxes or other controls on emissions; |

| |

• |

|

regulation specific to the energy market and logistics providers to the industry; |

| |

• |

|

changes in the hours-of-service regulations, which govern the amount of time a driver may drive in any specific period; |

| |

• |

|

driver and vehicle electronic logging requirements; |

| |

• |

|

requirements leading to accelerated purchases of new tractors; |

| |

• |

|

mandatory limits on vehicle weight and size; |

| |

• |

|

driver hiring restrictions; |

| |

• |

|

increased bonding or insurance requirements; and |

| |

• |

|

mandatory regulations imposed by the Department of Homeland Security. |

From time to time, various legislative proposals are

introduced, including proposals to increase federal, state, or local taxes, including taxes on motor fuels and emissions, which may increase

our operating costs, require capital expenditures or adversely impact the recruitment of drivers.

Restrictions on emissions or other climate change

laws or regulations could also affect our customers that use significant amounts of energy or burn fossil fuels in producing or delivering

the products we carry. We also could lose revenue if our customers divert business from us because we have not complied with their sustainability

requirements.

Our business may be adversely affected by additional

security measures and regulations applicable to the transport of hazardous materials.

Federal, state and municipal authorities have implemented

and continue to implement various security measures, including checkpoints and travel restrictions on large trucks and fingerprinting

of drivers in connection with new hazardous materials endorsements on their licenses. Such measures may have costs associated with them

which we are forced to bear. While we believe we are in compliance with these regulations, if existing requirements are interpreted differently

by governmental authorities or additional new security measures are required, the timing of our deliveries may be disrupted and we may

fail to meet the needs of our customers or incur increased expenses to do so. Such developments could have a material adverse effect on

our operating results. Moreover, large trucks containing petroleum products are potential terrorist targets, and we may be obligated to

take measures, including possible capital expenditures intended to protect our trucks. In addition, the insurance premiums charged for

some or all of the coverage maintained by us could continue to increase dramatically or such coverage could be unavailable in the future.

Our operations involve hazardous materials and

could result in significant environmental liabilities and costs.

Our activities, which involve the transportation,

storage and disposal of fuels and other hazardous substances and wastes, are subject to various federal, state and local health and safety

laws and regulations relating to the protection of the environment, including, among others, those governing the transportation, management

and disposal of hazardous materials, vehicle emissions, underground and above ground storage tanks and the cleanup of contaminated sites.

Our operations involve risks of fuel spillage or seepage, hazardous waste disposal and other

activities that are potentially damaging to the environment.

If we are involved in a spill or other accident involving hazardous substances, or if we are found to be in violation of or liable under

applicable laws or regulations, it could significantly increase our cost of doing business.

Most of our truck terminals are located in industrial

areas, where groundwater or other forms of environmental contamination may have occurred. Under environmental laws, we could be held responsible

for the costs relating to any contamination at those or other of our past or present facilities and at third-party waste disposal sites,

including cleanup costs, fines and penalties and personal injury and property damages. Under some of these laws, such as the Comprehensive

Environmental Response Compensation and Liability Act (also known as the Superfund law) and comparable state statutes, liability for the

entire cost of the cleanup of contaminated sites can be imposed upon any current or former owner or operator, or upon any party who sent

waste to the site, regardless of the lawfulness of any disposal activities or whether a party owned or operated a contaminated property

at the time of the release of hazardous substances. From time to time, we have incurred remedial costs and/or regulatory penalties with

respect to spills and releases in connection with our operations and, notwithstanding the existence of our environmental management program,

such obligations may be incurred in the future. The discovery of contamination or the imposition of additional obligations or liabilities

in the future could result in a material adverse effect on our financial condition, results of operations or our business reputation.

Risks Relating to Our Common Stock

Your percentage of ownership in the Company may

be diluted in the future.

In the future, your percentage ownership in the Company

may be diluted because of equity issuances for acquisitions, capital market transactions or other corporate purposes, including equity

awards that we will grant to our directors, officers and employees. Our employees have options to purchase shares of our common stock

and we anticipate our compensation committee will grant additional stock options or other stock-based awards to our employees. Such awards

will have a dilutive effect on our earnings per share, which could adversely affect the market price of our common stock. From time to

time, we will issue additional options or other stock-based awards to our employees under our employee benefits plans.

In addition, our amended and restated articles of

incorporation authorizes us to issue, without the approval of our shareholders, one or more classes or series of preferred stock having

such designation, powers, preferences and relative, participating, optional and other special rights, including preferences over our common

stock respecting dividends and distributions, as our board of directors generally may determine. The terms of one or more classes or series

of preferred stock could dilute the voting power or reduce the value of our common stock. For example, we could grant the holders of preferred

stock the right to elect some number of our directors in all events or on the happening of specified events or the right to veto specified

transactions. Similarly, the repurchase or redemption rights or liquidation preferences we could assign to holders of preferred stock

could affect the residual value of the common stock.

Certain shareholders have effective control of

a significant percentage of our common stock and likely will control the outcome of any shareholder vote.

Two of our directors, John D Baker II and Thompson

S. Baker II, and their respective family members, beneficially own a significant percentage of our common stock. As a result, these individuals

effectively may have the ability to direct the election of all members of our board of directors and to exercise a controlling influence

over our business and affairs, including any determinations with respect to mergers or other business combinations involving us, our acquisition

or disposition of assets, our borrowing of monies, our issuance of any additional securities, our repurchase of common stock and our payment

of dividends. In connection with the pending merger, John D Baker II and Thompson S. Baker II entered into an Irrevocable Proxy and Agreement,

pursuant to which, among other things, they have granted an irrevocable proxy to vote the shares of Company common stock owned by such

shareholders in favor of the adoption of the merger agreement.

Provisions in our articles of incorporation and

bylaws and certain provisions of Florida law could delay or prevent a change in control of us.

The existence of some provisions of our articles of

incorporation and bylaws and Florida law could discourage, delay

or prevent a change in control of us that a shareholder

may consider favorable. These include provisions:

| |

• |

|

providing that our directors may be removed by our shareholders only for cause; |

| |

• |

|

establishing supermajority vote requirements for our shareholders to approve certain business combinations; |

| |

• |

|

establishing supermajority vote requirements for our shareholders to amend certain provisions of our articles of incorporation and our bylaws; |

| |

• |

|

authorizing a large number of shares of stock that are not yet issued, which would allow our board of directors to issue shares to persons friendly to current management, thereby protecting the continuity of our management, or which could be used to dilute the stock ownership of persons seeking to obtain control of us; |

| |

• |

|

prohibiting shareholders from calling special meetings of shareholders or taking action by written consent; and |

| |

• |

|

imposing advance notice requirements for nominations of candidates for election to our board of directors at the annual shareholder meetings. |

These provisions apply even if a takeover offer may

be considered beneficial by some shareholders and could delay or prevent an acquisition that our board of directors determines is not

in our and our shareholders’ best interests.

Item 1B. UNRESOLVED STAFF COMMENTS.

None.

Item 2. PROPERTIES.

As of September 30, 2023, our terminals and satellite

locations were located in the following cities:

|

State |

|

City |

Terminal or Satellite

Location |

|

Owned/Leased |

| |

|

|

|

|

|

| Alabama |

|

Mobile |

Satellite |

|

Leased |

| Alabama |

|

Montgomery |

Terminal |

|

Leased |

| Florida |

|

Cape Canaveral |

Satellite |

|

Leased |

| Florida |

|

Ft. Lauderdale |

Terminal |

|

Leased |

| Florida |

|

Freeport |

Satellite |

|

Leased |

| Florida |

|

Jacksonville |

Terminal |

|

Owned |

| Florida |

|

Newberry |

Satellite |

|

Leased |

| Florida |

|

Orlando |

Terminal |

|

Leased |

| Florida |

|

Panama City |

Terminal |

|

Owned |

| Florida |

|

Pensacola |

Terminal |

|

Owned |

| Florida |

|

Tampa |

Terminal |

|

Leased |

| Florida |

|

White Springs |

Terminal |

|

Owned |

| Georgia |

|

Albany |

Terminal |

|

Owned |

| Georgia |

|

Athens |

Satellite |

|

Leased |

| Georgia |

|

Augusta |

Terminal |

|

Owned |

| Georgia |

|

Bainbridge |

Terminal |

|

Owned |

| Georgia |

|

Columbus |

Terminal |

|

Owned |

| Georgia |

|

Doraville |

Terminal |

|

Owned |

| Georgia |

|

Macon |

Terminal |

|

Owned |

| Georgia |

|

Rome |

Satellite |

|

Leased |

| Georgia |

|

Savannah |

Terminal |

|

Leased |

| Tennessee |

|

Chattanooga |

Terminal |

|

Leased |

| Tennessee |

|

Knoxville |

Terminal |

|

Owned |

Item 3. LEGAL PROCEEDINGS.

Information about our legal proceedings is included

in Note 11, “Contingent Liabilities” of the accompanying consolidated financial statements.

On December 4, 2023, a lawsuit was filed (Philip Stone

v. Patriot Transportation Holding, Inc., John E. Anderson, John D. Baker, Thompson S. Baker II, Luke E Fichthorn III, Charles D. Hyman

and Eric K. Mann) against the Company and its individual directors in the U.S. District Court for the Southern District of New York (Case

1:23-cv-10580). The complaint alleges violations of Sections 14(a) and 20(a) of the Securities Exchange Act of 1934, as amended, in connection

with alleged misleading statements or omissions of material fact in the Company’s definitive proxy statement filed with the Securities

and Exchange Commission on December 1, 2023 in connection with the pending merger with an affiliate of UPT. The complaint seeks an injunction

and unspecified damages. The Company has also received several demand letters, purportedly on behalf of shareholders, making similar allegations.

The Company believes that the claims are frivolous, meritless and that the Company and the individual director defendants have substantial

legal and factual defenses to the claims.

Item 4. MINE SAFETY DISCLOSURES.

None.

PART II

Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY,

RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

There were approximately 312 holders of record of

Patriot Transportation Holding, Inc. common stock, $.10 par value, as of September 30, 2023. The Company's common stock is traded on the

Nasdaq Stock Market (Symbol PATI).

Dividends. On December 4, 2019, the

Company’s Board of Directors declared a special cash dividend of $3.00 per share on the Company’s outstanding common stock.

This special dividend was paid on January 30, 2020, to shareholders of record at the close of business on January 15, 2020. The Board

of Directors also declared a quarterly dividend of $0.15 per share, paid on January 30, 2020, to shareholders of record on January 15,

2020. On December 4, 2020, the Company’s Board of Directors declared a special cash dividend of $3.00 per share on the Company’s

outstanding common stock. This special dividend was paid on December 30, 2020, to shareholders of record at the close of business on December

17, 2020. On October 25, 2021, the Company’s Board of Directors declared a special cash dividend of $3.75 per share on the Company’s

outstanding common stock. This special dividend was paid on November 15, 2021, to shareholders of record at the close of business on November

8, 2021. Information concerning restrictions on the payment of cash dividends set forth in our debt instruments is included in Note 3

to the consolidated financial statements included herein. In addition, the merger agreement prohibits us from paying dividends.

Securities Authorized for Issuance Under Equity

Compensation Plans. Information regarding securities authorized for issuance under equity compensation plans is included in Item 12

of Part III of this Annual Report on Form 10-K.

Purchases of Equity Securities by the Issuer and

Affiliated Purchasers. Share repurchase activity during the three months ended September 30, 2023 was as follows:

| |

|

|

|

|

|

Total |

|

|

| |

|

|

|

|

|

Number of |

|

|

| |

|

|

|

|

|

Shares |

|

|

| |

|

|

|

|

|

Purchased |

|

Approximate |

| |

|

|

|

|

|

As Part of |

|

Dollar Value of |

| |

|

Total |

|

|

|

Publicly |

|

Shares that May |

| |

|

Number of |

|

Average |

|

Announced |

|

Yet Be Purchased |

| |

|

Shares |

|

Price Paid |

|

Plans or |

|

Under the Plans |

| Period |

|

Purchased |

|

per Share |

|

Programs |

|

or Programs (1) |

| |

July 1 through July 31 |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

5,000,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

August 1 through August 31 |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

5,000,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

September 1 through September 30 |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

5,000,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

|

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

|

|

|

(1) On February 4, 2015, the

Board of Directors authorized management to expend up to $5,000,000 to repurchase shares of the Company’s common stock from time

to time as opportunities arise. To date, the Company has not repurchased any common stock of the Company.

Item 6. [RESERVED]

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATION.

Overview

The business of the Company, conducted

through our wholly owned subsidiary, Florida Rock & Tank Lines, Inc. (Tank Lines), which is a Southeastern U.S. based tank truck company,

is to transport petroleum and other liquids and dry bulk commodities.

CONSOLIDATED FINANCIAL HIGHLIGHTS

Years ended September 30

(Amounts in thousands except per share

amounts)

| |

|

|

2023 |

|

|

|

2022 |

|

|

|

%

Change |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

94,785 |

|

|

|

87,882 |

|

|

|

7.9 |

|

| Operating profit |

|

$ |

3,282 |

|

|

|

9,299 |

|

|

|

-64.7 |

|

| Income before income taxes |

|

$ |

3,588 |

|

|

|

9,343 |

|

|

|

-61.6 |

|

| Net income |

|

$ |

2,673 |

|

|

|

7,190 |

|

|

|

-62.8 |

|

|

Per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

.76 |

|

|

|

2.08 |

|

|

|

-63.5 |

|

| Diluted |

|

$ |

.74 |

|

|

|

1.98 |

|

|

|

-62.6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

52,667 |

|

|

|

47,566 |

|

|

|

10.7 |

|

| Total Debt |

|

$ |

— |

|

|

|

— |

|

|

|

— |

|

| Shareholders' Equity |

|

$ |

34,331 |

|

|

|

31,187 |

|

|

|

10.1 |

|

| Common Shares Outstanding |

|

|

3,526 |

|

|

|

3,484 |

|

|

|

1.2 |

|

| Book Value Per Common Share |

|

$ |

9.74 |

|

|

|

8.95 |

|

|

|

8.8 |

|

Our revenues are primarily based on a set rate per

volume of product hauled to arrive at a desired rate per mile traveled. The rate also incorporates the cost of fuel at an assumed price

plus fuel surcharges to address the fluctuation in fuel prices. Over time, the fuel surcharge tables in the industry have become so numerous

and varied, both by

carriers and customers, that they have simply become

a part of the overall rating structure to arrive at that desired price per mile by market. We consider fuel surcharge revenue to be revenue

from services rather than other revenues. As a result, the Company determined there is no reason to report fuel surcharges as a separate

revenue line item and fuel surcharges are reported as part of Operating revenues.

The Company’s operations are influenced by a

number of external and internal factors. External factors include levels of economic and industrial activity, driver availability and

cost, government regulations regarding driver qualifications and limitations on the hours drivers can work, petroleum product demand in

the Southeast which is driven in part by tourism and commercial aviation, and fuel costs. Internal factors include revenue mix, equipment

utilization, Company imposed restrictions on hiring drivers under the age of 21 or drivers without at least one year of driving experience,

auto and workers’ compensation accident frequencies and severity, administrative costs, and group health claims experience.

Our operating costs primarily consist of the following:

| · | Compensation and Benefits - Wages and employee benefits for our drivers

and terminal support personnel is the largest component of our operating costs. These costs are impacted by such factors as miles driven,

driver pay increases, driver turnover and training costs and additional driver pay due to temporary out-of-town deployments to cover business. |

| · | Fuel Expenses - Our fuel expenses will vary depending on miles driven

as well as such factors as fuel prices (which can be highly volatile), the fuel efficiency of our fleet and the average haul length. |

| · | Repairs and Tires – This category consists of vehicle maintenance

and repairs (excluding shop personnel) and tire expense (including amortization of tire cost and road repairs). These expenses will vary

based on such factors as miles driven, the age of our fleet, and tire prices. |

| · | Other Operating Expenses – This category consists of tolls,

hiring costs, out-of-town driver travel cost, terminal facility maintenance and other operating expenses. These expenses will vary based

on such factors as, driver availability and out-of-town driver travel requirements, business growth and inflation among others. |

| · | Insurance and Losses – This includes costs associated with

insurance premiums, and the self-insured portion of liability, workers’ compensation, health insurance and cargo claims and wreck

repairs. We work very hard to manage these expenses through our safety and wellness programs, but these expenses will vary depending on

the frequency and severity of accident and health claims, insurance markets and deductible levels. |

| · | Depreciation Expense – Depreciation expense consists of the

depreciation of the cost of fixed assets such as tractors and trailers over the life assigned to those assets. The amount of depreciation

expense is impacted by equipment prices and the timing of new equipment purchases. We expect the cost of new tractors and trailers to

continue to increase, impacting our future depreciation expense. |

| · | Rents, Tags and Utilities Expenses – This category consists

of rents payable on leased facilities and leased equipment, federal highway use taxes, vehicle registrations, license and permit fees

and personal property taxes assessed against our equipment, communications, utilities and real estate taxes. |

| · | Sales, General and Administrative Expenses – This category

consists of the wages, bonus accruals, benefits, travel, vehicle and office costs for our administrative personnel as well as professional

fees and amortization charges for intangible assets purchased in acquisitions of other businesses. |

| · | Corporate Expenses – Corporate expenses consist of wages, bonus

accruals, insurance and other benefits, travel, vehicle and office costs for corporate executives, director fees, stock option expense

and aircraft expense. |

| · | Gains/Loss on Disposition of Property, Plant & Equipment –

Our financial results for any period may be impacted by any gain or loss that we realize on the sale of used equipment, losses on wrecked

equipment, and disposition of other assets. We periodically sell used equipment as we replace older tractors and trailers. Gains or losses

on equipment sales can vary significantly from period to period depending on the timing of our equipment replacement cycle, market prices

for used equipment and losses on wrecked equipment. |

To measure our performance, management focuses primarily

on transportation revenue growth, revenue miles, our preventable accident frequency rate (“PAFR”), our operating ratio (defined

as our operating expenses as a percentage of our operating revenue), turnover rate (excluding drivers related to terminal closures) and

average driver count (defined as average number of revenue producing drivers including owner operators (O.O.) under employment over the

specified time period) as compared to the same period in the prior year.

| ITEM |

FY 2023 vs. FY 2022 |