UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-38851

POWERBRIDGE TECHNOLOGIES CO., LTD.

(Translation of Registrant’s name into English)

Advanced Business Park, 9th Fl, Bldg C2,

29 Lanwan Lane, Hightech District,

Zhuhai, Guangdong 519080, China

(Address of Principal Executive Office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 21, 2023

| |

POWERBRIDGE TECHNOLOGIES CO., LTD. |

| |

|

|

| |

By: |

/s/ Stewart Lor |

| |

|

Stewart Lor |

| |

|

Chief Executive Officer |

2

Exhibit 99.1

Powerbridge Technologies Co., Ltd. Requested

a Hearing before the Nasdaq Hearings Panel after Received a Letter of Expected Delisting Determination from Nasdaq Staff

ZHUHAI, China, December 21, 2023 /PRNewswire/

— Powerbridge Technologies Co., Ltd. (Nasdaq: PBTS) (the “Company” or “PBTS”), a provider of multi-industry

technology solutions, today announced that it has requested a hearing before the Nasdaq Hearings Panel as the next step in the process

in seeking an extension to satisfy the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid

Price Rule”) for continued listing on The Nasdaq Capital Market (“Nasdaq”).

Reference is made to the form 6-K of the Company

filed with the Securities and Exchange Commission (the “SEC”) on June 30, 2023 (the “Previous Disclosure”) in

relation to a panel monitor imposed on the Company, for a period of one year from June 27, 2023, of the Company’s ongoing compliance

(the “Panel Monitor”), after the Company has regained compliance with Nasdaq Listing Rule 5550(a)(2). All capitalized terms

not otherwise defined herein shall have the meanings ascribed to them in the Previous Disclosure.

On August 11, 2023, the Company received the notice

from the Listing Qualifications Staff (the “Staff”) of Nasdaq notifying that, as of August 11, 2023, the Company’s securities

had a closing bid price less than US$1.00 for 30 consecutive trading days, which is not in compliance with the minimum bid price requirement

as set forth under Nasdaq Listing Rule 5550(a)(2) for continued listing on the Nasdaq.

On October 6, 2023, the Company received a notification

letter from the Staff of Nasdaq stating that, as of October 6, 2023, the closing bid price of the Company’s ordinary shares has

been at US$1.00 per share or greater for 10 consecutive trading days. Accordingly, the Company has regained compliance with the minimum

bid price requirement under Nasdaq Listing Rule 5550(a)(2).

On November 30, 2023, the Company received the

notice from the Staff of Nasdaq notifying that, as of November 30, 2023, the Company’s securities had a closing

bid price less than US$1.00 for 30 consecutive trading days, which is not in compliance with the minimum bid price requirement as set

forth under Nasdaq Listing Rule 5550(a)(2) for continued listing on the Nasdaq.

On December 15, 2023, the Company received a notification

letter (the “Notification Letter”) from the Staff of Nasdaq stating that, according to the written notification the Company

received from the Nasdaq Hearings Panel dated June 27, 2023, the one-year Panel Monitor was imposed on the Company from June 27, 2023,

under Nasdaq Listing Rule 5815(d)(4)(A). According to the terms of the Panel Monitor, if, within that one-year monitoring period, the

Staff finds the Company again out of compliance with the requirement that was the subject of the exception, notwithstanding Nasdaq Listing

Rule 5810(c)(2), the Company will not be permitted to provide the Staff with a plan of compliance with respect to that deficiency and

Staff will not be permitted to grant additional time for the Company to regain compliance with respect to that deficiency, nor will the

company be afforded an applicable cure or compliance period pursuant to Nasdaq Listing Rule 5810(c)(3). Instead, the Staff will issue

a delist determination letter and the Company will have an opportunity to request a hearing with the Nasdaq Hearings Panel.

The Notification Letter stated that unless the

Company requested an appeal of the Staff’s determination to delist its common shares, trading of the Company’s securities

will be suspended at the opening of business on December 27, 2023, and a Form 25-NSE will be filed with the SEC, which will remove the

Company’s securities from listing and registration on the Nasdaq.

As a result, the Staff had determined to delist

the Company’s securities from Nasdaq unless the Company requests a hearing no later than 4:00 p.m. Eastern Time on December 22,

2023. The Company timely submitted the request for a hearing to appeal Nasdaq’s delisting determination on December 20, 2023, and

was notified that the hearing is scheduled to be held on March 14, 2024. This request will ordinarily stay any further action made by

the Staff and the Company’s securities are expected to continue to be eligible to trade on Nasdaq at least pending the ultimate

conclusion of the hearing process.

The Company plans to appeal on the basis that

it has regained compliance with Nasdaq Listing Rule 5550(a)(2) as the closing bid price of its ordinary shares has been at US$1.00 per share

or greater for 10 consecutive trading days, as of December 20, 2023.

The Company will continue to monitor the closing

bid price of its ordinary shares and evaluate various alternative courses of action to regain compliance with the continued listing requirement

under the Nasdaq Listing Rules. However, there can be no assurance that the Company will be able to satisfy the Nasdaq’s continued

listing requirements or maintain compliance with the other Nasdaq continued listing requirements.

About Powerbridge Technologies

Powerbridge Technologies Co., Ltd. (Nasdaq: PBTS)

is a global provider of technology solutions and services across multiple industries. The Company is engaged in four segments of business:

global trade digital platform and services, agritech and agribusiness solutions, integrated renewable energy and agribusiness solutions,

and crypto equipment trading and cryptomining operations.

Safe Harbor Statement

This press release contains forward-looking statements

as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives,

goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical

facts. When the Company uses words such as “may”, “will”, “intend,” “should,” “believe,”

“expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate

solely to historical matters, it is making forward-looking statements; specifically, the Company’s statements regarding listing on the

NASDAQ Capital Market and the IPO are forward-looking statements. Forward-looking statements are not guarantees of future performance

and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed

in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the following:

the Company’s goals and strategies; the Company’s future business development; product and service demand and acceptance;

changes in technology; economic conditions; reputation and brand; the impact of competition and pricing; government regulations; fluctuations

in general economic and business conditions in China and assumptions underlying or related to any of the foregoing and other risks contained

in reports filed by the Company with the SEC. For these reasons, among others, investors are cautioned not to place undue reliance upon

any forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, which

are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect

events or circumstances that arise after the date hereof.

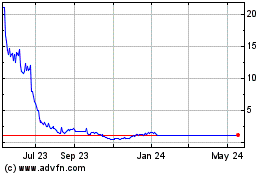

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Dec 2023 to Dec 2024