false000187407100018740712023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 08, 2023 |

Ponce Financial Group, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

001-41255 |

87-1893965 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2244 Westchester Avenue |

|

Bronx, New York |

|

10462 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (718) 931-9000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.01 per share |

|

PDLB |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Ponce Financial Group, Inc., (the “Company”), the holding company for Ponce Bank (the “Bank”), today announced that it will be presenting at a virtual bank conference hosted by Sycamore Analytics and Pendragon Capital Management on November 9, 2023 from 10:25 to 10:55 AM. To register for the event visit www.VirtualBankConference.com.

The Company’s press release is furnished as Exhibit 99.1 to this report and the Company's slide presentation is furnished as Exhibit 99.2 to this Current Report, and are both incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Ponce Financial Group, Inc. |

|

|

|

|

Date: |

November 8, 2023 |

By: |

/s/ Carlos P. Naudon |

|

|

|

Carlos P. Naudon

President and Chief Executive Officer |

Exhibit 99.1

Ponce Financial Group, Inc. Announces Participation in a Virtual Bank Conference

NEW YORK, November 8, 2023 - Ponce Financial Group, Inc., (the “Company”) (NASDAQ: PDLB), the holding company for Ponce Bank (the “Bank”), announced that it will be presenting at a virtual bank conference hosted by Sycamore Analytics and Pendragon Capital Management on November 9, 2023 from 10:25 to 10:55 AM. In addition, Sundie Seefried, CEO of SHF Holdings, Inc. and Mike Godby, Managing Director of Janney Montgomery Scott will be presenting. To register for the event visit www.VirtualBankConference.com.

About Ponce Financial Group, Inc.

Ponce Financial Group, Inc., is the holding company for Ponce Bank. Ponce Bank is a Minority Depository Institution, a Community Development Financial Institution, and a certified Small Business Administration lender. Ponce Bank’s business primarily consists of taking deposits from the general public and to a lesser extent alternative funding sources and investing those funds, together with funds generated from operations and borrowings, in mortgage loans, consisting of 1-4 family residences (investor-owned and owner-occupied), multifamily residences, nonresidential properties, construction and land, and, to a lesser extent, in business and consumer loans. Ponce Bank also invests in securities, which consist of U.S. Government and federal agency securities and securities issued by government-sponsored or government-owned enterprises, as well as, mortgage-backed securities, corporate bonds and obligations, and Federal Home Loan Bank stock.

Forward Looking Statements

Certain statements herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act and are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements may be identified by words such as “believes,” “will,” “would,” “expects,” “project,” “may,” “could,” “developments,” “strategic,” “launching,” “opportunities,” “anticipates,” “estimates,” “intends,” “plans,” “targets” and similar expressions. These statements are based upon the current beliefs and expectations of management and are subject to significant risks and uncertainties. Actual results may differ materially from those set forth in the forward-looking statements as a result of numerous factors. Factors that could cause such differences to exist include, but are not limited to, adverse conditions in the capital and debt markets and the impact of such conditions on business activities; changes in interest rates; competitive pressures from other financial institutions; the effects of general economic conditions on a national basis or in the local markets in which Ponce Bank operates, including changes that adversely affect borrowers’ ability to service and repay Ponce Bank’s loans; anticipated losses with respect to the Company's investment in Grain; changes in the value of securities in the investment portfolio; changes in loan default and charge-off rates; fluctuations in real estate values; the adequacy of loan loss reserves; decreases in deposit levels necessitating increased borrowing to fund loans and investments; operational risks including, but not limited to, cybersecurity, fraud and natural disasters; changes in government regulation; changes in accounting standards and practices; the risk that intangibles recorded in the financial statements will become impaired; demand for loans in Ponce Bank’s market area; Ponce Bank’s ability to attract and maintain deposits; risks related to the implementation of acquisitions, dispositions, and restructurings; the risk that Ponce Financial Group, Inc. may not be successful in the implementation of its business strategy; changes in assumptions used in making such forward-looking statements and the risk factors described in Ponce Financial Group, Inc.’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q as filed with the Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website, www.sec.gov. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. Ponce Financial Group, Inc. disclaims any obligation to publicly update or revise any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes, except as may be required by applicable law or regulation.

1

Carlos P. Naudon President & Chief Executive Officer Frank Perez EVP & Chief Investor Relations Officer Steven A. Tsavaris Executive Chairman of the Board Sergio Vaccaro EVP & Chief Financial Officer EXHIBIT 99.2 NASDAQ: PDLB

Cautionary Statements Forward Looking Statements Certain statements herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act and are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements may be identified by words such as “believes,” “will,” “would,” “expects,” “project,” “may,” “could,” “developments,” “strategic,” “launching,” “opportunities,” “anticipates,” “estimates,” “intends,” “plans,” “targets” and similar expressions. These statements are based upon the current beliefs and expectations of management and are subject to significant risks and uncertainties. Actual results may differ materially from those set forth in the forward-looking statements as a result of numerous factors. Factors that could cause such differences to exist include, but are not limited to, adverse conditions in the capital and debt markets and the impact of such conditions on business activities; changes in interest rates; competitive pressures from other financial institutions; the effects of general economic conditions on a national basis or in the local markets in which Ponce Bank operates, including changes that adversely affect borrowers’ ability to service and repay Ponce Bank’s loans; anticipated losses with respect to the Company’s investment in Grain and Ponce Bank’s attempts at mitigation; changes in the value of securities in the investment portfolio; changes in loan default and charge-off rates; fluctuations in real estate values; the adequacy of loan loss reserves; decreases in deposit levels necessitating increased borrowing to fund loans and investments; operational risks including, but not limited to, cybersecurity, fraud and natural disasters; changes in government regulation; changes in accounting standards and practices; the risk that intangibles recorded in the financial statements will become impaired; demand for loans in Ponce Bank’s market area; Ponce Bank’s ability to attract and maintain deposits; risks related to the implementation of acquisitions, dispositions, and restructurings; the risk that Ponce Financial Group, Inc. may not be successful in the implementation of its business strategy; changes in assumptions used in making such forward-looking statements and the risk factors described in Ponce Financial Group’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q as filed with the Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website, www.sec.gov. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. Ponce Financial Group, Inc. disclaims any obligation to publicly update or revise any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes, except as may be required by applicable law or regulation. Market and Industry Data The market and industry data used throughout this presentation is based, in part, on third-party sources, as indicated. Although management believes these third-party sources are reliable, they have not independently verified the information and cannot guarantee its accuracy and completeness.

Company Strengths Second step mutual conversion and ECIP Perpetual Preferred stock provides a meaningful amount of excess capital to deploy Strong core organic loan growth MDI and CDFI status provides access to lower-cost funding opportunities – will leverage to drive loan growth Corporate structure and focus on underserved and underbanked communities align with ESG Investment Guidelines 1

Ticker NASDAQ: PDLB Established 1960 Headquarters Bronx, NY Branches 13 full-service branches and 6 mortgage loan offices Total Assets $2.624 billion (as of 9/30/23) Total Loans $1.814 billion (as of 9/30/23) Total Deposits $1.401 billion (as of 9/30/23) TBV Per Common Share* $10.99 (as of 9/30/23) Market Cap $172.6 million (as of 11/02/2023) Total Stockholders Equity Per Common Share $20.5 Ponce Financial Group, Inc. (the “Company”), became the holding company of Ponce Bank (the “Bank”), a federally chartered stock savings association on January 27, 2022, after successfully completing the conversion and reorganization of Ponce Bank Mutual Holding Company from the mutual to stock form of organization. Aim to provide long-term value to stakeholders by executing a safe and sound business strategy that produces increasing value. Number of full-time equivalent employees as of September 30, 2023, was 243 equating to $10.7 million in assets per employee. The Company provides a full range of financial services to minority, immigrant, and low-income borrowers in a community-focused manner. Corporate Headquarters and Office Locations Branch Locations 2 *TBV Per Common Share is a Non-GAAP financial measure. Non-GAAP financial measures are not a substitute for GAAP financial measures. See the appendix of this presentation for a reconciliation to the most directly comparable GAAP financial measure. Branch Offices Loan Offices

Franchise Evolution Mutual Bank Path to Conversion Public Ownership Established 63-year-old institution focused on residential and nonresidential lending Headquartered in Bronx, NY with branch presence in Brooklyn, Queens, New Jersey, and Manhattan Grew assets from de novo to $700 million Carlos P. Naudon named President in 2015; CEO in 2018 Certified SBA lender Continued to remain focused on residential and commercial real estate Optimized real estate footprint by improving loan efficiency Certification as an MDI & CDFI Grew assets from $703 million to $2.3 billion Converted from Mutual Holding Company on January 27, 2022 Established a robust capital base to continue executing on strategic initiatives Continue focusing on residential and commercial lending with an emphasis on technological integration Received low-cost funding Preferred Stock in the amount of $225 million from the ECIP Sufficient capital to reach $5 billion in assets 1960 - 2015 2015 - 2022 2022 - Present 3

Growth Drivers Our Vision Low-Cost, Excess Capital - Ready to Deploy Robust capital position, inclusive of $225 million in ECIP funds provided by the U.S. Treasury Focused on growing loan book – Expanding CRE & Non-Residential Loans Stay with successful clients as they grow MDI and CDFI Status; Mission Driven Business Model Aligns with ESG The Bank is designated as both a Community Development Financial Institution (CDFI) and a Minority Deposit Institution (MDI) De-Mutualization Opportunity Completed the second-step in January 2022 Ability to return capital to shareholders – priorities Financial Strength/Geographic Focus The Company is well-positioned with a weighted average loan-to-value ratio of 58.3% as of September 30, 2023 Total CRE Loans comprise 263.1% of Tier 1 Capital plus allowance Accelerating Loan Growth Through Deployment of Excess Capital CRE and Residential Markets – Single Family & Multi-family markets Net Interest Income Growth Modernization Program Across Company Infrastructure Upgrading electronic infrastructure Expanding digital banking services Creating greater resiliency, capacity, and redundancies Restructure/refocus the retail business model Upgrade sales forces Growing alongside fastest growing, best clients 143% 123% Reaching Capital Deployment Capabilities 4

The CDFI Program offers both Financial Assistance and Technical Assistance awards to CDFIs. These competitive awards support and enhance the ability of the Company to meet the needs of the communities they serve. Community Development Financial Institution The Company is designated a CDFI As of June 30, 2023, there were approximately 1,000 CDFI’s operating nationwide, but fewer than 200 are banks, and the Bank ranks amongst the largest The CDFI designation qualifies the Company for grants and capital opportunities such as the Emergency Capital Investment Program (ECIP), which the Company benefitted from in the form of a $225 million investment from the U.S. Treasury for Senior Non-Cumulative Perpetual Preferred Stock; only CDFIs and MDIs were able to participate in this program – it comes at no cost (to capital) for the first two years and includes rate reduction incentives after that with a cap of 2.00% Ponce Bank has won awards and mandates for community development and ranks as one of the largest and most housing-focused CDFIs in the country. Rankings as of 2Q23 (177 Banks & Thrifts in Total)* Financial Assistance awards are made in the form of loans, grants, equity investments, and deposits, which CDFIs are required to match dollar-for-dollar with non-federal funds. This requirement enables the Company to multiply the impact of federal investment to meet the demand for affordable financial products in economically distressed communities. Technical Assistance grants are offered to CDFIs and Certifiable CDFIs to build their organizational capacity. Out of the 20 top CDFI Banks: in housing focus in DLI-HMDA (% of housing lending in LMI communities) in total assets in total loans in % of branches in LMI areas 7th 2nd 1st 5

As an MDI the Bank can provide financial services to and for underserved communities as designated by the federal government including African, Asian, Hispanic, and Native Americans. MDI allows the Bank to provide many benefits to low-to-moderate income communities, including access to credit, values-driven banking, international languages and locations, financial education, and community-specific services. Minority Depository Institution The Bank is designated an MDI, classified under the Federal Deposit Insurance Corporation (FDIC). The FDIC defines an MDI as, a federally insured depository institution for which (1) 51% or more of the voting stock is owned by minority individuals; or (2) majority of the board of directors is a minority and the community that the institution serves is predominantly minority. As of June 30, 2023, the FDIC recognized 147 MDIs across the United States and its territories, with collective assets of approximately $350 billion. One of 32 banks in the country with the MDI and CDFI designation. Rankings as of 2Q23 6 in total assets out of 147 MDIs in total assets New York Out of all the MDI Banks in Assets, the Bank ranks: 20th 3rd

Environmental, Social, & Governance Ponce Bank’s Inaugural Environmental, Social & Governance Fact Sheet is now available on www.poncebank.com 100% of Board of Directors and Executive Management �is either native of or second generation of immigrants Together with the �Foundation we have donated over $1 million to charitable organizations since 2017 Over 300 hours of �volunteer time donated to �non-profits in 2022 Originated over $260 million �in PPP Loans to support 5,340 small businesses during COVID-19 Over 80% of staff is minority As of 2020 we have been operating in a Paperless Work Environment Over 70% of our lending activities occurred in low-and-moderate income communities Did not furlough or layoff �any employees during the COVID-19 pandemic and took steps to protect our employees and customers Over 60% of our retail �branches are located in low-and-moderate income communities Partnered with Fintech companies to provide microlending opportunities �to both personal and �business customers Provided over 500 �customers with pandemic related loan deferrals Created a Financial Mastery Program through FDIC Money Smart Program to enhance individual’s financial skills and economic backgrounds 7

American Cancer Society / Morris Heights Health Center / Urban Youth Alliance Int / Castle Hill Little League / Iglesia Nuevo Amanecer La Hermosa / Phipps Neighborhood / InHisName United / YMCA of Greater NY / Washington Heights BID / Unique People Services / Hostos Community College Foundation / New Bronx Chamber of Commerce / Bronx Manhattan North Board of Realtors / Bronx Kings / Business Initiative Corporation / Neighborhood Shop COVID Relief Program / BOEDC/ Bronx Tourism Council / Bronx County Bar Association / NYS CDFI Coalition / Business Initiative Corporation / Bronx Overall Economic Development Corp / Unique People Services / Hope Gathering / Buy Local East Harlem & Greet / LSA Covid Relief / Citivas / Union Settlement / La Fortaleza / Hope Community / AHRC / Society of the Educational Arts / NYCHCC Women In Business / Riverdale Senior Services / Urban Design Forum / Upper Manhattan Mental Health Center / Comite Noviembre / RAICES Spanish Speaking Elderly Council / One Brooklyn Fund / MyTime Inc / Brooklyn Hospital Foundation / Gay Men's Health Crisis Inc / CommonPoint Queens / Immaculate Conception Catholic Academy / Hellenic Orthodox Community of Astoria /Greater Jamaica Development Corp / Queens Economic Development Corporation / Immaculate Conception Catholic Academy / Pancyprian Association Inc / NJ Law Enforcement / Union City Music Project / Queens Women's Chamber of Commerce / NJ Small Business Development Center at NJCU / Forest Hills Chambers of Commerce / Greater NY Chamber of Commerce / NYSCDFI Coalition / Brooklyn Kings County / Sharing and Caring Inc / Chamber Of Commerce of Washington Heights and Inwood in Manhattan / Save Latin America / Hispanic Chamber of Commerce / BNI Down to Business / & MANY MORE Community Sponsorships and Donations Includes Sponsorships and Donations by the Company and the Ponce De Leon Foundation 8

Technology Transformation The Company is now in the latter stages of its multi-faceted effort to �upgrade infrastructure, adopt digital banking services and �restructure the retail business model Salesforce deployment across retail services, lending processes, �back-office operations, digital banking, and loan underwriting Core processor upgrades have updated technology, cybersecurity �and network infrastructure enabling the Company to better operate remotely �through added resiliency, capacity, and redundancies Fintech partnerships including Bamboo, LendingFront and SaveBetter 9

Q3 2023 Q3 2022 Net interest income $16.5M $17.6M Net (loss) income $2.6M ($14.7)M Net interest margin 2.58% 3.59%M Net interest rate spread 1.58% 3.08% Efficiency ratio 78.11% 132.46% Net income of $2.6 million or $0.12 per diluted share, for the three months ended September 30, 2023, as compared to a net loss of ($14.7) million, or ($0.64) per diluted share for the three months ended September 30, 2022. Net loans receivable were $1.79 billion as of September 30, 2023, an increase of $294.5 million, or 19.72%, from December 31, 2022. Deposits were $1.40 billion as of September 30, 2023, an increase of $148.7 million, or 11.87%, from December 31, 2022. Cash and equivalents were $117.0 million as of September 30, 2023, an increase of $62.6 million, or 115.07%, from December 31, 2022, as we decided to keep ample sources of liquidity at hand while taking advantage of the positive spread between our interest bearing overnight deposits at the Fed and borrowing costs under the Bank Term Funding Program ("BTFP"). Received a $3.7 million grant in the 3rd Quarter from the U.S. Treasury as part of the Community Development Financial Institutions Equitable Recovery Program. Awarded a $0.5 million grant from the Community Development Financial Institution fund. Q3 2023 Highlights 10

On P/TBV basis Ponce trades in line (under 100%) with its peer group. This provides the Company the opportunity to repurchase its stock at a discount and increase shareholder value. On August 16, 2023, PDLB announced that it had completed repurchasing 1,235,000 shares of PDLB’s common stock at a cost of $8.91 per share, or 5% of PDLB’s issued and outstanding shares at the time the plan was implemented. Price-to-Tangible Book Value (as of 11/07/2023) 11

(as November 8, 2023) Over the past twelve months, the share price change of PDLB (20.63%) is in line with the S&P United States BMI Banks Index 19.56%) and the S&P 500 Bank Index (18.09%) and is considerably less than the NASDAQ Bank Index (28.50%) while the Russell 3000, which the Company is a part of, had a price improvement of 6.03%. All this amidst concerns related to the current macroeconomic environment, which has created numerous challenges for banks and related financial institutions, large regional bank failures in the spring of 2023 including rising interest rates and inflation. Price Performance Source: S&P Capital IQ 12

FORTRESS Capital Ratios 13

Strategies and Focus Enhance our multifamily and nonresidential loans. Leverage MDI/CDFI status. Build existing community lending programs. Improve core deposits, with an emphasis on low-cost commercial �demand deposits and add non-core funding sources. Manage credit risk to maintain a low level of nonperforming assets. Expand our employee base to support future growth. Develop a digital presence to deliver impactful services to our customers. 14

Appendix

Balance Sheet Source: Peer Group S&P Capital IQ Peer Average: BFLY, ESSA, GCBC, HONE, NECB, PBHC, PBFS, RKBK, WNEB Appx. 1 (1) (1) Ponce Financial Group Inc. & its predecessor

Net loans receivable were $1.8 billion as of September 30, 2023, an increase of $395.0 million, or 28.4%, from September 30, 2022. Non-performing assets decreased $4.0 million, or 15.7% to $21.4 million as of September 30, 2023, from $25.4 million as of September 30, 2022. Non-performing loans decreased $5.0 million, or 23.7%, to $16.2 million as of September 30, 2023, from $21.2 million as of September 30, 2022. Peer Average: BFLY, ESSA, GCBC, HONE, NECB, PBHC, PBFS, RKBK, WNEB Asset Quality Source: Peer Group S&P Capital IQ Appx. 2 (1) (1) Ponce Financial Group Inc. & its predecessor

Total Loans Appx. 3

Total Securities Appx. 4

Total Deposits Appx. 5

Grain Technologies, Inc. Appx. 6

Average Assets Appx. 8

Regulatory Capital Ratios Appx. 9

Share/Book Value Data Appx. 10

Non-GAAP Reconciliation to GAAP Financial Measures Appx. 10 Tangible book value per common share (Non-GAAP): Common shares outstanding 23,653,600 Shareholders' equity 485,058,000 Less: Preferred Stock 225,000,000 Tangible common shareholders' equity (Non-GAAP) 260,058,000 Tangible book value per common share (Non-GAAP) 10.99

Steven A. Tsavaris Executive Chairman of the Board Frank Perez Chief Investor Relations Officer Carlos P. Naudon President & CEO Sergio Vaccaro CFO Luis Gonzalez Jr. COO PDLB Executive Management Appx. 11

Visit our website : poncebank.com Email requests to : frank.perez@poncebank.net Call investor relations at : (718) 931-9000 Write to : Investor Relations Ponce Financial Group 2244 Westchester Avenue�Bronx, New York 10462 Investor Information Appx. 12

Thank you.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

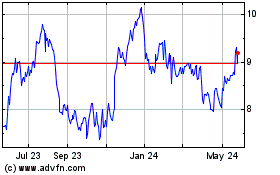

Ponce Financial (NASDAQ:PDLB)

Historical Stock Chart

From Apr 2024 to May 2024

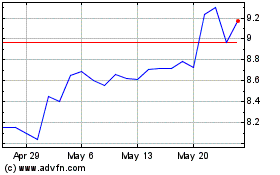

Ponce Financial (NASDAQ:PDLB)

Historical Stock Chart

From May 2023 to May 2024