false

0001861522

0001861522

2024-08-19

2024-08-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 19, 2024

Kidpik

Corp.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41032 |

|

81-3640708 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

200

Park Avenue South, 3rd Floor

New

York, New York |

|

10003 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (212) 399-2323

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☒ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☒ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

PIK |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02 Results of Operations and Financial Condition.

On

August 19, 2024, Kidpik Corp. (“Kidpik” or the “Company”) issued a press release regarding its

financial results for the quarter ended June 29, 2024. A copy of the press release, which includes a summary of such financial results

is furnished as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The

information contained in this Current Report and Exhibit 99.1 hereto shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the

liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended

or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item

9.01 Financial Statements and Exhibits.

*

Furnished herewith.

Non-Active

Hyperlinks

The

inclusion of any website address in this Form 8-K, and any exhibit thereto, is intended to be an inactive textual reference only and

not an active hyperlink. The information contained in, or that can be accessed through, such website is not part of or incorporated into

this Form 8-K.

Cautionary

Statement Regarding Forward-Looking Statements

Certain

statements contained in this Current Report on Form 8-K and the press release attached, regarding matters that are not historical facts,

are forward-looking statements within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995 (the “PSLRA”). These include, but are not limited to, statements regarding

the anticipated completion, timing and effects of the proposed merger (the “Merger”) contemplated by that certain

Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) entered into between the Company, Nina Footwear

Corp., a Delaware corporation (“Nina Footwear”), and Kidpik Merger Sub, Inc., a Delaware corporation and wholly-owned

subsidiary of Kidpik (“Merger Sub”), projections and estimates of Kidpik’s corporate strategies, future operations

and plans, including the costs thereof; and other statements regarding management’s intentions, plans, beliefs, expectations or

forecasts for the future. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected.

Kidpik and Nina Footwear undertake no obligation to publicly update any forward-looking statement, whether as a result of new information,

future events or otherwise, except to the extent required by law. We use words such as “anticipates,” “believes,”

“plans,” “expects,” “projects,” “future,” “intends,”

“may,” “will,” “should,” “could,” “estimates,”

“predicts,” “potential,” “continue,” “guidance,” and similar

expressions to identify these forward-looking statements that are intended to be covered by the safe-harbor provisions of the PSLRA.

Such forward-looking statements are based on our expectations and involve risks and uncertainties; consequently, actual results may differ

materially from those expressed or implied in the statements due to a number of factors, including, but not limited to, the outcome of

any legal proceedings that may be instituted against Nina Footwear or Kidpik following the announcement of the Merger; the inability

to complete the Merger, including due to the failure to obtain approval of the stockholders of Kidpik or Nina Footwear; delays in obtaining,

adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regular reviews required to complete

the Merger, if any; the inability to recognize the anticipated benefits of the Merger, which may be affected by, among other things,

competition, the ability of the combined company to grow and successfully execute on its business plan; costs related to the Merger;

changes in the applicable laws or regulations; the possibility that the combined company may be adversely affected by other economic,

business, and/or competitive factors; timing to complete the Merger; the combined company’s ability to manage future growth; the

combined company’s ability to raise funding; the complexity of numerous regulatory and legal requirements that the combined company

needs to comply with to operate its business; the reliance on the combined company’s management; the prior experience and successes

of the combined company’s management team are not indicative of any future success; Kidpik’s and the combined company’s

ability to meet Nasdaq’s continued listing requirements; Kidpik and the combined company’s ability to maintain the listing

of their common stock on Nasdaq, including as a result of the Company’s non-compliance with Nasdaq’s continued listing rules;

the ability to obtain additional funding, the terms of such funding and potential dilution caused thereby; dilution caused by the conversion

of convertible debentures; the continuing effect of changing interest rates and inflation on Kidpik’s and the combined company’s

operations, sales, and market for their products; deterioration of the global economic environment; rising interest rates and inflation

and Kidpik’s and the combined company’s ability to control costs, including employee wages and benefits and other operating

expenses; Kidpik’s decision to cease manufacturing new products; Kidpik’s history of losses; Kidpik’s and the combined

company’s ability to maintain current members and customers and grow members and customers; risks associated with the effect of

global pandemics, and governmental responses thereto on Kidpik’s and the combined company’s operations, those of Kidpik’s

and the combined company’s vendors, Kidpik’s and the combined company’s customers and members and the economy in general;

risks associated with Kidpik’s and the combined company’s supply chain and third-party service providers, interruptions in

the supply of raw materials and merchandise; increased costs of raw materials, products and shipping costs due to inflation; disruptions

at Kidpik’s and the combined company’s warehouse facility and/or of their data or information services, Kidpik’s and

the combined company’s ability to locate warehouse and distribution facilities and the lease terms of any such facilities; issues

affecting our shipping providers; disruptions to the internet; risks that effect our ability to successfully market Kidpik’s and

the combined company’s products to key demographics; the effect of data security breaches, malicious code and/or hackers; increased

competition and our ability to maintain and strengthen Kidpik’s and the combined company’s brand name; changes in consumer

tastes and preferences and changing fashion trends; material changes and/or terminations of Kidpik’s and the combined company’s

relationships with key vendors; significant product returns from customers, excess inventory and Kidpik’s and the combined company’s

ability to manage our inventory; the effect of trade restrictions and tariffs, increased costs associated therewith and/or decreased

availability of products; Kidpik’s and the combined company’s ability to innovate, expand their offerings and compete against

competitors which may have greater resources; the fact that Kidpik’s Chief Executive Officer has majority voting control over Kidpik

and will have majority control over the combined company; if the use of “cookie” tracking technologies is further restricted,

regulated, or blocked, or if changes in technology cause cookies to become less reliable or acceptable as a means of tracking consumer

behavior; Kidpik’s and the combined company’s ability to comply with the covenants of future loan and lending agreements

and covenants; Kidpik’s and the combined company’s ability to prevent credit card and payment fraud; the risk of unauthorized

access to confidential information; Kidpik’s and the combined company’s ability to protect intellectual property and trade

secrets, claims from third-parties that Kidpik and/or the combined company have violated their intellectual property or trade secrets

and potential lawsuits in connection therewith; Kidpik’s and the combined company’s ability to comply with changing regulations

and laws, penalties associated with any non-compliance (inadvertent or otherwise), the effect of new laws or regulations, and Kidpik’s

and the combined company’s ability to comply with such new laws or regulations; changes in tax rates; Kidpik’s and the combined

company’s reliance and retention of management; the outcome of future lawsuits, litigation, regulatory matters or claims; the fact

that Kidpik and the combined company have a limited operating history; the effect of future acquisitions on Kidpik’s and the combined

company’s operations and expenses; and others that are included from time to time in filings made by Kidpik with the Securities

and Exchange Commission, many of which are beyond the control of Kidpik and the combined company, including, but not limited to, in the

“Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” sections in Kidpik’s Form 10-Ks

and Form 10-Qs and in its Form 8-Ks, which it has filed, and files from time to time, with the Securities and Exchange Commission, including,

but not limited to its Annual Report on Form 10-K for the year ended December 30, 2023 and its Quarterly Report on Form 10-Q for the

quarter ended June 29, 2024. These reports are available at www.sec.gov and on Kidpik’s website at https://investor.kidpik.com/sec-filings.

Kidpik cautions that the foregoing list of important factors is not complete. All subsequent written and oral forward-looking statements

attributable to Kidpik or any person acting on behalf of Kidpik are expressly qualified in their entirety by the cautionary statements

referenced above. Other unknown or unpredictable factors also could have material adverse effects on Kidpik’s and the combined

company’s future results and/or could cause their actual results and financial condition to differ materially from those indicated

in the forward-looking statements. The forward-looking statements included in this Current Report on Form 8-K and the attached press

release are made only as of the date hereof. Kidpik cannot guarantee future results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these forward-looking statements. Except as required by law, neither Nina Footwear

nor Kidpik undertakes any obligation to update publicly any forward-looking statements for any reason after the date of this Current

Report on Form 8-K and the attached press release to conform these statements to actual results or to changes in their expectations.

If they update one or more forward-looking statements, no inference should be drawn that they will make additional updates with respect

to those or other forward-looking statements.

Additional

Information and Where to Find It

In

connection with the proposed Merger, Kidpik intends to file a proxy statement with the Securities and Exchange Commission (the “Proxy

Statement”), that will be distributed to holders of Kidpik’s common stock in connection with its solicitation of proxies

for the vote by Kidpik’s stockholders with respect to the proposed Merger and other matters as may be described in the Proxy Statement.

The Proxy Statement, when it is filed and mailed to stockholders, will contain important information about the proposed Merger and the

other matters to be voted upon at a meeting of Kidpik’s stockholders to be held to approve the proposed Merger and other matters

(the “Merger Meeting”). Kidpik may also file other documents with the SEC regarding the proposed Merger. Kidpik stockholders

and other interested persons are advised to read, when available, the Proxy Statement, as well as any amendments or supplements thereto,

because they will contain important information about the proposed Merger. When available, the definitive Proxy Statement will be mailed

to Kidpik stockholders as of a record date to be established for voting on the proposed Merger and the other matters to be voted upon

at the Merger Meeting.

Kidpik’s

stockholders may obtain copies of the aforementioned documents and other documents filed by Kidpik with the SEC, without charge, once

available, at the SEC’s web site at www.sec.gov, on Kidpik’s website at https://investor.kidpik.com/sec-filings or, alternatively,

by directing a request by mail, email or telephone to Kidpik at 200 Park Avenue South, 3rd Floor, New York, New York 10003; ir@kidpik.com;

or (212) 399-2323, respectively.

Participants

in the Solicitation

Kidpik,

Nina Footwear, and their respective directors, executive officers and other members of management and employees may be deemed to be participants

in the solicitation of proxies from Kidpik’s stockholders with respect to the proposed Merger. Information regarding the persons

who may be deemed participants in the solicitation of proxies from Kidpik’s stockholders in connection with the proposed Merger

will be contained in the Proxy Statement relating to the proposed Merger, when available, which will be filed with the SEC. Additionally,

information about Kidpik’s directors and executive officers and their ownership of Kidpik is available in Kidpik’s Annual

Report on Form 10-K/A (Amendment No. 1), as filed with the Securities and Exchange Commission on April 29, 2024 (the “Amended

Form 10-K”) . To the extent holdings of securities by potential participants (or the identity of such participants) have changed

since the information contained in the Amended Form 10-K, such information has been or will be reflected on Kidpik’s Statements

of Change in Ownership on Forms 3 and 4 filed with the SEC. You may obtain free copies of these documents using the sources indicated

above.

Other

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC regarding the Merger

Agreement when they become available. Investors should read the Proxy Statement carefully when it becomes available before making any

voting or investment decisions. You may obtain free copies of these documents from Kidpik using the sources indicated above.

Non-Solicitation

This

communication is for informational purposes only and is not intended to and shall not constitute a proxy statement or the solicitation

of a proxy, consent or authorization with respect to any securities or in respect of the Merger Agreement and is not intended to and

shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy or subscribe for

any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

August 19, 2024

| |

Kidpik

Corp. |

| |

|

|

| |

By: |

/s/

Ezra Dabah |

| |

Name: |

Ezra

Dabah |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

KIDPIK

Reports Second Quarter 2024 Financial Results

NEW

YORK – August 19, 2024—Kidpik Corp. (“KIDPIK” or the “Company”), an online clothing subscription-based

e-commerce company, today reported its financial results for the second quarter 2024 ended June 29, 2024.

Second

Quarter 2024 Highlights:

| ● | Revenue,

net: was $1.1 million, a year-over-year decrease of 67.3%. |

| ● | Gross

margin: was 66.2%, compared to 60.2% in the second quarter of 2023. |

| ● | Shipped

items: were 135,000 items, compared to 290,000 shipped items in the second quarter of

2023. |

| ● | Average

shipment keep rate: decreased to 74.6%, compared to 75.1% in the second quarter of 2023. |

| ● | Net

Loss: was $1.3 million or $0.67 per share, compared to $2.0 million or $1.31 per share

in the second quarter of 2023. |

“As

previously disclosed, on March 29, 2024, we entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”)

with Nina Footwear Corp., a Delaware corporation (“Nina Footwear”), and Kidpik Merger Sub, Inc., a Delaware corporation and

wholly-owned subsidiary of Kidpik (“Merger Sub”), whereby Nina Footwear will merge with and into Merger Sub, with Nina Footwear

continuing as the surviving entity trading, trading on Nasdaq under the new symbol – ‘NINA’, upon closing (the “Merger”).

While we work towards closing the Merger, we have eliminated marketing expenditures for subscription services and ceased the purchase

of new inventory as we are working to clear and maximize the return on our current inventory in anticipation of the combination with

Nina Footwear,” stated Mr. Ezra Dabah, the Company’s Chief Executive Officer.

“We

and Nina Footwear remain committed to closing the Merger, a transaction which we believe will increase Kidpik’s revenue, cashflow

and prospects, while also strengthening Kidpik’s balance sheet and significantly increasing stockholder value, said Mr. Dabah.”

The

closing of the Merger is subject to customary closing conditions, including the preparation and mailing of a proxy statement by Kidpik,

and the receipt of required stockholder approvals from Kidpik and Nina Footwear stockholders, and is expected to close in the fourth

quarter of 2024.

Kidpik

will not be holding an earnings call to discuss second quarter 2024 results, as the Company continues to move forward with the Merger.

About

Kidpik Corp.

Founded

in 2016, KIDPIK (Nasdaq:PIK) is an online clothing subscription box for kids, offering mix & match, expertly styled outfits that

are curated based on each member’s style preferences. KIDPIK delivers a surprise box monthly or seasonally, providing an effortless

shopping experience for parents and a fun discovery for kids. Each seasonal collection is designed in-house by a team with decades of

experience designing childrenswear. KIDPIK combines the expertise of fashion stylists with proprietary data and technology to translate

kids’ unique style preferences into surprise boxes of curated outfits. We also sell our branded clothing and footwear through our

e-commerce website, shop.kidpik.com. For more information, visit www.kidpik.com.

Cautionary

Statement Regarding Forward-Looking Statements

Certain

statements contained in this press release regarding matters that are not historical facts, are forward-looking statements within the

meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995

(the “PSLRA”). These include, but are not limited to, statements regarding the anticipated completion, timing and effects

of the proposed Merger, projections and estimates of Kidpik’s corporate strategies, future operations and plans, including the

costs thereof; and other statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future.

No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. Kidpik and Nina Footwear

undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise,

except to the extent required by law. We use words such as “anticipates,” “believes,” “plans,” “expects,”

“projects,” “future,” “intends,” “may,” “will,” “should,” “could,”

“estimates,” “predicts,” “potential,” “continue,” “guidance,” and similar

expressions to identify these forward-looking statements that are intended to be covered by the safe-harbor provisions of the PSLRA.

Such forward-looking statements are based on our expectations and involve risks and uncertainties; consequently, actual results may differ

materially from those expressed or implied in the statements due to a number of factors, including, but not limited to, the outcome of

any legal proceedings that may be instituted against Nina Footwear or Kidpik following the announcement of the Merger; the inability

to complete the Merger, including due to the failure to obtain approval of the stockholders of Kidpik or Nina Footwear; delays in obtaining,

adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regular reviews required to complete

the Merger, if any; the inability to recognize the anticipated benefits of the Merger, which may be affected by, among other things,

competition, the ability of the combined company to grow and successfully execute on its business plan; costs related to the Merger;

the timing to complete the Merger; changes in the applicable laws or regulations; the possibility that the combined company may be adversely

affected by other economic, business, and/or competitive factors; the combined company’s ability to manage future growth; the combined

company’s ability to raise funding; the complexity of numerous regulatory and legal requirements that the combined company needs

to comply with to operate its business; the reliance on the combined company’s management; the prior experience and successes of

the combined company’s management team are not indicative of any future success; Kidpik’s and the combined company’s

ability to meet Nasdaq’s continued listing requirements, including the fact that Kidpik is not currently in compliance with Nasdaq’s

continued listing standards; Kidpik and the combined company’s ability to maintain the listing of their common stock on Nasdaq;

the ability to obtain additional funding, the terms of such funding and potential dilution caused thereby; the continuing effect of rising

interest rates and inflation on Kidpik’s and the combined company’s operations, sales, and market for their products; deterioration

of the global economic environment; rising interest rates and inflation and Kidpik’s and the combined company’s ability to

control costs, including employee wages and benefits and other operating expenses; Kidpik’s decision to cease purchasing new products;

Kidpik’s history of losses; Kidpik’s and the combined company’s ability to maintain current members and customers and

grow members and customers; risks associated with the effect of global pandemics, and governmental responses thereto on Kidpik’s

and the combined company’s operations, those of Kidpik’s and the combined company’s vendors, Kidpik’s and the

combined company’s customers and members and the economy in general; risks associated with Kidpik’s and the combined company’s

supply chain and third-party service providers, interruptions in the supply of raw materials and merchandise; increased costs of raw

materials, products and shipping costs due to inflation; disruptions at Kidpik’s and the combined company’s warehouse facility

and/or of their data or information services, Kidpik’s and the combined company’s ability to locate warehouse and distribution

facilities and the lease terms of any such facilities; issues affecting our shipping providers; disruptions to the internet; risks that

effect our ability to successfully market Kidpik’s and the combined company’s products to key demographics; the effect of

data security breaches, malicious code and/or hackers; increased competition and our ability to maintain and strengthen Kidpik’s

and the combined company’s brand name; changes in consumer tastes and preferences and changing fashion trends; material changes

and/or terminations of Kidpik’s and the combined company’s relationships with key vendors; significant product returns from

customers, excess inventory and Kidpik’s and the combined company’s ability to manage our inventory; the effect of trade

restrictions and tariffs, increased costs associated therewith and/or decreased availability of products; Kidpik’s and the combined

company’s ability to innovate, expand their offerings and compete against competitors which may have greater resources; the fact

that Kidpik’s Chief Executive Officer has majority voting control over Kidpik and will have majority control over the combined

company; if the use of “cookie” tracking technologies is further restricted, regulated, or blocked, or if changes in technology

cause cookies to become less reliable or acceptable as a means of tracking consumer behavior; Kidpik’s and the combined company’s

ability to comply with the covenants of future loan and lending agreements and covenants; Kidpik’s and the combined company’s

ability to prevent credit card and payment fraud; the risk of unauthorized access to confidential information; Kidpik’s and the

combined company’s ability to protect intellectual property and trade secrets, claims from third-parties that Kidpik and/or the

combined company have violated their intellectual property or trade secrets and potential lawsuits in connection therewith; Kidpik’s

and the combined company’s ability to comply with changing regulations and laws, penalties associated with any non-compliance (inadvertent

or otherwise), the effect of new laws or regulations, and Kidpik’s and the combined company’s ability to comply with such

new laws or regulations; changes in tax rates; Kidpik’s and the combined company’s reliance and retention of management;

the outcome of future lawsuits, litigation, regulatory matters or claims; the fact that Kidpik and the combined company have a limited

operating history; dilution caused by the conversion of convertible debtentures; the effect of future acquisitions on Kidpik’s

and the combined company’s operations and expenses; and others that are included from time to time in filings made by Kidpik with

the Securities and Exchange Commission, many of which are beyond the control of Kidpik and the combined company, including, but not limited

to, in the “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” sections in Kidpik’s

Form 10-Ks and Form 10-Qs and in its Form 8-Ks, which it has filed, and files from time to time, with the Securities and Exchange Commission,

including, but not limited to its Annual Report on Form 10-K for the year ended December 30, 2023 and its Quarterly Report on Form 10-Q

for the quarter ended June 29, 2024. These reports are available at www.sec.gov and on Kidpik’s website at https://investor.kidpik.com/sec-filings.

Kidpik cautions that the foregoing list of important factors is not complete. All subsequent written and oral forward-looking statements

attributable to Kidpik or any person acting on behalf of Kidpik are expressly qualified in their entirety by the cautionary statements

referenced above. Other unknown or unpredictable factors also could have material adverse effects on Kidpik’s and the combined

company’s future results and/or could cause their actual results and financial condition to differ materially from those indicated

in the forward-looking statements. The forward-looking statements included in this press release are made only as of the date hereof.

Kidpik cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance

on these forward-looking statements. Except as required by law, neither Nina Footwear nor Kidpik undertakes any obligation to update

publicly any forward-looking statements for any reason after the date of this press release to conform these statements to actual results

or to changes in their expectations. If they update one or more forward-looking statements, no inference should be drawn that they will

make additional updates with respect to those or other forward-looking statements.

Additional

Information and Where to Find It

In

connection with the proposed Merger, Kidpik intends to file a proxy statement with the Securities and Exchange Commission (the “Proxy

Statement”), that will be distributed to holders of Kidpik’s common stock in connection with its solicitation of proxies

for the vote by Kidpik’s stockholders with respect to the proposed Merger and other matters as may be described in the Proxy Statement.

The Proxy Statement, when it is filed and mailed to stockholders, will contain important information about the proposed Merger and the

other matters to be voted upon at a meeting of Kidpik’s stockholders to be held to approve the proposed Merger and other matters

(the “Merger Meeting”). Kidpik may also file other documents with the SEC regarding the proposed Merger. Kidpik stockholders

and other interested persons are advised to read, when available, the Proxy Statement, as well as any amendments or supplements thereto,

because they will contain important information about the proposed Merger. When available, the definitive Proxy Statement will be mailed

to Kidpik stockholders as of a record date to be established for voting on the proposed Merger and the other matters to be voted upon

at the Merger Meeting.

Kidpik’s

stockholders may obtain copies of the aforementioned documents and other documents filed by Kidpik with the SEC, without charge, once

available, at the SEC’s web site at www.sec.gov, on Kidpik’s website at https://investor.kidpik.com/sec-filings or, alternatively,

by directing a request by mail, email or telephone to Kidpik at 200 Park Avenue South, 3rd Floor, New York, New York 10003; ir@kidpik.com;

or (212) 399-2323, respectively.

Participants

in the Solicitation

Kidpik,

Nina Footwear, and their respective directors, executive officers and other members of management and employees may be deemed to be participants

in the solicitation of proxies from Kidpik’s stockholders with respect to the proposed Merger. Information regarding the persons

who may be deemed participants in the solicitation of proxies from Kidpik’s stockholders in connection with the proposed Merger

will be contained in the Proxy Statement relating to the proposed Merger, when available, which will be filed with the SEC. Additionally,

information about Kidpik’s directors and executive officers and their ownership of Kidpik is available in Kidpik’s Annual

Report on Form 10-K/A (Amendment No. 1), as filed with the Securities and Exchange Commission on April 29, 2024 (the “Amended Form

10-K”). To the extent holdings of securities by potential participants (or the identity of such participants) have changed since

the information contained in the Amended Form 10-K, such information has been or will be reflected on Kidpik’s Statements of Change

in Ownership on Forms 3 and 4 filed with the SEC. You may obtain free copies of these documents using the sources indicated above.

Other

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC regarding the Merger

Agreement when they become available. Investors should read the Proxy Statement carefully when it becomes available before making any

voting or investment decisions. You may obtain free copies of these documents from Kidpik using the sources indicated above.

Non-Solicitation

This

communication is for informational purposes only and is not intended to and shall not constitute a proxy statement or the solicitation

of a proxy, consent or authorization with respect to any securities or in respect of the Merger Agreement and is not intended to and

shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy or subscribe for

any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction.

Kidpik

Corp.

Condensed

Interim Statements of Operations

(Unaudited)

| | |

For the 13 weeks ended | | |

For the 26 weeks ended | |

| | |

June 29, 2024 | | |

July 1, 2023 | | |

June 29, 2024 | | |

July 1, 2023 | |

| Revenues, net | |

$ | 1,128,323 | | |

$ | 3,448,919 | | |

$ | 3,367,628 | | |

$ | 7,478,397 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 381,577 | | |

| 1,372,563 | | |

| 1,055,118 | | |

| 2,991,789 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 746,746 | | |

| 2,076,356 | | |

| 2,312,510 | | |

| 4,486,608 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Shipping and handling | |

| 612,048 | | |

| 949,734 | | |

| 1,393,073 | | |

| 2,138,956 | |

| Payroll and related costs | |

| 512,466 | | |

| 1,094,135 | | |

| 1,411,025 | | |

| 2,205,236 | |

| General and administrative | |

| 902,999 | | |

| 2,024,871 | | |

| 2,514,815 | | |

| 4,049,435 | |

| Depreciation and amortization | |

| 12,066 | | |

| 12,426 | | |

| 24,641 | | |

| 23,113 | |

| Total operating expenses | |

| 2,039,579 | | |

| 4,081,166 | | |

| 5,343,554 | | |

| 8,416,740 | |

| Operating loss | |

| (1,292,833 | ) | |

| (2,004,810 | ) | |

| (3,031,044 | ) | |

| (3,930,132 | ) |

| Other expenses (income) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 8,617 | | |

| 24,415 | | |

| 39,817 | | |

| 49,605 | |

| Other expenses | |

| - | | |

| - | | |

| - | | |

| - | |

| Total other expenses | |

| 8,617 | | |

| 24,415 | | |

| 39,817 | | |

| 49,605 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,301,450 | ) | |

$ | (2,029,225 | ) | |

$ | (3,070,861 | ) | |

$ | (3,979,737 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to common stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| (0.67 | ) | |

| (1.31 | ) | |

| (1.60 | ) | |

| (2.58 | ) |

| Diluted | |

| (0.67 | ) | |

| (1.31 | ) | |

| (1.60 | ) | |

| (2.58 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 1,951,638 | | |

| 1,546,239 | | |

| 1,921,216 | | |

| 1,541,938 | |

| Diluted | |

| 1,951,638 | | |

| 1,546,239 | | |

| 1,921,216 | | |

| 1,541,938 | |

Kidpik

Corp.

Condensed

Interim Balance Sheets

| | |

June 29, 2024 | | |

December 30, 2023 | |

| | |

(Unaudited) | | |

(Audited) | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 34,030 | | |

$ | 194,515 | |

| Restricted cash | |

| 4,618 | | |

| 4,618 | |

| Accounts receivable | |

| 90,158 | | |

| 211,739 | |

| Inventory | |

| 3,799,522 | | |

| 4,854,641 | |

| Prepaid expenses and other current assets | |

| 712,512 | | |

| 761,969 | |

| Total current assets | |

| 4,640,840 | | |

| 6,027,482 | |

| | |

| | | |

| | |

| Leasehold improvements and equipment, net | |

| 72,495 | | |

| 97,136 | |

| Operating lease right-of-use assets | |

| 1,572,529 | | |

| 992,396 | |

| Total assets | |

$ | 6,285,864 | | |

$ | 7,117,014 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ (Deficit) Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,748,897 | | |

$ | 1,862,266 | |

| Accounts payable, related party | |

| 2,094,866 | | |

| 1,868,411 | |

| Accrued expenses and other current liabilities | |

| 296,032 | | |

| 438,034 | |

| Operating lease liabilities, current | |

| 406,656 | | |

| 281,225 | |

| Short-term debt | |

| 784,217 | | |

| - | |

| Related party loans | |

| 1,281,154 | | |

| 850,000 | |

| Total current liabilities | |

| 6,611,822 | | |

| 5,299,936 | |

| | |

| | | |

| | |

| Operating lease liabilities, net of current portion | |

| 1,253,980 | | |

| 780,244 | |

| | |

| | | |

| | |

| Total liabilities | |

| 7,865,802 | | |

| 6,080,180 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ (deficit) equity | |

| | | |

| | |

| Preferred stock, par value $0.001, 25,000,000 shares authorized, of which no shares are issued and outstanding as of June 29, 2024 and December 30, 2023, respectively | |

| - | | |

| - | |

| Common stock, par value $0.001, 75,000,000 shares authorized, of which 1,951,638 shares are issued and outstanding as of June 29, 2024, and 1,872,433 shares are issued and outstanding as of December 30, 2023 | |

| 1,952 | | |

| 1,872 | |

| Additional paid-in capital | |

| 52,929,198 | | |

| 52,475,189 | |

| Accumulated deficit | |

| (54,511,088 | ) | |

| (51,440,227 | ) |

| Total stockholders’ (deficit) equity | |

| (1,579,938 | ) | |

| 1,036,834 | |

| Total liabilities and stockholders’ (deficit) equity | |

$ | 6,285,864 | | |

$ | 7,117,014 | |

Kidpik

Corp.

Condensed

Interim Statements of Cash Flows

| | |

26

Weeks Ended | |

| | |

June

29, 2024 | | |

July

1, 2023 | |

| Cash flows from operating

activities | |

| | | |

| | |

| | |

| | | |

| | |

| Net

loss | |

$ | (3,070,861 | ) | |

$ | (3,979,737 | ) |

| Adjustments

to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation

and amortization | |

| 24,641 | | |

| 23,113 | |

| Equity-based

compensation | |

| 454,089 | | |

| 558,429 | |

| Bad debt

expense | |

| 26,928 | | |

| 151,362 | |

| Changes

in operating assets and liabilities: | |

| | | |

| | |

| Accounts

receivable | |

| 94,653 | | |

| 28,710 | |

| Inventory | |

| 1,055,119 | | |

| 2,870,243 | |

| Prepaid

expenses and other current assets | |

| 49,457 | | |

| 145,901 | |

| Operating

lease right-of-use assets and liabilities | |

| 19,034 | | |

| 22,802 | |

| Accounts

payable | |

| (113,369 | ) | |

| (450,965 | ) |

| Accounts

payable, related parties | |

| 226,455 | | |

| 431,238 | |

| Accrued

expenses and other current liabilities | |

| (142,002 | ) | |

| (167,429 | ) |

| Net

cash used in operating activities | |

| (1,375,856 | ) | |

| (366,333 | ) |

| | |

| | | |

| | |

| Cash flows from investing

activities | |

| | | |

| | |

| Purchases

of leasehold improvements and equipment | |

| - | | |

| (76,121 | ) |

| Net

cash used in investing activities | |

| - | | |

| (76,121 | ) |

| | |

| | | |

| | |

| Cash flows from financing

activities | |

| | | |

| | |

| Net proceeds

from advance payable | |

| 334,217 | | |

| - | |

| Net proceeds

from convertible debt | |

| 450,000 | | |

| - | |

| Net

proceeds from related party loan | |

| 431,154 | | |

| - | |

| Net

cash provided by financing activities | |

| 1,215,371 | | |

| - | |

| Net decrease

in cash and restricted cash | |

| (160,485 | ) | |

| (442,454 | ) |

| | |

| | | |

| | |

| Cash

and restricted cash, beginning of period | |

| 199,133 | | |

| 605,213 | |

| Cash

and restricted cash, end of period | |

$ | 38,648 | | |

$ | 162,759 | |

| | |

| | | |

| | |

| Reconciliation of cash and

restricted cash: | |

| | | |

| | |

| Cash | |

$ | 34,030 | | |

$ | 158,141 | |

| Restricted

cash | |

| 4,618 | | |

| 4,618 | |

| | |

$ | 38,648 | | |

$ | 162,759 | |

| Supplemental disclosure of

cash flow data: | |

| | | |

| | |

| Interest

paid | |

$ | 17,477 | | |

$ | - | |

| Supplemental disclosure of

non-cash investing and financing activities: | |

| | | |

| | |

| Record

right-of-use asset and operating lease liabilities | |

$ | 768,756 | | |

$ | - | |

RESULTS

OF OPERATIONS

The

Company’s revenue, net is disaggregated based on the following categories:

| | |

For the 13 weeks ended | | |

For the 26 weeks ended | |

| | |

June 29, 2024 | | |

July 1, 2023 | | |

June 29, 2024 | | |

July 1, 2023 | |

| Subscription boxes | |

$ | 804,837 | | |

$ | 2,607,543 | | |

$ | 2,321,502 | | |

$ | 5,579,110 | |

| 3rd party websites | |

| 32,801 | | |

| 426,914 | | |

| 291,702 | | |

| 863,212 | |

| Online website sales | |

| 290,685 | | |

| 414,462 | | |

| 754,424 | | |

| 1,036,075 | |

| Total revenue | |

$ | 1,128,323 | | |

$ | 3,448,919 | | |

$ | 3,367,628 | | |

$ | 7,478,397 | |

Gross

Margin

| | |

For

the 13 weeks ended | | |

For

the 26 weeks ended | |

| | |

June

29, 2024 | | |

July

1, 2023 | | |

June

29, 2024 | | |

July

1, 2023 | |

| | |

| | |

| | |

| | |

| |

| Gross margin | |

| 66.2 | % | |

| 60.2 | % | |

| 68.7 | % | |

| 60.0 | % |

Gross

profit is equal to our net sales less cost of goods sold. Gross profit as a percentage of our net sales is referred to as gross margin.

Cost of sales consists of the purchase price of merchandise sold to customers and includes import duties and other taxes, freight in,

returns from customers, inventory write-offs, and other miscellaneous shrinkage. The improvement in the gross margin was the result of

an inventory write-down in the fourth quarter of 2023. Without the reduction of the cost basis due to the write-down, gross margin would

be 60.7% for the 13 weeks ended June 29, 2024 and 55.9% for the 26 weeks ended June 29, 2024.

Shipped

Items

We

define shipped items as the total number of items shipped in a given period to our customers through our active subscription, Amazon

and online website sales.

| | |

For the 13 weeks ended | | |

For the 26 weeks ended | |

| | |

(in thousands) | | |

(in thousands) | |

| | |

June 29, 2024 | | |

July 1, 2023 | | |

June 29, 2024 | | |

July 1, 2023 | |

| | |

| | |

| | |

| | |

| |

| Shipped Items | |

| 135 | | |

| 290 | | |

| 330 | | |

| 630 | |

Average

Shipment Keep Rate

Average

shipment keep rate is calculated as the total number of items kept by our customers divided by total number of shipped items in a given

period.

| | |

For the 13 weeks ended | | |

For the 26 weeks ended | |

| | |

June 29, 2024 | | |

July 1, 2023 | | |

June 29, 2024 | | |

July 1, 2022 | |

| | |

| | |

| | |

| | |

| |

| Average Shipment Keep Rate | |

| 74.6 | % | |

| 75.1 | % | |

| 76.7 | % | |

| 71.3 | % |

Revenue

by Channel

| | |

13

weeks ended June

29, 2024 | | |

13

weeks ended July

1, 2023 | | |

Change ($) | | |

Change (%) | |

| Revenue

by channel | |

| | | |

| | | |

| | | |

| | |

| Subscription

boxes | |

$ | 804,837 | | |

$ | 2,607,543 | | |

$ | (1,802,706 | ) | |

| (69.1 | )% |

| Third-party

websites | |

| 32,801 | | |

| 426,914 | | |

| (394,113 | ) | |

| (92.3 | )% |

| Online

website sales | |

| 290,685 | | |

| 414,462 | | |

| (123,777 | ) | |

| (29.9 | )% |

| Total

revenue | |

$ | 1,128,323 | | |

$ | 3,448,919 | | |

$ | (2,320,596 | ) | |

| (67.3 | )% |

| | |

26

weeks ended June

29, 2024 | | |

26

weeks ended July

1, 2023 | | |

Change ($) | | |

Change (%) | |

| Revenue

by channel | |

| | | |

| | | |

| | | |

| | |

| Subscription

boxes | |

$ | 2,321,502 | | |

$ | 5,579,110 | | |

$ | (3,257,608 | ) | |

| (58.4 | )% |

| Third-party

websites | |

| 291,702 | | |

| 863,212 | | |

| (571,510 | ) | |

| (66.2 | )% |

| Online

website sales | |

| 725,424 | | |

| 1,036,075 | | |

| (281,651 | ) | |

| (27.2 | )% |

| Total

revenue | |

$ | 3,367,628 | | |

$ | 7,478,397 | | |

$ | (4,110,769 | ) | |

| (55.0 | )% |

Subscription

Boxes Revenue

| | |

13

weeks ended June

29, 2024 | | |

13

weeks ended July

1, 2023 | | |

Change ($) | | |

Change (%) | |

| Subscription

boxes revenue from | |

| | | |

| | | |

| | | |

| | |

| Active

subscriptions – recurring boxes | |

$ | 783,106 | | |

$ | 2,177,298 | | |

$ | (1,394,192 | ) | |

| (64.0 | )% |

| New

subscriptions – first box | |

| 21,731 | | |

| 430,245 | | |

| (913,838 | ) | |

| (94.9 | )% |

| Total

subscription boxes revenue | |

$ | 804,837 | | |

$ | 2,607,543 | | |

$ | (1,802,706 | ) | |

| (69.1 | )% |

| | |

26

weeks ended June

29, 2024 | | |

26

weeks ended July

1, 2023 | | |

Change ($) | | |

Change (%) | |

| Subscription

boxes revenue from | |

| | | |

| | | |

| | | |

| | |

| Active

subscriptions – recurring boxes | |

$ | 2,234,554 | | |

$ | 4,578,324 | | |

$ | (2,343,770 | ) | |

| (51.2 | )% |

| New

subscriptions – first box | |

| 86,948 | | |

| 1,000,786 | | |

| (913,838 | ) | |

| (91.3 | )% |

| Total

subscription boxes revenue | |

$ | 2,321,502 | | |

$ | 5,579,110 | | |

$ | (3,257,608 | ) | |

| (58.4 | )% |

Revenue

by Product Line

| | |

13

weeks ended June

29, 2024 | | |

13

weeks ended July

1, 2023 | | |

Change ($) | | |

Change (%) | |

| Revenue

by product line | |

| | | |

| | | |

| | | |

| | |

| Girls’

apparel | |

$ | 855,288 | | |

$ | 2,636,965 | | |

$ | (1,781,677 | ) | |

| (67.6 | )% |

| Boys’

apparel | |

| 233,680 | | |

| 640,937 | | |

| (407,258 | ) | |

| (63.5 | )% |

| Toddlers’

apparel | |

| 39,355 | | |

| 171,017 | | |

| (131,662 | ) | |

| (77.0 | )% |

| Total

revenue | |

$ | 1,128,323 | | |

$ | 3,448,919 | | |

$ | (2,320,596 | ) | |

| (67.3 | )% |

| | |

26

weeks ended June

29, 2024 | | |

26

weeks ended July

1, 2023 | | |

Change ($) | | |

Change (%) | |

| Revenue

by product line | |

| | | |

| | | |

| | | |

| | |

| Girls’

apparel | |

$ | 2,530,504 | | |

$ | 5,684,721 | | |

$ | (3,154,217 | ) | |

| (55.5 | )% |

| Boys’

apparel | |

| 720,676 | | |

| 1,428,096 | | |

| (707,420 | ) | |

| (49.5 | )% |

| Toddlers’

apparel | |

| 116,449 | | |

| 365,580 | | |

| (249,131 | ) | |

| (68.1 | )% |

| Total

revenue | |

$ | 3,367,628 | | |

$ | 7,478,397 | | |

$ | (4,110,768 | ) | |

| (55.0 | )% |

Contacts

Investor

Relations Contact:

ir@kidpik.com

Media:

press@kidpik.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

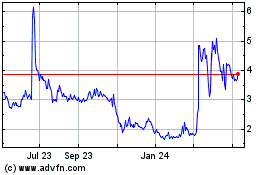

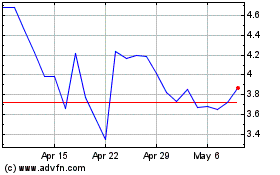

Kidpik (NASDAQ:PIK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kidpik (NASDAQ:PIK)

Historical Stock Chart

From Dec 2023 to Dec 2024