0001446159

False

0001446159

2025-02-28

2025-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): February 28,

2025

_______________________________

Predictive

Oncology Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware |

001-36790 |

33-1007393 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

91

43rd Street, Suite 110

Pittsburgh,

Pennsylvania

15201

(Address of Principal Executive Offices) (Zip Code)

(412)

432-1500

(Registrant's telephone number, including area code)

_______________________________

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name of each exchange

on which registered |

| Common

stock, $0.01 par value |

POAI |

Nasdaq

Capital Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

As previously reported, on January

1, 2025, Predictive Oncology Inc. a Delaware corporation (“Predictive Oncology”),

entered into binding letter of intent (the “LOI”) with Renovaro, Inc., a Delaware

corporation (“Renovaro”), with respect to the proposed acquisition of all

of the capital stock of Predictive Oncology by Renovaro (the “Transaction”).

On February 28, 2025, Predictive Oncology entered into an extension agreement with Renovaro (the “Extension

Agreement”), pursuant to which the parties amended the LOI to (i) eliminate Renovaro’s obligation to acquire certain

shares of Predictive Oncology’s common stock and (ii) extend the outside termination date of the LOI from February 28, 2025, to

March 31, 2025. Additionally, pursuant to the Extension Agreement, Renovaro is acquiring 467,290 shares of Predictive Oncology’s

common stock for an aggregate purchase price of $500,000 and agreed to purchase an additional 901,298 shares of Predictive Oncology common

stock for an aggregate of $964,389 upon, and subject to, the execution of a definitive agreement in respect of the Transaction.

The foregoing description of the Extension Agreement

is only a summary and is qualified in its entirety by reference to the complete text of the Extension Agreement, which is filed as Exhibit

10.1 to this Current Report on Form 8-K and incorporated by reference in this Item 1.01.

On March 3, 2025, the Company issued a press release announcing it had entered into the Extension

Agreement described above. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Additional Information and Where to Find It:

This communication may be deemed to relate to a proposed

acquisition of Predictive Oncology by Renovaro. In connection with the proposed acquisition, Predictive Oncology and Renovaro intend to

file relevant materials with the Securities and Exchange Commission (SEC), including a Registration Statement on Form S-4 to be filed

by Renovaro that will include a preliminary proxy statement of Predictive Oncology and also constitute a prospectus with respect to the

shares of equity securities of Renovaro to be issued in the proposed transaction. The information in the preliminary proxy statement/prospectus

will not be complete and may be changed. Predictive Oncology will deliver the definitive proxy statement to its stockholders as required

by applicable law. This communication is not a substitute for any prospectus, proxy statement or any other document that may be filed

with the SEC in connection with the proposed business combination.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

DEFINITIVE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain

these materials (when they are available) and other documents filed with the SEC free of charge at the SEC’s website, www.sec.gov.

Copies of documents filed with the SEC by Predictive Oncology (when they become available) may be obtained free of charge on Predictive

Oncology’s website at predictive-oncology.com. Copies of documents filed with the SEC by Renovaro (when they become available) may

be obtained free of charge at Renovaro’s website at renovarogroup.com.

Participants in the Solicitation:

Predictive Oncology and its directors, executive officers

and certain other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the

proposed transaction. Information regarding these persons who may, under the rules of the SEC, be considered participants in the solicitation

of Predictive Oncology stockholders in connection with the proposed transaction and their interests in the transaction will be set forth

in the proxy statement/prospectus described above filed with the SEC. Additional information regarding Predictive Oncology’s executive

officers and directors is included in Predictive Oncology’s annual report on Form 10-K for the year ended December 31, 2023 filed

with the SEC on March 28, 2024 and Predictive Oncology’s proxy statement for its 2024 annual meeting of stockholders filed with

the SEC on November 27, 2024. These documents may be obtained free of charge at the SEC’s website, www.sec.gov, or Predictive Oncology’s

website, predictive-oncology.com.

Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements include, but are not limited to, statements regarding Predictive Oncology’s

proposed business combination transaction with Renovaro, all statements regarding the Predictive Oncology’s expected future financial

position, results of operations, cash flows, dividends, financing plans, business strategy, budgets, capital expenditures, competitive

positions, growth opportunities, plans and objectives of management, and statements containing words such as “anticipate,”

“approximate,” “believe,” “plan,” “estimate,” “expect,” “project,”

“could,” “would,” “should,” “will,” “intend,” “may,” “potential,”

“upside,” and other similar expressions. All statements in this Current Report on Form 8-K, including its exhibits, that are

not historical facts, are forward-looking statements that reflect the best judgment of Predictive Oncology based upon currently available

information.

Such forward-looking statements are inherently uncertain,

and shareholders and other potential investors must recognize that actual results may differ materially from Predictive Oncology’s

expectations as a result of a variety of factors, including, without limitation, those discussed below. Such forward-looking statements

are based upon management’s current expectations and include known and unknown risks, uncertainties and other factors, many of which

Predictive Oncology is unable to predict or control, that may cause its actual results, performance or plans to differ materially from

any future results, performance or plans expressed or implied by such forward-looking statements. These statements involve risks, uncertainties

and other factors discussed below and detailed from time to time in Predictive Oncology’s filings with the SEC.

Risks and uncertainties related to the proposed Transaction

include, but are not limited to, the risk that Predictive Oncology’s stockholders do not approve the Transaction, potential adverse

reactions or changes to business relationships resulting from the announcement or completion of the Transaction, uncertainties as to the

timing of the Transaction, adverse effects on Predictive Oncology’s stock price resulting from the announcement of the Transaction

or the failure of the Transaction to be completed, competitive responses to the announcement of the Transaction, the risk that regulatory,

licensure or other approvals required for the consummation of the Transaction are not obtained or are obtained subject to terms and conditions

that are not anticipated, litigation relating to the Transaction, the inability to retain key personnel, and any changes in general economic

and/or industry-specific conditions.

In addition to the factors set forth above, other factors that may affect

Predictive Oncology’s plans, results or stock price are set forth in its most recent Annual Report on Form 10-K and in its subsequently

filed reports on Forms 10-Q and 8-K.

Many of these factors are beyond Predictive Oncology’s control. Predictive

Oncology cautions investors that any forward-looking statements made by it are not guarantees of future performance. Predictive Oncology

disclaims any obligation to update any such factors or to announce publicly the results of any revisions to any of the forward-looking

statements to reflect future events or developments, except as required by applicable law.

| Item 9.01 | Financial Statements and Exhibits. |

(d)

Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, as amended, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

Predictive Oncology Inc. |

| |

|

|

| |

|

|

| Date: March 5, 2025 |

By: |

/s/ Josh Blacher |

| |

|

Josh Blacher |

| |

|

Interim Chief Financial Officer |

| |

|

|

Exhibit 10.1

EXTENSION AGREEMENT

This Extension Agreement (“Agreement”)

is entered into this 28th day of February 2025, by Predictive Oncology, Inc., a Delaware corporation (the “POI”), and

Renovaro, Inc. a Delaware corporation (the, “Renovaro”)(collectively, POI and Renovaro may be referred to as the “Parties”).

BACKGROUND

WHEREAS, POI and Renovaro entered into

a definitive Letter agreement dated January 1, 2025 (the “Letter Agreement”) in connection with a merger transaction

(the “ Transaction”);

WHEREAS, the Parties of desirous of

amending the Letter Agreement on the terms and conditions set forth below.

NOW, THEREFORE, in consideration of

the foregoing, of the mutual agreements hereinafter set forth, and of other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the parties hereto hereby agree follows:

1.

The parties agree that the Recitals set forth above are true and correct and are incorporated into this Agreement by reference.

2.

Section 2 of the Letter Agreement is hereby amended to delete the following sentence in recognition that Renovaro shall have no obligation

thereunder:

“If the warrant exercise

for the full number of such shares in (i) does not happen by January 15, 2025, the Buyer will acquire the unpurchased shares up to a number

of shares that does not exceed 19.99% of the Company's

issued and outstanding shares on the same terms as were offered to the warrant holders, provided that such shares shall be unregistered.”

3.

Section 3 of the Letter Agreement shall be deleted in its entirety and replaced with the following:

4.

This Letter shall terminate upon the earliest to occur of: (i) the execution and delivery of the definitive purchase agreement by the

Company and Buyer and (ii) March 31, 2025. The Parties acknowledge and agree that the Transaction shall be subject to approval by the

Company's stockholders.

a. the Parties agree that if within

sixty days from the parties' execution of the definitive agreement the Company is unable to attain such stockholder approval on the

Transaction and the Buyer has purchased Company shares as provided in (Paragraph 2) or the equivalent amount of capital is received

by the Seller either through a warrant exercise or the Buyers purchase of common shares or a combination thereof representing, in

the aggregate, additional investment of not less than $1,000,000, then the Company shall provide the Buyer an exclusive royalty free

license to its proprietary biobank of tumor samples and its tumor-specific 3D cell culture models, and all related data and

technology for a period of two years from such execution. The Buyer agrees that any existing licensing or third-party contracts the

Company has at the time the exclusive license is entered into shall continue and be unaffected by the

Buyer's license, including any amendments thereto. Any business generated from the existing licenses will be distributed equally

with the Buyer throughout the term of the license.

b.

in the event of the Buyer's purchase or acquisition of any Company

shares, the Buyer agrees to vote or have voted all of the Company shares it has acquired in favor of the definitive agreement.

3.

Renovaro shall pay the sum of Five hundred Thousand Dollars ($500,00.00) to POI upon the execution of this Agreement to purchase 467,290

shares at a purchase price of $1.07 per share. Renovaro will purchase an additional 901,298 shares at $1.07 for a purchase price of $964,389

upon the execution of the definitive merger agreement in connection with the Transaction.

4.

POAI hereby affirms all obligations of Renovaro under the Letter Agreement are hereby satisfied in full and that no default under the

Letter Agreement exists.

5.

This Agreement shall bind and inure to the benefit of the parties hereto, their respective successors and permitted assigns.

6.

This Agreement may be executed in any number of counterparts, each of which shall constitute an original, and all of which, taken together,

shall constitute the same instrument.

7.

This Agreement may be executed by facsimile signature and that such facsimile signature shall have the same effect as original signatures.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have executed this Agreement

as of the day and year first above written.

| |

RENOVARO, INC. |

| |

|

| |

By: /s/ David Weinstein |

| |

Name: David Weinstein |

| |

Title: CEO |

| |

|

| |

|

| |

PREDICTIVE ONCOLOGY INC. |

| |

|

| |

By: /s/ Raymond Vennare |

| |

Name: Raymond Vennare |

| |

Title: CEO |

3

EXHIBIT

99.1

Predictive

Oncology Moves to Finalize Definitive Merger Agreement With Renovaro Biosciences

Predictive receives first tranche of financing to initiate integration

of

AI/ML platform technologies, core laboratory capabilities and business development efforts in Europe and the United States

Renovaro’s

recent strategic acquisition of BioSymetrics vastly expands Predictive Oncology’s biomarker

and drug discovery opportunities and the development of diagnostic applications in oncology

Merger

expected to enhance shareholder value, accelerate business development efforts and solidify

positioning in the capital markets

PITTSBURGH,

March 03, 2025 (GLOBE NEWSWIRE) -- Predictive Oncology Inc. (NASDAQ: POAI), a leader in AI-driven

drug discovery, today announced that it has received the first tranche of financing from

Renovaro Biosciences, Inc. (NASDAQ: RENB) to initiate the integration of AI/ML platform technologies,

core laboratory capabilities and business development efforts in Europe and the United States.

Predictive

and Renovaro reiterate their unwavering commitment to improving the outcomes of cancer patients

through earlier diagnosis, biomarker discovery and targeted therapies by integrating and

leveraging Predictive’s AI-driven drug discovery platform, vast biobank of more than

150,000 patient tumor samples, 200,000 pathology slides and decades of longitudinal drug

response data with Renovaro’s multi-disciplinary artificial intelligence, multi-omic

and multi-modal data expertise.

“Since

we first announced our intentions to merge with Renovaro Biosciences in January, Predictive

and Renovaro have worked diligently to thoroughly evaluate the expanded market opportunities

created by this merger. Renovaro’s recent acquisition of BioSymetrics, together with

our ability to launch ChemoFx in Europe, represent significant steps forward in these efforts,”

said Raymond Vennare, Chairman and Chief Executive Officer of Predictive Oncology.

Messrs.

Vennare and David Weinstein, CEO of Renovaro added, “Although we have been working

very hard over the past two months to anticipate all contingencies, the complicated logistics

of combining our core platform technologies and international team of experts still requires

a bit more effort. Nevertheless, we fully expect to sign a definitive merger agreement within

the next few weeks.”

Predictive

Oncology does not intend to discuss or disclose further developments regarding these discussions

unless and until its Board of Directors has approved a transaction or otherwise determined

that further disclosure is appropriate or required by law.

About

Renovaro

Renovaro

https://renovarogroup.com/ aims to accelerate precision and personalized medicine

for longevity powered by mutually reinforcing AI and biotechnology platforms for early diagnosis,

better-targeted treatments, and drug discovery. Renovaro Inc. includes RenovaroBio, an advanced

cell-gene immunotherapy company, and Renovaro Cube.

Renovaro

Cube has developed an award-winning AI platform that is committed to the early detection

of cancer and its recurrence and monitoring subsequent treatments. Renovaro Cube intervenes

at a stage where potential therapy can be most effective. Renovaro Cube is a molecular data

science company with a background in FinTech and a 12-year history. It brings together proprietary

artificial intelligence (AI) technology, multi-omics, multi-modal data, and the expertise

of a carefully selected multidisciplinary team to radically accelerate precision medicine

and enable breakthrough changes in disease agnostic decision support.

About

Predictive Oncology

Predictive

Oncology is on the cutting edge of the rapidly growing use of artificial intelligence and

machine learning to expedite early biomarker and drug discovery and enable drug development

for the benefit of cancer patients worldwide. The company’s proprietary AI/ML platform

has been scientifically validated to predict with 92% accuracy if a tumor sample will respond

to a certain drug compound, allowing for a more informed selection of drug/tumor type combinations

for subsequent in-vitro testing. Together with the company’s vast biobank of more than

150,000 assay-capable heterogenous human tumor samples, Predictive Oncology offers its academic

and industry partners one of the industry’s broadest AI-based drug discovery solutions,

further complimented by its wholly owned CLIA lab and GMP facilities. Predictive Oncology

is headquartered in Pittsburgh, PA.

Contact:

Tim

McCarthy

LifeSci Advisors, LLC

tim@lifesciadvisors.com

Forward-Looking

Statements:

Certain matters discussed in this release contain forward-looking statements.

These forward- looking statements reflect our current expectations and projections about

future events and are subject to substantial risks, uncertainties and assumptions about our

operations and the investments we make. All statements, other than statements of historical

facts, included in this press release regarding our strategy, future operations, future financial

position, future revenue and financial performance, projected costs, prospects, changes in

management, plans and objectives of management are forward-looking statements. The words

“anticipate,” “believe,” “estimate,” “expect,”

“intend,” “may,” “plan,” “would,” “target”

and similar expressions are intended to identify forward-looking statements, although not

all forward-looking statements contain these identifying words. Our actual future performance

may materially differ from that contemplated by the forward-looking statements as a result

of a variety of factors including, among other things, factors discussed under the heading

“Risk Factors” in our filings with the SEC. Except as expressly required by law,

the company disclaims any intent or obligation to update these forward-looking statements.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

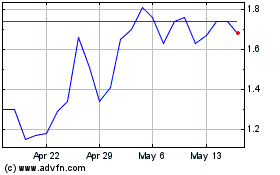

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Feb 2025 to Mar 2025

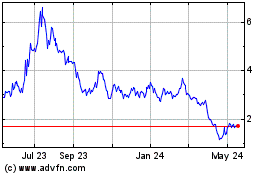

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Mar 2024 to Mar 2025