Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

15 February 2024 - 8:30AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 1)

Goal

Acquisitions Corp.

(Name

of Issuer)

Common

stock, par value $0.0001 per share

(Title

of Class of Securities)

38021H107

(CUSIP

Number)

12600

Hill Country Blvd.

Building

R, Suite 275

Bee

Cave, TX 78738

Attn:

Alex Greystoke

(888)

717-7678

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

February

14, 2024

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

| * |

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or other subject to the liabilities of that section of Act but shall be subject

to all other provisions of the Act (however, see the Notes).

CUSIP

NO. 38021H107

| 1 |

NAME

OF REPORTING PERSON

Goal

Acquisitions Sponsor LLC |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

|

| 4 |

SOURCE

OF FUNDS

WC |

|

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ☐

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH* |

7 |

SOLE

VOTING POWER

4,114,750 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

4,114,750 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,114,750 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

54.48% |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| 1 |

NAME

OF REPORTING PERSON

Alexander

Greystoke |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

|

| 4 |

SOURCE

OF FUNDS

AF |

|

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ☐

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH* |

7 |

SOLE

VOTING POWER

4,114,750 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

4,114,750 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,114,750 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

54.48% |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| 1 |

NAME

OF REPORTING PERSON

Raghunath

Kilambi |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

|

| 4 |

SOURCE

OF FUNDS

AF |

|

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ☐

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Canada |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH* |

7 |

SOLE

VOTING POWER

4,114,750 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

4,114,750 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,114,750 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

54.48% |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| 1 |

NAME

OF REPORTING PERSON

William

T. Duffy |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

|

| 4 |

SOURCE

OF FUNDS

AF |

|

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) ☐

|

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of American |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH* |

7 |

SOLE

VOTING POWER

4,114,750 |

| 8 |

SHARED

VOTING POWER

0 |

| 9 |

SOLE

DISPOSITIVE POWER

4,114,750 |

| 10 |

SHARED

DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,114,750 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

54.48% |

| 14 |

TYPE

OF REPORTING PERSON

IN |

SCHEDULE

13D/A

| Item

2. |

Identity

and Background. |

Item

2 is hereby amended and restated in its entirety to read as follows:

This

statement is filed by Goal Acquisitions Sponsor LLC (the “Sponsor”), Alexander Greystoke (“Mr. Greystoke”), William

T. Duffy (“Mr. Duffy”) and Raghunath Kilambi (“Mr. Kilambi”, and together with the Sponsor, Mr. Greystoke and

Mr. Duffy, each of the foregoing a “Reporting Person”, and collectively, the “Reporting Persons”). The Sponsor

is managed by Mr. Greystoke, Mr. Duffy. and Mr. Kilambi. The Sponsor holds approximately 54.48% of the issued and outstanding shares

of the Issuer (7,552,600) based on the number of shares of common stock, $0.0001 par value per share (the “Common Stock”)

it beneficially owns (4,114,750).

The

Reporting Person’s business address is 12600 Hill Country Blvd., Building R, Suite 275, Bee Cave, TX 78738.

(d)

During the last five years, none of the Reporting Persons has been convicted in a criminal proceeding (excluding traffic violations or

similar misdemeanors).

(e)

During the last five years, none of the Reporting Persons has been a party to a civil proceeding of a judicial or administrative body

of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree of final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect

to such laws.

(f)

The Sponsor is a Delaware limited liability company. Mr. Greystoke and Mr. Duffy are United States Citizens and Mr. Kilambi is a Canadian

Citizen.

| Item

5. |

Interest

in Securities of the Issuer. |

Item

5 is hereby amended and restated in its entirety to read as follows:

| (a) |

Amount beneficially

owned: 4,114,750 |

Percentage:

54.48%

| (b) |

Number

of shares to which the Reporting Persons have: |

Sole

power to vote or to direct the vote: 4,114,750

Shared

power to vote or to direct the vote: 0

Sole

power to dispose or to direct the disposition of: 4,114,750

Shared

power to vote or to direct the vote: 0

The

Sponsor is managed by Mr. Greystoke, Mr. Duffy and Mr. Kilambi.

Redemptions

On

February 10, 2023, the stockholders of the Issuer redeemed an aggregate of 16,328,643 shares of the Issuer’s Common Stock included

in the units issued in the IPO for cash (the “Redemptions”) in connection with a stockholder vote to approve an amendment

to the Issuer’s amended and restated certificate of incorporation to extend the deadline for the Issuer to consummate an initial

business combination from February 16, 2023 to March 18, 2023, subject to extension by the Issuer’s board of directors for up to

five additional thirty-day periods. On August 14, the stockholders of the Issuer redeemed an aggregate of 8,708,098 shares in connection

with a stockholder vote to approve an amendment to the Issuer’s amended and restated certificate of incorporation to extend the

deadline for the Issuer to consummate an initial business combination from August 17, 2023 to November 15, 2023. On November 14, 2023,

the stockholders of the Issuer redeemed an aggregate of 571,909 shares in connection with a stockholder vote to approve an amendment

to the Issuer’s amended and restated certificate of incorporation to extend the deadline for the Issuer to consummate an initial

business combination from November 15, 2023 to February 10, 2024. On February 7, 2024, the stockholders of the Issuer redeemed an aggregate

of 52,181 shares in connection with a stockholder vote to approve an amendment to the Issuer’s amended and restated certificate

of incorporation to extend the deadline for the Issuer to consummate an initial business combination from February 10, 2024 to August

8, 2024. Following the Redemptions, an aggregate of 7,552,600 shares of the Company’s Common Stock remained issued and outstanding.

Accordingly, although the Sponsor did not acquire additional shares of Common Stock in connection with the Redemptions, following the

Redemptions the percentage of the Common Stock owned by the Sponsor increased to 54.48%.

| Reporting Person | |

Amount beneficially owned | | |

Percent of Class | | |

Sole power to vote or to direct the vote | | |

Shared power to vote or to direct the vote | | |

Sole power to dispose or to direct the disposition | | |

Shared power to dispose or to direct the disposition | |

| Goal Acquisitions Sponsor LLC | |

| 4,114,750 | | |

| 54.48 | % | |

| 4,114,750 | | |

| 0 | | |

| 4,114,750 | | |

| 0 | |

| |

(c) |

Not applicable. |

| |

|

| |

(d) |

Not applicable. |

| |

|

| |

(e) |

Not applicable. |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| Dated:

February 14, 2024 |

GOAL

ACQUISITIONS SPONSOR LLC |

| |

|

|

| |

/s/

Alexander Greystoke |

| |

Name: |

Alexander

Greystoke |

| |

Title: |

Manager |

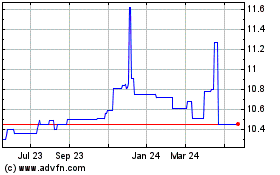

Goal Acquisition (NASDAQ:PUCKU)

Historical Stock Chart

From Mar 2024 to May 2024

Goal Acquisition (NASDAQ:PUCKU)

Historical Stock Chart

From May 2023 to May 2024