UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

August 14, 2023

GOAL

Acquisitions Corp.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-40026 |

|

85-3660880 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

12600

Hill Country Blvd,

Building

R,

Suite

275

Bee

Cave, Texas |

|

78738 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (888)

717-7678

| Not

Applicable |

| (Former

name or former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☒ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbols |

|

Name

of each exchange on which registered |

| Units,

each consisting of one share of common stock and one redeemable warrant |

|

PUCKU |

|

The

Nasdaq Stock Market LLC |

| Common

stock, par value $0.0001 per share |

|

PUCK |

|

The

Nasdaq Stock Market LLC |

| Redeemable

warrants exercisable for shares of common stock at an exercise price of $11.50 per share |

|

PUCKW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

August 14, 2023, stockholders of Goal Acquisitions Corp. (the “Company”) approved an amendment (the “Trust Agreement

Amendment”) to the Investment Management Trust Agreement, dated February 10, 2021, by and between the Company and Continental Stock

Transfer & Trust Company (“Continental”) (the “Trust Agreement”), to change the date on which Continental

must commence liquidation of the amount on deposit in the trust account (the “Trust Account”) established in connection with

the Company’s initial public offering from August 16, 2023 to August 23, 2023, subject to extension by the board of directors on

a day-by-day basis, with the ability to extend up to seven days at a time in advance, for a maximum of ninety-days (the latest of which

such date is referred to as the “New Termination Date”).

The

foregoing description of the Trust Agreement Amendment does not purport to be complete and is qualified in its entirety by reference

to 10.1 which is incorporated herein by reference.

Item

5.03. Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year

On

August 14, 2023, the Company’s stockholders also approved an amendment (the “Charter Amendment”) to the Amended and

Restated Certificate of Incorporation of the Company (the “Charter”) to (i) extend the initial period of time by which the

Company has to consummate an initial business combination to the New Termination Date and (ii) make other administrative and technical

changes in the Charter in connection with the New Termination Date, in each case, pursuant to an amendment in the form set forth in Annex

A of the proxy statement. The Company filed the Charter Amendment with the Secretary of State of the State of Delaware on August 14,

2023.

The

foregoing description of the Charter Amendment does not purport to be complete and is qualified in its entirety by reference to Exhibit

3.1 which is incorporated herein by reference.

Item

5.07. Submission of Matters to a Vote of Security Holders.

At

the Special Meeting, the following proposals were considered and acted upon by the stockholders of the Company: (a) a proposal to approve

the Charter Amendment (the “Charter Amendment Proposal”); (b) a proposal to approve the Trust Agreement Amendment (the “Trust

Amendment Proposal” and together with the Charter Amendment Proposal, the “Amendment Proposals”); and (c) a proposal

to approve the adjournment of the Special Meeting from time to time to solicit additional proxies in favor of the Amendment Proposals

or if otherwise determined by the chairperson of the Special Meeting to be necessary or appropriate (the “Adjournment Proposal”).

On

July 12, 2023, the record date for the Special Meeting, there were 16,832,607 shares of common stock of the Company entitled to be voted

at the Special Meeting. At the Special Meeting, 11,819,100 shares of common stock of the Company, or 70.22% of the shares entitled to

vote at the Special Meeting, were represented in person or by proxy. The number of votes cast for or against, as well as the number of

abstentions as to each proposal, are set forth below.

1.

Charter Amendment Proposal

| Votes

For | | |

Votes

Against | | |

Abstentions | |

| | 11,329,688 | | |

| 489,412 | | |

| 0 | |

Accordingly,

the Charter Amendment Proposal was approved.

2.

Trust Amendment Proposal

| Votes

For | | |

Votes

Against | | |

Abstentions | |

| | 11,329,688 | | |

| 489,412 | | |

| 0 | |

Accordingly,

the Early Termination Trust Amendment Proposal was approved.

3.

Adjournment Proposal

| Votes

For | | |

Votes

Against | | |

Abstentions | |

| | 11,300,687 | | |

| 518,113 | | |

| 300 | |

Accordingly,

the Adjournment Proposal was approved.

Item

8.01. Other Events.

In

connection with the stockholders’ approval and implementation of the Charter Amendment Proposal, the holders of 8,708,098 Public

Shares exercised their right to redeem their shares for cash at a redemption price of approximately $10.48 per share, for an aggregate

redemption amount of approximately $91,260,867. Following such redemptions, 838,259 Public Shares remain outstanding and the Company

expects to have approximately $8,822,615 remaining in the Trust Account.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

Date:

August 14, 2023

| Goal

Acquisitions Corp. |

|

| |

|

| By: |

/s/

William T. Duffy |

|

| Name: |

William

T. Duffy |

|

| Title: |

Chief

Financial Officer and Chief Operating Officer |

|

Exhibit 3.1

CERTIFICATE OF AMENDMENT

OF

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

GOAL ACQUISITIONS CORP.

Goal Acquisitions Corp. (hereinafter called the “Corporation”),

a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware, does hereby certify

as follows:

1. The Amended and Restated Certificate of Incorporation

of the Corporation is hereby amended by deleting provision (F) of Article 6 thereof in its entirety and inserting the following in lieu

thereof:

“In the event that the Corporation has not completed

an initial Business Combination by 24 months after the consummation of the IPO and in accordance with any previous extension, the Board

may extend the period of time to consummate an initial Business Combination to August 17, 2023, subject to extension by the Board on a

day-by-day basis, with the ability to extend up to seven days at a time in advance, for a maximum of ninety-days (the latest of which

such date is referred to as the “Termination Date”); provided that, in each case, the Sponsor (or its affiliates or

designees) has (i) provided to the Corporation a notice of such extension one calendar day prior, as applicable. In the event that the

Corporation does not consummate a Business Combination by the Termination Date, the Corporation shall (i) cease all operations except

for the purposes of winding up, (ii) as promptly as reasonably possible but not more than ten (10) business days thereafter, redeem 100%

of the IPO Shares for cash for a redemption price per share equal to the amount then held in the Trust Account, less any interest for

any income or other taxes payable, divided by the total number of IPO Shares then outstanding (which redemption will completely extinguish

such holders’ rights as stockholders, including the right to receive further liquidation distributions, if any), subject to applicable

law, and (iii) as promptly as reasonably possible following such redemption, subject to approval of the Corporation’s then stockholders

and subject to the requirements of the GCL, including the adoption of a resolution by the Board pursuant to Section 275(a) of the GCL

finding the dissolution of the Corporation advisable and the provision of such notices as are required by said Section 275(a) of the GCL,

dissolve and liquidate, subject (in the case of clauses (ii) and (iii) above) to the Corporation’s obligations under the GCL to

provide for claims of creditors and other requirements of applicable law.”

2. The foregoing amendment was duly adopted in accordance

with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the Corporation has caused this

Certificate of Amendment to be executed and acknowledged this 14th day of August, 2023.

| |

Goal Acquisitions Corp. |

| |

|

|

| |

By: |

/s/

Harvey Schiller |

| |

Name: |

Harvey Schiller |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

AMENDMENT TO INVESTMENT MANAGEMENT TRUST AGREEMENT

This Amendment to Investment Management Trust Agreement

(this “Amendment Agreement”) is entered into effective as of August 14, 2023 (the “Effective Date”)

by and between Goal Acquisitions Corp., a Delaware corporation (the “Company”), and Continental Stock Transfer

& Trust Company, a New York corporation (the “Trustee”).

WHEREAS, the parties hereto are parties to that certain

Investment Management Trust Agreement made effective as of February 10, 2021 (the “Trust Agreement”);

WHEREAS, capitalized terms contained in this Amendment

Agreement without definition shall have the meanings ascribed to such terms in the Trust Agreement;

WHEREAS, the Board of Directors of the Company has

approved and declared the advisability of certain amendments to the Charter with respect to the extension of the time within which the

Company must complete an initial Business Combination, which amendments have been submitted to the stockholders of the Company for their

consideration and vote, together with this Amendment Agreement, at a special of the stockholders of the Company held on or about the Effective

Date (the “Special Meeting”);

WHEREAS, Section 7(d) of the Trust Agreement provides

that the Trust Agreement may only be changed, amended or modified pursuant to Section 7(d) thereof (e.g., by a writing signed by each

of the parties to the Trust Agreement) with the Consent of the Stockholders, which is defined in Section 7(d) of the Trust Agreement,

as relevant to the Special Meeting, to mean “receipt by the Trustee of a certificate from the inspector of elections of the Special

Meeting certifying that the Company’s stockholders of record as of a record date established in accordance with Section 213(a) of

the Delaware General Corporation Law, as amended (or any successor rule), who hold fifty percent (50%) or more of all then outstanding

shares of the common stock, par value $0.0001 per share, of the Company, voting together as a single class, have voted in favor of such

change, amendment or modification…” (such certificate, the “Requisite Vote Certificate”);

WHEREAS, the Trustee has received the Requisite Vote

Certificate with respect to the Consent of the Stockholders to this Amendment Agreement; and

WHEREAS, each of the Company and the Trustee desires

to amend the Trust Agreement as provided in this Amendment Agreement.

NOW, THEREFORE, in consideration of the mutual agreements

contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending

to be legally bound hereby, the parties hereto agree as follows:

1. Definitions. Capitalized terms contained

in this Amendment Agreement, but not specifically defined in this Amendment, shall have the meanings ascribed to such terms in the Trust

Agreement.

2. Amendment to the Trust Agreement. Effective

as of the Effective Date, Section 1(j) of the Trust Agreement is hereby amended and restated in its entirety to read as follows:

“Upon receipt of a letter (an “Amendment

Notification Letter”) in the form of Exhibit C, signed on behalf of the Company by an authorized officer, extends the

date by which it will distribute to Public Stockholders who exercised their conversion rights in connection with an amendment to Article

Sixth of the Company’s Amended and Restated Certificate of Incorporation (an “Amendment”) an amount equal to

the pro rata share of the Property relating to the common stock for which such Public Stockholders have exercised conversion rights in

connection with such Amendment.”

3. No Further Amendment. The parties hereto

agree that except as provided in this Amendment Agreement, the Trust Agreement shall continue unmodified, in full force and effect and

constitute legal and binding obligations of all parties thereto in accordance with its terms. This Amendment Agreement forms an integral

and inseparable part of the Trust Agreement.

4. References. All references to the “Trust

Agreement” (including “hereof,” “herein,” “hereunder,” “hereby”

and “this Agreement”) in the Trust Agreement shall refer to the Trust Agreement as amended by this Amendment Agreement.

Notwithstanding the foregoing, references to the date of the Trust Agreement (as amended hereby) and references in the Trust Agreement

to “the date hereof,” “the date of this Trust Agreement” and terms of similar import shall in all

instances continue to refer to February 10, 2021.

5. Governing Law; Jurisdiction. This Amendment

Agreement shall be governed by and construed and enforced in accordance with the laws of the State of New York, without giving effect

to conflicts of law principles that would result in the application of the substantive laws of another jurisdiction. The parties hereto

consent to the jurisdiction and venue of any state or federal court located in the City of New York, State of New York, for purposes of

resolving any disputes under this Amendment Agreement. AS TO ANY CLAIM, CROSS-CLAIM OR COUNTERCLAIM IN ANY WAY RELATING TO THIS AMENDMENT

AGREEMENT, EACH PARTY WAIVES THE RIGHT TO TRIAL BY JURY.

6. Counterparts. This Amendment Agreement may

be executed in several original or electronic transmission or facsimile counterparts, each of which shall constitute an original, and

together shall constitute but one instrument.

7. Other Miscellaneous Terms. The provisions

of Sections 7(e), 6(f) and 6(g) of the Trust Agreement shall apply mutatis mutandis to this Amendment Agreement, as if set forth

in full herein.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused

this Amendment Agreement to be duly executed by their duly authorized representatives effective as of the Effective Date.

| |

CONTINENTAL STOCK TRANSFER &

TRUST COMPANY, as Trustee |

| |

|

|

| |

By: |

/s/

Francis Wolf |

| |

Name: |

Francis Wolf |

| |

Title: |

Vice President |

IN WITNESS WHEREOF, the parties hereto have caused

this Amendment Agreement to be duly executed by their duly authorized representatives effective as of the Effective Date.

| |

Goal Acquisitions Corp. |

| |

|

|

| |

By: |

/s/

Harvey Schiller |

| |

Name: |

Harvey Schiller |

| |

Title: |

Chief Executive Officer |

Goal Acquisition (NASDAQ:PUCKU)

Historical Stock Chart

From Apr 2024 to May 2024

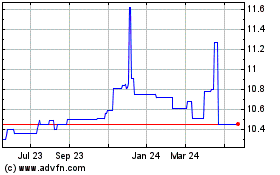

Goal Acquisition (NASDAQ:PUCKU)

Historical Stock Chart

From May 2023 to May 2024