Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

13 November 2024 - 9:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-41734

Prestige Wealth Inc.

Suite 3201, Champion Tower

3 Garden Road, Central

Hong Kong

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

On November 12, 2024, Prestige Wealth Inc. (the

“Company”) entered into a definitive acquisition agreement pursuant to which PWM will purchase all shares of Tokyo Bay Management

Inc. (“Tokyo Bay”), a company incorporated under the laws of the British Virgin Islands. The total purchase price is US$1,500,000,

subject to customary closing purchase price adjustments, in the form of 2,500,000 newly issued Class B ordinary shares of the Company

at a price per Class B ordinary share of US$0.60 to the seller and key employees of Tokyo Bay. The Company will also grant warrants to

purchase 1,875,000 Class A ordinary shares of the Company at an exercise price per share equal to US$0.72 to the seller parties. The warrants

will become exercisable on the six-month anniversary of the issuance date and will expire on the fifth anniversary from the date on which

they become exercisable. In addition, key employees will be retained and continue to be employed by Tokyo Bay after closing of the transaction.

The acquisition agreement also includes a third-year period non-competition and non-solicitation covenants from the seller parties. Upon

consummation of the acquisition of Tokyo Bay, that certain business development & marketing agreement by and between the Company and

Tokyo Bay dated as of June 24, 2024 will be terminated. The acquisition of Tokyo Bay is expected to close in the fourth quarter of 2024

and will enhance the Company’s strategy and development in Asia wealth management industry.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Prestige Wealth Inc. |

| |

|

|

| Date: November 12, 2024 |

By: |

/s/ Hongtao Shi |

| |

Name: |

Hongtao Shi |

| |

Title: |

Chief Executive Officer, Director, and

Chairman of the Board of Directors |

2

Exhibit 99.1

Prestige Wealth Inc. Announces Acquisition

of Tokyo Bay

Hong Kong, November 13,

2024 /GlobeNewswire/ -- Prestige Wealth Inc. (NASDAQ: PWM) (“PWM”, or the “Company”), a wealth management and

asset management services provider based in Hong Kong, today announced that, on November 12, 2024, it entered into a definitive acquisition

agreement pursuant to which PWM will purchase all shares of Tokyo Bay Management Inc. (“Tokyo Bay”), a company incorporated

under the laws of the British Virgin Islands. The total purchase price is US$1,500,000, subject to customary closing purchase price adjustments,

in the form of 2,500,000 newly issued Class B ordinary shares of the Company at a price per Class B ordinary share of US$0.60 to the seller

and key employees of Tokyo Bay. The Company will also grant warrants to purchase 1,875,000 Class A ordinary shares of the Company at an

exercise price per share equal to US$0.72 to the seller parties. The warrants will become exercisable on the six-month anniversary of

the issuance date and will expire on the fifth anniversary from the date on which they become exercisable. In addition, key employees

will be retained and continue to be employed by Tokyo Bay after closing of the transaction. The acquisition agreement also includes a

third-year period non-competition and non-solicitation covenants from the seller parties. Upon consummation of the acquisition of Tokyo

Bay, that certain business development & marketing agreement by and between PWM and Tokyo Bay dated as of June 24, 2024 will be terminated.

The acquisition of Tokyo Bay is expected to close in the fourth quarter of 2024 and will enhance PWM’s strategy and development

in Asia wealth management industry.

About Prestige Wealth Inc.

Prestige Wealth Inc. is a wealth management and

asset management services provider based in Hong Kong, assisting its clients in identifying and purchasing well-matched wealth management

products and global asset management products. With a focus on quality service, the Company has retained a loyal customer base consisting

of high-net-worth and ultra-high-net-worth clients in Asia. Through the Company’s wealth management service, it introduces clients

to customized wealth management products and provides them with tailored value-added services. The Company provides asset management services

via investment funds that it manages and also provides discretionary account management services and asset management-related advisory

services to clients. For more information, please visit the Company’s website: http://ir.prestigewm.hk.

About Tokyo Bay

Tokyo Bay is a company based in Tokyo, Japan.

Founded by experienced professionals, the Tokyo Bay team has accumulated extensive premium client resources and local market knowledge

over the past years, providing wealth management services, family affairs services, lifestyle management services and related value-added

services to high-net-worth clients in Japan.

Forward-Looking Statements

Certain statements in this announcement are forward-looking

statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current

expectations and projections about future events that the Company believes may affect its financial condition, results of operations,

business strategy and financial needs. Investors can find many (but not all) of these statements by the use of words such as “approximates,”

“believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,”

“intends,” “plans,” “will,” “would,” “should,” “could,” “may”

or other similar expressions in this press release. They include statements about the Company’s plans for the business of InnoSphere

Tech and Tokyo Bay; anticipated financial and other results from the acquisition of InnoSphere Tech and Tokyo Bay and its integration

into PWM; expectations regarding revenue and cost synergies resulting from the acquisition; discussion of other strategic initiatives

and related actions; and beliefs, expectations, intentions and strategies, among other things. Forward-looking statements are based on

management’s current beliefs, expectations and assumptions, and involve a number of known and unknown risks and uncertainties, many of

which are out of PWM’s control.

The Company undertakes no obligation to update

or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations,

except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results

may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results

in the Company’s filings with U.S. Securities and Exchange Commission.

For more information, please contact:

Prestige Wealth Inc.

Investor Relations Department

Email: ir@prestigefh.com

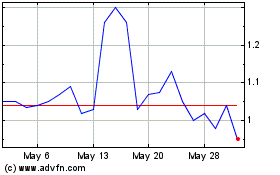

Prestige Wealth (NASDAQ:PWM)

Historical Stock Chart

From Dec 2024 to Jan 2025

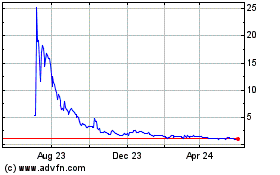

Prestige Wealth (NASDAQ:PWM)

Historical Stock Chart

From Jan 2024 to Jan 2025