Pyxis Tankers Announces Completion of Common Share Repurchase Program & Update on Chartering Activity

31 January 2025 - 12:00AM

Maroussi, Greece – January 30, 2025 – Pyxis

Tankers Inc. (NASDAQ Cap Mkts: PXS), (“we”, “our”, “us”, the

“Company” or “Pyxis Tankers”), an international shipping company,

announced today key shareholder and chartering updates.

- The

Company has completed its authorized expanded $3.0 million common

share repurchase program. Since summer 2023, we have acquired

730,683 common shares in the open market at an average cost of

$4.03 per share, excluding commissions. As of January 29, 2025,

there were 10,485,865 common shares of the Company outstanding,

with a public float of approximately 4.37 million PXS shares.

- In 2024, the Company also redeemed all of its outstanding

7.75% Series A Cumulative Convertible Preferred Stock, which

eliminated potential shareholder dilution of 1,799,871 common

shares. Thus, the Company has spent approximately $13.1 million, in

total, for equity re-purchases in order to save potential

shareholder dilution of 2.53 million common shares in aggregate or

19.4% of diluted common shares.

- As of January 29, 2025, 72% of available days in the

first quarter, 2025 for our three eco-MR product tankers were

booked at an average estimated daily time charter equivalent rate

(“TCE”) of $24,750 per vessel. As of the same date, 68% of

available days in the first quarter of 2025, for our three dry-bulk

vessels were booked at an average estimated daily TCE of

$15,400.

Pyxis Tankers Fleet (as of January 29, 2025)

|

Vessel Name |

Shipyard |

Vessel type |

Carrying Capacity(dwt) |

Year Built |

Type of charter |

Charter(1) Rate($ per day) |

AnticipatedEarliestRedelivery

Date |

|

| |

| |

| Tanker fleet |

|

|

|

|

|

|

|

|

| Pyxis Lamda |

SPP / S. Korea |

MR2 |

50,145 |

2017 |

Spot |

n/a |

n/a |

|

| Pyxis Theta (2) |

SPP / S. Korea |

MR2 |

51,795 |

2013 |

Time |

$ 22,000 |

Dec

2025 |

|

| Pyxis Karteria (3) |

Hyundai / S. Korea |

MR2 |

46,652 |

2013 |

Time |

24,500 |

Sep

2025 |

|

| |

|

|

148,592 |

|

|

|

|

|

| Dry-bulk

fleet |

|

|

|

|

|

|

|

|

| Konkar Ormi (4) |

SKD / Japan |

Ultramax |

63,520 |

2016 |

Time |

13,650 |

Mar

2025 |

|

| Konkar Asteri (5) |

JNYS / China |

Kamsarmax |

82,013 |

2015 |

Time |

12,850 |

Mar 2025 |

|

| Konkar Venture (6) |

JNYS / China |

Kamsarmax |

82,099 |

2015 |

Time |

10,000 |

Feb 2025 |

|

| |

|

|

227,632 |

|

|

|

|

|

- These tables

present gross rates in U.S.$ and do not reflect any commissions

payable.

-

“Pyxis Theta” is fixed on a time charter for 12 months +/- 30 days,

at $22,000 per day.

-

“Pyxis Karteria” is fixed on a time charter for 12 months +/- 30

days, at $24,500 per day.

-

“Konkar Ormi” is fixed on a time charter for 60 – 70 days, at

$13,650 per day, plus a $365,000 ballast bonus, plus an estimated

scrubber compensation of $69,000

-

“Konkar Asteri” is fixed on a time charter for 60 – 70 days, at

$12,850 per day, plus a $285,000 ballast bonus, plus an estimated

scrubber compensation of $93,000.

-

“Konkar Venture” was fixed on time charter for min 120 and max 130

days, at $10,000 per day.

About Pyxis Tankers Inc.

The Company currently owns a modern fleet of six

mid-sized eco-vessels, which are engaged in the seaborne

transportation of a broad range of refined petroleum products and

dry bulk commodities and consists of three MR product tankers, one

Kamsarmax bulk carrier and controlling interests in two dry bulk

joint ventures of a sister-ship Kamsarmax and an Ultramax. The

Company is positioned to opportunistically expand and maximize its

fleet of eco-efficient vessels due to significant capital

resources, competitive cost structure, strong customer

relationships and an experienced management team whose interests

are aligned with those of its shareholders. For more information,

visit: http://www.pyxistankers.com. The information on or

accessible through the Company’s website is not incorporated into

and does not form a part of this release.

Forward Looking Statements

This press release includes forward-looking

statements intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995

in order to encourage companies to provide prospective information

about their business. These statements include statements about our

plans, strategies, goals financial performance, prospects or future

events or performance and involve known and unknown risks that are

difficult to predict. As a result, our actual results, performance

or achievements may differ materially from those expressed or

implied by these forward-looking statements. In some cases, you can

identify forward-looking statements by the use of words such as

“may,” “could,” “expects,” “seeks,” “predict,” “schedule,”

“projects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “targets,” “continue,” “contemplate,” “possible,”

“likely,” “might,” “will, “should,” “would,” “potential,” and

variations of these terms and similar expressions, or the negative

of these terms or similar expressions. All statements that are not

statements of either historical or current facts, including among

other things, our expected financial performance, expectations or

objectives regarding future and market charter rate expectations

and, in particular, the effects of the war in the Ukraine and the

Red Sea conflict, on our financial condition and operations as well

as the nature of the product tanker and dry-bulk industries, in

general, are forward-looking statements. Such forward-looking

statements are necessarily based upon estimates and assumptions.

Although the Company believes that these assumptions were

reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond the Company’s

control, the Company cannot assure you that it will achieve or

accomplish these expectations, beliefs or projections. The

Company’s actual results may differ, possibly materially, from

those anticipated in these forward-looking statements as a result

of certain factors, including changes in the Company’s financial

resources and operational capabilities and as a result of certain

other factors listed from time to time in the Company’s filings

with the U.S. Securities and Exchange Commission. The Company is

reliant on certain independent and affiliated managers for its

operations, including most recently an affiliated private company,

Konkar Shipping Agencies, S.A., for the management of its dry-bulk

vessels. For more information about risks and uncertainties

associated with our business, please refer to our filings with the

U.S. Securities and Exchange Commission, including without

limitation, under the caption “Risk Factors” in our Annual Report

on Form 20-F for the fiscal year ended December 31, 2023. We

caution you not to place undue reliance on any forward-looking

statements, which are made as of the date of this press release. We

undertake no obligation to update publicly any information in this

press release, including forward-looking statements, to reflect

actual results, new information or future events, changes in

assumptions or changes in other factors affecting forward-looking

statements, except to the extent required by applicable laws.

CompanyPyxis Tankers Inc. 59 K. Karamanli Street

Maroussi, 15125 Greece info@pyxistankers.com

Visit our website at www.pyxistankers.com

Company ContactHenry Williams Chief Financial Officer

Tel: +30 (210) 638 0200 / +1 (516) 455-0106

Email: hwilliams@pyxistankers.com

Source: Pyxis Tankers Inc.

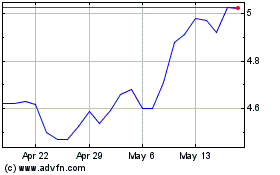

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Jan 2025 to Feb 2025

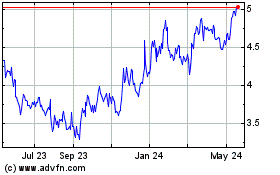

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Feb 2024 to Feb 2025