Maroussi, Greece, August 12, 2024 – Pyxis

Tankers Inc. (NASDAQ Cap Mkts: PXS), (“we”, “our”, “us”, the

“Company” or “Pyxis Tankers”), an international shipping company,

today announced unaudited results for the three and six month

periods ended June 30, 2024.

Summary

For the three months ended June 30, 2024, our

Revenues, net were $13.9 million. For the same period, our time

charter equivalent (“TCE”) revenues were $12.2 million, an increase

of $3.6 million, or 41.9%, over the comparable period in 2023. Our

net income attributable to common shareholders for the three months

ended June 30, 2024, was $5.0 million, an increase of

$2.3 million over the comparable period in 2023. For the

second quarter of 2024, the net income per common share was $0.48

basic and $0.43 diluted compared to the net income per common share

of $0.25 basic and $0.23 diluted for the same period in 2023. Our

Adjusted EBITDA for the three months ended June 30, 2024, was $8.0

million, an increase of $2.7 million over the comparable

period in 2023. Please see “Non-GAAP Measures and Definitions”

below.

On June 20, 2024, the Company paid $2.5 million

for the redemption of 100,000 shares of our Series A Cumulative

Convertible Preferred Stock (NASDAQ Cap Mkts: PXSAP). Upon this

redemption, 100,000 PXSAP shares were canceled by the Company and

it is no longer obligated to pay dividends in respect of these

shares. After this partial redemption, there are 303,631 PXSAP

shares outstanding, which are convertible into 1,355,496 common

shares if fully converted, a reduction of 446,429 in fully-diluted

common shares.

On June 28, 2024, we closed on our previously

announced dry bulk joint venture with an entity related to our

Chairman and Chief Executive Officer for the acquisition of an

82,099 dwt eco-efficient Kamsarmax built in 2015 at Jiangsu New

Yangzi Shipbuilding. The $30.0 million purchase price for the

“Konkar Venture”, which is fitted with a ballast water treatment

system, was funded by a combination of secured bank debt of $16.5

million, $12.0 million cash, of which the Company contributed $7.3

million in cash, and the issuance of 267,857 PXS restricted common

shares to the related party seller. Pyxis owns a 60% controlling

ownership interest in the joint venture. The five year amortizing

bank loan is priced at Term SOFR +2.15% and is secured by, among

other things, the vessel. The “Konkar Venture”, is a sister

ship to the Company’s eco-efficient “Konkar Asteri”, and is

continuing its employment under the existing time charter through

mid-August, 2024 at a contracted gross daily rate of $18,000.

On July 30, 2024, we agreed with an existing

lender to refinance the Seventhone Corp debt. The amended loan

agreement provides a five year amortizing bank loan, due July 2029,

with similar quarterly repayments, priced at SOFR plus 2.40% (from

3.35%) and is secured by, among other things, the vessel “Pyxis

Theta”. In addition, the same lender agreed to reduce the interest

margin from 3.15% to 2.40% applicable to the Eleventhone Corp.

(“Pyxis Lamda”) credit facility which matures in December 2026. As

of June 30, 2024, the outstanding balance of these two separate

loans aggregated $27.3 million, and the average reduction in

interest margin was 85 basis points.

Valentios Valentis, our Chairman and

CEO, commented:

“We are pleased to report strong results for the

second fiscal quarter of 2024 with revenues, net of $13.9 million

and net income attributable to common shareholders of $5.0

million with basic earnings per share of $0.48 basic and of $0.43

diluted. In the quarter ended June 30, 2024, the product tanker

sector continued to experience robust chartering activity driven by

global demand for transportation fuels, relatively low inventories

of many petroleum products, positive refinery activity, combined

with the significant effect of the ongoing conflicts

(Russia/Ukraine and Israeli/Hamas) which has led to continued

market dislocation of shifting trade patterns and ton-mile

expansion of seaborne cargo transportation. During the second

quarter, we reported an average daily TCE for our MRs of $32,868.

Despite the usual expected seasonal slowdown, the product tanker

environment remains strong, and as of August 9, 2024, 68%

of our MR available days in the quarter ending September 30, 2024,

were booked at an average estimated TCE of $33,850 per day. We now

own and operate three modern eco-efficient MRs, two of which are

currently employed under short-term time charters and one on spot

voyage. On the dry side, chartering conditions have also been

constructive. For the quarter ended June 30, 2024, our three

mid-sized eco-efficient bulk carriers generated an average TCE of

$22,333 per day. All of our dry bulk vessels are currently employed

under short-term time charters, and as of August 9, 2024, the

average estimated TCE was $17,200/d with bookings of 76% of

available days in the 2024 third quarter.

Tanker asset values continue to appreciate

reaching 10 year historical highs. We continue to monitor this

market for compelling acquisition opportunities. However, we

decided to further expand in the dry bulk sector and in late June,

we closed our second joint venture, where we acquired a 60%

controlling interest in the 2015-built Kamsarmax, the

“Konkar Venture,” and we now operate fleet of six mid-sized

eco-vessels under a mixed chartering strategy.

We anticipate the chartering environment for

product tankers and dry-bulk carriers to remain constructive for

the near-term. Solid global demand for seaborne cargoes across a

broad range of refined petroleum products and dry-bulk commodities

is expected to continue with the respective orderbooks remaining

relatively manageable. Longer-term supply/demand fundamentals

remain very supportive. Even though inflation is decelerating with

the prospect of interest rate cuts on the horizon and continued

moderate global economic growth, the uncertainty surrounding

macro-economic conditions and global events necessitate continued

prudent management. Besides potential vessel acquisitions, we

expect to continue to pursue additional value-enhancing

transactions including the repurchase of additional common shares

under our authorized program, while maintaining operational and

capital discipline."

Results for the three months ended June 30, 2023 and

2024

Amounts relating to variations in

period–on–period comparisons shown in this section are derived from

the interim consolidated financials presented below (Amounts are

presented in million U.S. dollars, rounded to the nearest one

hundred thousand, except as otherwise noted).

For the three months ended June 30, 2024, we

reported Revenues, net of $13.9 million, or 46.3% higher than $9.5

million in the comparable 2023 period. Our net income attributable

to common shareholders was $5.0 million, or $0.48 basic and $0.43

diluted net income per common share, compared to a net income

attributable to common shareholders of $2.8 million, or $0.25 basic

and $0.23 diluted net income per common share, for the same period

in 2023. The weighted average number of basic common shares

decreased by 0.35 million to 10.45 million in the most recent

period versus the second quarter of 2023. The weighted average

number of diluted common shares also decreased in 2024 to 12.1

million shares, which assumes the full conversion of all the

outstanding Preferred Stock in the most recent period. The average

MR daily TCE rate during the second quarter of 2024 was $32,868 or

31.5% higher than the $25,000 MR daily TCE rate for the same

period in 2023, due to higher demurrage income from spot chartering

activity and better market conditions. The new dry-bulkers

acquired, the Ultramax carrier in September 2023 and the two

Kamsarmaxes in February 2024 and June 2024, had an average TCE rate

of $22,333 for the second quarter of 2024. The revenue mix of the

MR tankers for the second quarter of 2024 was 56% from short-term

time charters and 44% from spot market employment, while the

dry-bulk carriers were hired for short-term time charters. Adjusted

EBITDA increased by $2.7 million to $8.0 million in the second

quarter of 2024 from $5.2 million for the same period in 2023

primarily due to 94 higher ownership days for our fleet from 458 in

the most recent period compared to 364 for the same period in

previous year and higher average TCE rates.

| Tanker

fleet |

|

|

Three monthsended June 30, |

|

Six monthsended June 30, |

|

(Amounts in thousands of U.S. dollars, except for daily TCE

rates) |

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

| |

|

|

|

|

|

|

|

|

|

| MR Revenues, net 1 |

$ |

|

9,505 |

|

10,137 |

|

21,121 |

|

19,824 |

| MR Voyage related costs and commissions

1 |

|

|

(855) |

|

(1,197) |

|

(3,257) |

|

(2,492) |

| MR Time charter equivalent revenues 1,

3 |

$ |

|

8,650 |

|

8,940 |

|

17,864 |

|

17,332 |

| |

|

|

|

|

|

|

|

|

|

| MR Total operating days 1 |

|

|

346 |

|

272 |

|

738 |

|

536 |

| MR Daily Time Charter Equivalent rate

1, 3 |

$/d |

|

25,000 |

|

32,868 |

|

24,207 |

|

32,337 |

| Average number of MR vessels 1 |

|

|

4.0 |

|

3.0 |

|

4.5 |

|

3.0 |

| |

|

|

|

|

|

|

|

|

|

|

Dry-bulk fleet |

|

|

Three monthsended June 30, |

|

Six monthsended June 30, |

|

(Amounts in thousands of U.S. dollars, except for daily TCE

rates) |

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

| |

|

|

|

|

|

|

|

|

|

| Dry-bulk Revenues, net 2 |

$ |

|

n/a |

|

3,774 |

|

n/a |

|

5,891 |

| Dry-bulk Voyage related costs and

commissions 2 |

|

|

n/a |

|

(468) |

|

n/a |

|

(823) |

| Dry-bulk charter equivalent revenues 2,

3 |

$ |

|

n/a |

|

3,306 |

|

n/a |

|

5,068 |

| |

|

|

|

|

|

|

|

|

|

| Dry-bulk Total operating days 2 |

|

|

n/a |

|

148 |

|

n/a |

|

252 |

| Dry-bulk Daily Time Charter Equivalent

rate 2,3 |

$/d |

|

n/a |

|

22,333 |

|

n/a |

|

20,111 |

| Average number of Dry-bulk vessels

2 |

|

|

n/a |

|

2.0 |

|

n/a |

|

1.8 |

| |

|

|

|

|

|

|

|

|

|

| Total

fleet |

|

|

Three monthsended June 30, |

|

Six monthsended June 30, |

|

(Amounts in thousands of U.S. dollars, except for daily TCE

rates) |

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

| |

|

|

|

|

|

|

|

|

|

| Revenues, net 1, 2 |

$ |

|

9,505 |

|

13,911 |

|

21,121 |

|

25,715 |

| Voyage related costs and commissions 1,

2 |

|

|

(855) |

|

(1,665) |

|

(3,257) |

|

(3,315) |

| Charter equivalent revenues 1, 2,

3 |

$ |

|

8,650 |

|

12,246 |

|

17,864 |

|

22,400 |

| |

|

|

|

|

|

|

|

|

|

| Total operating days 1, 2 |

|

|

346 |

|

420 |

|

738 |

|

788 |

| Daily Time Charter Equivalent rate 1,

2, 3 |

$/d |

|

25,000 |

|

29,156 |

|

24,207 |

|

28,427 |

| Average number of vessels

1,2 |

|

|

4.0 |

|

5.0 |

|

4.5 |

|

4.8 |

1 a) The eco-efficient MR “Pyxis Epsilon”

was sold to an unaffiliated buyer on December 15, 2023.2 a) The

dry-bulker “Konkar Ormi” was delivered on September 14, 2023 and

commenced her initial charter on October 5, 2023. b) The

dry-bulker “Konkar Asteri” was delivered on February 15, 2024 and

commenced her initial charter on February 29, 2024. c) The

dry-bulker “Konkar Venture” was delivered on June 28, 2024 and is

continuing its employment under the existing time charter through

mid-August.

3 Subject to rounding; please see “Non-GAAP

Measures and Definitions” below.

Management’s Discussion & Analysis

of Financial Results for the Three Months ended June 30, 2023 and

2024

Amounts relating to variations in

period–on–period comparisons shown in this section are derived from

the interim consolidated financials presented below (Amounts are

presented in million U.S. dollars, rounded to the nearest one

hundred thousand, except as otherwise noted).

Revenues, net: Revenues,

net of $13.9 million for the three months ended June 30, 2024,

represented an increase of $4.4 million, or 46.3%, from $9.5

million in the comparable period of 2023. In the second quarter of

2024, our average daily TCE rate for our MR fleet was $32,868, a

$7,868 per day increase from $25,000 for the same period in 2023

and for our recent acquired dry-bulk fleet was $22,333 per day.

These changes were the result of higher demurrage income due to MR

spot chartering activity in the second quarter of 2024 and better

market conditions. In the most recent period, our MRs generated

utilization of 99.6% in comparison to 98.6% in the same quarter of

2023. Our dry-bulk carriers for the three months ended June 30,

2024 achieved 80.0% utilization. Total fleet ownership days in the

second quarter of 2024 were 458 on an average of 5.0 vessels

compared with 364 days on an average of 4.0 vessels for the same

period of 2023. This increase was due to the sale of the “Pyxis

Epsilon” in December 2023 counterbalanced by the acquisitions of

the new dry-bulk carriers “Konkar Ormi”, “Konkar Asteri” and

“Konkar Venture” in September 2023, February 2024 and June 2024,

respectively.

Voyage related costs and

commissions: Voyage related costs

and commissions of $1.7 million in the second quarter of 2024,

represented an increase of $0.8 million, or 90.7%, from $0.9

million in the same period of 2023, primarily as a result of higher

spot employment days for our vessels, including idle days, from 48

days in the second quarter in 2023 to 128 days in the same period

of 2024. Under spot charters, all voyage expenses are typically

borne by us rather than the charterer and a decrease in spot

employment results in decreased voyage related costs and

commissions.

Vessel operating

expenses: Vessel operating expenses of

$3.0 million for the three-month period ended June 30, 2024,

represented an increase of $0.6 million, or 24.3% compared to same

period in 2023, and reflected 94 more vessel ownership days and

inflationary cost pressures.

General and administrative

expenses: General and administrative

expenses of $0.8 million for the second quarter of 2024 increased

by 17.1% compared to $0.7 million in the same period of 2023. The

increase was attributable to higher professional fees and an

increase in administrative fees that adjusted by 3.50% to reflect

the 2024 inflation rate in Greece.

Management fees: For the three

months ended June 30, 2024, management fees charged by our tanker

ship manager, Pyxis Maritime Corp. (“Maritime”), our dry-bulk ship

manager Konkar Shipping Agencies S.A. (“Konkar Agencies”), both

affiliated entities of our Chairman and Chief Executive Officer,

Mr. Valentis, and from International Tanker Management Ltd.

(“ITM”), the technical manager of our MRs, increased by $0.1

million, reflecting 94 more vessel ownership days compared to the

same period in 2023.

Amortization of special survey

costs: Amortization of special survey

costs of $0.1 million for the quarter ended June 30, 2024,

remained flat compared to the same period of 2023.

Depreciation:

Depreciation of $1.6 million for the quarter that ended June 30,

2024, represented an increase of $0.4 million, or 32.6%

compared to $1.2 million in 2023 and reflected additional

depreciation for the newly acquired bulker vessels “Konkar Ormi”,

“Konkar Asteri” and “Konkar Venture” partially offset by

depreciation ceasing of the sold tanker “Pyxis Epsilon”.

Interest and finance costs:

Interest and finance costs for the quarter ended June 30, 2024,

were $1.6 million compared to $1.3 million in the comparable

period in 2023, an increase of $0.3 million, or 20.0%. This

increase was attributed to higher average debt levels offset by

lower LIBOR/SOFR referenced interest rates paid on all the floating

rate bank debt. On June 27, 2024, the Company completed the debt

financing of the newly acquired dry-bulk carrier

“Konkar Venture”, our 2015 built Kamsarmax with a $16.5

million five year secured loan from an existing lender. The loan is

priced at SOFR plus 2.15%.

Interest income: Interest

income of $0.6 million was received during the quarter ended June

30, 2024 from the Company’s short term time deposits compared to

$0.4 million for the same period in 2023 due to higher cash

balances.

Management’s Discussion and Analysis of

Financial Results for the Six Months ended June 30, 2023 and

2024

Amounts relating to variations in

period–on–period comparisons shown in this section are derived from

the interim consolidated financials presented below (Amounts are

presented in million U.S. dollars, rounded to the nearest one

hundred thousand, except as otherwise noted).

Revenues, net: Revenues, net of

$25.7 million for the six months ended June 30, 2024, represented

an increase of $4.6 million, or 21.8%, from $21.1 million in the

comparable period of 2023. In the first half of 2024, our MR daily

TCE rate for our three MRs was $32,337, a $8,130 per day increase

from the same 2023 period as a result of higher demurrage income

due to MR spot chartering activity and better market conditions.

For the 2024 period, our dry-bulk daily TCE rate for our carriers

was $20,111.

Voyage related costs and

commissions: Voyage related costs and commissions of $3.3

million for the six months ended June 30, 2024, remained at the

same level compared to the 2023 period. For the six months ended

June 30, 2024, our MRs were on spot charters or unfixed for 182

days in total, compared to 169 days in 2023. This higher spot

chartering activity for our MRs contribute higher voyage costs

which are typically borne by us rather than the charterer, thus an

increase in spot employment results in increased voyage related

costs and commissions. In the first six-months of 2024 these higher

expenses were offset by lower bunker fuel costs.

Vessel operating expenses:

Vessel operating expenses of $6.1 million for the six months ended

June 30, 2024, represented a $0.3 million or 5.6% increase compared

to $5.8 million for the same period in 2023. This increase was

mainly attributed to the 61-day increase in ownership days from 806

for the six months ended June 30, 2023 to 867 for the 2024

period.

General and administrative

expenses: General and administrative expenses of $1.5

million for the six months ended June 30, 2024, represented a

decrease of $0.5 million or 22.7%, from $2.0 million in the

comparable period in 2023, mainly due to the performance bonus of

$0.6 million that paid in the first quarter of 2023 to Maritime,

partially offset by increased administrative fees which were

adjusted by 3.50% to reflect the 2024 inflation rate in Greece.

Management fees: For the six

months ended June 30, 2024, management fees remained at the same

level with the comparable period of 2023. Management fees represent

the charges by Maritime, Konkar Agencies and ITM.

Amortization of special survey

costs: Amortization of special survey costs of $0.2

million for the six months ended June 30, 2024, remained stable

compared to the same period in 2023.

Depreciation: Depreciation of

$3.1 million for the six months ended June 30, 2024, increased by

$0.5 million or 17.5% compared to $2.6 million in the comparable

period of 2023. The increase was attributed to the additions of

newly acquired dry-bulk vessels partially counterbalanced by the

ceasing of depreciation from the sales of tankers

“Pyxis Malou” during the first quarter of 2023 and “Pyxis

Epsilon” in late 2023.

Gain from the sale of vessels,

net: During the six months ended June 30, 2023, we

recorded a gain from the sale of the “Pyxis Malou” of $8.0 million,

which occurred in the first quarter of 2023.

Loss from debt extinguishment:

During the six months ended June 30, 2023, we recorded a loss from

debt extinguishment of approximately $0.3 million reflecting the

write-off of the remaining unamortized balance of deferred

financing costs, which were associated with the first quarter loan

repayments from the sale of the “Pyxis Malou” and debt refinancing

of the “Pyxis Karteria”.

Interest and finance costs:

Interest and finance costs for the six months ended June 30, 2024,

were $3.1 million, compared to $2.8 million in the comparable

period in 2023, an increase of $0.3 million, or 9.4%. Despite lower

LIBOR/SOFR indexed rates paid on all the floating rate bank debt,

this increase was primarily attributable to higher average debt

levels. On February 15, 2024, we completed the bank financing of

the newly acquired dry-bulk carrier, “Konkar Asteri” with a five

year secured loan of $14.5 million. On June 27, 2024, the Company

completed the debt financing of the newly acquired dry-bulk carrier

“Konkar Venture” with a $16.5 million five year secured loan

from an existing lender. Also, on June 28, 2024, we agreed with an

existing lender to refinance the Seventhone Corp.

(“Pyxis Theta”) debt. The amended agreement will provide a

five year amortizing bank loan with similar quarterly repayment and

reduced pricing at SOFR plus 2.40%. In addition, the same bank

agreed to reduce the interest rate margin from 3.15% to 2.40% on

the outstanding $16.5 million loan to the Eleventhone Corp. (“Pyxis

Lamda”).

Interest income: Interest

income of $1.3 million was received during the six-month period

ended June 30, 2024 from the Company’s short term time deposits

compared to $0.4 million for the same period in 2023. The increase

was a result of higher available cash balances during the most

recent period.

Interim Consolidated Statements of Comprehensive Net

IncomeFor the three months ended June 30, 2023 and

2024(Expressed in thousands of U.S. dollars, except for share and

per share data)

| |

|

|

Three months ended June 30, |

| |

|

|

2023 |

|

2024 |

| |

|

|

|

|

|

| Revenues, net |

|

|

$

9,505 |

|

$

13,910 |

| |

|

|

|

|

|

| Expenses: |

|

|

|

|

|

| Voyage related costs and

commissions |

|

|

(873) |

|

(1,665) |

| Vessel operating expenses |

|

|

(2,453) |

|

(3,049) |

| General and administrative

expenses |

|

|

(697) |

|

(815) |

| Management fees, related parties |

|

|

(164) |

|

(272) |

| Management fees, other |

|

|

(149) |

|

(122) |

| Amortization of special survey

costs |

|

|

(91) |

|

(97) |

| Depreciation |

|

|

(1,232) |

|

(1,634) |

| Allowance for credit losses |

|

|

75 |

|

— |

| Loss from the sale of vessels, net |

|

|

(1) |

|

— |

| Operating income |

|

|

3,920 |

|

6,256 |

| |

|

|

|

|

|

| Other expenses: |

|

|

|

|

|

| Interest and finance costs |

|

|

(1,317) |

|

(1,580) |

| Interest

income |

|

|

352 |

|

607 |

| Total other expenses,

net |

|

|

(965) |

|

(973) |

| |

|

|

|

|

|

| Net income |

|

|

$

2,955 |

|

$

5,283 |

| |

|

|

|

|

|

| Gain attributable to non-controlling

interest |

|

|

— |

|

(91) |

| Net income attributable to

Pyxis Tankers Inc. |

|

|

$

2,955 |

|

$

5,192 |

| |

|

|

|

|

|

| Dividend Series A Convertible Preferred

Stock |

|

|

(199) |

|

(174) |

| Net income attributable to

common shareholders |

|

|

$

2,756 |

|

$

5,018 |

| |

|

|

|

|

|

| Net income per common share, basic |

|

|

$

0.25 |

|

$

0.48 |

| Net income per common share,

diluted |

|

|

$

0.23 |

|

$

0.43 |

| |

|

|

|

|

|

| Weighted average number of common

shares, basic |

|

|

10,801,316 |

|

10,451,364 |

| Weighted average number of common

shares, diluted |

|

|

12,624,301 |

|

12,095,610 |

Interim Consolidated Statements of Comprehensive Net

IncomeFor the six months ended June 30, 2023 and

2024(Expressed in thousands of U.S. dollars, except for share and

per share data)

| |

|

Six months ended June 30, |

| |

|

2023 |

|

2024 |

| |

|

|

|

|

| Revenues, net |

$ |

21,121 |

$ |

25,715 |

| |

|

|

|

|

| Expenses: |

|

|

|

|

| Voyage related costs and

commissions |

|

(3,273) |

|

(3,315) |

| Vessel operating expenses |

|

(5,790) |

|

(6,116) |

| General and administrative

expenses |

|

(2,002) |

|

(1,546) |

| Management fees, related parties |

|

(330) |

|

(498) |

| Management fees, other |

|

(397) |

|

(244) |

| Amortization of special survey

costs |

|

(176) |

|

(194) |

| Depreciation |

|

(2,634) |

|

(3,095) |

| Allowance for credit losses |

|

75 |

|

— |

| Gain from the sale of vessels, net |

|

8,017 |

|

— |

| Operating income |

|

14,611 |

|

10,707 |

| |

|

|

|

|

| Other expenses,

net: |

|

|

|

|

| Loss from debt extinguishment |

|

(287) |

|

— |

| Loss from financial derivative

instruments |

|

(59) |

|

— |

| Interest and finance costs |

|

(2,808) |

|

(3,073) |

| Interest

income |

|

413 |

|

1,261 |

| Total other expenses,

net |

|

(2,741) |

|

(1,812) |

| |

|

|

|

|

| Net income |

$ |

11,870 |

$ |

8,895 |

| |

|

|

|

|

| Gain attributable to non-controlling

interest |

|

— |

|

(53) |

| Net

income attributable to Pyxis Tankers Inc. |

$ |

11,870 |

$ |

8,842 |

| |

|

|

|

|

| Dividend

Series A Convertible Preferred Stock |

|

(418) |

|

(383) |

| Net

income attributable to common shareholders |

$ |

11,452 |

$ |

8,459 |

| |

|

|

|

|

| Net income per common share, basic |

$ |

1.06 |

$ |

0.81 |

| Net income per common share,

diluted |

$ |

0.94 |

$ |

0.73 |

| |

|

|

|

|

| Weighted average number of common

shares, basic |

|

10,754,405 |

|

10,479,962 |

| Weighted average number of common

shares, diluted |

|

12,577,390 |

|

12,124,208 |

Consolidated Balance SheetsAs of December 31,

2023 and June 30, 2024(Expressed in thousands of U.S. dollars,

except for share and per share data)

| |

|

December 31, |

|

June 30, |

| |

|

2023 |

|

2024 |

| ASSETS |

|

|

|

|

| |

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

| Cash and cash equivalents |

$ |

34,539 |

$ |

25,411 |

| Short-term

investment in time deposits |

|

20,000 |

|

17,000 |

| Inventories |

|

957 |

|

2,111 |

| Trade accounts receivable, net |

|

4,964 |

|

5,216 |

| Due from related parties |

|

194 |

|

— |

| Prepayments and other current

assets |

|

226 |

|

1,359 |

| Total current

assets |

|

60,880 |

|

51,097 |

| |

|

|

|

|

| FIXED ASSETS,

NET: |

|

|

|

|

| Vessels, net |

|

99,273 |

|

143,833 |

| Advance for vessel acquisition |

|

2,663 |

|

— |

| Total fixed assets,

net |

|

101,936 |

|

143,833 |

| |

|

|

|

|

| OTHER NON-CURRENT

ASSETS: |

|

|

|

|

| Restricted cash, net of current

portion |

|

1,800 |

|

2,150 |

| Deferred dry-dock and special survey

costs, net |

|

1,622 |

|

1,432 |

| Prepayments and other non-current

assets |

|

75 |

|

75 |

| Total other non-current

assets |

|

3,497 |

|

3,657 |

| Total assets |

$ |

166,313 |

$ |

198,587 |

| |

|

|

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

|

| |

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

| Current portion of long-term debt, net

of deferred financing costs |

$ |

5,580 |

$ |

7,637 |

| Trade accounts payable |

|

1,695 |

|

1,936 |

| Due to related parties |

|

990 |

|

975 |

| Hire collected in advance |

|

1,173 |

|

877 |

| Accrued and other liabilities |

|

646 |

|

1,429 |

| Total current

liabilities |

|

10,084 |

|

12,854 |

| |

|

|

|

|

| NON-CURRENT

LIABILITIES: |

|

|

|

|

| Long-term debt, net of current portion

and deferred financing costs |

|

55,370 |

|

80,846 |

| Total non-current

liabilities |

|

55,370 |

|

80,846 |

| |

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

— |

|

— |

| |

|

|

|

|

| STOCKHOLDERS'

EQUITY: |

|

|

|

|

| Preferred stock ($0.001 par value;

50,000,000 shares authorized; of which 1,000,000 authorized Series

A Convertible Preferred Shares; 403,631 Series A Convertible

Preferred Shares issued and outstanding as at December 31,

2023 and 303,631 at June 30, 2024) |

|

— |

|

— |

| Common stock ($0.001 par value;

450,000,000 shares authorized; 10,542,547 shares issued and

outstanding as at December 31, 2023 and 10,458,767 at June

30, 2024, respectively) |

|

11 |

|

11 |

| Additional paid-in capital |

|

110,799 |

|

103,993 |

| Accumulated deficit |

|

(14,270) |

|

(5,819) |

| Total

equity attributable to Pyxis Tankers Inc. and

subsidiaries |

|

96,540 |

|

98,185 |

|

Non-controlling interest |

|

4,319 |

|

6,702 |

| Total stockholders'

equity |

|

100,859 |

|

104,887 |

| Total liabilities and

stockholders' equity |

$ |

166,313 |

$ |

198,587 |

Interim Consolidated Statements of Cash

FlowsFor the six months ended June 30, 2023 and

2024(Expressed in thousands of U.S. dollars)

| |

|

Six months ended June 30, |

| |

|

2023 |

|

2024 |

| Cash flows from operating

activities: |

|

|

|

|

| Net income |

$ |

11,870 |

$ |

8,895 |

| Adjustments to reconcile net income

to net cash provided by operating activities: |

|

|

|

|

| Depreciation |

|

2,634 |

|

3,095 |

| Amortization and write-off of special

survey costs |

|

176 |

|

194 |

| Allowance for credit losses |

|

(75) |

|

— |

| Amortization and write-off of financing

costs |

|

126 |

|

114 |

| Amortization of restricted common stock

grants |

|

47 |

|

17 |

| Loss from debt extinguishment |

|

287 |

|

— |

| Loss from financial derivative

instrument |

|

59 |

|

— |

| Gain on sale of vessels, net |

|

(8,017) |

|

— |

| Changes in assets and

liabilities: |

|

|

|

|

| Inventories |

|

1,053 |

|

(1,154) |

| Due from related parties |

|

50 |

|

178 |

| Trade accounts receivable, net |

|

6,398 |

|

(253) |

| Prepayments and other assets |

|

(339) |

|

(1,133) |

| Insurance claim receivable |

|

608 |

|

— |

| Special survey cost |

|

(814) |

|

(4) |

| Trade accounts payable |

|

(491) |

|

241 |

| Hire collected in advance |

|

(1,215) |

|

(296) |

| Accrued and other liabilities |

|

(88) |

|

785 |

| Net cash provided by operating

activities |

$ |

12,269 |

$ |

10,679 |

| |

|

|

|

|

| Cash flow from investing

activities: |

|

|

|

|

| Proceeds from the sale of vessel, net |

|

24,291 |

|

— |

| Vessel acquisitions |

|

— |

|

(44,969) |

| Vessel additions |

|

(21) |

|

(24) |

| Short-term

investment in time deposits |

|

— |

|

3,000 |

| Net cash (used in)/provided by

investing activities |

$ |

24,270 |

$ |

(41,993) |

| |

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

| Proceeds from long-term debt |

|

15,500 |

|

31,000 |

| Repayment of long-term debt |

|

(21,697) |

|

(3,313) |

| Contributions from non-controlling

interests to Joint Venture |

|

— |

|

5,880 |

| Partial redemption

of Series A Convertible Preferred shares |

|

— |

|

(2,500) |

| Repayment of promissory note |

|

(6,000) |

|

— |

| Financial derivative instrument |

|

561 |

|

— |

| Payment of financing costs |

|

(148) |

|

(267) |

| Preferred stock dividends paid |

|

(405) |

|

(391) |

| Common stock re-purchase program |

|

(91) |

|

(380) |

| Deemed dividend |

|

— |

|

(7,493) |

| Net cash provided by/(used in)

financing activities |

$ |

(12,280) |

$ |

22,536 |

| |

|

|

|

|

| Net (decrease)/increase in cash and cash

equivalents and restricted cash |

|

24,259 |

|

(8,778) |

| Cash and cash equivalents and restricted

cash at the beginning of the period |

|

10,189 |

|

36,339 |

| Cash and cash equivalents and

restricted cash at the end of the period |

$ |

34,448 |

$ |

27,561 |

| |

|

|

|

|

| SUPPLEMENTAL

INFORMATION: |

|

|

|

|

| Cash paid for

interest |

$ |

2,598 |

$ |

2,815 |

| Non-cash financing

activities – issuance of common stock financing acquisition of

vessel “Konkar Venture” |

|

— |

|

1,382 |

Liquidity, Debt and Capital Structure

Our total funded debt, net of deferred financing

costs at June 30, 2024 of $88.5 million includes $34.1 million of

bank loans, net of deferred financing costs with our two dry bulk

joint ventures. Pursuant to our loan agreements, as of

June 30, 2024, we were required to maintain a minimum

cash balance of $2.15 million. Total cash and cash

equivalents, including the minimum liquidity and cash that has been

classified as a short-term investment in time deposits, aggregated

$44.6 million as of June 30, 2024.

| |

|

|

December 31, |

|

June 30, |

|

|

|

|

2023 |

|

2024 |

| Funded debt, net of deferred financing

costs |

|

$ |

60,950 |

$ |

88,483 |

| Total funded debt |

|

$ |

60,950 |

$ |

88,483 |

On June 30, 2024, our weighted average interest

rate on our total funded debt for the three months ended

June 30, 2024 was 8.05% and we had short-term

interest-bearing money market investments of $32.0 million. Our

next loan maturity is scheduled for December 2026 with a balloon

principal payment of $12.2 million due on the

“Pyxis Lamda”.

On June 20, 2024, the Company paid $2.5 million

for the redemption of 100,000 shares of our Series A Cumulative

Convertible Preferred Stock (NASDAQ Cap Mkts: PXSAP). Upon this

redemption, 100,000 PXSAP shares were cancelled by the Company and

the Company is no longer obligated to pay dividends in respect of

these shares. After this partial redemption, which resulted in a

reduction of 446,429 in fully-diluted common shares, there are

303,631 PXSAP shares outstanding, which are convertible into

1,355,496 common shares, if fully converted.

On June 28, 2024, we closed on our previously

announced dry bulk joint venture with an entity related to our

Chairman and Chief Executive Officer for the acquisition of an

82,099 dwt eco-efficient Kamsarmax built in 2015 at Jiangsu New

Yangzi Shipbuilding. The $30.0 million purchase price for the

“Konkar Venture”, which is fitted with a ballast water treatment

system, was funded by a combination of secured bank debt of $16.5

million, $12.0 million cash, of which the Company contributed $7.3

million in cash, and the issuance of 267,857 PXS restricted common

shares (the “Restricted Common Shares”) to the related party

seller. Pyxis owns a 60% controlling ownership interest in the

joint venture. The five year amortizing bank loan is priced at Term

SOFR +2.15% and is secured by, among other things, the vessel. The

“Konkar Venture”, is a sister ship to the Company’s

eco-efficient “Konkar Asteri”, and is continuing its employment

under the existing time charter through mid-August, 2024 at a

contracted gross daily rate of $18,000.

On June 30, 2024, we had a total of 10,458,767

common shares issued and outstanding of which 54.8% were

beneficially owned by Mr. Valentis, 303,631 Preferred Shares

(NASDAQ Cap Mkts: PXSAP), which have conversion price of $5.60, and

1,591,062 warrants (NASDAQ Cap Mkts: PXSAW), which have an exercise

price of $5.60, (excluding non-tradeable underwriter’s common stock

purchase warrants of which 107,143 and 3,460 have exercise prices

of $8.75 and $5.60, respectively, and 2,000 and 2,683

Preferred Shares purchase warrants which have an exercise price of

$24.92 and $25.00 per share, respectively).

During the quarter ended June 30, 2024, we

repurchased 39,223 PXS common shares at an average price of $4.66

per share, including brokerage commissions, or $183,000. We

have repurchased a total of 415,371 PXS common shares at an

aggregate purchase price (including brokerage commissions) of $1.6

million under the authorized $3.0 million common share

re-purchase program which is scheduled to expire on May 16,

2025.

Subsequent Events:

On July 30,2024, we agreed with an existing

lender to refinance the Seventhone Corp (“Pyxis Theta”) outstanding

debt of $10.75 million. The amended agreement provides a five year

amortizing bank loan with similar quarterly repayment with a

maturity of July 2029 and reduce pricing to SOFR plus 2.40% (from

3.35%). In addition, the same bank agreed to reduce the interest

rate margin from 3.15% to 2.40% on the outstanding $16.5 million

loan to the Eleventhone Corp. (“Pyxis Lamda”).

After the quarter ended June 30, 2024, and as of

August 8, 2024 we repurchased an additional 25,537 PXS common

shares at an average price of $4.94 per share, including brokerage

commissions, or $126,000, under the share buy-back program. After

these additional open market purchases and the issuance of the

Restricted Common Shares, as of August 8, 2024, we had 10,701,087

outstanding common shares of which 56% was beneficially owned by

Mr. Valentis.

Non-GAAP Measures and Definitions

Earnings before interest, taxes, depreciation

and amortization (“EBITDA”) represent the sum of net income,

interest and finance costs, depreciation and amortization and, if

any, income taxes during a period. Adjusted EBITDA represents

EBITDA before certain non-operating charges, such as interest

income, loss from debt extinguishment, loss from financial

derivative instrument and gain from sales of vessels. EBITDA and

Adjusted EBITDA are not recognized measurements under U.S.

GAAP.

EBITDA and Adjusted EBITDA are presented in this

press release as we believe that they provide investors with means

of evaluating and understanding how our management evaluates

operating performance. These non-GAAP measures have limitations as

analytical tools, and should not be considered in isolation from,

as a substitute for, or superior to financial measures prepared in

accordance with U.S. GAAP. EBITDA and Adjusted EBITDA do not

reflect:

- our cash expenditures, or future requirements for capital

expenditures or contractual commitments;

- changes in, or cash requirements for, our working capital

needs; and

- cash requirements necessary to service interest and

principal payments on our funded debt.

In addition, these non-GAAP measures do not have

standardized meanings and are therefore unlikely to be comparable

to similar measures presented by other companies. The following

table reconciles net income, as reflected in the Unaudited

Consolidated Statements of Comprehensive Income to EBITDA and

Adjusted EBITDA:

| |

|

|

Three

monthsended June

30, |

|

Six months ended June 30, |

|

(Amounts in thousands of U.S. dollars) |

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

| Reconciliation of

Net income to EBITDA and Adjusted EBITDA |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

2,955 |

$ |

5,283 |

$ |

11,870 |

$ |

8,895 |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation |

|

|

1,232 |

|

1,634 |

|

2,634 |

|

3,095 |

|

|

|

|

|

|

|

|

|

|

|

| Amortization of special survey

costs |

|

|

91 |

|

97 |

|

176 |

|

194 |

|

|

|

|

|

|

|

|

|

|

|

| Interest and finance costs |

|

|

1,317 |

|

1,580 |

|

2,808 |

|

3,073 |

| |

|

|

|

|

|

|

|

|

|

| EBITDA |

|

$ |

5,595 |

$ |

8,594 |

$ |

17,488 |

$ |

15,257 |

| |

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

(352) |

|

(607) |

|

(413) |

|

(1,261) |

| |

|

|

|

|

|

|

|

|

|

| Loss from debt extinguishment |

|

|

— |

|

— |

|

287 |

|

— |

| |

|

|

|

|

|

|

|

|

|

| Loss from financial derivative

instrument |

|

|

— |

|

— |

|

59 |

|

— |

| |

|

|

|

|

|

|

|

|

|

| Gain from the sale of vessels, net |

|

|

1 |

|

— |

|

(8,017) |

|

— |

| |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

5,244 |

$ |

7,987 |

$ |

9,404 |

$ |

13,996 |

| |

|

|

|

|

|

|

|

|

|

|

Daily TCE is a shipping industry performance

measure of the average daily revenue performance of a vessel on a

per voyage basis. We utilize daily TCE because we believe it is a

meaningful measure to compare period-to-period changes in our

performance despite changes in the mix of charter types (i.e., spot

charters, time charters and bareboat charters) under which our

vessels may be employed between the periods. Our management also

utilizes daily TCE to assist them in making decisions regarding the

employment of the vessels. TCE Revenues are calculated by

presenting Revenues, net after deducting Voyage related costs and

commissions. We calculate daily TCE by dividing TCE Revenues, by

operating days for the relevant period. Voyage related costs and

commissions primarily consist of brokerage commissions, port, canal

and fuel costs that are unique to a particular voyage, which would

otherwise be paid by the charterer under a time charter contract.

TCE Revenues and daily TCE are not calculated in accordance with

U.S. GAAP.

Vessel operating expenses (“Opex”) per day are

our vessel operating expenses for a vessel, which primarily consist

of crew wages and related costs, insurance, lube oils,

communications, spares and consumables, tonnage taxes as well as

repairs and maintenance, divided by the ownership days in the

applicable period.

We calculate utilization (“Utilization”) by

dividing the number of operating days during a period by the number

of available days during the same period. We use fleet utilization

to measure our efficiency in finding suitable employment for our

vessels and minimize the number of days that our vessels are

off-hire for reasons other than scheduled repairs or repairs under

guarantee, vessel upgrades, special surveys and intermediate

dry-dockings or vessel positioning. Ownership days are the total

number of days in a period during which we owned each of the

vessels in our fleet. Available days are the number of ownership

days in a period, less the aggregate number of days that our

vessels were off-hire due to scheduled repairs or repairs under

guarantee, vessel upgrades or special surveys and intermediate

dry-dockings and the aggregate number of days that we spent

positioning our vessels during the respective period for such

repairs, upgrades and surveys. Operating days are the number of

available days in a period, less the aggregate number of days that

our vessels were off-hire or out of service due to any reason,

including technical breakdowns and unforeseen circumstances.

EBITDA, Adjusted EBITDA, Opex and daily TCE are

not recognized measures under U.S. GAAP and should not be regarded

as substitutes for Revenues, net and Net income. Our presentation

of EBITDA, Adjusted EBITDA, Opex and daily TCE does not imply, and

should not be construed as an inference, that our future results

will be unaffected by unusual or non-recurring items and should not

be considered in isolation or as a substitute for a measure of

performance prepared in accordance with U.S. GAAP.

Recent Daily Fleet Data:

| (Amounts

in U.S. dollars per day) |

|

|

Three months ended June 30, |

|

Six months ended June 30, |

| |

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

| Eco-Efficient MR2: (2024: 3

vessels) |

|

|

|

|

|

|

|

|

|

|

(2023: 4 vessels) |

Daily

TCE : |

|

24,980 |

|

32,868 |

|

24,897 |

|

32,337 |

| |

Opex

per day: |

|

6,629 |

|

7,130 |

|

6,953 |

|

7,175 |

| |

Utilization % : |

|

98.6% |

|

99.6% |

|

95.2% |

|

98.2% |

| Eco-Modified MR2: (2023: 1

vessel) |

|

|

|

|

|

|

|

|

|

| |

Daily

TCE : |

|

n/a |

|

n/a |

|

17,064 |

|

n/a |

| |

Opex

per day: |

|

n/a |

|

n/a |

|

9,236 |

|

n/a |

| |

Utilization % : |

|

n/a |

|

n/a |

|

79.3% |

|

n/a |

| MR Fleet:

(2024: 3 vessels) * |

|

|

|

|

|

|

|

|

|

|

(2023: 5 vessels) * |

Daily

TCE : |

|

25,000 |

|

32,868 |

|

24,207 |

|

32,337 |

| |

Opex

per day: |

|

6,786 |

|

7,130 |

|

7,185 |

|

7,175 |

| |

Utilization % : |

|

98.6% |

|

99.6% |

|

93.5% |

|

98.2% |

| |

|

|

|

|

|

|

|

|

|

| Average number of MR vessels * |

|

|

4.0 |

|

3.0 |

|

4.5 |

|

3.0 |

| |

|

|

|

|

|

|

|

|

|

| Dry-bulk : (2024: 3 vessels) |

|

|

|

|

|

|

|

|

|

| |

Daily

TCE : |

|

n/a |

|

22,333 |

|

n/a |

|

20,111 |

| |

Opex

per day: |

|

n/a |

|

5,952 |

|

n/a |

|

6,789 |

| |

Utilization % : |

|

n/a |

|

80.0% |

|

n/a |

|

78.5% |

| |

|

|

|

|

|

|

|

|

|

| Average number of Dry bulk vessels * |

|

|

n/a |

|

2.0 |

|

n/a |

|

1.8 |

| |

|

|

|

|

|

|

|

|

|

| Total Fleet:

(2024:

6 vessels) * |

|

|

|

|

|

|

|

|

|

|

(2023:

5 vessels) * |

Daily

TCE : |

|

25,000 |

|

29,156 |

|

24,207 |

|

28,427 |

| |

Opex

per day: |

|

6,786 |

|

6,654 |

|

7,185 |

|

7,032 |

| |

Utilization % : |

|

98.6% |

|

91.7% |

|

93.5% |

|

90.9% |

| |

|

|

|

|

|

|

|

|

|

| Average number of vessels * |

|

|

4.0 |

|

5.0 |

|

4.5 |

|

4.8 |

As of August 9, 2024, our fleet consisted of

three eco-efficient MR2 tankers, “Pyxis Lamda”, “Pyxis

Theta”, “Pyxis Karteria”, and three dry-bulk vessels,

“Konkar Ormi” delivered to our joint venture on September 14,

2023, “Konkar Asteri” delivered on February 15, 2024 and “Konkar

Venture” delivered to our joint venture on June 28, 2024.

During 2023 and 2024, the vessels in our fleet were employed under

time and spot charters.

* a) The Eco-Modified MR “Pyxis Epsilon”

was sold to an unaffiliated buyer on December 15,

2023. b) The dry-bulker “Konkar Ormi” was delivered on

September 14, 2023 and commenced her initial charter on October 5,

2023. c) The dry-bulker “Konkar Asteri” was delivered on

February 15, 2024 and commenced her initial charter on February 29,

2024. d) The dry-bulker “Konkar Venture” was delivered

on June 28, 2024 and is continuing its employment under the

existing time charter through mid-August.

Conference Call and Webcast

Today, Monday, August 12, 2024, at 8:30 a.m.

Eastern Time, the Company’s management will host a conference call

to discuss the results.

Participants should dial into the call 10

minutes before the scheduled time using the following numbers: +1

877 405 1226 (US Toll-Free Dial In) or +1 201 689 7823 (US and

Standard International Dial In). Please quote "Pyxis Tankers” to

the operator and/or conference ID 13748060. Click here for

additional International Toll-Free access numbers.

Alternatively, participants can register for the

call using the call me option for a faster connection to join the

conference call. You can enter your phone number and let the system

call you right away. Click here for the call me option

A webcast of the conference call will be

available through our website (http://www.pyxistankers.com) under

our Events Presentations page. A telephonic replay of the

conference and accompanying slides will be available following the

completion of the call and will remain available until Monday,

August 19, 2024.

Webcast participants of the live conference call

should register on the website approximately 10 minutes prior to

the start of the webcast and can also access it through the

following link:

https://www.webcaster4.com/Webcast/Page/2976/50933

Pyxis Tankers Fleet (as of August 9, 2024)

|

Vessel Name |

Shipyard |

Vessel type |

Carrying Capacity (dwt) |

Year Built |

Type of charter |

Charter(1) Rate (per day) |

Anticipated Earliest Redelivery Date |

|

| |

| |

| Tanker fleet |

|

|

|

|

|

|

|

|

| Pyxis Lamda |

SPP / S. Korea |

MR2 |

50,145 |

2017 |

Spot |

n/a |

n/a |

|

| Pyxis Theta (2) |

SPP / S. Korea |

MR2 |

51,795 |

2013 |

Time |

29,000 |

Aug

2024 |

|

| Pyxis Karteria (3) |

Hyundai / S. Korea |

MR2 |

46,652 |

2013 |

Time |

34,500 |

Sep

2024 |

|

| |

|

|

148,592 |

|

|

|

|

|

|

Dry-bulk fleet |

|

|

|

|

|

|

|

|

| Konkar Ormi (4) |

SKD / Japan |

Ultramax |

63,520 |

2016 |

Time |

18,250 |

Sep

2024 |

|

| Konkar Asteri (5) |

JNYS / China |

Kamsarmax |

82,013 |

2015 |

Time |

16,250 |

Oct

2024 |

|

| Konkar Venture (6) |

JNYS / China |

Kamsarmax |

82,099 |

2015 |

Time |

18,000 |

Aug

2024 |

|

| |

|

|

227,632 |

|

|

|

|

|

1) These tables present gross rates in U.S.$ and do not reflect

any commissions payable. 2) “Pyxis Theta” is fixed on a time

charter for a minimum of 11 maximum of 15 months, at $29,000 per

day.3) “Pyxis Karteria” was fixed on a time charter for a minimum

of 6 maximum of 9 months, at $34,500 per day. 4) “Konkar Ormi” was

fixed on a time charter for 55 – 65 days, at $18,250 per day.5)

“Konkar Asteri” was fixed on time charter for 90 – 105 days, at

$16,250 per day, plus scrubber premium of $168,828.6) “Konkar

Venture” was fixed on time charter for 95 – 105 days, at $18,000

per day.

About Pyxis Tankers Inc.

The Company currently owns a modern fleet of

mid-sized eco-vessels consisting of three MR product tankers

engaged in the seaborne transportation of refined petroleum

products and other bulk liquids, and three dry-bulk carriers,

including controlling interests in two dry-bulk joint ventures that

own a Kamsarmax and Ultramax carrier, respectively, and one 100%

owned Kamsarmax vessel, which transport a broad range of dry-bulk

commodities. The Company is positioned to opportunistically expand

and maximize its fleet of eco-efficient vessels due to significant

capital resources, competitive cost structure, strong customer

relationships and an experienced management team whose interests

are aligned with those of its shareholders. For more information,

visit: http://www.pyxistankers.com. The information on the

Company’s website is not incorporated into and does not form a part

of this release.

Forward Looking Statements

This press release includes forward-looking

statements intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995

in order to encourage companies to provide prospective information

about their business. These statements include statements about our

plans, strategies, goals financial performance, prospects or future

events or performance and involve known and unknown risks that are

difficult to predict. As a result, our actual results, performance

or achievements may differ materially from those expressed or

implied by these forward-looking statements. In some cases, you can

identify forward-looking statements by the use of words such as

“may,” “could,” “expects,” “seeks,” “predict,” “schedule,”

“projects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “targets,” “continue,” “contemplate,” “possible,”

“likely,” “might,” “will, “should,” “would,” “potential,” and

variations of these terms and similar expressions, or the negative

of these terms or similar expressions. All statements that are not

statements of either historical or current facts, including among

other things, our expected financial performance, expectations or

objectives regarding future and market charter rate expectations

and, in particular, the effects of the war in the Ukraine and the

Red Sea conflict, on our financial condition and operations as well

as the nature of the product tanker and dry-bulk industries, in

general, are forward-looking statements. Such forward-looking

statements are necessarily based upon estimates and assumptions.

Although the Company believes that these assumptions were

reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond the Company’s

control, the Company cannot assure you that it will achieve or

accomplish these expectations, beliefs or projections. The

Company’s actual results may differ, possibly materially, from

those anticipated in these forward-looking statements as a result

of certain factors, including changes in the Company’s financial

resources and operational capabilities and as a result of certain

other factors listed from time to time in the Company’s filings

with the U.S. Securities and Exchange Commission. The Company is

reliant on certain independent and affiliated managers for its

operations, including most recently an affiliated private company,

Konkar Shipping Agencies, S.A., for the management of its dry-bulk

vessels. For more information about risks and uncertainties

associated with our business, please refer to our filings with the

U.S. Securities and Exchange Commission, including without

limitation, under the caption “Risk Factors” in our Annual Report

on Form 20-F for the fiscal year ended December 31, 2023. We

caution you not to place undue reliance on any forward-looking

statements, which are made as of the date of this press release. We

undertake no obligation to update publicly any information in this

press release, including forward-looking statements, to reflect

actual results, new information or future events, changes in

assumptions or changes in other factors affecting forward-looking

statements, except to the extent required by applicable laws.

CompanyPyxis Tankers Inc. 59 K. Karamanli

Street Maroussi, 15125 Greece info@pyxistankers.com

Visit our website at www.pyxistankers.com

Company ContactHenry Williams Chief Financial

Officer Tel: +30 (210) 638 0200 / +1 (516) 455-0106

Email: hwilliams@pyxistankers.com

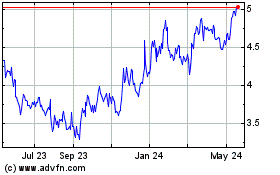

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Jan 2025 to Feb 2025

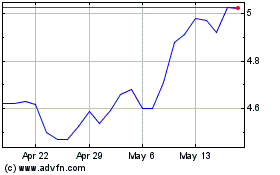

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Feb 2024 to Feb 2025