AVITA Medical, Inc. (NASDAQ: RCEL, ASX: AVH) (the

“

Company”), a regenerative medicine company

leading the development and commercialization of first-in-class

devices and autologous cellular therapies for skin restoration,

today reported financial results for the second quarter June 30,

2023.

Financial Highlights and Recent Updates

- Commercial revenue of $11.7 million, a 42% increase compared to

$8.2 million for the same period in 2022

- Received Food and Drug Administration (FDA) approval of

premarket approval (PMA) supplement for the use of RECELL to treat

full-thickness skin defects on June 7

- Initiated commercial launch of full-thickness skin defects,

along with additional eligible burn procedures, with expanded U.S.

commercial organization on June 8

- Received FDA approval of PMA application to use RECELL for

repigmentation of stable depigmented vitiligo lesions on June

16

- Submitted PMA supplement for automated cell disaggregation

device, RECELL GO™, which maintains the FDA Breakthrough Device

designation

- As of June 30, 2023, $68.8 million in cash, cash equivalents,

and marketable securities, with no debt

“We had an extraordinary second quarter with significant revenue

growth, two landmark FDA approvals, and a pivotal FDA submission,”

said Jim Corbett, AVITA Medical Chief Executive Officer. “As

anticipated, our expanded U.S. commercial organization was fully

prepared for the FDA approval of full-thickness skin defects. Our

proactive preparation enabled us to initiate the commercial launch

the day after receiving FDA approval. Additionally, our PMA

supplement for RECELL GO is on track, and we expect approval before

the end of the year. Collectively, these approvals and submission

mark significant advancement of our platform, empowering us to

continue to unlock our growth potential.”

Future Milestones

- Anticipate FDA approval of RECELL GO by December 27, 2023

- Conducting post-market study with vitiligo patients to

demonstrate the repigmentation and mental health benefits of

treatment with RECELL, and reduction of associated health care

costs

- Pursuing site of service reimbursement for the use of RECELL in

the physician office setting, which is expected in 2025

Financial Guidance

- Commercial revenue for the third quarter 2023 is expected to be

in the range of $13 to $14 million

- Raising commercial revenue for the full year 2023 from $49 to

$51 million to an expected range of $51 to $53 million

- Gross margin for the full year 2023 expected to be in the range

of 83% to 85%

Second Quarter 2023 Financial Results

Our commercial revenue, which excludes Biomedical Advanced

Research and Development Authority (BARDA) revenue, increased by

42% to $11.7 million in the three-months ended June 30, 2023,

compared to $8.2 million in the same period in 2022. Total revenue,

which includes BARDA revenue, increased by 41% to $11.8 million

compared to $8.3 million in the same period in 2022.

Gross profit margin decreased by 2% to 81% compared to 83% for

the second quarter of 2022. The decrease was largely driven by

lower production in one month of the quarter caused by the need to

qualify new vendors for certain manufacturing components.

Total operating expenses for the quarter increased by 53% to

$21.1 million, compared to $13.9 million in the same period in

2022, primarily due to the significant increase of the commercial

organization in preparation of the full-thickness skin defect

launch. Additionally, our research and development expenses

increased by approximately $2.0 million due to ongoing development

of the RECELL GO device and costs associated with our Medical

Science Liaison team.

Net loss was $10.4 million, or a loss of $0.41 per share,

compared to a net loss of $6.3 million, or a loss of $0.25 per

share, in the same period in 2022.

BARDA income consisted of funding from the Biomedical Advanced

Research and Development Authority, under the Assistant Secretary

for Preparedness and Response, within the U.S. Department of Health

and Human Services, under ongoing USG Contract No.

HHSO100201500028C.

Webcast and Conference Call Information

The Company will host a conference call to discuss the second

quarter financial results and, recent business highlights on

Thursday, August 10, 2023, at 1:30 p.m. Pacific Time. To access the

live call via telephone, please register in advance using the link

here. Upon registering, each participant will receive an email

confirmation with dial-in numbers and a unique personal PIN that

can be used to join the call. A simultaneous webcast of the call

will be available via the Company’s website at

https://ir.avitamedical.com.

ABOUT AVITA MEDICAL, INC.

AVITA Medical® is a regenerative medicine company leading

the development and commercialization of devices and autologous

cellular therapies for skin restoration. The RECELL® System

technology platform, approved by the FDA for the treatment of

thermal burn wounds and full-thickness skin defects and for

repigmentation of stable depigmented vitiligo lesions, harnesses

the regenerative properties of a patient’s own skin to create

Spray-On Skin™ cells. Delivered at the point-of-care, RECELL

enables improved clinical outcomes. RECELL is the catalyst of a new

treatment paradigm and AVITA Medical is leveraging its proven and

differentiated capabilities to develop first-in-class cellular

therapies for multiple indications.

In international markets, our products are approved under the

RECELL System brand to promote skin healing in a wide range of

applications including burns, soft tissue repair, vitiligo, and

aesthetics. The RECELL System is TGA-registered in Australia,

received CE-mark approval in Europe and has PMDA approval in

Japan.

To learn more, visit www.avitamedical.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This press release includes forward-looking statements. These

forward-looking statements generally can be identified by the use

of words such as “anticipate,” “expect,” “intend,” “could,” “may,”

“will,” “believe,” “estimate,” “look forward,” “forecast,” “goal,”

“target,” “project,” “continue,” “outlook,” “guidance,” “future,”

other words of similar meaning and the use of future dates.

Forward-looking statements in this press release include, but are

not limited to, statements concerning, among other things, our

ongoing clinical trials and product development activities,

regulatory approval of our products, the potential for future

growth in our business, and our ability to achieve our key

strategic, operational, and financial goal. Forward-looking

statements by their nature address matters that are, to different

degrees, uncertain. Each forward-looking statement contained in

this press release is subject to risks and uncertainties that could

cause actual results to differ materially from those expressed or

implied by such statements. Applicable risks and uncertainties

include, among others, the timing and realization of regulatory

approvals of our products; physician acceptance, endorsement, and

use of our products; failure to achieve the anticipated benefits

from approval of our products; the effect of regulatory actions;

product liability claims; risks associated with international

operations and expansion; and other business effects, including the

effects of industry, economic or political conditions outside of

the company’s control. Investors should not place considerable

reliance on the forward-looking statements contained in this press

release. Investors are encouraged to read our publicly available

filings for a discussion of these and other risks and

uncertainties. The forward-looking statements in this press release

speak only as of the date of this release, and we undertake no

obligation to update or revise any of these statements.

FOR FURTHER INFORMATION:

|

Investors & MediaAVITA Medical,

Inc.Jessica EkebergPhone +1 661 904

9269investor@avitamedical.commedia@avitamedical.com |

|

|

|

AVITA MEDICAL, INC.Consolidated Balance

Sheets(In thousands, except share and per share

data)(Unaudited) |

|

|

| |

|

As of |

| |

|

June 30, 2023 |

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

37,485 |

|

|

$ |

18,164 |

|

|

Marketable securities |

|

|

28,562 |

|

|

|

61,178 |

|

|

Accounts receivable, net |

|

|

5,754 |

|

|

|

3,515 |

|

|

BARDA receivables |

|

|

442 |

|

|

|

898 |

|

|

Prepaids and other current assets |

|

|

2,194 |

|

|

|

1,578 |

|

|

Inventory |

|

|

3,058 |

|

|

|

2,125 |

|

| Total

current assets |

|

|

77,495 |

|

|

|

87,458 |

|

|

Marketable securities long-term |

|

|

2,754 |

|

|

|

6,930 |

|

|

Plant and equipment, net |

|

|

1,598 |

|

|

|

1,200 |

|

|

Operating lease right-of-use assets |

|

|

1,651 |

|

|

|

851 |

|

|

Corporate-owned life insurance asset |

|

|

2,091 |

|

|

|

1,238 |

|

|

Intangible assets, net |

|

|

456 |

|

|

|

465 |

|

|

Other long-term assets |

|

|

285 |

|

|

|

122 |

|

| Total

assets |

|

$ |

86,330 |

|

|

$ |

98,264 |

|

|

LIABILITIES, NON-QUALIFIED DEFERRED COMPENSATION PLAN SHARE

AWARDS AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

3,837 |

|

|

|

3,002 |

|

|

Accrued wages and fringe benefits |

|

|

6,200 |

|

|

|

6,623 |

|

|

Current non-qualified deferred compensation liability |

|

|

2,572 |

|

|

|

78 |

|

|

Other current liabilities |

|

|

1,201 |

|

|

|

990 |

|

| Total

current liabilities |

|

|

13,810 |

|

|

|

10,693 |

|

|

Non-qualified deferred compensation liability |

|

|

1,224 |

|

|

|

1,270 |

|

|

Contract liabilities |

|

|

374 |

|

|

|

698 |

|

|

Operating lease liabilities, long term |

|

|

1,047 |

|

|

|

306 |

|

| Total

liabilities |

|

|

16,455 |

|

|

|

12,967 |

|

|

Non-qualified deferred compensation plan share awards |

|

|

1,228 |

|

|

|

557 |

|

|

Contingencies (Note 13) |

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

Common stock, $0.0001 par value per share, 200,000,000 shares

authorized, 25,447,615 and 25,208,436 shares issued and outstanding

at June 30, 2023 and December 31, 2022,

respectively |

|

|

3 |

|

|

|

3 |

|

|

Preferred stock, $0.0001 par value per share, 10,000,000 shares

authorized, no shares issued or outstanding at March 31, 2023 and

December 31, 2022. |

|

|

- |

|

|

|

- |

|

|

Company common stock held by the non-qualified deferred

compensation plan ("NQDC Plan") |

|

|

(892 |

) |

|

|

(127 |

) |

|

Additional paid-in capital |

|

|

343,769 |

|

|

|

339,825 |

|

|

Accumulated other comprehensive income |

|

|

7,959 |

|

|

|

7,627 |

|

|

Accumulated deficit |

|

|

(282,192 |

) |

|

|

(262,588 |

) |

| Total

stockholders' equity |

|

|

68,647 |

|

|

|

84,740 |

|

| Total

liabilities, non-qualified deferred compensation plan share awards

and stockholders' equity |

|

$ |

86,330 |

|

|

$ |

98,264 |

|

|

|

|

AVITA MEDICAL, INC.Consolidated Statements

of Operations(In thousands, except share and per

share data)(Unaudited) |

|

|

| |

|

Three-Months Ended |

|

Six-Months Ended |

|

|

|

June 30, 2023 |

|

June 30, 2022 |

|

June 30, 2023 |

|

June 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

11,753 |

|

|

$ |

8,335 |

|

|

$ |

22,303 |

|

|

$ |

15,874 |

|

| Cost of

sales |

|

|

(2,204 |

) |

|

|

(1,386 |

) |

|

|

(3,871 |

) |

|

|

(3,164 |

) |

|

Gross profit |

|

|

9,549 |

|

|

|

6,949 |

|

|

|

18,432 |

|

|

|

12,710 |

|

| BARDA

income |

|

|

530 |

|

|

|

551 |

|

|

|

1,157 |

|

|

|

1,285 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

|

(10,003 |

) |

|

|

(5,332 |

) |

|

|

(16,543 |

) |

|

|

(10,160 |

) |

|

General and administrative expenses |

|

|

(6,165 |

) |

|

|

(5,471 |

) |

|

|

(14,460 |

) |

|

|

(13,005 |

) |

|

Research and development expenses |

|

|

(5,076 |

) |

|

|

(3,059 |

) |

|

|

(9,662 |

) |

|

|

(6,679 |

) |

| Total

operating expenses |

|

|

(21,244 |

) |

|

|

(13,862 |

) |

|

|

(40,665 |

) |

|

|

(29,844 |

) |

|

Operating loss |

|

|

(11,165 |

) |

|

|

(6,362 |

) |

|

|

(21,076 |

) |

|

|

(15,849 |

) |

| Interest

expense |

|

|

(7 |

) |

|

|

(4 |

) |

|

|

(11 |

) |

|

|

(4 |

) |

| Other

income |

|

|

801 |

|

|

|

109 |

|

|

|

1,526 |

|

|

|

137 |

|

| Loss

before income taxes |

|

|

(10,371 |

) |

|

|

(6,257 |

) |

|

|

(19,561 |

) |

|

|

(15,716 |

) |

|

Provision for income tax |

|

|

(13 |

) |

|

|

(4 |

) |

|

|

(43 |

) |

|

|

(8 |

) |

| Net

loss |

|

$ |

(10,384 |

) |

|

$ |

(6,261 |

) |

|

$ |

(19,604 |

) |

|

$ |

(15,724 |

) |

| Net loss

per common share: |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

$ |

(0.41 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.78 |

) |

|

$ |

(0.63 |

) |

|

Weighted-average common shares: |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

25,239,723 |

|

|

|

24,971,243 |

|

|

|

25,221,009 |

|

|

|

24,954,712 |

|

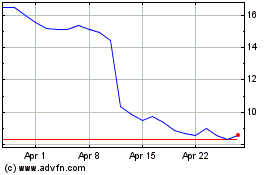

Avita Medical (NASDAQ:RCEL)

Historical Stock Chart

From Apr 2024 to May 2024

Avita Medical (NASDAQ:RCEL)

Historical Stock Chart

From May 2023 to May 2024