0001599901FALSE00015999012023-11-272023-11-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________

FORM 8-K

_________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 27, 2023

_________________________________________

AVIDITY BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

_________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-39321 | | 46-1336960 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

10578 Science Center Drive, Suite 125

San Diego, California 92121 92121

(Address of principal executive offices) (Zip Code)

(858) 401-7900

(Registrant’s telephone number, include area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

_________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | RNA | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01. | Entry into a Material Definitive Agreement. |

On November 27, 2023 (the "Effective Date"), Avidity Biosciences, Inc. (the “Company”) entered into a Research Collaboration and License Agreement (the "Collaboration Agreement") with Bristol-Myers Squibb Company ("BMS") for the development of certain cardiovascular treatments. The Collaboration Agreement replaces the previous research agreement between the Company and MyoKardia, Inc., a wholly-owned subsidiary of BMS. Additionally, on the Effective Date, the Company entered into a Securities Purchase Agreement (the "Purchase Agreement") with BMS, pursuant to which the Company sold to BMS shares of the Company's common stock, par value $0.0001 per share (“Common Stock”), in a private placement.

Research Collaboration and License Agreement

Research; Development

Under the terms of the Collaboration Agreement, BMS will have the right to select up to five cardiovascular targets (each a “Target”) for collaborative research programs under which the Company will utilize its proprietary antibody oligonucleotide conjugate (“AOC”) platform to conduct research and development activities in order to identify, generate and optimize AOC compounds directed to such Targets with the goal of generating an applicable development candidate. On a Target-by-Target basis, after the Company completes specified research activities in accordance with a research plan, BMS will have the right to develop, manufacture and commercialize such compounds generated during the research term, and products containing such compounds, worldwide.

Licenses; Exclusivity

The Company will grant BMS exclusive licenses under certain of its intellectual property rights (including its AOC platform) for the purpose of developing, manufacturing and commercializing the compounds developed under the Collaboration Agreement directed to the Targets. The Company will not pursue or engage in the discovery of any product competitive to the Targets, and BMS will not enter into a collaboration with any third party for the purpose of researching or developing certain AOC products competitive to the Targets.

Governance

The research and activities conducted under the Collaboration Agreement will be governed by a joint steering committee comprised of representatives from the Company and BMS.

Financial Terms

BMS has agreed to pay the Company an upfront payment of $60.0 million to be paid within 30 days after the Effective Date. The Company is also eligible to receive up to approximately $1.35 billion in research and development milestone payments, up to approximately $825.0 million in commercial milestone payments and tiered royalties up to low double-digits on net sales.

Termination

Either party may impose termination on a Target-by-Target or research program-by-research program basis for the other party’s uncured, material breach of such Target or research program. Subject to certain limitations, (1) BMS may terminate, on an at will basis, the Collaboration Agreement in its entirety, (in which case it would not be entitled to recoup any of the amounts paid under the “Financial Terms” subheading of this Item 1.01) or on a Target-by-Target or research program-by-research program basis, and (2) the Company may terminate the Collaboration Agreement in its entirety if BMS challenges a patent that is licensed to BMS under the Collaboration Agreement.

The foregoing description of the terms of the Collaboration Agreement is qualified in its entirety by reference to the full text of the Collaboration Agreement, a copy of which the Company intends to file as an exhibit to its Annual Report on Form 10-K for the fiscal year ending December 31, 2023.

Securities Purchase Agreement

Private Placement

The Purchase Agreement sets forth the private placement by the Company to BMS on the Effective Date of 5,075,304 shares of Common Stock (the "Shares") at a purchase price of $7.8813 per share, for an aggregate purchase price of approximately $40.0 million. The Purchase Agreement contains customary representations, warranties and covenants of each of the Company and BMS.

The Shares are subject to lock-up restrictions, which, without prior approval of the Company, prohibit BMS from transferring the Shares for a period of 180 days after the Effective Date. These lockup restrictions are subject to certain exceptions and shall terminate upon the occurrence of certain trigger events, including a change of control of the Company. The Company has agreed to register the Shares by filing a resale registration statement with the Securities and Exchange Commission within 150 days of the Effective Date.

Right of First Negotiation

The Company also granted BMS a 90-calendar day right of first negotiation ("ROFN") with respect to any potential grant by the Company of rights to acquire, develop, commercialize or promote any of the Company's current or future cardiovascular programs, products or product candidates, and excluding any change of control transaction. The ROFN remains in effect only during the term of the Collaboration Agreement, and provided that BMS continues to beneficially own at least 50% of the Shares.

The foregoing description of the terms of the Purchase Agreement is qualified in its entirety by reference to the full text of the Purchase Agreement, a copy of which the Company intends to file as an exhibit to its Annual Report on Form 10-K for the fiscal year ending December 31, 2023.

| | | | | |

| Item 3.02. | Unregistered Sale of Equity Securities. |

The information set forth in Item 1.01 above under the caption “Securities Purchase Agreement” is incorporated by reference into this Item 3.02. The Shares were issued in reliance on the exemption from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) based on the representations by BMS in the Securities Purchase Agreement. The Shares have not been registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration under the Securities Act or an applicable exemption from the registration requirements.

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

As previously announced, on November 28, 2023, the Company is participating in the 6th Annual Evercore ISI HealthCONx Conference (the "Evercore Conference"). At the Evercore Conference, Avidity will provide certain updates, including those discussed in Item 1.01 above and Item 3.02 above.

The Evercore Conference will be accessible via webcast under the "Events and Presentations" page in the "Investors" section of the Company's corporate website, at https://www.aviditybiosciences.com.

The information contained in this Item 7.01, including the information contained on the Company's corporate website, is being "furnished" and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as s hall be expressly set forth by specific reference in such a filing.

Forward-Looking Statements

Avidity cautions readers that statements contained in this Current Report on Form 8-K regarding maters that are not historical facts are forward-looking statements. These statements are based on the Company's current beliefs and expectations. Such forward-looking statements include, but are not limited to, statements regarding: expectations related to Avidity's collaboration with BMS and related actions, including without limitation potential benefits thereof and future payments thereunder. The inclusion of forward-looking statements should not be regarded as a representation by Avidity that any of these plans will be achieved. Actual results may differ from those set forth in this Current Report on Form 8-K due to the risks and uncertainties inherent in Avidity's business, including, without limitation: Avidity may not realize the expected benefits of its collaborations, including with BMS; Avidity’s collaboration with BMS could be terminated; Avidity could fail to achieve any milestone or royalty payments under its collaboration with BMS; Avidity is early in its development efforts; Avidity's approach to the discovery and development of product candidates based on its AOC platform is unproven, and Avidity does not know whether it or BMS will be able to develop any products of commercial value; Avidity's dependence on third parties in connection with preclinical and clinical testing and product manufacturing; regulatory developments in the United States and foreign countries; Avidity could exhaust its available capital resources sooner than it currently expects and fail to raise additional needed funds; and other risks described in Avidity's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange Commission (SEC) on February 28, 2023, and in subsequent filings with the SEC. Avidity cautions readers not to place undue reliance on these forward-looking statements, which speak only as

of the date hereof, and the company undertakes no obligation to update such statements to reflect events that occur or circumstances that arise after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | AVIDITY BIOSCIENCES, INC. |

| | |

| Date: November 28, 2023 | | By: | | /s/ Michael F. MacLean |

| | | | Michael F. MacLean |

| | | | Chief Financial and Chief Business Officer |

v3.23.3

Cover

|

Nov. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 27, 2023

|

| Entity Registrant Name |

AVIDITY BIOSCIENCES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39321

|

| Entity Tax Identification Number |

46-1336960

|

| Entity Address, Address Line One |

10578 Science Center Drive

|

| Entity Address, Address Line Two |

Suite 125

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

858

|

| Local Phone Number |

401-7900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

RNA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001599901

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

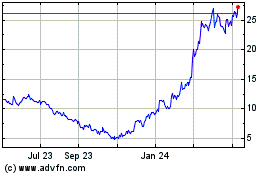

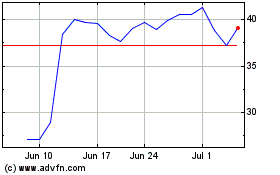

Avidity Biosciences (NASDAQ:RNA)

Historical Stock Chart

From Apr 2024 to May 2024

Avidity Biosciences (NASDAQ:RNA)

Historical Stock Chart

From May 2023 to May 2024