false

0001574094

0001574094

2024-02-09

2024-02-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 9, 2024 (February 5, 2024)

RenovoRx,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40738 |

|

27-1448452 |

(State

or other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

4546

El Camino Real, Suite B1

Los

Altos, CA 94022

(650)

284-4433

(Address

and telephone number, including area code, of registrant’s principal executive offices)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

5.02. |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers. |

On

February 5, 2024, James Ahlers provided written notice to RenovoRx, Inc. (the “Company”) of his resignation as the Company’s

Chief Financial Officer, effective immediately. Mr. Ahlers resignation was for personal reasons and not as a result of any disagreement

with the Company on any matter relating to the Company’s operations, policies or practices.

On

February 8, 2024, the Company’s board of directors (the “Board”), at the recommendation of the audit and compensation

committees of the Board, appointed Ronald B. Kocak, CPA, CGMA, the Company’s current Vice President and Controller, to the position

of Vice President, Controller and Principal Accounting Officer. In this capacity, Mr. Kocak will serve as the Company’s principal

accounting and financial officer. In connection with his appointment, Mr. Kocak entered into an amended and restated offer letter with

the Company effective as of February 9, 2024 (the “Kocak Offer Letter”).

The

following is certain biographical information regarding Mr. Kocak:

Ronald

B. Kocak, CPA, CGMA, age 67, is a seasoned financial reporting and accounting professional with extensive public and private company

experience in the life sciences industry. Mr. Kocak has served as the Company’s Controller since October 2021. Prior to joining

the Company, from 2017 to

2020, he served

as Controller and Senior Director of Finance at Sensei Biotherapeutics, Inc., where he led the finance and accounting activities, including

the information technology operations, for initial public offering readiness. From 2008 through 2013 he served as the Corporate Controller

and Chief Accounting Officer for Nabi Biopharmaceuticals, a NASDAQ-listed company, and was integral member leading that company’s

reverse merger acquisition and transitioning all finance and accounting activities. During his career he has held various senior accounting

and finance roles and provided consulting services for public and private companies. He holds a Bachelor of Science in accounting from

Duquesne University and a CPA license in the Commonwealth of Virginia. Mr. Kocak is also a member of the American Institute of Certified

Public Accountants and Association of Bioscience Financial Officers, and a Chartered Global Management Accountant.

The

Company believes Mr. Kocak is qualified for his position because of his extensive experience in public company accounting and finance

operations, and because of his existing knowledge of the Company and its industry.

There

is no arrangement or understanding between Mr. Kocak and any other person pursuant to which he was selected to his new position. Mr.

Kocak has no family relationships with any of the Company’s directors or executive officers, and has no direct or indirect material

interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Pursuant

to the Kocak Offer Letter, the Company shall pay to Mr. Kocak an annual base salary of $235,000. The Company may, in its sole

discretion, grant to Mr. Kocak an annual incentive bonus based upon targets set by the Board and its Compensation Committee. Mr. Kocak’s

bonus target shall be up to 35% of his base salary.

Pursuant

to the Kocak Agreement, the Company has also granted to Mr. Kocak, effective February 8,

2024, an option to purchase 15,000 shares of the Company’s common stock with an exercise price of $1.56

per share (the “Kocak Option”). The Kocak Option shall vest over four years. 1/48th of the shares

subject to the Kocak Option will vest on each monthly anniversary of the vesting commencement date (February 9, 2024), in each case

subject to Mr. Kocak’s continued service with the Company through the applicable vesting date. The Kocak Option and its

vesting shall be subject to, and governed by, the terms and conditions of the Company’s 2021 Omnibus Equity Incentive Plan (the

“Plan”), except that the Kocak Offer Letter provides that the Kocak Option and all other options previously

granted and to be granted to Kocak under the Plan will be subject to a double trigger vesting provision upon a Change in Control (as

defined in the Plan).

Mr.

Kocak’s employment is at will, meaning that either he or the Company may terminate the employment at any time for any reason or

no reason. The Kocak Offer Letter also contains customary provisions for confidentiality and matters related to intellectual property

and Company property.

The

foregoing description of the Kocak Offer Letter does not purport to be complete and is qualified in its entirety by reference

thereto, which is attached to this Report as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

RenovoRx,

Inc. |

| |

|

|

| Date:

February 9, 2024 |

By: |

/s/

Shaun Bagai |

| |

Name:

|

Shaun R. Bagai |

| |

Title: |

Chief Executive Officer |

Exhibit

10.1

RenovoRx

4546

El Camino Real, Ste. B1

Los

Altos, CA 94022

www.renovorx.com |

|

February

9, 2024

Ronald

B. Kocak, CPA, CGMA

43092

Binkley Circle

Leesburg,

VA 20176

| |

Re: |

Amended

and Restated Offer Letter |

Dear

Ron:

This

Amended and Restated Offer Letter amends, restates and replaces that certain offer letter, dated July 18, 2022 (the “Original

Offer Letter”), between yourself and RenovoRx, Inc. (the “Company”). Upon the mutual execution

of this Amended and Restated Offer Letter, the Company shall retain you in the new position as Vice President, Controller and Principal

Accounting Officer of the Company, with a start date of February 9, 2024 (the “Start Date”). For the avoidance

of doubt, the terms of the Original Offer Letter shall govern our relationship from July 18 2022 until the Start Date.

If

you accept the terms of this Amended and Restated Offer Letter (as evidenced by your signature hereto), you will receive an annualized

salary of $235,000 (based on working a minimum 30-hour work week over four days Monday through Thursday), less applicable withholdings,

which will be paid semi-monthly in accordance with the Company’s normal payroll procedures. In addition to any discretionary increases

in annual salary which you may be afforded from time to time in the Company’s sole discretion, your annual salary will be subject

to increase to $250,000 if and when the annual salary of the Company’s Chief Executive Officer (CEO) is increased to offset the

salary reductions undertaken by the Company for the CEO in January 2024. You will also be eligible to receive an annual discretionary

bonus of up to 35% of your annualized base salary, which for 2024 shall not be pro-rated based on your Start Date, dependent on the performance

of the Company and your individual performance, as determined by the Company in its discretion (the “Bonus”).

You must be employed by the Company on the date the Bonus is paid in order to be eligible to be paid a Bonus. This is a full-time exempt

position that will report to the CEO, or if applicable, the Company’s Chief Financial Officer (CFO).

A

job description for this position is included as Exhibit A. As of Start Date, the office of CFO is not filled, and therefore

you agree that will serve as the principal financial and accounting officer of the Company for SEC reporting and other compliance purposes.

The Company reserves the right to hire a full time CFO, who may be your superior and the principal financial and accounting officer of

the Company.

As

an employee, you will also be eligible to receive certain employee benefits as set forth in Exhibit B. You should note

that the Company may modify job titles, salaries, benefits, and other terms and conditions of employment from time to time as it deems

necessary. You acknowledge that this position may require travel up to six times per year to the Company’s headquarters, located

in Los Altos, CA, or to such other location as requested by the CEO or (if applicable) the CFO.

In

addition, if you accept this Amended and Restated Offer Letter, the Company will recommend to the Compensation Committee of its Board

of Directors (the “Committee”) that the Company grant you an option (in addition to all other options granted

to you prior to the Start Date) to purchase 15,000 shares of the Company’s common stock (the “Option”).

The exercise price per share of the Option will equal the fair market value per share of the Common Stock on the date of grant, as determined

in accordance with the Company’s 2021 Omnibus Equity Incentive Plan (the “Plan”) or such other Company

equity incentive plan under which the Option is granted. The Option will be granted to you only if you remain an employee of the Company

through the grant date. The Option will be subject to the terms and conditions of the Plan and a stock option agreement between you and

the Company, including vesting requirements (1/48th of the shares subject to the Option will vest on each monthly anniversary

of the vesting commencement date (your Start Date), in each case subject to your continued service with the Company through the applicable

vesting date). No right to any stock is earned or accrued until such time that vesting occurs, nor does the grant confer any right to

continue vesting or to a continued employment relationship.

It

is further agreed that, notwithstanding the provisions of the Original Offer Letter to the contrary, the Option and all other Company

options previously granted, or to be granted, to you under the Plan are and will be subject to a double trigger vesting provision, meaning

that if you are terminated (other than for Cause, as defined below) as an employee or independent contractor of the Company or any Affiliate

(as defined in the Plan) during the period beginning on the date of a Change in Control (as defined in the Plan) and ending on (and inclusive

of) the date that is the one (1) year anniversary of a Change in Control, 100% of the shares subject to then-outstanding portion of the

Option and all such other options will vest in full effective as of immediately prior to, and contingent upon, the closing of such Change

in Control. The term “Cause” means your (i) dishonesty of a material nature; (ii) theft or embezzlement of

Company funds or assets; (iii) being convicted of, or guilty plea or no contest plea to, a felony charge or any misdemeanor involving

moral turpitude, or the entry of a consent decree with any governmental body; (iv) noncompliance in any material respect with any U.S.

or non-U.S. laws or regulations; (v) violation of any express direction or any rule, regulation or policy established by the Company

or its Board of Directors; (vi) material breach of this Amended and Restated Offer Letter or the Confidentiality Agreement; (vii) breach

of any fiduciary duty to the Company; (viii) gross incompetence, neglect, or misconduct in the performance of your duties; or (ix) repeated

failure to perform your duties and responsibilities for the Company or follow the reasonable and lawful instructions of the Company.

You

acknowledge and agree that your employment with the Company is for no specified period and constitutes at-will employment. As a result,

you are free to resign at any time, for any reason or for no reason. Similarly, the Company is free to conclude its employment relationship

with you at any time, with or without cause, and with or without notice. We request that, in the event of resignation, you give the Company

at least two weeks’ notice.

The

Company reserves the right to conduct background investigations and/or reference checks on all of its potential employees. Your job offer,

therefore, is contingent upon a clearance of such a background investigation and/or reference check, if any.

For

purposes of federal immigration law, you will be required to provide to the Company documentary evidence of your identity and eligibility

for employment in the United States. Such documentation must be provided to us within three (3) business days of your date of hire, or

our employment relationship with you may be terminated.

We

also ask that, if you have not already done so, you disclose to the Company any and all agreements relating to your prior employment

that may affect your eligibility to be employed by the Company or limit the manner in which you may be employed. It is the Company’s

understanding that any such agreements will not prevent you from performing the duties of your position and you represent that such is

the case. Moreover, you agree that, during the term of your employment with the Company, you will not engage in any other employment,

occupation, consulting or other business activity directly related to the business in which the Company is now involved or becomes involved

during the term of your employment, nor will you engage in any other activities that conflict with your obligations to the Company. Similarly,

you agree not to bring any third-party confidential information to the Company, including that of your former employer, and that in performing

your duties for the Company you will not in any way utilize any such information. In addition, you acknowledge that the certain At-Will

Employment, Confidential Information, Invention Assignment, And Arbitration Agreement, dated July 18, 202, between you and the Company

(the “Confidentiality Agreement”) shall remain unmodified and in full force and effect.

As

a Company employee, you will be expected to abide by the Company’s rules and standards. Specifically, you will be required to sign

an acknowledgment that you have read and that you understand the Company’s rules of conduct which are included in the Company Manual.

To

accept the Company’s offer, please sign and date this letter in the space provided below. If you accept our offer, your first day

of employment in your new role will be February 9, 2024. This Amended and Restated Offer Letter, along with the Confidentiality Agreement,

set forth the terms of your employment with the Company and supersede any prior representations or agreements including, but not limited

to, any representations made during your recruitment, interviews or employment negotiations, whether written or oral. This Amended and

Restated Offer Letter, including, but not limited to, its at-will employment provision, may not be modified or amended except by a written

agreement signed by the CEO and you.

The

Company is excited about your new role and looks forward to continuing our beneficial and productive relationship. We look forward to

your favorable reply and your acceptance as indicated by your signature below.

| |

Sincerely, |

| |

|

| |

/s/

Shaun R. Bagai |

| |

Shaun

R. Bagai |

| |

Chief

Executive Officer |

| Agreed

to and accepted: |

|

| |

|

|

| Signature:

|

/s/

Ronald B. Kocak |

|

| Printed

Name: |

Ronald

B. Kocak, CPA, CGMA |

|

| Date:

|

February

9, 2024 |

|

Exhibit

A – Job Description

As

Vice President, Controller and Principal Accounting Offering, you will be responsible for all accounting, policy and procedures and control

functions within the Company. You will also serve as the Company’s principal financial and accounting officer for SEC reporting

and other compliance purposes. Specific areas of responsibilities include internal and external reporting, corporate accounting, and

the financial operations functions, which include Corporate Accounting policies and procedures and technical accounting. You will lead

the Company’s compliance efforts with respect to all SEC reporting issues. Additionally, you will be responsible for leading and

developing a diverse organization. Finally, you will be responsible for championing a vision to evolve the organization, transaction

systems and the operating guidelines and processes, to optimize productivity and third party collaborator satisfaction, including upgrading

financial systems as needed. This role will report directly to the CEO and will work closely with the senior management team.

Essential

Duties and Responsibilities:

| |

● |

Responsible

for the design, implementation and maintenance of accounting and control systems to reflect industry best practices including ongoing

testing and remediation. |

| |

● |

Build

a proactive Accounting organization by selecting, training and developing a quality team. Specifically, set clear goals and objectives,

monitor performance, provide frequent high-quality feedback, and support growth and development goals for staff. |

| |

● |

Be

primary liaison to external Auditors with regards to annual audits, scope and fees. Perform quarterly reviews and oversee the timely

and accurate preparation of all external financial reports, including 10-Qs, 10-Ks, 8-Ks. |

| |

● |

Establish

and maintain all corporate accounting policies and procedures, including compliance with new legislative actions. |

| |

● |

Ensure

proactive interpretation and application of all generally accepting accounting policies. Build an organization that will stay on

top of new pronouncements and interpretations and develop Company positions for application and appropriate training of other financial

people. |

| |

● |

Ensure

that all systems used in the Company have adequate internal controls to ensure information integrity and safeguarding of assets.

Develop, maintain and improve all relevant financial systems. |

| |

● |

Participate

with the finance leadership team in identifying, developing and implementing overall key business metrics and management reporting. |

| |

● |

Develop

annual budget and monthly comparison with actuals including any latest outlook / forecasts to changes in business strategy and /

or commitments. |

| |

● |

Set

expectations with internal and external customers and develop metrics to ensure compliance with service level commitments. |

| |

● |

Undertake

such other tasks and responsibilities as are customarily associated with the principal financial and accounting officer of a U.S.

publicly-traded company. |

Exhibit

B – Summary of Benefits

The

following is a brief summary of benefits. Full information concerning eligibility requirements are in RenovoRx, Inc.’s Employee

Manual and/or the Summary Plan Descriptions provided by the insurer.

PAID

TIME OFF

Holidays.

Our paid holidays are:

| |

New

Year’s Day |

Thanksgiving

Day |

| |

President’s

Day |

Day

after Thanksgiving |

| |

Memorial

Day |

Christmas

Eve |

| |

Juneteenth |

Christmas

Day |

| |

Independence

Day |

New

Year’s Eve |

| |

Labor

Day |

|

We

reserve the right to observe a holiday on the actual day or on another day of our choosing.

VACATION

Vacation

is provided by RenovoRx, Inc. for employees under Company’s Flexible Time Away (“FTA”) policy, which shall be provided

under separate cover.

PAID

SICK TIME

The

Company recognizes that the inability to work because of illness or injury may cause economic hardship. For this reason, the Company

provides 24 hours/3 days paid sick time upon hire and annually at the beginning of each anniversary year to all employees who work in

California at least 30 days within a year from hire. Employees are eligible to use the time upon their 90th day of employment. Sick time

may be used for your own or your family member’s health needs. Paid sick time may also be used for purposes relating to an employee

being a victim of domestic violence, sexual assault or stalking.

INSURANCE

We

offer medical, dental and vision insurance. Insurance details will be provided upon hire or earlier if requested.

RETIREMENT

SAVINGS

You

remain are eligible to participate in our 401(k) program that includes an employer match.

Employer

matching contributions are made on a per-pay period basis based on the amount of the employee’s pre-tax and/or Roth contributions.

The employer match is 100% of employee deferrals up to the first 3% of compensation for the period and 50% of the next 2% of compensation

for the period, and is immediately vested.

OTHER

BENEFITS

None

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

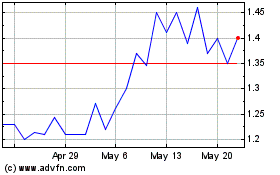

RenovoRx (NASDAQ:RNXT)

Historical Stock Chart

From Apr 2024 to May 2024

RenovoRx (NASDAQ:RNXT)

Historical Stock Chart

From May 2023 to May 2024