UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 16, 2023

RYVYL Inc.

(Exact name of registrant as specified in its charter)

| Nevada | | 001-34294 | | 22-3962936 |

| (State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| 3131 Camino Del Rio North, Suite 1400 San Diego, CA 92108 |

| (Address of principal executive offices, including zip code) |

Registrant’s telephone number, including area code: (619) 631-8261

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | RVYL | | The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On November 16, 2023, the board of directors (the “Board”) of RYVYL Inc. (the “Company”) adopted the RYVYL Inc. 2023 Long Term Incentive (LTI) Plan (“LTIP”). Under the Terms of the LTIP, each year the Company’s Chief Operating Officer (“COO”) has the responsibility to submit to the Board a list of eligible employees for participation in the LTIP for the next succeeding year and a summary of awards. All employees are eligible to participate in the LTIP, subject to selection by the COO; provided that, among other requirements, employees must be employed by September 30th of the applicable year to be eligible. The LTIP operates on a calendar year and payouts, if applicable, will be made no more than two weeks after the filing of the Company’s Annual Report on Form 10-K with the Securities and Exchange Commission. LTIP awards are based on overall financial performance objectives, which are determined by using the Company’s performance history and management’s judgment of what reasonable levels can be reached, based on previous experience. If the Company does not meet minimum performance levels, there will be no payouts for the Company performance objectives. However, LTIP participants may still be eligible to receive payouts related to their department or individual performance objectives. All awards are granted under one of the Company’s equity incentive plans for which the shares available for award thereunder are registered on a Registration Statement on Form S-8 (“each, an “Equity Plan”). Vesting of awards will be determined by the Company’s Compensation Committee and will be set forth in each participant’s award agreement. The LTIP is jointly administered by the Company’s Compensation Committee, the COO and the Company’s legal staff. In the event a participant’s employment is terminated prior to the vesting of any LTIP awards, such awards shall be treated as provided under the terms of the applicable Equity Plan. Additionally, in the event that the Company or any of its affiliates are subject to the applicable requirements of the Emergency Economic Stimulus Act of 2008, as amended from time to time, including but not limited to amendments enacted by the American Recovery and Reinvestment Act of 2009 (“TARP”), the LTIP will be directed in compliance with any incentive compensation limitations and clawback requirements provided for under the TARP requirements.

The foregoing description of the terms of the LTIP is qualified in its entirety by reference to the provisions of LTIP filed as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated by reference herein.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: November 21, 2023

|

RYVYL Inc.

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Fredi Nisan

|

|

| |

|

Name: Fredi Nisan

|

|

| |

|

Title: Chief Executive Officer

|

|

false

0001419275

0001419275

2023-11-16

2023-11-16

EXHIBIT 10.1

RYVYL INC.

2023 LONG TERM INCENTIVE (LTI) PLAN

INTRODUCTION

RYVYL Inc. (the “Company”) and its subsidiaries is willing to provide annual equity incentive award opportunities for eligible employees, through the use of a combined Performance and Time Based Long Term Incentive Compensation Plan (the “Plan”). The annual incentive awards will provide a payment based upon attainment of specified goals and objectives. The objective is to align the interests of these employees with the interests of the Company in retaining key talents and obtaining superior financial results.

SECTION 1. OBJECTIVE AND GENERAL PURPOSE

The Company believes in pay for performance, and desires to implement a performance-based culture. The Company is committed to rewarding employees for the achievement of annual long term business performance goals. This Plan is designed to reward and retain high performers, and to drive the long-term financial success of the Company. The Plan should encourage teamwork and create an environment where officers, directors, vice presidents, and other key persons are rewarded if the Company achieves or exceeds pre-determined annual performance criteria. It is prospective in design with the utilization of a defined payout formula that is based upon the achievement of a combination of pre- determined Company performance criteria.

SECTION 2. PARTICIPATION AND ELIGIBILITY

Each year the Company’s Chief Operating Officer (“COO”) shall submit to the Compensation Committee (“Committee”) of the Board of Directors of the Company a list of eligible employees (or employee groups) for participation in the Plan for the upcoming year. In addition to a listing of the eligible employees, the COO shall also provide the Committee with a summary of the annual incentive award tiers, the incentive award opportunities for each tier, and a summary of possible payouts, for the Committee’s review and approval. Each Plan participant shall be notified of eligibility for participation in the Plan.

The 2023 Plan is limited to selected employees of the Company. The COO will recommend such employees to the Committee for its approval. Additional eligibility requirements are the following:

| |

●

|

New employees must be employed by September 30th in a given Plan year to be eligible for an award related to performance in that Plan year.

|

| |

●

|

Employees hired after September 30th must wait until the next fiscal year to be eligible for an award.

|

| |

●

|

Employees hired before September 30th who work a partial year will receive pro-rated awards based on hours worked.

|

| |

●

|

Additional requirements and parameters for eligibility listed in the associated shareholder approved S-8 plan must also be met.

|

| |

●

|

Eligible employees who have earned an annual incentive award and terminate employment due to disability or death can receive a pro-rata award for the year following the requirements detailed in the shareholder approved S-8 plans.

|

SECTION 3. PLAN YEAR AND PERFORMANCE PERIOD

The Plan operates on a calendar year basis (January 1st to December 31st) (“Performance Period”) and Plan payouts will be made no later than 2 weeks after Company’s financial statements are publicly disclosed in the Company’s Form 10-K filed with the Securities and Exchange Commission for the Plan year that represents the Performance Period. This same Plan year is the Performance Period for determining the amount of incentive awards to be granted in the following Plan year.

SECTION 4. PLAN DESIGN

The Plan design incorporates a tiered approach with annual incentive awards that are linked to the achievement of pre-defined time or performance goals. The incentive ranges (as a percent of salary) are designed to provide market competitive payouts for the achievement of minimum, target and maximum performance goals. This design should be reviewed and possibly adjusted on an annual basis to be sure the Plan remains market competitive and includes all the appropriate Plan participants. The basic Plan design must be approved by the Committee on an annual basis, with respect to each Plan year/Performance Period.

SECTION 5. AWARD OPPORTUNITIES

For each Plan year/Performance Period minimum, target, and maximum performance award opportunity levels, expressed as a percent of salary, will be set for each eligible employee. The actual payouts will be calculated using a ratable approach, where payouts are calculated as a proportion of minimum, target and maximum performance levels.

| |

a.

|

Minimum Performance: The minimum level of performance needed to begin to be eligible to receive an incentive award.

|

| |

b.

|

Target Performance: The budgeted, or expected, level of performance based upon both historical data and management’s best judgment of expected performance during the performance period.

|

| |

c.

|

Maximum Performance: The level of performance which based upon historical performance and management’s judgment would be exceptional or significantly beyond the expected.

|

SECTION 6. PERFORMANCE OBJECTIVES

The Plan will provide annual incentive awards to Plan participants based on overall Company performance objectives. Subject to Section 16, the performance objectives are determined by using the Company’s performance history and management’s judgment of what reasonable levels can be reached, based on previous experience. Once the Target Performance is established, the Minimum and Maximum payout levels are also determined. The specific performance criteria will be based on the Plan’s overall goals, as approved by the Committee, and will be communicated to Plan participants by management. The communication will clearly define the performance objectives at Minimum, Target, and Maximum Performance levels and will define the potential award opportunity for the Plan participants. The Company’s performance will be based on the Company’s success as measured by criteria determined by the Committee with input from the CEO. The percentage of payout for overall Company performance will be allocated based on the specific weighting of the Company’s goal based on the participant’s tier, and the actual performance compared to the pre-determined Minimum, Target, and Maximum Performance levels.

SECTION 7. AWARD CALCULATION

The actual award payouts will be calculated using a ratable approach, where award payouts are calculated as a proportion of minimum, target and maximum award opportunities. If actual performance falls between a performance level, the payout will also fall between the pre-defined performance level on a pro-rated basis.

SECTION 8. EARNING OF ANNUAL INCENTIVE AWARDS

If the Company does not meet minimum performance levels, there will be no payouts for the Company performance objectives. However, the Plan participants may still be eligible to receive payouts related to their department or individual performance objectives.

SECTION 9. GRANT OF AWARDS

After all performance results are available following public disclosure of year-end financials in the Company’s Form 10-K, the awards will be calculated for each Plan participant and recommended by the COO for approval by the Committee. Awards are then granted under the Company’s registered S-8 plans. The vesting schedule for each award will be detailed in each participant’s grant agreement.

The following procedures will apply to the grant of awards:

| |

●

|

Grants will be made at the time provided for in Section 3.

|

| |

●

|

All parameters and requirements detailed in the appropriate shareholder approved S-8 must be followed.

|

| |

●

|

The result of the performance criteria is calculated as a percent of the total actual salary for participant during the current Plan year.

|

SECTION 10. PLAN ADMINISTRATION

Administration of the Plan is the joint responsibility of the Compensation Committee, the COO and the Legal department of the Company.

| |

a.

|

Responsibilities of the Compensation Committee

|

The Committee has the responsibility to approve, amend, or terminate the Plan as necessary. The actions of the Committee shall be final and binding on all parties. The Committee shall also review the operating rules of the Plan on an annual basis and revise these rules if necessary. The Committee also has the sole ability to decide if an extraordinary occurrence totally outside of management’s influence, be it a windfall or a shortfall, has occurred during the current Plan year, and whether the figures should be adjusted to neutralize the effects of such events. After approval by the Committee, management shall, as soon as practical, inform each of the Plan participants under the Plan of their potential award under the operating rules adopted for the Plan year.

| |

b.

|

Responsibilities of the COO

|

The COO of the Company administers the program directly and provides liaison to the Committee, including the following specific responsibilities:

| |

1)

|

Recommend the Plan participants to be included in the Plan for a Plan year/Performance Period. This includes determining if additional employees should be added to the Plan and if any Plan participants should be removed from participating in the Plan.

|

| |

2)

|

Provide recommendations for the award opportunity amounts at target and maximum for all other Plan participants. The COO will review the objectives and evaluations, adjust guideline awards for performance and recommend final awards to the Committee for its approval.

|

| |

3)

|

Provide other appropriate recommendations that may become necessary during the life of the Plan. This could include such items as changes to Plan provisions.

|

| |

c.

|

Responsibilities of Legal

|

The Legal department of the Company will act as the Plan Administrator with regard to responsibilities of administering the grant agreements following year end. Additional responsibilities may be assigned to the Legal department by the Committee or COO. All necessary reporting to outside auditors for inclusion in annual reporting will be carried out by the COO or designee.

SECTION 11. TERMINATION OF EMPLOYMENT

If a Plan participant is terminated by the Company, or voluntarily terminates his/her employment with the Company prior to the vesting date, the Company will follow the vesting restrictions as detailed in the associated shareholder approved S-8 plan.

SECTION 12. AMENDMENTS AND PLAN TERMINATION

The Company has developed the Plan on the basis of existing business, market and economic conditions. If substantial changes occur that affect these conditions, services, assignments, or forecasts, the Company may add to, amend, modify or discontinue any of the terms or conditions of the Plan at any time with approval from the Committee. In no event shall an amendment to the Plan cause the Plan to violate the requirements of Section 16 (related to the TARP Requirements (as defined therein)), cause any payment hereunder to violate Internal Revenue Code (“Code”) Section 409A, or violate any regulatory requirement applicable to the Company.

SECTION 13. PLAN FUNDING

The Plan shall not be funded. Amounts due hereunder shall be paid from the S-8 registered securities plans of the Company.

SECTION 14. CLAIMS AND REVIEW PROCEDURES

A Plan participant or beneficiary (“claimant”) who has not received awards under the Plan that he or she believes should be paid shall make a claim as follows:

| |

1.

|

Initiation – Written Claim. The claimant initiates a claim by submitting to the Plan Administrator a written claim for the benefits.

|

| |

2.

|

Timing of Plan Administrator Response. The Plan Administrator shall respond to such claimant within 90 days after receiving the claim. If the Plan Administrator determines that special circumstances require additional time for processing the claim, the Plan Administrator can extend the response period by an additional 90 days by notifying the claimant in writing.

|

| |

3.

|

Notice of Decision. If the Plan Administrator denies part or all of the claim, the Plan Administrator shall notify the claimant in writing of such denial.

|

If the Plan Administrator denies part or all of the claim, the claimant shall have the opportunity for review by the Plan Administrator of the denial, as follows:

| |

1.

|

Initiation – Written Request. To initiate the review, the claimant, within 60 days after receiving the Plan Administrator’s notice of denial, must file with the Plan Administrator a written request for review.

|

| |

2.

|

Additional Submissions – Information Access. The claimant shall then have the opportunity to submit written comments, documents, records and other information relating to the claim.

|

| |

3.

|

Considerations on Review - In considering the review, the Plan Administrator shall take into account all materials and information the claimant submits relating to the claim, without regard to whether such information was submitted or considered in the initial benefit determination.

|

| |

4.

|

Timing of Plan Administrator Response - The Plan Administrator shall respond in writing to such claimant within 60 days after receiving the request for review. If the Plan Administrator determines that special circumstances require additional time for processing the claim, the Plan Administrator can extend the response period by an additional 60 days by notifying the claimant in writing.

|

| |

5.

|

Notice of Decision - The Plan Administrator shall notify the claimant in writing of its decision on review. The Plan Administrator shall write the notification in a manner calculated to be understood by the claimant.

|

SECTION 15. COMMUNICATION OF PLAN TO PLAN PARTICIPANTS

Communication of the Plan will be vital to the overall success of the Plan. Key communication events can include the following:

| |

1.

|

An initial communication to Plan participants of the Plan details, including the performance targets set for the initial Plan year. This will typically take place in the first few months of the Plan year.

|

| |

2.

|

Communication of new performance targets, Plan procedure changes, etc., at the beginning of each Plan year.

|

| |

3.

|

Periodic reviews and/or performance updates throughout the Plan year. These reviews should include a year-to-date performance update and discuss any changes that may be necessary to assure attainment of the Plan targets.

|

| |

4.

|

An evaluation discussion surrounding the Plan participants’ final annual incentive awards to be conducted by the appropriate manager upon final determination of year-end results.

|

SECTION 16. MISCELLANEOUS

| |

a.

|

Binding Effect. This Plan shall bind the Plan the participant, the Company, and their respective beneficiaries, survivors, executors, successors, administrators and transferees.

|

| |

b.

|

No Guarantee of Employment. This Plan is not an employment policy or contract. It does not give the Plan participant the right to remain an employee of the Company, nor does it interfere with the Company’s right to discharge the Plan participant.

|

| |

c.

|

Non-Transferability. Benefits under this Plan cannot be sold, transferred, assigned, pledged, attached or encumbered in any manner.

|

| |

d.

|

Reorganization. If the Company shall (1) merge into or consolidate with another company, (2) reorganize, (3) sell substantially all of its assets to another company, firm, or person, or upon a change in control involving RYVYL stock, then the succeeding or continuing company, firm, or person shall succeed to, assume and discharge the obligations of the Company under this Plan. Upon the occurrence of such event, all grants will immediately vest.

|

| |

e.

|

Tax Withholding. The Company shall withhold any taxes that are required to be withheld from the benefits provided under this Plan.

|

| |

f.

|

Applicable Law. The Plan and all rights hereunder shall be governed by the laws of the State of California, except to the extent preempted by the laws of the United States of America.

|

| |

g.

|

Entire Plan. This Plan constitutes the entire Plan between the Company and the Plan participant as to the subject matter hereof. No rights are granted to the Plan participant by virtue of this Plan other than those specifically set forth herein.

|

| |

h.

|

Global TARP Limitation. Notwithstanding anything herein to the contrary, during such time as the Company or any affiliated entity shall be subject to the applicable requirements of the Emergency Economic Stimulus Act of 2008, as amended from time to time, including but not limited to amendments enacted by the American Recovery and Reinvestment Act of 2009, as such requirements are implemented by rules, regulations or other guidance as may be issued by the U.S. Treasury Department from time to time, including, but not limited to, the interim final rule (74 FR 28394) entitled “TARP Standards for Compensation and Corporate Governance” as published by the Treasury Department in the Federal Register on June 15, 2009, as amended from time to time (collectively referred to as the “TARP Requirements”), specifically including but not limited to the incentive compensation limitations and clawback requirements provided for therein, and for such time thereafter as required to comply with the TARP Requirements, all amounts payable hereunder shall be subject to, limited by, and subject to repayment in connection with, the TARP Requirements. By accepting any payment hereunder, a participant hereby voluntarily waives any claim against the Company for any changes, modification, restrictions, prohibitions, rescissions, reductions, or repayments that are required to comply with the TARP Requirements. This waiver includes all claims the participant may have under the laws of the United States or any state or locality related to the requirements imposed by the TARP Requirements, including, without limitation, a claim for any compensation, benefit, or other payments the participant would otherwise receive.

|

Code 162(m) Limitation. Any amounts payable hereunder that would not be deductible on account of the limitations of Code Section 162(m) shall be paid in the next following year in which the Company reasonably anticipates that the deduction of such payment would not be barred by the application of Code Section 162(m).

IN WITNESS WHEREOF, the Company has signed this Plan document as of November 16, 2023.

Company Name: RYVYL Inc.

By: /s/ Fredi Nisan

Title: CEO

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

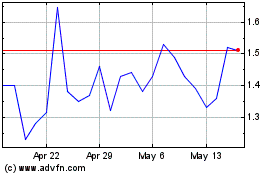

RYVYL (NASDAQ:RVYL)

Historical Stock Chart

From Apr 2024 to May 2024

RYVYL (NASDAQ:RVYL)

Historical Stock Chart

From May 2023 to May 2024