Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE

14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant |

☒ |

| Filed by a Party other than the Registrant |

☐ |

|

Check the appropriate box:

|

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under Rule 14a-12 |

|

Sunshine

Biopharma Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other

than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required. |

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

1. |

Title of each class of securities to which transaction applies:

|

| |

2. |

Aggregate number of securities to which transaction applies:

|

| |

3. |

Per unit price or other underlying value of transaction computed pursuant

to Exchange Act Rule 0-11 (Set forth amount on which filing fee is calculated and state how it was determined):

|

| |

4. |

Proposed maximum aggregate value of transaction:

|

| |

5. |

Total fee paid: |

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offering fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of the filing. |

| |

1. |

Amount previously paid:

|

| |

2. |

Form, Schedule or Registration Statement No.:

|

| |

3. |

Filing Party:

|

| |

4. |

Date Filed: |

SUNSHINE BIOPHARMA INC.

(a Colorado corporation)

Notice of Annual Shareholder Meeting

and

Proxy Statement

TABLE OF CONTENTS

SUNSHINE BIOPHARMA INC.

333 Las Olas Way, CU4 Suite 433

Fort Lauderdale, FL 33301

October 17, 2024

To our Stockholders:

On behalf of our Board of

Directors, I cordially invite you to attend our 2024 Annual Meeting of Stockholders on December 10, 2024, at 10:00 a.m., Eastern Time,

which shall be held online. During the meeting we will discuss the items of business described in the accompanying Notice of Annual Meeting

and Proxy Statement, update you on important developments in our business and respond to any questions that you may have about us.

We are furnishing proxy materials

to some of our shareholders via the Internet by mailing a Notice of Internet Availability of Proxy Materials instead of mailing or emailing

copies of those materials. The Notice of Internet Availability of Proxy Materials directs shareholders to a website where they can access

our proxy materials, including our proxy statement and our annual report, and view instructions on how to vote via the Internet, mobile

device, or by telephone. If you received a Notice of Internet Availability of Proxy Materials and would prefer to receive a paper copy

of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials.

I look forward to your participation

at the meeting.

| |

Yours truly, |

| |

|

| |

|

| |

Dr. Steve N. Slilaty |

| |

Chairperson of the Board of Directors |

SUNSHINE BIOPHARMA INC.

333 Las Olas Way, CU4 Suite 433

Fort Lauderdale, FL 33301

NOTICE OF 2024

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD TUESDAY, DECEMBER 10,

2024

Important Notice Regarding the Availability

of Proxy Materials for the

Shareholder Meeting to Be Held Tuesday, December

10, 2024

The Notice of 2024 Annual Meeting, Proxy Statement

and our Annual Report on Form 10-K

are available at www.sunshinebiopharma.com

To the Shareholders of SUNSHINE BIOPHARMA INC.:

Pursuant to the Company’s

Bylaws, please take notice that the 2024 Annual Meeting of Shareholders of Sunshine Biopharma Inc. will be held online on December 10,

2024, at 10:00 a.m., Eastern Time, to vote on the following matters:

| |

1. |

To elect five (5) persons to our Board of Directors, to hold such office until the 2025 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| |

|

|

| |

2. |

To ratify the appointment of Bush & Associates

CPA LLC as the Company’s independent registered public accountant for the year ending December 31, 2024; and

|

| |

3. |

To transact such other business as may properly come before the meeting or any adjournment thereof. |

It is important that your

share ownership be represented. Please vote using the procedures described on the Notice of Internet Availability of Proxy Materials which

include a proxy card. Your vote will mean that you are represented at the Annual Meeting. Returning the proxy does not deprive you of

your right to change your vote if you so desire.

October 16, 2024 has been

fixed as the Record Date of the shareholders entitled to vote at the meeting and only holders of shares of our voting securities of record

at the close of business on that day will be entitled to vote. The stock transfer books will not be closed.

All shareholders are cordially

invited to attend the meeting online. There will not be a physical meeting to attend.

To participate in the Annual

Meeting you will need to review the information included on your Notice on your proxy card or on the instructions that accompanied your

proxy materials. Please note that you will need your 16-digit control number included on your proxy card.

If you hold your shares through

an intermediary, such as a bank or broker, you must register in advance using the instructions below.

| |

By Order of the Board of Directors |

| |

|

| |

Dr. Steve N. Slilaty

Chairperson of the Board of Directors |

Dated: October 17, 2024

Sunshine Biopharma Inc.

PROXY STATEMENT SUMMARY

FOR THE ANNUAL MEETING OF SHAREHOLDERS

To Be Held Tuesday, December 10,

2024

This Proxy Statement is furnished in conjunction with

the solicitation of proxies by the Board of Directors of Sunshine Biopharma Inc. (“we,” “us,” “our”

or the “Company”), to be used in connection with Company’s Annual Meeting of Shareholders (the “Meeting”

or “Annual Meeting”) to be held on December 10, 2024, at 10:00 a.m. Eastern Time virtually via the Internet and at any adjournments

or postponements thereof.

The Meeting will be held as a virtual meeting

by webcast. You are entitled to participate in the Meeting only if you were a holder of the Company’s common stock as of the close

of business on the Record Date.

You will be able to attend the meeting online.

As an online attendee you may submit your questions during the meeting by visiting https://materials.proxyvote.com/867781. You also will

be able to vote your shares online by attending the meeting virtually by webcast by visiting https://: www.virtualshareholdermeeting.com/SBFM2024

To participate in the meeting you will need to

review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. Please

note you will need your 16-digit control number included on your proxy card.

The online meeting will begin promptly at 10:00

a.m. Eastern Time. We encourage you to attend by accessing the meeting prior to the start time leaving ample time for check-in. Please

follow the registration instructions as outlined in this proxy statement.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What will stockholders be voting on at the

Meeting?

| |

1. |

To elect five (5) persons to our Board of Directors, until the 2025 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| |

|

|

| |

2. |

To ratify the appointment of Bush & Associates

CPA LLC as the Company’s independent registered public accountant for the year ending December 31, 2024; and

|

| |

3. |

To transact such other business as may properly come before the meeting or any adjournment thereof. |

Who is entitled to vote at the Meeting and

how many votes do they have?

Only stockholders of record at

the close of business on October 16, 2024, the record date for the meeting, will be entitled to vote at the annual meeting. There were

1,999,660 shares of our common stock and 130,000 shares of Series B Preferred Stock outstanding

on the Record Date. Each share of Series B Preferred Stock (all of which are held by our chief executive officer) is entitled to 1,000

votes.

Stockholder of Record: Shares Registered in

Your Name

If on October 16, 2024, your

shares of Sunshine Biopharma Inc. common stock were registered directly in your name with our transfer agent, then you are a stockholder

of record. As a stockholder of record you may vote by proxy. Whether or not you plan to attend the meeting online, we urge you to fill

out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name

of a Broker or Bank

If on October 16, 2024, your

shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares

held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding

your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner you have the

right to direct your broker or other agent on how to vote the shares in your account.

How do I vote?

You may vote by proxy in one of three ways:

(1) VOTE BY INTERNET

Before The Meeting - Go to www.proxyvote.com

or scan the QR Barcode

Use the Internet to transmit

your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time the day before the cut-off date or

meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create

an electronic voting instruction form.

During The Meeting - Go to www.virtualshareholdermeeting.com/SBFM2024

You may attend the meeting

via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow

the instructions.

(2) VOTE BY PHONE – 1-800-690-6903

Use any touch-tone telephone

to transmit your voting instructions up until 11:59 p.m. Eastern Time the day before the cut-off date or meeting date. Have your proxy

card in hand when you call and then follow the instructions.

(3) VOTE BY MAIL

Mark, sign and date your proxy

card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood,

NY 11717.

If you vote by proxy the individuals

named on the proxy card (your “proxy”) will vote your shares in the manner you have indicated. If you grant a proxy without

indicating your instructions, your shares will be voted for the approval of all of the Proposals.

What is a proxy?

A proxy is a person you appoint

to vote on your behalf. If you complete and return the enclosed proxy card, your shares will be voted in accordance with your instructions

by the proxies identified on the proxy card.

By completing and returning this proxy card,

who am I designating as my proxy?

You will be designating Dr.

Steve N. Slilaty, our Chief Executive Officer as your proxy. He may act on your behalf and will have the authority to appoint a substitute

to act as proxy.

How will my proxy vote my shares?

Your proxy will vote your

shares according to the instructions on your proxy card.

Other than the Proposals included

below we do not intend to bring any other matter for a vote at the Meeting, and we do not know of anyone else who intends to do so. However,

your proxies are authorized to vote on your behalf, in their discretion, on any other business that properly comes before the Meeting

or any adjournments or postponements thereof.

How do I change or revoke my proxy?

You may change or revoke your

proxy at any time before your shares are voted at the Meeting by:

| |

· |

executing and delivering another later dated proxy card; |

| |

|

|

| |

· |

notifying the Company’s Corporate Secretary, in writing at that you are changing or revoking your proxy. |

All signed proxies that have

not been revoked will be voted at the Meeting. If your proxy contains any specific instructions, they will be followed.

Who will count the votes?

An inspector of election designated

by the Board will count the votes.

What constitutes a quorum?

A quorum, which is necessary

to conduct business at the Meeting, constitutes one-third of the outstanding shares of our common stock entitled to be cast at the Meeting,

present in person or represented by proxy. If you sign and return your proxy card, your shares will be counted in determining the presence

of a quorum, even if you withhold your vote or abstain from voting. If a quorum is not present at the Meeting, the Chairperson of the

Meeting or the stockholders present or by proxy may adjourn the Meeting to a date not more than 120 days after the Record Date, until

a quorum is present.

What are my voting choices when voting on director

nominees, and what vote is needed to elect directors?

When voting on the election

of director nominees to serve until the 2024 Annual Meeting of Stockholders and until their successors are elected, you may:

| |

· |

vote in favor of all nominees; |

| |

|

|

| |

· |

withhold votes as to all nominees; or |

| |

|

|

| |

· |

withhold votes as to one or more specific nominees. |

A nominee is elected to the

Board if a plurality of votes cast in the election of directors is cast “for” the nominee. Any votes withheld will not be

counted in determining the number of votes cast and, therefore, will have no effect on the outcome of the proposal. In the event that

any nominee for director is unavailable for election, the Board may either reduce the number of directors or choose a substitute nominee.

If the Board chooses a substitute nominee, the shares represented by a proxy will be voted for the substitute nominee, unless other instructions

are given in the proxy.

The Board recommends that

the stockholders vote “FOR” all of the nominees.

What vote is required to approve each Proposal?

Proposal No. l –

Election of Directors. The election of each director nominee requires the affirmative vote of a plurality of the votes cast, if a

quorum is present, in the election of directors.

Proposal No. 2 –

Ratification of Auditors. An affirmative vote of a majority of the votes cast at the Meeting, if a quorum is present, is required

for ratification of the selection of Bush & Associates CPA LLC as independent auditors for the year ending December 31, 2024.

What are my voting choices when voting on the

ratification of the appointment of Bush & Associates CPA LLC as our independent registered public accounting firm?

When voting on the ratification

of the appointment of Bush & Associates CPA LLC as our independent registered public accounting firm, you may:

| |

· |

vote in favor of the ratification; |

| |

|

|

| |

· |

vote against the ratification; or |

| |

|

|

| |

· |

abstain from voting. |

The affirmative vote of a

majority of the votes cast is required for approval of the ratification of Bush & Associates CPA LLC. Abstentions will not be counted

in determining the number of votes cast and, therefore, will have no effect on the outcome of the proposal.

The Board recommends that

the stockholders vote “FOR” the ratification of Bush & Associates CPA LLC.

What if I do not specify a choice for a matter

when returning a proxy?

If you sign your proxy but

do not give voting instructions, the individuals named as proxy holders on the proxy card will vote “FOR” the election of

all nominees, “FOR” the ratification of Bush & Associates CPA LLC and in their discretion on any other matters that may

properly come before the Meeting.

Will my shares be voted if I do not provide

my proxy or vote at the Meeting?

If you do not provide your

proxy or vote at the Meeting and you are a stockholder whose shares of common stock are registered directly in your name with our transfer

agent (Equiniti Trust Company), your shares of common stock will not be voted.

If you do not provide your

proxy or vote at the Meeting and you are a stockholder whose shares of common stock are held in street name with a bank, brokerage firm

or other nominee (i.e., in “street name”), your nominee may vote your shares in its discretion on the proposal to ratify

Bush & Associates CPA LLC as independent auditors for the fiscal year ending December 31, 2024. The ratification of our independent

registered public accounting firm is a “routine matter” on which nominees are permitted to vote on behalf of their clients

if no voting instructions are furnished.

Who is soliciting my proxy, how is it being

solicited and who pays the cost?

The Board is soliciting your

proxy for the Meeting. The solicitation process is being conducted primarily by mail. However, proxies may also be solicited in person,

by telephone, facsimile or other electronic means. We pay the cost of soliciting proxies and may use employees to solicit proxies and

also reimburse stockbrokers and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding

proxy and solicitation material to the owners of our common stock.

What does it mean if I receive more than one

proxy card?

If you receive more than one

proxy card, it means you have multiple accounts with our transfer agent, and to vote all your shares you will need to sign and return

all proxy cards.

May stockholders ask questions at the Meeting?

Yes. At the end of the Meeting

our representatives will answer questions from stockholders.

PRINCIPAL SHAREHOLDERS

The following table sets forth

certain information regarding the ownership of common stock and Series B Preferred Stock as of October 16, 2024, by (i) each of our directors,

(ii) each of our executive officers, (iii) all of our directors and executive officers as a group, and (iv) any person or group as those

terms are used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), believed by us

to beneficially own more than 5% of our common stock. Unless otherwise indicated, all shares are owned directly and the indicated person

has sole voting and investment power. The percentages listed are based upon 1,999,660 common

shares issued and outstanding and 130,000 Series B Preferred shares outstanding as of October 16, 2024. Each share of Series B Preferred

Stock entitles the holder to 1,000 votes.

| Title of Class | |

Name and Address of Beneficial Owner | |

Amount and Nature of Beneficial Ownership | | |

Percent of Outstanding Shares | |

| | |

| |

| | |

| |

| | |

Dr. Steve N. Slilaty(1) 579 Rue Lajeunesse | |

| | | |

| | |

| Common | |

Laval, Quebec H7X 3K4, Canada | |

| 1,911 | (2) | | | * | |

| Series B Preferred | |

| |

| 130,000 | | |

| 100% | |

| | |

| |

| | | |

| | |

| Common | |

Mr. Camille Sebaaly(1) 3040 Levesque West, Suite 506

Laval, Quebec H7V 2G3, Canada | |

| 60 | | |

| * | |

| | |

| |

| | | |

| | |

| Common | |

Dr. Abderrazzak Merzouki(1)

731 Place de l’Eeau Vive

Laval, Quebec H7Y 2E1, Canada | |

| 59 | | |

| * | |

| | |

| |

| | | |

| | |

| Common | |

Dr. Rabi Kiderchah(1)

c/o Sunshine Biopharma Inc. 333 Las Olas Way, CU4 Suite 433 Fort Lauderdale, FL 33301 | |

| 1 | | |

| * | |

| | |

| |

| | | |

| | |

| Common | |

Dr. Andrew Keller(1) c/o Sunshine Biopharma Inc. 333 Las Olas Way, CU4 Suite 433 Fort Lauderdale, FL 33301 | |

| 0 | | |

| * | |

| | |

| |

| | | |

| | |

| Common | |

Mr. David Natan(1)

c/o Sunshine Biopharma Inc.

333

Las Olas Way, CU4 Suite 433

Fort Lauderdale, FL 33301 | |

| 0 | | |

| * | |

| | |

| |

| | | |

| | |

| | |

All Officers and Directors as Group (6 persons): | |

| | | |

| | |

| Common | |

| |

| 2,030 | | |

| * | |

| Series B Preferred | |

| |

| 130,000 | | |

| 100% | |

____________________

| * | Less

than 1%. |

| |

(1) |

Officer and/or director of our Company. |

| |

(2) |

Includes 1,850 common shares owned by Malek Chamoun, the President of

Nora Pharma Inc., a wholly-owned subsidiary of the Company. Mr. Chamoun is not an officer or director of the Company. Dr. Slilaty

controls the voting of Mr. Chamoun’s shares through a voting agreement between Mr. Chamoun and Dr. Slilaty dated October 20,

2022. |

BOARD OF DIRECTORS AND COMMITTEES

The primary responsibility

of the Board is to foster the long-term success of the Company consistent with its fiduciary duty to the stockholders. The Board has responsibility

for establishing broad corporate policies, setting strategic direction, and overseeing management, which is responsible for the day-to-day

operations of the Company. In fulfilling this role, each director must act in good faith in a manner he reasonably believes to be in the

best interests of the Company with the care an ordinarily prudent person in a like position would use under similar circumstances. The

directors are regularly kept informed about our business at meetings of the Board and its Committees and through supplemental reports

and communications. The responsibilities of the Board’s standing Committees are addressed separately in this Proxy Statement.

In 2023, the Board did not

meet in person but took action by unanimous consent on eighteen occasions. Directors are expected to attend Board meetings, the Annual

Meeting of Stockholders and meetings of the Committees on which they serve, with the understanding that on occasion a director may be

unable to attend a meeting.

Stockholders and other interested

parties who wish to communicate with the Board may do so by writing to:

Dr. Steve N. Slilaty, Chairperson of the Board of Directors

Sunshine Biopharma Inc.

333 Las Olas Way, CU4 Suite 433

Fort Lauderdale, FL 33301

The Board has established various

Committees of the Board to assist it with the performance of its responsibilities. These Committees and their members are listed below.

The Board designates the members of these Committees and the Committee Chairs based on the recommendation of the Nominating and Corporate

Governance Committee. The Board has adopted written charters for each of these Committees which can be found at the investor relations

section of the Company’s website at http://sunshinebiopharma.com.

Audit Committee

Our Board has established

an Audit Committee, which is composed of three independent directors, Mr. David Natan (Chairperson), Dr. Andrew Keller, and Dr. Rabi Kiderchah.

Mr. Natan is our audit committee financial expert. During 2023, the audit committee did not meet in person but took four actions by unanimous

consent. The Committee’s primary duties are to:

| |

· |

review and discuss with management and our independent auditor our annual and quarterly financial statements and related disclosures, including disclosure under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the results of the independent auditor’s audit or review, as the case may be; |

| |

|

|

| |

· |

review our financial reporting processes and internal control over financial reporting systems and the performance, generally, of our internal audit function; |

| |

|

|

| |

· |

oversee the audit and other services of our independent registered public accounting firm and be directly responsible for the appointment, independence, qualifications, compensation and oversight of the independent registered public accounting firm, which reports directly to the Audit Committee; |

| |

|

|

| |

· |

provide an open means of communication among our independent registered public accounting firm, management, our internal auditing function and our Board; |

| |

|

|

| |

· |

review any disagreements between our management and the independent registered public accounting firm regarding our financial reporting; |

| |

· |

prepare the Audit Committee report for inclusion in our proxy statement for our annual stockholder meetings; and |

| |

|

|

| |

· |

establish procedures for complaints received regarding our accounting, internal accounting control and auditing matters. |

Our Audit Committee charter

also mandates that our Audit Committee approve all audit and permissible non-audit services conducted by our independent registered public

accounting firm. The Audit Committee was established in 2022.

Audit Committee Report

In fulfilling its oversight responsibilities, the Audit

Committee reviewed the audited financial statements in our Annual Report on Form 10-K with management and discussed the quality and

acceptability of our accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in our financial

statements.

The Audit Committee reviewed with the independent auditors,

who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting

principles, their judgments as to the quality and acceptability of our accounting principles and such other matters as are required to

be discussed with the committee under the standards of the PCAOB, including Auditing Standard 1301 (Communications with Audit Committees).

In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from management and us,

including the matters in the written disclosures required by Independence Standards Board Standard No. 1 (Independent Discussions

with Audit Committees), which were submitted to us, and considered the compatibility of non-audit services with the auditors’ independence.

The Audit Committee discussed with our independent

auditors the overall scope and plans for their audit. The Audit Committee met with the independent auditors, with and without management

present, to discuss the results of their examination, their evaluation of our internal controls, and the overall quality of our financial

reporting.

In reliance on these reviews

and discussions, the Audit Committee recommended to our Board of Directors (and our Board has approved) that our audited financial statements

for the year ended December 31, 2023, be included in the Annual Report on Form 10-K for the year ended December 31, 2023,

for filing with the Securities and Exchange Commission.

The Audit Committee selects

the Company’s independent registered public accounting firm annually and has submitted such selection for the year ending December 31,

2024, for ratification by stockholders at the Company’s Annual Meeting.

The material in this report is not deemed to

be “soliciting material,” or to be “filed” with the Securities and Exchange

Commission and is not to be incorporated

by reference in any of our filings under the Securities Act of 1933,

as amended, or the Securities Exchange Act of 1934, as amended, whether

made before or after

the date hereof and irrespective of any general incorporation language in any such filings.

Compensation Committee

Our Board has established

a Compensation Committee, which is composed of three independent directors (as defined under the general independence standards of the

Nasdaq listing standards and our Corporate Governance Guidelines). Dr. Rabi Kiderchah (Chairperson) is a “non-employee director”

(within the meaning of Rule 16b-3 of the Exchange Act) and “outside director” (within the meaning of Section 162(m) of the

Internal Revenue Code). Mr. David Natan and Dr. Andrew Keller serve as the other members of this committee and meet similar requirements

as noted herein. During 2023, the Compensation Committee did not meet in person but took one action by unanimous consent. The Committee’s

primary duties are to:

| |

· |

approve corporate goals and objectives relevant to executive officer compensation and evaluate executive officer performance in light of those goals and objectives; |

| |

|

|

| |

· |

determine and approve executive officer compensation, including base salary and incentive awards; |

| |

|

|

| |

· |

make recommendations to the Board regarding compensation plans; |

| |

|

|

| |

· |

administer our stock plan; and |

| |

|

|

| |

· |

prepare a report on executive compensation for inclusion in our proxy statement for our annual stockholder meetings. |

Our Compensation Committee

determines and approves all elements of executive officer compensation. It also provides recommendations to the full Board of Directors

with respect to non-employee director compensation. The Compensation Committee may not delegate its authority to any other person, although

it may delegate its authority to a subcommittee.

The Compensation Committee

was established in 2022.

Nominating and Corporate Governance Committee

The Nominating and Corporate

Governance Committee consists of Dr. Andrew Keller (Chairperson) and Mr. David Natan and Dr. Rabi Kiderchah. During 2023, the Nominating

and Corporate Governance Committee did not meet in person but took one action by unanimous consent. The Committee’s primary duties

are to:

| |

· |

recruit new directors, consider director nominees recommended by stockholders and others and recommend nominees for election as directors; |

| |

|

|

| |

· |

review the size and composition of our Board and its Committees; |

| |

|

|

| |

· |

oversee the evaluation of the Board; |

| |

|

|

| |

· |

recommend actions to increase the Board’s effectiveness; and |

| |

|

|

| |

· |

develop, recommend and oversee our corporate governance principles, including our Code of Business Conduct and Ethics and our Corporate Governance Guidelines. |

The Nominating and Corporate

Governance Committee was established in 2022.

CORPORATE

GOVERNANCE

Code of Business Conduct and Ethics

Our Code of Business Conduct

and Ethics applies to all of our officers, employees and directors, including our Chief Executive Officer and Chief Financial Officer.

Our Code of Business Conduct and Ethics reflects the foregoing principles. Our Code of Business Conduct and Ethics is available on our

website (https://sunshinebiopharma.com/).

No Family Relationships

There is no family relationship between any director

and executive officer or among any directors or executive officers.

Involvement in Certain Legal Proceedings

Our directors and executive officers have not been

involved in any of the following events during the past ten years:

| |

1. |

any bankruptcy petition filed by or against such person or any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| |

|

|

| |

2. |

any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| |

|

|

| |

3. |

being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting his involvement in any type of business, securities or banking activities or to be associated with any person practicing in banking or securities activities; |

| |

|

|

| |

4. |

being found by a court of competent jurisdiction in a civil action, the SEC or the CFTC to have violated a Federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| |

|

|

| |

5. |

being subject of, or a party to, any Federal or state judicial or administrative order, judgment decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of any Federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| |

|

|

| |

6. |

being subject of or party to any sanction or order, not subsequently reversed, suspended, or vacated, of any self-regulatory organization, any registered entity or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Board Diversity

Our Board seeks members from

diverse professional backgrounds who combine a solid professional reputation and knowledge of our business and industry with a reputation

for integrity. Our Board does not have a formal policy concerning diversity and inclusion but is in the process of establishing a policy

on diversity. Diversity of experience, expertise, and viewpoints is one of many factors the Nominating and Corporate Governance Committee

considers when recommending director nominees to our Board. Further, our Board is committed to actively seeking highly qualified women

and individuals from minority groups and the LGBTQ+ community to include in the pool from which new candidates are selected. Our Board

also seeks members that have experience in positions with a high degree of responsibility or are, or have been, leaders in the companies

or institutions with which they are, or were, affiliated, but may seek other members with different backgrounds, based upon the contributions

they can make to our Company. While the Board has continued its efforts to identify candidates that have such experience, they have currently

been unable to identify any such candidates which fulfill the diversity requirement with the requisite professional experience.

Board leadership structure and role in risk oversight

Our Board of Directors is

responsible for the selection of the Chairman of the Board and the Chief Executive Officer. Our Board does not have a policy on whether

or not the roles of Chief Executive Officer and Chairman should be separate and, if they are to be separate, whether the Chairman should

be selected from the non-employee directors or be an employee. Currently our Chief Executive Officer acts as Chairman. Our Board believes

that Dr. Steve N. Slilaty, our Chief Executive Officer, is best suited to act as Chairman of the Board because he is the director most

familiar with the Company’s business and industry and is therefore best able to identify the strategic priorities to be discussed

by the Board.

Our management

is responsible for risk management on a day-to-day basis. The role of our Board and its committees includes overseeing the risk management

activities of management.

MANAGEMENT PROPOSALS

Proposal No. 1 – Election of Directors

Our Bylaws provide for the

election of directors at the Annual Meeting of shareholders. Each director serves until his or her successor is elected and qualified,

or until his or her resignation or removal. Directors are elected by a plurality of the votes cast, so that only votes cast “for”

directors are counted in determining which directors are elected.

The size of the Board of Directors

will remain as previously set at five directors, all of whom are running for re-election. Therefore, the five directors receiving the

most votes “for” will be elected. Broker non-votes (if any) and withheld votes will be treated as shares present for purposes

of determining the presence of a quorum but will have no effect on the vote for the election of directors. Information with respect to

the nominees proposed for election is set forth below.

The Board of Directors recommends

a vote FOR the director nominees. The persons named in the accompanying proxy card will vote for the election of the nominees named

in this proxy statement unless shareholders specify otherwise in their proxies. If any nominee at the time of election is unable to

serve, or otherwise is unavailable for election, and if other nominees are designated by the Board of Directors, the persons named as

proxy holders on the accompanying proxy card intend to vote for such nominees. Management is not aware of the existence of any circumstance

which would render the nominees named below unavailable for election. All of the nominees are currently directors of the Company.

Nominees for Directors

The following table sets forth

the name and the position(s) currently held by each person nominated as a director:

| Name |

|

Age |

|

Position(s) |

| |

|

|

|

|

| Dr. Steve N. Slilaty |

|

72 |

|

President, Chief Executive Officer and Chairman |

| |

|

|

|

|

| Dr. Abderrazzak Merzouki |

|

60 |

|

Chief Operating Officer and Director |

| |

|

|

|

|

| Dr. Rabi Kiderchah |

|

51 |

|

Independent Director |

| |

|

|

|

|

| Mr. David Natan |

|

71 |

|

Independent Director |

| |

|

|

|

|

| Dr. Andrew Keller |

|

71 |

|

Independent Director |

Each of the above persons,

if reelected, will serve as directors until the Annual Meeting of Stockholders held in 2025 and the election and qualification of the

director’s respective successor or until the director’s earlier death, removal or resignation.

All nominees have consented

to be named and have agreed to serve if elected. Although it is not anticipated that any of the persons named above will be unable or

unwilling to stand for reelection, a proxy, in the event of such occurrence, may be voted for a substitute nominee to be designated by

the Board, or, as an alternative, the Board may reduce the number of directors to be elected at the Meeting or leave the position(s) vacant.

Dr. Steve N. Slilaty was appointed as

our chief executive officer and chairman of our board of directors on October 15, 2009. Dr. Slilaty is an accomplished scientist

and business executive. His scientific publications are widely cited. Sunshine Biopharma is the third in a line of biotechnology companies

that Dr. Slilaty founded and managed. The first, Quantum Biotechnologies Inc. later known as Qbiogene Inc., was founded

in 1991 and is now a member of a family of companies owned by MP Biomedicals, one of the largest international suppliers of biotechnology

reagents and other research products. The second company which Dr. Slilaty founded, Genomics One Corporation, conducted an

initial public offering of its capital stock in 1999 and, on the basis of its ownership of Dr. Slilaty’s patented TrueBlue Technology®,

Genomics One became one of the key participants in the Human Genome Project and reached a market capitalization of $1 billion in

2000. Formerly, Dr. Slilaty was a research team leader at the Biotechnology Research Institute (Montreal), a division of the National

Research Council of Canada. Dr. Slilaty is one of the pioneers of Gene Therapy having developed the first gene delivery system applicable

to humans in 1983 [Science 220: 725-727 (1983)]. Dr. Slilaty's other distinguished scientific career accomplishments was

the discovery of a new class of enzymes, the S24 Family of Proteases (IUBMB Enzyme: EC 3.4.21.88) [Proc. Natl. Acad. Sci. U.S.A. 84:

3987-3991 (1987)]. In addition, Dr. Slilaty (i) developed the first site-directed mutagenesis system applicable to double-stranded

DNA [Analyt. Biochem. 185: 194-200 (1990)], (ii) cloned the gene for the first yeast-lytic enzyme (lytic beta-1,3-glucanase)

[J. Biol. Chem. 266: 1058-1063 (1991)], (iii) developed a new molecular strategy for increasing the rate of enzyme reactions

[Protein Engineering 4: 919-922 (1991)], and (iv) constructed a powerful new cloning system for genomic sequencing (TrueBlue

Technology®) [Gene 213: 83-91 (1998)]. In collaboration with Institut National des Sciences Appliquée (France),

State University of New York at Binghamton (USA) and École Polytechnique, Université de Montréal (Canada), Dr. Slilaty

designed, patented, and advanced the development the first, and currently the only known anticancer compound (Adva-27a) capable of destroying

multidrug resistant cancer cells in vitro [Anticancer Res. 32: 4423 (2012) and US Patent Numbers: 8,236,935 and 10,272,065].

Most recently, Dr. Slilaty assisted in the development of one of the first non-covalent inhibitors of the coronavirus protease, PLpro

[J. Med. Chem. 67: 13681 (2024)]. These and other works of Dr. Slilaty are cited in research papers, editorials,

review articles and textbooks. Dr. Slilaty is the author of 19 original research papers and 12 issued and pending patents. These and other

works of Dr. Slilaty are cited in research papers, editorials, review articles and textbooks. Dr. Slilaty received his Ph.D. degree in

Molecular Biology from the University of Arizona in 1983 and Bachelor of Science degree in Genetics and Biochemistry from Cornell University

in 1976. Dr. Slilaty has received research grants from the NIH and NSF and he is the recipient of the 1981 University of Arizona Foundation

award for Meritorious Performance in Teaching.

Dr. Abderrazzak Merzouki was appointed

as a director and our chief operating officer in February 2016. In addition to his positions with our Company, since January 2016 he has

been self-employed as a consultant in the fields of biotechnology and pharmacology. From July 2007 through December 2016, Dr. Merzouki

worked at the Institute of Biomedical Engineering in the Department of Chemical Engineering at Ecole Polytechnique de Montreal, where

he taught and acted as a senior scientist involved in the research and development of plasmid and siRNA-based therapies. Dr. Merzouki

is a molecular biologist and an immunologist with extensive experience in the area of gene therapy where he performed several preclinical

studies for pharmaceutical companies involving the use of adenoviral vectors for cancer therapy and plasmid vectors for the treatment

of peripheral arterial occlusions. Dr. Merzouki also has extensive expertise in the design of expression vectors, and production and purification

of recombinant proteins. He developed technologies for production of biogeneric therapeutic proteins for the treatment of various diseases

including cancer, diabetes, hepatitis and multiple sclerosis. Dr. Merzouki obtained his Ph.D. in Virology and Immunology from Institut

Armand-Frappier in Quebec and received his post-doctoral training at the University of British Columbia and the BC Center for Excellence

in HIV/AIDS research. Dr. Merzouki has over 30 publications and 70 communications in various, highly respected scientific journals in

the field of cellular and molecular biology.

Dr. Rabi Kiderchah has served as

a director since October 2021. Dr. Kiderchah is a licensed physician in Canada. From 2000 until August 2021, he was working at Argenteuil

Hospital, Lachute, Quebec, Canada, as an emergency room physician. He has also worked as what is referred to in Canada as a “medecins

depanneurs”, working in rural areas where there are not enough ER doctors. Since August 2011 he has worked at Rabi Kiderchah Medecin

Inc. as a freelance physician in the Quebec, Canada area. He received a Bachelor of Science degree in 1994 and an MD degree in 1998 from

the University of Montreal.

Mr. David Natan has served as

a director since February 10, 2022. Mr. Natan has served as President and CEO of Natan & Associates, LLC, a consulting firm

offering CFO services to public and private companies since 2007. From February 2010 to May 2020, Mr. Natan served as CEO of

ForceField Energy, Inc. (OTCMKTS: FNRG), a company focused on LED lighting products. From February 2002 to November 2007, Mr. Natan

served as CFO of PharmaNet Development Group, Inc., a drug development company, and, from June 1995 to February 2002, as CFO and VP

of Global Technovations, Inc., a manufacturer and marketer of speaker components. Prior to that, Mr. Natan served in various roles

with Deloitte & Touche LLP. In November 2023, Mr. Natan was appointed to the Board of Directors and Chair of the Audit Committee

of Minim Inc. (OTC: MINM), a provider of innovative internet access products. Mr. Natan holds a B.A. in Economics from Boston

University.

Dr. Andrew M. Keller has

served as a director since February 10, 2022. From 2016 through November 2019, Dr. Keller was the Chief Medical Officer at the Western

Connecticut Medical Group, Bethel CT, a multispecialty health organization. He was employed by this group beginning in 1989, and in 2003

became Chief – Section of Cardiovascular Diseases. Dr. Keller was an Associate Professor of Medicine at Columbia University from

1985 through 2024. Dr. Keller retired as a practicing physician in 2019 and obtained his Juris Doctor degree, graduating Summa Cum Laude

from Quinnipiac University College of Law in May 2024. Dr. Keller is admitted to practice law in Connecticut, Massachusetts, and the Federal

District of Connecticut. He is currently in private practice involved in special education law, representing families with children who

have special needs who have been denied services by their schools. Dr. Keller received his Doctor of Medicine degree in 1979 from

The Ohio State University and a Bachelor of Arts degree in Physics, Magna Cum Laude from Ithaca College in 1975.

All of the nominees for director

are directors presently. Our Nominating Committee did not receive any recommendations of director candidates from any stockholder or group

of stockholders during 2023. We did not utilize any third-party search firms to assist in identifying potential director candidates during

FY 2022. The Board, upon the recommendation of the Nominating Committee, has affirmatively determined that each of the following nominees

for director is independent under Nasdaq rules: Mr. Natan, Dr. Keller and Dr. Kiderchah.

The Nominating Committee is

responsible for reviewing with the Board the requisite skills and characteristics of new Board members as well as the composition of the

Board as a whole. This assessment includes members’ qualification as independent, as well as consideration of diversity, age, skills

and experience in the context of the Board’s needs. Nominees for directorships are selected by the Nominating Committee and recommended

to the Board in accordance with the policies and principles in its charter. The Nominating Committee does not distinguish between nominees

recommended by stockholders and other nominees. Stockholders wishing to suggest candidates to the Nominating Committee for consideration

as directors must submit a written notice to the Company’s Corporate Secretary, who will provide it to the Nominating Committee.

Our Bylaws set forth the procedures a stockholder must follow to nominate directors. These procedures are summarized in this Proxy Statement

under the caption “Stockholder Proposals for 2025 Annual Meeting of Stockholders.”

RECOMMENDATION OF THE BOARD FOR PROPOSAL

NO. 1

Our

Board of Directors unanimously recommendS A VOTE FOR THE ELECTION

AS DIRECTORS OF THE NOMINEES LISTED ABOVE

Proposal No. 2 – Ratification of Bush & Associates

CPA LLC as Our Independent Registered Public Accounting Firm

The Board of Directors has appointed

Bush & Associates CPA LLC as our independent registered public accounting firm for the year ending December 31, 2024. A representative

of Bush & Associates CPA LLC is expected to be present at the Meeting, will have an opportunity to make a statement if he so desires

and will be available to respond to appropriate questions.

The

financial statements of the Company for the fiscal years ended December 31, 2023 and 2022 were audited by BF Borgers CPA, PC (“Borgers”).

On May 3, 2024, the Securities and Exchange Commission (the “SEC”) announced that it had settled charges against Borgers that

it failed to conduct audits in accordance with the standards of the Public Company Accounting Oversight Board (the “PCAOB”).

As part of the settlement, Borgers agreed to a permanent ban on appearing or practicing before the SEC. As a result of Borgers’

settlement with the SEC, the Company dismissed Borgers as its independent accountant. The decision to dismiss Borgers as the Company’s

independent registered public accounting firm was approved by the audit committee of the Company’s board of directors.

Borgers’

reports on the Company’s financial statements for the two most recent fiscal years did not contain an adverse opinion or a disclaimer

of opinion, nor was it qualified or modified as to uncertainty, audit scope, or accounting principles.

During

the Company’s two most recent fiscal years ended December 31, 2023 and 2022 and the subsequent interim period through May 3, 2024,

there were no disagreements, within the meaning of Item 304(a)(1)(iv) of Regulation S-K, with Borgers on any matter of accounting principles

or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction

of Borgers, would have caused it to make reference to the subject matter of the disagreements in connection with its reports. Also during

this same period, there were no reportable events that existed within the meaning of Item 304(a)(1)(v) of Regulation S-K and the related

instructions thereto.

Effective

May 7, 2024, the Company retained Bush & Associates CPA LLC (“Bush & Associates”), as its independent registered public

accounting firm. The decision to engage Bush & Associates as the Company’s independent registered public accounting firm was

approved by the unanimous consent of the Company’s board of directors.

During

the two most recent fiscal years and in the subsequent interim period through May 7, 2024, the Company did not consult with Bush &

Associates with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type

of audit opinion that would have been rendered on the Company’s financial statements, or any other matters set forth in Item 304(a)(2)(i)

or (ii) of Regulation S-K.

Stockholder ratification

of the appointment of our independent registered public accounting firm is not required by our bylaws or otherwise. However, our Board

is submitting the appointment of Bush & Associates CPA LLC to the stockholders for ratification as a matter of what it considers

to be good corporate practice. Even if the appointment is ratified, our Board in its discretion may direct the appointment of a different

independent registered public accounting firm at any time during the year if the Board determines that such a change would be in our

and our stockholders’ best interests.

Fees Paid to Independent Registered Public

Accounting Firms

The table below presents fees

for professional audit services rendered by B F Borgers, CPA P.C., our independent auditors during our fiscal years ended December 31,

2023 and 2022:

| | |

December 31, 2022 | | |

December 31, 2023 | |

| Audit Fees | |

$ | 137,500 | | |

$ | 170,500 | |

| Audit-related Fees | |

| – | | |

| – | |

| Tax Fees | |

| – | | |

| – | |

| All Other Fees | |

| – | | |

| – | |

| Total | |

$ | 137,500 | | |

$ | 170,500 | |

Audit Fees. Consist

of amounts billed for professional services rendered for the audit of our annual financial statements included in our Form 10-K and reviews

of our interim financial statements included in our Quarterly Reports on Form 10-Q.

Tax Fees. Consists

of amounts billed for professional services rendered for tax return preparation, tax planning and tax advice.

All Other Fees. Consists

of amounts billed for services other than those noted above.

RECOMMENDATION OF THE BOARD FOR PROPOSAL 2

Our

Board of Directors unanimously recommendS A VOTE FOR RATIFICATION OF BUSH & ASSOCIATES CPA LLC AS OUR INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

EXECUTIVE OFFICERS

The following individuals

currently serve as our executive officers.

| Name |

|

Age |

|

Position(s) |

| |

|

|

|

|

| Dr. Steve N. Slilaty |

|

72 |

|

President, Chief Executive Officer and Chairman |

| |

|

|

|

|

| Dr. Abderrazzak Merzouki |

|

60 |

|

Chief Operating Officer |

| |

|

|

|

|

| Mr. Camille Sebaaly |

|

63 |

|

Chief Financial Officer and Secretary |

Biographical information regarding Dr. Slilaty

and Dr. Merzouki is provided under Proposal No. 1 above.

Mr. Camille Sebaaly was

appointed as our chief financial officer, secretary and a director of our Company on October 15, 2009. He resigned as a director of

the Company in October 2021. Since 2001, Mr. Sebaaly has been self-employed as a business consultant, primarily in the biotechnology

and biopharmaceutical sectors. He held a number of senior executive positions in various areas including financial management,

business development, project management and finance. As an executive and an entrepreneur, he combines expertise in strategic

planning and finance with strong skills in business development and deal structure and negotiations. In addition, Mr. Sebaaly

worked in operations, general management, investor relations, marketing and business development with emphasis on international

business and marketing of advanced technologies including hydrogen generation and energy saving. In the area of marketing, Mr.

Sebaaly has evaluated market demands and opportunities, created strategic marketing and business development plans, designed

marketing communications and launched market penetration programs. Mr. Sebaaly graduated from State University of New York at

Buffalo with an Electrical and Computer Engineering Degree in 1987.

EXECUTIVE COMPENSATION

The following table sets forth

compensation information for services rendered by our executive officers in all capacities (except as directors) during the last two completed

fiscal years.

| Name and Principal Position |

|

Year |

|

|

Salary($) |

|

|

Bonus($) |

|

|

Stock Awards($) |

|

|

All Other Compensation($) |

|

|

Total($) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dr. Steve N. Slilaty |

|

2023 |

|

|

378,000 |

(1) |

|

182,000 |

|

|

– |

|

|

– |

|

|

560,000 |

|

| Chief Executive Officer and Director |

|

2022 |

|

|

360,000 |

(1) |

|

10,000 |

(1) |

|

– |

|

|

– |

|

|

370,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mr. Camille Sebaaly |

|

2023 |

|

|

315,000 |

|

|

380,000 |

|

|

– |

|

|

– |

|

|

695,000 |

|

| Chief Financial Officer |

|

2022 |

|

|

300,000 |

|

|

630,000 |

|

|

– |

|

|

– |

|

|

930,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dr. Abderrazzak Merzouki |

|

2023 |

|

|

252,000 |

|

|

8,000 |

|

|

– |

|

|

– |

|

|

260,000 |

|

| Chief Operating Officer and Director |

|

2022 |

|

|

240,000 |

|

|

245000 |

|

|

– |

|

|

– |

|

|

485,000 |

|

________________

| (1) |

Portions of these amounts were paid to Advanomics Corporation, a company

controlled by Dr. Slilaty. |

Employment Agreements

Effective January 1, 2024,

we entered into an employment agreement with Dr. Steve N. Slilaty, our Chief Executive Officer which supersedes the prior agreement entered

into on April 8, 2022. Pursuant to the new employment agreement, Dr. Slilaty will continue to serve as our CEO and will be paid a base

annual salary of $543,753 CAD (approximately $397,000 USD), which will increase annually at the rate of the Consumer Price Index or 5%,

whichever is higher. The new employment agreement is continuing and has no termination date. Should the Company wish to terminate the

employment agreement without cause, the Company will be obligated to pay Dr. Slilaty $14 million as severance. In the event of death or

disability, the Company will be obligated to pay Dr. Slilaty $3 million.

Outstanding Equity Awards at 2023 Fiscal Year-End

We did not have any outstanding

equity awards as of December 31, 2023.

Director Compensation

The following table sets forth

compensation we paid to our directors during the year ended December 31, 2023.

| Name |

|

Fees Earned or Paid in Cash ($) |

|

Stock Awards |

|

Option Awards |

|

All Other Compensation |

|

Total ($) |

| Dr. Rabi Kiderchah |

|

80,000 |

|

– |

|

– |

|

– |

|

80,000 |

| Mr. David Natan |

|

80,000 |

|

– |

|

– |

|

– |

|

80,000 |

| Dr. Abderrazzak Merzouki |

|

80,000 |

|

– |

|

– |

|

– |

|

80,000 |

| Dr. Andrew Keller |

|

80,000 |

|

– |

|

– |

|

– |

|

80,000 |

| Dr. Steve N. Slilaty |

|

80,000 |

|

– |

|

– |

|

– |

|

80,000 |

In 2022 we paid our directors

an annual amount of $60,000 each. In 2023, director compensation was increased to $80,000 annually.

Pay Versus Performance Information

The information in this section is provided pursuant

to the SEC “pay versus performance” disclosure requirements set forth in Item 402(v) of SEC Regulation S-K, which requires companies

to disclose certain information about the relationship between performance and the compensation of executive officers. The following table

sets forth information concerning the compensation of our principal executive officer (PEO) and the aggregate compensation of our other

named executive officers (NEOs) for each of the fiscal years ending December 31, 2023 and 2022 as such compensation relates to our financial

performance for each such fiscal year:

| Year |

|

|

Summary Compensation Table for PEO(1) |

|

|

|

Compensation Actually Paid to PEO(1)(2) |

|

|

|

Summary Compensation Table for NEOs(1) |

|

|

|

Compensation Actually Paid to NEOs(1)(2) |

|

|

|

Total Shareholder Return Based On Value of Initial Fixed $1.00 Investment(3) |

|

|

|

Net Income |

|

| 2023 |

|

|

560,000 |

|

|

|

560,000 |

|

|

|

955,000 |

|

|

|

995,000 |

|

|

|

(22,837) |

|

|

|

(4,506,044 |

) |

| 2022 |

|

|

370,000 |

|

|

|

370,000 |

|

|

|

1,415,000 |

|

|

|

1,415,000 |

|

|

|

(22,100) |

|

|

|

(26,744,440 |

) |

___________________

| (1) | For

each of 2023 and 2022, the PEO is Dr. Steve N. Slilaty, Chief Executive

Officer, and the NEOs are Mr. Camille Sebaaly, Chief Financial Officer, Dr. Abderrazzak Merzouki, Chief Operating Officer. |

| (2) | We

do not have a pension plan and we have not issued any equity compensation; therefore, an

adjustment to the Summary Compensation Table totals and Compensation Actually Paid related

to pension and stock value for any of the years in this table is not needed. |

| (3) | Total

Shareholder Return assumes $1.00 was invested on December 31, 2021. |

Net Income and Net Sales are

the two main financial measures the Compensation Committee has been considering in its effort to develop a Cash Incentive Plan. Operating

Income is the next most important financial metric in determining Cash Compensation. We currently do not use these financial metrics in

our executive compensation program.

The value of our stock does

not impact our executive compensation as we currently do not use equity compensation (stock issuances or stock options) as part of our

executive compensation plan.

Certain

Relationships and Related Transactions

On February 22, 2022, we redeemed

990,000 shares of Series B Preferred Stock held by Dr. Steve Slilaty, our CEO, at a redemption price equal to the stated value of $0.10

per share.

On February 8, 2024, we sold

20,000 shares of Series B Preferred Stock to Dr. Slilaty for a purchase price equal to the stated value of $0.10 per share.

On March 4, 2024, we sold

100,000 shares of Series B Preferred Stock to Dr. Slilaty for a purchase price equal to the stated value of $0.10 per share.

2023 ANNUAL REPORT ON FORM 10-K

A copy of our Annual Report

on Form 10-K for the year ended December 31, 2023, is available on our website: http://sunshinebiopharma.com.

OTHER MATTERS

As of the date of this Proxy

Statement the Board does not intend to present any matter for action at the 2024 Annual Meeting of Stockholders other than as set forth

in the Notice of Annual Meeting. If any other matters properly come before the Meeting, or any adjournment or postponement thereof, it

is intended that the holders of the proxies will act in accordance with their best judgment.

STOCKHOLDER PROPOSALS FOR

THE 2025 ANNUAL MEETING OF

STOCKHOLDERS

To be eligible for inclusion

in the proxy materials for the Company’s 2025 Annual Meeting of Stockholders, stockholder proposals must be received at the Company’s

principal executive offices, Attention: Corporate Secretary, by June 30, 2025. We will consider written proposals received by that date

for inclusion in our proxy statement in accordance with regulations governing the solicitation of proxies. A stockholder who wishes to

present a proposal at the Company’s 2025 Annual Meeting of Stockholders, but who does not request that the Company solicit proxies

for the proposal, must submit the proposal to the Company’s principal executive offices, Attention: Corporate Secretary, no earlier

than December 29, 2024, and no later than June 30, 2025.

Our Corporate Secretary must

receive written notice of a stockholder’s intent to make such nomination or nominations at the 2025 Annual Meeting of Stockholders

not later than the close of business on June 30, 2025, and not earlier than the close of business on December 29, 2024.

Each notice of a stockholder proposal must set

forth:

| |

· |

as to each person whom the stockholder proposes to nominate for election or reelection as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest (even if an election contest is not involved), or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); and |

| |

|

|

| |

· |

as to any other business that the stockholder proposes to bring before the meeting, a brief description of the business desired to be brought before the meeting, the reasons for conducting such business at the meeting and any material interest in such business of such stockholder and of the beneficial owner, if any, on whose behalf the proposal is made. |

The stockholder giving the

notice, and the beneficial owner, if any, on whose behalf the nomination or proposal is made, must set forth:

| |

· |

the name and address of such stockholder, as they appear on our books, and of such beneficial owner; and |

| |

|

|

| |

· |

the number of shares of each class of our stock which are owned beneficially and of record by such stockholder and such beneficial owner. |

If the Board has determined

that directors will be elected at a special meeting of stockholders, any stockholder of the Company who is a stockholder of record both

at the time of giving of notice of such meeting and at the time of the special meeting, and who is entitled to vote at the meeting and

who complies with the notice procedures in the next sentence may nominate a person for election to the Company’s Board. Such stockholder

must deliver a notice containing the information described above to the Corporate Secretary not earlier than the close of business on

the 120th day prior to such special meeting and not later than the close of business on the later of the 90th day

prior to such special meeting or the tenth day following the day on which public announcement is first made of the date of the special

meeting and of the nominees proposed by the Board to be elected at such meeting.

These requirements are separate

from the requirements of the SEC that a stockholder must meet to have a proposal included in our proxy statement.

We will also furnish any stockholder

a copy of our bylaws without charge upon written request to the Corporate Secretary.

| |

By Order of the Board, |

| |

|

| |

|

| |

Camille Sebaaly |

| |

Corporate Secretary |

October 17, 2024

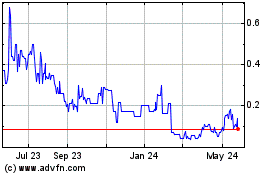

Sunshine Biopharma (NASDAQ:SBFMW)

Historical Stock Chart

From Feb 2025 to Mar 2025

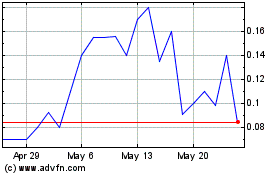

Sunshine Biopharma (NASDAQ:SBFMW)

Historical Stock Chart

From Mar 2024 to Mar 2025