Seneca Foods Reports Sales and Earnings for the Quarter and Nine Months Ended December 30, 2023

09 February 2024 - 8:15AM

Seneca Foods Corporation (NASDAQ: SENEA, SENEB) today announced

financial results for the third quarter and nine months ended

December 30, 2023.

Executive Summary (vs. year-ago, year-to-date

results):

- Net sales for the nine months ended

December 30, 2023 totaled $1,150.6 million compared to $1,178.3

million for the nine months ended December 31, 2022. The

year-over-year decrease of $27.7 million was mainly due to lower

sales volumes partially offset by higher selling prices.

- Gross margin as a percentage of net

sales for the nine months ended December 30, 2023 is 14.6% as

compared to 10.0% for the nine months ended December 31, 2022.

- Reported net earnings were $65.6

million and $42.3 million for the nine months ended December 30,

2023 and December 31, 2022, respectively.

“Third quarter results continued a strong fiscal

2024 for the Company. Decreasing LIFO charges compared to last year

as a result of moderating inflation had a positive impact on

reported net earnings,” stated Paul Palmby, President and Chief

Executive Officer of Seneca Foods. “Additionally, we are well along

with the integration of the Green Giant shelf stable business that

we acquired during the quarter and remain pleased with the positive

impact the business is delivering; we are excited about the

potential for this iconic brand.”

Executive Summary (vs. year-ago, third quarter

results):

- Net sales for the third quarter of

fiscal 2024 totaled $444.5 million compared to $473.3 million for

the third quarter of fiscal 2023. The year-over-year decrease of

$28.8 million was mainly due to lower sales volumes partially

offset by higher selling prices.

- Gross margin as a percentage of net

sales is 12.2% for the three months ended December 30, 2023 as

compared to 11.4% for the three months ended December 31,

2022.

- Reported net earnings were $17.7

million and $21.1 million for the three months ended December 30,

2023 and December 31, 2022, respectively.

About Seneca Foods Corporation

Seneca Foods is one of North America’s leading

providers of packaged fruits and vegetables, with facilities

located throughout the United States. Its high quality products are

primarily sourced from approximately 1,400 American farms and are

distributed to approximately 60 countries. Seneca holds a large

share of the market for retail private label, food service,

restaurant chains, international, contracting packaging,

industrial, chips and cherry products. Products are also sold

under the highly regarded brands of Libby’s®, Green Giant®, Aunt

Nellie’s®, Green Valley®, CherryMan®, READ®, and Seneca labels,

including Seneca snack chips. Seneca’s common stock is traded

on the Nasdaq Global Select Market under the symbols “SENEA” and

“SENEB”. SENEA is included in the S&P SmallCap 600, Russell

2000 and Russell 3000 indices.

Non-GAAP Financial Measures

Adjusted net earnings is calculated on a FIFO

basis. The Company believes this non-GAAP financial measure

provides for a better comparison of year over year operating

performance. The Company does not intend for this information to be

considered in isolation or as a substitute for other measures

prepared in accordance with GAAP. Set forth below is a

reconciliation of reported earnings before income taxes to adjusted

net earnings (in thousands).

| |

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

|

|

December 30, 2023 |

|

December 31, 2022 |

|

December 30, 2023 |

|

December 31, 2022 |

| |

|

|

|

|

|

|

|

|

Earnings before income taxes, as reported |

$ |

23,199 |

|

$ |

27,557 |

|

$ |

86,037 |

|

$ |

55,282 |

| LIFO charge |

12,027 |

|

30,898 |

|

19,643 |

|

79,333 |

| Adjusted earnings before

income taxes |

35,226 |

|

58,455 |

|

105,680 |

|

134,615 |

| Income taxes |

8,519 |

|

14,197 |

|

25,363 |

|

32,748 |

| Adjusted net earnings |

$ |

26,707 |

|

$ |

44,258 |

|

$ |

80,317 |

|

$ |

101,867 |

| |

|

|

|

|

|

|

|

Set forth below is a reconciliation of reported

net earnings to EBITDA and FIFO EBITDA (earnings before interest,

income taxes, depreciation, amortization and non-cash charges

related to the LIFO inventory valuation method). The Company does

not intend for this information to be considered in isolation or as

a substitute for other measures prepared in accordance with GAAP

(in thousands).

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

|

Nine Months Ended |

|

| EBITDA and FIFO EBITDA: |

December 30, 2023 |

|

|

December 31, 2022 |

|

|

December 30, 2023 |

|

|

December 31, 2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

$ |

17,675 |

|

|

$ |

21,054 |

|

|

$ |

65,565 |

|

|

$ |

42,288 |

|

| Income tax expense |

5,524 |

|

|

6,503 |

|

|

20,472 |

|

|

12,994 |

|

| Interest expense, net of

interest income |

9,388 |

|

|

4,277 |

|

|

23,146 |

|

|

8,037 |

|

| Depreciation and

amortization |

12,645 |

|

|

12,980 |

|

|

38,070 |

|

|

39,721 |

|

| Interest amortization |

(113 |

) |

|

(60 |

) |

|

(327 |

) |

|

(181 |

) |

| EBITDA |

45,119 |

|

|

44,754 |

|

|

146,926 |

|

|

102,859 |

|

| LIFO charge |

12,027 |

|

|

30,898 |

|

|

19,643 |

|

|

79,333 |

|

| FIFO EBITDA |

$ |

57,146 |

|

|

$ |

75,652 |

|

|

$ |

166,569 |

|

|

$ |

182,192 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Forward-Looking Information

This release contains “forward-looking

statements” as that term is used in the Private Securities

Litigation Reform Act of 1995. Forward-looking statements can be

identified by the fact that they address future events,

developments, and results and do not relate strictly to historical

facts. Any statements contained herein that are not statements of

historical fact may be deemed to be forward-looking statements.

Forward-looking statements include, without limitation, any

statement that may predict, forecast, indicate, or imply future

results, performance, or achievements, and may contain the words

"will," "anticipate," "estimate," "expect," "project," "intend,"

"plan," "believe," "seeks," "should," "likely," "targets," "may",

"can" and variations thereof and similar expressions.

Forward-looking statements are subject to known and unknown risks,

uncertainties, and other important factors that could cause actual

results to differ materially from those expressed. We believe

important factors that could cause actual results to differ

materially from our expectations include, but are not limited to,

the following:

- the effects of rising costs and

availability of raw fruit and vegetables, steel, ingredients,

packaging, other raw materials, distribution and labor;

- crude oil prices and their impact on

distribution, packaging and energy costs;

- an overall labor shortage, ability

to retain a sufficient seasonal workforce, lack of skilled labor,

labor inflation or increased turnover impacting our ability to

recruit and retain employees;

- climate and weather affecting

growing conditions and crop yields;

- our ability to successfully

implement sales price increases and cost saving measures to offset

cost increases;

- the loss of significant customers or

a substantial reduction in orders from these customers;

- effectiveness of our marketing and

trade promotion programs;

- competition, changes in consumer

preferences, demand for our products and local economic and market

conditions;

- the impact of a pandemic on our

business, suppliers, customers, consumers and employees;

- unanticipated expenses, including,

without limitation, litigation or legal settlement expenses;

- product liability claims;

- the anticipated needs for, and the

availability of, cash;

- the availability of financing;

- leverage and the ability to service

and reduce debt;

- foreign currency exchange and

interest rate fluctuations;

- the risks associated with the

expansion of our business;

- the ability to successfully

integrate acquisitions into our operations;

- our ability to protect information

systems against, or effectively respond to, a cybersecurity

incident or other disruption;

- other factors that affect the food

industry generally, including:

- recalls if products become

adulterated or misbranded, liability if product consumption causes

injury, ingredient disclosure and labeling laws and regulations and

the possibility that consumers could lose confidence in the safety

and quality of certain food products;

- competitors’ pricing practices and

promotional spending levels;

- fluctuations in the level of our

customers’ inventories and credit and other business risks related

to our customers operating in a challenging economic and

competitive environment; and

- the risks associated with

third-party suppliers, including the risk that any failure by one

or more of our third-party suppliers to comply with food safety or

other laws and regulations may disrupt our supply of raw materials

or certain finished goods products or injure our reputation;

and

- changes in, or the failure or inability to comply with, U.S.,

foreign and local governmental regulations, including environmental

and health and safety regulations.

Except for ongoing obligations to disclose material information

as required by the federal securities laws, the Company does not

undertake any obligation to release publicly any revisions to any

forward-looking statements to reflect events or circumstances after

the date of the filing of this report or to reflect the occurrence

of unanticipated events.

Contact: Michael Wolcott, Chief Financial

Officer585-495-4100

|

|

|

Seneca Foods Corporation |

|

Unaudited Selected Financial Data |

|

For the Periods Ended December 30, 2023 and December 31, 2022 |

|

(In thousands of dollars, except share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

|

Nine Months Ended |

|

| |

December 30, |

|

|

December 31, |

|

|

December 30, |

|

|

December 31, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

$ |

444,481 |

|

|

$ |

473,254 |

|

|

$ |

1,150,620 |

|

|

$ |

1,178,289 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Plant restructuring (income)

charge (note 2) |

$ |

(42 |

) |

|

$ |

1,829 |

|

|

$ |

107 |

|

|

$ |

1,937 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Other operating expense

(income), net (note 3) |

$ |

392 |

|

|

$ |

229 |

|

|

$ |

(1,151 |

) |

|

$ |

(2,411 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating income (note 1) |

30,762 |

|

|

29,817 |

|

|

104,683 |

|

|

58,249 |

|

| Other non-operating

income |

(1,825 |

) |

|

(2,017 |

) |

|

(4,500 |

) |

|

(5,070 |

) |

| Interest expense, net |

9,388 |

|

|

4,277 |

|

|

23,146 |

|

|

8,037 |

|

|

Earnings before income taxes |

$ |

23,199 |

|

|

$ |

27,557 |

|

|

$ |

86,037 |

|

|

$ |

55,282 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

5,524 |

|

|

6,503 |

|

|

20,472 |

|

|

12,994 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

$ |

17,675 |

|

|

$ |

21,054 |

|

|

$ |

65,565 |

|

|

$ |

42,288 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share |

$ |

2.47 |

|

|

$ |

2.77 |

|

|

$ |

8.86 |

|

|

$ |

5.36 |

|

|

Diluted earnings per common share |

$ |

2.45 |

|

|

$ |

2.74 |

|

|

$ |

8.78 |

|

|

$ |

5.31 |

|

| Note

1: |

The effect of the LIFO inventory valuation method on the third

quarter pre-tax results decreased operating earnings by $12.0

million and $30.9 million for the three months ended December 30,

2023 and December 31, 2022, respectively. The effect of the LIFO

inventory valuation method on YTD nine months pre-tax results

decreased operating earnings by $19.6 million and $79.3 million for

the nine months ended December 30, 2023 and December 31, 2022,

respectively. |

| |

|

| Note 2: |

During the three and nine months ended December 30, 2023,

respectively, the Company incurred restructuring charges primarily

due to plants that were closed in previous periods. During the

three and nine months ended December 31, 2022, respectively, the

Company incurred restructuring charges primarily associated with

ceasing production of green beans at a plant in the Northeast. The

charges were comprised of severance costs and a write down of

production equipment that was sold during the subsequent twelve

months. |

| |

|

| Note 3: |

The Company had net other operating expense of $0.4 million during

the three months ended December 30, 2023, which was driven by $0.6

million of transition service fees incurred in connection with an

asset acquisition. During the three months ended December 31, 2022,

the Company had net other operating expense of $0.2 million, which

was driven primarily by a write down of idle production equipment

to estimated selling price, less commission, as the assets met the

criteria to be classified as held for sale at December 31, 2022.

The write down was partially offset by a gain on the sale of an

aircraft. The Company had net other operating income of $1.2

million during the nine months ended December 30, 2023, which was

driven primarily by $1.8 million from the sale of non-operational

assets in the Pacific Northwest, offset by $0.6 million of

transition service fees during the nine-month period. During the

nine months ended December 31, 2022, the Company had net other

operating income of $2.4 million, which was driven primarily by a

gain on the sale of the Company’s western trucking fleet amongst

other fixed assets and a true-up of the supplemental early

retirement plan accrual, partially offset by the aforementioned

write down of idle production equipment. |

| |

|

| Note 4: |

The Company used the “two-class” method for basic earnings per

share by dividing the net earnings attributable to common

shareholders by the weighted average of common shares outstanding

during the period. |

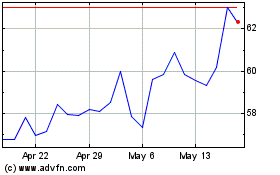

Seneca Foods (NASDAQ:SENEA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Seneca Foods (NASDAQ:SENEA)

Historical Stock Chart

From Jan 2024 to Jan 2025