false

0000095574

0000095574

2024-08-09

2024-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 9, 2024

Superior Group of Companies, Inc.

(Exact name of registrant as specified in its charter)

|

Florida

|

001-05869

|

11-1385670

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

|

200 Central Avenue, Suite 2000, St. Petersburg, Florida

(Address of principal executive offices)

|

33701

(Zip Code)

|

Registrant's telephone number including area code: (727) 397-9611

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230 .425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

SGC

|

NASDAQ

|

Item 7.01 Regulation FD Disclosure

On August 9, 2024, the Company’s Board of Directors approved a new stock repurchase plan. Under the plan, the Company is authorized to repurchase up to $10 million of its common stock during the period beginning today and ending twelve (12) months thereafter. This plan replaces the May 2, 2019 plan, as amended, which authorized the repurchase of up to 750,000 shares. 92,549 shares had been repurchased under the May 2, 2019 plan as of August 9, 2024. No further shares will be repurchased under that plan.

The new stock repurchase plan allows the Company to purchase common stock from time to time through, among other ways, open market purchases, privately negotiated transactions, block purchases, and/or pursuant to Rule 10b5-1 trading plans, subject to applicable securities laws and other legal requirements and relevant factors. The number of shares purchased and the timing of any purchases will depend upon a number of factors, including the price and availability of the Company’s stock and general market conditions. The stock repurchase plan may be modified, suspended or terminated at any time, without prior notice. Shares repurchased may be reissued later in connection with employee benefit plans and other general corporate purposes.

The information furnished pursuant to Item 7.01 of this Form 10-K, including Exhibit 99.1 hereto, shall not be deemed "filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act”), or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing

Disclosure Regarding Forward Looking Statements

Certain matters discussed in this current report are forward-looking statements” intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements can generally be identified by use of the words “may,” “will,” “should,” “could,” “expect,” anticipate,” “estimate,” “believe,” “intend,” “project,” “potential,” or “plan” or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements in this current report may include, without limitation: (1) statements about the Company’s stock repurchase plan, (2) projections of revenue, income, and other items relating to our financial position and results of operations, including short term and long term plans for cash, (3) statements of our plans, objectives, strategies, goals and intentions, (4) statements regarding the capabilities, capacities, market position and expected development of our business operations and (5) statements of expected industry and general economic trends.

Such forward-looking statements are subject to certain risks and uncertainties that may materially adversely affect the anticipated results. Such risks and uncertainties include, but are not limited to, the following: the impact of competition; uncertainties related to supply disruptions, inflationary environment (including with respect to the cost of finished goods and raw materials and shipping costs), employment levels (including labor shortages), and general economic and political conditions in the areas of the world in which the Company operates or from which it sources its supplies or the areas of the United States of America (“U.S.” or “United States”) in which the Company’s customers are located; changes in the healthcare, retail chain, food service, transportation and other industries where uniforms and service apparel are worn; our ability to identify suitable acquisition targets, discover liabilities associated with such businesses during the diligence process, successfully integrate any acquired businesses, or successfully manage our expanding operations; the price and availability of raw materials; attracting and retaining senior management and key personnel; the effect of the Company’s previously disclosed material weakness in internal control over financial reporting; the Company’s ability to successfully remediate its material weakness in internal control over financial reporting and to maintain effective internal control over financial reporting; and other factors described in the Company’s filings with the Securities and Exchange Commission, including those described in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and the Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements made herein and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this current report and we disclaim any obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances, except as may be required by law.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunder duly authorized.

| |

SUPERIOR GROUP OF COMPANIES, INC.

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Michael Koempel

|

|

| |

|

Michael Koempel

|

|

| |

|

Chief Financial Officer

|

|

Date: August 12, 2024

Exhibit 99.1

Superior Group of Companies Announces New Stock Repurchase Plan

ST. PETERSBURG, Fla., August 12, 2024 (GLOBE NEWSWIRE) -- Superior Group of Companies, Inc. (NASDAQ: SGC) (the “Company”) today announced that its Board of Directors approved a new stock repurchase plan. Under the plan, the Company is authorized to repurchase up to $10 million of its common stock over a period of one year. This plan replaces the previous plan approved by the Board of Directors on May 2, 2019, which had authorized the repurchase of up to 750,000 shares and through which the Company had purchased 92,549 shares.

The new stock repurchase plan allows the Company to purchase common stock from time to time through, among other ways, open market purchases, privately negotiated transactions, block purchases, and/or pursuant to Rule 10b5-1 trading plans, subject to certain requirements and factors. The number of shares purchased and the timing of any purchases will depend upon a number of factors, including the price and availability of the Company’s stock and general market conditions. Shares repurchased may be reissued later in connection with employee benefit plans and other general corporate purposes.

About Superior Group of Companies, Inc. (SGC):

Established in 1920, Superior Group of Companies is comprised of three attractive business segments each serving large, fragmented and growing addressable markets. Across Healthcare Apparel, Branded Products and Contact Centers, each segment enables businesses to create extraordinary brand engagement experiences for their customers and employees. SGC’s commitment to service, quality, advanced technology, and omnichannel commerce provides unparalleled competitive advantages. We are committed to enhancing shareholder value by continuing to pursue a combination of organic growth and strategic acquisitions. For more information, please visit www.superiorgroupofcompanies.com.

Contact:

Investor Relations

Investors@superiorgroupofcompanies.com

v3.24.2.u1

Document And Entity Information

|

Aug. 09, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Superior Group of Companies, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 09, 2024

|

| Entity, Incorporation, State or Country Code |

FL

|

| Entity, File Number |

001-05869

|

| Entity, Tax Identification Number |

11-1385670

|

| Entity, Address, Address Line One |

200 Central Avenue, Suite 2000

|

| Entity, Address, City or Town |

St. Petersburg

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

33701

|

| City Area Code |

727

|

| Local Phone Number |

397-9611

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SGC

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000095574

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

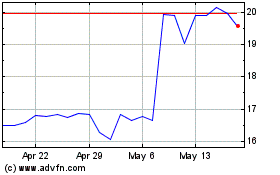

Superior Group of Compan... (NASDAQ:SGC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Superior Group of Compan... (NASDAQ:SGC)

Historical Stock Chart

From Nov 2023 to Nov 2024