UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-40786

Sigma

Lithium Corporation

(Translation of registrant's name into English)

2200 HSBC Building

885 West Georgia Street

Vancouver, British Columbia

V6C

3E8

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation

S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation

S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document

that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is

incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country

exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required

to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject

of a Form 6-K submission or other Commission filing on EDGAR.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Sigma Lithium Corporation |

| |

(Registrant) |

| |

|

| Date: August 29, 2024 |

/s/ Ana

Cristina Cabral Gardner |

| |

Ana Cristina Cabral Gardner |

| |

Chief Executive Officer |

Exhibit 99.1

SIGMA LITHIUM

RECEIVES BINDING COMMITMENT FROM BNDES

FOR A BRL 487 MILLION, 16-YEAR LOAN TO FULLY FUND

SECOND GREENTECH CARBON NEUTRAL PLANT IN BRAZIL

Highlights:

| · | Sigma

Lithium has received a binding commitment from BNDES (National Brazilian Bank for Economic

and Social Development) for a BRL487 million development loan to fully fund the construction

of Sigma Lithium’s Second Greentech Carbon Neutral Plant in Brazil. |

| · | Sigma

has initiated construction activities on site while conducting detailed engineering work

following the Final Investment Decision made by its Board of Directors. Based on the current

construction timetable, the Company plans to complete construction and commissioning in the

summer of 2025. |

| · | The

Development Loan provides the Company with a 16-year repayment period at a very low interest

rate, a hallmark of development debt financing. The key terms and conditions are: |

| o | Term:

192 months (16 years) |

| o | Interest

Rate: BRL 7.45% per year. |

| o | Grace

Period: 18 months - Amortization Period: 174 months |

| o | Assets

in Collateral: Not required. Development Loan shall be secured by letter of credit (“fianca

bancaria”) issued by a BNDES registered financial institution. |

| · | With

the second Greentech Carbon Neutral Plant, Sigma expects to approximately double the production

capacity of its Quintuple Zero Green Lithium from the current 270,000 tonnes per year to

a total of 520,000 tonnes per year. |

Sigma Lithium

Investor Day on September 24, 2024 at Nasdaq:

The Company will

host an Investor Day in New York on Tuesday, September 24, 2024 at Nasdaq, featuring a series of presentations focused on Sigma

Lithium's operations and growth initiatives. The Investor Day will also include a live question-and-answer session with members of the

Company’s senior leadership team. Presentations are scheduled to begin at 10:30 a.m. ET. The event will be concurrently webcast

and accessible on Sigma Lithium's Investor Relations website at “ir.sigmalithiumresources.com”

A replay will also

be available on the Investor Relations website following the conclusion of the live event.

São Paulo,

Brazil – (August 29, 2024) – Sigma Lithium Corporation (NASDAQ: SGML, BVMF: S2GM34, TSXV: SGML), a leading global

lithium producer dedicated to powering the next generation of electric vehicles with carbon neutral, socially and environmentally sustainable

Quintuple Zero Green Lithium Concentrate received a binding commitment letter dated August 27, 2024 (“Award Letter - Carta

64/2024 – BNDES GP/SG/ROD”) from BNDES (“National Brazilian Bank for Economic and Social Development”)

with the final approval for a BRL 486.8 million development loan to fund the construction of a Second Greentech Carbon Neutral industrial

production plant for lithium concentrate at Vale do Jequitinhonha in Brazil (“Second Greentech Carbon Neutral Plant”).

The Award Letter

by BNDES outlines its binding commitment to extend the Company a development loan as decided by its Credit Committee to be funded from

the National Climate Change Fund (“Fundo Nacional de Mudanca Climatica – FNMC, Climate Fund Program”) in accordance

with the terms and conditions outlined in the supporting documents (specifically “Decisao DIR 222/2024-BNDES”) and

in the Development Loan agreement.

The approved funding

of BRL 487 million represents almost 99% of the BRL 492 million capex budget submitted to BNDES for the construction of the Second Greentech

Carbon Neutral Plant, as per the Letter of Intent and the news release issued by the Company on 12 February 2024. Sigma’s

capital budget for the construction of the Second Greentech Carbon Neutral Plant has benefitted from fluctuations in local currency values,

as most of the equipment is produced and assembled in Brazil and/or quoted in BRL.

The Development

Loan provides the Company with a 16-year repayment period at the low interest rate of 7.45% per year (below the current Brazilian sovereign

interest rate of 10.5%), a hallmark of development debt financing. As a result of the significant duration of this new loan to finance

construction, during the third quarter of 2024 the Company has decided to retire most of its unused existing short term trade finance

lines. Sigma is repaying these lines using its current cash position.

The closing of

the Development Loan remains subject to the Company’s submission of satisfactory letters of credit (“Cartas de Fianca Bancaria”)

issued by Brazilian banking institutions accredited by BNDES, as well as the customary closing conditions for a Development Loan of this

nature, including the Company’s constant adherence to the operating policies of BNDES.

Closing conditions

for the Development Loan do not include lithium market-related conditions and cyclical lithium market and pricing elements that fall

outside of the control of the Company, as the Development Loan is a long-term development industrial & climate policy instrument

by BNDES.

With the Second

Greentech Carbon Neutral Plant, Sigma plans to double its production capacity of its Quintuple Zero Green Lithium from the current 270,000

tonnes to approximately 520,000 tonnes. The Second Greentech Carbon Neutral Plant will introduce innovations that will further increase

the efficiency of its industrial process to beneficiate mineral spodumene ore into Quintuple Zero Green Lithium pre chemical high purity

concentrate.

Sigma initiated

construction activities on site following the Final Investment Decision made by its Board of Directors. Based on the current construction

timetable, the Company expects to conclude construction and commissioning in the summer of 2025.

The Development

Loan is part of a broader strategic plan by BNDES to foster in Brazil the development of a competitive and scalable industrial supply

chain to globally supply environmentally and socially sustainable industrialized lithium materials. BNDES stated in the letter that the

Development Loan for Sigma Lithium to expand carbon neutral lithium industrial production capacity is part of BNDES’ long-term

strategy to support the development of a scalable, green and socially inclusive industrial base in Brazil.

Ana Cabral, CEO

and Co-Chairman said: “We were honored with the award by BNDES’s Directors of the binding commitment letter for our development

loan to finance the construction of our second Greentech lithium plant, which will double the production scale of our industrial facilities.

The award of this development loan by BNDES crowns over 10 years of relentless execution by our team at Sigma Lithium to build our global

leadership in the industrial production of carbon neutral, environmentally sustainable and socially traceable lithium materials. Our

unparalleled operational success has significantly contributed to attracting investment in Brazil from other global lithium companies,

creating one of the world’s fastest growing producing territories. Having BNDES as a creditor represents the support of the government

of Brazil for Sigma Lithium's industrial expansion plans at Vale do Jequitinhonha’.

“In the

last decade, we have pioneered and consistently championed the socially inclusive and environmentally sustainable industrialization of

battery materials. As a result, our region, once one of the most impoverished in Brazil, now prospers and is known the world over as

“Lithium Valley”. BNDES support allows Sigma to further amplify its socially transformational impact in Lithium Valley: illustrating

the effects of how a just and inclusive energy transition has the potential to lift an entire region.”

She added “we

believe that with the optimum long-term capital structure enabled by this development loan by BNDES, Sigma Lithium has a unique opportunity

to solidify its global industrial competitive leadership in producing low cost, environmentally and socially sustainable Quintuple Zero

lithium materials to supply the next generation of electric vehicles, which are fully aligned with the ethos of their traceability conscious

consumers. BNDES has demonstrated a visionary long-term counter-cyclical approach to industrial policy financing, in line with its peers

in large industrial countries, by fostering the base industry of lithium materials beneficiation, despite the deterioration in the short-term

market outlook this year”.

ABOUT SIGMA

LITHIUM

Sigma Lithium (NASDAQ:

SGML, TSXV: SGML, BVMF: S2GM34) is a leading global lithium producer dedicated to powering the next generation of electric vehicle batteries

with carbon neutral, socially and environmentally sustainable chemical-grade lithium concentrate.

Sigma Lithium is

one of the world’s largest lithium producers. The Company operates at the forefront of environmental and social sustainability

in the EV battery materials supply chain at its Grota do Cirilo Operation in Brazil. Here, Sigma produces Quintuple Zero Green Lithium

at its state-of-the-art Greentech lithium beneficiation plant that delivers net zero carbon lithium, produced with zero dirty power,

zero potable water, zero toxic chemicals and zero tailings’ dams.

Phase 1 of the

Company’s operations entered commercial production in the second quarter of 2023. The Company has issued a Final Investment Decision,

formally approving construction to double capacity to 520,000 tonnes of concentrate through the addition of a Phase 2 expansion of its

Greentech Plant.

Please

refer to the Company’s National Instrument 43-101 technical report titled “Grota do Cirilo Lithium Project Araçuaí

and Itinga Regions, Minas Gerais, Brazil, Amended and Restated Technical Report” issued March 19, 2024, which was prepared

for Sigma Lithium by Homero Delboni Jr., MAusIMM, Promon Engenharia; Marc-Antoine Laporte, P.Geo, SGS Canada Inc; Jarrett Quinn, P.Eng.,

Primero Group Americas; Porfirio Cabaleiro Rodriguez, (MEng), FAIG, GE21 Consultoria Mineral; and William van Breugel, P.Eng (the “Updated

Technical Report”). The Updated Technical Report is filed on SEDAR and is also available on the Company’s website.

For more information

about Sigma Lithium, visit https://www.sigmalithiumresources.com/

FOR ADDITIONAL INFORMATION PLEASE

CONTACT

Matthew DeYoe, EVP, Corporate

Affairs and Strategic Development

+1 (201) 819-0303

matthew.deyoe@sigmalithium.com.br

Daniel Abdo, Director, Investor

Relations

+55 11 2985-0089

daniel.abdo@sigmalithium.com.br

Sigma Lithium

|

Sigma Lithium |

|

@sigmalithium |

|

@SigmaLithium |

FORWARD-LOOKING

STATEMENTS

This

news release includes certain “forward-looking information” under applicable Canadian and U.S. securities legislation, including

but not limited to statements relating to timing and costs related to the general business and operational outlook of the Company, the

environmental footprint of tailings and positive ecosystem impact relating thereto, donation and upcycling of tailings, timing and quantities

relating to tailings and Green Lithium, achievements and projections relating to the Zero Tailings strategy, achievement of ramp-up volumes,

production estimates and the operational status of the Grota do Cirilo Project, and other forward-looking information. All statements

that address future plans, activities, events, estimates, expectations or developments that the Company believes, expects or anticipates

will or may occur is forward-looking information, including statements regarding the potential development of mineral resources and mineral

reserves which may or may not occur. Forward-looking information contained herein is based on certain assumptions regarding, among other

things: general economic and political conditions; the stable and supportive legislative, regulatory and community environment in Brazil;

demand for lithium, including that such demand is supported by growth in the electric vehicle market; the Company’s market position

and future financial and operating performance; the Company’s estimates of mineral resources and mineral reserves, including whether

mineral resources will ever be developed into mineral reserves; and the Company’s ability to operate its mineral projects including

that the Company will not experience any materials or equipment shortages, any labour or service provider outages or delays or any technical

issues. Although management believes that the assumptions and expectations reflected in the forward-looking information are reasonable,

there can be no assurance that these assumptions and expectations will prove to be correct. Forward-looking information inherently involves

and is subject to risks and uncertainties, including but not limited to that the market prices for lithium may not remain at current

levels; and the market for electric vehicles and other large format batteries currently has limited market share and no assurances can

be given for the rate at which this market will develop, if at all, which could affect the success of the Company and its ability to

develop lithium operations. There can be no assurance that such statements will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking

information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of

new information, future events or otherwise, except as required by law. For more information on the risks, uncertainties and assumptions

that could cause our actual results to differ from current expectations, please refer to the current annual information form of the Company

and other public filings available under the Company’s profile at www.sedarplus.com.

Neither the

TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this news release.

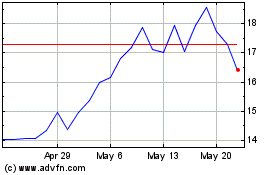

Sigma Lithium (NASDAQ:SGML)

Historical Stock Chart

From Oct 2024 to Nov 2024

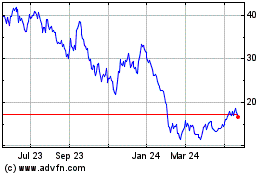

Sigma Lithium (NASDAQ:SGML)

Historical Stock Chart

From Nov 2023 to Nov 2024