0001816233false00018162332024-02-052024-02-050001816233us-gaap:CommonClassAMember2024-02-052024-02-050001816233shcr:RedeemableWarrantsMember2024-02-052024-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 5, 2024

SHARECARE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-39535 | 85-1365053 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

255 East Paces Ferry Road NE, Suite 700

Atlanta, Georgia 30305

(Address of principal executive offices)

Registrant's telephone number, including area code: (404) 671-4000

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol(s) | Name of each exchange

on which registered |

Common Stock, par value $0.0001 per share | SHCR | The Nasdaq Stock Market LLC |

| Warrants, each warrant exercisable for one share of common stock, each at an exercise price of $11.50 per share | SHCRW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Employment Agreement with Chief Executive Officer

On February 5, 2024, Sharecare, Inc. (the “Company”) and Sharecare Operating Company, Inc., a wholly-owned subsidiary of the Company, entered into an employment agreement (the “Employment Agreement”) with Brent Layton, the Company’s Chief Executive Officer. The Employment Agreement was reviewed and unanimously approved by the Compensation and Human Capital Committee of the Board of Directors of the Company and is consistent with the terms previously disclosed in that certain Form 8-K filed by the Company on November 9, 2023.

The foregoing description of the Employment Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Employment Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| | Description |

10.1† | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

†Certain of the exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). The Registrant agrees to furnish a copy of all omitted exhibits and schedules to the SEC upon its request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| SHARECARE, INC.

|

Dated: February 9, 2024 | |

| By: /s/ Carrie Ratliff |

| Name: Carrie Ratliff |

| Title: Chief Legal Officer |

EMPLOYMENT AGREEMENT

This Employment Agreement (“Agreement”) is made as of August 5, 2024 (the “Effective Date”), by and between Sharecare, Inc., a Delaware corporation (the “Company”), Sharecare Operating Company, Inc., a Delaware corporation (“Sharecare”) and Brent Layton an individual resident of the State of Georgia (“Executive”).

WHEREAS, the Company, Sharecare and Executive desire to enter into this Employment Agreement, and for Executive to become an employee of the Company on the terms and conditions set forth herein; and

WHEREAS, this Agreement provides compensation and other benefits to which Executive would not otherwise be entitled.

NOW, THEREFORE, in consideration of the mutual covenants set forth in this Agreement, the Company and Sharecare hereby offer Executive and Executive hereby accepts the employment of Executive by the Company and Sharecare upon the terms and conditions set forth herein.

I.EMPLOYMENT

A.Office, Duties and Authority. During the Term of Employment (as defined below), the Company and Sharecare agree to employ Executive to render services as Chief Executive Officer of each of the Company and Sharecare. Executive shall perform such duties and shall have such authority as is customary for the Chief Executive Officer of an organization of the size and nature of the Company, subject to the lawful directives of the Company’s Board of Directors (the “Board”) and the written policies of Sharecare and its affiliates (together, the “Company Group”) that apply to other senior executives of the Company. Executive shall report directly to the Board. During the Term of Employment, Executive shall also continue to serve as a member of the Board.

B.Acceptance and Time Commitment. Executive accepts such employment and agrees to render the services described above. Executive agrees to serve the Company Group to the best of Executive’s ability and in a manner that furthers the interests of the Company Group and agrees to devote to Executive’s duties under this Agreement such business time and energy as is reasonably necessary to perform satisfactorily Executive’s obligations hereunder.

C.Civic, Charitable, Business and Investment Activities. Notwithstanding any contrary provision of this Agreement, Executive shall have the right to (i) participate in civic, trade and charitable activities, (ii) engage in the activities described in Exhibit A hereto and (iii) pursue investment activities, so long as these other activities do not materially interfere with Executive’s obligations and ability to provide services to the Company Group under this Agreement and do not violate the restrictions of Section V(D) and (H) of this Agreement and the Company’s Corporate Governance Guidelines applicable to other senior executives of the Company, as they may be amended from time to time. In addition, Executive may pursue and engage in other outside business activities with the prior written approval of the Board.

D.Location. Executive’s principal place of employment shall be the Company’s executive offices located in Atlanta, Georgia, provided that Executive shall be required to reasonably travel from time to time in the performance of Executive’s duties.

II.TERM

Subject to Section IV, Executive’s term of employment pursuant to this Agreement shall commence on the Effective Date and end on December 31, 2026 (“Initial Term”); provided, however, that on each anniversary of the Effective Date following the end of the Initial Term, the term of this Agreement shall be automatically extended for successive one (1)-year periods (each, as “Renewal Term”), provided that either party hereto may elect not to extend this Agreement by giving written notice to the other party at least ninety (90) days prior to the end of the Initial Term or any Renewal Term (such notice, a “Non-Renewal Notice”). Notwithstanding the foregoing, Executive’s employment hereunder may be earlier terminated in accordance with Section IV hereof. The period of time between the Effective Date and the expiration or termination of Executive’s employment hereunder shall be referred to herein as the “Term of Employment.”

III.COMPENSATION

A.Base Salary. During the Term of Employment, the Company Group agrees to provide Executive with an annual base salary (as it may be increased from time to time, the “Base Salary”) of $500,000. The Base Salary amount shall be subject to annual review and adjustment but will not be decreased in any event. Sharecare will pay Executive the Base Salary in substantially equal periodic installments according to its standard payroll practices in effect from time to time, but no less frequently than once per month.

B.Performance Bonus. Each year during the Term of Employment, Executive will be eligible to receive a cash performance bonus (“Performance Bonus”) based on the achievement of performance milestones, as determined in good faith by the Compensation and Human Capital Committee of the Board (the “Committee”) with respect to each year. For fiscal year 2024, Executive will be eligible for a Performance Bonus based on the performance targets previously approved by the Board prior to the Effective Date. Commencing in fiscal year 2024 and for each fiscal year thereafter, Executive will be eligible for Performance Bonus with a target opportunity equal to 100% of Executive’s Base Salary, and with an over-performance maximum payout amount of 200% of Base Salary. Payment of the Performance Bonus shall be made on an annual basis or a more frequent basis as shall be established by the Committee on terms (including with respect to timing) consistent with other senior executives of the Company, subject to Executive’s continued employment through the time of payment (except as provided in Section IV hereof).

C.Benefits. Executive will be eligible to participate in all employee benefit programs which are provided by the Company Group generally to other senior executive officers of the Company, including (a) any pension, profit-sharing, retirement or deferred compensation plans and (b) any medical, health, dental, disability, life and other insurance programs, subject to the terms and conditions of such plans, as in effect from time to time.

D.Reimbursement of Expenditures. The Company Group will reimburse the Executive for all reasonable expenditures incurred by the Executive in the course of Executive’s

employment or in promoting the interests of the Company Group, in accordance with the written policies and procedures of the Company Group, as they may be amended from time to time, to the extent applicable generally to its senior executive officers. The Company will reimburse Executive for all reasonable legal fees and expenses that are incurred by the Executive in connection with the negotiation and entry into this Agreement (and any related ancillary documents and equity award documents), up to a maximum of $20,000.

A.Vacation. Executive will be entitled to the greater of (i) the amount provided for in any unlimited vacation policy then in effect for senior executive officers of the Company Group or (ii) four (4) weeks paid vacation annually, which may be taken in accordance with the policies and procedures of the Company Group, as in effect from time to time, to the extent applicable generally to senior executive officers. Any accrued and unused vacation outstanding at the date of termination of this Agreement (for any reason), if applicable, will be paid to Executive promptly following the date of termination.

B.Equity Award.

As an inducement to accept employment, on January 2, 2024, the Company granted 10,000,000 restricted stock units (“RSUs”) to Executive, and as soon as reasonably practicable following setting of the applicable performance metrics, the Company will grant 3,000,000 performance RSUs (“PSUs”) to Executive, in each case pursuant to the terms of the Sharecare, Inc. 2021 Omnibus Incentive Plan (the “Equity Plan”) and written award agreements between Executive and the Company, substantially similar forms (other than with respect to the PSUs and the performance metrics contained therein) of which are attached hereto as Exhibit B. The PSUs will be divided into three equal tranches, with each tranche representing 1/3 of the total number of PSUs granted (each, a “PSU Award Tranche”) that will be earned and become vested based on performance metrics related to revenue, adjusted EBITDA or other growth goals for the years ending December 31, 2024, 2025 and 2026 to be set by the Board or the Committee after discussion with Executive.

For the avoidance of doubt, the Board (or the Committee on behalf of the Board) shall continue to have sole and absolute discretion to grant any additional equity incentive awards to Executive commencing with fiscal 2025 and for each year thereafter (or such other periodic basis as may be determined by the Board or the Committee).

IV.TERMINATION

A.Death. If Executive should die during the Term of Employment, this Agreement will terminate. The Company Group shall pay to the Executive’s estate, or Executive’s heirs, (i) the amount of any accrued and unpaid Base Salary (determined as of the date of Executive’s termination of employment), payable within forty-five (45) days after termination, (ii) any amount payable to Executive for previously completed years in respect of Executive’s Performance Bonus that has not been paid as of the date of termination, payable within forty-five (45) days after termination, (iii) any unpaid expense reimbursements, payable in accordance with Company Group policy (iv) any accrued but unused vacation time, payable in accordance with Company Group policy, and (v) all other payments, benefits or fringe benefits to which Executive is entitled under the terms of any applicable compensation arrangement or benefit, equity or fringe benefit

plan or program or grant or this Agreement, payable in accordance with the terms of such plan or program (collectively, the “Accrued Amounts”). In addition, the Company Group shall pay to the Executive’s estate, or Executive’s heirs, an amount equal to the amount payable to Executive in respect of Executive’s Performance Bonus for services in the year in which Executive’s death occurs (determined in accordance with Section III(B)), pro-rated for the portion of such year occurring through the date of Executive’s death (the “Pro Rata Bonus”), and payable at the time the Performance Bonus would have been paid had Executive continued to be employed by the Company. No further amounts or benefits shall be payable except for the Company Group’s continuing obligation to provide indemnification protection under Section V(K), reimbursements under Section III(D) or as otherwise required by law or the policies and plans of the Company Group then in effect.

C.Disability. If, during the Term of Employment, Executive should become physically or mentally disabled, as confirmed by competent medical evidence, such that he is unable to perform his duties under Sections I(A) and (B) hereof for (i) a period of six (6) consecutive months or (ii) for shorter periods that add up to six (6) months in any eight (8) month period, then the Company Group may terminate this Agreement by written notice to the Executive. In that case, no further amounts or benefits shall be payable to Executive other than to pay the Accrued Amounts and the Pro Rata Bonus, which Pro Rata Bonus will be payable when the Performance Bonus would have been paid had Executive continued to be employed by the Company. No further amounts or benefits shall be payable except for the Company Group’s continuing obligation to provide indemnification protection under Section V(K), reimbursements under Section III(D) or as otherwise required by law or the policies and plans of the Company Group then in effect.

D.Termination for Cause/Resignation without Good Reason.

1.The Company Group may terminate Executive’s employment under this Agreement with “Cause”. For purposes of this Agreement, “Cause” shall mean:

(a)Executive’s conviction, plea of no contest or plea of nolo contendere, for any felony;

(b)Executive’s habitual refusal to perform substantially the duties of Executive’s position (other than any such failure resulting from incapacity due to physical or mental illness and specifically excluding any failure by Executive after reasonable efforts to meet performance expectations); or

(c)Executive’s material breach of any of Executive’s obligations to the Company Group under this Agreement or under the Company’s written policies with respect to harassment, discrimination and retaliation, code of business conduct and ethics, insider trading, anticorruption and bribery, and any other material written policies that are adopted by the Board or any committee of the Board from time to time that apply to similarly situated senior executives of the Company) which has (or is reasonably be expected to have) a material, adverse effect upon the Company (financially or reputationally);

Provided, that no termination under sections (b) or (c) above shall be effective unless Executive has received thirty (30) days advance written notice from the Board stating in reasonable detail the actions or omissions purported to constitute a breach of Executive’s duties or obligations hereunder, and Executive does not correct the acts or omissions documented in such notice within such thirty (30) day period. Executive may terminate Executive’s employment under this Agreement without Good Reason (as defined below) by providing sixty (60) days’ advance written notice to the Company.

2.Upon a termination by the Company Group for Cause or by Executive without Good Reason (as defined below), Executive shall be entitled to receive the Accrued Amounts. No further amounts or benefits shall be payable except for the Company’s continuing obligation to provide indemnification protection under Section V(K), reimbursements under Section III(D) or as otherwise required by law or the policies and plans of the Company Group then in effect.

E.Resignation for Good Reason/Termination of Employment Not for Cause

1.The Company Group may, by written notice to Executive, terminate Executive’s employment and this Agreement not for Cause (as “Cause” is defined above). Executive may terminate Executive’s employment and this Agreement for “Good Reason” as defined herein. “Good Reason” for purposes of this Agreement shall mean the occurrence of any of the following events without the prior written consent of Executive: (i) a material reduction in Executive’s Base Salary or a material reduction in Executive’s target bonus opportunity set forth in Section III(B), as the same may be in effect from time to time (in each case, which shall mean a reduction of 5% or more); (ii) a reduction in Executive’s title below that of Chief Executive Officer of the Company or any material diminution or adverse change in Executive’s position, authority, duties or responsibilities (for the avoidance of doubt, a material adverse change in the Executive’s position, authority, duties or responsibilities shall occur if the Company (or its successor) ceases to be publicly-traded or otherwise becomes a privately held company); (iii) a change in Executive’s reporting relationship which results in Executive reporting to a position below that of the Board; (iv) relocation of Executive’s principal place of employment to a location more than fifty (50) miles from Atlanta, Georgia (it being understood that requiring Executive to travel to an extent reasonably consistent with Executive’s present business travel obligations in the performance of the duties and responsibilities of Executive’s position shall not constitute Good Reason); (v) the material breach by the Company Group of any provision of this Agreement; or

(vi) the Company’s provision of a Non-Renewal Notice to Executive at any time in accordance with Section II of this Agreement. Notwithstanding anything to the contrary, if the Term of Employment expires due to Executive’s provision to the Company of a Non-Renewal Notice at any time pursuant to Section II, any subsequent termination of employment shall be deemed a resignation by Executive without Good Reason.

2.In the event that Executive reasonably believes that an event has occurred which would give Executive the right to terminate Executive’s employment and this Agreement for Good Reason (the “Triggering Event”) (i) Executive will provide written notice to the Company, certifying in reasonable detail the basis for such Triggering Event within ninety (90) days of the initial existence of such Triggering Event, (ii) if in fact an event has occurred based on which Executive has the right to terminate employment and this Agreement for Good Reason, the

Company Group will have a period of thirty (30) days following receipt of such notice in which to cure such Triggering Event, and (iii) if any Triggering Event is not cured within such thirty (30)- day period, any termination of employment by Executive for Good Reason must occur within seventy-five (75) days after the expiration of such cure period. If any Triggering Event is cured by the Company Group within such thirty (30)-day period, Executive shall not be entitled to terminate employment hereunder for Good Reason with respect to such Triggering Event.

3.If the Company Group terminates Executive’s employment and this Agreement not for Cause or if Executive terminates employment and this Agreement for Good Reason, then the Company Group will pay to Executive, without duplication, the Accrued Amounts, the Pro Rata Bonus and the Severance Payments. The “Severance Payments” means payments equal to:

(a)Twelve (12) months (the “Severance Period”) of Executive’s annual Base Salary in effect at the time of the Executive’s termination of employment; plus

(b)One (1) times the Performance Bonus based on actual performance for the year of termination.

In addition, if Executive timely elects and remains eligible for continuation coverage under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”), the Company Group will reimburse Executive (and, if applicable, Executive’s dependents) for the monthly premium for such coverage that are in excess of active employee rates for such coverage (at the coverage levels in effect immediately prior to Executive’s termination of employment), subject to any applicable tax withholdings (as determined by the Company Group, in sole discretion, to be necessary for tax or other reasons), until the earliest to occur of: (i) the end of the Severance Period and (ii) the date Executive becomes eligible for health benefits through any arrangement sponsored by, or paid for by, a subsequent employer of Executive (regardless of whether Executive enrolls for such coverage) (the “COBRA Benefit”). Executive shall provide prompt written notice to the Company Group in the event of the occurrence of clause (ii) in the preceding sentence. Notwithstanding the foregoing, if the remaining Severance Period is greater than the period during which Executive would be entitled to COBRA continuation coverage, the Company’s sole obligation for the portion of COBRA Benefit continuing after the expiration of such COBRA continuation coverage shall be to pay Executive a monthly amount, subject to any applicable tax withholdings, equal to the amount a similarly situated employee would have to pay for COBRA coverage.

4.The Severance Payments will be paid to Executive in substantially equal periodic installments according to standard payroll practices in effect from time to time during the one (1)-year period following termination of employment, and the COBRA Benefit will be reimbursed or paid to Executive on the last business day each month; provided, however, that the Performance Bonus will be payable when the Performance Bonus would have been paid had Executive continued to be employed by the Company. Executive will only be entitled to receive the Severance Payments and the COBRA Benefit if Executive signs and delivers to the Company Group the Release in substantially the form of Exhibit C hereto within fifty (50) days following Executive’s termination of employment and such Release becomes effective and irrevocable in accordance with its terms on or before the sixtieth (60th) day following termination of employment. The Severance Payments and COBRA Benefit will commence beginning on the first payroll period

or the last business day of the month, as applicable, that is on or after the sixtieth (60th) day following Executive’s termination of employment; provided, however, that the first payment shall include all amounts that would otherwise have been paid to Executive during the period beginning on the date of termination and ending on the first payment date (without interest). The Severance Payments and COBRA Benefit are also conditioned on Executive’s continued compliance with the restrictive covenants contained in this Agreement, specifically including but not limited to the noncompetition provision in Section V(H) and the provisions contained in the Confidentiality Agreement (defined below), which are incorporated herein by reference.

F.Change in Control

1.Executive will be entitled to the benefits of the Sharecare, Inc. Change in Control Plan effective January 25, 2023 (the “CIC Plan”), at a “Tier Level Multiplier” (as defined in the CIC Plan) of 2x for purposes of calculating the amount of cash severance pay and benefits Executive will be entitled to receive upon a qualifying termination event following a change in control, in each case as defined in the CIC Plan; provided that notwithstanding any provision of the CIC Plan or any related documents, in no event shall (i) the CIC Plan be amended, modified, altered or terminated in a manner that would adversely affect any of Executive's rights or entitlements to the payments or benefits under the CIC Plan or (ii) Executive's participation under the CIC be discontinued, in each case without the prior written consent of Executive.

2.Executive agrees that, notwithstanding anything to the contrary in the CIC Plan, to the extent a change in control (as defined in the CIC Plan) occurs prior to November 9, 2024, any acceleration of vesting of Executive’s RSUs pursuant to Section 4.03(b) of the CIC Plan shall be made a pro rata basis; provided that, for the avoidance of doubt, (i) if a change in control occurs on or after November 9, 2024, all of Executive’s outstanding RSUs and PSUs will be eligible for vesting in accordance with the CIC Plan and (ii) except as expressly set forth above, the terms of the CIC Plan will control the treatment of Executive’s outstanding equity awards.

V.ADDITIONAL COVENANTS

A.The validity and construction of this Agreement or any of its provisions shall be determined under the laws of the State of Georgia. The invalidity or unenforceability of any provision of this Agreement shall not affect or limit the validity and enforceability of the other provisions.

B.If any provision of this Agreement is held by a court of competent jurisdiction to be invalid, void or unenforceable, that provision will be modified by that court as needed to make it enforceable and the remaining provisions shall nevertheless continue in full force without being impaired or invalidated.

C.Executive expressly acknowledges that the Company Group has advised Executive to consult with independent legal counsel of Executive’s choosing to review and explain to Executive the legal effect of the terms and conditions of this Agreement prior to Executive’s signing this Agreement.

D.This Agreement cancels and supersedes any and all other agreements, either oral or in writing, between the parties with respect to the employment of Executive by the Company, and contains all of the covenants and agreements between the parties with respect to such employment in any manner whatsoever. Each party to this Agreement acknowledges that no representations, inducements, promises or agreements, orally or otherwise, have been made by any party, or anyone acting on behalf of any party, that are not stated in this Agreement, and that no other agreement, statement or promise not contained in this Agreement shall be valid or binding.

E.Any modifications to this Agreement will be effective only if made by a court of competent jurisdiction under Section V(B) or if in writing and signed by the party to be charged.

F.Any payments to be made by the Company Group hereunder shall be made subject to applicable law, including required tax deductions and withholdings.

G.Although the Company Group makes no guarantee with respect to the treatment of payments or benefits under this Agreement and shall not be responsible in any event with regard to this Agreement’s compliance with Section 409A, this Agreement is intended to be exempt from, or comply with, the applicable requirements of Section 409A and shall be limited, construed and interpreted in a manner consistent therewith. Notwithstanding any provision of this Agreement to the contrary, if any provision of this Agreement provides for any payments or benefits upon or following a termination of employment and such payments or benefits constitute nonqualified deferred compensation (within the meaning of Section 409A), a termination of employment shall not be deemed to have occurred for purposes of such provision of this Agreement unless such termination is also a “separation from service” within the meaning of Section 409A and, for purposes of any such provision of this Agreement, as it relates to any amounts or benefits that constitute nonqualified deferred compensation, references to a “termination,” “termination of employment” or like terms shall mean “separation from service.” If Executive is a “specified employee”, as defined in, and pursuant to, Treas. Reg. Section 1.409A-1(i) or any successor regulation, as determined by the Company, on the date of termination of Executive’s employment hereunder, any payment or benefit that is nonqualified deferred compensation (within the meaning of Section 409A) shall be made to the Executive on the date that is the earlier of (i) the expiration of the six-month period measured from the date of Executive’s termination of employment or (ii) the date of Executive’s death (the “Delay Period”). Upon the expiration of the Delay Period, all payments delayed pursuant to this V(G) shall be paid or reimbursed to Executive in a lump sum and any remaining payments due under this Agreement shall be paid or provided in accordance with the normal payment dates specified for them herein. Whenever payments under this Agreement are to be made in installments, each such installment shall be deemed to be a separate payment for purposes of Section 409A. With regard to any provision herein that provides for reimbursement of costs and expenses or in-kind benefits, except as permitted by Section 409A,

(i) the right to reimbursement or in-kind benefits shall not be subject to liquidation or exchange for another benefit, (ii) the amount of expenses eligible for reimbursement, or in-kind benefits, provided during any taxable year shall not affect the expenses eligible for reimbursement, or in- kind benefits to be provided, in any other taxable year, provided that the foregoing clause (ii) shall not be violated without regard to expenses reimbursed under any arrangement covered by Internal Revenue Code Section 105(b) solely because such expenses are subject to a limit related to the period the arrangement is in effect and (iii) such payments shall be made on or before the last day of Executive’s taxable year following the taxable year in which the expense occurred.

H.Executive agrees that while Executive is employed hereunder and for the Non- Compete Period following resignation or termination of Executive’s employment for any reason, Executive will not participate as an owner, partner, officer, employee, director, or consultant for, any company or business competing with any line of business of the Company Group in the Territory; provided, however, that nothing herein shall prevent Executive from investing as less than a five (5%) percent stockholder in the securities of (i) any company listed on a national securities exchange or quoted on an automated quotation system or (ii) any private equity fund or similar vehicle.

1.The “Non-Compete Period” means the first anniversary of Executive’s termination of employment.

2.The “Territory” means any place in the U.S. that the Company Group conducts the relevant competing line of business within the two (2)-year period preceding Executive’s termination of employment.

The obligations contained in this Section V(H) shall survive the termination of the Term of Employment and the termination Executive’s employment with the Company Group and shall be fully enforceable thereafter.

I.This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors, heirs (in the case of the Executive) and assigns. In the event that any person or entity succeeds to the business of the Company Group (including, but not limited to, by merger, reorganization or acquisition of substantially all the assets of such entity), from and after such event or occurrence, such successor shall be treated as the Company, as the case may be, for all purposes of this Agreement. The rights or obligations under this Agreement may not be assigned or transferred by either party, except that such rights or obligations may be assigned or transferred pursuant to a merger or consolidation in which the Company is not the continuing entity, or the sale or liquidation of all or substantially all of the assets of the Company; provided, however, that the assignee or transferee is the successor to all or substantially all of the assets of the Company and such assignee or transferee assumes the liabilities and duties of the Company, as contained in this Agreement, either contractually or as a matter of law.

J.All notices and other communications to be made or otherwise given hereunder shall be in writing and shall be deemed to have been given when the same are (i) addressed to the other party at the mailing address, facsimile number or email address indicated below, and (ii) either: (a) personally delivered or mailed, registered or certified mail, first class postage-prepaid return receipt requested, (b) delivered by a reputable private overnight courier service utilizing a written receipt or other written proof of delivery, to the applicable party, (c) faxed to such party, or (d) sent by electronic email. Any notice sent in the manner set forth above by U.S. mail shall be deemed to have been given and received three (3) days after it has been so deposited in the U.S. mail, and any notice sent in any other manner provided above shall be deemed to be given when received. The substance of any such notice shall be deemed to have been fully acknowledged in the event of refusal of acceptance by the party to whom the notice is addressed. Until further notice given in according with the foregoing, the respective addresses, fax numbers and email addresses for the parties are as following:

If to the Company or to Sharecare:

Sharecare, Inc.

255 E. Paces Ferry Rd. NE, Suite 700 Atlanta, GA 30305

Attn: Legal

Email: legal@sharecare.com If to Executive:

At the address or email shown on the records of the Company.

K.The Company Group agrees to defend and indemnify Executive against and to hold Executive harmless from any and all claims, suits, losses, liabilities, and expenses (but excluding disputes arising under or in relation to this Agreement) asserted against Executive for actions taken or omitted to be taken by Executive in good faith and within the scope of Executive’s responsibilities as an officer or employee of the Company Group. The Company Group shall cause Executive to be provided coverage under any D&O liability insurance policies that are maintained by the Company Group from time to time in the same manner as other executive officers and directors of the Company Group are covered.

L.The provisions of this Agreement shall be deemed severable and the invalidity or unenforceability of any provision shall not affect the validity or enforceability of the other provisions hereto.

M.This Agreement may be executed in several counterparts, each of which shall be deemed to be an original but all of which together will constitute one and the same instrument.

N.Limitation of Benefits. Notwithstanding anything to the contrary in the CIC Plan, the following provisions shall apply to Executive.

1.Anything in this Agreement to the contrary notwithstanding, in the event it shall be determined that any benefit, payment or distribution by the Company Group to or for the benefit of Executive (whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise, but determined without regard to any additional payments required under this Section V(N) (such benefits, payments or distributions are hereinafter referred to as “Payments”) would, if paid, be subject to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then, prior to the making of any Payments to Executive, a calculation shall be made comparing (i) the net after-tax benefit to Executive of the Payments after payment by Executive of the Excise Tax, to (ii) the net after-tax benefit to Executive if the Payments had been limited to the extent necessary to avoid being subject to the Excise Tax. If the amount calculated under (i) above is less than the amount calculated under (ii) above, then the Payments shall be limited to the extent necessary to avoid being subject to the Excise Tax (the “Reduced Amount”). The reduction of the Payments due hereunder, if applicable, shall be made by first reducing cash Payments and then, to the extent necessary, reducing those Payments having the next highest ratio of Parachute Value to actual present value of such Payments as of the date of the change of control, as determined by the Determination Firm (as defined below). For purposes of this Section V(N),

present value shall be determined in accordance with Section 280G(d)(4) of the Code and in a manner that is in compliance with Section 409A of the Code. For purposes of this Section V(N), the “Parachute Value” of a Payment means the present value as of the date of the change of control of the portion of such Payment that constitutes a “parachute payment” under Section 280G(b)(2) of the Code, as determined by the Determination Firm for purposes of determining whether and to what extent the Excise Tax will apply to such Payment.

2.All determinations required to be made under this Section V(N), including whether an Excise Tax would otherwise be imposed, whether the Payments shall be reduced, the amount of the Reduced Amount, and the assumptions to be used in arriving at such determinations, shall be made by an independent, nationally recognized accounting firm or compensation consulting firm mutually acceptable to the Company and Executive (the “Determination Firm”) which shall provide detailed supporting calculations both to the Company and Executive. All fees and expenses of the Determination Firm shall be borne solely by the Company. Any determination by the Determination Firm shall be binding upon the Company and Executive. As a result of the uncertainty in the application of Section 4999 of the Code at the time of the initial determination by the Determination Firm hereunder, it is possible that Payments hereunder will have been unnecessarily limited by this Section V(N) (“Underpayment”), consistent with the calculations required to be made hereunder. The Determination Firm shall determine the amount of the Underpayment that has occurred and any such Underpayment shall be promptly paid by the Company to or for the benefit of Executive, but no later than March 15 of the year after the year in which the Underpayment is determined to exist, which is when the legally binding right to such Underpayment arises.

O.Clawback/Recoupment. Any amounts payable under this Agreement are subject to any policy or policies (whether in existence as of the Effective Date or as later adopted) established by the Company providing for clawback or recovery of amounts that were paid to the Executive on the terms consistent with those applicable to other senior executives of the Company. The Company will make any determination for clawback or recovery in its sole discretion and in accordance with the terms of such policy or any applicable law, regulation and/or stock exchange listing requirement.

[signature page follows]

IN WITNESS WHEREOF, the parties have caused this Agreement to be duly executed as of the Effective Date.

Brent Layton

/s/ Brent Layton Signature

SHARECARE, INC.

By: /s/ Colin Daniel Colin Daniel, Chief Administrative Officer

SHARECARE OPERATING COMPANY, INC.

By: /s/ Colin Daniel Colin Daniel, Chief Administrative Officer

| | |

[Signature Page to Employment Agreement] |

EXHIBIT A PERMITTED ACTIVITIES

EXHIBIT B

FORMS OF AWARD AGREEMENTS UNDER THE SHARECARE, INC. 2021 OMNIBUS INCENTIVE PLAN

EXHIBIT C

FORM OF RELEASE

v3.24.0.1

Cover

|

Feb. 05, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 05, 2024

|

| Entity Registrant Name |

SHARECARE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39535

|

| Entity Tax Identification Number |

85-1365053

|

| Entity Address, Address Line One |

255 East Paces Ferry Road NE

|

| Entity Address, Address Line Two |

Suite 700

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30305

|

| City Area Code |

404

|

| Local Phone Number |

671-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001816233

|

| Amendment Flag |

false

|

| Common Stock, par value $0.0001 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

SHCR

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each warrant exercisable for one share of common stock, each at an exercise price of $11.50 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one share of common stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

SHCRW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=shcr_RedeemableWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

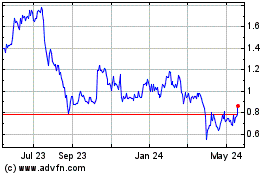

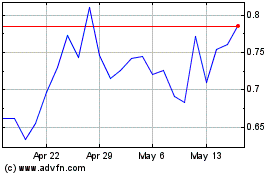

Sharecare (NASDAQ:SHCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sharecare (NASDAQ:SHCR)

Historical Stock Chart

From Apr 2023 to Apr 2024