Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

03 November 2021 - 7:09AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE AS OF 1934

For the month of November 2021

Commission File Number 000-27663

SIFY TECHNOLOGIES LIMITED

(Translation of registrant’s name

into English)

Tidel Park, 2nd Floor

4, Rajiv Gandhi Salai

Taramani, Chennai 600 113 India

(91) 44-2254-0770

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover Form 20-F or Form 40-F. Form 20-F þ Form 40

F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1). Yes o No þ

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7). Yes o No þ

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934. Yes o No þ

If “Yes” is marked, indicate below the file number

assigned to registrant in connection with Rule 12g3-2(b). Not applicable.

Debenture Subscription Agreement

Sify Technologies Limited

(the “Company”) announced that on November 01, 2021, its wholly owned subsidiary, Sify Infinit Spaces Limited (“SIS”),

entered into a Compulsorily Convertible Debenture Subscription Agreement (the “Agreement”) with Kotak Special Situations

Fund (“Investor”) managed by Kotak Investment Advisors Limited and/ or includes its Affiliates (being funds/

investment vehicles managed or advised by Kotak Investment Advisors Limited). Under the terms of the Agreement, Investor

will invest up to Rs.400cr (USD $53 Mn approx) in two tranches, which may be called upon before March 31, 2023. SIS can further

draw up to Rs.600 cr (USD $80 Mn approx) based on its discretion which option can be exercised any time up to October 1 2023. The

investment is in the form of compulsory convertible debentures (“Debentures”). SIS, which houses the Company’s

data centers, will use the proceeds from the sale of the Debentures for the expansion of new data centers, including land

acquisition for data centers, investment in renewable energy for data centers and repayment of debt.

The Debentures bear interest at a rate of

6% per annum, payable semi-annually. Unless converted earlier, the Debentures will automatically convert into equity of SIS

on October 31, 2031. The conversion price of the Debentures at any time will be fixed based on SIS’s operating performance

over a specified reference period, resulting in a fixed number of shares to be issued for the fixed amount of cash. The Debentures

include customary financial and operating covenants, as well provisions to protect the Investor in case of a potential change of

control. To provide possible liquidity to the Investor, SIS has agreed to explore a public offering of its securities no later

than 8 years from the date of the Agreement.

Further, pursuant to a Put Option Agreement

entered into between the Company and Investor, at any time on or after October 1, 2027, Investor has the right to put the Debentures

to the Company. The investor also has the right to put the Debentures to Company in case SIS does not provide an exit to the investor

within the period of 8 years from the date of Agreement. Upon exercise of the put right, Company, or another designated entity,

would purchase the Debentures at a price sufficient to provide the Investor with mutually agreed contracted rate of return.

The terms of Debentures include additional

terms and covenants, including certain consequences in case of events of default. Upon an event of default, the Investor also would

have additional rights and remedies, including certain pre-approval rights and escalation in the coupon rate payable on the Debentures

to such percentage which is sufficient to provide the Investor with mutually agreed contracted rate of return.

* Certain confidential portions of this Exhibit were omitted

by means of marking such portions with (***) because it is both not material and is the type that the Registrant treats as private

or confidential.

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: November 1, 2021

|

|

SIFY TECHNOLOGIES LIMITED

|

|

|

|

|

|

By:

|

/s/ MP Vijay Kumar

|

|

|

|

Name: MP Vijay Kumar

|

|

|

|

Title: Chief Financial Officer

|

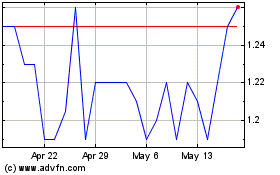

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From Oct 2024 to Nov 2024

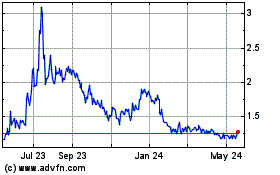

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From Nov 2023 to Nov 2024