Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

19 September 2024 - 3:44AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of: September 2024

Commission

File Number: 000-27663

SIFY

TECHNOLOGIES LIMITED

(Translation of registrant’s name into English)

Tidel

Park, Second Floor

No.

4, Rajiv Gandhi Salai, Taramani

Chennai

600 113, India

(91)

44-2254-0770

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

The Registrant issued a press release on September 18, 2024 announcing

plans to effect a ratio change for its ADS program, a copy of which is attached hereto as Exhibit 99.1.

EXHIBIT INDEX

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: September 18, 2024 |

|

|

| |

|

|

| |

For Sify Technologies Limited |

| |

|

|

| |

By: |

/s/ M P Vijay Kumar |

| |

|

Name: |

M P Vijay Kumar |

| |

|

Title: |

Chief Financial Officer and

Whole time director |

EXHIBIT 99.1

Sify Technologies Ltd.

Announces Plan to Implement ADS Ratio Change

Chennai, India, September

18, 2024 (GLOBE NEWSWIRE) — Sify Technologies Ltd. (Nasdaq: Sify) (the “Company”), a leading integrated information

communications technology (or ICT) Solutions and Services provider in India, today announced that it will change the ratio of its American

Depositary Shares (“ADSs”) to equity shares from the current ratio, where one (1) ADS represents one (1) equity

share, to a new ratio, where one (1) ADS will represent six (6) equity shares (the “ADS Ratio Change”). The ADS

Ratio Change is expected to become effective on or about October 4, 2024 (the “Effective Date”).

For the Company’s

ADS holders, the ADS Ratio Change will have the same effect as a one-for-six reverse ADS split and will have no impact on an

ADS holder’s proportional equity interest in the Company, except to the extent that the ratio change would have resulted in an ADS

holder owning fractional ADSs. There will be no change to the Company’s equity shares.

On the Effective Date,

registered holders of the Company’s ADSs held in certificated form will be required on a mandatory basis to surrender their certificated

ADSs to Citibank, N.A., the depositary bank (the “Depositary”), for cancellation and will receive one (1) new ADS in

exchange for every six (6) existing ADSs surrendered. Holders of uncertificated ADSs in The Depository Trust Company and Direct Registration

System will have their ADSs automatically exchanged and need not take any action. The exchange of every six (6) then-held (existing)

ADSs for one (1) new ADS will occur automatically at the Effective Date, with the then-held ADSs being cancelled and new ADSs being

issued by the Depositary.

The Company’s ADSs

will continue to be traded on the NASDAQ Capital Market under the symbol “SIFY”.

No fractional new ADSs

will be issued in connection with the change in the ADS Ratio Change. Instead, fractional entitlements to new ADSs will be aggregated

and sold by the Depositary and the net cash proceeds from the sale of the fractional ADS entitlements will be distributed to the applicable

ADS holders by the Depositary, in each case in accordance with the Depositary’s then current procedures and practices and after

any deductions as provided in the deposit agreement between the Company and the Depositary for the ADSs.

As a result of the ADS

Ratio Change, the ADS price is expected to increase proportionally, although the Company can give no assurance that the ADS price after

the ADS Ratio Change will be equal to or greater than six times the ADS price before the change.

About Sify Technologies Limited

A Fortune India 500 company,

Sify Technologies Limited is a comprehensive ICT service & solution provider. With cloud at the core of its solutions portfolio, the

Company is focused on the changing ICT requirements of the emerging digital economy and the resultant demands from large, mid and small-sized

businesses.

The Company’s infrastructure

comprises state-of-the-art data centers, the largest MPLS network, partnership with global technology majors and deep expertise in business

transformation solutions modelled on the cloud, making it an ideal partner for start-ups, SMEs and even large enterprises on the verge

of a revamp.

More than 10,000

businesses across multiple verticals have taken advantage of our data centers, networks and digital services to help conduct their business

from more than 1,700 cities in India. Internationally, the Company has presence across North America, the United Kingdom and Singapore.

Safe Harbor Statement

This release contains certain “forward-looking

statements” relating to the Company and its business. These forward-looking statements are often identified by the use of forward-looking

terminology such as “expects”, “intends”, “will”, or similar expressions. Such forward looking statements

involve known and unknown risks and uncertainties that may cause actual results to be materially different from those described herein

as expected, intended or planned. Investors should not place undue reliance on these forward-looking statements, which speak only as of

the date of this press release. The Company’s actual results could differ materially from those anticipated in these forward-looking

statements as a result of a variety of factors, including those discussed in the Company’s reports that are filed with the Securities

and Exchange Commission and available on its website (www.sec.gov). All forward-looking statements attributable to the Company or to persons

acting on its behalf are expressly qualified in their entirety by these factors other than as required under the securities laws. The

Company does not assume a duty to update these forward-looking statements.

For further information, please contact:

Sify Technologies

Limited

Mr. Praveen Krishna

Investor Relations & Public Relations

+91 9840926523

praveen.krishna@sifycorp.com |

20:20 Media

Nikhila Kesavan

+91 9840124036

nikhila.kesavan@2020msl.com |

Weber Shandwick

Lucia Domville

+1-212 546-8260

LDomville@webershandwick.com |

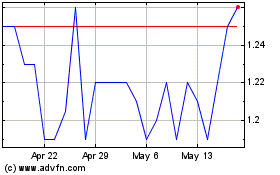

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From Oct 2024 to Nov 2024

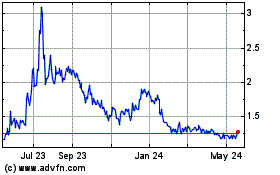

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From Nov 2023 to Nov 2024