false000023055700002305572025-01-292025-01-290000230557us-gaap:CommonStockMember2025-01-292025-01-290000230557us-gaap:NoncumulativePreferredStockMember2025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

| | | | | |

| Date of Report (Date of earliest event reported) | January 29, 2025 |

| | |

| SELECTIVE INSURANCE GROUP, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| New Jersey | | 001-33067 | | 22-2168890 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

40 Wantage Avenue, Branchville, New Jersey 07890

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code (973) 948-3000

| | |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol (s) | Name of each exchange on which registered |

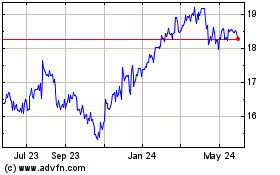

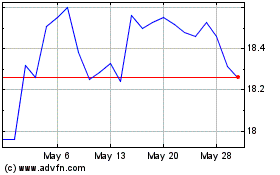

| Common Stock, par value $2 per share | SIGI | The Nasdaq Stock Market LLC |

| Depositary Shares, each representing a 1/1,000th interest in a share of 4.60% Non-Cumulative Preferred Stock, Series B, without par value | SIGIP | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Section 2 – Financial Information

Item 2.02. Results of Operations and Financial Condition.

On January 29, 2025, Selective Insurance Group, Inc. (the “Company”) issued a press release announcing results for the fourth quarter ended December 31, 2024. The press release is attached hereto as Exhibit 99.1.

Section 7 – Regulation FD

Item 7.01. Regulation FD Disclosure.

Attached as Exhibit 99.2 is supplemental financial information about the Company.

The Company may present to various investors and stockholders using the presentation materials, which include supplemental financial information about the Company, that are furnished as Exhibit 99.3 hereto and incorporated herein by reference.

The information contained in Item 2.02 and Item 7.01 of this Current Report on Form 8-K, including the exhibits attached hereto, is being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing. The Company makes no admission as to the materiality of any information in this report or the exhibits attached hereto.

Important information may be disseminated initially or exclusively via the Company’s corporate website, www.selective.com/investors. Investors should consult the site to access this information. Any website addresses included herein are inactive textual references only. The information contained on any such website referenced herein is not incorporated into this Current Report on Form 8-K.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description of Exhibit

99.1 Press Release of Selective Insurance Group, Inc. dated January 29, 2025 99.2 Financial Supplement, Fourth Quarter and Full Year 2024 99.3 Selective Insurance Group, Inc. Fourth Quarter 2024 Investor Presentation 104 The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | SELECTIVE INSURANCE GROUP, INC. |

| | | |

| Date: | January 29, 2025 | By: | /s/ Michael H. Lanza |

| | | Michael H. Lanza |

| | | Executive Vice President and General Counsel |

Selective Reports Fourth Quarter and Year-End 2024 Results

Fourth Quarter Net Income of $1.52 per Diluted Common Share and Non-GAAP Operating Income1 of $1.62 per

Diluted Common Share; Return on Common Equity ("ROE") of 12.7% and Non-GAAP Operating ROE1 of 13.5%

Full Year 2024 ROE of 7.0% and Non-GAAP Operating of ROE1 7.1%

In the fourth quarter of 2024:

•Net premiums written ("NPW") increased 10% from the fourth quarter of 2023;

•The GAAP combined ratio was 98.5%, compared to 93.7% in the fourth quarter of 2023;

•Commercial Lines renewal pure price increases averaged 8.8%, up 1.5 points from 7.3% in the fourth quarter of 2023;

•After-tax net investment income was $97 million, up 24% from the fourth quarter of 2023;

•Book value per common share was $47.99, down 2% from last quarter; and

•Adjusted book value per common share¹ was $52.10, up 3% from last quarter.

Branchville, NJ - January 29, 2025 - Selective Insurance Group, Inc. (NASDAQ: SIGI) reported financial results for the fourth quarter ended December 31, 2024, with net income per diluted common share of $1.52 and non-GAAP operating income1 per diluted common share of $1.62. Return on common equity was 12.7% and non-GAAP operating ROE1 was 13.5%.

For the quarter, Selective reported a combined ratio of 98.5%. Net unfavorable prior year casualty reserve development of $100 million increased the combined ratio by 8.8 points. NPW increased 10% from a year ago driven by renewal pure price increases of 10.7%. Net investment income generated 13.2 points of annualized ROE in the quarter, increasing to $97 million after-tax, up 24% from a year ago.

For the year, Selective reported net income per diluted common share of $3.23 and non-GAAP operating income1 per diluted common share of $3.27. The 2024 combined ratio was 103.0% including prior year casualty reserve strengthening of $311 million, which increased the combined ratio by 7.1 points. NPW increased 12% with renewal pure price increases of 9.5%. After-tax net investment income was $363 million, up 17% from a year ago, and generated 12.8 points of ROE.

“Despite strong investment results, overall financial performance in 2024 did not meet our expectations. Within insurance operations, we delivered solid underlying profitability but took meaningful actions to strengthen casualty reserves in response to social inflation. We also increased Standard Commercial Lines renewal pure pricing, achieving 8.8% in the fourth quarter and 8.3% for the year. We continue to focus on returning our performance to the combination of growth and profitability investors expect of us and we expect of ourselves. With these pricing actions and our ability to manage renewal pure price and retention at a granular level, we are well positioned to capitalize on our competitive strengths. These include our unique field model, the strength of our distribution partner relationships, and our customer experience focus,” said John J. Marchioni, Chairman, President and Chief Executive Officer.

“In 2024, we advanced important strategic initiatives that position Selective for long-term, profitable growth. We exceeded $500 million of NPW in Excess & Surplus Lines, added five states to our Standard Commercial Lines operating footprint, and took significant actions to reposition and drive our Personal Lines business toward improved profitability,” concluded Mr. Marchioni.

Operating Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Financial Results | Quarter ended December 31, | Change | Year-to-Date December 31, | Change |

| $ and shares in millions, except per share data | 2024 | 2023 | 2024 | 2023 |

| Net premiums written | $ | 1,089.6 | | | 991.5 | | 10 | | % | $ | 4,630.0 | | | 4,134.5 | | 12 | | % |

| Net premiums earned | 1,133.0 | | | 1,001.2 | | 13 | | | 4,376.4 | | | 3,827.6 | | 14 | | |

| Net investment income earned | 122.8 | | | 98.6 | | 25 | | | 457.1 | | | 388.7 | | 18 | | |

| Net realized and unrealized gains (losses), pre-tax | (8.0) | | | 5.4 | | (248) | | | (2.9) | | | (3.6) | | (17) | | |

| Total revenues | 1,256.4 | | | 1,110.7 | | 13 | | | 4,861.7 | | | 4,232.1 | | 15 | | |

| Net underwriting income (loss), after-tax | 13.3 | | | 50.2 | | (74) | | | (104.7) | | | 104.9 | | (200) | | |

| Net investment income, after-tax | 97.3 | | | 78.4 | | 24 | | | 362.6 | | | 309.5 | | 17 | | |

Net income (loss) available to common stockholders | 93.2 | | | 122.5 | | (24) | | | 197.8 | | | 356.0 | | (44) | | |

Non-GAAP operating income (loss)1 | 99.6 | | | 118.3 | | (16) | | | 200.1 | | | 358.8 | | (44) | | |

| Combined ratio | 98.5 | | % | 93.7 | | 4.8 | | pts | 103.0 | | % | 96.5 | | 6.5 | | pts |

| Loss and loss expense ratio | 67.8 | | | 62.4 | | 5.4 | | | 72.3 | | | 64.9 | | 7.4 | | |

| Underwriting expense ratio | 30.6 | | | 31.1 | | (0.5) | | | 30.6 | | | 31.4 | | (0.8) | | |

| Dividends to policyholders ratio | 0.1 | | | 0.2 | | (0.1) | | | 0.1 | | | 0.2 | | (0.1) | | |

| Net catastrophe losses | (0.9) | | pts | 2.5 | | (3.4) | | | 6.5 | | pts | 6.4 | | 0.1 | | |

| Non-catastrophe property losses and loss expenses | 15.7 | | | 17.2 | | (1.5) | | | 15.6 | | | 17.0 | | (1.4) | | |

(Favorable) unfavorable prior year reserve development on casualty lines | 8.8 | | | 1.0 | | 7.8 | | | 7.1 | | | (0.2) | | 7.3 | | |

Current year casualty loss costs | 44.2 | | | 41.7 | | 2.5 | | | 43.1 | | | 41.7 | | 1.4 | | |

Net income (loss) available to common stockholders per diluted common share | $ | 1.52 | | | 2.01 | | (24) | | % | $ | 3.23 | | | 5.84 | | (45) | | % |

Non-GAAP operating income (loss) per diluted common share1 | 1.62 | | | 1.94 | | (16) | | | 3.27 | | | 5.89 | | (44) | | |

| Weighted average diluted common shares | 61.3 | | 61.0 | — | | | 61.3 | | 61.0 | 1 | | |

| Book value per common share | $ | 47.99 | | | 45.42 | | 6 | | | $ | 47.99 | | | 45.42 | | 6 | | |

Adjusted book value per common share1 | 52.10 | | | 50.03 | | 4 | | | 52.10 | | | 50.03 | | 4 | | |

Overall Insurance Operations

For the fourth quarter, overall NPW increased 10% from a year ago. Average renewal pure price increased 10.7%, up 3.3 points from a year ago. Our 98.5% combined ratio was 4.8 points higher than a year ago. We recorded $100 million of unfavorable prior year casualty reserve development driven by recent accident years in general liability and excess and surplus lines. This was partially offset by lower catastrophe and non-catastrophe property losses and a lower expense ratio. Overall, our insurance segments contributed 1.8 points of ROE in the fourth quarter of 2024.

Standard Commercial Lines Segment

For the fourth quarter, Standard Commercial Lines premiums (representing 76% of total NPW) grew 9% from a year ago. The premium growth reflected average renewal pure price increases of 8.8% and stable retention of 85%. The fourth quarter combined ratio was 100.2%, up 7.1 points from a year ago. This was driven by net unfavorable prior year casualty reserve development of $75 million, partially offset by lower catastrophe and non-catastrophe losses. The fourth quarter 2024 prior year casualty reserve development included unfavorable development of $100 million in general liability. This was partially offset by favorable development of $25 million in workers compensation.

The following table shows the variances in key quarter-to-date and year-to date measures:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Standard Commercial Lines Segment | Quarter ended December 31, | Change | Year-to-Date December 31, | Change |

| $ in millions | 2024 | 2023 | 2024 | 2023 |

| Net premiums written | $ | 833.4 | | | 764.3 | | 9 | | % | $ | 3,632.1 | | | 3,281.3 | | 11 | | % |

| Net premiums earned | 884.6 | | | 792.1 | | 12 | | | 3,447.6 | | | 3,071.8 | | 12 | | |

| Combined ratio | 100.2 | | % | 93.1 | | 7.1 | | pts | 104.2 | | % | 94.9 | | 9.3 | | pts |

| Loss and loss expense ratio | 68.5 | | | 61.0 | | 7.5 | | | 72.5 | | | 62.5 | | 10.0 | | |

| Underwriting expense ratio | 31.6 | | | 31.9 | | (0.3) | | | 31.5 | | | 32.2 | | (0.7) | | |

| Dividends to policyholders ratio | 0.1 | | | 0.2 | | (0.1) | | | 0.2 | | | 0.2 | | — | | |

| Net catastrophe losses | (0.9) | | pts | 2.0 | | (2.9) | | | 5.3 | | pts | 4.9 | | 0.4 | | |

| Non-catastrophe property losses and loss expenses | 14.0 | | | 15.4 | | (1.4) | | | 13.3 | | | 15.0 | | (1.7) | | |

(Favorable) unfavorable prior year reserve development on casualty lines | 8.5 | | | 0.6 | | 7.9 | | | 8.3 | | | (0.5) | | 8.8 | | |

Current year casualty loss costs | 46.9 | | | 43.0 | | 3.9 | | | 45.6 | | | 43.1 | | 2.5 | | |

Standard Personal Lines Segment

For the fourth quarter, Standard Personal Lines premiums (representing 10% of total NPW) decreased 3% from a year ago with renewal pure price of 27.3% and higher average policy sizes. Retention was 75%, down 12 points from a year ago, and new business decreased 49% due to deliberate profit improvement actions. The fourth quarter 2024 combined ratio decreased 25.2 points from a year ago to 91.7%. The improvement reflects the benefit of renewal pure price increases in recent quarters, along with lower catastrophe and non-catastrophe property losses.

The following table shows the variances in key quarter-to-date and year-to-date measures:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Standard Personal Lines Segment | Quarter ended December 31, | Change | Year-to-Date December 31, | Change |

| $ in millions | 2024 | 2023 | 2024 | 2023 |

| Net premiums written | $ | 103.6 | | | 107.0 | | (3) | | % | $ | 430.7 | | | 414.6 | | 4 | | % |

| Net premiums earned | 107.1 | | | 101.0 | | 6 | | | 424.9 | | | 365.2 | | 16 | | |

| Combined ratio | 91.7 | | % | 116.9 | | (25.2) | | pts | 109.3 | | % | 121.7 | | (12.4) | | pts |

| Loss and loss expense ratio | 67.9 | | | 91.7 | | (23.8) | | | 85.8 | | | 96.7 | | (10.9) | | |

| Underwriting expense ratio | 23.8 | | | 25.2 | | (1.4) | | | 23.5 | | | 25.0 | | (1.5) | | |

| Net catastrophe losses | 1.0 | | pts | 9.1 | | (8.1) | | | 18.8 | | pts | 19.0 | | (0.2) | | |

| Non-catastrophe property losses and loss expenses | 36.3 | | | 42.4 | | (6.1) | | | 38.6 | | | 43.0 | | (4.4) | | |

Unfavorable prior year reserve development on casualty lines | 4.7 | | | 5.0 | | (0.3) | | | 1.2 | | | 3.8 | | (2.6) | | |

Current year casualty loss costs | 25.9 | | | 35.2 | | (9.3) | | | 27.2 | | | 30.9 | | (3.7) | | |

Excess and Surplus Lines Segment

For the fourth quarter, Excess and Surplus Lines premiums (representing 14% of total NPW) increased 27% compared to the prior-year period, driven by new business growth of 29% and average renewal pure price increases of 8.2%. The fourth quarter 2024 combined ratio was 93.1%, up 16.9 points compared to a year ago. Unfavorable prior year casualty reserve development was $20 million, or 14.2 points on the combined ratio, compared to no prior year casualty reserve development a year ago.

The following table shows the variances in key quarter-to-date and year-to-date measures:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Excess and Surplus Lines Segment | Quarter ended December 31, | Change | Year-to-Date December 31, | Change |

| $ in millions | 2024 | 2023 | 2024 | 2023 |

| Net premiums written | $ | 152.6 | | | 120.2 | | 27 | | % | $ | 567.2 | | | 438.6 | | 29 | | % |

| Net premiums earned | 141.3 | | | 108.1 | | 31 | | | 504.0 | | | 390.6 | | 29 | | |

| Combined ratio | 93.1 | | % | 76.2 | | 16.9 | | pts | 89.7 | | % | 86.0 | | 3.7 | | pts |

| Loss and loss expense ratio | 63.6 | | | 45.9 | | 17.7 | | | 59.2 | | | 54.3 | | 4.9 | | |

| Underwriting expense ratio | 29.5 | | | 30.3 | | (0.8) | | | 30.5 | | | 31.7 | | (1.2) | | |

| Net catastrophe losses | (2.0) | | pts | (0.7) | | (1.3) | | | 4.6 | | pts | 6.3 | | (1.7) | | |

| Non-catastrophe property losses and loss expenses | 10.8 | | | 6.8 | | 4.0 | | | 11.5 | | | 8.2 | | 3.3 | | |

(Favorable) prior year reserve development on casualty lines | 14.2 | | | — | | 14.2 | | | 4.0 | | | (1.3) | | 5.3 | | |

Current year casualty loss costs | 40.6 | | | 39.8 | | 0.8 | | | 39.1 | | | 41.1 | | (2.0) | | |

Investments Segment

For the fourth quarter, after-tax net investment income of $97 million was up 24% from a year ago. The after-tax income yield averaged 4.0% for the overall and fixed income securities portfolios. With this and invested assets per dollar of common stockholders' equity of $3.31 as of December 31, 2024, net investment income generated 13.2 points of annualized ROE.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments Segment | Quarter ended December 31, | Change | Year-to-Date December 31, | Change |

| $ in millions, except per share data | 2024 | 2023 | 2024 | 2023 |

| Net investment income earned, after-tax | $ | 97.3 | | | 78.4 | | 24 | | % | $ | 362.6 | | | 309.5 | | 17 | | % |

| Net investment income per common share | 1.59 | | | 1.29 | | 23 | | | 5.92 | | | 5.08 | | 17 | | |

| | | | | | | | | | |

| Effective tax rate | 20.7 | | % | 20.4 | | 0.3 | | pts | 20.7 | | % | 20.4 | | 0.3 | | pts |

| Average yields: | | | | | | | | | | |

| Portfolio: | | | | | | | | | | |

| Pre-tax | 5.1 | | | 4.7 | | 0.4 | | | 5.0 | | | 4.7 | | 0.3 | | |

| After-tax | 4.0 | | | 3.7 | | 0.3 | | | 4.0 | | | 3.7 | | 0.3 | | |

| Fixed income securities: | | | | | | | | | | |

| Pre-tax | 5.1 | | % | 5.1 | | — | | pts | 5.0 | | % | 4.9 | | 0.1 | | pts |

| After-tax | 4.0 | | | 4.0 | | — | | | 4.0 | | | 3.9 | | 0.1 | | |

| Annualized ROE contribution | 13.2 | | | 12.1 | | 1.1 | | | 12.8 | | | 12.4 | | 0.4 | | |

Balance Sheet

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ in millions, except per share data | December 31, 2024 | | December 31, 2023 | | Change |

| Total assets | $ | 13,514.2 | | | | 11,802.5 | | | | 15 | % | |

| Total investments | 9,651.3 | | | | 8,693.7 | | | | 11 | | |

| | | | | | | | |

| | | | | | | | |

| Long-term debt | 507.9 | | | | 503.9 | | | | 1 | | |

| Stockholders’ equity | 3,120.1 | | | | 2,954.4 | | | | 6 | | |

| Common stockholders' equity | 2,920.1 | | | | 2,754.4 | | | | 6 | | |

| Invested assets per dollar of common stockholders’ equity | 3.31 | | | | 3.16 | | | | 5 | | |

| Net premiums written to policyholders' surplus | 1.60 | | | | 1.51 | | | | 6 | | |

| Book value per common share | 47.99 | | | | 45.42 | | | | 6 | | |

Adjusted book value per common share1 | 52.10 | | | | 50.03 | | | | 4 | | |

| Debt to total capitalization | 14.0 | | % | | 14.6 | | % | | (0.6) | | pts |

Book value per common share increased by $2.57, or 6%, during 2024. The increase was primarily attributable to $3.23 of net income per diluted common share and a $0.47 decrease in after-tax net unrealized losses on our fixed income securities portfolio, partially offset by $1.43 in common stockholder dividends. The decrease in after-tax net unrealized losses on our

fixed income securities portfolio was primarily driven by a tightening of credit spreads, partially offset by an increase in interest rates. In the fourth quarter of 2024, the Company did not repurchase any shares of common stock. During 2024, the company repurchased 103,000 shares of common stock at an average price of $84.34 for $8.7 million. Capacity under the existing repurchase authorization was $75.5 million as of December 31, 2024.

Selective's Board of Directors declared:

• A quarterly cash dividend on common stock of $0.38 per common share that is payable March 3, 2025, to holders of record on February 14, 2025; and

• A quarterly cash dividend of $287.50 per share on our 4.60% Non-Cumulative Preferred Stock, Series B (equivalent to $0.28750 per depositary share) payable on March 17, 2025, to holders of record as of February 28, 2025.

Guidance

For 2025, our full-year expectations are as follows:

•A GAAP combined ratio of 96% to 97%, including net catastrophe losses of 6 points. Our combined ratio estimate assumes no prior year casualty reserve development;

•After-tax net investment income of $405 million;

•An overall effective tax rate of 21.5%; and

•Weighted average shares of 61.5 million on a fully diluted basis.

The supplemental investor package, with financial information not included in this press release, is available on the Investors page of Selective’s website at www.Selective.com.

Selective’s quarterly analyst conference call will be simulcast at 8:30 AM ET, on Thursday, January 30, 2025, on www.Selective.com. The webcast will be available for rebroadcast until the close of business on February 28, 2025.

About Selective Insurance Group, Inc.

Selective Insurance Group, Inc. (Nasdaq: SIGI) is a holding company for 10 property and casualty insurance companies rated "A+" (Superior) by AM Best. Through independent agents, the insurance companies offer standard and specialty insurance for commercial and personal risks and flood insurance through the National Flood Insurance Program's Write Your Own Program. Selective's unique position as both a leading insurance group and an employer of choice is recognized in a wide variety of awards and honors, including listing in Forbes Best Midsize Employers in 2024 and certification as a Great Place to Work® in 2024 for the fifth consecutive year. For more information about Selective, visit www.Selective.com.

1Reconciliation of Net Income (Loss) Available to Common Stockholders to Non-GAAP Operating Income (Loss) and Certain Other Non-GAAP Measures

Non-GAAP operating income (loss), non-GAAP operating income (loss) per diluted common share, and non-GAAP operating return on common equity differ from net income (loss) available to common stockholders, net income (loss) available to common stockholders per diluted common share, and return on common equity, respectively, by the exclusion of after-tax net realized and unrealized gains and losses on investments included in net income (loss). Adjusted book value per common share differs from book value per common share by excluding total after-tax unrealized gains and losses on investments included in accumulated other comprehensive income (loss). These non-GAAP measures are used as important financial measures by management, analysts, and investors, because the timing of realized and unrealized investment gains and losses on securities in any given period is largely discretionary. In addition, net realized and unrealized gains and losses on investments could distort the analysis of trends. These operating measurements are not intended to be a substitute for net income (loss) available to common stockholders, net income (loss) available to common stockholders per diluted common share, return on common equity, and book value per common share prepared in accordance with U.S. generally accepted accounting principles (GAAP). Reconciliations of net income (loss) available to common stockholders, net income (loss) available to common stockholders per diluted common share, return on common equity, and book value per common share to non-GAAP operating income (loss), non-GAAP operating income (loss) per diluted common share, non-GAAP operating return on common equity, and adjusted book value per common share, respectively, are provided in the tables below.

Note: All amounts included in this release exclude intercompany transactions.

Reconciliation of Net Income (Loss) Available to Common Stockholders to Non-GAAP Operating Income (Loss)

| | | | | | | | | | | | | | | | | | | | | | | |

| $ in millions | Quarter ended December 31, | | Year-to-Date December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss) available to common stockholders | $ | 93.2 | | | 122.5 | | | 197.8 | | | 356.0 | |

| Net realized and unrealized investment (gains) losses included in net income, before tax | 8.0 | | | (5.4) | | | 2.9 | | | 3.6 | |

| | | | | | | |

| Tax on reconciling items | (1.7) | | | 1.1 | | | (0.6) | | | (0.7) | |

| | | | | | | |

Non-GAAP operating income (loss) | $ | 99.6 | | | 118.3 | | | 200.1 | | | 358.8 | |

Reconciliation of Net Income (Loss) Available to Common Stockholders per Diluted Common Share to Non-GAAP Operating Income (Loss) per Diluted Common Share

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended December 31, | | Year-to-Date December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss) available to common stockholders per diluted common share | $ | 1.52 | | | 2.01 | | | 3.23 | | | 5.84 | |

| Net realized and unrealized investment (gains) losses included in net income, before tax | 0.13 | | | (0.09) | | | 0.05 | | | 0.06 | |

| | | | | | | |

| Tax on reconciling items | (0.03) | | | 0.02 | | | (0.01) | | | (0.01) | |

| | | | | | | |

Non-GAAP operating income (loss) per diluted common share | $ | 1.62 | | | 1.94 | | | 3.27 | | | 5.89 | |

Reconciliation of Return on Common Equity to Non-GAAP Operating Return on Common Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended December 31, | | Year-to-Date December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Return on Common Equity | 12.7 | | % | | 18.9 | | | 7.0 | | | 14.3 | |

| Net realized and unrealized investment (gains) losses included in net income, before tax | 1.1 | | | | (0.8) | | | 0.1 | | | 0.1 | |

| | | | | | | | |

| Tax on reconciling items | (0.3) | | | | 0.1 | | | — | | | — | |

| | | | | | | | |

| Non-GAAP Operating Return on Common Equity | 13.5 | | % | | 18.2 | | | 7.1 | | | 14.4 | |

Reconciliation of Book Value per Common Share to Adjusted Book Value per Common Share

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended December 31, | | Year-to-Date December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Book value per common share | $ | 47.99 | | | 45.42 | | | 47.99 | | | 45.42 | |

| Total unrealized investment (gains) losses included in accumulated other comprehensive (loss) income, before tax | 5.21 | | | 5.83 | | | 5.21 | | | 5.83 | |

| Tax on reconciling items | (1.10) | | | (1.22) | | | (1.10) | | | (1.22) | |

| Adjusted book value per common share | $ | 52.10 | | | 50.03 | | | 52.10 | | | 50.03 | |

Note: Amounts in the tables above may not foot due to rounding.

Forward-Looking Statements

Certain statements in this report, including information incorporated by reference, are “forward-looking statements” defined in the Private Securities Litigation Reform Act of 1995 ("PSLRA"). The PSLRA provides a forward-looking statement safe harbor under the Securities Act of 1933 and the Securities Exchange Act of 1934. These statements discuss our intentions, beliefs, projections, estimations, or forecasts of future events and financial performance. They involve known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, activity levels, or performance to materially differ from those in or implied by the forward-looking statements. In some cases, forward-looking statements include the words “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “attribute,” “confident,” “strong,” “target,” “project,” “intend,” “believe,” “estimate,” “predict,” “potential,” “pro forma,” “seek,” “likely,” “continue,” or comparable terms. Our forward-looking statements are only predictions; we cannot guarantee or assure that such expectations will prove correct. We undertake no obligation to publicly update or revise any forward-looking statements for any reason, except as may be required by law.

Factors that could cause our actual results to differ materially from what we project, forecast, or estimate in forward-looking statements include, without limitation:

•Challenging conditions in the economy, global capital markets, the banking sector, and commercial real estate, including prolonged higher inflation, could increase loss costs and negatively impact investment portfolios;

•Deterioration in the public debt, public equity, or private investment markets that could lead to investment losses and interest rate fluctuations;

•Ratings downgrades on individual securities we own could affect investment values and, therefore, statutory surplus;

•The development and adequacy of our loss reserves and loss expense reserves;

•Frequency and severity of catastrophic events, including natural events that may be impacted by climate change, such as hurricanes, severe convective storms, tornadoes, windstorms, earthquakes, hail, severe winter weather, floods, and fires, and man-made events such as criminal and terrorist acts, including cyber-attacks, explosions, and civil unrest;

•Adverse market, governmental, regulatory, legal, political, or judicial rulings, conditions or actions, including the impact of social inflation;

•The significant geographic concentration of our business in the eastern portion of the United States;

•The cost, terms and conditions, and availability of reinsurance;

•Our ability to collect on reinsurance and the solvency of our reinsurers;

•The impact of changes in U.S. trade policies and imposition of tariffs on imports that may lead to higher than anticipated inflationary trends for our loss and loss expenses;

•Related to COVID-19, we have successfully defended against payment of COVID-19-related business interruption losses based on our policies' terms, conditions, and exclusions. However, should the highest courts determine otherwise, our loss and loss expenses may increase, our related reserves may not be adequate, and our financial condition and liquidity may be materially impacted.

•Ongoing wars and conflicts impacting global economic, banking, commodity, and financial markets, exacerbating ongoing economic challenges, including inflation and supply chain disruption, which influences insurance loss costs, premiums, and investment valuations;

•Uncertainties related to insurance premium rate increases and business retention;

•Changes in insurance regulations that impact our ability to write and/or cease writing insurance policies in one or more states;

•The effects of data privacy or cyber security laws and regulations on our operations;

•Major defect or failure in our internal controls or information technology and application systems that result in harm to our brand in the marketplace, increased senior executive focus on crisis and reputational management issues, and/or increased expenses, particularly if we experience a significant privacy breach;

•Potential tax or federal financial regulatory reform provisions that could pose certain risks to our operations;

•Our ability to maintain favorable financial ratings, which may include sustainability considerations, from rating agencies, including AM Best, Standard & Poor’s, Moody’s, and Fitch;

•Our entry into new markets and businesses; and

•Other risks and uncertainties we identify in filings with the United States Securities and Exchange Commission, including our Annual Report on Form 10-K and other periodic reports.

| | | | | |

Investor Contact: Brad B. Wilson 973-948-1283 Brad.Wilson@Selective.com | Media Contact: Jamie M. Beal 973-948-1234 Jamie.Beal@Selective.com |

| |

Selective Insurance Group, Inc. 40 Wantage Avenue Branchville, New Jersey 07890 www.Selective.com | |

Exhibit 99.2

FINANCIAL SUPPLEMENT

FOURTH QUARTER AND FULL YEAR 2024

Forward-Looking Statements

Certain statements in this report, including information incorporated by reference, are “forward-looking statements” defined in the Private Securities Litigation Reform Act of 1995 ("PSLRA"). The PSLRA provides a forward-looking statement safe harbor under the Securities Act of 1933 and the Securities Exchange Act of 1934. These statements discuss our intentions, beliefs, projections, estimations, or forecasts of future events and financial performance. They involve known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, activity levels, or performance to materially differ from those in or implied by the forward-looking statements. In some cases, forward-looking statements include the words “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “attribute,” “confident,” “strong,” “target,” “project,” “intend,” “believe,” “estimate,” “predict,” “potential,” “pro forma,” “seek,” “likely,” “continue,” or comparable terms. Our forward-looking statements are only predictions; we cannot guarantee or assure that such expectations will prove correct. We undertake no obligation to publicly update or revise any forward-looking statements for any reason, except as may be required by law.

Factors that could cause our actual results to differ materially from what we project, forecast, or estimate in forward-looking statements include, without limitation:

•Challenging conditions in the economy, global capital markets, the banking sector, and commercial real estate, including prolonged higher inflation, could increase loss costs and negatively impact investment portfolios;

•Deterioration in the public debt, public equity, or private investment markets that could lead to investment losses and interest rate fluctuations;

•Ratings downgrades on individual securities we own could affect investment values and, therefore, statutory surplus;

•The development and adequacy of our loss reserves and loss expense reserves;

•Frequency and severity of catastrophic events, including natural events that may be impacted by climate change, such as hurricanes, severe convective storms, tornadoes, windstorms, earthquakes, hail, severe winter weather, floods, and fires, and man-made events such as criminal and terrorist acts, including cyber-attacks, explosions, and civil unrest;

•Adverse market, governmental, regulatory, legal, political, or judicial rulings, conditions or actions, including the impact of social inflation;

•The significant geographic concentration of our business in the eastern portion of the United States;

•The cost, terms and conditions, and availability of reinsurance;

•Our ability to collect on reinsurance and the solvency of our reinsurers;

•The impact of changes in U.S. trade policies and imposition of tariffs on imports that may lead to higher than anticipated inflationary trends for our loss and loss expenses;

•Related to COVID-19, we have successfully defended against payment of COVID-19-related business interruption losses based on our policies' terms, conditions, and exclusions. However, should the highest courts determine otherwise, our loss and loss expenses may increase, our related reserves may not be adequate, and our financial condition and liquidity may be materially impacted.

•Ongoing wars and conflicts impacting global economic, banking, commodity, and financial markets, exacerbating ongoing economic challenges, including inflation and supply chain disruption, which influences insurance loss costs, premiums, and investment valuations;

•Uncertainties related to insurance premium rate increases and business retention;

•Changes in insurance regulations that impact our ability to write and/or cease writing insurance policies in one or more states;

•The effects of data privacy or cyber security laws and regulations on our operations;

•Major defect or failure in our internal controls or information technology and application systems that result in harm to our brand in the marketplace, increased senior executive focus on crisis and reputational management issues, and/or increased expenses, particularly if we experience a significant privacy breach;

•Potential tax or federal financial regulatory reform provisions that could pose certain risks to our operations;

•Our ability to maintain favorable financial ratings, which may include sustainability considerations, from rating agencies, including AM Best, Standard & Poor’s, Moody’s, and Fitch;

•Our entry into new markets and businesses; and

•Other risks and uncertainties we identify in filings with the United States Securities and Exchange Commission, including our Annual Report on Form 10-K and other periodic reports.

Selective Insurance Group, Inc. & Consolidated Subsidiaries

TABLE OF CONTENTS

| | | | | |

| Page |

| Consolidated Financial Highlights | |

| Consolidated Statements of Operations | |

| Consolidated Balance Sheets | |

| Financial Metrics | |

| |

| Consolidated Insurance Operations Statement of Operations | |

| Standard Commercial Lines Statement of Operations and Supplemental Data | |

| Standard Commercial Lines GAAP Line of Business Results | |

| Standard Personal Lines Statement of Operations and Supplemental Data | |

| Standard Personal Lines GAAP Line of Business Results | |

| Excess and Surplus Lines Statement of Operations and Supplemental Data | |

| Excess and Surplus Lines GAAP Line of Business Results | |

| |

| Consolidated Investment Income | |

| Consolidated Composition of Invested Assets | |

| |

| |

| |

| Credit Quality of Invested Assets | |

| |

Reconciliation of Net Income (Loss) Available to Common Stockholders to Non-GAAP Operating Income (Loss) and Certain Other Non-GAAP Measures | |

| |

| Ratings and Contact Information | |

| |

Selective Insurance Group, Inc. & Consolidated Subsidiaries

CONSOLIDATED FINANCIAL HIGHLIGHTS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended | | Year-to-date |

| | Dec. 31, | | | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Dec. 31, | | | Dec. 31, |

| ($ and shares in millions, except per share data) | 2024 | | | 2024 | | 2024 | | 2024 | | 2023 | | 2024 | | | 2023 |

| For Period Ended | | | | | | | | | | | | | | | |

| Gross premiums written | $ | 1,275.9 | | | | 1,343.1 | | | 1,406.2 | | | 1,321.9 | | | 1,149.7 | | | 5,347.0 | | | | 4,749.5 | |

| Net premiums written | 1,089.6 | | | | 1,157.6 | | | 1,226.1 | | | 1,156.6 | | | 991.5 | | | 4,630.0 | | | | 4,134.5 | |

| Change in net premiums written, from comparable prior year period | 10 | | % | | 9 | | | 13 | | | 16 | | | 17 | | | 12 | | | | 16 | |

| | | | | | | | | | | | | | | | |

| Underwriting income (loss), before-tax | $ | 16.8 | | | | 5.3 | | | (173.7) | | | 19.0 | | | 63.6 | | | (132.6) | | | | 132.8 | |

| Net investment income earned, before-tax | 122.8 | | | | 117.8 | | | 108.6 | | | 107.8 | | | 98.6 | | | 457.1 | | | | 388.7 | |

| Net realized and unrealized investment gains (losses), before-tax | (8.0) | | | | 5.4 | | | 1.3 | | | (1.6) | | | 5.4 | | | (2.9) | | | | (3.6) | |

| | | | | | | | | | | | | | | | |

| Net income (loss) | $ | 95.5 | | | | 92.3 | | | (63.3) | | | 82.5 | | | 124.8 | | | 207.0 | | | | 365.2 | |

| Net income (loss) available to common stockholders(1) | 93.2 | | | | 90.0 | | | (65.6) | | | 80.2 | | | 122.5 | | | 197.8 | | | | 356.0 | |

| Non-GAAP operating income (loss)(2) | 99.6 | | | | 85.7 | | | (66.6) | | | 81.5 | | | 118.3 | | | 200.1 | | | | 358.8 | |

| | | | | | | | | | | | | | | | |

| At Period End | | | | | | | | | | | | | | | |

| Total assets | 13,514.2 | | | | 13,473.1 | | | 12,565.5 | | | 12,056.1 | | | 11,802.5 | | | 13,514.2 | | | | 11,802.5 | |

| Total invested assets | 9,651.3 | | | | 9,635.3 | | | 9,021.8 | | | 8,745.7 | | | 8,693.7 | | | 9,651.3 | | | | 8,693.7 | |

| Stockholders' equity | 3,120.1 | | | | 3,167.8 | | | 2,922.7 | | | 3,006.5 | | | 2,954.4 | | | 3,120.1 | | | | 2,954.4 | |

| Common stockholders' equity(3) | 2,920.1 | | | | 2,967.8 | | | 2,722.7 | | | 2,806.5 | | | 2,754.4 | | | 2,920.1 | | | | 2,754.4 | |

| Common shares outstanding | 60.8 | | | | 60.8 | | | 60.9 | | | 60.8 | | | 60.6 | | | 60.8 | | | | 60.6 | |

| | | | | | | | | | | | | | | | |

| Per Share and Share Data | | | | | | | | | | | | | | | |

| Net income (loss) available to common stockholders per common share (diluted) | $ | 1.52 | | | | 1.47 | | | (1.08) | | | 1.31 | | | 2.01 | | | 3.23 | | | | 5.84 | |

| Non-GAAP operating income (loss) per common share (diluted)(2) | 1.62 | | | | 1.40 | | | (1.10) | | | 1.33 | | | 1.94 | | | 3.27 | | | | 5.89 | |

| Weighted average common shares outstanding (diluted) | 61.3 | | | | 61.3 | | | 60.9 | | | 61.2 | | | 61.0 | | | 61.3 | | | | 61.0 | |

| Book value per common share | $ | 47.99 | | | | 48.82 | | | 44.74 | | | 46.17 | | | 45.42 | | | 47.99 | | | | 45.42 | |

| Adjusted book value per common share(2) | 52.10 | | | | 50.80 | | | 49.67 | | | 50.97 | | | 50.03 | | | 52.10 | | | | 50.03 | |

| Dividends paid per common share | 0.38 | | | | 0.35 | | | 0.35 | | | 0.35 | | | 0.35 | | | 1.43 | | | | 1.25 | |

| | | | | | | | | | | | | | | | |

| Financial Ratios | | | | | | | | | | | | | | | |

| Loss and loss expense ratio | 67.8 | | % | | 68.8 | | | 85.7 | | | 67.0 | | | 62.4 | | | 72.3 | | | | 64.9 | |

| Underwriting expense ratio | 30.6 | | | | 30.6 | | | 30.3 | | | 30.9 | | | 31.1 | | | 30.6 | | | | 31.4 | |

| Dividends to policyholders ratio | 0.1 | | | | 0.1 | | | 0.1 | | | 0.3 | | | 0.2 | | | 0.1 | | | | 0.2 | |

| GAAP combined ratio | 98.5 | | % | | 99.5 | | | 116.1 | | | 98.2 | | | 93.7 | | | 103.0 | | | | 96.5 | |

| | | | | | | | | | | | | | | | |

| Return on common stockholders' equity ("ROE") | 12.7 | | | | 12.6 | | | (9.5) | | | 11.5 | | | 18.9 | | | 7.0 | | | | 14.3 | |

| Non-GAAP operating ROE(2) | 13.5 | | | | 12.1 | | | (9.6) | | | 11.7 | | | 18.2 | | | 7.1 | | | | 14.4 | |

| Debt to total capitalization | 14.0 | | | | 13.8 | | | 14.8 | | | 14.3 | | | 14.6 | | | 14.0 | | | | 14.6 | |

| | | | | | | | | | | | | | | | |

| Net premiums written to policyholders' surplus | 1.60 | | | | 1.63 | | | 1.64 | | | 1.55 | | | 1.51 | | | 1.60 | | | | 1.51 | |

| Invested assets per dollar of common stockholders' equity | $ | 3.31 | | | | 3.25 | | | 3.31 | | | 3.12 | | | 3.16 | | | 3.31 | | | | 3.16 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

(1) | Net income (loss) available to common stockholders is net income (loss) reduced by preferred stock dividends. | | | | | | | |

(2) | Non-GAAP measure. Refer to Page 15 for definition. | | | | | | | | | | | | | | | |

(3) | Excludes equity related to preferred stock. | | | | | | | | | | | | | | | |

Selective Insurance Group, Inc. & Consolidated Subsidiaries

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended | | Year-to-date |

| | Dec. 31, | | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Dec. 31, | | Dec. 31, |

| ($ and shares in millions, except per share data) | 2024 | | 2024 | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | | | | | | | |

| Net premiums earned | $ | 1,133.0 | | | 1,112.2 | | | 1,080.2 | | | 1,050.9 | | | 1,001.2 | | | $ | 4,376.4 | | | 3,827.6 | |

| Net investment income earned | 122.8 | | | 117.8 | | | 108.6 | | | 107.8 | | | 98.6 | | | 457.1 | | | 388.7 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net realized and unrealized gains (losses) | (8.0) | | | 5.4 | | | 1.3 | | | (1.6) | | | 5.4 | | | (2.9) | | | (3.6) | |

| Other income | 8.5 | | | 8.9 | | | 5.8 | | | 7.8 | | | 5.5 | | | 31.1 | | | 19.4 | |

| Total revenues | 1,256.4 | | | 1,244.3 | | | 1,196.0 | | | 1,165.0 | | | 1,110.7 | | | 4,861.7 | | | 4,232.1 | |

| | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | |

| Loss and loss expense incurred | 769.0 | | 765.7 | | | 925.5 | | | 704.3 | | | 624.8 | | | 3,164.5 | | | 2,484.3 | |

| Amortization of deferred policy acquisition costs | 241.0 | | 235.6 | | | 226.4 | | | 219.4 | | | 210.5 | | | 922.4 | | 796.2 | |

| Other insurance expenses | 114.8 | | 114.7 | | | 107.8 | | | 116.0 | | | 107.8 | | | 453.2 | | 433.7 | |

| Interest expense | 7.2 | | 7.3 | | | 7.2 | | | 7.2 | | | 7.2 | | | 28.9 | | 28.8 | |

| Corporate expenses | 5.3 | | 4.7 | | | 9.2 | | | 15.5 | | | 3.4 | | | 34.6 | | 30.7 | |

| Total expenses | 1,137.3 | | | 1,127.8 | | | 1,276.1 | | | 1,062.4 | | | 953.7 | | | 4,603.6 | | | 3,773.7 | |

| | | | | | | | | | | | | | |

Income (loss) before federal income tax | $ | 119.1 | | | 116.5 | | | (80.1) | | | 102.6 | | | 157.0 | | | 258.0 | | 458.4 | |

Federal income tax expense (benefit) | 23.5 | | | 24.2 | | | (16.8) | | | 20.0 | | | 32.1 | | | 51.0 | | | 93.2 | |

| | | | | | | | | | | | | | |

Net Income (loss) | $ | 95.5 | | | 92.3 | | | (63.3) | | | 82.5 | | | 124.8 | | | 207.0 | | 365.2 | |

| Preferred stock dividends | 2.3 | | 2.3 | | | 2.3 | | | 2.3 | | | 2.3 | | | 9.2 | | 9.2 | |

Net income (loss) available to common stockholders | $ | 93.2 | | | 90.0 | | | (65.6) | | | 80.2 | | | 122.5 | | | 197.8 | | 356.0 |

| | | | | | | | | | | | | | |

Net realized and unrealized investment (gains) losses, after tax(1) | 6.3 | | | (4.3) | | | (1.0) | | | 1.3 | | | (4.3) | | | 2.3 | | | 2.8 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Non-GAAP operating income (loss)(2) | $ | 99.6 | | | 85.7 | | | (66.6) | | | 81.5 | | | 118.2 | | | $ | 200.1 | | | 358.7 | |

| | | | | | | | | | | | | | |

| Weighted average common shares outstanding (diluted) | 61.3 | | 61.3 | | | 60.9 | | | 61.2 | | | 61.0 | | | 61.3 | | 61.0 | |

| | | | | | | | | | | | | | |

Net income (loss) available to common stockholders per common share (diluted) | $ | 1.52 | | | 1.47 | | | (1.08) | | | 1.31 | | | 2.01 | | | $ | 3.23 | | | 5.84 | |

| | | | | | | | | | | | | | |

Non-GAAP operating income (loss) per common share (diluted)(2) | $ | 1.62 | | | 1.40 | | | (1.10) | | | 1.33 | | | 1.94 | | | $ | 3.27 | | | 5.89 | |

| | | | | | | | | | | | | | |

(1) | Amounts are provided to reconcile net income (loss) available to common stockholders to non-GAAP operating income (loss). | | | | |

(2) | Non-GAAP measure. Refer to Page 15 for definition. | | | | | | | | | | | | | |

| Note: Amounts may not foot due to rounding. | | | | | | | | | | | | | |

Selective Insurance Group, Inc. & Consolidated Subsidiaries

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dec. 31, | | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, |

| ($ in millions, except per share data) | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| | | | | | | | | |

| ASSETS | | | | | | | | | |

| Investments | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Fixed income securities, held-to-maturity, net of allowance for credit losses | $ | 25.4 | | | 22.0 | | | 19.5 | | | 20.3 | | | 22.7 | |

| Fixed income securities, available-for-sale, at fair value, net of allowance for credit losses | 8,127.3 | | | 8,088.6 | | | 7,669.0 | | | 7,583.5 | | | 7,499.2 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Commercial mortgage loans, net of allowance for credit losses | 233.7 | | | 223.6 | | | 219.5 | | | 208.0 | | | 188.4 | |

| Equity securities, at fair value | 213.6 | | | 205.6 | | | 192.0 | | | 194.3 | | | 187.2 | |

| Short-term investments | 509.3 | | | 561.0 | | | 417.3 | | | 247.9 | | | 309.3 | |

| Alternative investments | 440.9 | | | 432.0 | | | 414.8 | | | 402.7 | | | 395.8 | |

| Other investments | 101.1 | | | 102.5 | | | 89.7 | | | 89.0 | | | 91.2 | |

| Total investments |

| 9,651.3 | | | 9,635.3 | | | 9,021.8 | | | 8,745.7 | | | 8,693.7 | |

| Cash | 0.1 | | | 0.1 | | | 0.2 | | | 0.1 | | | 0.2 | |

| Restricted cash | 62.9 | | | 12.6 | | | 10.7 | | | 11.7 | | | 13.1 | |

| Accrued investment income | 76.9 | | | 73.8 | | | 72.3 | | | 68.0 | | | 66.3 | |

| | | | | | | | | |

| | | | | | | | | |

| Premiums receivable, net of allowance for credit losses | 1,467.8 | | | 1,531.9 | | | 1,579.7 | | | 1,439.1 | | | 1,313.1 | |

| | | | | | | | | |

| | | | | | | | | |

| Reinsurance recoverable, net of allowance for credit losses | 1,061.1 | | | 1,057.3 | | | 685.6 | | | 651.4 | | | 656.8 | |

| Prepaid reinsurance premiums | 235.4 | | | 230.7 | | | 219.8 | | | 208.0 | | | 203.3 | |

| Current federal income tax | — | | | 13.0 | | | 38.6 | | | — | | | — | |

| Deferred federal income tax | 146.8 | | | 100.7 | | | 145.9 | | | 144.7 | | | 140.2 | |

| Property and equipment, net of accumulated depreciation and amortization | 93.3 | | | 92.2 | | | 89.2 | | | 82.7 | | | 83.3 | |

| Deferred policy acquisition costs | 479.3 | | | 488.5 | | | 476.5 | | | 448.3 | | | 424.9 | |

| Goodwill | 7.8 | | | 7.8 | | | 7.8 | | | 7.8 | | | 7.8 | |

| Other assets | 231.4 | | | 229.1 | | | 217.4 | | | 248.5 | | | 199.8 | |

| Total assets | | $ | 13,514.2 | | | 13,473.1 | | | 12,565.5 | | | 12,056.1 | | | 11,802.5 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | | |

| Liabilities | | | | | | | | | |

| Reserve for loss and loss expense | $ | 6,589.8 | | | 6,452.0 | | | 5,903.5 | | | 5,501.8 | | | 5,336.9 | |

| Unearned premiums | 2,616.3 | | | 2,655.0 | | | 2,598.7 | | | 2,441.0 | | | 2,330.7 | |

| | | | | | | | | |

| Long-term debt | 507.9 | | | 508.2 | | | 508.8 | | | 503.3 | | | 503.9 | |

| Current federal income tax | 19.7 | | | — | | | — | | | 26.5 | | | 6.3 | |

| | | | | | | | | |

| Accrued salaries and benefits | 121.7 | | | 113.5 | | | 92.6 | | | 97.9 | | | 122.0 | |

| Other liabilities | 538.7 | | | 576.6 | | | 539.2 | | | 479.1 | | | 548.4 | |

| Total liabilities | | $ | 10,394.1 | | | 10,305.3 | | | 9,642.8 | | | 9,049.6 | | | 8,848.2 | |

| | | | | | | | | |

| Stockholders' Equity | | | | | | | | | |

| Preferred stock of $0 par value per share | $ | 200.0 | | | 200.0 | | | 200.0 | | | 200.0 | | | 200.0 | |

| Common stock of $2 par value per share | 211.2 | | | 211.1 | | | 211.0 | | | 210.9 | | | 210.4 | |

| Additional paid-in capital | 557.0 | | | 549.8 | | | 545.3 | | | 534.3 | | | 522.7 | |

| Retained earnings | 3,139.5 | | | 3,069.6 | | | 3,001.1 | | | 3,088.2 | | | 3,029.4 | |

Accumulated other comprehensive income (loss) | (336.8) | | | (211.9) | | | (392.7) | | | (385.0) | | | (373.0) | |

| Treasury stock, at cost | (650.8) | | | (650.7) | | | (641.9) | | | (641.9) | | | (635.2) | |

| Total stockholders' equity | | $ | 3,120.1 | | | 3,167.8 | | | 2,922.7 | | | 3,006.5 | | | 2,954.4 | |

| Commitments and contingencies | | | | | | | | | |

| | | | | | | | | |

| Total liabilities and stockholders' equity | | $ | 13,514.2 | | | 13,473.1 | | | 12,565.5 | | | 12,056.1 | | | 11,802.5 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Note: Amounts may not foot due to rounding. | | | | | | | | | |

Selective Insurance Group, Inc. & Consolidated Subsidiaries

FINANCIAL METRICS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter ended | | Year-to-date |

| | | Dec. 31, | | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Dec. 31, | | Dec. 31, |

| ($ and shares in millions, except per share data) | 2024 | | 2024 | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Book value per common share | | | | | | | | | | | | | | |

| | Common stockholders' equity | $ | 2,920.1 | | | | 2,967.8 | | | 2,722.7 | | | 2,806.5 | | | 2,754.4 | | | 2,920.1 | | | 2,754.4 | |

| | Common shares issued and outstanding, at period end | 60.8 | | | | 60.8 | | | 60.9 | | | 60.8 | | | 60.6 | | | 60.8 | | | 60.6 | |

| | Book value per common share | $ | 47.99 | | | | 48.82 | | | 44.74 | | | 46.17 | | | 45.42 | | | 47.99 | | | 45.42 | |

| | Adjusted book value per common share(2) | 52.10 | | | | 50.80 | | | 49.67 | | | 50.97 | | | 50.03 | | | 52.10 | | | 50.03 | |

| Financial results (after-tax) | | | | | | | | | | | | | | |

| | Underwriting income (loss) | 13.3 | | | | 4.1 | | | (137.2) | | | 15.0 | | | 50.2 | | | (104.7) | | | 104.9 | |

| | Net investment income | 97.3 | | | | 93.4 | | | 86.3 | | | 85.6 | | | 78.4 | | | 362.6 | | | 309.5 | |

| | Interest expense and preferred stock dividends | (8.0) | | | | (8.0) | | | (8.0) | | | (8.0) | | | (8.0) | | | (32.0) | | | (32.0) | |

| | Corporate expense | (3.0) | | | | (3.8) | | | (7.7) | | | (11.2) | | | (2.4) | | | (25.7) | | | (23.7) | |

| | Net realized and unrealized investment gains (losses) | (6.3) | | | | 4.3 | | | 1.0 | | | (1.3) | | | 4.3 | | | (2.3) | | | (2.8) | |

| | | | | | | | | | | | | | | | |

| | Total after-tax net income (loss) available to common stockholders | 93.2 | | | | 90.0 | | | (65.6) | | | 80.2 | | | 122.5 | | | 197.8 | | | 356.0 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Return on average equity | | | | | | | | | | | | | | |

| | Insurance segments | 1.8 | | | | 0.6 | | | (19.9) | | | 2.2 | | | 7.7 | | | (3.7) | | | 4.2 | |

| | Net investment income | 13.2 | | | | 13.1 | | | 12.5 | | | 12.3 | | | 12.1 | | | 12.8 | | | 12.4 | |

| | Interest expense and preferred stock dividends | (1.1) | | | | (1.1) | | | (1.2) | | | (1.1) | | | (1.2) | | | (1.1) | | | (1.3) | |

| | Corporate expense | (0.4) | | | | (0.5) | | | (1.0) | | | (1.7) | | | (0.4) | | | (0.9) | | | (0.9) | |

| | Net realized and unrealized investment gains (losses) | (0.8) | | | | 0.5 | | | 0.1 | | | (0.2) | | | 0.7 | | | (0.1) | | | (0.1) | |

| | | | | | | | | | | | | | | | |

| | ROE | 12.7 | | | | 12.6 | | | (9.5) | | | 11.5 | | | 18.9 | | | 7.0 | | | 14.3 | |

| | Net realized and unrealized (gains) losses(1) | 0.8 | | | | (0.5) | | | (0.1) | | | 0.2 | | | (0.7) | | | 0.1 | | | 0.1 | |

| | | | | | | | | | | | | | | | |

| | Non-GAAP Operating ROE(2) | 13.5 | | | | 12.1 | | | (9.6) | | | 11.7 | | | 18.2 | | | 7.1 | | | 14.4 | |

| Debt and total capitalization | | | | | | | | | | | | | | |

| Notes payable: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | 3.03% Borrowings from Federal Home Loan Bank of Indianapolis | 60.0 | | | | 60.0 | | | 60.0 | | | 60.0 | | | 60.0 | | | 60.0 | | | 60.0 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | 7.25% Senior Notes | 49.8 | | | | 49.8 | | | 49.8 | | | 49.8 | | | 49.8 | | | 49.8 | | | 49.8 | |

| | 6.70% Senior Notes | 99.4 | | | | 99.4 | | | 99.4 | | | 99.4 | | | 99.3 | | | 99.4 | | | 99.3 | |

| | 5.375% Senior Notes | 292.4 | | | | 292.4 | | | 292.3 | | | 292.2 | | | 292.2 | | | 292.4 | | | 292.2 | |

| | Finance Lease Obligations | 6.3 | | | | 6.7 | | | 7.3 | | | 1.9 | | | 2.6 | | | 6.3 | | | 2.6 | |

| Total debt | 507.9 | | | | 508.2 | | | 508.8 | | | 503.3 | | | 503.9 | | | 507.9 | | | 503.9 | |

| Stockholders' equity | 3,120.1 | | | | 3,167.8 | | | 2,922.7 | | | 3,006.5 | | | 2,954.4 | | | 3,120.1 | | | 2,954.4 | |

| Total capitalization | $ | 3,628.0 | | | | 3,676.0 | | | 3,431.5 | | | 3,509.8 | | | 3,458.3 | | | 3,628.0 | | | 3,458.3 | |

| Ratio of debt to total capitalization | 14.0 | | | | 13.8 | | | 14.8 | | | 14.3 | | | 14.6 | | | 14.0 | | | 14.6 | |

| | | | | | | | | | | | | | | |

| Policyholders' surplus | $ | 2,902.8 | | | | 2,787.5 | | | 2,698.8 | | | 2,777.3 | | | 2,742.3 | | | 2,902.8 | | | 2,742.3 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

(1) | Amounts are provided to reconcile ROE to non-GAAP operating ROE. | | | | | | | | | | | | |

(2) | Non-GAAP measure. Refer to Page 15 for definition. | | | | | | | | | | | | | | |

| | Note: Amounts may not foot due to rounding. | | | | | | | | | | | | | | |

Selective Insurance Group, Inc. & Consolidated Subsidiaries

CONSOLIDATED INSURANCE OPERATIONS

STATEMENT OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter ended | | Year-to-date |

| Dec. 31, | | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Dec. 31, | | Dec. 31, |

| ($ in millions) | 2024 | | 2024 | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | | | | | |

| Underwriting results | | | | | | | | | | | | | | |

| Net premiums written | $ | 1,089.6 | | | | 1,157.6 | | | 1,226.1 | | | 1,156.6 | | | 991.5 | | | 4,630.0 | | | 4,134.5 | |

| Change in net premiums written, from comparable prior year period | 10 | | % | | 9 | | | 13 | | | 16 | | | 17 | | | 12 | | | 16 | |

| | | | | | | | | | | | | | |

| Net premiums earned | $ | 1,133.0 | | | | 1,112.2 | | | 1,080.2 | | | 1,050.9 | | | 1,001.2 | | | 4,376.4 | | | 3,827.6 | |

| Losses and loss expenses incurred | 769.0 | | | | 765.7 | | | 925.5 | | | 704.3 | | | 624.8 | | | 3,164.5 | | | 2,484.3 | |

| Net underwriting expenses incurred | 346.4 | | | | 340.0 | | | 327.3 | | | 324.4 | | | 311.1 | | | 1,338.0 | | | 1,203.8 | |

| Dividends to policyholders | 0.8 | | | | 1.4 | | | 1.1 | | | 3.3 | | | 1.8 | | | 6.5 | | | 6.8 | |

| GAAP underwriting income (loss) | $ | 16.8 | | | | 5.3 | | | (173.7) | | | 19.0 | | | 63.6 | | | (132.6) | | | 132.8 | |

| | | | | | | | | | | | | | | | |

| Net catastrophe losses | $ | (10.1) | | | | 148.8 | | | 90.5 | | | 55.2 | | | 24.6 | | | 284.5 | | | 244.5 | |

| (Favorable) unfavorable prior year casualty reserve development | 100.0 | | | | — | | | 176.0 | | | 35.0 | | | 10.0 | | | 311.0 | | | (6.5) | |

| | | | | | | | | | | | | | | | |

| Underwriting ratios | | | | | | | | | | | | | | |

| Loss and loss expense ratio | 67.8 | | % | | 68.8 | | | 85.7 | | | 67.0 | | | 62.4 | | | 72.3 | | | 64.9 | |

| Underwriting expense ratio | 30.6 | | | | 30.6 | | | 30.3 | | | 30.9 | | | 31.1 | | | 30.6 | | | 31.4 | |

| Dividends to policyholders ratio | 0.1 | | | | 0.1 | | | 0.1 | | | 0.3 | | | 0.2 | | | 0.1 | | | 0.2 | |

| | Combined ratio | 98.5 | | % | | 99.5 | | | 116.1 | | | 98.2 | | | 93.7 | | | 103.0 | | | 96.5 | |

| | | | | | | | | | | | | | | | |

| Net catastrophe losses | (0.9) | | pts | | 13.4 | | | 8.4 | | | 5.3 | | | 2.5 | | | 6.5 | | | 6.4 | |

| (Favorable) unfavorable prior year casualty reserve development | 8.8 | | | | — | | | 16.3 | | | 3.3 | | | 1.0 | | | 7.1 | | | (0.2) | |

| | Combined ratio before net catastrophe losses | 99.4 | | % | | 86.1 | | | 107.7 | | | 92.9 | | | 91.2 | | | 96.5 | | | 90.1 | |

| | | | | | | | | | | | | | | | |

| | Combined ratio before net catastrophe losses and prior year casualty development | 90.6 | | % | | 86.1 | | | 91.4 | | | 89.6 | | | 90.2 | | | 89.4 | | | 90.3 | |

| | | | | | | | | | | | | | | | |

| Other Statistics | | | | | | | | | | | | | | |

| Non-catastrophe property loss and loss expenses | $ | 178.2 | | | | 146.7 | | | 185.5 | | | 171.2 | | | 172.1 | | | 681.6 | | | 650.4 | |

| Non-catastrophe property loss and loss expenses | 15.7 | | pts | | 13.2 | | | 17.2 | | | 16.3 | | | 17.2 | | | 15.6 | | | 17.0 | |

| Direct new business | $ | 232.0 | | | | 234.2 | | | 267.4 | | | 260.8 | | | 232.7 | | | 994.3 | | | 923.5 | |

| Renewal pure price increases | 10.7 | % | | 10.5 | | | 9.1 | | | 8.1 | | | 7.4 | | | 9.5 | | | 6.8 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Note: Amounts may not foot due to rounding. | | | | | | | | | | | | | | |

Selective Insurance Group, Inc. & Consolidated Subsidiaries

STANDARD COMMERCIAL LINES

STATEMENT OF OPERATIONS AND SUPPLEMENTAL DATA

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter ended | | Year-to-date |

| Dec. 31, | | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Dec. 31, | | Dec. 31, |

| ($ in millions) | 2024 | | 2024 | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | | | | | |

| Underwriting results | | | | | | | | | | | | | | |

| Net premiums written | $ | 833.4 | | | | 903.9 | | | 963.1 | | | 931.7 | | | 764.3 | | | 3,632.1 | | | 3,281.3 | |

| Change in net premiums written, from comparable prior year period | 9 | | % | | 8 | | | 11 | | | 15 | | | 13 | | | 11 | | | 13 | |

| | | | | | | | | | | | | | |

| Net premiums earned | $ | 884.6 | | | | 875.4 | | | 853.5 | | | 834.1 | | | 792.1 | | | 3,447.6 | | | 3,071.8 | |

| Losses and loss expenses incurred | 606.3 | | | | 591.6 | | | 748.0 | | | 555.8 | | | 482.6 | | | 2,501.6 | | | 1,919.2 | |

| Net underwriting expenses incurred | 279.3 | | | | 275.1 | | | 265.4 | | | 264.6 | | | 252.9 | | | 1,084.4 | | | 988.5 | |

| Dividends to policyholders | 0.8 | | | | 1.4 | | | 1.1 | | | 3.3 | | | 1.8 | | | 6.5 | | | 6.8 | |

| GAAP underwriting income (loss) | $ | (1.8) | | | | 7.3 | | | (160.9) | | | 10.4 | | | 54.9 | | | (145.0) | | | 157.3 | |

| | | | | | | | | | | | | | | | |

| Net catastrophe losses | $ | (8.2) | | | | 100.4 | | | 50.9 | | | 38.5 | | | 16.1 | | | 181.5 | | | 150.5 | |

| (Favorable) unfavorable prior year casualty reserve development | 75.0 | | | | — | | | 176.0 | | | 35.0 | | | 5.0 | | | 286.0 | | | (15.5) | |

| | | | | | | | | | | | | | | | |

| Underwriting ratios | | | | | | | | | | | | | | |

| Loss and loss expense ratio | 68.5 | | % | | 67.6 | | | 87.6 | | | 66.7 | | | 61.0 | | | 72.5 | | | 62.5 | |

| Underwriting expense ratio | 31.6 | | | | 31.4 | | | 31.1 | | | 31.7 | | | 31.9 | | | 31.5 | | | 32.2 | |

| Dividends to policyholders ratio | 0.1 | | | | 0.2 | | | 0.1 | | | 0.4 | | | 0.2 | | | 0.2 | | | 0.2 | |

| | Combined ratio | 100.2 | | % | | 99.2 | | | 118.8 | | | 98.8 | | | 93.1 | | | 104.2 | | | 94.9 | |

| | | | | | | | | | | | | | | | |

| Net catastrophe losses | (0.9) | | pts | | 11.5 | | | 6.0 | | | 4.6 | | | 2.0 | | | 5.3 | | | 4.9 | |

| (Favorable) unfavorable prior year casualty reserve development | 8.5 | | | | — | | | 20.6 | | | 4.2 | | | 0.6 | | | 8.3 | | | (0.5) | |

| | Combined ratio before net catastrophe losses | 101.1 | | % | | 87.7 | | | 112.8 | | | 94.2 | | | 91.1 | | | 98.9 | | | 90.0 | |

| | | | | | | | | | | | | | | | |

| | Combined ratio before net catastrophe losses and prior year casualty development | 92.6 | | % | | 87.7 | | | 92.2 | | | 90.0 | | | 90.5 | | | 90.6 | | | 90.5 | |

| | | | | | | | | | | | | | | | |

| Other Statistics | | | | | | | | | | | | | | |

| Non-catastrophe property loss and loss expenses | $ | 124.1 | | | | 95.9 | | | 124.5 | | | 115.0 | | | 122.0 | | | 459.5 | | | 461.6 | |

| Non-catastrophe property loss and loss expenses | 14.0 | | pts | | 11.0 | | | 14.6 | | | 13.8 | | | 15.4 | | | 13.3 | | | 15.0 | |

| Direct new business | $ | 139.5 | | | | 139.2 | | | 168.4 | | | 172.1 | | | 145.2 | | | 619.1 | | | 597.5 | |

| Renewal pure price increases | 8.8 | | % | | 9.1 | | | 7.9 | | | 7.6 | | | 7.3 | | | 8.3 | | | 7.0 | |

| Retention | 85 | | | | 86 | | | 85 | | | 86 | | | 86 | | | 85 | | | 85 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Note: Amounts may not foot due to rounding. | | | | | | | | | | | | | | |

Selective Insurance Group, Inc. & Consolidated Subsidiaries

STANDARD COMMERCIAL LINES

GAAP LINE OF BUSINESS RESULTS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended December 31, 2024 | | Quarter ended December 31, 2023 |

| | General | | Commercial | Commercial | Workers | | | | | | General | Commercial | Commercial | Workers | | | | |

| ($ in millions) | | Liability | | Auto | Property(1) | Compensation | BOP | Bonds | Other | Total | | Liability | Auto | Property(1) | Compensation | BOP | Bonds | Other | Total |

| Net premiums written | | $ | 265.0 | | | 257.3 | | 174.6 | | 66.1 | | 50.2 | | 12.2 | | 8.0 | | 833.4 | | | 248.2 | | 226.8 | | 154.9 | | 73.5 | | 42.7 | | 10.7 | | 7.4 | | 764.3 | |

| Net premiums earned | | 285.3 | | | 276.8 | | 180.6 | | 76.3 | | 44.7 | | 12.7 | | 8.1 | | 884.6 | | | 261.0 | | 239.1 | | 157.1 | | 79.1 | | 37.0 | | 11.5 | | 7.4 | | 792.1 | |

| | | | | | | | | | | | | | | | | | | |

| Loss and loss expense ratio | | 108.7 | | % | 67.7 | | 23.6 | | 37.1 | | 76.6 | | 27.3 | | (0.5) | | 68.5 | | | 77.4 | | 73.1 | | 48.9 | | 3.7 | | 62.9 | | 25.6 | | (0.5) | | 61.0 | |

| Underwriting expense ratio | | 31.1 | | | 28.9 | | 34.8 | | 26.3 | | 37.3 | | 55.3 | | 49.3 | | 31.6 | | | 31.4 | | 29.0 | | 35.4 | | 27.1 | | 38.7 | | 57.6 | | 48.7 | | 31.9 | |

| Dividend ratio | | — | | | — | | 0.1 | | 0.6 | | — | | — | | 0.1 | | 0.1 | | | 0.1 | | 0.2 | | 0.3 | | 0.5 | | — | | — | | 0.2 | | 0.2 | |

| Combined ratio | | 139.8 | | % | 96.6 | | 58.5 | | 64.0 | | 113.9 | | 82.6 | | 48.9 | | 100.2 | | | 108.9 | | 102.3 | | 84.6 | | 31.3 | | 101.6 | | 83.2 | | 48.4 | | 93.1 | |

| | | | | | | | | | | | | | | | | | | |

| Underwriting income (loss) | | $ | (113.7) | | | 9.3 | | 74.9 | | 27.5 | | (6.2) | | 2.2 | | 4.1 | | (1.8) | | | (23.3) | | (5.5) | | 24.1 | | 54.3 | | (0.6) | | 1.9 | | 3.8 | | 54.9 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Year-to-Date December 31, 2024 | | Year-to-Date December 31, 2023 |

| | General | | Commercial | Commercial | Workers | | | | | | General | Commercial | Commercial | Workers | | | | |

| ($ in millions) | | Liability | | Auto | Property(1) | Compensation | BOP | Bonds | Other | Total | | Liability | Auto | Property(1) | Compensation | BOP | Bonds | Other | Total |

| Net premiums written | | $ | 1,183.2 | | | 1,121.5 | | 739.5 | | 320.6 | | 183.0 | | 51.7 | | 32.6 | | 3,632.1 | | | 1,087.1 | | 976.9 | | 648.8 | | 338.1 | | 152.9 | | 47.4 | | 30.2 | | 3,281.3 | |

| Net premiums earned | | 1,125.5 | | | 1,058.2 | | 685.6 | | 327.7 | | 169.3 | | 49.7 | | 31.5 | | 3,447.6 | | | 1,020.4 | | 916.1 | | 586.3 | | 333.7 | | 140.5 | | 46.2 | | 28.6 | | 3,071.8 | |

| | | | | | | | | | | | | | | | | | | |

| Loss and loss expense ratio | | 95.1 | | % | 70.5 | | 57.0 | | 55.7 | | 60.8 | | 17.4 | | 0.3 | | 72.5 | | | 61.4 | | 73.8 | | 61.6 | | 43.9 | | 69.5 | | 24.9 | | (0.1) | | 62.5 | |

| Underwriting expense ratio | | 31.1 | | | 29.2 | | 35.0 | | 25.7 | | 34.5 | | 56.3 | | 48.0 | | 31.5 | | | 31.6 | | 29.8 | | 36.4 | | 26.3 | | 36.5 | | 56.9 | | 50.8 | | 32.2 | |

| Dividend ratio | | 0.1 | | | 0.1 | | 0.2 | | 1.0 | | — | | — | | — | | 0.2 | | | 0.1 | | 0.1 | | 0.2 | | 1.2 | | — | | — | | 0.1 | | 0.2 | |

| Combined ratio | | 126.3 | | % | 99.8 | | 92.2 | | 82.4 | | 95.3 | | 73.7 | | 48.3 | | 104.2 | | | 93.1 | | 103.7 | | 98.2 | | 71.4 | | 106.0 | | 81.8 | | 50.8 | | 94.9 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Underwriting income (loss) | | $ | (295.9) | | | 2.5 | | 53.3 | | 57.7 | | 8.0 | | 13.1 | | 16.3 | | (145.0) | | | 70.8 | | (33.7) | | 10.8 | | 95.4 | | (8.4) | | 8.4 | | 14.1 | | 157.3 | |

| | | | | | | | | | | | | | | | | | | |

(1) Includes Inland Marine. | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Note: Amounts may not foot due to rounding. | | | | | | | | | | | | | | | |

Selective Insurance Group, Inc. & Consolidated Subsidiaries

STANDARD PERSONAL LINES

STATEMENT OF OPERATIONS AND SUPPLEMENTAL DATA

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter ended | | Year-to-date |

| Dec. 31, | | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Dec. 31, | | Dec. 31, |

| ($ in millions) | 2024 | | 2024 | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | | | | | |

| Underwriting results | | | | | | | | | | | | | | |

| Net premiums written | $ | 103.6 | | | | 111.0 | | | 116.1 | | | 99.9 | | | 107.0 | | | 430.7 | | | 414.6 | |

| Change in net premiums written, from comparable prior year period | (3) | | % | | (2) | | | 6 | | | 17 | | | 27 | | | 4 | | | 30 | |

| | | | | | | | | | | | | | | | |

| Net premiums earned | $ | 107.1 | | | | 107.5 | | | 106.4 | | | 103.8 | | | 101.0 | | | 424.9 | | | 365.2 | |

| Losses and loss expenses incurred | 72.7 | | | | 106.1 | | | 101.4 | | | 84.3 | | | 92.5 | | | 364.6 | | | 353.2 | |

| Net underwriting expenses incurred | 25.5 | | | | 25.2 | | | 24.3 | | | 24.8 | | | 25.5 | | | 99.8 | | | 91.3 | |

| GAAP underwriting income (loss) | $ | 8.9 | | | | (23.8) | | | (19.3) | | | (5.3) | | | (17.0) | | | (39.5) | | | (79.3) | |

| | | | | | | | | | | | | | | | |

| Net catastrophe losses | $ | 1.0 | | | | 41.7 | | | 25.4 | | | 11.8 | | | 9.2 | | | 80.0 | | | 69.3 | |

| (Favorable) unfavorable prior year casualty reserve development | 5.0 | | | | — | | | — | | | — | | | 5.0 | | | 5.0 | | | 14.0 | |

| | | | | | | | | | | | | | | | |

| Underwriting ratios | | | | | | | | | | | | | | |

| Loss and loss expense ratio | 67.9 | | % | | 98.7 | | | 95.3 | | | 81.2 | | | 91.7 | | | 85.8 | | | 96.7 | |

| Underwriting expense ratio | 23.8 | | | | 23.4 | | | 22.8 | | | 23.9 | | | 25.2 | | | 23.5 | | | 25.0 | |

| | Combined ratio | 91.7 | | % | | 122.1 | | | 118.1 | | | 105.1 | | | 116.9 | | | 109.3 | | | 121.7 | |

| | | | | | | | | | | | | | | | |

| Net catastrophe losses | 1.0 | | pts | | 38.8 | | | 23.9 | | | 11.4 | | | 9.1 | | | 18.8 | | | 19.0 | |

| (Favorable) unfavorable prior year casualty reserve development | 4.7 | | | | — | | | — | | | — | | | 5.0 | | | 1.2 | | | 3.8 | |

| | Combined ratio before net catastrophe losses | 90.7 | | % | | 83.3 | | | 94.2 | | | 93.7 | | | 107.8 | | | 90.5 | | | 102.7 | |

| | | | | | | | | | | | | | | | |

| | Combined ratio before net catastrophe losses and prior year casualty development | 86.0 | | % | | 83.3 | | | 94.2 | | | 93.7 | | | 102.8 | | | 89.3 | | | 98.9 | |

| | | | | | | | | | | | | | | | |

| Other Statistics | | | | | | | | | | | | | | |

| Non-catastrophe property loss and loss expenses | $ | 38.9 | | | | 38.0 | | | 45.4 | | | 41.9 | | | 42.8 | | | 164.0 | | | 156.9 | |

| Non-catastrophe property loss and loss expenses | 36.3 | | pts | | 35.3 | | | 42.6 | | | 40.3 | | | 42.4 | | | 38.6 | | | 43.0 | |

| Direct new business | $ | 13.3 | | | | 16.0 | | | 22.0 | | | 21.3 | | | 26.0 | | | 72.6 | | | 116.5 | |

| Renewal pure price increases | 27.3 | | % | | 22.8 | | | 20.7 | | | 14.3 | | | 8.9 | | | 20.6 | | | 5.2 | |

| Retention | 75 | | | | 75 | | | 78 | | | 83 | | | 87 | | | 77 | | | 87 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Note: Amounts may not foot due to rounding. | | | | | | | | | | | | | | |

Selective Insurance Group, Inc. & Consolidated Subsidiaries

STANDARD PERSONAL LINES

GAAP LINE OF BUSINESS RESULTS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended December 31, 2024 | | Quarter ended December 31, 2023 |

| Personal | | | | | | Personal | | | |

| ($ in millions) | Auto | | Homeowners | Other | Total | | Auto | Homeowners | Other | Total |

| Net premiums written | $ | 50.3 | | | 49.4 | | 4.0 | | 103.6 | | | 56.6 | | 46.7 | | 3.7 | | 107.0 | |

| Net premiums earned | 55.0 | | | 48.2 | | 3.9 | | 107.1 | | | 55.0 | | 42.7 | | 3.3 | | 101.0 | |

| | | | | | | | | | |

| Loss and loss expense ratio | 94.3 | | % | 43.8 | | (7.9) | | 67.9 | | | 107.4 | | 75.6 | | 37.0 | | 91.7 | |

| Underwriting expense ratio | 25.4 | | | 28.4 | | (57.2) | | 23.8 | | | 27.1 | | 28.7 | | (51.1) | | 25.2 | |

| | | | | | | | | | |

| Combined ratio | 119.7 | | % | 72.2 | | (65.1) | | 91.7 | | | 134.5 | | 104.3 | | (14.1) | | 116.9 | |

| | | | | | | | | | |

| Underwriting income (loss) | $ | (10.8) | | | 13.4 | | 6.4 | | 8.9 | | | (18.9) | | (1.8) | | 3.8 | | (17.0) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Year-to-Date December 31, 2024 | | Year-to-Date December 31, 2023 |

| Personal | | | | | | Personal | | | |

| ($ in millions) | Auto | | Homeowners | Other | Total | | Auto | Homeowners | Other | Total |

| Net premiums written | $ | 219.0 | | | 197.9 | | 13.8 | | 430.7 | | | 224.9 | | 177.6 | | 12.1 | | 414.6 | |

| Net premiums earned | 226.1 | | | 185.7 | | 13.1 | | 424.9 | | | 200.0 | | 154.8 | | 10.4 | | 365.2 | |

| | | | | | | | | | |

| Loss and loss expense ratio | 89.1 | | % | 89.0 | | (13.9) | | 85.8 | | | 97.9 | | 99.7 | | 28.9 | | 96.7 | |

| Underwriting expense ratio | 25.1 | | | 28.1 | | (70.8) | | 23.5 | | | 28.1 | | 28.9 | | (93.3) | | 25.0 | |

| | | | | | | | | | |

| Combined ratio | 114.2 | | % | 117.1 | | (84.7) | | 109.3 | | | 126.0 | | 128.6 | | (64.4) | | 121.7 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Underwriting income (loss) | $ | (32.1) | | | (31.7) | | 24.2 | | (39.5) | | | (52.0) | | (44.3) | | 17.0 | | (79.3) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| |

| Note: Amounts may not foot due to rounding. | | | | | | | | | | |

Selective Insurance Group, Inc. & Consolidated Subsidiaries

EXCESS AND SURPLUS LINES

STATEMENT OF OPERATIONS AND SUPPLEMENTAL DATA

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter ended | | Year-to-date |

| Dec. 31, | | Sept. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Dec. 31, | | Dec. 31, |

| ($ in millions) | 2024 | | 2024 | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | | | | | | | |

| Underwriting results | | | | | | | | | | | | | | |

| Net premiums written | $ | 152.6 | | | | 142.7 | | | 146.8 | | | 125.0 | | | 120.2 | | | 567.2 | | | 438.6 | |

| Change in net premiums written, from comparable prior year period | 27 | | % | | 28 | | | 39 | | | 24 | | | 36 | | | 29 | | | 24 | |

| | | | | | | | | | | | | | |

| Net premiums earned | $ | 141.3 | | | | 129.3 | | | 120.3 | | | 113.0 | | | 108.1 | | | 504.0 | | | 390.6 | |

| Losses and loss expenses incurred | 90.0 | | | | 68.0 | | | 76.2 | | | 64.1 | | | 49.7 | | | 298.3 | | | 211.9 | |

| Net underwriting expenses incurred | 41.6 | | | | 39.6 | | | 37.7 | | | 34.9 | | | 32.7 | | | 153.8 | | | 124.0 | |

| GAAP underwriting income (loss) | $ | 9.7 | | | | 21.7 | | | 6.5 | | | 14.0 | | | 25.7 | | | 51.9 | | | 54.8 | |

| | | | | | | | | | | | | | | | |

| Net catastrophe losses | $ | (2.9) | | | | 6.7 | | | 14.3 | | | 4.9 | | | (0.7) | | | 23.0 | | | 24.7 | |