false

0000064463

0000064463

2023-11-20

2023-11-20

0000064463

SLNH:CommonStockParValue0.001PerShareMember

2023-11-20

2023-11-20

0000064463

SLNH:Sec9.0SeriesCumulativePerpetualPreferredStockParValue0.001PerShareMember

2023-11-20

2023-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 20, 2023

SOLUNA

HOLDINGS, INC.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-40261 |

|

14-1462255 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification

No.) |

325

Washington Avenue Extension

Albany,

New York |

|

12205 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

Telephone Number, Including Area Code: (516) 216-9257

N/A

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

|

SLNH |

|

The

Nasdaq Stock Market LLC |

| 9.0%

Series A Cumulative Perpetual Preferred Stock, par value $0.001 per share |

|

SLNHP |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Compensatory Arrangements of Certain Officers

On

November 20, 2023, the Board of Directors (the “Board”) of Soluna Holdings, Inc. (the “Company”) approved and

entered into an Amended and Restated Employment Agreement with John Belizaire, the Company’s CEO, and an amendment to the employment

agreement with Michael Toporek, the Company’s Executive Chairman.

John

Belizaire Amended and Restated Employment Agreement

Pursuant

to the Merger with Soluna Callisto, Soluna Computing, Inc. (“SCI”) and John Belizaire entered into an employment agreement,

dated as of October 29, 2021, pursuant to which Mr. Belizaire would serve as President and Chief Executive Officer of SCI. The employment

agreement provided for an initial term beginning on October 29, 2021, the effective date of the Merger, and ending 36 months thereafter

and, unless either party provides written notice that the agreement will not be renewed, would be automatically renewed for an

additional 12-month period on the third and each subsequent anniversary date of the effective date of the Merger. Mr. Belizaire assumed

the additional role of Chief Executive Officer of the Company on May 1, 2023. Pursuant

to the Amended and Restated Employment Agreement dated November 20, 2023 (the “Belizaire Amended Agreement”), Mr. Belizaire

agreed to continue to serve as our Chief Executive Officer for an initial term beginning as of May 1, 2023, and continuing through December

31, 2027, to be extended automatically for successive one-year periods, in consideration for a retroactive (to May 1, 2023) cash adjustment

of his prior base salary through to the date of the Amended Agreement and a base salary thereafter of $450,000, which will be subject

to annual cost of living adjustments and annual review by the Board or the Compensation Committee and may be increased from time to time

by the Board or the Compensation Committee (“Belizaire Base Salary”). The Belizaire Amended Agreement provides for annual

performance bonuses under the Executive Bonus Plan based on achievement of Key Performance Objectives; and eligibility for employee benefit

plans in effect until Mr. Belizaire’s employment with the Company is terminated.

Pursuant

to the Belizaire Amended Agreement, if Mr. Belizaire is terminated for any reason other than termination without cause or resignation

for good reason, he is entitled to receive (i) a lump sum payment in the amount equal to the sum of Mr. Belizaire’s earned but

unpaid Belizaire Base Salary through the date of termination, (ii) his earned but unpaid Annual Performance Bonus for the calendar year

preceding the date of termination, (iii) his earned but unpaid Annual Performance Bonus for the current calendar year as though the key

performance objectives were achieved, (iv) his accrued but unused vacation days as of the date of termination, (v) reimbursement for

any unreimbursed business expenses incurred through the date of termination, and (vi) any other benefits or rights Mr. Belizaire will

have accrued or earned through his date of termination under the terms of any employee benefit plan. Additionally, if Mr. Belizaire is

terminated without cause or he resigns for good reason, subject to satisfaction of certain release conditions, he will also be entitled

to coverage under any health insurance plan covering Mr. Belizaire for 18 months after the termination of his employment, six months of

his then-current Belizaire Base Salary, both paid in a single lump sum in cash on the first regular Company payroll date next following

the 60th calendar day following the date of termination.

Amendment

to Michael Toporeck’s Employment Agreement

Mr.

Toporeck’s Employment Agreement was amended to provide that subsequent to May 1, 2023, he will serve as Executive Chairman (as

opposed to CEO), to provide an expiration of the agreement on May 1, 2028, to remove the provisions regarding Long-Term Incentive Awards

and Future Performance Awards from the Employment Agreement and to increase the payment for termination without cause or resignation

for good reason from one year to three years.

ITEM

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

|

|

SOLUNA

HOLDINGS, INC. |

| |

|

|

|

| Date: |

November

29, 2023 |

By: |

/s/

David Michaels |

| |

|

|

David

Michaels

Chief Financial Officer

(principal financial and accounting officer) |

Exhibit

10.1

AMENDED

AND RESTATED EMPLOYMENT AGREEMENT

This

AMENDED AND RESTATED EMPLOYMENT AGREEMENT (this “Agreement”) is dated November 20, 2023 by and between Soluna

Holdings, Inc., a Nevada corporation (the “Company”) and John Belizaire (“Executive”).

WHEREAS,

Executive has been serving as the President and Chief Executive Officer of Soluna Computing, Inc., a Nevada corporation (“SCI”),

a wholly owned subsidiary of the Company, pursuant to that certain Employment Agreement executed on or as of October 29, 2021 (the “Existing

Employment Agreement”);

WHEREAS,

the Company desires to retain the services of Executive as its chief executive officer and Executive desires to be employed by the Company

in such capacity;

WHEREAS,

Company and Executive each desire to enter into this Agreement to provide the terms of such employment, including an extension of the

initial employment term; and

WHEREAS,

SCI has consented to the amendment and restatement of the Existing Employment Agreement in the form of this Agreement.

NOW,

THEREFORE, the parties agree as follows:

1. Definitions.

As used herein, the following terms shall have

the following meanings:

“Board”

means the Company’s Board of Directors.

“Bonus

Plan” means the 2023 annual bonus incentive plan and each other cash or non-cash bonus or incentive plan established by the

Board during or with respect to the Employment Period in which senior executives are eligible to participate.

“Cause”

means any of the following: (i) Executive’s theft, dishonesty, fraud, embezzlement, willful misconduct, breach of fiduciary duty

or material falsification of any Group Company documents or records; (ii) Executive’s material failure to abide by the Company’s

code of conduct or other policies (including policies relating to confidentiality and reasonable workplace conduct) made available to

the Executive; (iii) Executive’s unauthorized use, misappropriation, destruction or diversion of any tangible or intangible asset

or corporate opportunity of any Group Company (including the Executive’s improper use or disclosure of any Group Company’s

confidential or proprietary information); (iv) any misconduct, moral turpitude, gross negligence or malfeasance of Executive that has

or, in the good faith judgment of the Board, could reasonably be expected to have, a material detrimental effect on a Group Company’s

reputation or business; (v) Executive’s repeated willful failure to perform Executive’s assigned duties after written notice

from the Board of such failure; (vi) any material breach by Executive of this Agreement (including, for the avoidance of doubt, the “PRRCA”,

as defined further below); or (vii) Executive’s conviction (including any plea of guilty or nolo contendere) of any criminal

act involving fraud, dishonesty, misappropriation or moral turpitude, or that materially and permanently impairs the Executive’s

ability to perform his duties with the Company; provided that in order for the Company’s termination or other claim based

upon Cause to be effective hereunder with respect to any failure or violation that the Board reasonably determines to be susceptible

of cure, Executive must have failed to cure such failure or violation during a period of thirty (30) days after Executive receives notice

from the Company of such failure or violation.

“Change

in Control” means the occurrence of one or more of the following events:

(a) an

event, as a result of which any one person or more than one person acting as a “Group,” as defined in Treas. Reg. Sec. 1.409A-3(i)(5)(v)(B),

acquires ownership of stock or other equity of the Company that, together with stock or other equity held by such person or Group, constitutes

more than fifty percent (50%) of the total fair market value or total voting power of the stock or other equity of the Company. However,

if any one person or more than one person acting as a Group, is considered to own more than fifty percent (50%) of the total fair market

value or total voting power of the stock or other equity of the Company, the acquisition of additional stock or other equity by the same

person or Group is not considered to cause a change in the ownership of the Company. An increase in the percentage of stock or other

equity owned by any one person or Group, as a result of a transaction in which the Company acquires its stock or other equity in exchange

for property will be treated as an acquisition of stock or other equity for purposes of this subsection (a); or

(b) an

event as a result of which any one person or more than one person acting as a “Group,” as defined in Treas. Reg. Sec. 1.409A-3(i)(5)(vii)(C),

acquires (or has acquired during the twelve (12)-month period ending on the date of the most recent acquisition by such person or Group)

assets from the Company that have a total gross fair market value equal to or more than fifty percent (50%) of the total gross fair market

value of all of the assets of the Company immediately before such acquisition or acquisitions. For this purpose, gross fair market value

means the value of the assets of the Company or the value of the assets being disposed of, determined without regard to any liabilities

associated with such assets.

“Code”

means the United States Internal Revenue Code of 1986, as amended, and any applicable regulations and administrative guidelines.

“Committee”

means the compensation committee of the Board.

“Disability”

means Executive’s inability to perform the essential duties, responsibilities and functions of Executive’s position with

the Company for a continuous period of ninety (90) days as a result of any mental or physical disability or incapacity, with or without

reasonable accommodation, all as determined by the Board in its reasonable discretion. Executive shall cooperate in all

respects with the Company if a question arises as to whether Executive has become Disabled (including, subject to restrictions under

any applicable law, submitting to an examination by a medical doctor or other health care specialists the Company selects and authorizing

such medical doctor or such other health care specialist to provide an opinion to the Company as to whether or not Executive’s

condition falls within the definition of “Disability”, but without disclosing any details of Executive’s medical or

psychological condition). Executive shall have the right to challenge any such opinion with a medical opinion of Executive’s

own medical doctor or health care specialist. In the event that the conclusions reached by such medical doctors or healthcare

specialists as to the question of whether or not Executive has a Disability differ, then the two medical doctors or health care specialists

providing the opinions shall agree on a third medical doctor or health care specialist, who shall examine Executive and whose determination

as to whether Executive has become disabled shall be binding on the parties.

“Good

Reason” means the occurrence of one or more of the following without Executive’s express written consent:

(a) the

Company demotes Executive from the position set forth in Section 2(b)(i) or materially reduces Executive’s responsibilities (including

reporting responsibilities) in a manner inconsistent with Executive’s position, other than temporarily while Executive is physically

or mentally incapacitated to a degree that would constitute a Disability if it continued for the requisite number of days, or as required

by applicable law;

(b) the

Company materially breaches this Agreement, including, without limitation, by materially reducing Executive’s compensation hereunder,

including any material benefits or material reimbursements to be provided to Executive hereunder (in each case, other than in connection

with an across the board reduction of such compensation, benefits or reimbursements applicable to senior executives of the Company generally);

(c) the

Company causes Executive to report to a Person other than the Board or a committee thereof; or

(d) the

Company changes Executive’s place of work to a location more than thirty (30) miles from the principal location from which he works

as of the date of this Agreement, and such change increases Executive’s one-way commute;

provided,

in each case, that Executive delivers written notice detailing the specific circumstance alleged to constitute Good Reason to the Company

within thirty (30) days after Executive has actual knowledge of the initial existence of such circumstance, the Company fails to remedy

such circumstance within thirty (30) days after it receives such notice from Executive, and Executive actually terminates his employment

within sixty (60) days following the expiration of the Company’s cure period described above. Otherwise, any claim of such circumstance

as “Good Reason” shall be deemed irrevocably waived by Executive.

“Group

Company” means (a) the Company and (b) each Material Subsidiary.

“Key

Performance Objectives” means those Company and/or personal performance objectives relating to each Bonus Plan approved by

the Board.

“Material

Subsidiary” means each direct or indirect subsidiary of the Company that owns at least 5% percent of the consolidated total

assets of the Company and its subsidiaries as of the last day of any fiscal quarter of the Company or contributes at least 5% of the

consolidated revenues of the Company and its consolidated subsidiaries during the twelve- month period ending as of the last day of any

fiscal quarter of the Company, in each case as determined pursuant to the Company’s quarterly securities filings.

“Person”

means an individual, a partnership, a corporation, an association, a limited liability company, a joint stock company, a trust, a joint

venture, an unincorporated organization, a governing body of any of the foregoing, or a governmental entity or any department, agency

or political subdivision thereof.

“Termination

Date” has the meaning set forth in Section 2.

2. Employment.

(a) Employment;

Termination. The Company agrees to employ Executive, and Executive hereby accepts employment with the Company, effective as of

May 1, 2023, upon the terms and conditions set forth in this Agreement. Executive’s employment under this Agreement shall commence

on May 1, 2023 and shall continue through December 31, 2027 (the “Initial Term”). Effective upon the expiration of

the Initial Term and of each “Additional Term” (as defined below), Executive’s employment under this Agreement will

be automatically extended, upon the same terms and conditions, for an additional twelve (12)-month period (each, an “Additional

Term”), unless, at least ninety (90) calendar days prior to the expiration of the Initial Term or such Additional Term, as

applicable, either Executive or the Company notifies the other party hereto in writing that such extension will not take effect. Notwithstanding

the foregoing, Executive’s employment under this Agreement, and the Initial Term or any Additional Term, as applicable, shall terminate

upon the earlier occurrence of any of the following:

(i) immediately

upon Executive’s death;

(ii) immediately

upon the determination that Executive is Disabled as set forth above;

(iii) upon

thirty (30) days’ advance written notice from Executive to the Company of Executive’s voluntary resignation of his employment

with the Company other than for Good Reason (which the Company may, in its sole discretion, make effective earlier than any notice date);

(iv) immediately

upon written notice from Executive to the Company of the Executive’s resignation for Good Reason, subject to compliance with the

applicable notice and cure requirements in Section 1;

(v) immediately

upon written notice from the Company to Executive of the termination of Executive’s employment for any reason other than Cause

(which, for the avoidance of doubt, will not include any termination described in clauses (i) or (ii) above); and

(vi) immediately

upon written notice from the Company to Executive of the termination of Executive’s employment for Cause, subject to compliance

with the applicable notice and cure requirements in Section 1.

As

used in this Agreement, the phrase “Employment Period” means Executive’s period of employment from May 1, 2023

until the date Executive’s employment ends for any reason. The effective date of any termination of the Employment

Period, and of Executive’s employment hereunder, is hereinafter referred to as the “Termination Date.” Effective

upon any Termination Date, this Agreement shall automatically terminate and shall be of no further force or effect, except as otherwise

provided in Section 7(a) hereof, and Executive shall immediately resign, in writing, from all positions then held by Executive with the

Company and its affiliates unless otherwise requested by the Company and agreed to by Executive.

For

the avoidance of doubt, Executive’s employment is at-will and either Executive or the Company may terminate the Employment

Period at any time, for any or no reason. The provisions in Section 2(d) shall govern the amount of compensation and benefits, if any,

to be provided to Executive upon termination of the Employment Period and of Executive’s employment hereunder, and do not alter

the Company’s right to terminate Executive’s employment at any time.

(b) Position

and Duties.

(i) Position.

Commencing on May 1, 2023 and continuing during the Employment Period, Executive shall serve as the Chief Executive Officer of the Company

and shall report directly to the Board or a committee thereof. In addition, Executive shall continue to serve as the President and Chief

Executive Officer of SCI until a successor is appointed by the Board; at such time, Executive shall resign as the President and Chief

Executive Officer of SCI and such resignation shall not be, or deemed to be, a termination of Executive’s employment for any purpose.

(ii) Responsibilities.

In Executive’s capacity set forth in Section 2(b)(i), Executive will provide strategic and tactical leadership to the Company,

driving financial performance, managing the leadership team, and working with the Board or a committee thereof to create value for constituents

and elevate each Group Company’s reputation with all constituents, including current and prospective partners, and will have such

other and further duties and responsibilities as are customarily exercised by an individual serving in Executive’s capacity at

an entity of the Company’s size and nature, including but not limited to direct supervision of and reporting from all other Company

senior executives. Executive shall also perform and have all such other and further duties and responsibilities commensurate

with Executive’s position as and to the extent directed or assigned by the Board or a committee thereof, and shall have such power

and authority as shall reasonably be required to enable him to perform such duties and responsibilities hereunder. Executive

will also have such other duties and responsibilities, consistent with Executive’s position, as are set forth in the Company’s

organizational documents from time to time, and Executive will faithfully perform all of Executive’s duties hereunder to the best

of Executive’s ability. The Board or the Committee will provide a performance review to Executive on no less than

an annual basis.

(iii) Time

to be Devoted to Employment. Except for vacation in accordance with Company policy, absences due to temporary illness and other

absences resulting from a Disability, Executive shall (A) devote substantially all of Executive’s business time, attention, energy

and skill to the Company’s business, subject, however, to such reasonable time and effort as the Executive shall

be required to devote to those efforts and activities set forth in Exhibit A (the “Outside Responsibilities”);

provided that Executive’s Outside Responsibilities shall not, individually or in the aggregate, materially interfere with

the Executive’s ability to discharge his duties and responsibilities hereunder; (B) use Executive’s best efforts to promote

the success of the Company’s businesses, and (C) cooperate fully with the Board or a committee thereof in advancing the Company’s

best interests. During the Employment Period, other than with respect to any of the Outside Responsibilities, Executive

shall not engage in any other business activity which, in the Board’s reasonable judgment, would conflict with Executive’s

ability to perform his duties hereunder, whether or not such activity is pursued for gain, profit or other pecuniary advantage.

(iv) Work

Location. Executive’s principal place of work shall be located in New York City, New York, or such other location as Executive

and the Company agree upon from time to time.

(v) Policies.

Executive will be subject to, and will comply with, the policies, standards and procedures generally applicable and made available to

the Company’s senior management employees from time to time.

(c) Base

Salary and Benefits.

(i) Base

Salary. During the Employment Period, the Company shall pay to Executive a base salary (the “Base Salary”)

at an annual rate as follows: (a) for the first month of the Employment Period, $400,000.00; (b) for the second month of the Employment

Period, $408,333.33; (c) for the third month of the Employment Period, $416,666.67; (c) for the fourth month of the Employment Period,

$425,000.00; (d) for the fifth month, $433,333.33; (e) for the sixth month of the Employment Period, $441,666.67; and (f) thereafter,

$450,000.00. The Company shall pay the Base Salary in regular installments in accordance with the Company’s general

payroll practices, subject to customary withholding, payroll and other taxes. The Base Salary will be subject to annual

review by the Committee and/or the Board, as applicable, during the Employment Period and, at the Committee’s and/or the Board’s,

as applicable, sole option, may be increased, provided that at a minimum there shall be annual cost of living increases proportionate

to annual increases in the consumer price index published by the U.S. Bureau of Labor Statistics, and following any such increase for

all purposes hereunder such changed amount shall be Executive’s “Base Salary.”

(ii) Performance

Bonus. In addition to the Base Salary, for each calendar year ending during the Employment Period (each, a “Bonus Year”),

Executive shall be eligible to receive an annual bonus based on Executive’s performance with respect to the Key Performance Objectives

in such Bonus Year (the “Performance Bonus”). The Key Performance Objectives for each Bonus Year will be established

in accordance with the Bonus Plan for such Bonus Year.

Executive’s

target Performance Bonus for each Bonus Year will be a maximum cash bonus equal to the percentage set forth in the Bonus Plan for such

Bonus Year for members of the “executive team”. No portion of the Performance Bonus is guaranteed but, shall be dependent

upon Executive having achieved the applicable Key Performance Objectives in accordance with the written terms of the Bonus Plan for such

Bonus Year. Subject to Section 2(d), any Performance Bonus shall be determined by the Company in accordance with the applicable Bonus

Plan and paid to Executive on or prior to the date for payment of all performance bonuses set forth in the applicable Bonus Plan, contingent

on Executive’s continued employment with the Company through the last day of such Bonus Year (or, if the Board and Committee elect

to extend the payment of bonuses earned under the Bonus Plan for the 2023 Bonus Year, March 15, 2024), except as otherwise contemplated

in Section 2(d)(ii)(3). The Performance Bonus and the Key Performance Objectives applicable to Executive shall be prorated for any partial

Bonus Year; provided that 2023 shall not be deemed a partial Bonus Year as provided above. The Performance Bonus shall be determined

and paid in such a manner as qualifies for the “short-term deferral” exemption from “Section 409A”

(as defined below). Following the adoption of Key Performance Objectives for each Bonus Year, the Company will not without the written

consent of the Executive, modify the Key Performance Objectives, the effect of which would be to materially impair Executive’s

ability to attain the Performance Bonus for such Bonus Year or portion thereof.

(iii) Business

Expenses. The Company shall reimburse Executive for all reasonable expenses that he incurs in performing his duties hereunder

during the Employment Period, in each case subject to the terms and conditions of the Company’s policies in effect from time to

time with respect to travel, entertainment and other business expenses. The Company shall also reimburse Executive for

the amount of any fees and costs up to $12,000.00, incurred by Executive for the services of Executive’s counsel and other financial

advisors in connection with the review and completion of this Agreement and related documentation. Executive shall furnish the Company

with evidence relating to such expenses as the Company reasonably requires in order to substantiate such expenses.

(iv) Employee

Benefits. Executive will be eligible for all customary and usual employee benefits generally available to the Company’s

executives subject to the terms and conditions of the Company’s benefit plan documents. The Company reserves the right to

change or eliminate its employee benefits arrangements on a prospective basis, at any time and without notice. Executive will be eligible

for vacation time during the Employment Period in accordance with the Company’s vacation policy. Following the Termination Date,

Executive may have the right to continue coverage under the Company’s health insurance plan for a period of time in accordance

with and subject to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”).

(d) Effect

of Termination.

(i) If

the Employment Period, or Executive’s employment as chief executive officer of the Company hereunder, is terminated (A) due to

non-renewal of the Employment Period by either party under Section 2(a), (B) by the Company for Cause under Section 2(a)(iv)

or due to Executive’s Disability under Section 2(a)(ii), (C) by reason of Executive’s death under Section 2(a)(i), or (D)

by Executive’s resignation other than for Good Reason under Section 2(a)(iii), Executive or his estate, as the case may be, shall

be entitled to the following (collectively, the payments and benefits described in Sections 2(d)(i)(1) through 2(d)(i)(4) hereof shall

be hereafter referred to as the “Accrued Benefits”):

(1) all

previously earned and accrued but unpaid Base Salary through the Termination Date, paid on the next regularly scheduled date for the

Company to make payroll payments following Termination Date or such earlier date as may be required by applicable law;

(2) subject

to Section 2(c)(v), all previously approved but unreimbursed expenses incurred by the Executive through the Termination Date, paid within

sixty (60) days following Termination Date or such earlier date as may be required by applicable law or as set forth in the Company’s

expense reimbursement policy;

(3) any

accrued but unused paid vacation time, paid subject to and in accordance with Company policy; and

(4) all

other payments and benefits to which Executive shall be entitled under the terms of any employee benefit plan of the Company, paid or

provided subject to and in accordance with the terms of such plan.

(ii) If

the Employment Period, or Executive’s employment as chief executive officer of the Company hereunder, is terminated (A) by the

Company other than for Cause under Section 2(a)(v) or (B) by Executive for Good Reason under Section 2(a)(iv), Executive shall be entitled

to the Accrued Benefits and, subject to Executive’s compliance with the Release Condition in Section 2(d)(iv), may also receive

the following additional payments:

(1) a

severance payment in an amount equal to Executive’s Base Salary for six (6) months (the “Severance Period”),

paid in equal monthly installments on regular Company payroll dates over the Severance Period following the Termination Date (the “Severance

Payment”); provided that the first installment of the Severance Payment will be paid on the first regular Company payroll

date next following the sixtieth (60th) calendar day following the Termination Date and will include payment of any installment payments

that were otherwise due prior thereto.

(2) the

Performance Bonus (if any) earned for the most recently-completed Bonus Year preceding the Termination Date in accordance

with Section 2(c)(ii) based on actual attainment of the applicable Key Performance Objectives for such year, to the extent unpaid as

of the Termination Date, paid in a single lump sum in cash on the first regular Company payroll date next following the sixtieth (60th)

calendar day following the Termination Date (the “Prior Year Bonus”);

(3) the

Performance Bonus (if any) earned for the Bonus Year containing the Termination Date in accordance with Section 2(c)(ii) based on actual

attainment of the applicable Key Performance Objectives for such year, which shall be paid in its entirety if the applicable Key Performance

Objectives were achieved prior to the end of the Employment Period, and which otherwise shall be prorated based on the ratio of the number

of days employed during such year to three hundred sixty-five (365) (the “Current Year Bonus”), in each

case paid in a single lump sum in cash when annual bonuses for such Bonus Year are paid to other executives.

(4) subject

to (x) Executive’s eligibility for and timely election of continuation coverage under COBRA, and (y) Executive’s continued

copayment of premiums at the same level and cost to Executive as if Executive were an employee of the Company (excluding, for purposes

of calculating cost, an employee’s ability to pay premiums with pre-tax dollars), continued copayment by the Company

for Executive’s coverage under the Company’s group health plan during the eighteen (18)-month period following

the Termination Date to the same extent that the Company paid for such coverage immediately prior to the Termination Date, in a manner

intended to avoid any excise tax under Section 4980D of the Code, subject to the eligibility requirements and other terms and conditions

of such insurance coverage (the “COBRA Subsidy”).

(iii) The

treatment of any equity or equity-based award upon any termination of Executive’s employment hereunder shall be subject

to the documents and agreements governing such awards.

(iv) Executive

shall be eligible to receive the Severance Payment, the Prior Year Bonus, the Current Year Bonus, and the COBRA Subsidy only if (A) Executive

remains in compliance with Section 3 at all times, and (B) Executive has executed and delivered to the Company a general release of claims

in the form then provided by the Company to Executive (the “General Release”), which General Release has become effective

and irrevocable according to its terms no later than 60 days following the Termination Date, and only so long as Executive has not revoked

or breached any of the provisions of the General Release and does not subsequently breach any such provisions (the “Release

Condition”). To the extent that any amount under Section 2(d) constitutes “deferred compensation” for purposes

of Section 409A, any payment of such amount scheduled to occur during the first sixty (60) days following the Termination Date shall

not be made until the Company’s first regularly scheduled pay period next following the sixtieth (60th) day after the Termination

Date and shall include payment of all amounts that were otherwise scheduled to be paid prior thereto.

(v) The

payments and benefits described in this Section 2(d) shall be in full and complete satisfaction of Executive’s rights and entitlements

under this Agreement and any other claims that Executive may have in respect of Executive’s employment with the Company or any

of its affiliates, and Executive acknowledges that such amounts are fair and reasonable, and are Executive’s sole and exclusive

remedy, in lieu of all other remedies at law or in equity, with respect to the termination of Executive’s employment hereunder

or any breach of this Agreement. As of the date of the final payment described in this Section 2(d), the Company shall

not have any further obligation to Executive under this Agreement or otherwise, except as may be required by law.

(vi) The

Company’s obligation to make the payments provided for in this Agreement and otherwise to perform its obligations hereunder shall

not be affected by any set-off, counterclaim, recoupment, defense or other claim, right or action which the Company may

have against Executive or others. In no event shall Executive be obligated to seek other employment or take any other action

by way of mitigation of the amounts payable to Executive under any of the provisions of this Agreement and such amounts shall not be

reduced whether or not Executive obtains other employment.

(e) Indemnification;

D&O Coverage.

(i) The

Company will indemnify Executive to the full extent required under the Company’s Certificate of Incorporation and Bylaws, and under

applicable law.

(ii) The

Company will maintain a directors’ and officers’ liability insurance policy (or policies) providing coverage for Executive

that is no less favorable to him in any respect (including as to the length of any post-employment tail coverage) than

the coverage then being provided to any other officer or director of the Company.

3. Proprietary

Rights and Restrictive Covenants. Concurrently

herewith, Executive shall enter into an Amended and Restated Proprietary Rights and Restrictive Covenants Agreement with the Company

in the form attached as Exhibit B hereto (the “PRRCA”), which is hereby made a part hereof, and hereby agrees

to comply in full with all of the terms and conditions thereof.

4. Notices.

All notices, demands or other communications to be given or delivered under or by reason of the provisions of this Agreement will be

in writing and will be deemed to have been given when delivered personally, the third Business Day after having been mailed by certified

or registered mail, return receipt requested and postage prepaid, or the first Business Day after the date sent via a nationally recognized

overnight courier. “Business Day” is any day other than a Saturday, Sunday or a day on which banks in

New York are required or authorized to be closed. Such notices, demands and other communications will be sent to the address indicated

below:

To

the Company:

Soluna

Holdings, Inc.

Attention:

Board of Directors

325

Washington Ave. Extension

Albany

NY 12205

With

a copy (which shall not constitute notice) to:

Nixon

Peabody LLP

70

W. Madison, Suite 5200

Chicago,

IL 60657

Attention:

Robert A. Drobnak

To

Executive: wat Executive’s most recent address in the Company’s records

With

a copy (which shall not constitute notice) to:

Berkowitz,

Trager & Trager, LLC

8

Wright Street

Westport,

Ct 06880

Attention:

Samuel Febbraio

or

such other address or to the attention of such other person as the recipient party shall have specified by prior written notice to the

sending party.

5. Dispute

Resolution.

(a) Agreement

to Arbitrate. Any dispute, claim, or controversy between the parties arising out of or in connection with this Agreement, or

the employment relationship, shall be settled by binding arbitration under the Employment Arbitration Rules of the American Arbitration

Association then in effect, provided, however, either party may request provisional, injunctive or extraordinary relief from a court

of competent jurisdiction, under applicable law of the State of New York, if necessary to preserve the status quo pending arbitration.

The arbitrator shall have the exclusive authority to resolve any dispute relating to the arbitrability of any individual claim or the

enforceability or formation of this Agreement. The arbitration proceeding shall be conducted in English, before a single arbitrator,

and any hearing shall be held in New York City, New York. The cost of such arbitration shall be borne by the Company; however,

each party shall be responsible for its own attorney fees. This arbitration clause shall survive the termination of this

Agreement. This Agreement to arbitrate disputes is governed by the Federal Arbitration Act (9 U.S.C. Sections 1, et seq.).

The arbitrator shall apply the substantive law relating to all claims and defenses to be arbitrated the same as if the matter

had been heard in court, including with respect to the award of any remedy or relief on an individual basis and any award of costs and

attorneys’ fees to the prevailing party. The decision of the arbitrator shall be binding, and judgment thereon may

be entered by any court of competent jurisdiction. Any type of class, collective claims or multi-party claims

are expressly prohibited, and the arbitrator will have no authority to alter the parties’ agreement in this regard. In

the event of any legal proceeding between the Company and Executive relating to this Agreement, neither party may claim the right to

a trial by jury, and both parties waive any right they may have under applicable law or otherwise to a trial by jury. To

the extent permitted by applicable law, the arbitration shall be kept confidential and the existence of the arbitration proceeding and

any element of it (including but not limited to any pleadings, briefs or other documents submitted and exchanged and testimony or other

oral submissions and any awards made) shall not be disclosed beyond the arbitrator, the parties hereto, their counsel and any person

to whom disclosure is necessary to the conduct of the proceeding. Nothing in this Agreement prevents Executive from reporting

good faith allegations of unlawful employment practices to appropriate federal, state or local agencies; reporting any good faith allegation

of criminal conduct to any appropriate federal, State, or local official; participating in a proceeding with any appropriate federal,

State, or local government agency enforcing discrimination laws; making any truthful statements or disclosures required by law, regulation,

or legal process; or requesting or receiving confidential legal advice.

(b) Consideration.

The mutual promise by the Company and Executive to arbitrate all disputes between them, rather than to litigate them before the courts

or other bodies, provides the consideration for this agreement to arbitrate. The Company’s offer of employment to Executive and

the Company’s agreement to pay all fees and costs unique to arbitration serve as additional consideration.

6. Clawback.

All amounts paid or provided to Executive hereunder shall be subject to any clawback or recoupment policy that may be maintained by the

Company from time to time, and the requirements of any law or regulation applicable to the Company and governing the clawback or recoupment

of executive compensation, or as set forth in any final non-appealable order by any court of competent jurisdiction or

arbitrator.

7. Miscellaneous.

(a) Survival.

Sections 2(d), and 3 through 7 shall survive and shall continue in full force and effect in accordance with their respective terms notwithstanding

any expiration or termination of the Employment Period and/or this Agreement.

(b) Severability.

Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective and valid under applicable

law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under any applicable law or

rule in any jurisdiction, such invalidity, illegality or unenforceability will not affect any other provision or any other jurisdiction,

but this Agreement will be reformed, construed and enforced in such jurisdiction as if such invalid, illegal or unenforceable provision

had never been contained herein.

(c) Complete

Agreement. This Agreement, together with its exhibits and attachments, embodies the parties’ complete agreement and understanding

regarding the subject matter hereof and supersedes and preempts any prior understandings, agreements or representations by or between

the parties, as well as by or between the Executive and Company, written or oral, which may have related to the subject matter hereof

in any way.

(d) Existing

Employment Agreement. This Agreement does not amend or modify any term of the Existing Employment Agreement for any period ending

prior to May 1, 2023.

(e) Successors

and Assigns. Except as otherwise provided herein, this Agreement shall bind and inure to the benefit of and be enforceable by

Executive and the Company, and their respective heirs, executors, successors, assigns and legal representatives; provided, that

the services provided by Executive hereunder are of a personal nature and the rights and obligations of Executive hereunder shall not

be assignable. Notwithstanding the foregoing, the Company may assign this Agreement, and its rights and obligations hereunder,

to any successor to all or substantially all of the business and/or assets of the Company, provided that the Company shall require such

successor to expressly assume and agree to perform this Agreement in the same manner and to the same extent that the Company would be

required to perform it if no such succession had taken place (and any such successor shall thereafter become the “Company”

for purposes of this Agreement).

(f) Governing

Law and Forum Selection Clause. Except as provided in Section 5, the law of the State of New York shall govern all questions

concerning the construction, validity, interpretation and enforceability of this Agreement, and the performance of the obligations imposed

by this Agreement, without giving effect to any choice of law or conflict of law rules or provisions. Each party submits

to the jurisdiction of the state and federal courts located in New York City, New York in any action or proceeding arising out of or

relating to this Agreement and agrees that all claims in respect of the action or proceeding may be heard and determined in any such

court. Each party also agrees not to bring any action or proceeding arising out of or relating to this Agreement in any

other court. Each party waives any defense of inconvenient forum to the maintenance of any action or proceeding so brought

and waives any bond, surety or other security that might be required of the other party with respect thereto. A party may

make service on the other party by sending or delivering a copy of the process to the party to be served at the address and in the manner

provided for the giving of notices in Section 4. Nothing in this Section 7(e), however, shall affect a party’s right

to serve legal process in any other manner permitted by law or at equity. Each party agrees that a final judgment in any

action or proceeding so brought shall be conclusive and may be enforced by suit on the judgment or in any other manner provided by law

or at equity.

(g) Executive’s

Cooperation. During the Employment Period and thereafter Executive shall cooperate with the Company and its affiliates in any

internal investigation or administrative, regulatory or judicial proceeding as reasonably requested by the Company (including Executive

being available to the Company upon reasonable notice for interviews and factual investigations, appearing at the Company’s request

to give testimony without requiring service of a subpoena or other legal process, volunteering to the Company all pertinent information

and turning over to the Company all relevant documents which are or may come into Executive’s possession, all at times and on schedules

that are reasonably consistent with Executive’s other permitted activities and commitments). Such services will be without additional

compensation if Executive is then employed by the Company and for reasonable compensation if Executive is not then employed by the Company.

The provisions of this Section 7(g) shall not apply to legal actions between Executive and the Company.

(h) Consent

and Waiver by Third Parties. Executive represents and warrants that his employment with the Company on the terms and conditions

set forth herein and his execution and performance of this Agreement do not constitute a breach or violation of any other agreement,

obligation or understanding with any third party. Executive represents that he is not bound by any agreement or any other existing or

previous business relationship which conflicts with, or may conflict with, the performance of his obligations hereunder or prevent the

full performance of his duties and obligations hereunder, and that, upon the execution and delivery of this Agreement by the parties,

this Agreement shall be a valid and binding obligation of Executive, enforceable against Executive in accordance with its terms, except

to the extent that enforceability may be limited by applicable bankruptcy, insolvency or similar laws affecting the enforcement of creditors’

rights generally.

(i) Amendment

and Waiver. The provisions of this Agreement may be amended and waived only with the prior written consent of the Company and

Executive. No waiver shall be effective unless in a writing signed by the person against whom such waiver is sought to be enforced. The

failure of a party to insist upon strict adherence to any term of this Agreement on any occasion shall not be considered a waiver thereof

or deprive that party of the right thereafter to insist upon strict adherence to that term or any other term of this Agreement.

(j) No

Strict Construction. The language used in this Agreement shall be deemed to be the language chosen by the parties to express

their mutual intent, and no rule of strict construction shall be applied against either party.

(k) Tax

Matters.

(i) Tax

Withholding. The Company shall withhold from any compensation and benefits payable under this Agreement all applicable federal,

state, local, or other taxes, and any other applicable withholdings.

(ii) Section

409A.

(A) The

parties intend for payments and benefits hereunder to either comply with, or be exempt from, Section 409A of the Code and the regulations

promulgated thereunder (collectively “Section 409A”) and, accordingly, to the maximum extent permitted, this

Agreement shall be interpreted and construed consistent with such intent. To the extent that any provision hereof is modified

in order to comply with Section 409A, such modification shall be made in good faith and shall, to the maximum extent reasonably possible,

maintain the original intent and economic benefit to Executive and the Company of the applicable provision without violating the provisions

of Section 409A. Notwithstanding the foregoing, the Company does not guarantee any particular tax result, and in no event

whatsoever shall the Company, its affiliates, or their respective officers, directors, employees, counsel or other service providers

be liable for any tax, interest or penalty that may be imposed on Executive by Section 409A or damages for failing to comply with Section

409A.

(B) To

the extent that reimbursements or other in-kind benefits hereunder constitute “deferred compensation” for purposes

of Section 409A, (x) all expenses or other reimbursements hereunder shall be made on or prior to the last day of the taxable year following

the taxable year in which such expenses were incurred by Executive, (y) any right to reimbursement or in-kind benefits

shall not be subject to liquidation or exchange for another benefit, and (z) no such reimbursement, expenses eligible for reimbursement,

or in-kind benefits provided in any taxable year shall in any way affect the expenses eligible for reimbursement, or in-kind

benefits to be provided, in any other taxable year.

(C) For

purposes of Section 409A, Executive’s right to receive installment payments pursuant to this Agreement shall be treated as a right

to receive a series of separate and distinct payments. Whenever a payment hereunder specifies a payment period with reference

to a number of days, the actual date of payment within the specified period shall be within the sole discretion of the Company.

(D) Any

other provision of this Agreement to the contrary notwithstanding, in no event shall any payment or benefit hereunder that constitutes

“deferred compensation” for purposes of Section 409A be subject to offset by any other amount unless otherwise permitted

by Section 409A.

(E) A

termination of employment shall not be deemed to have occurred for purposes of any provision of this Agreement providing for the payment

of any amounts or benefits upon or following a termination of employment unless such termination is also a “separation from service”

within the meaning of Section 409A, and, for purposes of any such provision, all references in this Agreement to Executive’s “termination”,

“termination of employment” and like terms shall mean Executive’s “separation from service” with the Company.

(F) Notwithstanding

any other provision of this Agreement to the contrary, if, at the time of Executive’s separation from service, Executive is a “Specified

Employee”, then the Company will defer the payment or commencement of any nonqualified deferred compensation subject to Section

409A payable upon separation from service (without any reduction in such payments or benefits ultimately paid or provided to Executive)

until the date that is six (6) months following separation from service or, if earlier, the earliest other date as is permitted under

Section 409A (and any amounts that otherwise would have been paid during this deferral period will be paid in a lump sum on the day after

the expiration of the six (6) month period or such shorter period, if applicable). Executive will be a “Specified

Employee” for purposes of this Agreement if, on the date of Executive’s separation from service, Executive is an individual

who is, under the method of determination adopted by the Company, designated as, or within the category of employees deemed to be, a

“Specified Employee” within the meaning and in accordance with Treasury Regulation Section 1.409A-1(i).

The Company shall determine in its sole discretion all matters relating to who is a “Specified Employee” and the

application of and effects of the change in such determination.

(l) Parachute

Payments. In the event that any payments and other benefits provided for in this Agreement or otherwise payable to Executive

constitute “parachute payments” within the meaning of Section 280G of the Code, and, but for this paragraph, would be subject

to the excise tax imposed by Section 4999 of the Code, then any post-termination severance payments and benefits payable

under this Agreement or otherwise will be either (1) delivered in full or (2) delivered as to such lesser extent which would result in

no portion of such payments and benefits being subject to excise tax under Section 4999 of the Code, whichever of the foregoing amounts,

taking into account the applicable federal, state and local income taxes and the excise tax imposed by Section 4999 of the Code, results

in the receipt by Executive, on an after-tax basis, of the greatest amount of payments and benefits, notwithstanding that

all or some portion of such benefits may be taxable under Section 4999 of the Code. If a reduction in Executive’s payments and

benefits is necessitated by the preceding sentence, such reduction will occur in the following order: (i) any cash severance based on

a multiple of base salary or annual bonus, (ii) any other cash amounts payable to Executive, (iii) benefits valued as parachute payments,

and (iv) acceleration of vesting of any equity awards. Unless the Company and Executive otherwise agree in writing, any

determination required under this paragraph will be made in writing by the Company’s or its affiliates’ independent public

accountants (the “Firm”), whose determination will be conclusive and binding upon Executive and the Company. For purposes

of making the calculations required by this paragraph, the Firm may make reasonable assumptions and approximations concerning applicable

taxes and may rely on reasonable, good faith interpretations concerning the application of Sections 280G and 4999 of the Code.

The Company and Executive will furnish to the Firm such information and documents as the Firm may reasonably request in order

to make a determination under this paragraph. The Company will bear all costs the Firm may incur in connection with any

calculations contemplated by this paragraph.

(m) Headings.

Section headings are used herein for convenience of reference only and shall not affect the meaning of any provision of this Agreement.

(n) Counterparts;

Facsimile Signatures. This Agreement may be executed in separate counterparts, each of which is deemed to be an original and

all of which taken together constitute one and the same agreement. Facsimile, PDF, and electronic counterpart signatures

to and versions of this Agreement shall be acceptable and binding on the parties.

IN

WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

| |

SOLUNA

HOLDINGS, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

Michael

Toporek |

| |

Title: |

Executive

Chairman of the Company |

| |

|

|

| |

EXECUTIVE |

| |

|

|

| |

By: |

|

| |

|

John

Belizaire |

EXHIBIT

A

OUTSIDE

RESPONSIBILITIES

Board

Member, Center for American Entrepreneurship

Managing

Editor, CEO Playbook Media LLC

Operating

Advisor, Pilot Growth Equity Partners

EXHIBIT

B

PROPRIETARY

RIGHTS AND RESTRICTIVE COVENANTS AGREEMENT

See

attached.

Exhibit

10.2

Amendment

No. 1 to Employment Agreement

This

Amendment No. 1 to Employment Agreement, dated as of November 20, 2023 (this “Amendment”), is entered

into by and between Soluna Holdings, Inc., a Nevada corporation (the “Company”), and Michael Toporek (the “Executive”)

(the Company and the Executive are each a “Party” and, collectively, the “Parties”).

Preliminary

Statements:

WHEREAS,

the Parties entered into that certain Employment Agreement dated as of January 14, 2022 (the “Employment Agreement”;

capitalized terms not otherwise defined in this Amendment have the same meanings as specified in the Employment Agreement);

WHEREAS,

the Company has requested, and the Executive has agreed, to change positions from Chief Executive Officer to Executive Chairman; and

WHEREAS,

the Parties have agreed to amend the Employment Agreement as set forth herein.

Now,

Therefore, in consideration of the premises and for

other good and valuable consideration (the receipt and sufficiency of which are hereby acknowledged), the parties hereto hereby agree

as follows:

| Section 1. |

Amendments

to employment Agreement. |

The

Employment Agreement is, subject to the satisfaction (or waiver by each Party) of the conditions precedent set forth in Section 3, hereby

amended as follows:

(a) Section

1(a) of the Employment Agreement is hereby amended by replacing the phrase “Chief Executive Officer of the Company” with

the phrase “Chief Executive Officer of the Company until May 1, 2023 and the Executive Chairman of the Company after such date”.

(b) Section

2 of the Employment Agreement is hereby amended by replacing the phrase “of three (3) years” with the phrase “ending

on May 1, 2028”.

(c) Section

3(c) of the Employment Agreement is hereby amended and restated in its entirety to read as follows:

(c) [Reserved]

(d) Section

3(d) of the Employment Agreement is hereby amended and restated in its entirety to read as follows:

(d) [Reserved]

(e) Section

5(b)(i) of the Employment Agreement is hereby amended by replacing the phrase “one (1) year” with the phrase “three

(3) years”.

| SECTION 2. |

Reference

to and Effect on the employment agreement. |

(a) On

and after the date hereof, each reference in the Employment Agreement to “this Agreement”, “hereunder”, “hereof”

or words of like import referring to the Employment Agreement, shall mean and be a reference to the Employment Agreement, as amended

by this Amendment.

(b) The

Employment Agreement, as specifically amended by this Amendment is, and shall continue to be, in full force and effect, and is hereby

in all respects ratified and confirmed.

| SECTION 3. |

Conditions of Effectiveness

for Amendment. |

This

Amendment shall become effective upon each Party having receiving counterparts to this Amendment duly executed by the other Party.

| SECTION 4. |

Execution

in Counterparts; Electronic Execution. |

This

Amendment may be executed in one or more counterparts and by different parties hereto in separate counterparts, each of which when so

executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement. Delivery of an

executed counterpart of a signature page of (x) this Amendment and/or (y) any document, approval, consent, information, notice, certificate,

request, statement disclosure or authorization related to this Amendment and/or the transactions contemplated hereby (each an “Ancillary

Document”) that is an Electronic Signature (as defined below) transmitted by telecopy, e-mailed .pdf or any other electronic

means that reproduces an image of an actual executed signature page shall be effective as delivery of a manually executed counterpart

of this Amendment or such Ancillary Document, as applicable. The words “execution,” “signed,” “signature,”

“delivery,” and words of like import in or relating to this Amendment and/or any Ancillary Document shall be deemed to include

Electronic Signatures, deliveries or the keeping of records in any electronic form (including deliveries by telecopy, emailed pdf, or

any other electronic means that reproduces an image of an actual executed signature page), each of which shall be of the same legal effect,

validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system

as the case may be. For purposes of this Section, “Electronic Signature” means an electronic sound, symbol, or process attached

to, or associated with, a contract or other record and adopted by a person with the intent to sign, authenticate or accept such contract

or record.

| SECTION 5. |

arbitration,

Notice, Governing Law, miscellaneous. |

This

Amendment is subject to the provisions of Section 7, 10, 13 and 14 of the Employment Agreement, the provisions which are by this reference

incorporated herein in full.

[REMAINDER

OF THIS PAGE INTENTIONALLY LEFT BLANK]

In

Witness Whereof, the parties have caused this Amendment

to Employment Agreement as of the date first above written.

| |

SOLUNA

HOLDINGS, INC. |

| |

|

|

| |

By:

|

|

| |

Name: |

Bill

Phelan |

| |

Title: |

Board

Director |

| |

|

|

| |

EXECUTIVE |

| |

|

|

| |

|

| |

Michael Toporek |

v3.23.3

Cover

|

Nov. 20, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 20, 2023

|

| Entity File Number |

001-40261

|

| Entity Registrant Name |

SOLUNA

HOLDINGS, INC.

|

| Entity Central Index Key |

0000064463

|

| Entity Tax Identification Number |

14-1462255

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

325

Washington Avenue Extension

|

| Entity Address, City or Town |

Albany

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

12205

|

| City Area Code |

(516)

|

| Local Phone Number |

216-9257

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common

stock, par value $0.001 per share

|

| Trading Symbol |

SLNH

|

| Security Exchange Name |

NASDAQ

|

| 9.0% Series A Cumulative Perpetual Preferred Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

9.0%

Series A Cumulative Perpetual Preferred Stock, par value $0.001 per share

|

| Trading Symbol |

SLNHP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SLNH_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SLNH_Sec9.0SeriesCumulativePerpetualPreferredStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

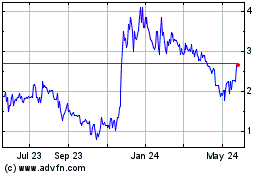

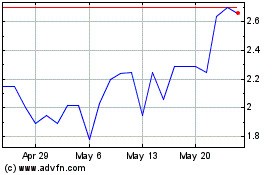

Soluna (NASDAQ:SLNHP)

Historical Stock Chart

From Apr 2024 to May 2024

Soluna (NASDAQ:SLNHP)

Historical Stock Chart

From May 2023 to May 2024