0000913760false00009137602024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

Form 8-K

_______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2024

_______________

StoneX Group Inc.

(Exact name of registrant as specified in its charter)

_______________

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 000-23554 | | 59-2921318 |

| (State of Incorporation) | | (Commission File Number) | | (IRS Employer ID No.) |

230 Park Ave, 10th Floor

New York, NY 10169

(Address of principal executive offices, including Zip Code)

(212) 485-3500

(Registrant’s telephone number, including area code)

_______________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to rule 14d-2(b) under the Exchange Act 17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | SNEX | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01. Regulation FD Disclosure

On February 15, 2024, StoneX Group Inc. (the “Company”) commenced an offering (the “Offering”) pursuant to exemptions from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), for the issuance of $550 million in aggregate principal amount of senior secured notes due 2031 (the “Notes”).

In connection with the Offering, the Company disclosed certain information to prospective investors in a preliminary offering memorandum dated February 15, 2024. The preliminary offering memorandum disclosed certain information that supplements or updates certain prior disclosures of the Company.

Pursuant to Regulation FD, the Company is furnishing herewith such information, in the general form presented in the preliminary offering memorandum, as Exhibit 99.1 to this Form 8-K.

Item 8.01. Other Events

On February 15, 2024, the Company issued a press release pursuant to Rule 135c under the Securities Act regarding commencement of the Offering. A copy of the press release is attached hereto as Exhibit 99.2.

The offer and sale of the Notes and related guarantees have not been, and will not be, registered under the Securities Act, or the securities laws of any other jurisdiction, and the Notes and related guarantees may not be offered or sold in the United States absent registration or applicable exemptions from registration requirements.

Cautionary Note Regarding Forward-Looking Statements

Certain statements herein that are not historical facts are "forward-looking" statements and "safe harbor statements" within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and/or uncertainties, including those described in the Company's public filings with the Securities and Exchange Commission. Forward-looking statements are based on management's current expectations and assumptions and not on historical facts. Examples of these statements include, but are not limited to, the closing of the offering and expected use of proceeds. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Therefore, we caution you against relying on any of these forward-looking statements. Among the important factors that could cause actual results to differ materially from those indicated in such forward-looking statements include risks and other factors described in the Company's periodic reports filed with the Securities and Exchange Commission. In providing forward-looking statements, the Company is not undertaking any duty or obligation to update these statements publicly as a result of new information, future events or otherwise, except as required by law. If the Company updates one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those other forward-looking statements.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

Signature

Pursuant to the Requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the Undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | StoneX Group Inc. |

| | | (Registrant) |

| February 15, 2024 | | /s/ WILLIAM J. DUNAWAY |

| (Date) | | William J. Dunaway |

| | | Chief Financial Officer |

Exhibit 99.1 Excerpts from Preliminary Offering Memorandum of StoneX Group Inc., dated February 15, 2024 CERTAIN NON-U.S. GAAP FINANCIAL MEASURES In this offering memorandum, we present certain non-GAAP financial measures of the Company, such as EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted Return on Equity, which are not required by, or presented in accordance with, U.S. GAAP. For additional information, please see the financial information and statements and the notes thereto included in our Annual Report on Form 10-K for the year ended September 30, 2023, and in our Quarterly Report on Form 10-Q for the period ended December 31, 2023, which are incorporated by reference into this offering memorandum. The Company’s EBITDA represents net income plus consolidated interest expense, income taxes and depreciation and amortization. The Company’s Adjusted EBITDA represents EBITDA plus amortization of share-based compensation and less interest expenses attributable to trading activities, including the credit facilities of our subsidiaries, gain on acquisitions, acquisition-related expenses, recovery of bad debt on physical coal and gain on FX anti-trust class action settlements. The Company’s Adjusted Net Income represents net income, adjusted to exclude the effects of gain on acquisitions, acquisition-related transaction costs, net of tax and the recovery of bad debt on physical coal, net of tax. The term Adjusted Return on Equity represents the average stockholder’s equity during a period over adjusted net income. We have included each of EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted Return on Equity in this offering memorandum because we believe they are important supplemental measures for evaluating our business performance and provides investors with greater transparency by facilitating comparison of operating results across a broad spectrum of companies with varying capital structures, compensation strategies and amortization methods, thereby providing a more complete understanding of our financial performance, competitive position and prospects for the future. We also believe that these measures are frequently used by securities analysts, investors and other interested persons in the evaluation of companies in our industry. Further, covenants contained in the indenture that will govern the Notes (the “Indenture”) will be, and the covenants contained in the Revolving Credit Agreement are, determined by reference to a financial measure that is substantially similar to the Company’s Adjusted EBITDA. In particular, we will be permitted by the Indenture that will govern the Notes to make certain adjustments when calculating Adjusted EBITDA that will depend on factors that are beyond our control and are uncertain, such as expected cost savings from actions anticipated to be taken in the future. We may not be successful in achieving cost savings or such other results in connection with any items we may reflect in these adjustments in the future, but we will nevertheless be permitted to calculate Adjusted EBITDA as if such cost savings or other adjustments have been or will be

achieved, which would increase the size of various baskets available to us under the negative covenants in the Indenture and permit us to take actions that might otherwise be prohibited. See “Risk Factors” beginning on page 23, of this Offering Memorandum. In addition, the Company’s Adjusted EBITDA includes an adjustment to consolidated interest expense to remove interest expense attributable to trading activities, including the credit facilities of our subsidiaries, and exclude certain costs and other items we do not consider indicative of our ongoing operating performance. Because Adjusted EBITDA is not affected by fluctuations in such costs and other items, we believe that Adjusted EBITDA is helpful in comparing operating performance from period to period. However, EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted Return on Equity have limitations as analytical tools because, among other things, they: • do not reflect our cash expenditures, or future requirements, for capital expenditures; • do not reflect the significant interest expense, or the cash requirements necessary to service our indebtedness, including the Notes; • do not reflect cash requirements for certain tax payments that may represent a reduction in cash available to us; and • do not reflect changes in, or cash requirements for, our working capital needs. In addition, although depreciation and amortization are non-cash charges, the assets being depreciated or amortized will often have to be replaced in the future, and EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted Return on Equity, do not reflect any cash requirements for these replacements. Moreover, other companies in our industry may calculate or use the terms EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted Return on Equity or other similar terms differently than we do, limiting their usefulness as comparative measures. Non-GAAP financial measures have certain limitations, including that they do not have a standardized meaning and, therefore, may be different from similar non-GAAP financial measures used by other companies and/or analysts. EBITDA, Adjusted EBITDA, Adjusted Net Income, Adjusted Return on Equity and the other non-GAAP financial measures included in, or incorporated by reference into, this offering memorandum are supplemental measures of performance that are not recognized or required by U.S. GAAP, and none of these should be considered as alternatives to, or in isolation from, operating revenues, net operating revenues or net income calculated under U.S. GAAP or as alternatives to, or in isolation from, any other measures of performance or liquidity determined in accordance with U.S. GAAP.

Track Record of Success: Over the past 21 years, since the current management team joined StoneX, we have compounded operating revenue at 32% per annum and stockholders’ equity at 28% per annum.(1) Over this period, our market value has increased from below $10 million to over $2.0 billion and our share price(2) has increased from $0.43 to $64.61— a gain of approximately 150 times for a 27% compound return. In fiscal 2023, operating revenues reached a record $2.9 billion (up 38% over fiscal year 2022) while net income increased to $239 million, up 15%. Stockholders’ equity rose to $1.4 billion, more than doubling since 2019. Our strategy has enabled us to create our own capital runway for growth, which has reduced our reliance on the capital markets. (1) As of FY 2023 ending September 30, 2023. (2) Subsequent to September 30, 2023, we announced a 3-for-2 split of our common stock, effected as a stock dividend. Share prices and earnings per share amounts reflect pre-split amounts. (3) See “Selected Summary Historical Consolidated Financial Information” for reconciliations of certain non- GAAP financial measures, including Adj. Net Income (non-GAAP) and Adj. Return on Equity.

Recent Developments Recent Performance: Q1’24 operating revenues were up 20% year over year with topline growth generally driven by increased client volumes and a strong rebound in the Retail segment. Interest income earned on client balances also increased 14% due to higher realized rates. Interest expense was up due to increased financing cost related to fixed income dealer and securities lending activities, but interest expense on corporate funding was down due to reduced corporate borrowings. We achieved a Return on Equity of 19.3% for the quarter and 17.4% for the last twelve months, while equity has increased 56% over the last two years. Common Stock Split: On November 7, 2023, the Company’s Board of Directors approved a three-for-two split of its common stock, to be effected as a stock dividend. The stock split was effective on November 24, 2023, and entitled each shareholder of record as of November 17, 2023 to receive one additional share of common stock for every two shares owned and cash in lieu of fractional shares. The stock split increased the number of shares of common stock outstanding. All share and per share amounts contained herein have been retroactively adjusted for the stock split. The shares of common stock retain a par value of $0.01 per share. Accordingly, an amount equal to the par value of the increased shares resulting from the stock split was reclassified from Additional paid-in-capital to Common stock. The following is a reconciliation of the numerator and denominator of the diluted earnings per share computations for the periods presented below.

NON-GAAP Financial Information: The following table reconciles net income to EBITDA and Adjusted EBITDA:

Exhibit 99.2

StoneX Group Inc. Announces Private Offering of $550 Million of Senior Secured Notes due 2031

February 15, 2024

NEW YORK, Feb. 15, 2024 (GLOBE NEWSWIRE) -- StoneX Group Inc. (the "Company"; NASDAQ: SNEX), today announced that it intends to offer, subject to market conditions and other factors, $550 million in aggregate principal amount of Senior Secured Notes due 2031 (the "Notes"). The Notes and the related Note guarantees will be offered in a private offering to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"), and to certain persons outside the United States pursuant to Regulation S under the Securities Act.

The Company intends to use the net proceeds from the sale of the Notes, together with cash on hand, to (i) fund the redemption in full of the Company's 8.625% Senior Secured Notes due 2025, (ii) repay in full current borrowings under the Company's senior secured revolving credit facility, and (iii) pay related fees and expenses associated with the foregoing.

The Notes will be fully and unconditionally guaranteed, jointly and severally, on a senior secured second lien basis by each of the Company's existing and future subsidiaries that guarantees indebtedness under the Company's senior secured revolving credit facility and certain other senior indebtedness. The guarantees are subject to release under specified circumstances. The Notes and the related guarantees will be secured on a second priority basis by liens on substantially all of the Company's and the guarantors' property and assets, subject to certain exceptions and permitted liens. The liens on the Company's and the guarantors' assets that secure the Notes and the related guarantees will be contractually subordinated to the liens on the Company's and the guarantors' assets that secure the Company's and the guarantors' existing and future first lien obligations, including indebtedness under the Company's senior secured revolving credit facility, as a result of an intercreditor agreement to be entered into by the collateral agent for the Notes and the agent for the Company's senior secured revolving credit facility. The Notes are expected to pay interest semi-annually, in arrears.

This press release is neither an offer to sell nor a solicitation of an offer to buy the Notes, the related guarantees or any other security, nor shall there be any offer, solicitation or sale of any securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful. Any offers of the Notes and the related guarantees will be made only by means of a private offering memorandum. The Company gives no assurance that the proposed offering can be completed on any terms or at all.

The offer and sale of the Notes and related guarantees have not been, and will not be, registered under the Securities Act, or the securities laws of any other jurisdiction, and the Notes and related guarantees may not be offered or sold in the United States absent registration or applicable exemptions from registration requirements.

Cautionary Note Regarding Forward-Looking Statements

Statements in this release that are not historical facts are "forward-looking" statements and "safe harbor statements" within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and/or uncertainties, including those described in the Company's public filings with the Securities and Exchange Commission. Forward-looking statements are based on management's current expectations and assumptions and not on historical facts. Examples of these statements include, but are not limited to, the closing of the offering and expected use of proceeds. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Therefore, we caution you against relying on any of these forward-looking statements. Among the important factors that could cause actual results to differ materially from those indicated in such forward-looking statements include risks and other factors described in the Company's periodic reports filed with the Securities and Exchange Commission. In providing forward-looking statements, the Company is not undertaking any duty or obligation to update these statements publicly as a result of new information, future events or otherwise, except as required by law. If the Company updates one or more forward-

looking statements, no inference should be drawn that it will make additional updates with respect to those other forward-looking statements.

StoneX Group Inc.

Investor inquiries:

Kevin Murphy

(212) 403 - 7296

kevin.murphy@stonex.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

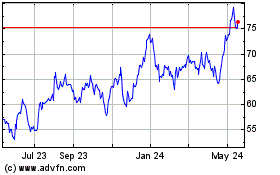

StoneX (NASDAQ:SNEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

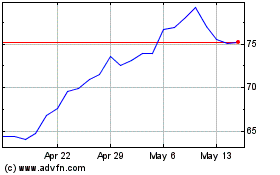

StoneX (NASDAQ:SNEX)

Historical Stock Chart

From Apr 2023 to Apr 2024