SonoSite, Inc. (Nasdaq:SONO), the world leader and specialist in

point-of-care, hand-carried ultrasound, today announced financial

results for the fourth quarter and full year ended December 31,

2007. Worldwide revenue in the fourth quarter of 2007 grew 19% to

$64.8 million compared with $54.4 million in the fourth quarter of

2006. For the full year of 2007, worldwide revenue grew 20% to

$205.1 million compared with $171.1 million for 2006. SonoSite

reported net income of $4.3 million or $0.25 per diluted share for

the fourth quarter of 2007 compared with net income of $5.8 million

or $0.34 per diluted share in the fourth quarter of 2006. The 2007

comparison with 2006 was impacted by SonoSite�s effective tax rate

of 40% in the fourth quarter of 2007 compared with 1% in the fourth

quarter of 2006. Income taxes are largely a non-cash expense due to

unused net operating loss carryforwards. For the full year of 2007,

SonoSite reported net income of $6.9 million or $0.40 per diluted

share compared with net income of $7.2 million or $0.43 per diluted

share in the prior year. The 2007 comparison was impacted by the

company�s tax rate of 38% for the year compared to 8% for the full

year of 2006. �The fourth quarter capped a year of steadily

improving execution and culminated with the largest new product

introduction in our history,� said Kevin M. Goodwin, President and

CEO. �The early success of our M-Turbo� system and S Series�

ultrasound tools added momentum to our fourth quarter growth and

positions us solidly for 2008.� �Increased expenses for pending

patent litigation inflated G&A expense, which alongside a

planned step-up in R&D investment, affected overall bottom-line

progress,� Mr. Goodwin said. �Importantly, the R&D investment

has positioned SonoSite to open new market opportunities in 2008.

We are pleased that even with a $4.0 million increase in legal

expenses, we grew operating income 16% for 2007.� During the fourth

quarter of 2007, US revenue grew 18% to $32.8 million and accounted

for 51% of total revenue. International revenue grew 21% to $32.0

million. For the year, US revenue grew approximately 16%,

accounting for 51% of total year revenue. International revenue

grew 24% for the year. Changes in foreign currency rates increased

worldwide revenue by approximately 3% in the fourth quarter and 2%

for the year. �We continued to take steps during 2007 to increase

our global presence and opened new subsidiaries in India and Italy,

bringing us to ten international subsidiaries,� Mr. Goodwin said.

�In the US, we saw strong progress in our direct hospital channel,

which grew revenue approximately 25% in the quarter,� Mr. Goodwin

said. �Although our physician office channel partner improved

performance as we moved through the year, sales were down in the

segment on a year-over-year basis. At year-end, we decided to bring

the office channel in-house and integrate the office sales

representatives with our direct sales team. We now have 70 sales

territories in the US.� Operating expenses in the fourth quarter

increased 19% to $39.6 million and 18% for the full year to $138.1

million. Changes in foreign currency rates increased expenses by 2%

for both the quarter and the year. As of December 31, 2007, cash

and investments totaled $309.8 million. Cash and investments

increased by $14.2 million for the year, net of the proceeds of the

convertible senior note financing. Days sales outstanding decreased

by four days compared to the prior year due to improved collections

worldwide. Inventories increased by $6.7 million for the year.

Company Outlook for 2008 The company updated its outlook for the

full year 2008. SonoSite continues to target revenue growth of

approximately 15% for the year and an operating margin of 7-8%,

which includes estimated expenses for pending litigation. R&D

expenses are expected to be approximately 12% of revenue while

SG&A expenses are targeted at approximately 49 � 50% of

revenue. The company expects other income to approximate $5 million

and to have a tax rate of approximately 38% for the year. Diluted

shares outstanding are expected to be in a range of 17.5 � 17.8

million. Conference Call Information SonoSite will hold a

conference call today at 1:30 pm PT/4:30 pm ET. The call will be

broadcast live and can be accessed via the �Investors� Section of

SonoSite�s website at www.sonosite.com. A replay of the audio

webcast will be available beginning February 14, 2008, at 4:30 pm

(PT) until�March 13, 2008, at 10:00 pm (PT) by dialing (719)

457-0820 or toll-free (888) 203-1112. The confirmation code 9103418

is required to access the replay. The call will also be archived on

SonoSite�s website at http://ir.sonosite.com. About SonoSite

SonoSite, Inc. (www.sonosite.com) is the innovator and world leader

in hand-carried ultrasound. Headquartered near Seattle, the company

is represented by ten subsidiaries and a global distribution

network in over 100 countries. SonoSite�s small, lightweight

systems are expanding the use of ultrasound across the clinical

spectrum by cost-effectively bringing high performance ultrasound

to the point of patient care. The company employs over 600 people

worldwide. Forward-looking Information and the Private Litigation

Reform Act of 1995 Certain statements in this press release

relating to the market acceptance of our products, possible future

sales relating to expected orders, and our future financial

position and operating results are �forward-looking statements� for

the purposes of the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements are based on the opinions and estimates of our

management at the time the statements are made and are subject to

risks and uncertainties that could cause actual results to differ

materially from those expected or implied by the forward-looking

statements. These statements are not guaranties of future

performance and are subject to known and unknown risks and

uncertainties and are based on potentially inaccurate assumptions.

Factors that could affect the rate and extent of market acceptance

of our products, the receipt of expected orders, and our financial

performance include our ability to successfully manufacture, market

and sell our ultrasound systems, our ability to accurately forecast

customer demand for our products, our ability to manufacture and

ship our systems in a timely manner to meet customer demand,

variability in quarterly results caused by the timing of large

project orders from governmental or international entities and the

seasonality of hospital purchasing patterns, timely receipts of

regulatory approvals to market and sell our products, regulatory

and reimbursement changes in various national health care markets,

constraints in government and public health spending, the ability

of our distribution partners and other sales channels to market and

sell our products, the impact of patent litigation, our ability to

execute our acquisition strategy, the effect of transactions and

activities associated with our issuance of senior convertible debt

in July 2007 on the market price of our common stock, and as well

as other factors contained in the Item 1A. �Risk Factors� section

of our most recent Annual Report on Form 10-K, as updated by our

most recent quarterly reports filed on Form 10-Q filed with the

Securities and Exchange Commission. We caution readers not to place

undue reliance upon these forward-looking statements that speak

only as to the date of this release. We undertake no obligation to

publicly revise any forward-looking statements to reflect new

information, events or circumstances after the date of this release

or to reflect the occurrence of unanticipated events. SonoSite,

Inc. Selected Financial Information � Consolidated Statements of

Operations (in thousands except per share data) (unaudited) � Three

Months Ended Twelve Months Ended December 31, December 31, � 2007 �

� � 2006 � � 2007 � � � 2006 � � Revenue $ 64,835 $ 54,353 $

205,068 $ 171,083 Cost of revenue � 19,687 � � 16,140 � � 62,505 �

� 49,673 � Gross margin 45,148 38,213 142,563 121,410 Gross margin

percentage 69.6 % 70.3 % 69.5 % 71.0 % � Operating expenses:

Research and development 6,234 6,126 25,872 20,183 Sales and

marketing 26,200 22,746 91,054 81,631 General and administrative �

7,145 � � 4,491 � � 21,186 � � 15,760 � Total operating expenses

39,579 33,363 138,112 117,574 � Other income, net � 1,522 � � 1,060

� � 6,565 � � 3,977 � � Income before income taxes 7,091 5,910

11,016 7,813 � Income tax provision � 2,838 � � 85 � � 4,132 � �

582 � . Net income $ 4,253 � $ 5,825 � $ 6,884 � $ 7,231 � � � Net

income per share: Basic $ 0.25 � $ 0.35 � $ 0.41 � $ 0.44 � Diluted

$ 0.25 � $ 0.34 � $ 0.40 � $ 0.43 � � � Weighted average common and

potential common shares outstanding: Basic � 16,723 � � 16,409 � �

16,621 � � 16,274 � Diluted � 17,350 � � 16,918 � � 17,168 � �

16,857 � Condensed Consolidated Balance Sheets (in thousands)

(unaudited) � December 31, December 31, � 2007 � � 2006 � � Cash

and cash equivalents $ 188,701 $ 45,673 Short-term investment

securities 119,873 38,428 Accounts receivable, net 60,954 52,838

Inventories 29,740 23,020 Deferred income taxes, current 13,138

7,684 Prepaid expenses and other current assets � 7,759 � � 4,821 �

Total current assets 420,165 172,464 � Property and equipment, net

10,133 10,752 Investment securities 1,257 3,014 Deferred income

taxes 12,959 20,113 Intangible assets, net 16,346 3,864 Other

assets � 9,521 � � 1,687 � Total assets $ 470,381 � $ 211,894 � �

Accounts payable $ 8,868 $ 6,450 Accrued expenses 24,431 15,459

Deferred revenue, current portion 3,502 3,253 Deferred tax

liability , current � 115 � � - � Total current liabilities 36,916

25,162 � Long-term debt 225,000 - Deferred tax liability 4,528 384

Other liabilities, net of current portion � 11,075 � � 5,317 �

Total liabilities 277,519 30,863 � Shareholders' equity: Common

stock and additional paid-in capital 236,325 231,551 Accumulated

deficit (44,893 ) (51,777 ) Accumulated other comprehensive income

� 1,430 � � 1,257 � Total shareholders' equity � 192,862 � �

181,031 � Total liabilities and shareholders' equity $ 470,381 � $

211,894 �

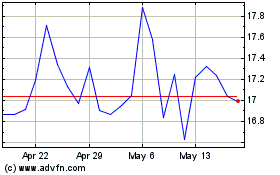

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jun 2024 to Jul 2024

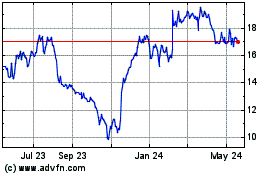

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jul 2023 to Jul 2024