South Plains Financial, Inc. (NASDAQ:SPFI) (“South Plains” or the

“Company”), the parent company of City Bank, today reported its

results as of and for the quarter ended March 31, 2019.

First Quarter 2019 Financial

Highlights

- Net income for the first quarter of 2019 increased to $4.8

million, compared to $4.6 million(1) in the first quarter of

2018.

- Diluted earnings per share were $0.32 for the first quarter of

2019, compared to $0.31(1) for the first quarter of 2018.

- Net interest margin(2) was 3.93%, compared to 3.87% in the

first quarter of 2018.

- Deposit growth of $27.5 million, or 1.2%, for the three months

ended March 31, 2019.

- Return on average assets was 0.71% annualized.

- Book value per share(3) of $14.80 for the first quarter of

2019, compared to $14.59 per share for the quarter ended March 31,

2018.

- Total stockholders’ equity to total assets(3) was 7.96%.

Curtis Griffith, South Plains’ Chairman and

Chief Executive Officer, stated, “The first quarter was a good

start to the year for South Plains as we delivered improved

earnings, year-over-year, in what is typically our lowest earnings

quarter of the year given seasonality in our agricultural lending

segment. Additionally, we maintained a relentless focus on

expense reduction in the first quarter of 2019 as we work to drive

efficiencies through the Bank and improve our profitability while

delivering the outstanding customer service that our customers are

accustomed to and which differentiates South Plains in our local

markets. Looking forward, we continue to see opportunities to

further reduce our cost structure over the balance of the year as

we work to achieve an efficiency ratio more in-line with our

peers. Credit quality also remained strong in all of our

markets and while competition lowered our overall growth in loans,

demand increased through the end of the quarter and has remained on

an improving trend through the second quarter of 2019.”

“We are also extremely pleased with our recent

successful initial public offering when our Company’s common stock

began trading on the NASDAQ Global Select Market under the ticker

symbol “SPFI” on May 9th,” continued Mr. Griffith. “We issued

3,207,000 shares, including the overallotment option, generating

net proceeds of approximately $51.4 million. We were

delighted with the strong support that we received from investors

during the IPO process and with the quality of our new

shareholders. Our public listing is an important milestone in

our Company’s more than 75 year history and we believe it will

position South Plains to seek attractive acquisition opportunities

in our core markets of West Texas. We would like to thank our

employees, customers and legacy shareholders for their trust and

confidence, and we look forward to their continued support as we

begin our next chapter as a public company.”

Results of Operations, Quarter Ended March 31,

2019

Net Interest Income

Net interest income totaled $24.5 million for the first quarter

of 2019, an increase of $1.8 million from $22.7 million for

the first quarter of 2018.

Interest income totaled $32.0 million for the first quarter of

2019, an increase of $4.7 million from $27.3 million in the same

period in 2018. Interest and fees on loans increased by $4.0

million from the first quarter of 2018 due to organic growth of

$129.4 million in average loans and an increase of 48 basis points

in interest rates.

Interest expense was $7.5 million for the first quarter of 2019

compared to $4.6 million in the prior year period. The

increase from the first quarter of 2018 was due to an increase in

the rate paid on interest-bearing liabilities of 54 basis points

and growth in the deposit base. The average cost of deposits

were 105 basis points for the first quarter of 2019, representing a

39 basis point increase from the first quarter of 2018.

The net interest margin for the first quarter of 2019 was 3.93%,

an increase of 6 basis points from the first quarter of 2018.

The increase from the prior year period was due primarily to the

impact of higher interest-earning asset rates, offset by increases

in the cost of interest-bearing liabilities.

Noninterest Income and Noninterest Expense

Noninterest income totaled $12.1 million for the first quarter

of 2019, compared to $11.5 million for the first quarter of

2018. The increase in noninterest income was primarily the

result of an increase of $349 thousand on the net gains on loans

sold from an increase of $12.0 million in the origination of

mortgage loans held for sale.

The primary components of noninterest income for the first

quarter of 2019 were $4.9 million in revenue from mortgage banking

activities and $2.0 million in bank card services and interchange

fees.

Noninterest expense totaled $30.0 million in the first quarter

of 2019, an increase of $2.1 million from $27.9 million in the

prior year period. This increase in noninterest expense was

primarily driven by $1.4 million in 2019 operating expenses related

to the online mortgage and staff acquisition, which closed on

November 30, 2018.

During the quarter, the Company incurred $115,000 of after-tax

legal expenses in connection with the initial public offering and

related activities.

The primary components of noninterest expense for the first

quarter of 2019 were $19.1 million in salaries and employee

benefits, $3.4 million in net occupancy expense, and $1.7 million

in professional services.

Loan Portfolio and Composition

Loans held for investment were $1.9 billion as of March 31,

2019, compared to $2.0 billion as of December 31, 2018 and

$1.8 billion as of March 31, 2018. Loans held for

investment as of March 31, 2019 decreased $42.0 million, or 2.1%,

from December 31, 2018, as a result of a net reduction of $43.4

million in seasonal annual paydowns on agricultural productions

loans. As of March 31, 2019, loans held for investment

increased $91.0 million, or 5.0%, from March 31, 2018. The

primary segments of our organic growth for this period were $50.1

million in 1-4 family residential loans and $41.8 million in auto

loans.

Agricultural production loans were $107.3 million at March 31,

2019, compared to $150.7 million at December 31, 2018 and $106.8

million at March 31, 2018.

Deposits and Borrowings

Deposits totaled $2.3 billion as of March 31, 2019, compared to

$2.3 billion as of December 31, 2018 and $2.2 billion as of March

31, 2018. Deposits increased $27.5 million in the first

quarter of 2019 and increased $145.6 million from March 31, 2018 as

a result of the Company’s organic growth.

Noninterest-bearing deposits were $497.6 million as of March 31,

2019, compared to $510.1 million as of December 31, 2018 and $468.3

million as of March 31, 2018. Noninterest-bearing deposits

represented 21.6%, 22.4%, and 21.7% of total deposits as of March

31, 2019, December 31, 2018, and March 31, 2018,

respectively.

Subordinated debt securities declined to $26.5 million at March

31, 2019 from $34.0 million as of December 31, 2018. This

decline was the result of the redemption in January 2019 of the

$7.5 million remaining securities that were issued by the Company

in 2014.

Asset Quality

The provision for loan losses recorded for the first quarter of

2019 was $608 thousand, compared to $778 thousand for the first

quarter of 2018. The allowance for loan losses to loans held for

investment was 1.22% at March 31, 2019 compared to 1.18% at

December 31, 2018 and 1.20% at March 31, 2018.

The nonperforming assets to total assets ratio as of March 31,

2019 was 0.37%, compared to 0.34% as of December 31, 2018 and 0.55%

at March 31, 2018.

Annualized net charge-offs were 0.07% for the first quarter of

2019, compared to 0.06% for the first quarter of 2018.

(1) The Company’s S Corporation revocation was effective May 31,

2018. Net income, return on average assets, return on average

shareholders’ equity and earnings per share for periods prior to

the revocation are presented herein as if we had converted to a C

Corporation as of January 1, 2018. The tax adjustment is

calculated by adding back its franchise S Corporation tax to net

income, and using tax rates for Federal income taxes of 21.0%. This

calculation reflects only the revocation of the Company’s status as

an S Corporation and does not give effect to any other

transaction.

(2) Net interest margin is calculated as the annual net interest

income, on a fully tax-equivalent basis, divided by average

interest-earning assets.

(3) Amounts are presented giving effect to the ESOP Repurchase

Right Termination. See Pro Forma Financial Information below

for further details.

About South Plains Financial, Inc.

South Plains is the bank holding company for City Bank, a Texas

chartered bank headquartered in Lubbock, Texas. City Bank is

one of the largest independent banks in West Texas and has

additional banking operations in the Dallas and El Paso markets, as

well as in the Greater Houston, and College Station Texas markets,

and the Ruidoso and Eastern New Mexico markets. South Plains

provides a wide range of commercial and consumer financial services

to small and medium-sized businesses and individuals in its market

areas. Its principal business activities include commercial and

retail banking, along with insurance, investment, trust and

mortgage services. Please visit https://www.spfi.bank for

more information.

Pro Forma Financial Information

As a result of the revocation of the Company’s S corporation

election, the net income and earnings per share data presented

herein may not be comparable for all periods presented herein. As a

result, the Company is disclosing pro forma net income, income tax

expense, and earnings per share as if the Company’s conversion to a

C corporation had occurred as of January 1, 2018.

Additionally, in accordance with applicable provisions of the

Internal Revenue Code, the terms of the South Plains Financial,

Inc. Employee Stock Ownership Plan (“ESOP”) currently provide that

ESOP participants have the right, for a specified period of time,

to require us to repurchase shares of our common stock that are

distributed to them by the ESOP. The shares of common stock held by

the ESOP are reflected in our consolidated balance sheets as a line

item called ‘‘ESOP owned shares’’ appearing between total

liabilities and shareholders’ equity. As a result, the ESOP-owned

shares are deducted from shareholders’ equity in our consolidated

balance sheets. This repurchase right terminated upon the listing

of our common stock on the NASDAQ, which we sometimes refer to as

the ESOP Repurchase Right Termination, whereupon our repurchase

liability will be extinguished and thereafter the ESOP-owned shares

will not be deducted from shareholders’ equity. We have

disclosed the pro forma balance sheet as of March 31, 2019 to

reflect the ESOP Repurchase Right Termination.

Non-GAAP Financial Measures

Some of the financial measures included in this press release

are not measures of financial performance recognized in accordance

with generally accepted accounting principles in the United States

(“GAAP”). These non-GAAP financial measures

include Tangible Book Value Per Common Share and Tangible Common

Equity to Tangible Assets. The Company believes these

non-GAAP financial measures provide both management and investors a

more complete understanding of the Company’s financial position and

performance. These non-GAAP financial measures are supplemental and

are not a substitute for any analysis based on GAAP financial

measures. Not all companies use the same calculation of these

measures; therefore, this presentation may not be comparable to

other similarly titled measures as presented by other companies.

Reconciliation of non-GAAP financial measures, to GAAP financial

measures are provided at the end of this press release.

Forward Looking Statements

This press release contains forward-looking statements. These

forward-looking statements reflect South Plains’ current views with

respect to, among other things, the completion of the initial

public offering of its common stock. Any statements about South

Plains’ expectations, beliefs, plans, predictions, forecasts,

objectives, assumptions or future events or performance are not

historical facts and may be forward-looking. These statements are

often, but not always, made through the use of words or phrases

such as “anticipate,” “believes,” “can,” “could,” “may,”

“predicts,” “potential,” “should,” “will,” “estimate,” “plans,”

“projects,” “continuing,” “ongoing,” “expects,” “intends” and

similar words or phrases. South Plains cautions that the

forward-looking statements in this press release are based largely

on South Plains’ expectations and are subject to a number of known

and unknown risks and uncertainties that are subject to change

based on factors which are, in many instances, beyond South Plains’

control. Additional information regarding these risks and

uncertainties to which South Plains’ business and future financial

performance are subject is contained in South Plains’ Prospectus

filed with the U.S. Securities and Exchange Commission (“SEC”)

dated May 8, 2019 (“Prospectus”), and other documents South Plains

files with the SEC from time to time. South Plains urges readers of

this press release to review the Risk Factors section of that

Prospectus and the Risk Factors section of other documents South

Plains files with the SEC from time to time. Actual results,

performance or achievements could differ materially from those

contemplated, expressed, or implied by the forward-looking

statements due to additional risks and uncertainties of which South

Plains is not currently aware or which it does not currently view

as, but in the future may become, material to its business or

operating results. Due to these and other possible uncertainties

and risks, readers are cautioned not to place undue reliance on the

forward-looking statements contained in this press release. Any

forward-looking statements presented herein are made only as of the

date of this press release, and South Plains does not undertake any

obligation to update or revise any forward-looking statements to

reflect changes in assumptions, new information, the occurrence of

unanticipated events, or otherwise, except as required by law.

| Contact: |

Mikella Newsom, Chief Risk

Officer and Secretary |

|

|

mnewsom@city.bank |

|

|

(806) 792-7101 |

|

|

|

| Source: South

Plains Financial, Inc. |

|

South Plains Financial, Inc. |

|

Consolidated Financial Highlights -

(Unaudited) |

| (Dollars

in thousands, except share data) |

| |

As of and for the quarter ended |

|

|

March 31, 2019 |

|

December 31, 2018 |

|

September 30, 2018 |

|

June 30, 2018 |

|

March 31, 2018 |

|

|

Selected Income Statement Data: |

|

|

|

|

|

|

Interest income |

$ |

32,004 |

|

$ |

31,672 |

|

$ |

30,731 |

|

$ |

28,408 |

|

$ |

27,283 |

|

|

Interest expense |

|

7,458 |

|

|

7,005 |

|

|

5,943 |

|

|

4,969 |

|

|

4,565 |

|

|

Net interest income |

|

24,546 |

|

|

24,667 |

|

|

24,788 |

|

|

23,439 |

|

|

22,718 |

|

|

Provision for loan losses |

|

608 |

|

|

1,168 |

|

|

3,415 |

|

|

1,540 |

|

|

778 |

|

|

Noninterest income |

|

12,075 |

|

|

14,390 |

|

|

13,295 |

|

|

12,968 |

|

|

11,468 |

|

|

Noninterest expense |

|

30,036 |

|

|

30,498 |

|

|

28,646 |

|

|

28,422 |

|

|

27,877 |

|

|

Income tax expense |

|

1,204 |

|

|

1,528 |

|

|

1,109 |

|

|

(6,568 |

) |

|

30 |

|

|

Net income |

|

4,773 |

|

|

5,863 |

|

|

4,913 |

|

|

13,013 |

|

|

5,501 |

|

|

Net income - pro forma (2) |

|

4,773 |

|

|

5,863 |

|

|

4,913 |

|

|

5,333 |

|

|

4,648 |

|

|

Per Share Data: |

|

|

|

|

|

|

Net earnings, diluted (1) (2) |

|

0.32 |

|

|

0.40 |

|

|

0.33 |

|

|

0.36 |

|

|

0.31 |

|

|

Cash dividends declared and paid, dilutive |

|

- |

|

|

0.85 |

|

|

- |

|

|

1.04 |

|

|

0.15 |

|

| Book value, dilutive

(1) |

|

14.80 |

|

|

14.40 |

|

|

14.63 |

|

|

14.43 |

|

|

14.59 |

|

|

Selected Period End Balance Sheet Data: |

|

|

|

|

|

|

Total assets |

|

2,745,997 |

|

|

2,712,745 |

|

|

2,687,610 |

|

|

2,616,647 |

|

|

2,585,134 |

|

|

Total loans held for investment |

|

1,915,183 |

|

|

1,957,197 |

|

|

1,968,085 |

|

|

1,913,884 |

|

|

1,824,157 |

|

|

Allowance for loan losses |

|

23,381 |

|

|

23,126 |

|

|

21,073 |

|

|

21,715 |

|

|

21,969 |

|

|

Investment securities |

|

339,051 |

|

|

338,196 |

|

|

398,475 |

|

|

254,517 |

|

|

258,328 |

|

|

Noninterest-bearning deposits |

|

497,566 |

|

|

510,067 |

|

|

517,000 |

|

|

495,293 |

|

|

468,290 |

|

|

Total deposits |

|

2,304,929 |

|

|

2,277,454 |

|

|

2,261,356 |

|

|

2,183,631 |

|

|

2,159,321 |

|

|

Total stockholders' equity |

|

218,565 |

|

|

212,775 |

|

|

216,169 |

|

|

213,096 |

|

|

215,453 |

|

|

Summary Performance Ratios: |

|

|

|

|

|

|

Return on average assets |

|

0.71 |

% |

|

0.86 |

% |

|

0.74 |

% |

|

2.04 |

% |

|

0.86 |

% |

|

Return on average assets - pro forma |

|

0.71 |

% |

|

0.86 |

% |

|

0.74 |

% |

|

0.84 |

% |

|

0.73 |

% |

|

Return on average equity |

|

8.98 |

% |

|

10.85 |

% |

|

9.08 |

% |

|

24.36 |

% |

|

10.33 |

% |

|

Return on average equity - pro forma |

|

8.98 |

% |

|

10.85 |

% |

|

9.08 |

% |

|

9.98 |

% |

|

8.73 |

% |

| Net interest

margin |

|

3.93 |

% |

|

3.89 |

% |

|

4.02 |

% |

|

3.98 |

% |

|

3.87 |

% |

| Yield on

loans |

|

5.84 |

% |

|

5.67 |

% |

|

5.57 |

% |

|

5.42 |

% |

|

5.36 |

% |

| Cost of interest-bearing

deposits |

|

1.34 |

% |

|

1.26 |

% |

|

1.09 |

% |

|

0.92 |

% |

|

0.84 |

% |

|

Efficiency ratio |

|

81.79 |

% |

|

77.88 |

% |

|

74.85 |

% |

|

77.39 |

% |

|

80.74 |

% |

|

Summary Credit Quality Data: |

|

|

|

|

|

|

Nonperforming loans |

|

7,937 |

|

|

6,954 |

|

|

7,225 |

|

|

11,774 |

|

|

11,460 |

|

|

Nonperforming loans to total loans held for

investment |

|

0.41 |

% |

|

0.36 |

% |

|

0.37 |

% |

|

0.62 |

% |

|

0.63 |

% |

|

Other real estate owned |

|

2,340 |

|

|

2,285 |

|

|

2,704 |

|

|

6,590 |

|

|

2,683 |

|

|

Nonperforming assets to total assets |

|

0.37 |

% |

|

0.34 |

% |

|

0.37 |

% |

|

0.70 |

% |

|

0.55 |

% |

|

Allowance for loan losses to total loans held for

investment |

|

1.22 |

% |

|

1.18 |

% |

|

1.07 |

% |

|

1.13 |

% |

|

1.20 |

% |

| Net charge-offs to

average loans outstanding (annualized) |

|

0.07 |

% |

|

-0.18 |

% |

|

0.82 |

% |

|

0.38 |

% |

|

0.06 |

% |

|

Capital Ratios: |

|

|

|

|

|

|

Total stockholders' equity to total assets |

|

7.96 |

% |

|

7.84 |

% |

|

8.04 |

% |

|

8.14 |

% |

|

8.33 |

% |

|

Tangible common equity to tangible assets |

|

7.96 |

% |

|

7.84 |

% |

|

8.04 |

% |

|

8.14 |

% |

|

8.33 |

% |

|

Tier 1 capital to average assets |

|

9.70 |

% |

|

9.63 |

% |

|

10.09 |

% |

|

10.23 |

% |

|

10.19 |

% |

|

Common equity tier 1 to risk-weighted assets |

|

10.27 |

% |

|

9.91 |

% |

|

10.03 |

% |

|

10.35 |

% |

|

11.00 |

% |

|

Total capital to risk-weighted assets |

|

14.74 |

% |

|

14.28 |

% |

|

14.29 |

% |

|

14.54 |

% |

|

15.41 |

% |

| |

|

(1) - Reflects the ESOP Repurchase Right Termination. |

|

(2) - Assumes the Company's S Coporation revocation was effective

at the beginning of each period prior to May 31, 2018. The

Federal tax rate used was 35.0% for periods prior to January 1,

2018 and 21.0% for periods after January 1, 2018. |

|

|

|

South Plains Financial, Inc. |

|

Average Balances and Yields |

|

(Unaudited) |

For the Three Months Ended |

| |

March 31, 2019 |

|

March 31, 2018 |

| |

(Dollars in thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Interest |

|

|

|

|

|

Interest |

|

|

| |

Average |

|

Income |

|

|

|

Average |

|

Income |

|

|

| |

Balance |

|

Expense |

|

Yield |

|

Balance |

|

Expense |

|

Yield |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Loans (1) |

$ |

1,955,783 |

|

$ |

28,141 |

|

5.84 |

% |

|

$ |

1,826,391 |

|

$ |

24,158 |

|

5.36 |

% |

| Debt securities - taxable |

|

309,670 |

|

|

2,109 |

|

2.76 |

% |

|

|

118,267 |

|

|

759 |

|

2.60 |

% |

| Debt securities -

nontaxable |

|

32,172 |

|

|

286 |

|

3.61 |

% |

|

|

154,460 |

|

|

1,386 |

|

3.64 |

% |

| Other interest-bearing

assets |

|

243,610 |

|

|

1,571 |

|

2.62 |

% |

|

|

319,984 |

|

|

1,320 |

|

1.67 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Total interest-earning

assets |

|

2,541,235 |

|

|

32,107 |

|

5.12 |

% |

|

|

2,419,102 |

|

|

27,623 |

|

4.63 |

% |

| Noninterest-earning

assets |

|

176,437 |

|

|

|

|

|

|

172,891 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total

assets |

$ |

2,717,672 |

|

|

|

|

|

$ |

2,591,993 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities &

stockholders' equity |

|

|

|

|

|

|

|

|

|

|

|

| NOW, Savings, MMA's |

$ |

1,470,199 |

|

|

4,534 |

|

1.25 |

% |

|

$ |

1,360,833 |

|

|

2,409 |

|

0.72 |

% |

| Time deposits |

|

309,687 |

|

|

1,355 |

|

1.77 |

% |

|

|

324,113 |

|

|

1,084 |

|

1.36 |

% |

| Short-term borrowings |

|

22,722 |

|

|

111 |

|

1.98 |

% |

|

|

25,434 |

|

|

72 |

|

1.15 |

% |

| Notes payable & other

long-term borrowings |

|

95,000 |

|

|

539 |

|

2.30 |

% |

|

|

95,000 |

|

|

358 |

|

1.53 |

% |

| Subordinated debt

securities |

|

27,727 |

|

|

406 |

|

5.94 |

% |

|

|

20,887 |

|

|

245 |

|

4.76 |

% |

| Junior subordinated deferable

interest debentures |

|

46,393 |

|

|

513 |

|

4.48 |

% |

|

|

46,393 |

|

|

397 |

|

3.47 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Total interest-bearing

liabilities |

|

1,971,728 |

|

|

7,458 |

|

1.53 |

% |

|

|

1,872,660 |

|

|

4,565 |

|

0.99 |

% |

| Demand deposits |

|

501,120 |

|

|

|

|

|

|

473,993 |

|

|

|

|

| Other liabilities |

|

29,153 |

|

|

|

|

|

|

29,410 |

|

|

|

|

| Stockholders' equity |

|

215,671 |

|

|

|

|

|

|

215,930 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities &

stockholders' equity |

$ |

2,717,672 |

|

|

|

|

|

$ |

2,591,993 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

$ |

24,649 |

|

|

|

|

|

$ |

23,058 |

|

|

| Net interest margin (2) |

|

|

|

|

3.93 |

% |

|

|

|

|

|

3.87 |

% |

| |

|

(1) Average loan balances include nonaccrual loans and loans held

for sale. |

|

(2) Net interest margin is calculated as the annualized net income,

on a fully tax-equivalent basis, divided byaverage interest-earning

assets. |

| |

| South Plains

Financial, Inc. and Subsidiaries |

| Consolidated

Balance Sheets |

|

(Unaudited) |

| (Dollars in

thousands, except per share data) |

| |

March 31, |

|

December 31, |

|

Pro Forma March 31, |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

| ASSETS |

|

|

|

| Cash and due from banks |

$ |

37,632 |

|

|

$ |

47,802 |

|

|

$ |

37,632 |

|

| Interest-bearing deposits in

banks |

|

301,778 |

|

|

|

198,187 |

|

|

|

301,778 |

|

|

Cash and cash equivalents |

|

339,410 |

|

|

|

245,989 |

|

|

|

339,410 |

|

| Securities available for

sale |

|

339,051 |

|

|

|

338,196 |

|

|

|

339,051 |

|

| Loans held for sale |

|

21,447 |

|

|

|

38,382 |

|

|

|

21,447 |

|

| Loans held for investment |

|

1,915,183 |

|

|

|

1,957,197 |

|

|

|

1,915,183 |

|

| Allowance for loan losses |

|

(23,381 |

) |

|

|

(23,126 |

) |

|

|

(23,381 |

) |

| Accrued interest receivable |

|

9,962 |

|

|

|

12,957 |

|

|

|

9,962 |

|

| Premises and equipment, net |

|

59,572 |

|

|

|

59,787 |

|

|

|

59,572 |

|

| Bank-owned life insurance |

|

57,499 |

|

|

|

57,172 |

|

|

|

57,499 |

|

| Other assets |

|

27,254 |

|

|

|

26,191 |

|

|

|

27,254 |

|

| |

|

|

|

|

|

|

Total assets |

$ |

2,745,997 |

|

|

$ |

2,712,745 |

|

|

$ |

2,745,997 |

|

| |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

| |

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

Noninterest-bearing |

$ |

497,566 |

|

|

$ |

510,067 |

|

|

$ |

497,566 |

|

|

Interest-bearing |

|

1,807,363 |

|

|

|

1,767,387 |

|

|

|

1,807,363 |

|

| |

|

|

|

|

|

|

Total deposits |

|

2,304,929 |

|

|

|

2,277,454 |

|

|

|

2,304,929 |

|

| Short-term borrowings |

|

18,915 |

|

|

|

17,705 |

|

|

|

18,915 |

|

| Accrued expenses and other

liabilities |

|

35,723 |

|

|

|

29,416 |

|

|

|

35,723 |

|

| Notes payable & other

borrowings |

|

95,000 |

|

|

|

95,000 |

|

|

|

95,000 |

|

| Subordinated debt securities |

|

26,472 |

|

|

|

34,002 |

|

|

|

26,472 |

|

| Junior subordinated deferrable

interest debentures |

|

46,393 |

|

|

|

46,393 |

|

|

|

46,393 |

|

| |

|

|

|

|

|

|

Total liabilities |

|

2,527,432 |

|

|

|

2,499,970 |

|

|

|

2,527,432 |

|

| |

|

|

|

|

|

| Commitments and contingent

liabilities |

|

|

|

|

|

| ESOP owned shares |

|

58,195 |

|

|

|

58,195 |

|

|

|

- |

|

| |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

Common stock, $1.00 par value per share, 30,000,000 |

|

|

|

|

|

|

shares authorized; 14,771,520 issued and outstanding |

|

14,772 |

|

|

14,772 |

|

|

|

14,772 |

|

|

Additional paid-in capital |

|

80,412 |

|

|

|

80,412 |

|

|

|

80,412 |

|

|

Retained earnings |

|

123,328 |

|

|

|

119,834 |

|

|

|

123,328 |

|

|

Accumulated other comprehensive income (loss) |

|

53 |

|

|

|

(2,243 |

) |

|

|

53 |

|

|

|

|

218,565 |

|

|

|

212,775 |

|

|

|

218,565 |

|

|

Less ESOP owned shares |

|

58,195 |

|

|

|

58,195 |

|

|

|

- |

|

|

Total stockholder' equity |

|

160,370 |

|

|

|

154,580 |

|

|

|

218,565 |

|

| |

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

2,745,997 |

|

|

$ |

2,712,745 |

|

|

$ |

2,745,997 |

|

| |

|

|

|

|

|

| South

Plains Financial, Inc. and Subsidiaries |

|

Consolidated Statements of Income |

|

(Unaudited) |

| (Dollars

in thousands, except per share data) |

| |

Three Months Ended March 31, |

| |

|

|

|

|

Pro Forma |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2018 |

|

| Interest income: |

|

|

|

|

|

|

Loans, including fees |

$ |

28,098 |

|

|

$ |

24,109 |

|

|

$ |

24,109 |

|

|

Securities: |

|

|

|

|

|

|

Taxable |

|

2,176 |

|

|

|

795 |

|

|

|

795 |

|

|

Non taxable |

|

225 |

|

|

|

1,095 |

|

|

|

1,095 |

|

|

Federal funds sold and interest-bearing deposits in banks |

|

1,505 |

|

|

|

1,284 |

|

|

|

1,284 |

|

| |

|

|

|

|

|

|

Total interest income |

|

32,004 |

|

|

|

27,283 |

|

|

|

27,283 |

|

| |

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

Deposits |

|

5,889 |

|

|

|

3,493 |

|

|

|

3,493 |

|

|

Notes payable & other borrowings |

|

650 |

|

|

|

430 |

|

|

|

430 |

|

|

Subordinated debt securities |

|

406 |

|

|

|

245 |

|

|

|

245 |

|

|

Junior subordinated deferrable interest debentures |

|

513 |

|

|

|

397 |

|

|

|

397 |

|

| |

|

|

|

|

|

|

Total interest expense |

|

7,458 |

|

|

|

4,565 |

|

|

|

4,565 |

|

| |

|

|

|

|

|

| Net interest income |

|

24,546 |

|

|

|

22,718 |

|

|

|

22,718 |

|

| Provision for loan losses |

|

608 |

|

|

|

778 |

|

|

|

778 |

|

| |

|

|

|

|

|

|

Net interest income, after provision for loan losses |

|

23,938 |

|

|

|

21,940 |

|

|

|

21,940 |

|

| |

|

|

|

|

|

| Noninterest income: |

|

|

|

|

|

|

Service charges on deposit accounts |

|

1,905 |

|

|

|

1,917 |

|

|

|

1,917 |

|

|

Income from insurance activities |

|

1,750 |

|

|

|

1,395 |

|

|

|

1,395 |

|

|

Net gain on sales of loans |

|

4,660 |

|

|

|

4,311 |

|

|

|

4,311 |

|

|

Bank card services and interchange fees |

|

2,010 |

|

|

|

1,958 |

|

|

|

1,958 |

|

|

Investment commissions |

|

333 |

|

|

|

450 |

|

|

|

450 |

|

|

Other |

|

1,417 |

|

|

|

1,437 |

|

|

|

1,437 |

|

| |

|

|

|

|

|

|

Total noninterest income |

|

12,075 |

|

|

|

11,468 |

|

|

|

11,468 |

|

| |

|

|

|

|

|

| Noninterest expense: |

|

|

|

|

|

|

Salaries and employee benefits |

|

19,125 |

|

|

|

17,601 |

|

|

|

17,601 |

|

|

Occupancy and equipment, net |

|

3,407 |

|

|

|

3,324 |

|

|

|

3,324 |

|

|

Professional services |

|

1,706 |

|

|

|

1,429 |

|

|

|

1,429 |

|

|

Marketing and development |

|

717 |

|

|

|

818 |

|

|

|

818 |

|

|

IT and data services |

|

693 |

|

|

|

550 |

|

|

|

550 |

|

|

Bank card expenses |

|

724 |

|

|

|

664 |

|

|

|

664 |

|

|

Appraisal expenses |

|

323 |

|

|

|

285 |

|

|

|

285 |

|

|

Other |

|

3,341 |

|

|

|

3,206 |

|

|

|

3,206 |

|

| |

|

|

|

|

|

|

Total noninterest expense |

|

30,036 |

|

|

|

27,877 |

|

|

|

27,877 |

|

| |

|

|

|

|

|

| Income before income

taxes |

|

5,977 |

|

|

|

5,531 |

|

|

|

5,531 |

|

| Income tax expense |

|

1,204 |

|

|

|

30 |

|

|

|

883 |

|

| |

|

|

|

|

|

|

Net income |

$ |

4,773 |

|

|

$ |

5,501 |

|

|

$ |

4,648 |

|

| |

|

|

|

|

|

| South

Plains Financial, Inc. and Subsidiaries |

| Loan

Portfolio Composition |

|

(Unaudited) |

| (Dollars

in thousands, except per share data) |

| |

As of |

| |

March 31, 2019 |

|

December 31, 2018 |

|

March 31, 2018 |

| |

|

| Loans: |

|

|

|

|

|

|

Commercial Real Estate |

$ |

528,598 |

|

$ |

538,037 |

|

$ |

526,339 |

| Commercial - Specialized |

|

258,975 |

|

|

305,022 |

|

|

273,805 |

| Commercial - General |

|

413,093 |

|

|

427,728 |

|

|

418,426 |

| Consumer: |

|

|

|

|

|

|

1-4 Family Residential |

|

354,981 |

|

|

346,153 |

|

|

304,906 |

|

Auto Loans |

|

200,366 |

|

|

191,647 |

|

|

158,534 |

|

Other Consumer |

|

71,939 |

|

|

70,209 |

|

|

66,722 |

| Construction |

|

87,231 |

|

|

78,401 |

|

|

75,425 |

| Total loans held for

investment |

$ |

1,915,183 |

|

$ |

1,957,197 |

|

$ |

1,824,157 |

| |

|

|

|

|

|

|

|

|

| South

Plains Financial, Inc. and Subsidiaries |

| Deposit

Composition |

|

(Unaudited) |

| (Dollars

in thousands, except per share data) |

| |

As of |

| |

March 31, 2019 |

|

December 31, 2018 |

|

March 31, 2018 |

| |

(Dollars in thousands except share data) |

|

Deposits: |

|

|

|

|

|

|

Noninterest-bearing demand deposits |

$ |

497,566 |

|

$ |

510,067 |

|

$ |

468,290 |

| NOW & other transaction

accounts |

|

285,962 |

|

|

277,041 |

|

|

281,873 |

| MMDA & other savings |

|

1,204,702 |

|

|

1,178,809 |

|

|

1,087,044 |

| Time deposits |

|

316,699 |

|

|

311,537 |

|

|

322,114 |

| Total

deposits |

$ |

2,304,929 |

|

$ |

2,277,454 |

|

$ |

2,159,321 |

| |

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

Our accounting and reporting policies conform to GAAP and the

prevailing practices in the banking industry. However, we also

evaluate our performance based on certain additional financial

measures discussed in this press release as being non-GAAP

financial measures. We classify a financial measure as being a

non-GAAP financial measure if that financial measure excludes or

includes amounts, or is subject to adjustments that have the effect

of excluding or including amounts, that are included or excluded,

as the case may be, in the most directly comparable measure

calculated and presented in accordance with GAAP as in effect from

time to time in the United States in our statements of income,

balance sheets or statements of cash flows. Non-GAAP financial

measures do not include operating and other statistical measures or

ratios or statistical measures calculated using exclusively either

financial measures calculated in accordance with GAAP, operating

measures or other measures that are not non-GAAP financial measures

or both.

The non-GAAP financial measures that we discuss in this press

release should not be considered in isolation or as a substitute

for the most directly comparable or other financial measures

calculated in accordance with GAAP. Moreover, the manner in which

we calculate the non-GAAP financial measures that we discuss in

this press release may differ from that of other companies

reporting measures with similar names. It is important to

understand how other banking organizations calculate their

financial measures with names similar to the non-GAAP financial

measures we have discussed in this press release when comparing

such non-GAAP financial measures.

Tangible Book Value Per Common Share. Tangible book value per

share is a non-GAAP measure generally used by investors, financial

analysts and investment bankers to evaluate financial institutions.

The most directly comparable GAAP financial measure for tangible

book value per common share is book value per common share. We

believe that the tangible book value per common share measure is

important to many investors in the marketplace who are interested

in changes from period to period in book value per common share

exclusive of changes in intangible assets. Goodwill and other

intangible assets have the effect of increasing total book value

while not increasing our tangible book value.

As we did not have any goodwill or other intangible assets for

the periods presented, our tangible book value per common share for

such periods ended was the same as our respective book value per

common share.

Tangible Common Equity to Tangible Assets. Tangible common

equity to tangible assets is a non-GAAP measure generally used by

investors, financial analysts and investment bankers to evaluate

financial institutions. We calculate tangible common equity, as

described above, and tangible assets as total assets less goodwill,

core deposit intangibles and other intangible assets, net of

accumulated amortization. The most directly comparable GAAP

financial measure for tangible common equity to tangible assets is

total common shareholders’ equity to total assets. We believe that

this measure is important to many investors in the marketplace who

are interested in the relative changes from period to period of

tangible common equity to tangible assets, each exclusive of

changes in intangible assets. Goodwill and other intangible assets

have the effect of increasing both total shareholders’ equity and

assets while not increasing our tangible common equity or tangible

assets.

As we did not have any goodwill or other intangible assets for

the periods presented, our tangible common equity to tangible

assets for such periods ended was the same as our respective common

shareholders’ equity to total assets.

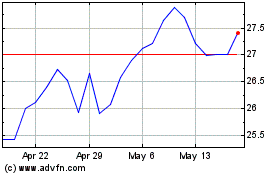

South Plains Financial (NASDAQ:SPFI)

Historical Stock Chart

From Jun 2024 to Jul 2024

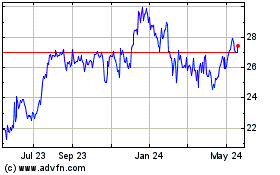

South Plains Financial (NASDAQ:SPFI)

Historical Stock Chart

From Jul 2023 to Jul 2024