ProShares Announces ETF Share Splits

05 August 2020 - 12:35AM

Business Wire

Q&A on Splits and Reverse Splits

ProShares, a premier provider of ETFs, announced today forward

and reverse share splits on eleven of its ETFs. The splits will not

change the total value of a shareholder's investment.

Forward Splits

Five ETFs will forward split their shares at the following split

ratios:

Ticker

ProShares ETF

Split Ratio

UBT

Ultra 20+ Year Treasury

2:1

QLD

Ultra QQQ

2:1

SSO

Ultra S&P500

2:1

UCC

Ultra Consumer Services

2:1

ROM

Ultra Technology

4:1

All forward splits will be effective prior to market open on

August 18, 2020, when the funds will begin trading at their

post-split price. The ticker symbols and

CUSIP numbers for the funds will not change.

The forward splits will decrease the price per share of each

fund with a proportionate increase in the number of shares

outstanding. For example, for a 3-for-1 split, every pre-split

share will result in the receipt of three post-split shares, which

will be priced at one-third the net asset value (“NAV”) of a

pre-split share.

Illustration of a Forward Split

The following table shows the effect of a hypothetical 3-for-1

split:

Period

# of Shares Owned

Hypothetical NAV

Value of Shares

Pre-Split

100

$120.00

$12,000.00

Post-Split

300

$40.00

$12,000.00

Reverse Splits

Six ETFs will reverse split shares at the following split

ratios:

Ticker

ProShares ETF

Split Ratio

Old CUSIP

New CUSIP

SQQQ

UltraPro Short QQQ

1:5

74347G408

74347G861

REW

UltraShort Technology

1:4

74347G101

74347G853

SSG

UltraShort Semiconductors

1:4

74347G200

74347G846

BIS

UltraShort Nasdaq Biotechnology

1:4

74347B789

74347G838

SZK

UltraShort Consumer Goods

1:2

74347R115

74347G820

SCC

UltraShort Consumer Services

1:2

74348A236

74347G812

All reverse splits will be effective prior to market open on

August 18, 2020, when the funds will begin trading at their

post-split price. The ticker symbols for the funds will not change.

The funds will be issued new CUSIP numbers, listed above.

The reverse splits will increase the price per share of each

fund with a proportionate decrease in the number of shares

outstanding. For example, for a one-for-four reverse split, every

four pre-split shares will result in the receipt of one post-split

share, which will be priced four times higher than the NAV of a

pre-split share.

Illustration of a Reverse Split

The following table shows the effect of a hypothetical

one-for-four reverse split:

Period

# of Shares Owned

Hypothetical NAV

Value of Shares

Pre-Split

1,000

$10.00

$10,000.00

Post-Split

250

$40.00

$10,000.00

Fractional Shares from Reverse Splits

For shareholders who hold quantities of shares that are not an

exact multiple of the reverse split ratio (for example, not a

multiple of four for a one-for-four reverse split), the reverse

split will result in the creation of a fractional share.

Post-reverse split fractional shares will be redeemed for cash.

Proceeds will be sent to your broker of record. This redemption may

cause some shareholders to realize gains or losses, which could be

a taxable event for those shareholders.

About ProShares

ProShares has been at the forefront of the ETF revolution since

2006. ProShares now offers one of the largest lineups of ETFs, with

more than $40 billion in assets. The company is the leader in

strategies such as dividend growth, interest rate hedged bond and

geared (leveraged and inverse) ETF investing. ProShares continues

to innovate with products that provide strategic and tactical

opportunities for investors to manage risk and enhance returns.

ProShares is the leader in strategies such as dividend growth,

interest rate hedged bond and geared (leveraged and inverse) ETF

investing. Source: ProShares, 2020.

Geared (leveraged or short) ProShares ETFs seek returns that are

a multiple of (e.g., 2x or -2x) the return of a benchmark (target)

for a single day, as measured from one NAV calculation to

the next. Due to the compounding of daily returns, holding periods

of greater than one day can result in returns that are

significantly different than the target return and ProShares'

returns over periods other than one day will likely differ in

amount and possibly direction from the target return for the same

period. These effects may be more pronounced in funds with larger

or inverse multiples and in funds with volatile benchmarks.

Investors should monitor their holdings as frequently as daily.

Investors should consult the prospectus for further details on the

calculation of the returns and the risks associated with investing

in this product. Investing involves risk, including the possible

loss of principal. Geared ProShares ETFs are non-diversified and

entail certain risks, including risk associated with the use of

derivatives (swap agreements, futures contracts and similar

instruments), imperfect benchmark correlation, leverage and market

price variance, all of which can increase volatility and decrease

performance. Short ProShares ETFs should lose money when their

benchmarks or indexes rise. Please see their summary and full

prospectuses for a more complete description of risks. There is no

guarantee any ProShares ETF will achieve its investment

objective.

Carefully consider the investment objectives, risks, charges

and expenses of ProShares before investing. This and other

information can be found in their summary and full prospectuses.

Read them carefully before investing.

Investing involves risk, including the possible loss of

principal. Geared ProShares ETFs are non-diversified and entail

certain risks, including risk associated with the use of

derivatives (swap agreements, futures contracts and similar

instruments), imperfect benchmark correlation, leverage and market

price variance, all of which can increase volatility and decrease

performance. Short ProShares ETFs should lose money when their

benchmarks or indexes rise. Please see their summary and full

prospectuses for a more complete description of risks. There is no

guarantee any ProShares ETF will achieve its investment

objective.

ProShares are distributed by SEI Investments Distribution Co.,

which is not affiliated with the funds' advisor or sponsor.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200804005709/en/

Media: Tucker Hewes, Hewes Communications, Inc.,

212.207.9451, tucker@hewescomm.com

Investors: ProShares, 866.776.5125, ProShares.com

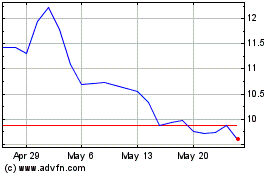

ProShares UltraPro Short... (NASDAQ:SQQQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

ProShares UltraPro Short... (NASDAQ:SQQQ)

Historical Stock Chart

From Dec 2023 to Dec 2024