UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement. |

| ☐ |

Confidential, for use of the Commission Only (as permitted by Rule 14a- 6(e)(2)). |

| ☒ |

Definitive Proxy Statement. |

| ☐ |

Definitive Additional Materials. |

| ☐ |

Soliciting Material Pursuant to § 240.14a-12.

|

Thornburg Income Builder Opportunities Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was

determined): |

|

|

|

|

|

|

|

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

|

|

|

|

(5) |

|

Total fee paid: |

|

|

|

|

|

|

|

|

|

|

| ☐ |

|

Fee paid previously with preliminary materials: |

|

|

| ☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount Previously Paid: |

|

|

|

|

|

|

|

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

|

|

|

|

(3) |

|

Filing Party: |

|

|

|

|

|

|

|

|

|

|

(4) |

|

Date Filed: |

|

|

|

|

|

|

|

|

THORNBURG INCOME BUILDER OPPORTUNITIES TRUST

2300 North Ridgetop Road

Santa

Fe, NM 87506

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held March 14, 2024

Thornburg Income

Builder Opportunities Trust (the “Trust”), a Delaware statutory trust, will host an Annual Meeting of Shareholders on March 14, 2024 at the principal executive offices of the Trust, 2300 North Ridgetop Road, Santa Fe, NM, 87506 at

9:00 a.m. (Mountain Time) (the “Annual Meeting” or “Meeting”). The Annual Meeting is being held so that shareholders can consider the following proposals:

| |

1. |

To elect two (2) Class II Trustees of the Trust. |

| |

2. |

To transact such other business as may properly come before the Annual Meeting or any adjournments or

postponements thereof. |

THE BOARD OF TRUSTEES OF THE TRUST UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF THE

NOMINEES.

Shareholders of record of the Trust at the close of business on January 19, 2024 are entitled to notice of and to vote at the Annual

Meeting and any adjournment(s) thereof. The Notice of the Annual Meeting of Shareholders, proxy statement and proxy card are being mailed on or about February 12, 2024 to such shareholders of record.

|

| By Order of the Board of Trustees, |

|

| /s/ Nimish S. Bhatt |

| Nimish S. Bhatt |

| President of the Trust |

February 5, 2024

YOUR

VOTE IS IMPORTANT

You can vote easily by mail, by toll-free telephone number or, by using the Internet. Just follow the simple instructions that

appear on your proxy card. Please help the Trust reduce the need to conduct telephone solicitation and/or follow-up mailings by voting today.

1

THORNBURG INCOME BUILDER OPPORTUNITIES TRUST

February 5, 2024

To the Shareholders of the Trust,

Thank you for your investment in the Trust. You are invited to attend an annual meeting of shareholders (the “Annual Meeting” or

“Meeting”) of Thornburg Income Builder Opportunities Trust (the “Trust”). The Meeting will occur on March 14, 2024 at the principal executive offices of the Trust, 2300 North Ridgetop Road, Santa Fe, NM, 87506. The Annual

Meeting will be held at 9:00 a.m. (Mountain Time). Formal notice of the Meeting and the Proxy Statement for the Meeting follows this letter.

At the

Meeting, you are being asked to vote on the following matters and to transact such other business, if any, as may properly come before the Meeting:

| |

1. |

The election of two (2) Class II Trustees to the Board of Trustees (the “Board”) of the

Trust. |

The Board of the Trust unanimously recommends that shareholders vote FOR the election of the nominees.

I encourage you to exercise your rights in governing the Trust by voting on the proposal. Your vote is important.

Whether or not you expect to attend the Meeting, it is important that your shares be represented. Your immediate response will help reduce the need for the

Trust to conduct additional proxy solicitations. Please review the proxy statement and then vote by mail, by toll-free telephone number or, by using the Internet as soon as possible. If you vote by mail, please sign and return the proxy card

included in this package. If you have any questions regarding the proposal or the voting process, please call Computershare Fund Services at 888-815-3880.

|

| Sincerely, |

|

| /s/ Nimish S. Bhatt |

| Nimish S. Bhatt |

| President of the Trust |

1

SUMMARY OF IMPORTANT INFORMATION CONTAINED

IN THIS PROXY STATEMENT

| Q. |

Why am I receiving this proxy statement? |

| A. |

You are being asked to vote on one important matter affecting the Trust, the election of two

(2) Class II Trustees. |

| Q. |

Why am I being asked to vote? |

| A. |

The Trust is required to hold an annual meeting of shareholders for the election of members of the Board. The

Trust’s Board is divided into three classes, each class having a term of three years. Each year, the term of office for one class will expire and the Trustees within that class or new Trustee nominees will be required to stand for election. For

the Trust, the Class II Trustees’ terms are currently up for election. Nimish S. Bhatt and Dina A. Tantra have been designated as nominees for re-election as Class II Trustees of the Trust. More

information about the Trustees is available in the Proxy Statement. |

| Q. |

Who can vote on this proposal? |

| A. |

Shareholders of record at the close of business on January 19, 2024 of the Trust are able to vote.

|

| Q. |

How many of the proposed individuals will be Independent Trustees if

re-elected? |

| A. |

Class II Trustee Dina A. Tantra is currently an Independent Trustee and is expected to remain an

Independent Trustee if re-elected by shareholders. |

| Q. |

When will the proposed individuals take office? |

| A. |

Class II Trustees Nimish S. Bhatt and Dina A. Tantra are currently Trustees and are expected to continue

serving on the Trust’s Board following re-election at the Annual Meeting. |

| Q. |

What shareholder vote is required for the election of Trustees to the Board of the Trust?

|

| A. |

For the Trust, the affirmative vote of a majority of the shares present or represented by proxy and entitled to

vote at the Annual Meeting will be required to elect the Trustee nominees of the Trust, provided a quorum is present. A “majority of the shares” means the number of votes cast “FOR” a Trustee nominee must exceed the number of

votes cast “AGAINST” that nominee. Broker non-votes will be excluded from the denominator of the calculation of the number of votes required to approve any proposal to adjourn a meeting.

|

| Q. |

How does the Board recommend that I vote? |

| A. |

The Board recommends that you vote FOR the proposal for the election of the Trustees to the Board of the Trust

as outlined in the Proxy Statement. |

| Q. |

I have only a few shares — does my vote matter? |

| A. |

Your vote is important. If many shareholders choose not to vote, the Trust might not receive enough votes to

reach a quorum to hold the Meeting. If it appears that there will not be a quorum, the Trust would have to send additional mailings or otherwise solicit shareholders to try to obtain more votes. |

| Q. |

What is the deadline for submitting my vote? |

| A. |

We encourage you to vote as soon as possible to make sure that the Trust receives enough votes to act on the

proposal. Unless you attend the Meeting to vote in person, your vote (cast by paper proxy cards as described below) must be received by the Trust for the Annual Meeting by 9:00 a.m. (Mountain Time). |

1

| A. |

You may vote in any of the following ways: |

| |

• |

|

By mailing in your proxy card. |

| |

• |

|

Vote via the telephone or via Internet in advance of the Meeting (follow the instructions on the proxy card).

|

| |

• |

|

In person at the Meeting at the principal executive offices of the Trust on March 14, 2024.

|

| Q. |

Who should I call if I have questions? |

| A. |

If you have any questions regarding the proposal or the voting process, please call Computershare Fund Services

at (888) 815-3880 . |

| Q. |

How should I sign the proxy card? |

| A. |

You should sign your name exactly as it appears on the proxy card. Unless you have instructed us otherwise,

either owner of a joint account may sign the card, but again, the owner must sign the name exactly as it appears on the card. The proxy card for accounts of which the signer is not the owner should be signed in a way that indicates the signer’s

authority—for example, “Mary Smith, Custodian.” |

| Q. |

Will the Trust pay for the proxy solicitation and related legal costs? |

| A. |

The expenses incurred in connection with preparing the Proxy Statement and its enclosures will be paid by the

Trust. |

2

THORNBURG INCOME BUILDER OPPORTUNITIES TRUST

2300 North Ridgetop Road

Santa

Fe, NM 87506

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

to held on March 14, 2024 at 9:00 a.m. (Mountain Time)

Introduction

This Proxy Statement is furnished in

connection with the solicitation of proxies by the Board of Trustees (the “Board”) of Thornburg Income Builder Opportunities Trust (the “Trust”), a Delaware statutory trust, for use at the Annual Meeting of Shareholders of the

Trust (the “Annual Meeting” or “Meeting”) to be held on March 14, 2024, at 9:00 a.m. (Mountain Time), at the principal executive offices of the Trust, 2300 North Ridgetop Road, Santa Fe, NM, 87506, and at any adjournments or

postponements thereof. The following table identifies the proposals set forth in this proxy statement.

|

|

|

Proposal

Number |

|

Proposal Description |

| 1 |

|

To elect two (2) Class II Trustees of the Trust. |

| 2 |

|

To consider and vote upon such other matters, including adjournments, as may properly come before the Meeting or any adjournments thereof. |

The Board of the Trust unanimously recommends that shareholders vote FOR the election of the applicable nominees.

You will find this proxy statement divided into three parts:

Part 1 Provides details on the proposal to elect Trustees to the Board of the Trust (see page 3).

Part 2 Provides information about ownership of shares of the Trust (see page 14).

Part 3 Provides other information on the Trust, voting, and the Meeting (see page 15).

A Notice of the Annual Meeting of Shareholders and a proxy card accompany this Proxy Statement, which is expected to be mailed to shareholders on or about

February 12, 2024.

The close of business on January 19, 2024 has been fixed as the record date (the “Record Date”) for the

determination of shareholders entitled to notice of and to vote at the Annual Meeting. The Trust has one class of stock: common shares with a par value of $0.001 per share. Throughout this Proxy Statement, common shares of the Trust will be

referred to as “Common Shares” and, unless the context otherwise requires, Common Shares will generally be referred to as “Shares.” Shareholders of record on the Record Date are entitled to one vote for each Share the shareholder

owns and a pro rata fractional vote for any fractional Share the shareholder owns.

Please read the Proxy Statement before voting on the proposal. If

you have any questions regarding the proposal or the voting process, please call Computershare Fund Services at (888) 815-3880.

1

Important Notice Regarding the Availability of Materials

for the Meeting to be Held on March 14, 2024

The Proxy Statement for the Meeting is available at https://www.proxy-direct.com/tbl-33722. Please call 1-877-847-0200 on how to obtain directions to be able to attend the Meeting and vote in person.

Annual and Semi-Annual Reports. The Trust’s most recent annual and semi-annual reports to shareholders are available, upon request, at no cost.

You may view these reports at the Trust’s website at https://www.thornburg.com/investments/closed-end-funds/. You may also request a report by calling

toll-free at 1-800-847-0200 or via email at fundaccounting@thornburg.com.

2

PART 1

PROPOSAL 1

ELECTION OF TRUSTEES

The proposal relates to the election of two (2) Class II Trustees of the Trust.

Under the organizational documents of the Thornburg Income Builder Opportunities Trust (the “Trust”), the Trust’s Board of Trustees (the

“Board”) is divided into three classes of trustees serving staggered three-year terms. The current terms of the first, second and third classes of Trustees will expire at the annual meetings of shareholders (or special meetings in lieu

thereof) in following years: Class I, 2026; Class II, 2024; and Class III, 2025; or, if later, in each case, until their successors are duly elected and qualify, or until a Trustee sooner dies, retires, resigns, is declared bankrupt

or incompetent by a court of appropriate jurisdiction or is removed as provided in the governing documents of the Trust. At each subsequent annual meeting, the class of Trustees whose terms are expiring, will be nominated to serve for three-year

terms or until their successors are duly elected and qualify, and at each annual meeting, one class of Trustees will be elected by the shareholders.

At

the Trust’s Annual Meeting, two Class II Trustees are to be elected by all shareholders. Class II Trustees Nimish S. Bhatt and Dina A. Tantra have been designated as nominees for election as Class II Trustees for a term expiring

at the annual meeting of shareholders in 2027 or until their successors have been duly elected and qualify. Trustees Benjamin D. Kirby and Anne W. Kritzmire (the Class I Trustees) and Brian W. Wixted (the Class III Trustee) are current and

continuing Trustees.

MANAGEMENT

Management of the Trust

The management of the Trust,

including general supervision of the duties performed for the Trust under the investment management agreement between the Trust and Thornburg Investment Management, Inc. (the “Adviser”), is the responsibility of the Board. The Board

consists of five (5) trustees (“Trustees”) of which three (3) are not considered to be interested persons (as the term “interested person” is defined in the Investment Company Act of 1940, as amended (the “1940

Act”) (referred to herein as “Independent Trustees”)). The Trustees set broad policies for the Trust, choose the Trust’s officers and hire the Adviser. The officers of the Trust manage the day-to-day operations of the Trust and serve at the pleasure of the Trust’s Board.

The following is a list

of Trustees and officers of the Trust and a statement of their present positions, principal occupations during the past five years, the number of portfolios each Trustee oversees and the other directorships held by the Trustees during the past

five years, if applicable. There are no familial relationships among the officers and Trustees. Except as otherwise noted, the address for all Trustees and officers is 2300 North Ridgetop Road, Santa Fe, NM, 87506.

3

|

|

|

|

|

|

|

|

NAME, YEAR OF BIRTH,

YEAR ELECTED

POSITION HELD WITH TRUST

|

|

PRINCIPAL OCCUPATION(S) DURING PAST FIVE

YEARS

|

|

NUMBER OF

PORTFOLIOS

IN

FUND COMPLEX(1)

OVERSEEN

BY

TRUSTEE |

|

OTHER

DIRECTORSHIPS

HELD BY TRUSTEE

|

| INTERESTED TRUSTEES(2)(3) |

|

|

|

|

| Nimish Bhatt(4)

Year of Birth: 1963 Trustee Since 2020 |

|

President of the Trust (since September 2023); Managing Director, Chief Financial Officer and Treasurer of Thornburg Investment Management, Inc. and Principal Financial Officer and Treasurer of Thornburg Securities LLC since 2016;

Secretary of Thornburg Securities LLC (2018-2022); President of Thornburg Investment Trust (since September 2023); Chief Financial Officer of Thornburg Investment Trust (2019-2023); Treasurer of Thornburg Investment Trust (2016-2019); Secretary of

Thornburg Investment Trust (2018-2019). |

|

1 |

|

None |

|

|

|

|

| Ben Kirby(5)

Year of Birth: 1979 Trustee since 2020 |

|

Head of Investments since 2019, and Portfolio Manager and Managing Director since 2013, of Thornburg Investment Management, Inc; Vice President of Thornburg Investment Trust since 2014. |

|

1 |

|

None |

|

| INDEPENDENT TRUSTEES(2)(3) |

|

|

|

|

| Anne Kritzmire Year of Birth: 1962

Trustee since 2020, Lead Independent Trustee |

|

Principal AW Kritzmire Consulting (business and leadership consulting) since 2021, Head of Multi-Asset/Solutions Marketing at Nuveen Investments (global asset manager) (2018-2020); Managing Director, |

|

1 |

|

None |

|

|

|

|

|

|

Closed-End Funds (2012-2018; 2005-2010), Managing Director, Channel Marketing (2011-2012) at Nuveen Investments; Business Leader Faculty, Lake Forest Graduate School of Management

(2021-present); Partner, YourTrueNote Consulting (2021-2023). |

|

|

|

|

|

|

|

|

| Dina Tantra Year of Birth: 1969

Trustee since 2020, Chair of Nominating

and Corporate Governance Committee |

|

Co-founder/Chief Executive Officer of Global Rhino (asset management consulting) since 2018; Chief Strategy Officer of JOOT (asset management consulting) (2019-2023); Executive Vice President,

Ultimus Fund Solutions (2017-2018). |

|

1 |

|

Advisers Investment Trust (2012-2017), Boston

Trust Walden Funds (2021-present), Heartland Funds (April

2022-present) |

|

|

|

|

| Brian Wixted Year of Birth: 1959

Trustee since 2020, Chair of Audit Committee |

|

Principal Consultant at CKC Consulting Corporation (asset management consulting) since 2017; Senior Vice President - Finance and Fund Treasurer, Oppenheimer Funds, Inc. (1999-2016). |

|

1 |

|

Lincoln Variable Insurance Products Trust

(104 funds) (2019 -

present) |

4

|

|

|

|

|

|

|

|

NAME, YEAR OF BIRTH,

YEAR ELECTED

POSITION HELD WITH TRUST

|

|

PRINCIPAL OCCUPATION(S) DURING PAST FIVE

YEARS

|

|

NUMBER OF

PORTFOLIOS

IN

FUND COMPLEX(1)

OVERSEEN

BY

TRUSTEE |

|

OTHER

DIRECTORSHIPS

HELD BY TRUSTEE

|

|

| OFFICERS OF THE TRUST (WHO ARE NOT TRUSTEES)(2) |

|

|

|

|

| Randy Dry Year of Birth: 1974

Vice President since 2021 |

|

Managing Director, Chief Operating Officer since 2020 of Thornburg Investment Management, Vice President of Thornburg Investment Trust since 2014. |

|

Not applicable |

|

Not applicable |

|

|

|

|

| Curtis Holloway Year of Birth: 1967

Treasurer and Chief Financial Officer

since 2020 |

|

Managing Director, Director of Finance since 2021 and Director of Fund Administration of Thornburg Investment Management, Inc.; Treasurer of Thornburg Investment Trust since 2019; Senior Vice President, Head of Fund Administration

(2017-2019) of Calamos Investments, and Chief Financial Officer (2017-2019) and Treasurer (2010-2019) of Calamos Funds. |

|

Not applicable |

|

Not applicable |

|

|

|

|

| Jeff Klingelhofer Year of Birth: 1981

Vice President since 2021 |

|

Head of Investments since 2019, Portfolio Manager and Managing Director since 2015, Associate Portfolio Manager (2012-2015) of Thornburg Investment Management, Inc; Vice President of Thornburg Investment Trust since 2016. |

|

Not applicable |

|

Not applicable |

|

|

|

|

| Vilayphone Lithiluxa Year of Birth: 1970

Assistant Treasurer since 2020 |

|

Managing Director, Tax Director, Fund Administration of Thornburg Investment Management, Inc.; Vice President of Thornburg Investment Trust (2017-2020); Assistant Treasurer of Thornburg Investment Trust since 2020; Senior Vice

President, Citi Fund Services, Inc. (2014-2017); Vice President, Citi Fund Services, Inc. (2007-2014). |

|

Not applicable |

|

Not applicable |

|

|

|

|

| Christopher Luckham Year of Birth: 1976

Assistant Treasurer since 2022 |

|

Senior Manager, Fund Administration of Thornburg Investment Management, Inc. since 2010. |

|

Not applicable |

|

Not applicable |

|

|

|

|

| Natasha Rippel Year of Birth: 1982

Secretary since 2021 |

|

Managing Director since 2022, Director of Fund Operations since 2021, Supervisor of Fund Operations (2017-2021) of Thornburg Investment Management, Inc.; Secretary of Thornburg Investment Trust since 2021. |

|

Not applicable |

|

Not applicable |

|

|

|

|

| Stephen Velie Year of Birth: 1967

Chief Compliance Officer since 2020 |

|

Chief Compliance Officer of Thornburg Investment Trust and Thornburg Investment Management, Inc. since 2009. |

|

Not applicable |

|

Not applicable |

| (1) |

The Fund Complex consists of the Trust, and Thornburg Investment Trust, a mutual fund trust comprised of 24

separate investment “funds” or “series.” |

5

| (2) |

Each person’s address is 2300 North Ridgetop Road, Santa Fe, New Mexico 87506. |

| (3) |

The Bylaws of the Trust currently require that each Independent Trustee shall retire by the end of the calendar

year during which the Trustee reached the age of 75 years. Otherwise each Trustee serves in office until the election and qualification of a successor or until the Trustee sooner dies, resigns, retires or is removed. |

| (4) |

Mr. Bhatt is considered an “interested” Trustee under the Investment Company Act of 1940 because

he is a managing director and the chief financial officer of Thornburg Investment Management, Inc. |

| (5) |

Mr. Kirby is considered an “interested” Trustee under the Investment Company Act of 1940 because

he is a managing director and a portfolio manager of Thornburg Investment Management, Inc. |

Board Leadership Structure. The

Board, which has overall responsibility for the oversight of the Trust’s investment programs and business affairs, believes that it has structured itself in a manner that allows it to effectively perform its oversight obligations. Nimish S.

Bhatt, the Chair of the Board, is not an Independent Trustee. The Board believes that the use of an interested trustee as Chair is the appropriate leadership structure for the Trust given (i) Mr. Bhatt’s role in the day to day

operations of the Adviser, (ii) the extent to which the work of the Board is conducted through the Audit Committee of the Board (the “Audit Committee”) and the Nominating and Corporate Governance Committee of the Board (the

“Nominating and Corporate Governance Committee”), each of which is chaired by an Independent Trustee, (iii) the frequency that Independent Trustees meet with their independent legal counsel and auditors in the absence of members of

the Board who are interested trustees of the Trust and management, and (iv) the overall sophistication of the Independent Trustees, both individually and collectively.

The members of the Board will also complete an annual self-assessment during which the Trustees review their overall structure and consider where and how

their structure remains appropriate in light of the Trust’s current circumstances. The Chair’s role is to preside at all meetings of the Board and in between meetings of the Board to generally act as the liaison between the Board and the

Trust’s officers, attorneys and various other service providers, including but not limited to the Adviser and other such third parties servicing the Trust. The Board believes that having an interested person serve as Chair of the Board enables

the Chair to more effectively carry out these liaison activities. The Board also believes that it benefits during its meetings from having a person intimately familiar with the operations of the Trust to set the agenda for meetings of the Board to

ensure that important matters are brought to the attention of and considered by the Board.

The Trust has two standing committees, each of which enhances

the leadership structure of the Board: the Audit Committee and the Nominating and Corporate Governance Committee. The Audit Committee and Nominating and Corporate Governance Committee are each chaired by, and composed of, members who are Independent

Trustees.

The Audit Committee is comprised of Anne Kritzmire, Dina Tantra and Brian Wixted, all of whom are “independent” as defined in the

listing standard of the NASDAQ. Brian Wixted is the Chair of the Audit Committee and has been determined to qualify as an “audit committee financial expert” as such term is defined in

Form N-CSR. The role of the Audit Committee is to assist the Board in its oversight of (i) the quality and integrity of the Trust’s financial statements, reporting process and the

independent registered public accounting firm (the “independent accountants”) and reviews thereof, (ii) the Trust’s accounting and financial reporting policies and practices, its internal controls and, as appropriate, the

internal controls of certain service providers, (iii) the Trust’s compliance with certain legal and regulatory requirements, and (iv) the independent accountants’ qualifications, independence and performance. The Audit Committee

is also required to prepare an audit committee report pursuant to the rules of the U.S. Securities and Exchange Commission (“SEC”) for inclusion in the Trust’s annual proxy statement. The Audit Committee operates pursuant to the Audit

Committee Charter that was most recently reviewed and approved by the Board on June 15, 2023. The Audit Committee Charter is available at the Trust’s website,

https://www.thornburg.com/investments/closed-end-funds/cib. As set forth in the Audit Committee Charter, management is responsible for preparing the Trust’s

financial statements and maintaining appropriate systems for accounting and internal control, and the Trust’s independent accountants are

6

responsible for planning and carrying out proper audits and reviews. The independent accountants are ultimately accountable to the Board and to the Audit Committee, as representatives of the

Common Shareholders. The independent accountants for the Trust report directly to the Audit Committee. During the last fiscal year, the Audit Committee held four meetings.

The Nominating and Corporate Governance Committee is comprised of Anne Kritzmire, Dina Tantra and Brian Wixted. Dina Tantra is the Chair of the Nominating and

Corporate Governance Committee. The Nominating and Corporate Governance Committee operates pursuant to the Nominating and Corporate Governance Committee Charter that was reviewed and approved by the Board on June 15, 2023. The Nominating and

Corporate Governance Committee Charter is available at the Trust’s website, https://www.thornburg.com/investments/closed-end-funds/cib. The Nominating and Corporate

Governance Committee is responsible for identifying and recommending to the Board individuals believed to be qualified to become members of the Board in the event that a position is vacated or created. The Nominating and Corporate Governance

Committee will consider trustee candidates recommended by Common Shareholders. In considering candidates to fill vacancies on the Board, the Nominating and Corporate Governance Committee will take into consideration the candidates’

qualifications for Board membership and their independence from the Adviser and other principal service providers. Persons selected as Independent Trustees must be independent in terms of both the spirit and letter of the 1940 Act. The Committee

shall also consider the effect of any relationships beyond those delineated in the 1940 Act that might impair independence, e.g., business, financial or family relationships with the Trust’s investment adviser or service providers. Common

Shareholders wishing to recommend candidates to the Nominating and Corporate Governance Committee should submit such recommendations to the Secretary of the Trust, who will forward the recommendations to the committee for consideration. With respect

to each individual whom the Common Shareholder proposes to nominate for election or reelection as Trustee (each, a “Proposed Nominee”), the submission must include: (i) the name or names, age, date of birth, business address,

residence address and nationality of such Proposed Nominee, (ii) whether such Shareholder believes the Proposed Nominee is, or is not, an “interested person” (as defined in the 1940 Act) of the Trust (an “Interested Person”)

and, if not an Interested Person, information regarding the Proposed Nominee that will be sufficient for the Board or any committee thereof or any authorized officer of the Trust to make such determination, (iii) sufficient information to

enable the Nominating and Corporate Governance Committee of the Board, or any other committee of the Board as determined by the Trustees from time to time, to make the determination as to the Proposed Nominee’s qualifications required under the

Trust’s Agreement and Declaration of Trust, and (iv) the Proposed Nominee’s written, signed and notarized statement confirming the Proposed Nominee’s consent to being named in the proxy statement and intention to serve as a

Trustee, if elected. During the last fiscal year, the Nominating and Corporate Governance Committee held three meetings.

The Trust does not require the

Trustees to attend annual meetings of shareholders.

Trustee Qualifications.

Nimish S. Bhatt. Mr. Bhatt has served as an Interested Trustee and Chair of the Board since its inception. Since September 2023,

Mr. Bhatt has served as the President of the Trust. Mr. Bhatt also serves as the Chief Financial Officer of Thornburg Investment Management, and he has been responsible for corporate finance, tax, fund accounting, and fund administration

since 2016. He has over 30 years of progressive experience in strategy, leveraged finance, equity issuance, mergers and acquisitions, operations, technology, accounting, administration, and tax-related matters

in the global investment management industry. Mr. Bhatt previously served as Senior Vice President and Chief Financial Officer of Calamos Asset Management, Inc. During his tenure at Calamos, he was also responsible for fund administration,

operations, and information technology. He also served as Vice President and Chief Financial Officer of the Calamos Fund Complex, which included mutual funds, an ETF and closed-end funds. Previously, he served

in various capacities for The BISYS Group, Inc., Evergreen Asset Management Corp., PricewaterhouseCoopers LLP, Ernst & Young LLP, and KPMG. He serves as a member of the Board for Thornburg Global Investment plc (Ireland), New Mexico Museum

of Natural History Foundation, Greater Albuquerque Chamber of Commerce, Goldvest Financial Services Pvt. Ltd. (India), and Share My

7

Fortune, Inc. Mr. Bhatt holds a B.S. in Advanced Accounting and Auditing and an LL.B. from Gujarat University, an M.B.A. from The Ohio State University Fisher College of Business, and an

Advanced Management Program certificate from The Wharton School of Business at the University of Pennsylvania. He holds FINRA Series 27 and 99 securities registrations.

Benjamin D. Kirby, CFA. Mr. Kirby has served as an Interested Trustee of the Trust since its inception. Mr. Kirby is the Co-Head of Investments and a Managing Director at Thornburg Investment Management. Mr. Kirby joined Thornburg in 2008 as Equity Research Analyst, was promoted to Associate Portfolio Manager in 2011, and was

named Portfolio Manager and Managing Director in 2013. He is responsible for driving the investment process at the firm level. Mr. Kirby has served as a portfolio manager of the Thornburg Investment Income Builder Fund since 2013, the Thornburg

Developing World Fund since 2015, and the Thornburg Summit Fund since 2019. Mr. Kirby holds a B.A. in Computer Science from Fort Lewis College and an M.B.A. from Duke University’s Fuqua School of Business. Prior to graduate school, he was

a software engineer at Pinnacle Business Systems in Oklahoma City, Oklahoma. Mr. Kirby is a CFA charterholder and also holds FINRA Series 7 and 63 securities registrations.

Anne W. Kritzmire. Ms. Kritzmire has served as an Independent Trustee and as the Lead Independent Trustee of the Trust since its inception.

Through more than 20 years of experience in the investment management industry, she has overseen strategic marketing, support and education for closed-end funds and various other investment solutions,

including as Head of Multi-Asset and Solutions Marketing and as a Managing Director at Nuveen Investments. Ms. Kritzmire has held senior marketing positions with Abbott Laboratories and served in sales, engineering and consulting capacities

with IBM Corporation. She has served as the President of the Closed-End Fund Association and a Director of Chicago Public Media (WBEZ radio). Ms. Kritzmire serves as the Trustee and Finance Commissioner

of the Village of Long Grove and is a Principal at AW Kritzmire Consulting. Ms. Kritzmire holds a B.S., cum laude, in Electrical Engineering from the University of Notre Dame and an M.B.A. in Marketing and Finance, with distinction, from the

Kellogg Graduate School of Management at Northwestern University. Ms. Kritzmire has previously held FINRA Series 7, 24 and 65 securities registrations.

Dina A. Tantra. Ms. Tantra has served as an Independent Trustee and as Chair of the Nominating and Corporate Governance Committee of the Trust

since its inception. Ms. Tantra has more than 30 years of financial services industry legal and compliance experience. Ms. Tantra’s experience includes leadership and management roles working with investment advisers, broker-dealers

and financial products, with particular expertise in mutual fund distribution, servicing and governance. She has held various senior leadership positions in the legal, compliance and governance areas and has experience overseeing a staff of legal,

finance and compliance experts. Since 2018, Ms. Tantra has served as the Co-Chief Executive Officer of Global Rhino. She previously served as Trustee and President of Advisers Investment Trust, as

Executive Vice President of Ultimus Fund Solutions, Director and General Counsel of Beacon Hill Fund Services, and Managing Director of Foreside Financial. Ms. Tantra holds a B.A. in Psychology from Pomona College, a J.D. from The Ohio State

University Moritz College of Law, and a certificate in Finance for Executives from the University of Chicago, Booth School of Business.

Brian W.

Wixted. Mr. Wixted has served as an Independent Trustee and as Chair of the Audit Committee of the Trust since its inception. Mr. Wixted has more than 40 years of financial services and investment management industry and

accounting experience. He has served as a Trustee and Audit Committee Chair of Lincoln Variable Insurance Products Trust since 2019. Since 2017, he has served as a consultant for CKC Consulting and since 2019, as an Advisory Partner with AI Capital.

Mr. Wixted previously served as the Senior Vice President of Finance and Fund Treasurer of the Oppenheimer Funds. He also previously served as the Principal and Chief Operating Officer of Bankers Trust Company’s Mutual Funds Group, the

Vice President and Chief Financial Officer for CS First Boston Investment Management Corp, and as Vice President and Accounting Manager with Merrill Lynch Asset Management. Mr. Wixted holds a Certified Public Accountant designation and is a

member of the American Institute of Certified Public Accountants and the New Jersey State Society of Certified Public Accountants. He is the former Chair of the Investment Company Institute Accounting Treasurers Committee and member of the AICPA

Investment Company Expert Panel. Mr. Wixted holds a B.S. in Accounting from Creighton University.

8

Compensation. The Trust pays no salaries or compensation to any of its interested trustees or its

officers. For their services, the Independent Trustees of the Trust receive an annual retainer in the amount of $50,000. In addition, the Lead Independent Trustee receives $8,000 annually, and the Chair of the Audit Committee and the Chair of the

Nominating and Corporate Governance Committee each receives $6,000 annually, and each other member of the Audit Committee and Nominating and Corporate Governance Committee receives $1,500 annually for each committee on which they serve. Prior to

January 1, 2023, the Independent Trustees received an annual retainer in the amount of $20,000, and an additional $2,500 for attendance at each meeting of the Board. In addition, the Lead Independent Trustee received $3,500 annually, and the

Chair of the Audit Committee and the Chair of the Nominating and Corporate Governance Committee each received $2,500 annually, and each other member of the Audit Committee and Nominating and Corporate Governance Committee received $1,500 annually

for each committee on which they served. The Independent Trustees are also reimbursed for all reasonable out-of-pocket expenses relating to attendance at

meetings of the Board. The following tables show compensation with respect to the Trust and the Fund Complex. Nimish Bhatt and Ben Kirby are interested persons of the Trust of the Trust and have not received any compensation from the Trust.

|

|

|

|

|

|

|

|

|

| Name of Trustee |

|

Aggregate

Compensation

from Trust |

|

|

Aggregate Total

Compensation from the

Trust Complex(1) |

|

| Anne Kritzmire |

|

$ |

54,875 |

|

|

$ |

54,875 |

|

| Dina Tantra |

|

$ |

51,625 |

|

|

$ |

51,625 |

|

| Brian Wixted |

|

$ |

51,625 |

|

|

$ |

51,625 |

|

| (1) |

The Fund Complex consists of the Trust, and Thornburg Investment Trust, a mutual fund trust comprising of 24

separate investment “funds” or “series.” This information is as of the fiscal year ended September 30, 2023. |

Trustee Ownership in the Trust

As of December 31,

2023, the dollar range of equity securities beneficially owned by the Trustees is provided in the following table:

|

|

|

|

|

| Name of Trustee |

|

Dollar Range of Equity

Securities in the Fund |

|

Aggregate Dollar

Range of

Equity Securities in All

Registered Investment

Companies Overseen

by Trustee

in

Family of Investment

Companies |

| Nimish S. Bhatt |

|

None |

|

None |

| Benjamin D. Kirby |

|

None |

|

None |

| Anne Kritzmire |

|

$1-10,000 |

|

$1-10,000 |

| Dina A. Tantra |

|

$50,001-100,000 |

|

$50,001-100,000 |

| Brian W. Wixted |

|

None |

|

None |

As of December 31, 2023, none of the Trustees or their immediate family members own beneficially, or of record, any class

of securities of the investment adviser or principal underwriter of the Trust or any person directly or indirectly controlling, controlled by, or under common control with an investment adviser or principal underwriter of the Trust.

Audit Committee Report

In performing its oversight

function, during the fiscal year ended September 30, 2023, the Audit Committee reviewed and discussed with management and the Trust’s independent accountant, PricewaterhouseCoopers LLP (“PwC”), the audited financial statements of

the Trust as of and for the fiscal year ended September 30, 2023, and discussed the audits of such financial statements with the Trust’s independent accountant.

9

In addition, the Audit Committee discussed with the Trust’s independent accountant the accounting principles

applied by the Trust and such other matters brought to the attention of the Audit Committee by the independent accountant required by Auditing Standard 1301, Communications with Audit Committees, as adopted by the Public Company

Accounting Oversight Board (“PCAOB”). The Audit Committee also received from the Trust’s independent accountant the written disclosures and letters required by PCAOB Rule 3526, Communication with Audit Committees

Concerning Independence, and discussed the relationship between the independent accountant and the Trust and the impact that any such relationships might have on the objectivity and independence of the independent accountant.

As set forth above, and as more fully set forth in the Audit Committee Charter, the Audit Committee has significant duties and powers in its oversight role

with respect to the Trust’s financial reporting procedures, internal control systems and the independent audit process.

The members of the Audit

Committee are not, and do not represent themselves to be, professionally engaged in the practice of auditing or accounting and are not employed by the Trust for accounting, financial management or internal control purposes. Moreover, the Audit

Committee relies on and makes no independent verification of the facts presented to it or representations made by management or the respective Trust’s independent registered public accounting firm. Accordingly, the Audit Committee’s

oversight does not provide an independent basis to determine that management has maintained appropriate accounting and/or financial reporting principles and policies, or internal controls and procedures designed to assure compliance with accounting

standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not provide assurance that the audits of the Trust’s financial statements have been carried out in

accordance with generally accepted accounting standards or that the financial statements are presented in accordance with generally accepted accounting principles.

Based on its consideration of the audited financial statements and the discussions referred to above with management and the Trust’s independent

accountants, and subject to the limitations on the responsibilities and role of the Audit Committee set forth in the Audit Committee Charter and those discussed above, the Audit Committee recommended to the Board that the Trust’s audited

financial statements be included in the Trust’s Annual Report for the fiscal year ended September 30, 2023.

Submitted by the Audit Committee

of the Board of Trustees

Anne W. Kritzmire

Dina A.

Tantra

Brian W. Wixted

Independent Registered Public

Accounting Firm’s Fees

At the Trust’s Audit Committee meeting held on September 6, 2023, PwC was approved to serve as the independent

registered public accounting firm for the Trust for its current fiscal year, and acted as the independent registered public accounting firm for the Trust during its most recently completed fiscal year. PwC has advised the Trust that, to the best of

its knowledge and belief, its professionals did not have any direct or material indirect ownership interest in the independent registered public accounting firm inconsistent with independent professional standards pertaining to independent

registered public accounting firms. It is not expected that representatives of PwC will be present at the Annual Meeting; however, representatives of PwC are expected to be available by telephone to answer any questions that may arise and will have

the opportunity to make a statement if they desire to do so. In reliance on Rule 32a-4 under the 1940 Act, the Trust is not seeking shareholder ratification of the selection of their independent

registered public accounting firm.

10

Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees

The aggregate fees billed by the independent registered public accounting firm for the following services during each of the last two fiscal

years for the Trust are disclosed below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Audit Fees(1) |

|

Audit-Related

Fees(2) |

|

Tax Fees(3) |

|

All Other

Fees(4) |

| 2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| $52,458 |

|

$51,430 |

|

$5,417 |

|

$7,917 |

|

$17,232 |

|

$47,207 |

|

$ 0 |

|

$0 |

| (1) |

“Audit Fees” are fees for professional services for the audit of the Trust’s annual financial

statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements. |

| (2) |

“Audit-Related Fees” are for assurance and related services that are reasonably related to the

performance of the audit of the Trust’s financial statements and are not reported under “Audit Fees.” This includes assurance and diligence work related to offerings of preferred and common shares and reviews of semi-annual financial

statements. |

| (3) |

“Tax Fees” are for professional services for tax compliance, tax advice and tax planning.

|

| (4) |

“All Other Fees” are for products and services other than those services reported under “Audit

Fees,” “Audit-Related Fees” and “Tax Fees.” |

Non-Audit Fees

Neither the Trust nor the Adviser had fees billed by the independent registered public accounting firm for non-audit

fees for services during the last two fiscal years for the Trust.

Pre-Approval

The Trust’s Audit Committee Charter requires that the Audit Committee pre-approve all audit and non-audit services to be provided by the independent registered public accounting firm. There were no Trust or Adviser non-audit fees billed by PwC in 2023 or 2022.

VOTING

For the Trust, the

affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting will be required to elect the Trustee nominees of the Trust, provided a quorum is present. A “majority of the shares”

means number of votes cast “FOR” a Trustee nominee must exceed the number of votes cast “AGAINST” that nominee. Broker non-votes will be excluded from the denominator of the calculation of

the number of votes required to approve any proposal to adjourn a meeting.

If the enclosed proxy card is properly executed and returned in time to be

voted at the Trust’s Annual Meeting, the Trust’s Shares represented thereby will be voted in accordance with the instructions marked thereon or, if no instructions are marked thereon, will be voted in the discretion of the persons

named on the proxy card. Accordingly, unless instructions to the contrary are marked thereon, a properly executed and returned proxy will be voted FOR the election of the nominees as Trustees and, at the discretion of the named proxies, on any

other matters that may properly come before the Trust’s Annual Meeting, as deemed appropriate. Any shareholder who has given a proxy has the right to revoke it at any time prior to its exercise either by attending the Annual Meeting and

voting his or her Shares in person, or by timely submitting a letter of revocation or a later-dated proxy to the Trust at its address above. A list of shareholders entitled to notice of and to be present and to vote at the Annual Meeting will be

available at the office of the Trust, for inspection by any shareholder during regular business hours prior to the Meeting. Shareholders will need to show valid identification and proof of Share ownership to be admitted to the Annual Meeting or to

inspect the list of shareholders.

11

Under the organizational documents of the Trust, a quorum is constituted by the presence in person or by proxy of

the holders of thirty-three and one-third percent (331/3%) of the voting power of each

outstanding class of Shares entitled to vote on a matter. Any meeting of shareholders may be postponed prior to the meeting by notice of the date, hour and place to which the meeting is postponed shall be provided to the shareholders entitled to

vote at that meeting. Such notice shall be given not fewer than two (2) days before the date of such meeting. Any meeting of shareholders convened on the date for which it was called, whether or not a quorum is present, may be adjourned from

time to time by (i) the chairman of the meeting; or (ii) the vote of a majority of the Shares represented at the meeting, either in person or by proxy. Notice of adjournment of a shareholders meeting to another time or place need not be

given, if such time and place are announced at the meeting at which adjournment is taken and the adjourned meeting is held within a reasonable time after the date set for the original meeting. If the adjournment is for more than sixty (60) calendar

days from the date set for the original meeting or a new record date is fixed for the adjourned meeting, notice of any such adjourned meeting shall be given to each shareholder of record entitled to vote at the adjourned meeting. The adjournment to

any meeting may be limited solely with regard to a particular proposal scheduled to be voted on at such meeting. At any adjourned meeting, the Trust may transact any business which might have been transacted at the original meeting.

THE BOARD OF THE TRUST UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF THE

TRUST’S NOMINEES.

12

PART 2

INFORMATION ABOUT OWNERSHIP OF SHARES OF THE TRUST

Outstanding Shares

On the Record Date, the Trust had

32,081,883 Common Shares outstanding:

To the knowledge of the Trust, as of the Record Date, no single shareholder or “group” (as that term is

used in Section 13(d) of the Securities Exchange Act of 1934, as amended (the “1934 Act”)) beneficially owned more than 5% of the Trust’s outstanding Shares, except as described in the following table. A control person is one who

owns, either directly or indirectly, more than 25% of the voting securities of the Trust or acknowledges the existence of control. A party that controls the Trust may be able to significantly affect the outcome of any item presented to shareholders

for approval. Information as to beneficial ownership of Shares, including percentage of outstanding Shares beneficially owned, is based on securities position listing reports as of the Record Date and reports filed with the SEC by shareholders.

The Trust does not have any knowledge of the identity of the ultimate beneficiaries of the Shares listed below.

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name And Address Of Beneficial Owner |

|

Shares Of A Class

Beneficially Owned |

|

|

% Outstanding

Shares

Beneficially

Owned |

|

|

Type of

Ownership |

|

| Charles Schwab

211 Main St

San Francisco CA 94105-1905 |

|

|

2,561,651 |

|

|

|

8.0 |

% |

|

|

Record |

* |

| RBC Capital Markets

60 S. 6th Street-P08

Minneapolis, MN 55402 |

|

|

2,063,635 |

|

|

|

6.4 |

% |

|

|

Record |

* |

| Stifel

One Financial Plaza

501 North Broadway

St Louis MO 63102 |

|

|

2,372,247 |

|

|

|

7.4 |

% |

|

|

Record |

* |

| UBS WM USA

1000 Harbor Blvd

Weehawken NJ 07086-6761 |

|

|

8,425,760 |

|

|

|

26.3 |

% |

|

|

Record |

* |

| Wells Fargo

2801 Market St

Saint Louis MO 63103-22523 |

|

|

5,578,062 |

|

|

|

17.4 |

% |

|

|

Record |

* |

| * |

Information regarding this record owner is derived from the most recent Schedule 13G or Form 13F filings made

such owner as of the Record Date. |

13

PART 3

OTHER INFORMATION ON THE TRUST, VOTING, AND THE MEETING

Who is Eligible To Vote

Shareholders of record at the

close of business on January 19, 2024 of the Trust are able to vote.

Shares represented by properly executed proxies, unless revoked before or at the

Meeting, will be voted according to the shareholder’s instructions. If you sign a proxy, but do not fill in a vote, your shares will be voted to approve the proposal. If any other business comes before the Meeting, your shares will be voted at

the discretion of the persons named as proxies.

Organization and Operation of the Trust

The Trust is a diversified, closed-end management investment company registered under the Act. The Trust’s

principal office is located at 2300 North Ridgetop Road Santa Fe, NM 87506, and its telephone number is 1-800-847-0200.

The Trust was organized as a Delaware statutory trust on July 28, 2020 and commenced operations on July 27, 2021. Common Shares of the Trust are

listed on the NASDAQ under the ticker symbol “TBLD.”

Shareholder Proposals

Shareholders who wish to submit proposals for inclusion in the proxy statement for the 2025 shareholder meeting (or any other future shareholder meeting) must

give timely notice and submit their written proposals to the Trust’s Secretary at its principal office. To be timely, a proposal must be delivered to the Secretary not earlier than the 150th

day or later than 5:00 p.m., Eastern Time, on the 120th day prior to the first anniversary of the date of the proxy statement for the preceding year’s annual meeting.

Section 30(h) and Section 16(a) Beneficial Ownership Reporting Compliance

Section 30(h) of the 1940 Act and Section 16(a) of the 1934 Act require the Trust’s officers and Trustees, the Adviser and any sub-adviser, certain persons affiliated with the Adviser and any sub-adviser, and persons who beneficially own more than 10% of a registered class of the Trust’s equity

securities to file forms reporting their affiliation with the Trust and reports of ownership and changes of ownership with the SEC and NASDAQ, as applicable. These persons and entities are required to furnish the Trust with copies of all

Section 16(a) forms they file. Based solely upon a review of copies of such forms received by the Trust and certain written representations, the Trust believes that during its last fiscal year, all such filing requirements applicable to its

officers and Trustees, the Adviser and any sub-adviser, and affiliated persons of the Adviser and any sub-adviser were met. To the knowledge of the Trust, no shareholder

of the Trust has filed under Section 16(a) as an owner of more than 10% of the Trust’s equity securities.

Method of Solicitation and

Expenses

In addition to the solicitation of proxies by mail, for the Trust, officers of the Trust and officers and regular employees of the

Trust’s transfer agent, and affiliates of such transfer agent, the Adviser, as well as other representatives of the Trust may also solicit proxies by telephone, Internet or in person. The expenses incurred in connection with preparing the Proxy

Statement and its enclosures will be paid by the Trust.

Shareholder Communications

Shareholders may send communications to the Board. Shareholders should send communications intended for the Board by addressing the communication directly to

the Board of Trustees (or individual Trustee(s)) and/or otherwise clearly indicating in the salutation that the communication is for the Board (or individual Trustee(s)) and by sending the communication to the Trust’s address for the Trustee(s)

at c/o Thornburg Income Builder

14

Opportunities Trust, 2300 North Ridgetop Road Santa Fe, NM 87506. Other shareholder communications received by the Trust not directly addressed and sent to the Board will be reviewed and

generally responded to by management, and will be forwarded to the Board only at management’s discretion based on the matters contained therein.

Other Matters to Come Before the Meeting

No business other than the matters described above is expected to come before the Meeting, but should any other matter requiring a vote of shareholders

arise, including any question as to an adjournment or postponement of the Meeting, the persons named on the enclosed proxy card will vote thereon according to their best judgment in the interests of the Trust.

Delivery of Certain Documents

Annual reports are sent to

shareholders of record of the Trust following the Trust’s fiscal year end. The Trust will furnish, without charge, a copy of its annual report and/or semi-annual report once available upon request. You may also view these reports on the

Trust’s website at https://www.thornburg.com/investments/closed-end-funds/. Such written or oral requests should be directed to the Trust at 2300 North Ridgetop

Road Santa Fe, NM 87506, or by calling toll-free at 1-800-847-0200.

Please note that only one annual or semi-annual report or proxy statement (as applicable) may be delivered to two or more shareholders of the Trust who share

an address, unless the Trust has received instructions to the contrary. To request a separate copy of an annual or semi-annual report or proxy statement (as applicable), or for instructions as to how to request a separate copy of such documents or

as to how to request a single copy if multiple copies of such documents are received, shareholders should contact the Trust at the address and phone number set forth above. Pursuant to a request, a separate copy will be delivered promptly.

Other Service Providers

Thornburg Investment Management,

Inc., c/o Thornburg Income Builder Opportunities Trust, 2300 North Ridgetop Road Santa Fe, NM 87506, serves as the Trust’s investment adviser and administrator.

State Street Bank & Trust Co., State Street Financial Center, One Lincoln Street, Boston, MA 02111, serves as the Trust’s custodian.

Computershare Trust Company N.A., 250 Royall Street, Canton, MA 02021, serves as the Trust’s transfer agent, registrar, Plan Administrator and dividend disbursing agent.

Fiscal Year

The Trust’s fiscal year ends on

September 30.

YOUR VOTE IS IMPORTANT! PLEASE VOTE BY DATING AND SIGNING THE ENCLOSED PROXY AND RETURNING IT PROMPTLY IN THE ENCLOSED REPLY ENVELOPE.

IT IS IMPORTANT THAT THE PROXY BE RETURNED PROMPTLY. YOU MAY ALSO VOTE BY ATTENDING THE MEETING.

15

|

|

|

|

|

| THORNBURG INCOME BUILDER OPPORTUNITIES TRUST

PO Box 43131 Providence, RI 02940-3131 |

|

EVERY VOTE IS IMPORTANT

EASY VOTING OPTIONS: |

|

|

|

|

|

|

|

VOTE ON THE INTERNET

Log on to:

www.proxy-direct.com

or scan the QR code Follow

the on-screen instructions available 24 hours |

|

|

|

|

|

|

|

VOTE BY PHONE

Call 1-800-337-3503 Follow

the recorded instructions available 24 hours |

|

|

|

|

|

|

|

VOTE BY MAIL

Vote, sign and date this Proxy

Card and return in the

postage-paid envelope |

Please detach at perforation before mailing.

|

|

|

|

|

| PROXY |

|

THORNBURG INCOME BUILDER OPPORTUNITIES TRUST |

|

|

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 14, 2024

THIS PROXY IS SOLICITED BY THE TRUSTEES OF THORNBURG INCOME BUILDER OPPORTUNITIES TRUST. The undersigned shareholder of Thornburg Income

Builder Opportunities Trust (the “Trust”), a Delaware statutory trust, hereby appoints Natasha Ripple and Curtis Holloway and each of them with full power of substitution, as proxies to represent the undersigned at the Annual Meeting of

Shareholders (the “Meeting”) of the Trust, to be held on March 14, 2024 at 9:00 a.m. Mountain Time at the principal offices of the Trust, 2300 North Ridgetop Road, Santa Fe, NM, 87506, and at any and all adjournments thereof, and at

the Meeting to vote all shares of the Trust which the undersigned would be entitled to vote, with all powers the undersigned would possess if personally present, in accordance with the instructions on the reverse side of this card.

The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Shareholders and accompanying Proxy Statement (the terms of

each of which are incorporated by reference herein) and revokes any proxy heretofore given with respect to the Meeting. IF THIS PROXY IS PROPERLY EXECUTED, THE VOTES ENTITLED TO BE CAST BY THE UNDERSIGNED WILL BE CAST AS INSTRUCTED ON THE REVERSE

SIDE HEREOF. IF THIS PROXY IS PROPERLY EXECUTED BUT NO INSTRUCTION IS GIVEN, THE VOTES ENTITLED TO BE CAST BY THE UNDERSIGNED WILL BE CAST “FOR” THE NOMINEES FOR TRUSTEES AS DESCRIBED IN THE PROXY STATEMENT. ADDITIONALLY, IF THIS PROXY IS

PROPERLY EXECUTED, THE VOTES ENTITLED TO BE CAST BY THE UNDERSIGNED WILL BE CAST IN THE DISCRETION OF THE PROXY HOLDER(S) ON ANY OTHER MATTER THAT MAY PROPERLY COME BEFORE THE MEETING OR ANY POSTPONEMENT OR ADJOURNMENT THEREOF.

|

|

|

|

|

|

|

VOTE VIA THE INTERNET: www.proxy-direct.com

VOTE VIA THE TELEPHONE:

1-800-337-3503 |

|

|

|

|

|

TBL_33722_011124

WE URGE YOU TO SIGN AND DATE ON THE REVERSE SIDE AND MAIL THE ENCLOSED PROXY PROMPTLY

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholder to be held on March 14, 2024.

The Proxy Statement and Proxy Card for this Meeting are available at:

https://www.proxy-direct.com/tbl-33722

Please detach at perforation before mailing.

TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: ☒

|

|

|

|

|

|

|

Proposal |

|

THE BOARD OF TRUSTEES OF THE TRUST RECOMMENDS A VOTE “FOR” THE TRUST’S NOMINEES. |

| 1. |

|

To elect two (2) Class II Trustees of the Trust: |

|

|

|

|

|

|

|

|

|

FOR |

|

WITHHOLD |

|

|

|

|

|

|

| 01. Nimish S. Bhatt |

|

☐ |

|

☐ |

|

|

| 02. Dina A. Tantra |

|

☐ |

|

☐ |

|

|

| 2. |

To consider and vote upon such other matters, including adjournments, as may properly come before the Meeting or

any postponements thereof. |

|

|

|

|

|

|

|

Authorized Signatures — This section must be completed for your vote to be counted.— Sign and Date Below |

Note: Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each

holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of a corporation or other entity or in another representative capacity, please give the full title under the signature.

|

|

|

|

|

|

|

|

|

| Date (mm/dd/yyyy) – Please print date below |

|

|

|

Signature 1 – Please keep signature within the box |

|

|

|

Signature 2 – Please keep signature within the box |

| /

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| xxxxxxxxxxxxxx |

|

TBL 33722 |

|

xxxxxxxx |

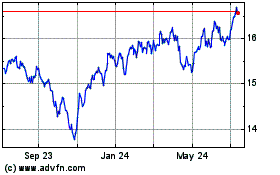

Thomburg Income Builder ... (NASDAQ:TBLD)

Historical Stock Chart

From Apr 2024 to May 2024

Thomburg Income Builder ... (NASDAQ:TBLD)

Historical Stock Chart

From May 2023 to May 2024