Texas Capital Bank Private Wealth Advisors, a subsidiary of Texas

Capital Bank, and the Texas Capital Funds Trust today announced the

launch of the Texas Capital Government Money Market ETF (NYSE:

MMKT) (the “MMKT ETF” or “Fund”). This innovative and

first-of-its-kind ETF will hold highly liquid, short-term U.S.

government debt instruments and cash equivalents, providing an

exchange-traded investment option for investors focused on managing

credit risk and preserving capital.

The MMKT ETF is the latest fund launched by Texas Capital ETF

& Funds Management, whose managed ETFs include the flagship

Texas Capital Texas Equity Index ETF (NYSE Arca: TXS) that helps

investors gain investment exposure to the diversity and growth of

the eighth largest economy in the world, Texas1. Complementing

Texas Capital’s other funds, the MMKT ETF is designed to provide

investors with a government money market fund in the form of an

ETF, combining the intraday liquidity and flexibility of an ETF

with the risk and return characteristics of a money market

fund.

“With the substantial changes in the interest rate environment

over the last few years, the Texas Capital Government Money Market

ETF offers an exciting alternative for investors,” said Daniel S.

Hoverman, Head of Corporate & Investment Banking at Texas

Capital. “As the first ETF committed to following Rule 2a-7, the

provision of the Investment Company Act of 1940 that governs money

market funds, Texas Capital believes the combination of the

tradability of an ETF and the structure of a money market fund will

prove an important investment alternative for investors looking to

manage liquidity, volatility and credit risks in their securities

portfolio.”

The Texas Capital Government Money Market ETF seeks to provide

as high a level of current interest income as is consistent with

maintaining liquidity and stability of principal while following

Rule 2a-7.

“As the premier full-service financial services firm

headquartered in the state of Texas, the launch of the MMKT ETF

continues our commitment to serving our clients’ liquidity and

investment needs,” added Hoverman. “Innovation is an integral part

of the Texas Capital experience, ranging from Initio, our

commercial banking platform that enables new account onboarding

within a single business day, to today’s announcement about the

revolutionary combination of ETF flexibility and money market

sensibility. We look forward to welcoming investors in MMKT to our

suite of funds and to Texas Capital.”

The Texas Capital Funds Trust is a Delaware statutory trust

formed in 2023 and registered as an open-end management investment

company under the Investment Company Act of 1940. The Trust has

retained Texas Capital Bank Wealth Management Services, Inc., doing

business as Texas Capital Bank Private Wealth Advisors, as the

adviser to the Fund. Edward Rosenberg, head of ETF & Funds

Management for Texas Capital serves as the president of the Texas

Capital Funds Trust. The Fund’s portfolio is managed by the chief

investment officer of Texas Capital Bank Private Wealth Advisors,

J. Steven Orr, who brings more than 30 years of portfolio

management experience. The Board of Trustees for the Texas Capital

Funds Trust includes Hayman Capital Management Founder and Chief

Investment Officer J. Kyle Bass, Texas Capital’s Head of Corporate

& Investment Banking Daniel S. Hoverman, Avery Capital

Co-founder and Chief Executive Officer Avery Johnson, Texas

Capital’s Head of Investor Relations & Corporate Development

Jocelyn Kukulka and PIXIU Founder and Chief Executive Officer Eddie

Margain.

Additional details on the Fund can be found here.

About Texas Capital Texas Capital Bancshares,

Inc. (NASDAQ®: TCBI), a member of the Russell 2000® Index and

the S&P MidCap 400®, is the parent company of Texas Capital

Bank (“TCB”). Texas Capital is the collective brand name for TCB

and its separate, non-bank affiliates and wholly-owned

subsidiaries. Texas Capital is a full-service financial services

firm that delivers customized solutions to businesses,

entrepreneurs and individual customers. Founded in 1998, the

institution is headquartered in Dallas with offices in Austin,

Houston, San Antonio and Fort Worth, and has built a network of

clients across the country. With the ability to service clients

through their entire lifecycles, Texas Capital has established

commercial banking, consumer banking, investment banking and wealth

management capabilities. All services are subject to applicable

laws, regulations, and service terms. Deposit and lending products

and services are offered by TCB. For deposit products, member FDIC.

For more information, please visit www.texascapital.com.

Trading in securities and financial instruments, strategic

advisory, and other investment banking activities are performed by

TCBI Securities, Inc., doing business as Texas Capital Securities.

TCBI Securities, Inc. is a member of FINRA and SIPC and has

registered with the SEC and other state securities regulators as a

broker dealer. TCBI Securities, Inc. is a subsidiary of TCB. All

investing involves risks, including the loss of principal. Past

performance does not guarantee future results. Securities and other

investment products offered by TCBI Securities, Inc. are not FDIC

insured, may lose value and are not bank guaranteed.

DisclosuresInvestors should carefully

consider the investment objectives, risks and charges of the Fund

before investing. The prospectus contains this information and

other information about the Fund, and it should be read carefully

before investing. Investors can obtain a copy of the prospectus by

calling 844.TCB.ETFS (844.822.3837).

Credit Risk. Issuers of money market

instruments or financial institutions that have entered into

repurchase agreements with the Fund may fail to make payments when

due or complete transactions or they may become less willing or

less able to do so.Interest Rate Risk. The

value of the Fund’s investments generally will fall when interest

rates rise, and its yield will tend to lag behind prevailing rates.

The Fund may face a heightened level of interest rate risk due to

certain changes in general economic conditions, inflation and

monetary policy, such as certain types of interest rate changes by

the Federal Reserve.U.S. Government Securities

Risk. There are different types of U.S. government

securities with different levels of credit risk, including the risk

of default, depending on the nature of the particular government

support for that security. For example, a U.S. government-sponsored

entity, such as Federal National Mortgage Association (“Fannie

Mae”) or Federal Home Loan Mortgage Corporation (“Freddie Mac”),

although chartered or sponsored by an Act of Congress, may issue

securities that are neither insured nor guaranteed by the U.S.

Treasury and are therefore riskier than those that

are.Repurchase Agreements Risk. Repurchase

agreements carry certain risks not associated with direct

investments in securities, including a possible decline in the

market value of the underlying obligations.Portfolio

Liquidity Risk. Although the Fund invests in a

diversified portfolio of high-quality instruments, the Fund’s

investments may become less liquid as a result of market

developments or adverse investor perception. In stressed market

conditions, the market for the Fund’s shares may become less liquid

in response to deteriorating liquidity in the markets for the

Fund’s underlying portfolio holdings.Management

Risk. The risk that the investment strategies,

techniques and risk analyses employed by the Adviser may not

produce the desired results.Investment and Market

Risk. As with all investments, an investment in the

Fund is subject to investment risk. Investors in the Fund could

lose money, including the possible loss of the entire principal

amount of an investment, over short or prolonged periods of

time. Markets can decline in value sharply

and unpredictably which may affect the Fund’s net asset value

(“NAV”) per share. The increasing interconnectivity between global

economies and financial markets increases the likelihood that

events or conditions in one region or financial market may

adversely impact issuers in a different country, region, or

financial market.ETF Risks. The Fund is an

ETF, and because of the ETF’s structure, it is exposed to the

following risks:

Authorized Participants,

Market Makers, and Liquidity Providers Concentration

Risk. The Fund has a limited number of financial

institutions that may act as Authorized Participants (“APs”). In

addition, there may be a limited number of market makers and/or

liquidity providers in the marketplace. To the extent either of the

following events occur, Shares may trade at a material discount to

NAV and possibly face trading halts or delisting: (i) APs exit the

business or otherwise become unable to process creation and/or

redemption orders and no other APs step forward to perform these

services; or (ii) market makers and/or liquidity providers exit the

business or significantly reduce their business activities and no

other entities step forward to perform their

functions.Costs of Buying or Selling

Shares. Due to the costs of buying or selling Shares,

including brokerage commissions imposed by brokers and bid/ask

spreads, frequent trading of Shares may significantly reduce

investment results and an investment in Shares may not be advisable

for investors who anticipate regularly making small

investments.Large Shareholder Risk. From time

to time, an AP, a third-party investor, an affiliate of the

Adviser, or a fund may invest in the Fund and hold its investment

for a specific time period to allow the Fund to achieve size or

scale. There can be no assurance that any such entity will not

redeem its investment or that the size of the Fund will be

maintained at such levels, which could negatively impact the

Fund.Premium-Discount Risk. The Shares may

trade above or below their NAV. The market prices of Shares will

generally fluctuate in accordance with changes in NAV as well as

the relative supply of, and demand for, Shares on the Exchange or

other securities exchanges. The existence of significant market

volatility, disruptions to creations and redemptions, or potential

lack of an active trading market for Shares (including through a

trading halt), among other factors, may result in the Shares

trading significantly above (at a premium) or below (at a discount)

to NAV.Trading Risk. Although Shares are

listed for trading on the Exchange and may be traded on U.S.

exchanges other than the Exchange, there can be no assurance that

Shares will trade with any volume, or at all, on any stock

exchange. In stressed market conditions, the liquidity of Shares

may begin to mirror the liquidity of the Fund’s underlying

portfolio holdings, which can be significantly less liquid than

Shares.Trading Halt Risk. Sharp price

declines in securities owned by the Fund may trigger trading halts,

which may result in the Fund’s shares trading in the market at an

increasingly large discount to NAV during part (or all) of a

trading day or cause the Fund itself to halt trading. In such

market conditions, market, or stop-loss orders to sell the ETF

shares may be executed at market prices that are significantly

below NAV or investors might not even be able to transact in Shares

if the Fund halts trading.

New Adviser Risk. The

Adviser has only served as an adviser to a registered fund for less

than one year. As a result, there is no long-term track record

against which an investor may judge the Adviser and it is possible

the Adviser may not achieve the Fund’s intended investment

objective.New Fund Risk. The Fund is new and

does not have shares outstanding as of the date of this Prospectus.

As a result, prospective investors have no track record or history

on which to base their investment decisions. In addition, there can

be no assurance that the Fund will grow to or maintain an

economically viable size. If the Fund does not grow large once it

commences trading, it will be at greater risk than larger funds of

wider bid-ask spreads for its shares, trading at a greater premium

or discount to NAV, liquidation and/or a stop to trading. Any

liquidation of the Fund could cause the Fund to incur elevated

transaction costs for the Fund and negative tax consequences for

its shareholders.

Shares are not individually redeemable and are issued

and redeemed at their net asset value only in large, specified

blocks of shares called creation units. Shares otherwise can be

bought and sold only through exchange trading at market price (not

NAV). Shares may trade at a premium or discount to their net asset

value in the secondary market. Brokerage commissions will reduce

returns.

Texas Capital Bank Wealth Management Services, Inc. d/b/a Texas

Capital Bank Private Wealth Advisors (“PWA”), a wholly owned

subsidiary of Texas Capital Bank and a Registered Investment

Advisor with the U.S. Securities and Exchange Commission (“SEC”),

serves as investment adviser to the Texas Capital Government Money

Market ETF and Texas Capital Texas Equity Index ETF and is paid a

fee for its services. Shares of the Texas Capital Government Money

Market ETF and Texas Capital Texas Equity Index ETF are not

deposits or obligations of, or guaranteed or endorsed by, Texas

Capital Bank or its affiliates. The Texas Capital Government Money

Market ETF and Texas Capital Texas Equity Index ETF are not insured

by the FDIC or any other government agency. The Texas Capital

Government Money Market ETF and Texas Capital Texas Equity Index

ETF are distributed by Northern Lights Distributors, LLC, member

FINRA/SIPC, which is not affiliated with Texas Capital Bank Private

Wealth Advisors.

INVESTMENTS: NOT FDIC INSURED | MAY LOSE VALUE | NO BANK

GUARANTEE

1 Source: Texas Economic Development Corporation

MEDIA CONTACT

Julia Monter, 469.399.8425

julia.monter@texascapitalbank.com

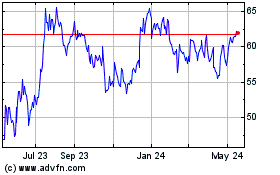

Texas Capital Bancshares (NASDAQ:TCBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

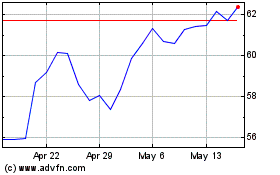

Texas Capital Bancshares (NASDAQ:TCBI)

Historical Stock Chart

From Jan 2024 to Jan 2025