Texas Capital Bancshares, Inc. (NASDAQ: TCBI), the parent company

of Texas Capital Bank, announced operating results for the third

quarter of 2024.

Net loss available to common stockholders was

$65.6 million, or $1.41 net loss per diluted share, for the third

quarter of 2024, compared to net income available to common

stockholders of $37.4 million, or $0.80 net income per diluted

share, and $57.4 million, or $1.18 per diluted share, for the for

the second quarter of 2024 and third quarter of 2023,

respectively.

The third quarter of 2024 included a $179.6

million loss on sale of available-for-sale debt securities ($2.92

net loss per diluted share) and restructuring expense of $5.9

million ($0.10 net loss per diluted share), partially offset by a

$651,000 release of Federal Deposit Insurance Corporation (“FDIC”)

special assessment accrual ($0.01 net income per diluted

share).

“We achieved significant financial milestones

this quarter as our multi-year transformation is increasingly

delivering financial outcomes consistent with realized success

delivering our proven and differentiated strategy,” said Rob C.

Holmes, President and CEO. “Our current business momentum coupled

with our sustained leading capital and liquidity levels positions

us well to effectively drive execution through 2025.”

| FINANCIAL

RESULTS |

|

|

|

|

|

| (dollars and shares in

thousands) |

|

|

|

|

|

| |

3rd Quarter |

|

2nd Quarter |

|

3rd Quarter |

|

|

|

2024 |

|

|

|

2024 |

|

|

|

2023 |

|

|

OPERATING RESULTS |

|

|

|

|

|

|

Net income/(loss) |

$ |

(61,319 |

) |

|

$ |

41,662 |

|

|

$ |

61,679 |

|

|

Net income/(loss) available to common stockholders |

$ |

(65,632 |

) |

|

$ |

37,350 |

|

|

$ |

57,366 |

|

|

Diluted earnings/(loss) per common share |

$ |

(1.41 |

) |

|

$ |

0.80 |

|

|

$ |

1.18 |

|

|

Diluted common shares |

|

46,609 |

|

|

|

46,872 |

|

|

|

48,529 |

|

|

Return on average assets |

(0.78)% |

|

|

0.56 |

% |

|

|

0.81 |

% |

|

Return on average common equity |

(8.87)% |

|

|

5.26 |

% |

|

|

8.08 |

% |

| |

|

|

|

|

|

| BALANCE

SHEET |

|

|

|

|

|

|

Loans held for investment |

$ |

16,764,512 |

|

|

$ |

16,700,569 |

|

|

$ |

16,183,882 |

|

|

Loans held for investment, mortgage finance |

|

5,529,659 |

|

|

|

5,078,161 |

|

|

|

4,429,489 |

|

|

Total loans held for investment |

|

22,294,171 |

|

|

|

21,778,730 |

|

|

|

20,613,371 |

|

|

Loans held for sale |

|

9,022 |

|

|

|

36,785 |

|

|

|

155,073 |

|

|

Total assets |

|

31,629,299 |

|

|

|

29,854,994 |

|

|

|

29,628,249 |

|

|

Non-interest bearing deposits |

|

9,070,804 |

|

|

|

7,987,715 |

|

|

|

9,352,883 |

|

|

Total deposits |

|

25,865,255 |

|

|

|

23,818,327 |

|

|

|

23,878,978 |

|

|

Stockholders’ equity |

|

3,354,044 |

|

|

|

3,175,601 |

|

|

|

3,077,700 |

|

|

|

|

|

|

|

|

|

(1) |

Fee areas of focus include service charges on deposit accounts,

wealth managment and trust fee income, investment banking and

advisory fees and trading income. |

| (2) |

Stockholders’ equity excluding

preferred stock, less goodwill and intangibles, divided by shares

outstanding at period end. |

| |

|

THIRD QUARTER

2024 COMPARED TO

SECOND QUARTER

2024

For the third quarter of 2024, net loss

available to common stockholders was $65.6 million, or $1.41 net

loss per diluted share, compared to net income available to common

stockholders of $37.4 million, or $0.80 net income per diluted

share, for the second quarter of 2024. The net loss for the third

quarter of 2024 resulted primarily from the $179.6 million loss on

the sale of available-for-sale debt securities ($2.92 net loss per

diluted share).

Provision for credit losses for the third

quarter of 2024 was $10.0 million, compared to $20.0 million for

the second quarter of 2024. The $10.0 million provision for credit

losses recorded in the third quarter of 2024 resulted primarily

from growth in total loans held for investment (“LHI”) and $6.1

million in net charge-offs.

Net interest income was $240.1 million for the

third quarter of 2024, compared to $216.6 million for the second

quarter of 2024, as increases in average earning assets and yields

on average earning assets were partially offset by an increase in

average interest bearing deposits. Net interest margin for the

third quarter of 2024 was 3.16%, an increase of 15 basis points

from the second quarter of 2024. LHI, excluding mortgage finance,

yields increased 1 basis point from the second quarter of 2024 and

LHI, mortgage finance, yields increased 26 basis points from the

second quarter of 2024. Total cost of deposits was 2.94% for the

third quarter of 2024, a 5 basis point decrease from the second

quarter of 2024.

Non-interest income for the third quarter of

2024 decreased $165.2 million compared to the second quarter of

2024, primarily due to the $179.6 million loss on sale of

available-for-sale debt securities recognized during the third

quarter of 2024, partially offset by increases in investment

banking and advisory fees and other non-interest income.

Non-interest expense for the third quarter of

2024 increased $6.9 million, or 4%, compared to the second quarter

of 2024, primarily due to increases in salaries and benefits,

occupancy expense and communications and technology expense,

partially offset by decreases in FDIC assessment expense and other

non-interest expense. The third quarter of 2024 included

restructuring expenses of $2.4 million recorded in salaries and

benefits, $476,000 recorded in occupancy expense and $3.1 million

recorded in communications and technology expense. The third

quarter of 2024 also included a $651,000 release of FDIC special

assessment accrual.

THIRD QUARTER

2024 COMPARED TO

THIRD QUARTER

2023

Net loss available to common stockholders was

$65.6 million, or $1.41 net loss per diluted share, for the third

quarter of 2024, compared to net income available to common

stockholders of $57.4 million, or $1.18 net income per diluted

share, for the third quarter of 2023.

The third quarter of 2024 included a $10.0

million provision for credit losses, reflecting growth in total LHI

and $6.1 million in net charge-offs, compared to an $18.0 million

provision for the third quarter of 2023.

Net interest income increased to $240.1 million

for the third quarter of 2024, compared to $232.1 million for the

third quarter of 2023, primarily due to increases in average total

LHI and yields on average earning assets, partially offset by an

increase in average interest bearing liabilities. Net interest

margin increased 3 basis points to 3.16% for the third quarter of

2024 compared to the third quarter of 2023. LHI, excluding mortgage

finance, yields increased 12 basis points compared to the third

quarter of 2023 and LHI, mortgage finance yields decreased 9 basis

points from the third quarter of 2023. Total cost of deposits

increased 32 basis points compared to the third quarter of

2023.

Non-interest income for the third quarter of

2024 decreased $161.6 million compared to the third quarter of

2023. The decrease was primarily due to the $179.6 million loss on

sale of available-for-sale debt securities recognized during the

third quarter of 2024, partially offset by increases in investment

banking and advisory fees and other non-interest income.

Non-interest expense for the third quarter of

2024 increased $15.4 million, or 9%, compared to the third quarter

of 2023, primarily due to increases in salaries and benefits,

occupancy expense and communications and technology expense,

partially offset by decreases in legal and professional

expense.

CREDIT QUALITY

Net charge-offs of $6.1 million were recorded

during the third quarter of 2024, compared to net charge-offs of

$12.0 million and $8.9 million during the second quarter of 2024

and the third quarter of 2023, respectively. Criticized loans

totaled $897.7 million at September 30, 2024, compared to

$859.7 million at June 30, 2024 and $677.4 million at

September 30, 2023. Non-accrual LHI totaled $89.0 million at

September 30, 2024, compared to $85.0 million at June 30, 2024

and $63.1 million at September 30, 2023. The ratio of

non-accrual LHI to total LHI for the third quarter of 2024 was

0.40%, compared to 0.39% for the second quarter of 2024 and 0.31%

for the third quarter of 2023. The ratio of total allowance for

credit losses to total LHI was 1.43% at September 30, 2024,

compared to 1.44% and 1.41% at June 30, 2024 and September 30,

2023, respectively.

REGULATORY RATIOS AND

CAPITAL

All regulatory ratios continue to be in excess

of “well capitalized” requirements as of September 30, 2024.

CET1, tier 1 capital, total capital and leverage ratios were 11.2%,

12.6%, 15.2% and 11.4%, respectively, at September 30, 2024,

compared to 11.6%, 13.1%, 15.7% and 12.2%, respectively, at June

30, 2024 and 12.7%, 14.3%, 17.1% and 12.1%, respectively, at

September 30, 2023. At September 30, 2024, our ratio of

tangible common equity to total tangible assets was 9.7%, compared

to 9.6% at June 30, 2024 and 9.4% at September 30, 2023.

About Texas Capital Bancshares,

Inc.

Texas Capital Bancshares, Inc. (NASDAQ: TCBI), a

member of the Russell 2000® Index and the S&P MidCap 400®, the

parent company of Texas Capital Bank d/b/a Texas Capital, is a

full-service financial services firm that delivers customized

solutions to businesses, entrepreneurs and individual customers.

Founded in 1998, the institution is headquartered in Dallas with

offices in Austin, Houston, San Antonio, and Fort Worth, and has

built a network of clients across the country. With the ability to

service clients through their entire lifecycles, Texas Capital has

established commercial banking, consumer banking, investment

banking and wealth management capabilities.

Forward Looking Statements

This communication contains “forward-looking

statements” within the meaning of and pursuant to the Private

Securities Litigation Reform Act of 1995 regarding, among other

things, TCBI’s financial condition, results of operations, business

plans and future performance. These statements are not historical

in nature and may often be identified by the use of words such as

“believes,” “projects,” “expects,” “may,” “estimates,” “should,”

“plans,” “targets,” “intends” “could,” “would,” “anticipates,”

“potential,” “confident,” “optimistic” or the negative thereof, or

other variations thereon, or comparable terminology, or by

discussions of strategy, objectives, estimates, trends, guidance,

expectations and future plans.

Because forward-looking statements relate to

future results and occurrences, they are subject to inherent and

various uncertainties, risks, and changes in circumstances that are

difficult to predict, may change over time, are based on

management’s expectations and assumptions at the time the

statements are made and are not guarantees of future results.

Numerous risks and other factors, many of which are beyond

management’s control, could cause actual results to differ

materially from future results expressed or implied by such

forward-looking statements. While there can be no assurance that

any list of risks is complete, important risks and other factors

that could cause actual results to differ materially from those

contemplated by forward-looking statements include, but are not

limited to: economic or business conditions in Texas, the United

States or globally that impact TCBI or its customers; negative

credit quality developments arising from the foregoing or other

factors; TCBI’s ability to effectively manage its liquidity and

maintain adequate regulatory capital to support its businesses;

TCBI’s ability to pursue and execute upon growth plans, whether as

a function of capital, liquidity or other limitations; TCBI’s

ability to successfully execute its business strategy, including

its strategic plan and developing and executing new lines of

business and new products and services; the extensive regulations

to which TCBI is subject and its ability to comply with applicable

governmental regulations, including legislative and regulatory

changes; TCBI’s ability to effectively manage information

technology systems, including third party vendors, cyber or data

privacy incidents or other failures, disruptions or security

breaches; elevated or further changes in interest rates, including

the impact of interest rates on TCBI’s securities portfolio and

funding costs, as well as related balance sheet implications

stemming from the fair value of our assets and liabilities; the

effectiveness of TCBI’s risk management processes strategies and

monitoring; fluctuations in commercial and residential real estate

values, especially as they relate to the value of collateral

supporting TCBI’s loans; the failure to identify, attract and

retain key personnel and other employees; increased or expanded

competition from banks and other financial service providers in

TCBI’s markets; adverse developments in the banking industry and

the potential impact of such developments on customer confidence,

liquidity and regulatory responses to these developments, including

in the context of regulatory examinations and related findings and

actions; negative press and social media attention with respect to

the banking industry or TCBI, in particular; claims, litigation or

regulatory investigations and actions that TCBI may become subject

to; severe weather, natural disasters, climate change, acts of war,

terrorism, global conflict (including those already reported by the

media, as well as others that may arise), or other external events,

as well as related legislative and regulatory initiatives; and the

risks and factors more fully described in TCBI’s most recent Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and other

documents and filings with the SEC. The information contained in

this communication speaks only as of its date. Except to the extent

required by applicable law or regulation, we disclaim any

obligation to update such factors or to publicly announce the

results of any revisions to any of the forward-looking statements

included herein to reflect future events or developments.

| TEXAS

CAPITAL BANCSHARES, INC. |

| SELECTED

FINANCIAL HIGHLIGHTS (UNAUDITED) |

| (dollars in

thousands except per share data) |

| |

3rd Quarter |

2nd Quarter |

1st Quarter |

4th Quarter |

3rd Quarter |

|

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

| CONSOLIDATED

STATEMENTS OF INCOME |

|

|

|

|

|

|

Interest income |

$ |

452,533 |

|

$ |

422,068 |

|

$ |

417,378 |

|

$ |

417,072 |

|

$ |

425,769 |

|

|

Interest expense |

|

212,431 |

|

|

205,486 |

|

|

202,369 |

|

|

202,355 |

|

|

193,698 |

|

|

Net interest income |

|

240,102 |

|

|

216,582 |

|

|

215,009 |

|

|

214,717 |

|

|

232,071 |

|

|

Provision for credit losses |

|

10,000 |

|

|

20,000 |

|

|

19,000 |

|

|

19,000 |

|

|

18,000 |

|

| Net interest income after

provision for credit losses |

|

230,102 |

|

|

196,582 |

|

|

196,009 |

|

|

195,717 |

|

|

214,071 |

|

|

Non-interest income |

|

(114,771 |

) |

|

50,424 |

|

|

41,319 |

|

|

31,133 |

|

|

46,872 |

|

|

Non-interest expense |

|

195,324 |

|

|

188,409 |

|

|

202,393 |

|

|

201,385 |

|

|

179,891 |

|

| Income/(loss) before income

taxes |

|

(79,993 |

) |

|

58,597 |

|

|

34,935 |

|

|

25,465 |

|

|

81,052 |

|

|

Income tax expense/(benefit) |

|

(18,674 |

) |

|

16,935 |

|

|

8,793 |

|

|

5,315 |

|

|

19,373 |

|

|

Net income/(loss) |

|

(61,319 |

) |

|

41,662 |

|

|

26,142 |

|

|

20,150 |

|

|

61,679 |

|

|

Preferred stock dividends |

|

4,313 |

|

|

4,312 |

|

|

4,313 |

|

|

4,312 |

|

|

4,313 |

|

|

Net income/(loss) available to common stockholders |

$ |

(65,632 |

) |

$ |

37,350 |

|

$ |

21,829 |

|

$ |

15,838 |

|

$ |

57,366 |

|

|

Diluted earnings/(loss) per common share |

$ |

(1.41 |

) |

$ |

0.80 |

|

$ |

0.46 |

|

$ |

0.33 |

|

$ |

1.18 |

|

|

Diluted common shares |

|

46,608,742 |

|

|

46,872,498 |

|

|

47,711,192 |

|

|

48,097,517 |

|

|

48,528,698 |

|

| |

|

|

|

|

|

| CONSOLIDATED BALANCE

SHEET DATA |

|

|

|

|

|

|

Total assets |

$ |

31,629,299 |

|

$ |

29,854,994 |

|

$ |

29,180,585 |

|

$ |

28,356,266 |

|

$ |

29,628,249 |

|

|

Loans held for investment |

|

16,764,512 |

|

|

16,700,569 |

|

|

16,677,691 |

|

|

16,362,230 |

|

|

16,183,882 |

|

|

Loans held for investment, mortgage finance |

|

5,529,659 |

|

|

5,078,161 |

|

|

4,153,313 |

|

|

3,978,328 |

|

|

4,429,489 |

|

|

Loans held for sale |

|

9,022 |

|

|

36,785 |

|

|

37,750 |

|

|

44,105 |

|

|

155,073 |

|

|

Interest bearing cash and cash equivalents |

|

3,894,537 |

|

|

2,691,352 |

|

|

3,148,157 |

|

|

3,042,357 |

|

|

3,975,860 |

|

|

Investment securities |

|

4,405,520 |

|

|

4,388,976 |

|

|

4,414,280 |

|

|

4,143,194 |

|

|

4,069,717 |

|

|

Non-interest bearing deposits |

|

9,070,804 |

|

|

7,987,715 |

|

|

8,478,215 |

|

|

7,328,276 |

|

|

9,352,883 |

|

|

Total deposits |

|

25,865,255 |

|

|

23,818,327 |

|

|

23,954,037 |

|

|

22,371,839 |

|

|

23,878,978 |

|

|

Short-term borrowings |

|

1,035,000 |

|

|

1,675,000 |

|

|

750,000 |

|

|

1,500,000 |

|

|

1,400,000 |

|

|

Long-term debt |

|

660,172 |

|

|

659,997 |

|

|

859,823 |

|

|

859,147 |

|

|

858,471 |

|

|

Stockholders’ equity |

|

3,354,044 |

|

|

3,175,601 |

|

|

3,170,662 |

|

|

3,199,142 |

|

|

3,077,700 |

|

| |

|

|

|

|

|

|

End of period shares outstanding |

|

46,207,757 |

|

|

46,188,078 |

|

|

46,986,275 |

|

|

47,237,912 |

|

|

48,015,003 |

|

|

Book value per share |

$ |

66.09 |

|

$ |

62.26 |

|

$ |

61.10 |

|

$ |

61.37 |

|

$ |

57.85 |

|

| Tangible book value per

share(1) |

$ |

66.06 |

|

$ |

62.23 |

|

$ |

61.06 |

|

$ |

61.34 |

|

$ |

57.82 |

|

| |

|

|

|

|

|

|

SELECTED FINANCIAL RATIOS |

|

|

|

|

|

|

Net interest margin |

|

3.16 |

% |

|

3.01 |

% |

|

3.03 |

% |

|

2.93 |

% |

|

3.13 |

% |

|

Return on average assets |

(0.78)% |

|

0.56 |

% |

|

0.36 |

% |

|

0.27 |

% |

|

0.81 |

% |

|

Return on average common equity |

(8.87)% |

|

5.26 |

% |

|

3.03 |

% |

|

2.25 |

% |

|

8.08 |

% |

|

Non-interest income to average earning assets |

(1.52)% |

|

0.71 |

% |

|

0.59 |

% |

|

0.43 |

% |

|

0.64 |

% |

|

Efficiency ratio(2) |

|

155.8 |

% |

|

70.6 |

% |

|

79.0 |

% |

|

81.9 |

% |

|

64.5 |

% |

|

Non-interest expense to average earning assets |

|

2.59 |

% |

|

2.65 |

% |

|

2.89 |

% |

|

2.79 |

% |

|

2.46 |

% |

| Common equity to total

assets |

|

9.7 |

% |

|

9.6 |

% |

|

9.8 |

% |

|

10.2 |

% |

|

9.4 |

% |

| Tangible common equity to

total tangible assets(3) |

|

9.7 |

% |

|

9.6 |

% |

|

9.8 |

% |

|

10.2 |

% |

|

9.4 |

% |

| Common Equity Tier 1 |

|

11.2 |

% |

|

11.6 |

% |

|

12.4 |

% |

|

12.6 |

% |

|

12.7 |

% |

| Tier 1 capital |

|

12.6 |

% |

|

13.1 |

% |

|

13.9 |

% |

|

14.2 |

% |

|

14.3 |

% |

| Total capital |

|

15.2 |

% |

|

15.7 |

% |

|

16.6 |

% |

|

17.1 |

% |

|

17.1 |

% |

| Leverage |

|

11.4 |

% |

|

12.2 |

% |

|

12.4 |

% |

|

12.2 |

% |

|

12.1 |

% |

|

(1) |

Stockholders’ equity excluding preferred stock, less goodwill and

intangibles, divided by shares outstanding at period end. |

| (2) |

Non-interest expense divided by

the sum of net interest income and non-interest income. |

| (3) |

Stockholders’ equity excluding

preferred stock, less goodwill and intangibles, divided by total

assets, less goodwill and intangibles. |

| |

|

| TEXAS

CAPITAL BANCSHARES, INC. |

|

CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

| (dollars in

thousands) |

| |

September 30, 2024 |

September 30, 2023 |

% Change |

| Assets |

|

|

|

|

Cash and due from banks |

$ |

297,048 |

|

$ |

216,916 |

|

37 |

% |

| Interest bearing cash and cash

equivalents |

|

3,894,537 |

|

|

3,975,860 |

|

(2)% |

| Available-for-sale debt

securities |

|

3,518,662 |

|

|

3,147,865 |

|

12 |

% |

|

Held-to-maturity debt securities |

|

812,432 |

|

|

881,352 |

|

(8)% |

|

Equity securities |

|

74,426 |

|

|

40,500 |

|

84 |

% |

|

Investment securities |

|

4,405,520 |

|

|

4,069,717 |

|

8 |

% |

|

Loans held for sale |

|

9,022 |

|

|

155,073 |

|

(94)% |

| Loans held for investment,

mortgage finance |

|

5,529,659 |

|

|

4,429,489 |

|

25 |

% |

| Loans held for investment |

|

16,764,512 |

|

|

16,183,882 |

|

4 |

% |

| Less: Allowance for credit

losses on loans |

|

273,143 |

|

|

244,902 |

|

12 |

% |

|

Loans held for investment, net |

|

22,021,028 |

|

|

20,368,469 |

|

8 |

% |

| Premises and equipment,

net |

|

81,577 |

|

|

31,050 |

|

163 |

% |

| Accrued interest receivable

and other assets |

|

919,071 |

|

|

809,668 |

|

14 |

% |

| Goodwill and intangibles,

net |

|

1,496 |

|

|

1,496 |

|

— |

% |

| Total

assets |

$ |

31,629,299 |

|

$ |

29,628,249 |

|

7 |

% |

| |

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

Liabilities: |

|

|

|

| Non-interest bearing

deposits |

$ |

9,070,804 |

|

$ |

9,352,883 |

|

(3)% |

| Interest bearing deposits |

|

16,794,451 |

|

|

14,526,095 |

|

16 |

% |

|

Total deposits |

|

25,865,255 |

|

|

23,878,978 |

|

8 |

% |

| Accrued interest payable |

|

18,679 |

|

|

31,149 |

|

(40)% |

| Other liabilities |

|

696,149 |

|

|

381,951 |

|

82 |

% |

| Short-term borrowings |

|

1,035,000 |

|

|

1,400,000 |

|

(26)% |

| Long-term debt |

|

660,172 |

|

|

858,471 |

|

(23)% |

| Total

liabilities |

|

28,275,255 |

|

|

26,550,549 |

|

6 |

% |

| |

|

|

|

| Stockholders’

equity: |

|

|

|

| Preferred stock, $.01 par

value, $1,000 liquidation value: |

|

|

|

|

Authorized shares - 10,000,000 |

|

|

|

|

Issued shares - 300,000 shares issued at September 30, 2024

and 2023 |

|

300,000 |

|

|

300,000 |

|

— |

% |

|

Common stock, $.01 par value: |

|

|

|

|

Authorized shares - 100,000,000 |

|

|

|

| Issued shares - 51,494,260 and

51,110,447 at September 30, 2024 and 2023, respectively |

|

515 |

|

|

511 |

|

1 |

% |

|

Additional paid-in capital |

|

1,054,614 |

|

|

1,039,074 |

|

1 |

% |

|

Retained earnings |

|

2,428,940 |

|

|

2,419,555 |

|

— |

% |

| Treasury stock - 5,286,503 and

3,095,444 shares at cost at September 30, 2024 and 2023,

respectively |

|

(301,868 |

) |

|

(175,528 |

) |

72 |

% |

|

Accumulated other comprehensive loss, net of taxes |

|

(128,157 |

) |

|

(505,912 |

) |

(75)% |

| Total stockholders’

equity |

|

3,354,044 |

|

|

3,077,700 |

|

9 |

% |

| Total liabilities and

stockholders’ equity |

$ |

31,629,299 |

|

$ |

29,628,249 |

|

7 |

% |

| |

|

|

|

|

|

|

|

|

| TEXAS CAPITAL

BANCSHARES, INC. |

|

|

|

|

| CONSOLIDATED

STATEMENTS OF INCOME (UNAUDITED) |

|

|

|

|

| (dollars in thousands except

per share data) |

|

|

|

|

| |

Three Months Ended September 30, |

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

2024 |

|

|

2023 |

| Interest

income |

|

|

|

|

| Interest and fees on

loans |

$ |

361,407 |

|

$ |

345,138 |

$ |

1,037,537 |

|

$ |

975,443 |

| Investment securities |

|

38,389 |

|

|

27,070 |

|

104,117 |

|

|

79,840 |

| Interest bearing cash and cash

equivalents |

|

52,737 |

|

|

53,561 |

|

150,325 |

|

|

157,568 |

|

Total interest income |

|

452,533 |

|

|

425,769 |

|

1,291,979 |

|

|

1,212,851 |

| Interest

expense |

|

|

|

|

| Deposits |

|

190,255 |

|

|

160,117 |

|

547,135 |

|

|

417,602 |

| Short-term borrowings |

|

13,784 |

|

|

19,576 |

|

39,316 |

|

|

52,573 |

| Long-term debt |

|

8,392 |

|

|

14,005 |

|

33,835 |

|

|

43,270 |

|

Total interest expense |

|

212,431 |

|

|

193,698 |

|

620,286 |

|

|

513,445 |

| Net interest

income |

|

240,102 |

|

|

232,071 |

|

671,693 |

|

|

699,406 |

| Provision for credit

losses |

|

10,000 |

|

|

18,000 |

|

49,000 |

|

|

53,000 |

| Net interest income

after provision for credit losses |

|

230,102 |

|

|

214,071 |

|

622,693 |

|

|

646,406 |

| Non-interest

income |

|

|

|

|

| Service charges on deposit

accounts |

|

6,307 |

|

|

5,297 |

|

18,557 |

|

|

15,477 |

| Wealth management and trust

fee income |

|

4,040 |

|

|

3,509 |

|

11,306 |

|

|

10,653 |

| Brokered loan fees |

|

2,400 |

|

|

2,532 |

|

6,442 |

|

|

6,842 |

| Investment banking and

advisory fees |

|

34,753 |

|

|

23,099 |

|

78,225 |

|

|

56,764 |

| Trading income |

|

5,786 |

|

|

6,092 |

|

16,148 |

|

|

18,693 |

| Available-for-sale debt

securities gains/(losses), net |

|

(179,581 |

) |

|

— |

|

(179,581 |

) |

|

489 |

| Other |

|

11,524 |

|

|

6,343 |

|

25,875 |

|

|

21,368 |

|

Total non-interest income |

|

(114,771 |

) |

|

46,872 |

|

(23,028 |

) |

|

130,286 |

| Non-interest

expense |

|

|

|

|

| Salaries and benefits |

|

121,138 |

|

|

110,010 |

|

368,705 |

|

|

351,730 |

| Occupancy expense |

|

12,937 |

|

|

9,910 |

|

33,340 |

|

|

29,011 |

| Marketing |

|

5,863 |

|

|

4,757 |

|

17,895 |

|

|

20,168 |

| Legal and professional |

|

11,135 |

|

|

17,614 |

|

38,603 |

|

|

47,797 |

| Communications and

technology |

|

25,951 |

|

|

19,607 |

|

69,078 |

|

|

57,655 |

| Federal Deposit Insurance

Corporation insurance assessment |

|

4,906 |

|

|

5,769 |

|

18,897 |

|

|

11,632 |

| Other |

|

13,394 |

|

|

12,224 |

|

39,608 |

|

|

37,569 |

|

Total non-interest expense |

|

195,324 |

|

|

179,891 |

|

586,126 |

|

|

555,562 |

| Income/(loss) before

income taxes |

|

(79,993 |

) |

|

81,052 |

|

13,539 |

|

|

221,130 |

| Income tax

expense/(benefit) |

|

(18,674 |

) |

|

19,373 |

|

7,054 |

|

|

52,139 |

| Net

income/(loss) |

|

(61,319 |

) |

|

61,679 |

|

6,485 |

|

|

168,991 |

| Preferred stock

dividends |

|

4,313 |

|

|

4,313 |

|

12,938 |

|

|

12,938 |

| Net income/(loss)

available to common stockholders |

$ |

(65,632 |

) |

$ |

57,366 |

$ |

(6,453 |

) |

$ |

156,053 |

| |

|

|

|

|

| Basic earnings/(loss)

per common share |

$ |

(1.42 |

) |

$ |

1.19 |

$ |

(0.14 |

) |

$ |

3.24 |

| Diluted

earnings/(loss) per common share |

$ |

(1.41 |

) |

$ |

1.18 |

$ |

(0.14 |

) |

$ |

3.20 |

| |

|

|

|

|

|

|

|

|

|

|

| TEXAS

CAPITAL BANCSHARES, INC. |

| SUMMARY

OF CREDIT LOSS EXPERIENCE |

| (dollars in

thousands) |

| |

3rd Quarter |

2nd Quarter |

1st Quarter |

4th Quarter |

3rd Quarter |

|

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

| Allowance for credit

losses on loans: |

|

|

|

|

|

| Beginning balance |

$ |

267,297 |

|

$ |

263,962 |

|

$ |

249,973 |

|

$ |

244,902 |

|

$ |

237,343 |

|

| Allowance established for

acquired purchase credit deterioration loans |

|

2,579 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Loans charged-off: |

|

|

|

|

|

|

Commercial |

|

6,120 |

|

|

9,997 |

|

|

7,544 |

|

|

8,356 |

|

|

13,246 |

|

|

Commercial real estate |

|

262 |

|

|

2,111 |

|

|

3,325 |

|

|

5,500 |

|

|

— |

|

|

Consumer |

|

30 |

|

|

— |

|

|

— |

|

|

— |

|

|

41 |

|

|

Total charge-offs |

|

6,412 |

|

|

12,108 |

|

|

10,869 |

|

|

13,856 |

|

|

13,287 |

|

| Recoveries: |

|

|

|

|

|

|

Commercial |

|

329 |

|

|

153 |

|

|

105 |

|

|

15 |

|

|

4,346 |

|

|

Commercial real estate |

|

— |

|

|

— |

|

|

— |

|

|

4 |

|

|

— |

|

|

Consumer |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Total recoveries |

|

329 |

|

|

153 |

|

|

105 |

|

|

19 |

|

|

4,346 |

|

| Net charge-offs |

|

6,083 |

|

|

11,955 |

|

|

10,764 |

|

|

13,837 |

|

|

8,941 |

|

| Provision for credit losses on

loans |

|

9,350 |

|

|

15,290 |

|

|

24,753 |

|

|

18,908 |

|

|

16,500 |

|

| Ending balance |

$ |

273,143 |

|

$ |

267,297 |

|

$ |

263,962 |

|

$ |

249,973 |

|

$ |

244,902 |

|

| |

|

|

|

|

|

| Allowance for

off-balance sheet credit losses: |

|

|

|

|

|

| Beginning balance |

$ |

45,319 |

|

$ |

40,609 |

|

$ |

46,362 |

|

$ |

46,270 |

|

$ |

44,770 |

|

| Provision for off-balance

sheet credit losses |

|

650 |

|

|

4,710 |

|

|

(5,753 |

) |

|

92 |

|

|

1,500 |

|

| Ending balance |

$ |

45,969 |

|

$ |

45,319 |

|

$ |

40,609 |

|

$ |

46,362 |

|

$ |

46,270 |

|

| |

|

|

|

|

|

| Total allowance for credit

losses |

$ |

319,112 |

|

$ |

312,616 |

|

$ |

304,571 |

|

$ |

296,335 |

|

$ |

291,172 |

|

| Total provision for credit

losses |

$ |

10,000 |

|

$ |

20,000 |

|

$ |

19,000 |

|

$ |

19,000 |

|

$ |

18,000 |

|

| |

|

|

|

|

|

| Allowance for credit losses on

loans to total loans held for investment |

|

1.23 |

% |

|

1.23 |

% |

|

1.27 |

% |

|

1.23 |

% |

|

1.19 |

% |

| Allowance for credit losses on

loans to average total loans held for investment |

|

1.24 |

% |

|

1.27 |

% |

|

1.32 |

% |

|

1.24 |

% |

|

1.17 |

% |

| Net charge-offs to average

total loans held for investment(1) |

|

0.11 |

% |

|

0.23 |

% |

|

0.22 |

% |

|

0.27 |

% |

|

0.17 |

% |

| Net charge-offs to average

total loans held for investment for last 12 months(1) |

|

0.20 |

% |

|

0.22 |

% |

|

0.20 |

% |

|

0.25 |

% |

|

0.26 |

% |

| Total provision for credit

losses to average total loans held for investment(1) |

|

0.18 |

% |

|

0.38 |

% |

|

0.38 |

% |

|

0.37 |

% |

|

0.34 |

% |

| Total allowance for credit

losses to total loans held for investment |

|

1.43 |

% |

|

1.44 |

% |

|

1.46 |

% |

|

1.46 |

% |

|

1.41 |

% |

|

(1) |

Interim period ratios are annualized. |

| |

|

| TEXAS CAPITAL

BANCSHARES, INC. |

|

|

|

|

|

| SUMMARY OF

NON-PERFORMING ASSETS AND PAST DUE LOANS |

|

|

|

| (dollars in thousands) |

|

|

|

|

|

| |

3rd Quarter |

2nd Quarter |

1st Quarter |

4th Quarter |

3rd Quarter |

|

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

| Non-accrual loans held for

investment |

$ |

88,960 |

|

$ |

85,021 |

|

$ |

92,849 |

|

$ |

81,398 |

|

$ |

63,129 |

|

| Non-accrual loans held for

sale(1) |

|

— |

|

|

— |

|

|

9,250 |

|

|

— |

|

|

— |

|

| Other real estate owned |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Total non-performing

assets |

$ |

88,960 |

|

$ |

85,021 |

|

$ |

102,099 |

|

$ |

81,398 |

|

$ |

63,129 |

|

| |

|

|

|

|

|

| Non-accrual loans held for

investment to total loans held for investment |

|

0.40 |

% |

|

0.39 |

% |

|

0.45 |

% |

|

0.40 |

% |

|

0.31 |

% |

| Total non-performing assets to

total assets |

|

0.28 |

% |

|

0.28 |

% |

|

0.35 |

% |

|

0.29 |

% |

|

0.21 |

% |

| Allowance for credit losses on

loans to non-accrual loans held for investment |

3.1x |

3.1x |

2.8x |

3.1x |

3.9x |

| Total allowance for credit

losses to non-accrual loans held for investment |

3.6x |

3.7x |

3.3x |

3.6x |

4.6x |

| |

|

|

|

|

|

| Loans held for investment past

due 90 days and still accruing |

$ |

5,281 |

|

$ |

286 |

|

$ |

3,674 |

|

$ |

19,523 |

|

$ |

4,602 |

|

| Loans held for investment past

due 90 days to total loans held for investment |

|

0.02 |

% |

|

— |

% |

|

0.02 |

% |

|

0.10 |

% |

|

0.02 |

% |

| Loans held for sale past due

90 days and still accruing |

$ |

— |

|

$ |

64 |

|

$ |

147 |

|

$ |

— |

|

$ |

— |

|

|

(1) |

First quarter 2024 includes one non-accrual loan previously

reported in loans held for investment that was transferred at fair

value to held for sale as of March 31, 2024. |

| |

|

| TEXAS

CAPITAL BANCSHARES, INC. |

|

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) |

| (dollars in

thousands) |

| |

|

|

|

|

|

| |

3rd Quarter |

2nd Quarter |

1st Quarter |

4th Quarter |

3rd Quarter |

|

|

|

2024 |

|

|

2024 |

|

2023 |

|

2023 |

|

2023 |

| Interest

income |

|

|

|

|

|

| Interest and fees on

loans |

$ |

361,407 |

|

$ |

345,251 |

$ |

330,879 |

$ |

325,210 |

$ |

345,138 |

| Investment securities |

|

38,389 |

|

|

33,584 |

|

32,144 |

|

28,454 |

|

27,070 |

| Interest bearing deposits in

other banks |

|

52,737 |

|

|

43,233 |

|

54,355 |

|

63,408 |

|

53,561 |

|

Total interest income |

|

452,533 |

|

|

422,068 |

|

417,378 |

|

417,072 |

|

425,769 |

| Interest

expense |

|

|

|

|

|

| Deposits |

|

190,255 |

|

|

181,280 |

|

175,600 |

|

170,173 |

|

160,117 |

| Short-term borrowings |

|

13,784 |

|

|

12,749 |

|

12,783 |

|

18,069 |

|

19,576 |

| Long-term debt |

|

8,392 |

|

|

11,457 |

|

13,986 |

|

14,113 |

|

14,005 |

|

Total interest expense |

|

212,431 |

|

|

205,486 |

|

202,369 |

|

202,355 |

|

193,698 |

| Net interest

income |

|

240,102 |

|

|

216,582 |

|

215,009 |

|

214,717 |

|

232,071 |

| Provision for credit

losses |

|

10,000 |

|

|

20,000 |

|

19,000 |

|

19,000 |

|

18,000 |

| Net interest income

after provision for credit losses |

|

230,102 |

|

|

196,582 |

|

196,009 |

|

195,717 |

|

214,071 |

| Non-interest

income |

|

|

|

|

|

| Service charges on deposit

accounts |

|

6,307 |

|

|

5,911 |

|

6,339 |

|

5,397 |

|

5,297 |

| Wealth management and trust

fee income |

|

4,040 |

|

|

3,699 |

|

3,567 |

|

3,302 |

|

3,509 |

| Brokered loan fees |

|

2,400 |

|

|

2,131 |

|

1,911 |

|

2,076 |

|

2,532 |

| Investment banking and

advisory fees |

|

34,753 |

|

|

25,048 |

|

18,424 |

|

6,906 |

|

23,099 |

| Trading income |

|

5,786 |

|

|

5,650 |

|

4,712 |

|

3,819 |

|

6,092 |

| Available-for-sale debt

securities gains/(losses), net |

|

(179,581 |

) |

|

— |

|

— |

|

— |

|

— |

| Other |

|

11,524 |

|

|

7,985 |

|

6,366 |

|

9,633 |

|

6,343 |

|

Total non-interest income |

|

(114,771 |

) |

|

50,424 |

|

41,319 |

|

31,133 |

|

46,872 |

| Non-interest

expense |

|

|

|

|

|

| Salaries and benefits |

|

121,138 |

|

|

118,840 |

|

128,727 |

|

107,970 |

|

110,010 |

| Occupancy expense |

|

12,937 |

|

|

10,666 |

|

9,737 |

|

9,483 |

|

9,910 |

| Marketing |

|

5,863 |

|

|

5,996 |

|

6,036 |

|

5,686 |

|

4,757 |

| Legal and professional |

|

11,135 |

|

|

11,273 |

|

16,195 |

|

17,127 |

|

17,614 |

| Communications and

technology |

|

25,951 |

|

|

22,013 |

|

21,114 |

|

23,607 |

|

19,607 |

| Federal Deposit Insurance

Corporation insurance assessment |

|

4,906 |

|

|

5,570 |

|

8,421 |

|

25,143 |

|

5,769 |

| Other |

|

13,394 |

|

|

14,051 |

|

12,163 |

|

12,369 |

|

12,224 |

|

Total non-interest expense |

|

195,324 |

|

|

188,409 |

|

202,393 |

|

201,385 |

|

179,891 |

| Income/(loss) before

income taxes |

|

(79,993 |

) |

|

58,597 |

|

34,935 |

|

25,465 |

|

81,052 |

| Income tax

expense/(benefit) |

|

(18,674 |

) |

|

16,935 |

|

8,793 |

|

5,315 |

|

19,373 |

| Net

income/(loss) |

|

(61,319 |

) |

|

41,662 |

|

26,142 |

|

20,150 |

|

61,679 |

| Preferred stock

dividends |

|

4,313 |

|

|

4,312 |

|

4,313 |

|

4,312 |

|

4,313 |

| Net income/(loss)

available to common shareholders |

$ |

(65,632 |

) |

$ |

37,350 |

$ |

21,829 |

$ |

15,838 |

$ |

57,366 |

| |

|

|

|

|

|

|

|

|

|

|

|

| TEXAS

CAPITAL BANCSHARES, INC. |

| TAXABLE

EQUIVALENT NET INTEREST INCOME ANALYSIS

(UNAUDITED)(1) |

| (dollars in

thousands) |

| |

3rd Quarter 2024 |

|

2nd Quarter 2024 |

|

1st Quarter 2024 |

|

4th Quarter 2023 |

|

3rd Quarter 2023 |

| |

AverageBalance |

Income/Expense |

Yield/Rate |

|

AverageBalance |

Income/Expense |

Yield/Rate |

|

AverageBalance |

Income/Expense |

Yield/Rate |

|

AverageBalance |

Income/Expense |

Yield/Rate |

|

AverageBalance |

Income/Expense |

Yield/Rate |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment securities(2) |

$ |

4,314,834 |

$ |

38,389 |

3.34 |

% |

|

$ |

4,427,023 |

$ |

33,584 |

2.80 |

% |

|

$ |

4,299,368 |

$ |

32,144 |

2.77 |

% |

|

$ |

4,078,975 |

$ |

28,454 |

2.48 |

% |

|

$ |

4,204,749 |

$ |

27,070 |

2.33 |

% |

| Interest bearing cash and cash

equivalents |

|

3,958,843 |

|

52,737 |

5.30 |

% |

|

|

3,273,069 |

|

43,233 |

5.31 |

% |

|

|

4,051,627 |

|

54,355 |

5.40 |

% |

|

|

4,637,374 |

|

63,408 |

5.42 |

% |

|

|

3,965,045 |

|

53,561 |

5.36 |

% |

| Loans held for sale |

|

23,793 |

|

565 |

9.44 |

% |

|

|

28,768 |

|

683 |

9.55 |

% |

|

|

51,164 |

|

1,184 |

9.31 |

% |

|

|

29,071 |

|

672 |

9.17 |

% |

|

|

31,878 |

|

647 |

8.06 |

% |

| Loans held for investment,

mortgage finance(4) |

|

5,152,317 |

|

54,371 |

4.20 |

% |

|

|

4,357,288 |

|

42,722 |

3.94 |

% |

|

|

3,517,707 |

|

31,455 |

3.60 |

% |

|

|

3,946,280 |

|

33,709 |

3.39 |

% |

|

|

4,697,702 |

|

50,813 |

4.29 |

% |

| Loans held for

investment(3)(4) |

|

16,792,446 |

|

306,541 |

7.26 |

% |

|

|

16,750,788 |

|

301,910 |

7.25 |

% |

|

|

16,522,089 |

|

298,306 |

7.26 |

% |

|

|

16,164,233 |

|

290,897 |

7.14 |

% |

|

|

16,317,324 |

|

293,750 |

7.14 |

% |

| Less: Allowance for credit

losses on loans |

|

266,915 |

|

— |

— |

|

|

|

263,145 |

|

— |

— |

|

|

|

249,936 |

|

— |

— |

|

|

|

244,287 |

|

— |

— |

|

|

|

238,883 |

|

— |

— |

|

| Loans held for investment,

net |

|

21,677,848 |

|

360,912 |

6.62 |

% |

|

|

20,844,931 |

|

344,632 |

6.65 |

% |

|

|

19,789,860 |

|

329,761 |

6.70 |

% |

|

|

19,866,226 |

|

324,606 |

6.48 |

% |

|

|

20,776,143 |

|

344,563 |

6.58 |

% |

| Total earning assets |

|

29,975,318 |

|

452,603 |

5.96 |

% |

|

|

28,573,791 |

|

422,132 |

5.86 |

% |

|

|

28,192,019 |

|

417,444 |

5.88 |

% |

|

|

28,611,646 |

|

417,140 |

5.69 |

% |

|

|

28,977,815 |

|

425,841 |

5.75 |

% |

| Cash and other assets |

|

1,239,855 |

|

|

|

|

1,177,061 |

|

|

|

|

1,058,463 |

|

|

|

|

1,120,354 |

|

|

|

|

1,106,031 |

|

|

| Total

assets |

$ |

31,215,173 |

|

|

|

$ |

29,750,852 |

|

|

|

$ |

29,250,482 |

|

|

|

$ |

29,732,000 |

|

|

|

$ |

30,083,846 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transaction deposits |

$ |

1,988,688 |

$ |

15,972 |

3.20 |

% |

|

$ |

2,061,622 |

$ |

16,982 |

3.31 |

% |

|

$ |

2,006,493 |

$ |

16,858 |

3.38 |

% |

|

$ |

1,972,324 |

$ |

15,613 |

3.14 |

% |

|

$ |

1,755,451 |

$ |

13,627 |

3.08 |

% |

| Savings deposits |

|

12,240,616 |

|

147,770 |

4.80 |

% |

|

|

11,981,668 |

|

143,173 |

4.81 |

% |

|

|

11,409,677 |

|

136,790 |

4.82 |

% |

|

|

11,043,155 |

|

132,801 |

4.77 |

% |

|

|

10,858,306 |

|

127,323 |

4.65 |

% |

| Time deposits |

|

2,070,537 |

|

26,513 |

5.09 |

% |

|

|

1,658,899 |

|

21,125 |

5.12 |

% |

|

|

1,719,325 |

|

21,952 |

5.14 |

% |

|

|

1,716,812 |

|

21,759 |

5.03 |

% |

|

|

1,610,235 |

|

19,167 |

4.72 |

% |

| Total interest bearing

deposits |

|

16,299,841 |

|

190,255 |

4.64 |

% |

|

|

15,702,189 |

|

181,280 |

4.64 |

% |

|

|

15,135,495 |

|

175,600 |

4.67 |

% |

|

|

14,732,291 |

|

170,173 |

4.58 |

% |

|

|

14,223,992 |

|

160,117 |

4.47 |

% |

| Short-term borrowings |

|

1,012,608 |

|

13,784 |

5.42 |

% |

|

|

927,253 |

|

12,749 |

5.53 |

% |

|

|

912,088 |

|

12,783 |

5.64 |

% |

|

|

1,257,609 |

|

18,069 |

5.70 |

% |

|

|

1,393,478 |

|

19,576 |

5.57 |

% |

| Long-term debt |

|

660,098 |

|

8,392 |

5.06 |

% |

|

|

778,401 |

|

11,457 |

5.92 |

% |

|

|

859,509 |

|

13,986 |

6.54 |

% |

|

|

858,858 |

|

14,113 |

6.52 |

% |

|

|

858,167 |

|

14,005 |

6.47 |

% |

| Total interest bearing

liabilities |

|

17,972,547 |

|

212,431 |

4.70 |

% |

|

|

17,407,843 |

|

205,486 |

4.75 |

% |

|

|

16,907,092 |

|

202,369 |

4.81 |

% |

|

|

16,848,758 |

|

202,355 |

4.76 |

% |

|

|

16,475,637 |

|

193,698 |

4.66 |

% |

| Non-interest bearing

deposits |

|

9,439,020 |

|

|

|

|

8,647,594 |

|

|

|

|

8,637,775 |

|

|

|

|

9,247,491 |

|

|

|

|

10,016,579 |

|

|

| Other liabilities |

|

558,368 |

|

|

|

|

537,754 |

|

|

|

|

509,286 |

|

|

|

|

541,162 |

|

|

|

|

474,869 |

|

|

| Stockholders’ equity |

|

3,245,238 |

|

|

|

|

3,157,661 |

|

|

|

|

3,196,329 |

|

|

|

|

3,094,589 |

|

|

|

|

3,116,761 |

|

|

| Total liabilities and

stockholders’ equity |

$ |

31,215,173 |

|

|

|

$ |

29,750,852 |

|

|

|

$ |

29,250,482 |

|

|

|

$ |

29,732,000 |

|

|

|

$ |

30,083,846 |

|

|

| Net interest

income |

|

$ |

240,172 |

|

|

|

$ |

216,646 |

|

|

|

$ |

215,075 |

|

|

|

$ |

214,785 |

|

|

|

$ |

232,143 |

|

| Net interest

margin |

|

|

3.16 |

% |

|

|

|

3.01 |

% |

|

|

|

3.03 |

% |

|

|

|

2.93 |

% |

|

|

|

3.13 |

% |

|

(1) |

Taxable equivalent rates used where applicable. |

| (2) |

Yields on investment securities

are calculated using available-for-sale securities at amortized

cost. |

| (3) |

Average balances include

non-accrual loans. |

| (4) |

In the first quarter of 2024,

enhancements were made to our methodology for applying relationship

pricing credits to mortgage client loans. To conform to the current

period presentation, certain prior period interest income amounts

have been reclassified from loans held for investment, mortgage

finance to loans held for investment and related yields have been

adjusted accordingly. |

INVESTOR CONTACT

Jocelyn Kukulka, 469.399.8544

jocelyn.kukulka@texascapitalbank.com

MEDIA CONTACT

Julia Monter, 469.399.8425

julia.monter@texascapitalbank.com

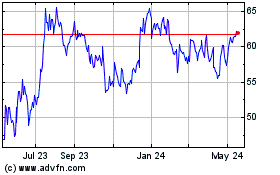

Texas Capital Bancshares (NASDAQ:TCBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

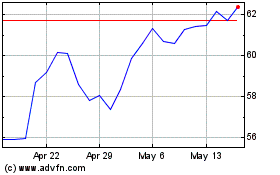

Texas Capital Bancshares (NASDAQ:TCBI)

Historical Stock Chart

From Jan 2024 to Jan 2025