TIAN RUIXIANG Holdings Ltd Reports Financial Results for Fiscal Year Ended October 31, 2023

18 July 2024 - 7:42AM

TIAN RUIXIANG Holdings Ltd (Nasdaq: TIRX) (the "Company"), a

China-based insurance broker conducting business through its

variable interest entity in China, today announced its financial

results for the fiscal year ended October 31, 2023.

Ms. Sheng Xu, the Chief Executive Officer of the Company,

commented, “For the year ended October 31, 2023, the Company

generated revenue of about $1.2 million, representing an 8.0%

decrease compared to the prior year's revenue. This decline was

primarily attributable to the lower commissions from several

insurance products and loss of certain insurance company partners

amid an increasingly competitive market and challenging

macroeconomic environment in China.”

“However, we achieved a significant increase of approximately

$612,000 in the commissions from our liability insurance products,

driven by our efforts to expand our liability insurance

business.”

“Despite the revenue decline, we were able to reduce the

net loss by 47.6% to $2.5 million, down from $4.7 million in the

prior year. Overall, while we faced headwinds in certain insurance

products, we were able to drive substantial growth in the liability

insurance commissions, which is a positive indicator for the

Company's strategic focus. Additionally, the reduction in the net

loss demonstrates improved financial performance and operational

efficiency compared to the prior year.”

Selected Fiscal Year 2023 Financial Metrics

|

|

|

Years Ended October 31, |

|

Changes in |

|

|

($ in millions, except per share data, differences due to

rounding.) |

|

2023 |

|

2022 |

|

Percentage |

|

|

Revenues |

|

$ |

1.2 |

|

$ |

1.4 |

|

(8.0) |

% |

|

Total operating expenses |

|

|

4.3 |

|

|

6.4 |

|

(33.6) |

% |

|

Loss from operations |

|

|

(3.0) |

|

|

(5.1) |

|

(40.5) |

% |

|

Net loss |

|

|

(2.5) |

|

|

(4.7) |

|

(47.6) |

% |

|

Loss per share |

|

|

(3.87) |

|

|

(9.03) |

|

(55.4) |

% |

- Revenue decreased by 8.0% to $1.2

million for the year ended October 31, 2023, compared with $1.4

million for the same period in 2022.

- Total operating expenses were $4.3

million for the year ended October 31, 2023, decreased from $6.4

million for the same period in 2022.

- Loss from operations narrowed by

40.5% to $3.0 million for the year ended October 31, 2023, from

$5.1 million for the same period in 2022.

- Net loss also decreased by 47.6% to

$2.5 million for the year ended October 31, 2023, from $4.7 million

for the same period in 2022.

About TIAN RUIXIANG Holdings Ltd

TIAN RUIXIANG Holdings Ltd, headquartered in Beijing, China, is

an insurance broker operating in China through its China-based

variable interest entity. It distributes a wide range of insurance

products, which are categorized into two major groups: (1) property

and casualty insurance, such as commercial property insurance,

liability insurance, accidental insurance, and automobile

insurance; and (2) other types of insurance, such as health

insurance, life insurance, and other miscellaneous insurance. For

more information, visit the company's website at

http://ir.tianrx.com/.

Forward-Looking Statements

Certain statements in this announcement are forward-looking

statements. These forward-looking statements involve known and

unknown risks and uncertainties and are based on current

expectations and projections about future events and financial

trends that the Company believes may affect its financial

condition, results of operations, business strategy and financial

needs. Investors can identify these forward-looking statements by

words or phrases such as "may," "will," "expect," "anticipate,"

"aim," "estimate," "intend," "plan," "believe," "potential,"

"continue," "is/are likely to" or other similar expressions. The

Company undertakes no obligation to update forward-looking

statements to reflect subsequent occurring events or circumstances,

or changes in its expectations, except as may be required by law.

Although the Company believes that the expectations expressed in

these forward-looking statements are reasonable, it cannot assure

you that such expectations will turn out to be correct, and the

Company cautions investors that actual results may differ

materially from the anticipated results and encourages investors to

review risk factors that may affect its future results in the

Company's registration statement and in its other filings with the

U.S. Securities and Exchange Commission.

For investor and media enquiries, please

contact:

TIAN RUIXIANG Holdings LtdInvestor Relations DepartmentEmail:

ir@tianrx.com

Wealth Financial Services LLCConnie KangPartnerEmail:

ckang@wealthfsllc.comTel: +86 1381 185 7742 (CN)

|

TIAN RUIXIANG HOLDINGS LTD AND SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(IN U.S. DOLLARS) |

| |

| |

|

|

|

|

|

|

| |

|

As of October 31, |

| |

|

2023 |

|

|

2022 |

|

| ASSETS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash |

|

$ |

2,383 |

|

|

$ |

2,508 |

|

| Restricted cash |

|

|

692,692 |

|

|

|

692,734 |

|

| Short-term investments |

|

|

26,797,081 |

|

|

|

26,179,662 |

|

| Accounts receivable |

|

|

18,960 |

|

|

|

51,202 |

|

| Note receivable |

|

|

— |

|

|

|

7,500,000 |

|

| Interest receivable |

|

|

— |

|

|

|

262,192 |

|

| Due from related party |

|

|

— |

|

|

|

1,369 |

|

| Other current assets |

|

|

107,508 |

|

|

|

168,957 |

|

| |

|

|

|

|

|

|

| Total Current Assets |

|

|

27,618,624 |

|

|

|

34,858,624 |

|

| |

|

|

|

|

|

|

| NON-CURRENT ASSETS: |

|

|

|

|

|

|

| Note receivable |

|

|

7,800,000 |

|

|

|

— |

|

| Property and equipment,

net |

|

|

6,280 |

|

|

|

8,688 |

|

| Right-of-use assets, operating

leases, net |

|

|

54,870 |

|

|

|

143,438 |

|

| Other non-current assets |

|

|

— |

|

|

|

20,078 |

|

| |

|

|

|

|

|

|

| Total Non-current Assets |

|

|

7,861,150 |

|

|

|

172,204 |

|

| |

|

|

|

|

|

|

| Total Assets |

|

$ |

35,479,774 |

|

|

$ |

35,030,828 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

| Taxes payable |

|

$ |

623,825 |

|

|

$ |

466,878 |

|

| Salary payable |

|

|

726,330 |

|

|

|

424,987 |

|

| Accrued liabilities and other

payables |

|

|

481,801 |

|

|

|

384,893 |

|

| Due to related parties |

|

|

1,173,510 |

|

|

|

126,530 |

|

| Operating lease

liabilities |

|

|

57,402 |

|

|

|

90,800 |

|

| |

|

|

|

|

|

|

| Total Current Liabilities |

|

|

3,062,868 |

|

|

|

1,494,088 |

|

| |

|

|

|

|

|

|

| NON-CURRENT LIABILITIES: |

|

|

|

|

|

|

| Operating lease liabilities -

noncurrent portion |

|

|

— |

|

|

|

54,718 |

|

| |

|

|

|

|

|

|

| Total Non-current

Liabilities |

|

|

— |

|

|

|

54,718 |

|

| |

|

|

|

|

|

|

| Total Liabilities |

|

|

3,062,868 |

|

|

|

1,548,806 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| EQUITY: |

|

|

|

|

|

|

| TIAN RUIXIANG Holdings Ltd

Shareholders' Equity: |

|

|

|

|

|

|

| Ordinary shares: $0.025 par

value; 40,000,000 shares authorized; |

|

|

|

|

|

|

| Class A ordinary shares:

$0.025 par value; 36,000,000 shares authorized; 674,949 shares

issued and outstanding at October 31, 2023; 507,440 shares issued

and 505,440 shares outstanding at October 31, 2022 |

|

|

16,874 |

|

|

|

12,636 |

|

| Class B ordinary shares:

$0.025 par value; 4,000,000 shares authorized; 50,000 shares issued

and outstanding at October 31, 2023 and 2022 |

|

|

1,250 |

|

|

|

1,250 |

|

| Additional paid-in

capital |

|

|

44,108,774 |

|

|

|

42,663,012 |

|

| Less: ordinary stock held in

treasury, at cost; 0 share at October 31, 2023 and 2,000 shares at

October 31, 2022 |

|

|

— |

|

|

|

— |

|

| Accumulated deficit |

|

|

(8,303,691 |

) |

|

|

(5,800,817 |

) |

| Statutory reserve |

|

|

275,150 |

|

|

|

226,253 |

|

| Accumulated other

comprehensive loss |

|

|

(3,681,845 |

) |

|

|

(3,620,712 |

) |

| Total TIAN RUIXIANG Holdings

Ltd shareholders' equity |

|

|

32,416,512 |

|

|

|

33,481,622 |

|

| Non-controlling interest |

|

|

394 |

|

|

|

400 |

|

| |

|

|

|

|

|

|

| Total Equity |

|

|

32,416,906 |

|

|

|

33,482,022 |

|

| |

|

|

|

|

|

|

| Total Liabilities and

Equity |

|

$ |

35,479,774 |

|

|

$ |

35,030,828 |

|

| |

|

|

|

|

|

|

|

|

|

TIAN RUIXIANG HOLDINGS LTD AND SUBSIDIARIESCONSOLIDATED STATEMENTS

OF OPERATIONS AND COMPREHENSIVE LOSS(IN U.S. DOLLARS) |

| |

| |

|

For the Years Ended October 31, |

| |

|

2023 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

| REVENUES |

|

|

|

|

|

|

|

|

|

|

Commissions |

|

$ |

1,244,247 |

|

|

$ |

1,324,655 |

|

|

$ |

2,675,611 |

|

| Risk management services |

|

|

— |

|

|

|

27,254 |

|

|

|

115,006 |

|

| |

|

|

|

|

|

|

|

|

|

| Total Revenues |

|

|

1,244,247 |

|

|

|

1,351,909 |

|

|

|

2,790,617 |

|

| |

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

| Selling and marketing |

|

|

2,438,248 |

|

|

|

1,764,909 |

|

|

|

2,517,497 |

|

| General and administrative -

professional fees |

|

|

1,220,367 |

|

|

|

1,185,930 |

|

|

|

1,011,053 |

|

| General and administrative -

compensation and related benefits |

|

|

460,791 |

|

|

|

2,691,751 |

|

|

|

948,900 |

|

| General and administrative -

other |

|

|

141,167 |

|

|

|

654,587 |

|

|

|

566,971 |

|

| Impairment loss |

|

|

— |

|

|

|

123,646 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

| Total Operating Expenses |

|

|

4,260,573 |

|

|

|

6,420,823 |

|

|

|

5,044,421 |

|

| |

|

|

|

|

|

|

|

|

|

| LOSS FROM OPERATIONS |

|

|

(3,016,326 |

) |

|

|

(5,068,914 |

) |

|

|

(2,253,804 |

) |

| |

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

731,961 |

|

|

|

434,406 |

|

|

|

315,070 |

|

| Other (expense) income |

|

|

(8,278 |

) |

|

|

(26,042 |

) |

|

|

18,686 |

|

| |

|

|

|

|

|

|

|

|

|

| Total Other Income, net |

|

|

723,683 |

|

|

|

408,364 |

|

|

|

333,756 |

|

| |

|

|

|

|

|

|

|

|

|

| LOSS BEFORE INCOME TAXES |

|

|

(2,292,643 |

) |

|

|

(4,660,550 |

) |

|

|

(1,920,048 |

) |

| |

|

|

|

|

|

|

|

|

|

| INCOME TAXES |

|

|

161,339 |

|

|

|

23,639 |

|

|

|

24,529 |

|

| |

|

|

|

|

|

|

|

|

|

| NET LOSS |

|

$ |

(2,453,982 |

) |

|

$ |

(4,684,189 |

) |

|

$ |

(1,944,577 |

) |

| |

|

|

|

|

|

|

|

|

|

| LESS: NET LOSS ATTRIBUTABLE TO

NON-CONTROLLING INTEREST |

|

|

(5 |

) |

|

|

(32 |

) |

|

|

(28 |

) |

| |

|

|

|

|

|

|

|

|

|

| NET LOSS ATTRIBUTABLE TO TIAN

RUIXIANG HOLDINGS LTD ORDINARY SHAREHOLDERS |

|

$ |

(2,453,977 |

) |

|

$ |

(4,684,157 |

) |

|

$ |

(1,944,549 |

) |

| |

|

|

|

|

|

|

|

|

|

| NET LOSS PER ORDINARY SHARE

ATTRIBUTABLE TO TIAN RUIXIANG HOLDINGS LTD ORDINARY

SHAREHOLDERS: |

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

(3.87 |

) |

|

$ |

(9.03 |

) |

|

$ |

(5.65 |

) |

| |

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE ORDINARY

SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

633,336 |

|

|

|

518,655 |

|

|

|

344,425 |

|

| |

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE LOSS: |

|

|

|

|

|

|

|

|

|

| NET LOSS |

|

$ |

(2,453,982 |

) |

|

$ |

(4,684,189 |

) |

|

$ |

(1,944,577 |

) |

| OTHER COMPREHENSIVE (LOSS)

INCOME |

|

|

|

|

|

|

|

|

|

| Unrealized foreign currency

translation (loss) gain |

|

|

(61,134 |

) |

|

|

(3,717,478 |

) |

|

|

214,123 |

|

| COMPREHENSIVE LOSS |

|

|

(2,515,116 |

) |

|

|

(8,401,667 |

) |

|

|

(1,730,454 |

) |

| LESS: COMPREHENSIVE LOSS

ATTRIBUTABLE TO NON-CONTROLLING INTEREST |

|

|

(6 |

) |

|

|

(89 |

) |

|

|

(6 |

) |

| COMPREHENSIVE LOSS

ATTRIBUTABLE TO TIAN RUIXIANG HOLDINGS LTD ORDINARY

SHAREHOLDERS |

|

$ |

(2,515,110 |

) |

|

$ |

(8,401,578 |

) |

|

$ |

(1,730,448 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

TIAN RUIXIANG HOLDINGS LTD AND SUBSIDIARIESCONSOLIDATED STATEMENTS

OF CASH FLOWS(IN U.S. DOLLARS) |

| |

| |

|

For the Years Ended October 31, |

| |

|

2023 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,453,982 |

) |

|

$ |

(4,684,189 |

) |

|

$ |

(1,944,577 |

) |

| Adjustments to reconcile net

loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

| Depreciation expense and

amortization of intangible assets |

|

|

1,631 |

|

|

|

22,853 |

|

|

|

27,447 |

|

| Amortization of right-of-use

assets |

|

|

78,126 |

|

|

|

185,421 |

|

|

|

227,661 |

|

| Impairment loss |

|

|

— |

|

|

|

123,646 |

|

|

|

696 |

|

| Stock-based compensation and

service expense |

|

|

1,450,000 |

|

|

|

2,888,787 |

|

|

|

— |

|

| Bad debt provision |

|

|

7,338 |

|

|

|

— |

|

|

|

— |

|

| Loss on disposal of property

and equipment |

|

|

848 |

|

|

|

— |

|

|

|

— |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

25,983 |

|

|

|

254,109 |

|

|

|

969,374 |

|

| Security deposit |

|

|

6,726 |

|

|

|

37,853 |

|

|

|

(43,750 |

) |

| Interest receivable |

|

|

262,192 |

|

|

|

(149,178 |

) |

|

|

(113,014 |

) |

| Due from related party |

|

|

1,417 |

|

|

|

(1,511 |

) |

|

|

— |

|

| Other assets |

|

|

91,348 |

|

|

|

495,668 |

|

|

|

(74,120 |

) |

| Taxes payable |

|

|

163,500 |

|

|

|

36,553 |

|

|

|

(78,932 |

) |

| Salary payable |

|

|

347,567 |

|

|

|

349,436 |

|

|

|

— |

|

| Accrued liabilities and other

payables |

|

|

99,649 |

|

|

|

304,576 |

|

|

|

(123,052 |

) |

| Due to related parties |

|

|

992,277 |

|

|

|

126,228 |

|

|

|

12,025 |

|

| Operating lease liabilities -

related party |

|

|

— |

|

|

|

— |

|

|

|

(29,355 |

) |

| Operating lease

liabilities |

|

|

(80,316 |

) |

|

|

(189,012 |

) |

|

|

(194,341 |

) |

| |

|

|

|

|

|

|

|

|

|

| NET CASH PROVIDED BY (USED IN)

OPERATING ACTIVITIES |

|

|

994,304 |

|

|

|

(198,760 |

) |

|

|

(1,363,938 |

) |

| |

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

| Purchase of property and

equipment |

|

|

— |

|

|

|

(2,346 |

) |

|

|

(3,411 |

) |

| Investment in note

receivable |

|

|

(7,800,000 |

) |

|

|

— |

|

|

|

(7,500,000 |

) |

| Proceeds from note

receivable |

|

|

7,500,000 |

|

|

|

— |

|

|

|

— |

|

| Purchase of short-term

investments |

|

|

(27,779,231 |

) |

|

|

(29,011,783 |

) |

|

|

- |

|

| Proceeds from sale of

short-term investments |

|

|

27,086,514 |

|

|

|

116,663 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

| NET CASH USED IN INVESTING

ACTIVITIES |

|

|

(992,717 |

) |

|

|

(28,897,466 |

) |

|

|

(7,503,411 |

) |

| |

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES |

|

|

|

|

|

|

|

|

|

| Proceeds from note

payable |

|

|

— |

|

|

|

— |

|

|

|

75,581 |

|

| Repayment of note payable |

|

|

— |

|

|

|

— |

|

|

|

(75,581 |

) |

| Proceeds from related parties'

borrowings |

|

|

9,535 |

|

|

|

225,171 |

|

|

|

1,893,932 |

|

| Repayments of related parties'

borrowings |

|

|

(9,818 |

) |

|

|

(225,171 |

) |

|

|

(2,272,145 |

) |

| Proceeds from initial public

offering |

|

|

— |

|

|

|

— |

|

|

|

12,300,000 |

|

| Disbursements for initial

public offering costs |

|

|

— |

|

|

|

— |

|

|

|

(1,489,388 |

) |

| Proceeds from the June 2021

public offering |

|

|

— |

|

|

|

— |

|

|

|

24,562,500 |

|

| Disbursements for the June

2021 public offering costs |

|

|

— |

|

|

|

— |

|

|

|

(2,352,418 |

) |

| |

|

|

|

|

|

|

|

|

|

| NET CASH (USED IN) PROVIDED BY

FINANCING ACTIVITIES |

|

|

(283 |

) |

|

|

— |

|

|

|

32,642,481 |

|

| |

|

|

|

|

|

|

|

|

|

| EFFECT OF EXCHANGE RATE ON

CASH AND RESTRICTED CASH |

|

|

(1,471 |

) |

|

|

(1,052,173 |

) |

|

|

145,014 |

|

| |

|

|

|

|

|

|

|

|

|

| NET (DECREASE) INCREASE IN

CASH AND RESTRICTED CASH |

|

|

(167 |

) |

|

|

(30,148,399 |

) |

|

|

23,920,146 |

|

| |

|

|

|

|

|

|

|

|

|

| CASH AND RESTRICTED CASH -

beginning of year |

|

|

695,242 |

|

|

|

30,843,641 |

|

|

|

6,923,495 |

|

| |

|

|

|

|

|

|

|

|

|

| CASH AND RESTRICTED CASH - end

of year |

|

$ |

695,075 |

|

|

$ |

695,242 |

|

|

$ |

30,843,641 |

|

| |

|

|

|

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURE OF

CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

|

| Cash paid for: |

|

|

|

|

|

|

|

|

|

| Interest |

|

$ |

— |

|

|

$ |

22 |

|

|

$ |

725 |

|

| Income taxes |

|

$ |

807 |

|

|

$ |

— |

|

|

$ |

2,251 |

|

| |

|

|

|

|

|

|

|

|

|

| NON-CASH INVESTING AND

FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

| Reissuance of treasury

stock |

|

$ |

25,000 |

|

|

$ |

— |

|

|

$ |

— |

|

| Payments made by related

parties on the Company’s behalf |

|

$ |

1,068,700 |

|

|

$ |

— |

|

|

$ |

119,886 |

|

| |

|

|

|

|

|

|

|

|

|

| RECONCILIATION OF CASH AND

RESTRICTED CASH |

|

|

|

|

|

|

|

|

|

| Cash at beginning of year |

|

$ |

2,508 |

|

|

$ |

30,024,372 |

|

|

$ |

6,137,689 |

|

| Restricted cash at beginning

of year |

|

|

692,734 |

|

|

|

819,269 |

|

|

|

785,806 |

|

| Total cash and restricted cash

at beginning of year |

|

$ |

695,242 |

|

|

$ |

30,843,641 |

|

|

$ |

6,923,495 |

|

| |

|

|

|

|

|

|

|

|

|

| Cash at end of year |

|

$ |

2,383 |

|

|

$ |

2,508 |

|

|

$ |

30,024,372 |

|

| Restricted cash at end of

year |

|

|

692,692 |

|

|

|

692,734 |

|

|

|

819,269 |

|

| Total cash and restricted cash

at end of year |

|

$ |

695,075 |

|

|

$ |

695,242 |

|

|

$ |

30,843,641 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

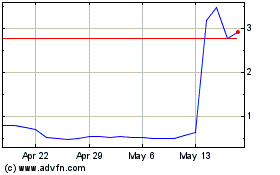

Tian Ruixiang (NASDAQ:TIRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tian Ruixiang (NASDAQ:TIRX)

Historical Stock Chart

From Feb 2024 to Feb 2025