Alpha Teknova, Inc. (“Teknova” or the “Company”) (Nasdaq: TKNO), a

leading provider of critical reagents for the discovery, research,

development, and commercialization of drug therapies, novel

vaccines, and molecular diagnostics, today announced financial

results for the third quarter ended September 30, 2022.

“Teknova delivered a solid third quarter revenue

performance, driven by robust Lab Essentials growth and healthy

demand across our broad customer base,” said Stephen Gunstream,

President and CEO of Teknova. “Most recently, we entered the

qualification phase of our new state-of-the-art production facility

and announced an Early Access Program for the first novel products

to emerge from our R&D pipeline. We are balancing selective

strategic investments with prudent management of our capital to

position Teknova for accelerated growth and remain on our path to

profitability.”

Corporate and Financial

Updates

- Achieved quarterly total revenue of $10.7 million, up 14%

compared to $9.4 million in the third quarter 2021

- Remained on track with capacity expansion of existing

facilities and are nearing completion of the Company’s new,

state-of-the-art manufacturing facility. Qualification activities

are underway, and facility expected to be operational for

production of research grade products by the end of 2022

- Reported cash position of $49.9 million, supporting ongoing

investment in future growth

- Introduced an Early Access Program for two novel products in

development and added WFI Quality Water to the Company’s product

portfolio

- Goodwill was fully impaired, resulting in a one-time, non-cash

impairment charge of $16.6 million in the third quarter 2022

Revenue for the Third Quarter and

Year-to-Date 2022

|

|

|

For the Three Months EndedSeptember 30, |

|

|

For the Nine Months EndedSeptember 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Lab Essentials |

|

$ |

9,470 |

|

|

$ |

7,195 |

|

|

$ |

24,838 |

|

|

$ |

20,440 |

|

|

Clinical Solutions |

|

|

919 |

|

|

|

1,690 |

|

|

|

7,673 |

|

|

|

4,354 |

|

|

Sample Transport |

|

|

— |

|

|

|

73 |

|

|

|

6 |

|

|

|

1,035 |

|

|

Other |

|

|

303 |

|

|

|

434 |

|

|

|

1,012 |

|

|

|

954 |

|

|

Total revenue |

|

$ |

10,692 |

|

|

$ |

9,392 |

|

|

$ |

33,529 |

|

|

$ |

26,783 |

|

Third Quarter 2022 Financial

Results

Total revenue for the third quarter 2022 was $10.7

million, up 14% compared to $9.4 million in the third quarter

2021.

Gross profit for the third quarter 2022 was $4.8

million, compared to $4.3 million in the third quarter 2021. Gross

margin for the third quarter 2022 was 44.6% of revenue. This

compares to gross margin of 45.4% in the third quarter 2021. The

lower gross margin for the third quarter 2022 compared to the gross

margin in the prior year primarily reflects additional headcount

resulting in higher labor costs.

Operating expenses for the third quarter 2022 were

$27.7 million compared to $8.2 million in the third quarter 2021.

The increase was primarily related to a one-time, $16.6 million

non-cash goodwill impairment charge in the quarter, coupled with

additional headcount, stock-based compensation expense, and

marketing costs.

Net loss for the third quarter 2022 was $22.5

million, or negative $0.80 per diluted share, compared to net loss

of $3.3 million, or negative $0.12 per diluted share, for the third

quarter 2021.

Cash used in operating activities for the third

quarter 2022 was $8.3 million, compared to cash used in operating

activities of $4.8 million for the third quarter 2021.

Adjusted EBITDA for the third quarter 2022 was

negative $4.6 million, compared to negative $2.7 million for the

third quarter 2021. Free Cash Flow was negative $14.9 million for

the third quarter 2022, compared to negative $8.7 million for the

third quarter 2021.

2022 Revenue Outlook

Teknova is updating its outlook for the fiscal

year ending December 31, 2022, to total revenue of $40 million to

$42 million, which assumes approximately 16% growth at the

mid-point of guidance, excluding Sample Transport revenue earned in

2021. The Company expects an approximately 15% increase in Lab

Essentials and at least a 25% increase in Clinical Solutions

revenue to drive total revenue growth for the year. The Company

does not anticipate any material revenue from Sample Transport in

2022.

Conference Call and Webcast

Teknova will host a webcast and conference call on

Wednesday, November 9, 2022, beginning at 4:30 p.m. ET.

Participants can access the live webcast on the Investor Relations

section of the Teknova website and at this link:

https://edge.media-server.com/mmc/p/rjjxxr67. To receive a PIN

number for dial in, participants can register for the webcast via

this link:

https://register.vevent.com/register/BIc8c72fb8e9214c49b689933915e724ad.

The webcast will be available for replay on the Company’s website

approximately two hours after the event.

About Teknova

Teknova is expediting clinical breakthroughs in

life sciences by providing custom products and reagents for drug

therapies, novel vaccines, and molecular diagnostics. With a focus

on agility and customization, Teknova delivers research-grade and

GMP products, including cell culture media and supplements, protein

and nucleic acid purification buffers, and molecular biology

reagents for a multitude of established and emerging applications,

including cell and gene therapy, mRNA therapeutics, genomics, and

synthetic biology. Teknova's proprietary processes enable the

manufacture and delivery of high-quality, custom, made-to-order

products with short turnaround times and at scale across all stages

of development, including commercialization.

Non-GAAP Financial Measures

This press release contains financial measures

that have not been calculated in accordance with U.S. generally

accepted accounting principles (GAAP). Teknova uses the following

non-GAAP financial measures in assessing the performance of its

business and the effectiveness of its business strategies: (a)

Adjusted EBITDA and (b) Free Cash Flow.

Teknova defines Adjusted EBITDA as net loss

adjusted for interest income (expense), net, benefit from income

taxes, depreciation expense, amortization of intangible assets, and

stock-based compensation expense. Adjusted EBITDA reflects further

adjustments to eliminate the impact of certain items, including

certain non-cash and other items that Teknova does not consider

representative of its ongoing operating performance.

Teknova defines Free Cash Flow as cash used in

operating activities less purchases of property, plant, and

equipment.

Teknova presents Adjusted EBITDA and Free Cash

Flow in this press release because Teknova believes that analysts,

investors, and other interested parties frequently use these

measures to evaluate companies in Teknova's industry and that such

measures facilitate comparisons on a consistent basis across

reporting periods. Teknova also believes such measures are helpful

in highlighting trends in Teknova's operating results because they

exclude items that are not indicative of Teknova's core operating

performance. Investors should consider non-GAAP financial measures

in addition to, and not as a substitute for, or as superior to,

measures of financial performance prepared in accordance with GAAP.

The non-GAAP financial measures presented by Teknova may be

different from the non-GAAP financial measures used by other

companies.

A full reconciliation of these non-GAAP measures

to the most comparable GAAP measures is included at the end of this

release.

Forward-Looking Statements

Statements in this press release about future

expectations, plans and prospects, as well as any other statements

regarding matters that are not historical facts, may constitute

“forward-looking statements.” These statements include, but are not

limited to, statements relating to Teknova’s anticipated total

revenue, expected growth in Lab Essentials and Clinical Solutions,

ongoing capacity expansion, new research and development products,

prospects, including to achieve profitability, and long-term growth

strategy. The words, without limitation, “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these or similar identifying words. These

forward-looking statements are based on management’s current

expectations and beliefs and are subject to uncertainties and

factors, all of which are difficult to predict and many of which

are beyond Teknova’s control and could cause actual results to

differ materially and adversely from those described in the

forward-looking statements. These risks include, but are not

limited to, demand for Teknova’s products (including the delay or

pausing of customer orders); Teknova’s assessment of fundamental

indicators of future demand across its target customer base;

Teknova’s ability to expand its production capacity and commercial

and R&D capabilities; Teknova’s cash flows and revenue growth

rate; Teknova’s supply chain, sourcing, manufacturing and

warehousing; inventory management; risks related to global economic

and marketplace uncertainties related to the impact of the COVID-19

pandemic, including the impact of the pandemic on Teknova’s supply

chain; reliance on a limited number of customers for a high

percentage of Teknova’s revenue; potential acquisitions and

integration of other companies and other factors discussed in the

“Risk Factors” section of Teknova’s most recent periodic reports

filed with the Securities and Exchange Commission (“SEC”),

including in Teknova’s Annual Report on Form 10-K for the year

ended December 31, 2021 and subsequent Quarterly Reports on Form

10-Q filed with the SEC, all of which you may obtain for free on

the SEC’s website at www.sec.gov. Although Teknova believes that

the expectations reflected in its forward-looking statements are

reasonable, Teknova does not know whether its expectations will

prove correct. You are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

hereof, even if subsequently made available by Teknova on its

website or otherwise. Teknova does not undertake any obligation to

update, amend or clarify these forward-looking statements, whether

as a result of new information, future events or otherwise, except

as may be required under applicable securities laws.

ALPHA TEKNOVA, INC.

Condensed Statements of Operations

(Unaudited) (In thousands, except share

and per share data)

|

|

|

For the Three Months EndedSeptember 30, |

|

|

For the Nine Months EndedSeptember 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Revenue |

|

$ |

10,692 |

|

|

$ |

9,392 |

|

|

$ |

33,529 |

|

|

$ |

26,783 |

|

|

Cost of sales |

|

|

5,922 |

|

|

|

5,129 |

|

|

|

18,163 |

|

|

|

14,141 |

|

|

Gross profit |

|

|

4,770 |

|

|

|

4,263 |

|

|

|

15,366 |

|

|

|

12,642 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

1,925 |

|

|

|

1,372 |

|

|

|

5,867 |

|

|

|

2,922 |

|

|

Sales and marketing |

|

|

2,397 |

|

|

|

885 |

|

|

|

6,592 |

|

|

|

2,494 |

|

|

General and administrative |

|

|

6,502 |

|

|

|

5,607 |

|

|

|

20,856 |

|

|

|

13,606 |

|

|

Amortization of intangible assets |

|

|

287 |

|

|

|

287 |

|

|

|

861 |

|

|

|

861 |

|

|

Goodwill impairment |

|

|

16,613 |

|

|

|

— |

|

|

|

16,613 |

|

|

|

— |

|

|

Total operating expenses |

|

|

27,724 |

|

|

|

8,151 |

|

|

|

50,789 |

|

|

|

19,883 |

|

|

Loss from operations |

|

|

(22,954 |

) |

|

|

(3,888 |

) |

|

|

(35,423 |

) |

|

|

(7,241 |

) |

|

Other income (expenses), net |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

|

70 |

|

|

|

(255 |

) |

|

|

85 |

|

|

|

(553 |

) |

|

Other income (expense), net |

|

|

36 |

|

|

|

— |

|

|

|

36 |

|

|

|

(2 |

) |

|

Total other income (expenses), net |

|

|

106 |

|

|

|

(255 |

) |

|

|

121 |

|

|

|

(555 |

) |

|

Loss before income taxes |

|

|

(22,848 |

) |

|

|

(4,143 |

) |

|

|

(35,302 |

) |

|

|

(7,796 |

) |

|

Benefit from income taxes |

|

|

(374 |

) |

|

|

(892 |

) |

|

|

(1,128 |

) |

|

|

(1,640 |

) |

|

Net loss |

|

$ |

(22,474 |

) |

|

$ |

(3,251 |

) |

|

$ |

(34,174 |

) |

|

$ |

(6,156 |

) |

|

Net loss per share—basic and diluted |

|

$ |

(0.80 |

) |

|

$ |

(0.12 |

) |

|

$ |

(1.22 |

) |

|

$ |

(0.51 |

) |

|

Weighted average shares used in computing net loss per share—basic

and diluted |

|

|

28,090,267 |

|

|

|

28,011,917 |

|

|

|

28,059,897 |

|

|

|

12,069,214 |

|

ALPHA TEKNOVA, INC.

Condensed Balance Sheets

(Unaudited) (In thousands)

|

|

|

As of September 30, |

|

|

As of December 31, |

|

|

|

|

2022 |

|

|

2021 |

|

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

49,855 |

|

|

$ |

87,518 |

|

|

Accounts receivable, net |

|

|

5,581 |

|

|

|

4,666 |

|

|

Contract assets |

|

|

667 |

|

|

|

— |

|

|

Inventories, net |

|

|

10,323 |

|

|

|

5,394 |

|

|

Income taxes receivable |

|

|

120 |

|

|

|

1,188 |

|

|

Prepaid expenses and other current assets |

|

|

3,521 |

|

|

|

2,438 |

|

|

Total current assets |

|

|

70,067 |

|

|

|

101,204 |

|

|

Property, plant and equipment, net |

|

|

52,628 |

|

|

|

29,810 |

|

|

Operating right-of-use lease assets |

|

|

18,558 |

|

|

|

— |

|

|

Goodwill |

|

|

— |

|

|

|

16,613 |

|

|

Intangible assets, net |

|

|

17,843 |

|

|

|

18,704 |

|

|

Other non-current assets |

|

|

1,176 |

|

|

|

180 |

|

|

Total assets |

|

$ |

160,272 |

|

|

$ |

166,511 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,485 |

|

|

$ |

2,248 |

|

|

Accrued liabilities |

|

|

6,590 |

|

|

|

5,495 |

|

|

Current portion of operating lease liabilities |

|

|

2,253 |

|

|

|

— |

|

|

Total current liabilities |

|

|

12,328 |

|

|

|

7,743 |

|

|

Deferred tax liabilities |

|

|

2,028 |

|

|

|

3,153 |

|

|

Other accrued liabilities |

|

|

212 |

|

|

|

273 |

|

|

Long-term debt, net |

|

|

16,878 |

|

|

|

11,870 |

|

|

Deferred rent |

|

|

— |

|

|

|

269 |

|

|

Long-term operating lease liabilities |

|

|

16,830 |

|

|

|

— |

|

|

Total liabilities |

|

|

48,276 |

|

|

|

23,308 |

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock |

|

|

— |

|

|

|

— |

|

|

Common stock |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

153,708 |

|

|

|

150,741 |

|

|

Accumulated deficit |

|

|

(41,712 |

) |

|

|

(7,538 |

) |

|

Total stockholders’ equity |

|

|

111,996 |

|

|

|

143,203 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

160,272 |

|

|

$ |

166,511 |

|

ALPHA TEKNOVA, INC.

Condensed Statements of Cash Flows

(Unaudited) (In thousands)

|

|

|

For the Three Months EndedSeptember 30, |

|

|

For the Nine Months EndedSeptember 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(22,474 |

) |

|

$ |

(3,251 |

) |

|

$ |

(34,174 |

) |

|

$ |

(6,156 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bad debt expense |

|

|

2 |

|

|

|

4 |

|

|

|

34 |

|

|

|

235 |

|

|

Inventory reserve |

|

|

186 |

|

|

|

(23 |

) |

|

|

178 |

|

|

|

676 |

|

|

Depreciation and amortization |

|

|

729 |

|

|

|

748 |

|

|

|

2,272 |

|

|

|

2,100 |

|

|

Stock-based compensation |

|

|

968 |

|

|

|

442 |

|

|

|

2,689 |

|

|

|

927 |

|

|

Deferred taxes |

|

|

(374 |

) |

|

|

(893 |

) |

|

|

(1,125 |

) |

|

|

(1,640 |

) |

|

Amortization of debt financing costs |

|

|

60 |

|

|

|

43 |

|

|

|

159 |

|

|

|

89 |

|

|

Non-cash lease expense |

|

|

75 |

|

|

|

11 |

|

|

|

256 |

|

|

|

60 |

|

|

Loss on disposal of property, plant and equipment |

|

|

210 |

|

|

|

— |

|

|

|

210 |

|

|

|

4 |

|

|

Goodwill impairment |

|

|

16,613 |

|

|

|

|

|

|

16,613 |

|

|

|

— |

|

|

Other |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(10 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

227 |

|

|

|

(504 |

) |

|

|

(949 |

) |

|

|

(170 |

) |

|

Contract assets |

|

|

(667 |

) |

|

|

— |

|

|

|

(667 |

) |

|

|

— |

|

|

Inventories |

|

|

(2,600 |

) |

|

|

(500 |

) |

|

|

(5,107 |

) |

|

|

(1,497 |

) |

|

Income taxes receivable |

|

|

(3 |

) |

|

|

447 |

|

|

|

1,068 |

|

|

|

226 |

|

|

Prepaid expenses and other current assets |

|

|

(1,820 |

) |

|

|

(2,195 |

) |

|

|

(1,083 |

) |

|

|

(1,777 |

) |

|

Other non-current assets |

|

|

(407 |

) |

|

|

2 |

|

|

|

(996 |

) |

|

|

(5 |

) |

|

Accounts payable |

|

|

1,247 |

|

|

|

501 |

|

|

|

969 |

|

|

|

468 |

|

|

Accrued liabilities |

|

|

(283 |

) |

|

|

348 |

|

|

|

343 |

|

|

|

553 |

|

|

Other |

|

|

(21 |

) |

|

|

(17 |

) |

|

|

(61 |

) |

|

|

(70 |

) |

|

Cash used in operating activities |

|

|

(8,332 |

) |

|

|

(4,837 |

) |

|

|

(19,371 |

) |

|

|

(5,987 |

) |

|

Investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(6,582 |

) |

|

|

(3,907 |

) |

|

|

(23,419 |

) |

|

|

(12,465 |

) |

|

Proceeds from loan to related party |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

529 |

|

|

Proceeds on sales of short-term marketable securities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,132 |

|

|

Proceeds from maturities of short-term marketable securities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

695 |

|

|

Cash used in investing activities |

|

|

(6,582 |

) |

|

|

(3,907 |

) |

|

|

(23,419 |

) |

|

|

(10,109 |

) |

|

Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from long-term debt |

|

|

— |

|

|

|

1 |

|

|

|

5,135 |

|

|

|

11,890 |

|

|

Payment of debt issuance costs |

|

|

— |

|

|

|

— |

|

|

|

(151 |

) |

|

|

(153 |

) |

|

Payment of exit fee costs |

|

|

— |

|

|

|

— |

|

|

|

(135 |

) |

|

|

— |

|

|

Payment of costs related to initial public offering |

|

|

— |

|

|

|

(1,266 |

) |

|

|

— |

|

|

|

(3,615 |

) |

|

Proceeds from initial public offering, net of underwriters’

commissions and discounts |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

102,672 |

|

|

Proceeds from exercise of stock options |

|

|

35 |

|

|

|

— |

|

|

|

134 |

|

|

|

— |

|

|

Proceeds from issuance of common stock under employee stock

purchase plan |

|

|

— |

|

|

|

— |

|

|

|

144 |

|

|

|

— |

|

|

Cash provided by financing activities |

|

|

35 |

|

|

|

(1,265 |

) |

|

|

5,127 |

|

|

|

110,794 |

|

|

Change in cash and cash equivalents |

|

|

(14,879 |

) |

|

|

(10,009 |

) |

|

|

(37,663 |

) |

|

|

94,698 |

|

|

Cash and cash equivalents at beginning of period |

|

|

64,734 |

|

|

|

108,022 |

|

|

|

87,518 |

|

|

|

3,315 |

|

|

Cash and cash equivalents at end of period |

|

$ |

49,855 |

|

|

$ |

98,013 |

|

|

$ |

49,855 |

|

|

$ |

98,013 |

|

ALPHA TEKNOVA, INC.

Reconciliation of Non-GAAP Measures to the Most Comparable

GAAP Measures (Unaudited) (In

thousands)

|

|

|

For the Three Months EndedSeptember 30, |

|

|

For the Nine Months EndedSeptember 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Net loss – as reported |

|

$ |

(22,474 |

) |

|

$ |

(3,251 |

) |

|

$ |

(34,174 |

) |

|

$ |

(6,156 |

) |

|

Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

|

70 |

|

|

|

(255 |

) |

|

|

85 |

|

|

|

(553 |

) |

|

Benefit from income taxes |

|

|

(374 |

) |

|

|

(892 |

) |

|

|

(1,128 |

) |

|

|

(1,640 |

) |

|

Depreciation expense |

|

|

442 |

|

|

|

461 |

|

|

|

1,411 |

|

|

|

1,239 |

|

|

Amortization of intangible assets |

|

|

287 |

|

|

|

287 |

|

|

|

861 |

|

|

|

861 |

|

|

EBITDA |

|

$ |

(22,189 |

) |

|

$ |

(3,140 |

) |

|

$ |

(33,115 |

) |

|

$ |

(5,143 |

) |

|

Other and one-time expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

968 |

|

|

|

442 |

|

|

|

2,689 |

|

|

|

927 |

|

|

Goodwill impairment charge |

|

|

16,613 |

|

|

|

— |

|

|

|

16,613 |

|

|

|

— |

|

|

Adjusted EBITDA |

|

$ |

(4,608 |

) |

|

$ |

(2,698 |

) |

|

$ |

(13,813 |

) |

|

$ |

(4,216 |

) |

|

|

|

For the Three Months EndedSeptember 30, |

|

|

For the Nine Months EndedSeptember 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Cash used in operating activities |

|

$ |

(8,332 |

) |

|

$ |

(4,837 |

) |

|

$ |

(19,371 |

) |

|

$ |

(5,987 |

) |

|

Purchase of property, plant and equipment |

|

|

(6,582 |

) |

|

|

(3,907 |

) |

|

|

(23,419 |

) |

|

|

(12,465 |

) |

|

Free Cash Flow |

|

$ |

(14,914 |

) |

|

$ |

(8,744 |

) |

|

$ |

(42,790 |

) |

|

$ |

(18,452 |

) |

Investor Contacts

Matt Lowell

Chief Financial Officer

matt.lowell@teknova.com

+1 831-637-1100

Sara Michelmore

MacDougall Advisors

smichelmore@macdougall.bio

+1 781-235-3060

Media Contact

Jenn Henry

Senior Vice President, Marketing

jenn.henry@teknova.com

+1 831-313-1259

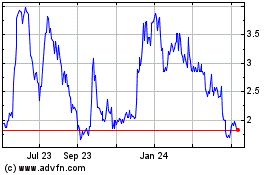

Alpha Teknova (NASDAQ:TKNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

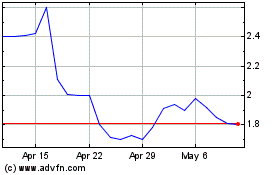

Alpha Teknova (NASDAQ:TKNO)

Historical Stock Chart

From Apr 2023 to Apr 2024