UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14-A

Proxy Statement Pursuant

to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary

Proxy Statement

¨ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive

Proxy Statement

¨ Definitive

Additional Materials

¨ Soliciting

Material Pursuant to Section 240.14a-12

Corner Growth

Acquisition Corp. 2

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee paid

previously with preliminary materials.

¨ Fee computed on

table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11

Corner Growth Acquisition Corp. 2

A Cayman Islands Exempted Company

251 Lytton Avenue, Suite 200

Palo Alto, California 94301

NOTICE OF EXTRAORDINARY GENERAL MEETING OF

SHAREHOLDERS

To Be Held at 1:00 p.m. Eastern Time on March 8, 2024

Dear Shareholders:

NOTICE IS HEREBY GIVEN that an extraordinary general

meeting (the “Extraordinary General Meeting”) of Corner Growth Acquisition Corp. 2 (“Corner Growth 2,” “CGAC2,”

the “Company,” “we,” “us” or “our”), a Cayman Islands exempted company, will be held in

person and virtually at 1:00 p.m. Eastern Time on March 8, 2024, at the offices of Duane Morris LLP located at 1540 Broadway, New

York, New York 10036, or at such other time, on such other date and at such other place at which the meeting may be adjourned or postponed.

If you plan on attending in person please email meetingcgac@duanemorris.com at least one day prior to the Extraordinary General Meeting.

The accompanying proxy statement (the “Proxy Statement”) is dated February 26, 2024 and is first being mailed to shareholders

of the Company on or about that date. Shareholders that wish to listen to the Extraordinary General Meeting via teleconference, but will

not be able to participate in the Extraordinary General Meeting or vote, may use the following teleconference dial-in numbers:

Telephone access (listen-only):

Within the U.S. and Canada: 1 800-450-7155 (toll-free)

Outside of the U.S. and Canada: +1 857-999-9155 (standard

rates apply)

Conference ID: 1037346#

Extraordinary General Meeting-meeting webpage (information,

webcast, telephone access and replay): https://www.cstproxy.com/cgac2/2024

While Shareholders may attend

the Extraordinary General Meeting in person at the meeting location, we strongly encourage the Shareholders to attend the meeting virtually

or by telephone.

The sole purpose of the Extraordinary General

Meeting is to:

| |

· |

consider and vote on a proposal

to approve by special resolution (the “Extension Proposal”), pursuant to the terms of the Company’s amended and

restated memorandum and articles of association, as amended (the “Articles”), as provided by the resolution in the form

set forth in Annex A to the accompanying Proxy Statement (the “Extension Amendment”), to amend the Articles to extend

the date by which the Company must consummate a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization

or similar business combination with one or more businesses or entities (a “business combination”) from March 21,

2024 (the “Original Termination Date”) to December 31, 2024 (the “Extension,” and such later date, the

“Extended Date”), or such earlier date as shall be determined by the Company’s board of directors (the “Board”)

in its sole discretion (the “Amended Termination Date”); |

| |

· |

consider and vote on a proposal

to approve by special resolution, pursuant to the terms of the Company’s Articles, as provided by the second resolution in

the form set forth in Annex A to the accompanying Proxy Statement (the “Redemption Limitation Amendment” and such

proposal, the “Redemption Limitation Amendment Proposal”) to amend the Articles to eliminate from the Articles the limitation

that the Company shall not redeem Class A Ordinary Shares included as part of the units sold in the IPO (the “Public Shares”)

to the extent that such redemption would cause the Company’s net tangible assets to be less than $5,000,001 (the “Redemption

Limitation”). The Redemption Limitation Amendment would allow the Company to redeem Public Shares irrespective of whether such

redemption would exceed the Redemption Limitation; and |

| |

· |

consider and vote on a proposal

to approve by ordinary resolution the adjournment of the Extraordinary General Meeting to a later date or dates, if necessary,

to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with,

the approval of the Extension Proposal and/or the Redemption Limitation Amendment Proposal, which we refer to as the “Adjournment

Proposal”. The Adjournment Proposal will only be presented at the Extraordinary General Meeting if there are not sufficient votes

to approve the Extension Proposal and/or the Redemption Limitation Amendment Proposal. |

The Extension Proposal, the Redemption Limitation

Amendment Proposal and the Adjournment Proposal are more fully described in the accompanying proxy statement. Please take the time to

read carefully each of the proposals in the accompanying proxy statement before you vote.

The purpose of the Extension is to allow us more

time to complete an initial business combination. You are not being asked to vote on a business combination at this time.

The Company is listed on The Nasdaq Capital Market

(“Nasdaq”). Nasdaq rule IM-5101-2 requires that a special purpose acquisition company complete one

or more business combinations within 36 months of the effectiveness of its IPO registration statement, which, in the case of the Company,

would be June 21, 2024 (the “Nasdaq Deadline”). The Articles provide that we have until March 21, 2024 to complete an

initial business combination. Therefore, our Board has determined that it is in the best interests of the Company and its shareholders

to amend the Articles, in the form set forth in Annex A, to extend the date that we have to consummate a business combination. If the

Extension Proposal is approved, the Company would have an additional nine months and ten days after the Original Termination Date to

consummate a business combination, which is a total of up to forty-two (42) months and ten days (the “Extension Date”) to

complete a business combination after the IPO, unless the Board otherwise sets an earlier Amended Termination Date. The Extension to

the Extension Date would extend the Company’s life beyond the Nasdaq Deadline. As a result, the contemplated Extension does not

comply with Nasdaq rules. We may be subject to suspension or delisting by Nasdaq if the Extension Amendment Proposal is approved and

the Extension is implemented. For more information see “Risk Factors – The Extension contemplated by the Extension Amendment

Proposal contravenes Nasdaq rules, and as a result, could lead Nasdaq to suspend trading in the Company’s securities or lead the

Company to be delisted from Nasdaq.”

In connection with the Extension Proposal and

the Redemption Limitation Amendment Proposal, public shareholders may elect to redeem their shares for a per-share price, payable in

cash, equal to the aggregate amount then on deposit in the Trust Account, including interest earned, divided by the number of the then

outstanding Public Shares, and which election we refer to as the “Election.” An Election can be made regardless of whether

such public shareholders vote “FOR” or “AGAINST” the Extension Proposal and the Redemption Limitation Amendment

Proposal and an Election can also be made by public shareholders who do not vote, or do not instruct their broker or bank how to vote,

at the Extraordinary General Meeting. The public shareholders may make an Election regardless of whether such public shareholders were

holders as of the record date for the Extraordinary General Meeting. Public shareholders who do not make the Election would be entitled

to have their shares redeemed for cash if we have not completed our initial business combination by the Extended Date or the Amended

Termination Date, as applicable. In addition, regardless of whether public shareholders vote “FOR” or “AGAINST”

the Extension Proposal, the Redemption Limitation Amendment Proposal or do not vote, or do not instruct their broker or bank how to vote,

at the Extraordinary General Meeting, if the Extension is implemented and a public shareholder does not make an Election, they will retain

the right to vote on any proposed initial business combination through the Extended Date if the Extended Date is approved and the right

to redeem their Public Shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account

as of two business days prior to the consummation of such initial business combination, including interest (which interest shall be net

of taxes payable), divided by the number of then outstanding Public Shares, in the event a proposed business combination is completed.

We are not asking you to vote on any proposed

business combination at this time. If the Extension Proposal and the Redemption Limitation Amendment Proposal are implemented and you

do not elect to redeem your Public Shares now, you will retain the right to vote on a business combination when it is submitted to shareholders

and the right to redeem your Public Shares into a pro rata portion of the Trust Account in the event a business combination is approved

and completed (as long as your election is made in accordance with the Articles prior to the meeting at which the shareholders’

vote is sought) or the Company has not consummated a business combination by the Extended Date. If the Extension Proposal and the Redemption

Limitation Amendment Proposal are not approved, we may not be able to consummate a business combination. We urge you to vote at the Extraordinary

General Meeting regarding the Extension Proposal and the Redemption Limitation Amendment Proposal.

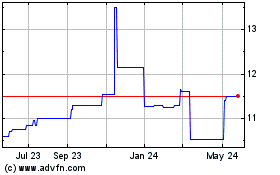

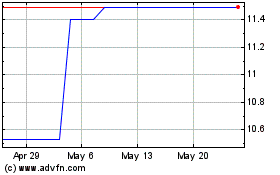

Based upon the amount in the Trust Account as of February 23, 2024,

which was approximately $21,492,032.25 we anticipate that the per-share price at which Public Shares will be redeemed from cash held in

the Trust Account will be approximately $11.55 at the time of the Extraordinary General Meeting. The closing price of the Public Shares

on Nasdaq on February 23, 2024, the most recent practicable closing price prior to the mailing of this Proxy Statement, was $11.54. We

cannot assure shareholders that they will be able to sell their shares in the open market, even if the market price per share is higher

than the redemption price stated above, as there may not be sufficient liquidity in our securities when such shareholders wish to sell

their shares. We will not proceed with the Extension if redemptions of our Public Shares would cause us to have less than $5,000,001 of

net tangible assets following approval of the Extension Proposal unless the Redemption Limitation Amendment Proposal is approved.

TO DEMAND REDEMPTION, PRIOR TO 5:00 P.M. EASTERN

TIME ON MARCH 6, 2024, TWO BUSINESS DAYS BEFORE THE EXTRAORDINARY GENERAL MEETING, YOU SHOULD ELECT EITHER TO PHYSICALLY TENDER YOUR

SHARE CERTIFICATES TO CONTINENTAL STOCK TRANSFER & TRUST COMPANY, LLC OR TO DELIVER YOUR SHARES TO THE TRANSFER AGENT ELECTRONICALLY

USING DTC’S DWAC (DEPOSIT/WITHDRAWAL AT CUSTODIAN), AS DESCRIBED HEREIN. YOU SHOULD ENSURE THAT YOUR BANK OR BROKER COMPLIES WITH

THE REQUIREMENTS IDENTIFIED ELSEWHERE HEREIN.

Unless the Redemption Limitation Amendment Proposal

is approved, we will not proceed with the Extension if redemptions of our Public Shares would cause the Company to exceed the Redemption

Limitation. If the Redemption Limitation Amendment Proposal is not approved and there are significant requests for redemption such that

the Company’s net tangible assets would be less than $5,000,001, the Articles would prevent the Company from being able to consummate

the Business Combination even if all other conditions to closing are met. The Company believes that the Redemption Limitation is not

needed. The purpose of such limitation was initially to ensure that, in connection with the Company’s initial business combination,

the Company would continue, as we have since our IPO, to be not subject to the “penny stock” rules of the SEC, and therefore

not a “blank check company” as defined under Rule 419 of the Securities Act of 1933, as amended, because it

complied with Rule 3a51-1(g)(1) (the “NTA Rule”). The NTA Rule is one of several exclusions from the “penny

stock” rules of the SEC and we believe that we may rely on another exclusion, which relates to the Company being listed on

Nasdaq (Rule 3a51-1(a)(2)) (the “Exchange Rule”). Therefore, the Company intends to rely on the Exchange Rule to

not be deemed a penny stock issuer, however, we may be subject to suspension or delisting by Nasdaq if the Extension Amendment Proposal

is approved and the Extension is implemented, and accordingly, could not rely on the Exchange Rule. For more information see “Risk

Factors – The Extension contemplated by the Extension Amendment Proposal contravenes Nasdaq rules, and as a result, could lead

Nasdaq to suspend trading in the Company’s securities or lead the Company to be delisted from Nasdaq.” In the event that

the Redemption Limitation Amendment Proposal is not approved and we receive notice of redemptions of Public Shares approaching or in

excess of the Redemption Limitation, we and/or CGA Sponsor2, LLC, a Delaware limited liability company (our “Sponsor”), may

take action to increase our net tangible assets to avoid exceeding the Redemption Limitation.

If the Extension Proposal is not approved and

we do not consummate a business combination by March 21, 2024, as contemplated by our IPO prospectus and in accordance with our

Articles, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but

not more than ten business days thereafter, redeem the Public Shares at a per-share price, payable in cash, equal to the aggregate amount

then on deposit in the Trust Account established by the Company upon the consummation of the IPO and into which certain amount of the

net proceeds of the IPO, together with certain of the proceeds of a private placement of warrants simultaneously with the closing date

of the IPO, was deposited, including interest earned on the funds held in the Trust Account and not previously released to us to pay

our franchise and income taxes (less up to $100,000 of interest to pay dissolution expenses and net of taxes payable), divided by the

number of the then outstanding Public Shares, which redemption will completely extinguish the rights of the holders of Public Shares

(the “public shareholders”) as shareholders (including the right to receive further liquidation distributions, if any); and

(iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining shareholders and our

Board, liquidate and dissolve, subject in each case to its obligations under Cayman Islands law to provide for claims of creditors and

to the other requirements of applicable law.

There will be no redemption rights or liquidating

distributions with respect to our warrants, which will expire worthless in the event of our winding up. In the event of a liquidation,

holders of our Class B Ordinary Shares (the “founder shares” and, together with the Public Shares, the “shares”

or “ordinary shares”), including our Sponsor, and our independent directors, will not receive any monies held in the Trust

Account as a result of their ownership of founder shares.

The Adjournment Proposal, if adopted, will allow

our Board to adjourn the Extraordinary General Meeting to a later date or dates to permit further solicitation of proxies. The Adjournment

Proposal will only be presented to our shareholders in the event that there are insufficient votes for, or otherwise in connection with,

the approval of the Extension Proposal.

The approval of each of the Extension Proposal

and the Redemption Limitation Amendment Proposal requires a special resolution under the Articles, being a resolution passed by at least

two-thirds of the votes cast by the shareholders who, being present in person or by proxy and entitled to vote at the Extraordinary General

Meeting.

The approval of the Adjournment Proposal requires

an ordinary resolution under the Articles, being a resolution passed by a simple majority of the votes cast by the shareholders who,

being present in person or by proxy and entitled to vote at the Extraordinary General Meeting, vote at the Extraordinary General Meeting.

Our Board has fixed the close of business on February 20,

2024 as the record date for determining the shareholders entitled to receive notice of and vote at the Extraordinary General Meeting

and any adjournment or postponement thereof. Only holders of record of the ordinary shares on that date are entitled to have their votes

counted at the Extraordinary General Meeting or any adjournment or postponement thereof.

After

careful consideration of all relevant factors, our Board has determined that each of the Extension Proposal and the Redemption

Limitation Amendment Proposal is advisable and recommends that you vote or give instruction to vote “FOR” such proposal.

No other business other than, if necessary, the

Adjournment Proposal, is proposed to be transacted at the Extraordinary General Meeting.

Enclosed is the Proxy Statement containing detailed

information concerning the Extension Proposal, the Redemption Limitation Amendment Proposal, the Adjournment Proposal and the Extraordinary

General Meeting. Whether or not you plan to attend the Extraordinary General Meeting, we urge you to read this material carefully and

vote your ordinary shares.

| |

By Order of the Board of Directors of |

| |

Corner Growth Acquisition Corp. 2 |

| |

|

| |

|

Marvin Tien |

| |

|

Chief Executive Officer |

February 26,

2024

Your vote is important. If you are a shareholder

of record, please sign, date and return your proxy card as soon as possible to make sure that your shares are represented at the Extraordinary

General Meeting. To be counted, all proxy cards must be returned to the Company at 251 Lytton Avenue, Suite 200, Palo Alto, California

94301 so as to be received before the Extraordinary General Meeting. If you are a shareholder of record, you may also cast your vote

in person at the Extraordinary General Meeting. If your shares are held in an account at a brokerage firm or bank, you must instruct

your broker or bank how to vote your shares, or you may cast your vote in person at the Extraordinary General Meeting by obtaining a

proxy from your brokerage firm or bank. Your failure to vote or instruct your broker or bank how to vote will mean that your ordinary

shares will not count towards the quorum requirement for the Extraordinary General Meeting and will not be voted. An abstention or broker

non-vote will be counted towards the quorum requirement but will not count as a vote cast at the Extraordinary General Meeting.

Important Notice Regarding the Availability

of Proxy Materials for the Extraordinary General Meeting to be held at 1:00 p.m. Eastern Time on March 8, 2024: This notice of extraordinary

general meeting and the accompanying Proxy Statement are available at https://www.cstproxy.com/cgac2/2024.

CORNER GROWTH ACQUISITION CORP. 2

A Cayman Islands Exempted Company

251 Lytton Avenue, Suite 200

Palo Alto, California 94301

NOTICE OF EXTRAORDINARY GENERAL MEETING OF

SHAREHOLDERS

To Be Held at 1:00 p.m. Eastern Time, on

March 8, 2024

PROXY STATEMENT

The extraordinary general meeting (the “Extraordinary General

Meeting”) of Corner Growth Acquisition Corp. 2 (“Corner Growth 2,” the “Company,” “we,” “CGAC2,”

“us” or “our”), a Cayman Islands exempted company, will be held in person and virtually at 1:00 p.m. Eastern

Time on March 8, 2024, at the offices of Duane Morris LLP located at 1540 Broadway, New York, New York 10036, or at such other time, on

such other date and at such other place at which the meeting may be adjourned or postponed. If you plan on attending in person please

email meetingcgac@duanemorris.com at least one day prior to the Extraordinary General Meeting. Shareholders that wish to listen to the

Extraordinary General Meeting via teleconference, but will not be able to participate in the Extraordinary General Meeting or vote, may

use the following teleconference dial-in numbers:

Telephone access (listen-only):

Within the U.S. and Canada: 1 800-450-7155 (toll-free)

Outside of the U.S. and Canada: +1 857-999-9155 (standard

rates apply)

Conference ID: 1037346#

Extraordinary General Meeting-meeting webpage (information,

webcast, telephone access and replay): https://www.cstproxy.com/cgac2/2024

While Shareholders may attend the Extraordinary

General Meeting in person at the meeting location, we strongly encourage the Shareholders to attend the meeting virtually or by telephone.

The sole purpose of the Extraordinary General

Meeting is to:

| |

· |

consider and vote on a proposal to approve by special

resolution (the “Extension Proposal”), pursuant to the terms of the Company’s amended and restated memorandum and

articles of association, as amended (the “Articles”), as provided by the resolution in the form set forth in Annex A

to the accompanying Proxy Statement (the “Extension Amendment”), to amend the Articles to extend the date by which the

Company must consummate a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business

combination with one or more businesses or entities (a “business combination”) from March 21, 2024 (the “Original

Termination Date”) to December 31, 2024 (the “Extension,” and such later date, the “Extended Date”),

or such earlier date as shall be determined by the Company’s board of directors (the “Board”) in its sole discretion

(the “Amended Termination Date”); |

| |

● |

consider and vote on a proposal to approve by special

resolution, pursuant to the terms of the Company’s Articles, as provided by the second resolution in the form set forth in

Annex A to the accompanying Proxy Statement (the “Redemption Limitation Amendment” and such proposal, the “Redemption

Limitation Amendment Proposal”) to amend the Articles to eliminate from the Articles the limitation that the Company shall

not redeem Class A Ordinary Shares included as part of the units sold in the IPO (the “Public Shares”) to the extent

that such redemption would cause the Company’s net tangible assets to be less than $5,000,001 (the “Redemption Limitation”).

The Redemption Limitation Amendment would allow the Company to redeem Public Shares irrespective of whether such redemption would

exceed the Redemption Limitation; and |

| |

· |

consider and vote on a proposal to approve by ordinary resolution the adjournment

of the Extraordinary General Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the

event that there are insufficient votes for, or otherwise in connection with, the approval of the Extension Proposal and/or the Redemption

Limitation Amendment Proposal, which we refer to as the “Adjournment Proposal”. The Adjournment Proposal will only be presented

at the Extraordinary General Meeting if there are not sufficient votes to approve the Extension Proposal and/or the Redemption Limitation

Amendment Proposal. |

Each of the Extension Proposal, the Redemption

Limitation Amendment Proposal and the Adjournment Proposal is more fully described in the accompanying proxy statement. Please take the

time to read carefully each of the proposals in the accompanying proxy statement before you vote.

The purpose of the Extension is to allow us more

time to complete an initial business combination. You are not being asked to vote on a business combination at this time.

The Company is listed on The Nasdaq Capital Market

(“Nasdaq”). Nasdaq rule IM-5101-2 requires that a special purpose acquisition company complete one

or more business combinations within 36 months of the effectiveness of its IPO registration statement, which, in the case of the Company,

would be June 21, 2024 (the “Nasdaq Deadline”). The Articles provide that we have until March 21, 2024 to complete an

initial business combination. The Company has determined that there will not be sufficient time before March 21, 2024 to consummate

a business combination. Therefore, our Board has determined that it is in the best interests of the Company and its shareholders

to amend the Articles, in the form set forth in Annex A, to extend the date that we have to consummate a business combination. If the

Extension Proposal is approved, the Company would have an additional nine months and ten days after the Original Termination Date to

consummate a business combination, which is a total of up to forty-two (42) months and ten days (the “Extension Date”) to

complete a business combination after the IPO, unless the Board otherwise sets an earlier Amended Termination Date. The Extension to

the Extension Date would extend the Company’s life beyond the Nasdaq Deadline. As a result, the contemplated Extension does not

comply with Nasdaq rules. We may be subject to suspension or delisting by Nasdaq if the Extension Amendment Proposal is approved and

the Extension is implemented. For more information see “Risk Factors – The Extension contemplated by the Extension Amendment

Proposal contravenes Nasdaq rules, and as a result, could lead Nasdaq to suspend trading in the Company’s securities or lead the

Company to be delisted from Nasdaq.”

In connection with the Extension Proposal and

the Redemption Limitation Amendment Proposal public shareholders may elect to redeem their shares for a per-share price, payable in cash,

equal to the aggregate amount then on deposit in the Trust Account, including interest earned, divided by the number of the then outstanding

Public Shares, and which election we refer to as the “Election.” An Election can be made regardless of whether such public

shareholders vote “FOR” or “AGAINST” the Extension Proposal and the Redemption Limitation Amendment Proposal

and an Election can also be made by public shareholders who do not vote, or do not instruct their broker or bank how to vote, at the

Extraordinary General Meeting. The public shareholders may make an Election regardless of whether such public shareholders were holders

as of the record date for the Extraordinary General Meeting. Public shareholders who do not make the Election would be entitled to have

their shares redeemed for cash if we have not completed our initial business combination by the Extended Date or the Amended Termination

Date, as applicable. In addition, regardless of whether public shareholders vote “FOR” or “AGAINST” the Extension

Proposal and the Redemption Limitation Amendment Proposal, or do not vote, or do not instruct their broker or bank how to vote, at the

Extraordinary General Meeting, if the Extension is implemented and a public shareholder does not make an Election, they will retain the

right to vote on any proposed initial business combination through the Extended Date if the Extended Date is approved and the right to

redeem their Public Shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account

as of two business days prior to the consummation of such initial business combination, including interest (which interest shall be net

of taxes payable), divided by the number of then outstanding Public Shares, in the event a proposed business combination is completed.

We are not asking you to vote on any proposed

business combination at this time. If the Extension Proposal and the Redemption Limitation Amendment Proposal are implemented and you

do not elect to redeem your Public Shares now, you will retain the right to vote on the Business Combination when it is submitted to

shareholders and the right to redeem your Public Shares into a pro rata portion of the Trust Account in the event the Business Combination

is approved and completed (as long as your election is made in accordance with the Articles prior to the meeting at which the shareholders’

vote is sought) or the Company has not consummated the Business Combination by the Extended Date. If the Extension Proposal and the Redemption

Limitation Amendment Proposal are not approved, we may not be able to consummate the Business Combination. We urge you to vote at the

Extraordinary General Meeting regarding the Extension Proposal and the Redemption Limitation Amendment Proposal.

Based upon the amount in the Trust Account as of February 23, 2024,

which was approximately $21,492,032.25 we anticipate that the per-share price at which Public Shares will be redeemed from cash held in

the Trust Account will be approximately $11.55 at the time of the Extraordinary General Meeting. The closing price of the Public Shares

on Nasdaq on February 23, 2024, the most recent practicable closing price prior to the mailing of this Proxy Statement, was $11.54. We

cannot assure shareholders that they will be able to sell their shares in the open market, even if the market price per share is higher

than the redemption price stated above, as there may not be sufficient liquidity in our securities when such shareholders wish to sell

their shares. We will not proceed with the Extension if redemptions of our Public Shares would cause us to have less than $5,000,001 of

net tangible assets following approval of the Extension Proposal unless the Redemption Limitation Amendment Proposal is approved.

The withdrawal of funds from the Trust Account in connection with the

Election (the “Withdrawal Amount”) will reduce the amount held in the Trust Account following the Election, and the amount

remaining in the Trust Account may be only a small fraction of the approximately $21,492,032.25 that was in the Trust Account as of February

23, 2024. In such event, we may need to obtain additional funds to complete an initial business combination, and there can be no assurance

that such funds will be available on terms acceptable or at all.

TO DEMAND REDEMPTION, PRIOR TO 5:00 P.M. EASTERN

TIME ON MARCH 6, 2024, TWO BUSINESS DAYS BEFORE THE EXTRAORDINARY GENERAL MEETING, YOU SHOULD ELECT EITHER TO PHYSICALLY TENDER YOUR

SHARE CERTIFICATES TO CONTINENTAL STOCK TRANSFER & TRUST COMPANY, LLC OR TO DELIVER YOUR SHARES TO THE TRANSFER AGENT ELECTRONICALLY

USING DTC’S DWAC (DEPOSIT/WITHDRAWAL AT CUSTODIAN), AS DESCRIBED HEREIN. YOU SHOULD ENSURE THAT YOUR BANK OR BROKER COMPLIES WITH

THE REQUIREMENTS IDENTIFIED ELSEWHERE HEREIN.

Unless the Redemption Limitation Amendment Proposal

is approved, we will not proceed with the Extension if redemptions of our Public Shares would cause the Company to exceed the Redemption

Limitation. If the Redemption Limitation Amendment Proposal is not approved and there are significant requests for redemption such that

the Company’s net tangible assets would be less than $5,000,001, the Articles would prevent the Company from being able to consummate

the Business Combination even if all other conditions to closing are met. The Company believes that the Redemption Limitation is not needed.

The purpose of such limitation was initially to ensure that, in connection with the Company’s initial business combination, the

Company would continue, as we have since our IPO, to be not subject to the “penny stock” rules of the SEC, and therefore

not a “blank check company” as defined under Rule 419 of the Securities Act of 1933, as amended, because it

complied with Rule 3a51-1(g)(1) (the “NTA Rule”). The NTA Rule is one of several exclusions from the “penny

stock” rules of the SEC and we believe that we may rely on another exclusion, which relates to the Company being listed on

Nasdaq (Rule 3a51-1(a)(2)) (the “Exchange Rule”). Therefore, the Company intends to rely on the Exchange Rule to

not be deemed a penny stock issuer, however, we may be subject to suspension or delisting by Nasdaq if the Extension Amendment Proposal

is approved and the Extension is implemented, and accordingly, could not rely on the Exchange Rule. For more information see “Risk

Factors – The Extension contemplated by the Extension Amendment Proposal contravenes Nasdaq rules, and as a result, could lead Nasdaq

to suspend trading in the Company’s securities or lead the Company to be delisted from Nasdaq.” In the event that the

Redemption Limitation Amendment Proposal is not approved and we receive notice of redemptions of Public Shares approaching or in excess

of the Redemption Limitation, we and/or CGA Sponsor2, LLC, a Delaware limited liability company (our “Sponsor”), may take

action to increase our net tangible assets to avoid exceeding the Redemption Limitation.

If the Extension Proposal is not approved and

we do not consummate a business combination by March 21, 2024, as contemplated by our IPO prospectus and in accordance with our

Articles, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but

not more than ten business days thereafter, redeem the Public Shares at a per-share price, payable in cash, equal to the aggregate amount

then on deposit in the Trust Account established by the Company upon the consummation of the IPO and into which certain amount of the

net proceeds of the IPO, together with certain of the proceeds of a private placement of warrants simultaneously with the closing date

of the IPO, was deposited, including interest earned on the funds held in the Trust Account and not previously released to us to pay

our franchise and income taxes (less up to $100,000 of interest to pay dissolution expenses and net of taxes payable), divided by the

number of the then outstanding Public Shares, which redemption will completely extinguish the rights of the holders of Public Shares

(the “public shareholders”) as shareholders (including the right to receive further liquidation distributions, if any); and

(iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining shareholders and our

Board, liquidate and dissolve, subject in each case to its obligations under Cayman Islands law to provide for claims of creditors and

to the other requirements of applicable law.

There will be no redemption rights or liquidating

distributions with respect to our warrants, which will expire worthless in the event of our winding up. In the event of a liquidation,

holders of our Class B Ordinary Shares (the “founder shares” and, together with the Public Shares, the “shares”

or “ordinary shares”), including our Sponsor, and our independent directors, will not receive any monies held in the Trust

Account as a result of their ownership of founder shares.

The Adjournment Proposal, if adopted, will allow

our Board to adjourn the Extraordinary General Meeting to a later date or dates to permit further solicitation of proxies. The Adjournment

Proposal will only be presented to our shareholders in the event that there are insufficient votes for, or otherwise in connection with,

the approval of the Extension Proposal or the Redemption Limitation Amendment Proposal.

The approval of each of the Extension Proposal

and the Redemption Limitation Amendment Proposal requires a special resolution under the Articles, being a resolution passed by at least

two-thirds of the votes cast by the shareholders who, being present in person or by proxy and entitled to vote at the Extraordinary General

Meeting, vote at the Extraordinary General Meeting.

The approval of the Adjournment Proposal requires

an ordinary resolution under the Articles, being a resolution passed by a simple majority of the votes cast by the shareholders who,

being present in person or by proxy and entitled to vote at the Extraordinary General Meeting, vote at the Extraordinary General Meeting.

Our Board has fixed the close of business on February 20,

2024 as the record date for determining the shareholders entitled to receive notice of and vote at the Extraordinary General Meeting

and any adjournment or postponement thereof. Only holders of record of the ordinary shares on that date are entitled to have their votes

counted at the Extraordinary General Meeting or any adjournment or postponement thereof

This Proxy Statement contains important information

about the Extraordinary General Meeting and the proposals. Please read it carefully and vote your shares.

We will pay for the entire cost of soliciting

proxies. We have engaged Morrow Sodali LLC (“Morrow Sodali”), to assist in the solicitation of proxies for the Extraordinary

General Meeting. We have agreed to pay Morrow Sodali a fee of $10,000. We will also reimburse Morrow Sodali for reasonable out-of-pocket

expenses and will indemnify Morrow Sodali and its affiliates against certain claims, liabilities, losses, damages and expenses. In addition

to these mailed proxy materials, our directors and officers may also solicit proxies in person, by telephone or by other means of communication.

These parties will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other

agents for the cost of forwarding proxy materials to beneficial owners.

This Proxy Statement is dated February 26, 2024

and is first being mailed to shareholders on or about that date.

QUESTIONS AND ANSWERS ABOUT THE EXTRAORDINARY

GENERAL MEETING

These Questions and Answers are only summaries

of the matters they discuss. They do not contain all of the information that may be important to you. You should read carefully the entire

document.

Q.

Why am I receiving this Proxy Statement? |

|

A.

We are a blank check company incorporated on February 10, 2021 as a Cayman Islands exempted

company for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition,

share purchase, reorganization or similar business combination with one or more businesses

or entities. On June 21, 2021, we consummated our IPO from which we derived gross proceeds

of $185,000,000. Like many blank check companies, our Articles provide for the return of

the funds held in trust to the holders of ordinary shares sold in our IPO if there is no

qualifying business combination(s) consummated on or before a certain date (in our case,

March 21, 2024).

Our Board has determined that it is in the best interests of the

Company and its shareholders to amend the Articles, in the form set forth in Annex A, to extend the date that we have to consummate

a business combination to the Extended Date, or the Amended Termination Date, as applicable, in order that our shareholders are given

the chance to participate in an investment opportunity, and to make the other changes set forth in this Proxy Statement. |

Q.

What is being voted on? |

|

A.

You are being asked to vote on: |

| |

· |

Proposal No. 1 – The

Extension Proposal – to approve, by special resolution, the amendment of the Articles as provided by the resolution in the

form set forth in Annex A to this Proxy Statement to extend the date by which the Company must consummate a merger, share exchange,

asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities (a “business

combination”), from March 21, 2024 (the “Original Termination Date”, which is forty-two (42) months

and ten days from the closing date of our IPO) to December 31, 2024 (the “Extension,” and such later date, the “Extended

Date”), or such earlier date as determined by our board in its sole discretion (the “Amended Termination Date”); |

| |

· |

Proposal No. 2 - The Redemption

Limitation Amendment Proposal - to approve, by special resolution, the amendment of the Articles as provided by the second resolution

in the form set forth in Annex A to this Proxy Statement to eliminate from the Articles the limitation that the Company shall not

redeem Public Shares to the extent that such redemption would cause the Company’s net tangible assets to be less than $5,000,001.

The Redemption Limitation Amendment would allow the Company to redeem Public Shares irrespective of whether such redemption would

exceed such Redemption Limitation; and |

| |

· |

Proposal No. 3 – The

Adjournment Proposal – to approve, as an ordinary resolution, the adjournment of the Extraordinary General Meeting to a later

date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for,

or otherwise in connection with, the approval of the Extension Proposal and/or the Redemption Limitation Amendment

Proposal. |

| |

We

are not asking you to vote on any proposed business combination at this time. If the Extension Amendment and

the Redemption Limitation Amendment Proposal are implemented and you do not elect to redeem

your Public Shares now, you will retain the right to vote on a business combination when it is submitted to

shareholders and the right to redeem your Public Shares into a pro rata portion of the Trust Account in the

event a business combination is approved and completed (as long as your election is made in accordance with

the Articles prior to the meeting at which the shareholders’ vote is sought) or the Company has not

consummated a business combination by the Extended Date. If the Extension Proposal and the Redemption Limitation

Amendment Proposal are not approved, we may not be able to consummate a business combination. We urge you

to vote at the Extraordinary General Meeting regarding the Extension Amendment.

|

| |

Unless the Redemption Limitation Amendment Proposal is approved,

we will not proceed with the Extension if redemptions of our Public Shares would cause us to have less than $5,000,001 of net tangible

assets following approval of the Extension Proposal.

If the Extension Proposal is approved and the Extension is implemented,

the removal of the Withdrawal Amount will reduce the amount held in the Trust Account following the Election. We cannot predict the amount

that will remain in the Trust Account if the Extension Proposal is approved and the amount remaining in the Trust Account may be only

a small fraction of the approximately $21,492,032.25 that was in the Trust Account as of February 23, 2024. In such event, we may need

to obtain additional funds to complete an initial business combination, and there can be no assurance that such funds will be available

on terms acceptable or at all.

If the Extension Proposal is not approved and we do not consummate

a business combination by March 21, 2024, as contemplated by our IPO prospectus and in accordance with our Articles, we will

(i) cease all operations except for the purpose of winding up; (ii) as promptly as reasonably possible but not more than

ten business days thereafter, redeem the Public Shares, at a per-share price, payable in cash, equal to the aggregate amount then

on deposit in the Trust Account, including interest earned on the funds held in the Trust Account and not previously released to

us to pay our franchise and income taxes (less up to $100,000 of interest to pay liquidation expenses and net of taxes payable),

divided by the number of the then outstanding Public Shares, which redemption will completely extinguish public shareholders’

rights as shareholders (including the right to receive further liquidating distributions, if any); and (iii) as promptly as

reasonably possible following such redemption, subject to the approval of our remaining shareholders and our Board, liquidate and

dissolve, subject in each case to its obligations under Cayman Islands law to provide for claims of creditors and to the other requirements

of applicable law. There will be no redemption rights or liquidating distributions with respect to our warrants, which will expire

worthless in the event of our winding up. In the event of a liquidation, holders of our founder shares, including our Sponsor and

our independent directors, will not receive any monies held in the Trust Account as a result of their ownership of the founder shares. |

Q.

Why is the Company proposing the Extension Proposal? |

|

A.

Our Articles provide for the return of the funds held in the Trust Account to the holders of Public Shares

if there is no qualifying business combination(s) consummated on or before March 21, 2024. As we

explain below, we may not be able to complete an initial business combination by that date.

The purpose of the Extension is to allow us more time to complete

an initial business combination. Our board currently believes that there is not sufficient time to complete a business combination

before March 21, 2024 Therefore, our Board has determined that it is in the best interests of the Company to amend the Articles,

in the form set forth in Annex A, to extend the date that we have to consummate a business combination to the Extended Date or the

Amended Termination Date (as applicable), in order that our shareholders are given the chance to participate in an investment opportunity.

Accordingly, our Board is proposing the Extension Proposal to

amend the Articles, pursuant to the resolutions set forth in Annex A, to extend the date by which the Company must consummate a business

combination to the Extended Date, or the Amended Termination Date, as applicable.

YOU ARE NOT BEING ASKED TO VOTE ON A PROPOSED BUSINESS COMBINATION

AT THIS TIME. IF THE EXTENSION IS IMPLEMENTED AND YOU DO NOT MAKE AN ELECTION, YOU WILL RETAIN THE RIGHT TO VOTE ON A PROPOSED INITIAL

BUSINESS COMBINATION WHEN AND IF ONE IS SUBMITTED TO SHAREHOLDERS AND THE RIGHT TO REDEEM YOUR PUBLIC SHARES AT A PER-SHARE PRICE,

PAYABLE IN CASH, EQUAL TO THE PRO RATA PORTION OF THE TRUST ACCOUNT IN THE EVENT A PROPOSED BUSINESS COMBINATION IS APPROVED AND

COMPLETED OR THE COMPANY HAS NOT CONSUMMATED A BUSINESS COMBINATION BY THE EXTENDED DATE. |

Q

Why should I vote “FOR” the Extension Proposal? |

|

A.

Our Articles provide that if our shareholders approve an amendment of our Articles modifying the timing of

our obligation to redeem all of our Public Shares if we do not complete our initial business combination before

March 21, 2024, we will provide our public shareholders with the opportunity to redeem all or a portion

of their ordinary shares upon such approval at a per-share price, payable in cash, equal to the aggregate

amount then on deposit in the Trust Account, including interest earned net of taxes paid or payable, divided

by the number of the then outstanding Public Shares. We believe that this provision of the Articles was included

to protect our shareholders from having to sustain their investments for an unreasonably long period if we

failed to find a suitable business combination in the timeframe contemplated by the Articles.

Given our expenditure of time, effort and money to identify potential

targets for a potential initial business combination our Board believes current circumstances warrant providing those who believe

the Company might execute a potential business combination that is an attractive investment opportunity with an opportunity to consider

such a transaction, inasmuch as we are also affording shareholders who wish to redeem their public shares the opportunity to do so.

If you do not elect to redeem your public shares, you will retain the right to vote on any proposed initial business combination

in the future and the right to redeem your public shares in connection with such initial business combination.

Whether a holder of Public Shares votes in favor of or against

the Extension Proposal, if such proposal is approved, the holder may, but is not required to, redeem all or a portion of its Public

Shares for a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest

earned net of taxes paid or payable, divided by the number of then outstanding Public Shares. We will not proceed with the Extension

if redemptions of our Public Shares would cause us to have less than $5,000,001 of net tangible assets following approval of the

Extension Proposal, unless the Redemption Limitation Amendment Proposal is approved.

Liquidation of the Trust Account is a fundamental obligation of

the Company to the public shareholders and we are not proposing and will not propose to change that obligation to the public shareholders.

If the public shareholders do not elect to redeem their Public Shares, such holders will retain redemption rights in connection with

any initial business combination we may propose. Assuming the Extension Proposal is approved, we will have until the Extended Date,

or the Amended Termination Date, as applicable, to complete a business combination.

Our Board recommends that you vote in favor of the Extension

Proposal. |

| Q:

Why is the Company proposing the Redemption Limitation Amendment Proposal? |

|

A.

The Company is presenting the Redemption Limitation Amendment

Proposal to facilitate the consummation of the Business Combination. If the Redemption Limitation Amendment Proposal is not approved

and there are significant requests for redemption such that the Company’s net tangible assets would be less than $5,000,001,

the Articles would prevent the Company from being able to consummate the Business Combination even if all other conditions to closing

are met. The Company believes that the Redemption Limitation is not needed. The purpose of such limitation was initially to ensure

that, in connection with the Company’s initial business combination, the Company would continue, as we have since our IPO,

to be not subject to the “penny stock” rules of the SEC, and therefore not a “blank check company” as

defined under Rule 419 of the Securities Act because it complied with Rule 3a51-1(g)(1) (the “NTA Rule”).

The NTA Rule is one of several exclusions from the “penny stock” rules of the SEC and we believe that we may

rely on another exclusion, which relates to the Company being listed on Nasdaq (Rule 3a51-1(a)(2)) (the “Exchange

Rule”). Therefore, the Company intends to rely on the Exchange Rule to not be deemed a penny stock issuer, however, we

may be subject to suspension or delisting by Nasdaq if the Extension Amendment Proposal is approved and the Extension is implemented,

and accordingly, could not rely on the Exchange Rule. For more information see “Risk Factors – The Extension contemplated

by the Extension Amendment Proposal contravenes Nasdaq rules, and as a result, could lead Nasdaq to suspend trading in the Company’s

securities or lead the Company to be delisted from Nasdaq.” |

| Q: Why should

I vote “FOR” the Redemption Limitation Amendment Proposal? |

|

A.

As discussed above, our board believes the opportunity to consummate

the Business Combination is in the best interests of the Company and its shareholders.

Whether a holder of Public Shares votes in favor of or against

the Extension Amendment Proposal, if such proposal is approved, the holder may, but is not required to, redeem all or a portion of

her, his or its Public Shares for a per-share price, payable in cash, equal to the aggregate amount then on deposit in

the Trust Account including interest earned on the funds held in the Trust Account (which interest shall be net of taxes paid or

payable) and not previously released to the Company to pay its taxes, divided by the number of then-outstanding

Public Shares. Unless the Redemption Limitation Amendment Proposal is approved, we will not proceed with the Extension if redemptions

of our Public Shares would cause the Company to exceed the Redemption Limitation. By eliminating the Redemption Limitation, we make

it more likely that we will proceed with the Extension and have the opportunity to consummate the Business Combination.

If holders of Public Shares do not elect to redeem their Public

Shares, such holders will retain redemption rights in connection with any future initial business combination we may propose. Assuming

the Extension Amendment Proposal is approved and the Articles are amended as set forth in the Extension Amendment, we will have until

the Extended Date to consummate our initial business combination. |

Q.

Why should I vote “FOR” the Adjournment Proposal? |

|

A.

If the Adjournment Proposal is not approved by our shareholders, our Board may not be able to adjourn the

Extraordinary General Meeting to a later date or dates in the event that there are insufficient votes for,

or otherwise in connection with, the approval of the Extension Proposal and the Redemption Limitation Amendment

Proposal.

If presented, our Board recommends that you vote in favor of the

Adjournment Proposal. |

Q.

How do the Company insiders intend to vote their shares? |

|

A.

Our Sponsor and independent directors own an aggregate of 150,000 founder shares and 4,475,000 non-redeemable Class A ordinary

shares. Such shares in the aggregate represent approximately 70.6% of our issued and outstanding ordinary shares. We have been informed

by our Sponsor and independent directors that they intend to vote in favor of the Extension Proposal. In addition, our Sponsor, directors,

officers, advisors or any of their affiliates may purchase Public Shares in privately negotiated transactions or in the open market

prior to the Extraordinary General Meeting. However, they have no current commitments, plans or intentions to engage in such transactions

and have not formulated any terms or conditions for any such transactions. None of the funds in the Trust Account will be used to

purchase Public Shares in such transactions. Any such purchases that are completed after the record date for the Extraordinary General

Meeting may include an agreement with a selling shareholder that such shareholder, for so long as it remains the record holder of

the shares in question, will vote in favor of the Extension Proposal and/or will not exercise its redemption rights with respect

to the shares so purchased. The purpose of such share purchases and other transactions would be to increase the likelihood that the

resolutions to be put to the Extraordinary General Meeting are approved by the requisite number of votes. In the event that such

purchases do occur, the purchasers may seek to purchase shares from shareholders who would otherwise have voted against the Extension

Proposal and elected to redeem their shares for a portion of the Trust Account. Any such privately negotiated purchases may be effected

at purchase prices that are below or in excess of the per-share pro rata portion of the Trust Account. Any Public Shares held by

or subsequently purchased by our affiliates may be voted in favor of the Extension Proposal. |

Q.

What vote is required to adopt the Extension Proposal? |

|

A.

The approval of the Extension Proposal requires a special resolution under the Articles, being a resolution passed by at least two-thirds

of the votes cast by the shareholders who, being present in person or by proxy and entitled to vote at the Extraordinary General

Meeting, vote at the Extraordinary General Meeting. |

Q.

What vote is required to approve the Adjournment Proposal and

the Redemption Limitation Amendment Proposal? |

|

The approval of the Adjournment Proposal and the Redemption Limitation

Amendment Proposal requires an ordinary resolution under the Articles, being a resolution passed by a simple majority of the votes cast

by the shareholders who, being present in person or by proxy and entitled to vote at the Extraordinary General Meeting, vote at the Extraordinary

General Meeting. |

Q.

What if I do not want to vote “FOR” the Extension Amendment

or the Redemption Limitation Amendment Proposal? |

|

A.

If you do not want the Extension Amendment or the Redemption Limitation

Amendment Proposal to be approved, you must vote “AGAINST” such proposal. If the Extension Proposal is approved, and the Extension

is implemented, then the Withdrawal Amount will be withdrawn from the Trust Account and paid pro rata to the redeeming holders. You will

still be entitled to make the Election if you vote against, abstain or do not vote on the Extension Proposal.

Broker “non-votes” and abstentions will count towards the

quorum requirement for the Extraordinary General Meeting but will have no effect with respect to the approval of the Extension Proposal

(i.e. it will be treated as neither a vote “for” nor “against” any matter and will not be counted when calculating

the votes cast).

If the Extension Amendment and the Redemption Limitation Amendment

Proposal is approved, the Adjournment Proposal will not be presented for a vote.

|

Q.

What happens if the Extension Proposal is not approved? |

|

A.

Our Board will abandon the Extension if our shareholders do not approve the Extension Proposal. If the Extension

Proposal is not approved and we do not consummate a business combination by March 21, 2024, as contemplated

by our IPO prospectus and in accordance with our Articles, we will (i) cease all operations except for

the purpose of winding up; (ii) as promptly as reasonably possible but not more than ten business days

thereafter, redeem the Public Shares, at a per-share price, payable in cash, equal to the aggregate amount

then on deposit in the Trust Account, including interest (less up to $100,000 of interest to pay liquidation

expenses and net of taxes payable), divided by the number of then outstanding Public Shares, which redemption

will completely extinguish public shareholders’ rights as shareholders (including the right to receive

further liquidating distributions, if any); and (iii) as promptly as reasonably possible following such

redemption, subject to the approval of our remaining shareholders and our Board, liquidate and dissolve, subject

in each case to its obligations under Cayman Islands law to provide for claims of creditors and to the other

requirements of applicable law.

There will be no redemption rights or liquidating distributions

with respect to our warrants, which will expire worthless in the event of our winding up. In the event of a liquidation, holders

of our founder shares, including our Sponsor and our independent directors, will not receive any monies held in the Trust Account

as a result of their ownership of the founder shares. |

Q.

If the Extension Proposal is approved, what happens next? |

|

A.

We will continue our efforts to complete a business combination until the Extended Date. Upon approval of

the Extension Proposal by the requisite number of votes, the Extension will become effective. We will remain

a reporting company under the Securities Exchange Act of 1934 (the “Exchange Act”) and our units,

Public Shares and warrants will remain publicly traded. However, the Extension to the Extended Date would

extend the Company’s life beyond the Nasdaq Deadline. As a result, the contemplated Extension does not

comply with Nasdaq rules. We may be subject to suspension or delisting by Nasdaq if the Extension Amendment

Proposal is approved and the Extension is implemented. For more information see “Risk Factors –

The Extension contemplated by the Extension Amendment Proposal contravenes Nasdaq rules, and as a result,

could lead Nasdaq to suspend trading in the Company’s securities or lead the Company to be delisted

from Nasdaq.”

If the Extension Proposal is approved, the removal of the Withdrawal

Amount from the Trust Account will reduce the amount remaining in the Trust Account and increase the percentage interest of our ordinary

shares held by our Sponsor and our independent directors as a result of their ownership of the founder shares. We will, on or about

the __-month anniversary of the effective date of the registration statement relating to the IPO, instruct Continental Stock Transfer &

Trust Company to liquidate the securities held in the Trust Account and instead hold all funds in the Trust Account in cash.

|

|

|

If the Extension Proposal is approved but we do not complete a

business combination by the Extended Date, or the Amended Termination Date, as applicable, we will (i) cease all operations

except for the purpose of winding up; (ii) as promptly as reasonably possible but not more than ten business days thereafter,

redeem the Public Shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account,

including interest (less up to $100,000 of interest to pay liquidation expenses and net of taxes payable), divided by the number

of then outstanding Public Shares, which redemption will completely extinguish public shareholders’ rights as shareholders

(including the right to receive further liquidating distributions, if any); and (iii) as promptly as reasonably possible following

such redemption, subject to the approval of our remaining shareholders and our Board, liquidate and dissolve, subject in the each

case to its obligations under Cayman Islands law to provide for claims of creditors and to the other requirements of applicable law.

We cannot assure you that the per share distribution from the Trust Account, if we liquidate, will not be less than $10.00 due to

unforeseen claims of creditors.

There will be no redemption rights or liquidating distributions

with respect to our warrants, which will expire worthless in the event of our winding up. In the event of a liquidation, holders

of our founder shares, including our Sponsor and our independent directors, will not receive any monies held in the Trust Account

as a result of their ownership of the founder shares. |

Q.

What happens to the Company’s outstanding warrants if the Extension Proposal is not approved? |

|

A.

If the Extension Proposal is not approved and we have not consummated a business combination

by March 21, 2024, we will (i) cease all operations except for the purpose of winding

up; (ii) as promptly as reasonably possible but not more than ten business days thereafter,

redeem the Public Shares, at a per-share price, payable in cash, equal to the aggregate amount

then on deposit in the Trust Account, including interest (less up to $100,000 of interest

to pay liquidation expenses and net of taxes payable), divided by the number of then outstanding

Public Shares, which redemption will completely extinguish public shareholders’ rights

as shareholders (including the right to receive further liquidating distributions, if any);

and (iii) as promptly as reasonably possible following such redemption, subject to the

approval of our remaining shareholders and our Board, liquidate and dissolve, subject in

each case to its obligations under Cayman Islands law to provide for claims of creditors

and to the other requirements of applicable law.

There will be no redemption rights or liquidating distributions

with respect to our warrants, which will expire worthless in the event of our winding up. In the event of a liquidation, holders

of our founder shares, including our Sponsor and our independent directors, will not receive any monies held in the Trust Account

as a result of their ownership of the founder shares.

If the Extension Proposal is not approved and we do not consummate

an initial business combination by the Original Termination Date, our warrants will expire worthless. |

| Q.

What happens to the Company’s outstanding warrants if the Extension Proposal is approved? |

|

A.

If the Extension Proposal is approved, we will retain the blank check company restrictions

previously applicable to us and continue to attempt to consummate an initial business combination

until the Extended Date, or the Amended Termination Date, as applicable.

All other public warrants will remain outstanding and will become

exercisable for one Class A ordinary share 30 days after the completion of an initial business combination at an initial exercise

price of $11.50 per warrant for a period of five years, provided we have an effective registration statement under the Securities

Act of 1933 (the “Securities Act”) covering the ordinary shares issuable upon exercise of the warrants and a current

prospectus relating to them is available (or we permit holders to exercise warrants on a cashless basis). |

Q.

If I do not exercise my redemption rights now, would I still be able to exercise my redemption rights in connection with a proposed

business combination? |

|

A.

Unless you elect to redeem your shares at this time, you will be able to exercise redemption rights in respect of any future initial

business combination, subject to any limitations set forth in our Articles. |

Q.

How do I change my vote? |

|

A.

You may change your vote by sending a later-dated, signed proxy card to our Secretary at Corner Growth Acquisition Corp. 2, 251 Lytton

Avenue, Suite 200, Palo Alto, California 94301, so that it is received prior to the Extraordinary General Meeting or by attending

the Extraordinary General Meeting in person and voting. You also may revoke your proxy by sending a notice of revocation to the same

address, which must be received by our Secretary prior to the Extraordinary General Meeting. |

| |

|

Please

note, however, that if on the record date your shares were held, not in your name, but rather in an account at a brokerage firm,

custodian bank, or other nominee then you are the beneficial owner of shares held in “street name” and these proxy materials

are being forwarded to you by that organization. If your shares are held in street name, and you wish to attend the Extraordinary

General Meeting and vote at the Extraordinary General Meeting, you must bring to the Extraordinary General Meeting a legal proxy

from the broker, bank or other nominee holding your shares, confirming your beneficial ownership of the shares and giving you the

right to vote your shares. |

Q.

How are votes counted? |

|

A.

Votes will be counted by the inspector of election appointed for the

Extraordinary General Meeting, who will separately count “FOR” and “AGAINST” votes, abstentions and broker non-votes.

The Extension Amendment and the Redemption Limitation Amendment Proposal must be approved as a special resolution under the Articles,

being a resolution passed by at least two-thirds of the votes cast by the shareholders who, being present in person or by proxy and entitled

to vote at the Extraordinary General Meeting, vote at the Extraordinary General Meeting.

Accordingly, a shareholder’s failure to vote by proxy or to vote in person at the Extraordinary General Meeting means that such

shareholder’s ordinary shares will not count towards the quorum requirement for the Extraordinary General Meeting and will not be

voted. An abstention or broker non-vote will be counted towards the quorum requirement but will not count as a vote cast at the Extraordinary

General Meeting. |

Q.

If my shares are held in “street name,” will my broker automatically vote them for me? |

|

A.

No. Under the rules of various national and regional securities exchanges, your broker, bank, or nominee cannot vote your

shares with respect to non-discretionary matters unless you provide instructions on how to vote in accordance with the information

and procedures provided to you by your broker, bank, or nominee. We believe all the proposals presented to the shareholders will

be considered non-discretionary and therefore your broker, bank, or nominee cannot vote your shares without your instruction. Your

bank, broker, or other nominee can vote your shares only if you provide instructions on how to vote. You should instruct your broker

to vote your shares in accordance with directions you provide. If your shares are held by your broker as your nominee, which we refer

to as being held in “street name,” you may need to obtain a proxy form from the institution that holds your shares and

follow the instructions included on that form regarding how to instruct your broker to vote your shares. |

Q.

What is a quorum requirement? |

|

A.

A quorum of our shareholders is necessary to hold a valid Extraordinary

General Meeting. A quorum will be present at the Extraordinary General Meeting if the holders of a majority of the issued and outstanding

ordinary shares are represented in person or by proxy or if a corporation or other non-natural person by its duly authorized representative

or proxy. As of the record date for the Extraordinary General Meeting, the holders of at least 3,242,608 ordinary shares would be

required to achieve a quorum.

Your shares will be counted towards the quorum only if you submit

a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Extraordinary

General Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement, but will not count as a vote cast

at the Extraordinary General Meeting. In the absence of a quorum, the chairman of the meeting has power to adjourn the Extraordinary

General Meeting. |

Q.

Who can vote at the Extraordinary General Meeting? |

|

A.

Only holders of record of our ordinary shares at the close of

business on February 20, 2024 are entitled to have their vote counted at the Extraordinary General Meeting and any adjournment or postponement

thereof. On this record date, [•] ordinary shares were outstanding and entitled to vote.

Shareholder of Record: Shares Registered in Your Name. If on the

record date your shares were registered directly in your name with our transfer agent, Continental Stock Transfer & Trust

Company, then you are a shareholder of record. As a shareholder of record, you may vote in person at the Extraordinary General Meeting

or vote by proxy. Whether or not you plan to attend the Extraordinary General Meeting in person, we urge you to fill out and return

the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or

Bank. If on the record date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer,

or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials

are being forwarded to you by that organization. As a beneficial owner, you have the right to direct your broker or other agent on

how to vote the shares in your account. You are also invited to attend the Extraordinary General Meeting. However, since you are

not the shareholder of record, you may not vote your shares in person at the Extraordinary General Meeting unless you request and

obtain a valid proxy from your broker or other agent. |

Q.

What interests do the Company’s Sponsor, directors

and officers have in the approval of the proposals? |

|

A.

Our Sponsor, directors and officers have interests in the proposals

that may be different from, or in addition to, your interests as a shareholder. These interests include ownership, including indirect

ownership, of founder shares and warrants that may become exercisable in the future and the possibility of future compensatory arrangements. |

Q.

Do I have appraisal or dissenters’ rights if I object

to the Extension Proposal? |

|

A.

Our shareholders do not have appraisal or dissenters’ rights

in connection with the Extension Proposal under Cayman Islands law. |

Q.

What do I need to do now? |

|

A.

We urge you to read carefully and consider the information contained

in this Proxy Statement, and to consider how the proposals will affect you as a shareholder. You should then vote as soon as possible

in accordance with the instructions provided in this Proxy Statement and on the enclosed proxy card. |

Q.

How are the funds in the Trust Account currently being held? |

|

A.

With respect to the regulation of special purpose acquisition

companies like us (“SPACs”), on March 30, 2022, the SEC issued proposed rules which were adopted in large part

on January 24, 2024 (the “New SPAC Rules”) relating to, among other items, the extent to which SPACs could become

subject to regulation under the Investment Company Act of 1940, as amended.

The longer that the funds in the trust account are held in U.S. Treasury

securities or in money market funds invested primarily in such securities, there is a greater risk that we may be considered an unregistered

investment company, in which case we would be subject to additional regulatory burdens and expenses for which we have not allotted

funds, and as a result we may be required to liquidate. If we are required to liquidate the Company, our investors would not be able

to realize the benefits of owning stock in a successor operating business, including the potential appreciation in the value of our

stock and rights following such a transaction, and our rights would expire worthless. For so long as the funds in the trust account

are held in U.S. Treasury securities or in money market funds invested primarily in such securities, the risk that we may be

considered an unregistered investment company and required to liquidate is greater than that of a special purpose acquisition company

that has elected to liquidate such investments and to hold all funds in its trust account in cash (i.e., in one or more bank accounts).

Accordingly, we may determine, in our discretion, to instruct Continental Stock Transfer & Trust Company to liquidate the

securities held in the Trust Account and instead hold all funds in the Trust Account in cash until the earliest of the Company’s

completion of an initial business combination, the Extended Date, or the Amended Termination Date, as applicable. |

Q.

How do I vote? |

|

A.

If you are a holder of record of our ordinary shares, you may

vote in person at the Extraordinary General Meeting or by submitting a proxy for the Extraordinary General Meeting. Whether or not

you plan to attend the Extraordinary General Meeting in person, we urge you to vote by proxy to ensure your vote is counted. You

may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage

paid envelope. You may still attend the Extraordinary General Meeting and vote in person if you have already voted by proxy.

If your ordinary shares are held in “street name”

by a broker or other agent, you have the right to direct your broker or other agent on how to vote the shares in your account. You

are also invited to attend the Extraordinary General Meeting. However, since you are not the shareholder of record, you may not vote

your shares in person at the Extraordinary General Meeting unless you request and obtain a valid proxy from your broker or other

agent. |