- Thoughtworks stockholders to receive $4.40 per share in

cash

- Deal price represents a 48% premium to the 30-day VWAP

- Unanimously recommended by special committee of the

Thoughtworks Board of Directors

Thoughtworks (NASDAQ: TWKS), a global technology consultancy

that integrates strategy, design and engineering, today announced

that it has entered into a definitive merger agreement pursuant to

which an affiliate of funds advised by Apax Partners LLP (“Apax”

and such funds, the “Apax Funds”) will purchase all of the

outstanding shares of Thoughtworks common stock that they do not

already own, for $4.40 per share, which implies a total enterprise

value of approximately $1.75 billion for Thoughtworks. A special

committee (the “Special Committee”) of the Board of Directors of

Thoughtworks (the “Board”), composed entirely of independent and

disinterested directors and advised by its own independent legal

and financial advisors, unanimously recommended that the Board

approve the transaction and determined it was in the best interests

of the Company and its stockholders that are not affiliated with

Apax. Acting upon the recommendation of the Special Committee, the

Board subsequently unanimously approved the transaction. The

purchase price represents a 30% premium to Thoughtworks’ closing

stock price on August 2, 2024, the last full trading day prior to

the transaction announcement, and a premium of approximately 48%

over the volume weighted average price of Thoughtworks’ stock for

the 30 days ending August 2, 2024.

“We appreciate the Special Committee’s comprehensive evaluation

of the Apax Funds’ offer and are confident that this transaction

provides immediate and fair value to Thoughtworks minority

stockholders,” said Mike Sutcliff, Thoughtworks’ Chief Executive

Officer. “Apax has been a longstanding strategic partner for

Thoughtworks. With their continued support, we plan to make the

necessary long-term investments and advance our vision of being a

stronger, strategic partner for our clients.”

“For 30 years, Thoughtworks has created an extraordinary impact

on the world through its culture and technology excellence. We look

forward to continuing our partnership with the company in its next

chapter of growth,” said Salim Nathoo, Partner at Apax and

Non-Executive Director of Thoughtworks.

“We are deeply committed to Thoughtworks’ unique culture, its

unwavering focus on technological excellence, and its mission of

transforming the world through technology. We believe that it is in

the interest of all stakeholders for the Company to return to

private ownership to allow the organization to re-focus on growth,”

said Rohan Haldea, Partner at Apax and Non-Executive Director of

Thoughtworks.

Certain terms, approvals and timing

The transaction is expected to close in the fourth calendar

quarter of 2024, subject to the satisfaction of customary closing

conditions. The transaction has been approved by an affiliate of

the Apax funds, in its capacity as the majority stockholder of

Thoughtworks, and no other stockholder approval is required. Upon

completion of the transaction, Thoughtworks common stock will no

longer be publicly listed on NASDAQ, and Thoughtworks will become a

privately held company again. The Apax Funds intend to finance the

transaction with fully committed equity financing and the

transaction is not subject to any financing condition.

Advisors

Goldman Sachs & Co. LLC is acting as the exclusive financial

advisor to Apax. Kirkland & Ellis LLP and Richards, Layton

& Finger, P.A. are acting as legal counsel to Apax.

Lazard is acting as financial advisor to the Special Committee.

Kramer Levin Naftalis & Frankel LLP and Potter Anderson &

Corroon LLP are acting as legal counsel to the Special

Committee.

Paul Hastings LLP is acting as legal counsel to

Thoughtworks.

Supporting resources:

- Keep up with Thoughtworks news by visiting the company’s

website.

- Follow us on X, LinkedIn and YouTube.

- ### - <TWKS915>

About Thoughtworks

Thoughtworks is a global technology consultancy that integrates

strategy, design and engineering to drive digital innovation. We

are over 10,500 Thoughtworkers strong across 48 offices in 19

countries. For 30 years, we’ve delivered extraordinary impact

together with our clients by helping them solve complex business

problems with technology as the differentiator.

About Apax Partners

Apax Partners LLP is a leading global private equity advisory

firm. For over 50 years, Apax has worked to inspire growth and

ideas that transform businesses. The firm has raised and advised

funds with aggregate commitments of almost $80 billion. The Apax

Funds invest in companies across four global sectors of Tech,

Services, Healthcare and Internet/Consumer. These funds provide

long-term equity financing to build and strengthen world-class

companies. For further information about Apax, please visit

www.apax.com. Apax is authorised and regulated by the Financial

Conduct Authority in the UK.

Cautionary statement regarding forward-looking

statements

This communication contains forward-looking statements,

including statements regarding the timing and the effects of the

proposed acquisition of Thoughtworks by an affiliate of Apax

Partners. In addition, other statements in this communication that

are not historical facts or information may be forward-looking

statements. The forward-looking statements in this communication

are based on information available at the time the statements are

made and/or management’s belief as of that time with respect to

future events and involve risks and uncertainties that could cause

actual results and outcomes to be materially different. These

forward-looking statements are not guarantees of future

performance, conditions, or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside Thoughtworks’ control, that

could cause actual results or outcomes to differ materially from

those discussed in the forward-looking statements. Important

factors that could cause such differences include, but are not

limited to: (1) risks associated with the consummation of

transactions generally, such as the inability to obtain, or delays

in obtaining, any required regulatory approvals or other consents;

(2) the failure to consummate or delay in (or uncertainty in the

timing of) consummating the merger for any reason; (3) the risk

that a condition to closing of the merger may not be satisfied; (4)

the occurrence of any event, change or other circumstances that

could give rise to the termination of the merger agreement; (5) the

impact and/or the outcome of any legal proceedings that may be

instituted following announcement of the proposed merger; failure

to retain key management and employees of Thoughtworks; (6)

unfavorable reaction to the merger by customers, competitors,

suppliers and employees; (7) certain restrictions during the

pendency of the proposed merger and proposed transactions that may

impact Thoughtworks’ ability to pursue certain business

opportunities or strategic transactions; (8) unexpected costs,

charges or expenses resulting from the proposed transactions; (9)

risks caused by delays in upturns or downturns being reflected in

the Thoughtworks’ financial position and results of operations;

(10) the failure to obtain the necessary financing arrangements set

forth in the equity commitment letter received in connection with

the proposed merger; and (11) those additional risks discussed

under the heading “Risk Factors” in Thoughtworks’ most recent

Annual Report on Form 10-K, most recent Quarterly Reports on Form

10-Q and in other reports and filings with the Securities and

Exchange Commission (the “SEC”). All information provided in this

communication is as of the date hereof, and Thoughtworks undertakes

no duty to update or revise this information unless required by

law.

Important additional information and where to find It

Thoughtworks will prepare and file with the SEC an information

statement on Schedule 14C and may file or furnish other documents

with the SEC regarding the proposed merger, including a transaction

statement on Schedule 13E-3. When completed, a definitive

information statement will be mailed to Thoughtworks’ stockholders.

You may obtain free copies of all documents filed by Thoughtworks

with the SEC regarding this transaction, free of charge, at the

SEC’s website, www.sec.gov or from Thoughtworks’ website at

https://investors.thoughtworks.com/sec-filings.

Stockholders of Thoughtworks are urged to read all relevant

documents regarding the proposed merger filed with the SEC,

including the information statement on Schedule 14C and any other

relevant documents in their entirety, including the transaction

statement on Schedule 13E-3, as well as any amendments or

supplements to these documents, carefully when they become

available because they will contain important information about

proposed transactions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240804237135/en/

For Thoughtworks

Investor contact: Rob Muller, Head of Investor Relations

Email: investor-relations@thoughtworks.com Phone: +1 (312)

373-1000

Media contact: Linda Horiuchi, Global Head of Public

Relations Email: linda.horiuchi@thoughtworks.com Phone: +1 (646)

581-2568

For Apax Katarina Sallerfors, Head of Communications

Email: katarina.sallerfors@apax.com Phone: +44 7436908492

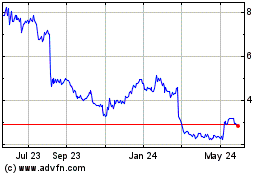

Thoughtworks (NASDAQ:TWKS)

Historical Stock Chart

From Oct 2024 to Nov 2024

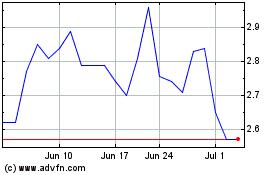

Thoughtworks (NASDAQ:TWKS)

Historical Stock Chart

From Nov 2023 to Nov 2024