United Community Banks, Inc. (NASDAQ: UCBI) (“United”) completed

its merger with First Miami Bancorp, Inc. (OTC: FMIA) (“First

Miami”), effective July 1, 2023. In this transaction, First Miami’s

bank subsidiary, the First National Bank of South Miami (“FNBSM”),

was also merged into United’s bank subsidiary, United Community

Bank (“United Community”). After conversion, FNBSM will operate

under the United Community brand.

FNBSM is headquartered in South Miami, Florida,

and operates three offices in the high-growth Miami metropolitan

area. As of March 31, 2023, FNBSM had total assets of $945 million,

total loans of $605 million, and total deposits of $823 million. In

addition to traditional banking services, FNBSM offers private

banking, trust and wealth management services with approximately

$320 million in assets under management. FNBSM has an excellent

reputation in its local communities and is led by a skilled banking

team that is well-known for providing excellent customer

service.

“We are thrilled to welcome this group of

talented bankers to the United Community team. While we have been

acquainted for some time, we’ve had the opportunity to really get

to know the FNBSM team since announcing the merger. Their culture

and approach to community engagement, customer service, and the

employee experience is very similar to ours at United Community,”

said Lynn Harton, Chairman and Chief Executive Officer of United.

“This partnership with FNBSM meaningfully expands our presence in

the vibrant Miami market, which continues to be one of the most

attractive metropolitan markets in the country. We look forward to

working with our new team to continue growing in Miami, providing

enhanced products and services with the attention and local service

that customers deserve.”

W. Rockwell “Rocky” Wirtz, Chairman and

President of First Miami, stated, “We built FNBSM focused on

growth, getting there with a fierce commitment to the delivery of

preeminent customer service. These are the same virtues that United

Community is known for. We are delighted and excited to join forces

with an organization and a group of professionals that share the

same values and integrity.”

Stephens Inc. and Morgan Stanley & Co. LLC

acted as financial advisors to United, and Wachtell, Lipton, Rosen

& Katz served as United’s legal advisor. D.A. Davidson &

Co. served as financial advisor to First Miami, and Barack

Ferrazzano Kirschbaum & Nagelberg LLP and Gozdecki, Del

Giudice, Americus & Brocato LLP served as First Miami’s legal

advisors.

About United Community Banks,

Inc.United Community Banks, Inc. (NASDAQ: UCBI) is a top

100 U.S. financial institution with $25.9 billion in assets, and

through its subsidiaries, provides a full range of banking, wealth

management and mortgage services. UCBI is the financial holding

company for United Community Bank (“United Community”) which has

207 offices across Alabama, Florida, Georgia, North Carolina, South

Carolina, and Tennessee, as well as a national SBA lending

franchise and a national equipment lending subsidiary. United

Community is committed to improving the financial health and

well-being of its customers and ultimately the communities it

serves. Among other awards, United Community is a nine-time winner

of the J.D. Power award that ranked the bank #1 in customer

satisfaction with consumer banking in the Southeast and was

recognized in 2023 by Forbes as one of the World’s Best Banks and

one of America’s Best Banks. The bank is also a multi-award

recipient of the Greenwich Excellence Awards, including the 2022

awards for Small Business Banking-Likelihood to Recommend (South)

and Overall Satisfaction (South), and was named one of the "Best

Banks to Work For" by American Banker in 2022 for the sixth

consecutive year. Additional information about United can be found

at www.ucbi.com.

Caution About Forward-Looking StatementsThis

press release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

In general, forward-looking statements usually may be identified

through use of words such as “may,” “believe,” “expect,”

“anticipate,” “intend,” “will,” “should,” “plan,” “estimate,”

“predict,” “continue” and “potential” or the negative of these

terms or other comparable terminology, and include statements

related to expected returns and other benefits of the merger to

shareholders, expected improvement in operating efficiency

resulting from the merger, estimated expense reductions resulting

from the merger and the timing of achievement of such reductions,

the impact on and timing of the recovery of the impact on tangible

book value, and the effect of the merger on United’s capital

ratios. Forward-looking statements are not historical facts and

represent management’s beliefs, based upon information available at

the time the statements are made, with regard to the matters

addressed; they are not guarantees of future performance. Actual

results may prove to be materially different from the results

expressed or implied by the forward-looking statements.

Forward-looking statements are subject to numerous assumptions,

risks and uncertainties that change over time and could cause

actual results or financial condition to differ materially from

those expressed in or implied by such statements.

Factors that could cause or contribute to such differences

include, but are not limited to (1) the risk that the cost savings

and any revenue synergies from the merger may not be realized or

take longer than anticipated to be realized, (2) disruption from

the merger of customer, supplier, employee or other business

partner relationships, (3) reputational risk and the reaction of

each of the companies’ customers, suppliers, employees or other

business partners to the merger, (4) risks relating to the

integration of First Miami’s operations into the operations of

United, including the risk that such integration will be materially

delayed or will be more costly or difficult than expected, (5)

risks associated with United’s pursuit of future acquisitions, (6)

the risks associated with expansion into new geographic or product

markets, and (7) general competitive, economic, political and

market conditions. Further information regarding additional factors

which could affect the forward-looking statements can be found in

the cautionary language included under the headings “Cautionary

Note Regarding Forward-Looking Statements” and “Risk Factors” in

United’s Annual Report on Form 10-K for the year ended December 31,

2022, and other documents subsequently filed by United with the

U.S. Securities and Exchange Commission.

Many of these factors are beyond United’s ability to control or

predict. If one or more events related to these or other risks or

uncertainties materialize, or if the underlying assumptions prove

to be incorrect, actual results may differ materially from the

forward-looking statements. Accordingly, shareholders and investors

should not place undue reliance on any such forward-looking

statements. Any forward-looking statement speaks only as of the

date of this communication, and United undertakes no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law. New risks and uncertainties may emerge from time

to time, and it is not possible for United to predict their

occurrence or how they will affect United.

United qualifies all forward-looking statements by these

cautionary statements.

For more information:Jefferson HarralsonChief

Financial Officer(864) 240-6208Jefferson_Harralson@ucbi.com

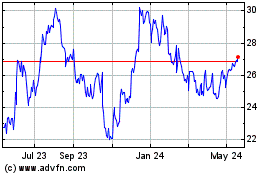

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Dec 2024 to Jan 2025

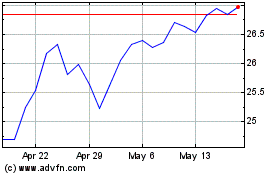

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Jan 2024 to Jan 2025