Standard Motor Beats by a Penny - Analyst Blog

07 March 2012 - 11:03PM

Zacks

Standard Motor Products Inc. (SMP) saw a profit

of $3.9 million or 17 cents per share in the fourth quarter of 2011

compared with $2.6 million or 11 cents per share in the same

quarter of 2010 (excluding non-operational gains and losses in both

the quarters). With this, the company has beaten the Zacks

Consensus Estimate by a penny.

Consolidated net sales in the quarter rose marginally by $1.2

million to $174.2 million from $173 million in the corresponding

quarter of 2010.

The company had an operating profit of $6.4 million (3.7%)

compared with $6.5 million (3.8%) in the fourth quarter of 2010.

The decline was attributable to increases in selling, general and

administrative expenses and restructuring and integration

expenses.

Revenues in the Engine Management segment rose 4% to $139.4

million. Operating profit in the segment climbed 14% to $10.1

million (7.3%) from $8.9 million (6.6%) in the fourth quarter of

2010.

Revenues in the Temperature Control segment declined 13% to

$31.8 million. The segment had an operating loss of $9 thousand

compared with an operating profit of $260,000 (0.7%) in the fourth

quarter of 2010.

For full year 2011, Standard Motor reported a profit of $36.1

million or $1.57 per share compared with $24.2 million or $1.07 per

share a year ago (all excluding non-operational gains and losses).

The profit was higher than the Zacks Consensus Estimate by a

penny.

Consolidated net sales increased 8% to $874.6 million from

$810.9 million in 2010. Operating profit went up 39% to $64.9

million (7.4%) from $46.8 million (5.8%) a year ago.

Standard Motor’s cash balance decreased to $10.9 million as of

December 31, 2011 from $12.1 million as of December 31, 2010.

Long-term debt plummeted to $299 thousand compared with $12.8

million as of December 31, 2010. Consequently, long-term

debt-to-capitalization ratio reduced significantly to 0.11% as of

December 31, 2011 from 5.7% a year ago.

Standard Motor Products, based in Long Island City, New York, is

engaged in manufacturing and distributing replacement parts for

motor vehicles. The major competitive advantages of the company are

a trained sales force, extensive product range, sophisticated parts

cataloging systems and an effective inventory management.

As a result, the company retains a Zacks #1 Rank (Strong Buy) on

its stock for the short term (1 to 3 months). It competes with

Visteon Corporation (VC).

STANDARD MOTOR (SMP): Free Stock Analysis Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

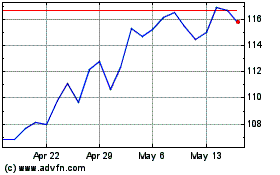

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

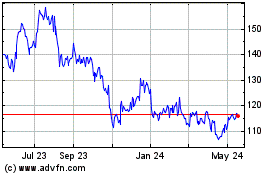

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024