Vodafone to Sell Spanish Unit to Zegona Communications for Around $5.3 Billion -- Update

31 October 2023 - 7:34PM

Dow Jones News

By Elena Vardon

Vodafone Group has agreed to sell its Spanish unit to European

telecommunications investment company Zegona Communications for an

enterprise value of around 5 billion euros ($5.31 billion).

The U.K.-based telecommunications group on Tuesday said the deal

is for 100% of Vodafone Spain.

The consideration is for at least EUR4.1 billion in cash and up

to EUR900 million in redeemable preference shares, Vodafone said.

The shares will be redeemed no later than six years after the

closing of the transaction for an amount made up of the

subscription price and accrued preferential dividend, it said.

As part of the deal, the companies entered an agreement for

Vodafone to provide certain services to Vodafone Spain for a charge

of around EUR110 million a year. They will also enter a brand

license agreement that allows Zegona to use the Vodafone brand in

Spain for up to 10 years after the completion of the transaction.

Other potential arrangements for services include access to

procurement, "Internet of Things," roaming and carrier services,

Vodafone said.

"We are very excited about the opportunity to return to the

Spanish telecoms market," Zegona Chief Executive Eamonn O'Hare

said.

Zegona said it entered into committed debt financing of EUR4.2

billion and a committed revolving credit line of EUR500 million to

fund the acquisition, along with the EUR900 million in financing

provided by Vodafone. It also intends to raise between EUR300

million and EUR600 million in equity from institutional investors

at GBP1.5 for each new share.

The transaction--which constitutes a reverse takeover--is set to

complete in the first half of 2024, subject to certain approvals

from shareholders and regulatory clearances. Zegona said it its

targeting completion in the first quarter and that trading in its

shares remains suspended pending the publication of a prospectus on

the acquisition.

"The sale of Vodafone Spain is a key step in right-sizing our

portfolio for growth and will enable us to focus our resources in

markets with sustainable structures and sufficient local scale,"

Vodafone Chief Executive Margherita Della Valle said. The group

will review how to best use the proceeds from the sale at

completion, it said.

Write to Elena Vardon at elena.vardon@wsj.com

(END) Dow Jones Newswires

October 31, 2023 04:19 ET (08:19 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

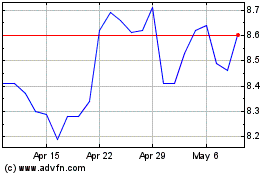

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

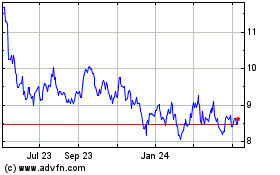

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024