0001851194false00018511942024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 07, 2024 |

VENTYX BIOSCIENCES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40928 |

83-2996852 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

12790 El Camino Real Suite 200 |

|

San Diego, California |

|

92130 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 760 593-4832 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

VTYX |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2024, Ventyx Biosciences, Inc. (the “Company”) issued a press release announcing its financial results for the third quarter ended September 30, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in this Current Report on Form 8-K shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or in any filing under the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

VENTYX BIOSCIENCES, INC. |

|

|

|

|

Date: |

November 7, 2024 |

By: |

/s/ Raju Mohan |

|

|

|

Raju Mohan, Ph.D.

Chief Executive Officer |

Exhibit 99.1

Ventyx Biosciences Reports Third Quarter 2024 Financial Results and Highlights Recent Corporate Progress

Topline results from the Phase 2a trial of VTX3232 in patients with early Parkinson’s disease expected in H1 2025

Phase 2 trial of VTX3232 in subjects with obesity and cardiometabolic risk factors expected to initiate by year-end, with topline results anticipated in H2 2025

Phase 2 trial of VTX2735 in patients with recurrent pericarditis expected to initiate by year-end, with topline results anticipated in H2 2025

Cash balance of $274.8M as of September 30, 2024 expected to fund operations into at least H2 2026

SAN DIEGO, November 7, 2024 (GLOBE NEWSWIRE) – Ventyx Biosciences, Inc. (Nasdaq: VTYX) (“Ventyx”), a clinical-stage biopharmaceutical company focused on advancing novel oral therapies that address a broad range of inflammatory diseases with significant unmet medical need, today announced financial results for the third quarter ended September 30, 2024, and highlighted recent pipeline and business progress.

“Thanks to the continued execution of our team, we are on track to initiate a Phase 2 trial of VTX2735 in recurrent pericarditis and a Phase 2 obesity and cardiometabolic trial of VTX3232 by the end of this year, in addition to advancing enrollment in the ongoing Phase 2a trial of VT3232 in patients with early Parkinson’s disease,” said Raju Mohan, PhD, President and Chief Executive Officer. “With our potential best-in-class NLRP3 inhibitors, we believe we are well positioned to unlock the vast therapeutic potential of the inflammasome pathway.”

Pipeline Updates

NLRP3 Portfolio

•VTX3232 (CNS-penetrant NLRP3 Inhibitor): We initiated a Phase 2a trial of VTX3232 in participants with early Parkinson’s disease during the third quarter of 2024, with the primary goal of evaluating safety and key inflammatory biomarkers in the plasma and cerebrospinal fluid (CSF). The trial also includes an exploratory endpoint of PET-tracer imaging as an assessment of microglial activation. We also expect to initiate a 12-week Phase 2 trial of VTX3232 in participants with obesity and additional cardiovascular and cardiometabolic risk factors by year-end. This trial will evaluate the effect of VTX3232 on key inflammatory and cardiometabolic biomarkers as well as on weight change, when dosed as a monotherapy and in combination with a GLP-1 receptor agonist.

These Phase 2 trials follow positive topline results from the Phase 1 single- and multiple-ascending dose (SAD, MAD) trial of VTX3232 in adult healthy volunteers. In the Phase 1 trial, VTX3232 exhibited a dose-dependent and dose-linear pharmacokinetic profile with repeat once-daily doses of VTX3232 exceeding steady-state IL-1β IC90 coverage in both plasma and CSF. We believe these data support the potential for VTX3232 as a best-in-class CNS-penetrant NLRP3 inhibitor for the treatment of neuroinflammatory and cardiometabolic diseases.

•VTX2735 (Peripheral NLRP3 Inhibitor): We expect to initiate a Phase 2 trial of VTX2735 in participants with recurrent pericarditis by year-end, with the goal of evaluating safety and the effect of VTX2735 on disease-relevant biomarkers and pain scores. We believe that by treating and preventing disease recurrence, VTX2735 has the potential to become the first approved oral therapy for recurrent pericarditis, a debilitating autoinflammatory disease associated with activation of the NLRP3 inflammasome.

We previously announced data from a Phase 2 trial of VTX2735 in participants with cryopyrin-associated periodic syndromes (CAPS), a group of rare autoinflammatory conditions caused by gain-of-function mutations in the NLRP3 gene. These proof-of-concept data demonstrated the therapeutic benefit of targeting NLRP3 in humans with evidence of strong efficacy and a favorable safety profile. We believe these results support the therapeutic potential of VTX2735 in recurrent pericarditis and numerous additional chronic peripheral inflammatory diseases.

IBD Portfolio

•Tamuzimod (formerly VTX002, S1P1R Modulator): We recently presented new long-term extension (LTE) data from the tamuzimod Phase 2 trial in patients with ulcerative colitis at the United European Gastroenterology (UEG) Week meeting in Vienna, Austria. These 52-week data continue to reinforce the potential best-in-class profile of tamuzimod in ulcerative colitis (UC) including a potential best-in-disease safety profile amongst all the oral options for UC therapy. We believe the high rates of clinical remission and endoscopic remission position tamuzimod as the backbone of future combination therapies. We intend to identify a partner or other source of non-dilutive financing to support the pivotal Phase 3 trial of tamuzimod in UC.

•VTX958 (TYK2 Inhibitor): As previously announced, VTX958 did not meet the primary endpoint of change from baseline in CDAI (symptomatic outcome) in a Phase 2 trial in patients with Crohn’s disease, due to abnormally high placebo response. VTX958 did demonstrate robust, dose-dependent, nominally statistically significant endoscopic response rates at Week 12, as measured by SES-CD (an objective endpoint), and showed a greater magnitude of decrease compared to placebo in two key biomarkers of inflammation, C-reactive protein and fecal calprotectin. Recognizing the opportunity for a safe and effective oral TYK2 inhibitor as early-line therapy in Crohn’s disease, we are continuing the analysis of the Phase 2 data including data from the 52-week treat-through long-term extension phase to better understand the path forward for VTX958. At this time, we do not plan to commit significant internal resources to further development of VTX958.

Third Quarter 2024 Financial Results:

•Cash Position: Cash, cash equivalents and marketable securities were $274.8 million as of September 30, 2024. We believe our current cash, cash equivalents and marketable securities are sufficient to fund our planned operations into at least the second half of 2026.

•Research and Development (R&D) expenses: R&D expenses were $30.6 million for the third quarter of 2024, compared to $49.8 million for the third quarter of 2023.

•General and Administrative (G&A) expenses: G&A expenses were $7.9 million for the third quarter of 2024, compared to $8.2 million for the third quarter of 2023.

•Net loss: Net loss was $35.2 million for the third quarter of 2024, compared to $54.0 million for the third quarter of 2023.

About Ventyx Biosciences

Ventyx is a clinical-stage biopharmaceutical company focused on developing innovative oral medicines for patients living with autoimmune and inflammatory disorders. We believe our ability to efficiently discover and develop differentiated drug candidates will allow us to address important unmet medical needs with novel oral therapies that can shift inflammation and immunology markets from injectable to oral drugs. Our current pipeline includes internally discovered clinical programs targeting NLRP3, S1P1R and TYK2, positioning us to become a leader in the development of oral immunology therapies for peripheral and neuroinflammatory diseases. Ventyx is headquartered in San Diego, California. For more information about Ventyx, please visit www.ventyxbio.com.

Forward-Looking Statements

Ventyx cautions you that statements contained in this press release regarding matters that are not historical facts are forward-looking statements. These statements are based on Ventyx’s current beliefs and expectations. Such forward-looking statements include, but are not limited to, statements regarding: the potential of Ventyx’s product candidates, including the potential of VTX3232 and VTX2735, to emerge as a best-in-class NLRP3 inhibitor for the treatment of inflammatory, neuroinflammatory and cardiometabolic diseases and conditions, the potential of tamuzimod as a best-in-disease oral agent in Ulcerative Colitis (UC) and best-in-disease safety profile, and the potential of VTX2735 to be the first approved oral therapy for recurrent pericarditis and to have therapeutic potential in additional chronic peripheral inflammatory diseases; the design of clinical studies to be conducted by the Company; the anticipated timing for the initiation of a Phase 2 trial of VTX3232 subjects with obesity and cardiometabolic risk factors by year-end 2024, and the initiation of a Phase 2 trial of VTX2735 in recurrent pericarditis by year-end 2024; the timing of clinical updates for all three Phase 2 studies of VTX3232 and VTX2735, including the publication of any clinical data from these studies in 2025; the continued analysis of the Phase 2 data from the study of VTX958 in subjects with Crohn’s disease; management’s plans with respect to a potential pivotal Phase 3 trial for tamuzimod in UC, supported by a partner or other source of non-dilutive financing; management’s plans with respect to the commitment of internal resources toward development of VTX958; and the expected timeframe for funding Ventyx’s operating plan with current cash, cash equivalents and marketable securities.

The inclusion of forward-looking statements should not be regarded as a representation by Ventyx that any of its plans will be achieved. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in Ventyx’s business, including, without limitation: potential delays in the commencement, enrollment and completion of clinical trials; Ventyx’s dependence on third parties in connection with product manufacturing, research and preclinical and clinical testing; disruptions in the supply chain, including raw materials needed for manufacturing and animals used in research, delays in site activations and enrollment of clinical trials; the results of preclinical studies and clinical trials; early clinical trials not necessarily being predictive of future results; interim results not necessarily being predictive of final results; the potential of one or more outcomes to materially change as a trial continues and more patient data become available and following more comprehensive audit and verification procedures; regulatory developments in the United States and foreign countries; unexpected adverse side effects or inadequate efficacy of Ventyx’s product candidates that may limit their development, regulatory approval and/or commercialization, or may result in recalls or product liability claims; Ventyx’s ability to obtain and maintain intellectual property protection for its product candidates; the use of capital resources by Ventyx sooner than expected; and other risks described in Ventyx’s prior press releases and Ventyx’s filings with the Securities and Exchange Commission (SEC), including in Part II, Item 1A (Risk Factors) of Ventyx’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed on or about November 7, 2024, and Ventyx’s subsequent filings with the SEC.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and Ventyx undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Investor Relations Contact

Joyce Allaire

Managing Director

LifeSci Advisors

IR@ventyxbio.com

Ventyx Biosciences, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except share and per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

30,629 |

|

|

$ |

49,750 |

|

|

$ |

92,181 |

|

|

$ |

133,747 |

|

General and administrative |

|

|

7,923 |

|

|

|

8,201 |

|

|

|

23,851 |

|

|

|

23,901 |

|

Total operating expenses |

|

|

38,552 |

|

|

|

57,951 |

|

|

|

116,032 |

|

|

|

157,648 |

|

Loss from operations |

|

|

(38,552 |

) |

|

|

(57,951 |

) |

|

|

(116,032 |

) |

|

|

(157,648 |

) |

Other (income) expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

(3,350 |

) |

|

|

(3,932 |

) |

|

|

(10,360 |

) |

|

|

(11,453 |

) |

Other expense |

|

|

47 |

|

|

|

8 |

|

|

|

99 |

|

|

|

14 |

|

Total other (income) expense |

|

|

(3,303 |

) |

|

|

(3,924 |

) |

|

|

(10,261 |

) |

|

|

(11,439 |

) |

Net loss |

|

$ |

(35,249 |

) |

|

$ |

(54,027 |

) |

|

$ |

(105,771 |

) |

|

$ |

(146,209 |

) |

Unrealized gain on marketable securities |

|

|

922 |

|

|

|

192 |

|

|

|

741 |

|

|

|

544 |

|

Foreign currency translation |

|

|

199 |

|

|

|

11 |

|

|

|

182 |

|

|

|

72 |

|

Comprehensive loss |

|

$ |

(34,128 |

) |

|

$ |

(53,824 |

) |

|

$ |

(104,848 |

) |

|

$ |

(145,593 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.50 |

) |

|

$ |

(0.92 |

) |

|

$ |

(1.56 |

) |

|

$ |

(2.51 |

) |

Weighted average common shares outstanding, basic and diluted |

|

|

70,667,570 |

|

|

|

58,880,427 |

|

|

|

67,694,970 |

|

|

|

58,363,174 |

|

Ventyx Biosciences, Inc.

Selected Condensed Consolidated Balance Sheet Data

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash, cash equivalents and marketable securities |

|

$ |

274,825 |

|

|

$ |

252,220 |

|

Working capital |

|

|

277,105 |

|

|

|

242,080 |

|

Total assets |

|

|

301,100 |

|

|

|

277,693 |

|

Total liabilities |

|

|

22,328 |

|

|

|

33,770 |

|

Accumulated deficit |

|

|

(524,958 |

) |

|

|

(419,187 |

) |

Total stockholders' equity |

|

|

278,772 |

|

|

|

243,923 |

|

v3.24.3

Document And Entity Information

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity Registrant Name |

VENTYX BIOSCIENCES, INC.

|

| Entity Central Index Key |

0001851194

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-40928

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

83-2996852

|

| Entity Address, Address Line One |

12790 El Camino Real

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92130

|

| City Area Code |

760

|

| Local Phone Number |

593-4832

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

VTYX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

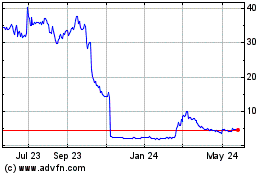

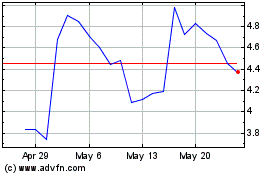

Ventyx Biosciences (NASDAQ:VTYX)

Historical Stock Chart

From Dec 2024 to Dec 2024

Ventyx Biosciences (NASDAQ:VTYX)

Historical Stock Chart

From Dec 2023 to Dec 2024