Ventyx Biosciences Reports Fourth Quarter and Full Year 2024 Financial Results and Highlights Recent Corporate Progress

28 February 2025 - 8:05AM

Ventyx Biosciences, Inc. (Nasdaq: VTYX) (“Ventyx”, “Company”), a

clinical-stage biopharmaceutical company focused on developing

innovative oral therapies for patients with autoimmune,

inflammatory, and neurodegenerative diseases, today reported fourth

quarter and full year 2024 financial results and highlighted recent

pipeline and business progress.

“Heading into 2025, Ventyx has established

itself as the leader in the field of NLRP3 inhibition having

progressed two novel inhibitors, VTX3232 and VTX2735, into Phase 2

trials in neurodegenerative, cardiovascular, and metabolic

indications. These disease states are thought to be driven by

pathologic activation of the NLRP3 inflammasome,” said Raju Mohan,

PhD, President and Chief Executive Officer. “We are on track to

complete the Phase 2 biomarker trial of VTX3232 in Parkinson’s

disease in Q2 2025 and have initiated planning for the next phase

of development. In the second half of 2025, we expect to share

results from the Phase 2 trial of VTX3232 in participants with

obesity and cardiometabolic risk factors and the Phase 2 trial of

VX2735 in patients with recurrent pericarditis. 2025 promises to be

an exciting year for Ventyx and we look forward to sharing data and

development plans as they become available.”

Pipeline Updates and Anticipated

Milestones

NLRP3 Inhibitor Portfolio:

Ventyx is advancing a portfolio of potential best-in-class oral

NLRP3 inhibitors for systemic inflammatory conditions and

neurodegenerative diseases, including VTX2735, a peripherally

restricted NLRP3 inhibitor, and VTX3232, a CNS-penetrant NLRP3

inhibitor.

- VTX2735 in Recurrent

Pericarditis: We are evaluating VTX2735 in an open-label

Phase 2 trial in patients with recurrent pericarditis. The trial

will enroll approximately 30 patients for a 6-week primary

treatment period, followed by a 7-week extension period. Key

endpoints include safety, change in the NRS (numerical rating

scale) pain score, and change in high sensitivity C-reactive

protein (hsCRP). Topline results are expected in the second half of

2025.

By treating and

preventing disease recurrence, VTX2735 has the potential to offer a

safe, effective, and convenient oral therapy for patients suffering

from recurrent pericarditis.

- VTX3232 in Cardiometabolic

Diseases: We are evaluating VTX3232 in a Phase 2 trial in

participants with obesity and cardiometabolic risk factors. The

trial is expected to enroll approximately 160 subjects randomized

to one of four groups for a 12-week primary treatment period:

monotherapy placebo, monotherapy VTX3232, combination semaglutide +

placebo, or combination semaglutide + VTX3232. Key endpoints

include safety and change in hsCRP. The trial will assess a panel

of exploratory endpoints, including biomarkers of inflammation and

cardiometabolic disease, as well as imaging to assess body

composition and liver fat. Topline results are expected in the

second half of 2025.

Data from the Phase 2

trial are expected to inform future development of the Company’s

NLRP3 inhibitors in cardiometabolic diseases.

- VTX3232 in Parkinson’s

Disease: The ongoing Phase 2 open-label biomarker and

imaging trial of VTX3232 in patients with early Parkinson’s disease

is on track to complete in the second quarter of 2025. Key

endpoints include safety, pharmacokinetics, and inflammatory and

disease-related biomarkers in cerebrospinal fluid and plasma,

downstream of NLRP3 activation. The trial also includes exploratory

TSPO (Translocator Protein) PET imaging as a marker of microglial

activation.

Data from the Phase 2

study are expected to inform future development of VTX3232 in

Parkinson’s disease. Beyond Parkinson’s disease, NLRP3 inhibition

in the CNS may have therapeutic utility in a range of other

neurodegenerative diseases, including Alzheimer’s disease, multiple

sclerosis, and amyotrophic lateral sclerosis.

Inflammatory Bowel Disease (IBD)

Portfolio:

- Tamuzimod

(S1P1R Modulator, ulcerative colitis): Publication of the

tamuzimod Phase 2 induction data in Lancet (January 2025,

doi:10.1016/S2468-1253(24)00386-8) highlighted robust clinical and

endoscopic remission rates in patients treated with tamuzimod

compared to placebo. Combination treatment is emerging as a

compelling concept in IBD to break through the modest clinical

remission rates seen with monotherapies today. Tamuzimod’s efficacy

and safety profile could position it as the backbone of future

combination regimens with another oral or biologic agent. The

Company continues to explore partnership opportunities for

tamuzimod in ulcerative colitis.

- VTX958 (TYK2 Inhibitor,

Crohn’s disease): Presentation of Phase 2 data for VTX958

in Crohn’s disease at the 20th Congress of the European Crohn’s and

Colitis Organisation (ECCO, February 2025, Journal of Crohn's and

Colitis, doi.org/10.1093/ecco-jcc/jjae190.1175) demonstrated a

robust, dose-dependent endoscopic response at Week 12 for VTX958

compared to placebo, including a greater magnitude of reduction in

two key biomarkers of inflammation, CRP and fecal

calprotectin.

The totality of the

Phase 2 data suggest that VTX958 may have disease-modifying

benefits in Crohn’s disease. We are exploring a path for continued

development of VTX958 in Crohn's disease, including potential

partnership opportunities.

Fourth Quarter and 2024 Financial

Results

- Cash

Position: Cash, cash equivalents and marketable securities

were $252.9 million as of December 31, 2024. We believe our current

cash, cash equivalents and marketable securities are sufficient to

fund our planned operations into at least the second half of

2026.

-

Research and Development (R&D)

expenses: R&D expenses were $24.8 million for the

fourth quarter of 2024, compared to $42.0 million for the fourth

quarter of 2023. R&D expenses were $117.0 million for the year

ended December 31, 2024, compared to $175.8 million for the

year ended December 31, 2023.

- General and

Administrative (G&A) expenses: G&A expenses were

$7.6 million for the fourth quarter of 2024, compared to $8.3

million for the fourth quarter of 2023. G&A expenses were $31.4

million for the year ended December 31, 2024, compared to $32.2

million for the year ended December 31, 2023.

- Net

loss: Net loss was $29.4 million for the fourth quarter of

2024, compared to $46.8 million for the fourth quarter of 2023. Net

loss was $135.1 million for the year ended December 31, 2024,

compared to $193.0 million for the year ended December 31,

2023.

About Ventyx Biosciences

Ventyx Biosciences is a clinical-stage

biopharmaceutical company developing innovative oral therapies for

patients with autoimmune, inflammatory, and neurodegenerative

diseases. Our expertise in medicinal chemistry, structural biology,

and immunology enables the discovery of differentiated oral small

molecule therapeutics for conditions with high unmet medical need,

and our extensive experience in clinical development allows the

rapid progression of these drug candidates through clinical trials.

Our lead portfolio of NLRP3 inhibitors includes VTX2735, a

peripherally restricted NLRP3 inhibitor in Phase 2 development for

recurrent pericarditis, and VTX3232, a CNS-penetrant NLRP3

inhibitor in Phase 2 development for neurodegenerative and

cardiometabolic diseases. Our inflammatory bowel disease portfolio

includes tamuzimod (VTX002), an S1P1R modulator, and VTX958, a TYK2

inhibitor, both of which have completed Phase 2 clinical trials.

For more information on Ventyx, please visit our website at

https://ventyxbio.com.

Forward-Looking Statements

Ventyx cautions you that statements contained in

this press release regarding matters that are not historical facts

are forward-looking statements. These statements are based on

Ventyx’s current beliefs and expectations. Such forward-looking

statements include, but are not limited to, statements regarding:

the potential of each of Ventyx’s product candidates, including the

potential of VTX2735 and VTX3232, to emerge as best-in-class NLRP3

inhibitors and produce safe, effective or disease modifying results

for the treatment of systemic inflammatory conditions or

neurodegenerative diseases, the anticipated timing of enrollment of

subjects, and the estimated total subjects enrolled, in each of the

Phase 2 trials; the anticipated timing for the topline results of

the ongoing Phase 2 trials of VTX3232 subjects in Parkinson’s

disease in Q2 2025, and in the setting of obesity with

cardiometabolic risk factors in H2 2025, and the Phase 2 trial of

VTX2735 in recurrent pericarditis in H2 2025; management’s plans

with respect to the commitment of internal resources toward further

analysis, or development, including future studies, partnerships or

other source of non-dilutive financing for tamuzimod in ulcerative

colitis and VTX958 in Crohn’s disease; the potential for VTX3232

and VTX2735 in multiple cardiometabolic, systemic or neurological

diseases; and the expected timeframe for funding Ventyx’s operating

plan with current cash, cash equivalents and marketable

securities.

The inclusion of forward-looking statements

should not be regarded as a representation by Ventyx that any of

its plans will be achieved. Actual results may differ from those

set forth in this press release due to the risks and uncertainties

inherent in Ventyx’s business, including, without limitation:

potential delays in the commencement, enrollment and completion of

clinical trials; Ventyx’s dependence on third parties in connection

with product manufacturing, research and preclinical and clinical

testing; disruptions in the supply chain, including raw materials

needed for manufacturing and animals used in research, delays in

site activations and enrollment of clinical trials; the results of

preclinical studies and clinical trials; early clinical trials not

necessarily being predictive of future results; interim results not

necessarily being predictive of final results; the potential of one

or more outcomes to materially change as a trial continues and more

patient data become available and following more comprehensive

audit and verification procedures; regulatory developments in the

United States and foreign countries; unexpected adverse side

effects or inadequate efficacy of Ventyx’s product candidates that

may limit their development, regulatory approval and/or

commercialization, or may result in recalls or product liability

claims; Ventyx’s ability to obtain and maintain intellectual

property protection for its product candidates; the use of capital

resources by Ventyx sooner than expected; and other risks described

in Ventyx’s prior press releases and Ventyx’s filings with the

Securities and Exchange Commission (SEC), including in Part II,

Item 1A (Risk Factors) of Ventyx’s Annual Report on Form 10-K for

the full year ended December 31, 2024, filed on or about the date

hereof, and Ventyx’s subsequent filings with the SEC.

You are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

hereof, and Ventyx undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist

after the date hereof. All forward-looking statements are qualified

in their entirety by this cautionary statement, which is made under

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995.

Investor Relations Contact:Joyce

AllaireManaging DirectorLifeSci AdvisorsIR@ventyxbio.com

Financial Tables

| |

|

|

|

|

|

|

|

|

|

Ventyx Biosciences, Inc. |

|

Consolidated Statements of Operations and Comprehensive

Loss |

|

(in thousands, except share and per share

amounts) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

Three months ended December 31, |

|

Year ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

24,821 |

|

|

$ |

42,020 |

|

|

$ |

117,002 |

|

|

$ |

175,767 |

|

|

General and administrative |

|

|

7,597 |

|

|

|

8,326 |

|

|

|

31,448 |

|

|

|

32,227 |

|

|

Total operating expenses |

|

|

32,418 |

|

|

|

50,346 |

|

|

|

148,450 |

|

|

|

207,994 |

|

|

Loss from operations |

|

|

(32,418 |

) |

|

|

(50,346 |

) |

|

|

(148,450 |

) |

|

|

(207,994 |

) |

|

Other (income) expense: |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

(3,056 |

) |

|

|

(3,621 |

) |

|

|

(13,416 |

) |

|

|

(15,074 |

) |

|

Other (income) expense |

|

|

(11 |

) |

|

|

28 |

|

|

|

88 |

|

|

|

42 |

|

|

Total other (income) expense |

|

|

(3,067 |

) |

|

|

(3,593 |

) |

|

|

(13,328 |

) |

|

|

(15,032 |

) |

|

Net loss |

|

$ |

(29,351 |

) |

|

$ |

(46,753 |

) |

|

$ |

(135,122 |

) |

|

$ |

(192,962 |

) |

|

Unrealized gain (loss) on marketable securities |

|

|

(480 |

) |

|

|

577 |

|

|

|

261 |

|

|

|

1,121 |

|

|

Foreign currency translation |

|

|

(236 |

) |

|

|

(120 |

) |

|

|

(54 |

) |

|

|

(48 |

) |

|

Comprehensive loss |

|

$ |

(30,067 |

) |

|

$ |

(46,296 |

) |

|

$ |

(134,915 |

) |

|

$ |

(191,889 |

) |

|

Net loss per share attributable to common shareholders, basic and

diluted |

|

$ |

(0.41 |

) |

|

$ |

(0.79 |

) |

|

$ |

(1.97 |

) |

|

$ |

(3.30 |

) |

|

Shares used to compute basic and diluted net loss per share

attributable to common shareholders |

|

|

70,810,758 |

|

|

|

59,076,498 |

|

|

|

68,478,172 |

|

|

|

58,542,974 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Ventyx Biosciences, Inc. |

|

Selected Condensed Consolidated Balance Sheet

Data |

|

(in thousands) |

|

(unaudited) |

| |

|

|

|

|

| |

|

December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Cash, cash equivalents and marketable securities |

|

$ |

252,943 |

|

|

$ |

252,220 |

|

|

Working capital |

|

|

216,849 |

|

|

|

242,080 |

|

|

Total assets |

|

|

276,563 |

|

|

|

277,693 |

|

|

Total liabilities |

|

|

22,518 |

|

|

|

33,770 |

|

|

Accumulated deficit |

|

|

(554,309 |

) |

|

|

(419,187 |

) |

|

Total stockholders' equity |

|

|

254,045 |

|

|

|

243,923 |

|

|

|

|

|

|

|

|

|

|

|

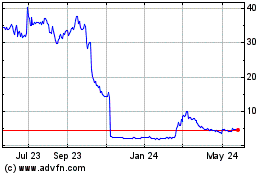

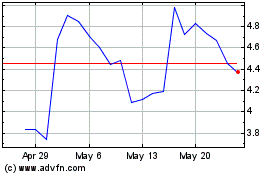

Ventyx Biosciences (NASDAQ:VTYX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ventyx Biosciences (NASDAQ:VTYX)

Historical Stock Chart

From Mar 2024 to Mar 2025