Proxy Statement Pursuant to Section 14(a) of the Securities Exchange

Act of 1934

You are invited to attend the Annual Meeting

of Stockholders (the “Annual Meeting”) of Wilhelmina International, Inc. The Annual Meeting will be held on Tuesday,

June 8, 2021, at 4:00 p.m., local time, at the offices of our counsel, McGuire, Craddock & Strother, P.C., located at 500 N.

Akard Street, Suite 2200, Dallas, Texas 75201.

We describe in detail the actions we expect

to submit to a vote of stockholders at the Annual Meeting in the accompanying Notice of Annual Meeting of Stockholders and Proxy

Statement.

Your vote is important regardless of the

number of shares you own. Whether or not you plan to attend the Annual Meeting, we ask that you promptly sign, date and return

the enclosed proxy card or voting instruction card in the envelope provided, or submit your proxy by telephone or over the Internet

in accordance with the instructions on the enclosed proxy card or voting instruction card. Submitting your proxy now will not

prevent you from voting your shares in person at the Annual Meeting if you desire to do so, as your proxy is revocable at your

option before it is exercised at the Annual Meeting.

On behalf of the Board of Directors, I would

like to express our appreciation for your continued interest in Wilhelmina International, Inc. We look forward to seeing you at

the Annual Meeting.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 8, 2021

To the Stockholders of Wilhelmina International, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of

Stockholders (the “Annual Meeting”) of Wilhelmina International, Inc. (the “Company”), will be held on

Tuesday, June 8, 2021, at 4:00 p.m., local time, at the offices of our counsel, McGuire, Craddock & Strother, P.C., located

at 500 N. Akard Street, Suite 2200, Dallas, Texas 75201, for the following purposes:

|

|

1.

|

To elect seven directors to serve until the next Annual Meeting of Stockholders and until their

successors are duly elected and qualify;

|

|

|

2.

|

To conduct an advisory vote on a resolution approving the Company’s compensation of its named

executive officers;

|

|

|

3.

|

To ratify the appointment of Baker Tilly US, LLP as the Company’s independent registered

public accounting firm for fiscal year 2021; and

|

|

|

4.

|

To transact such other business as may properly come before the Annual Meeting or any postponement

or adjournment thereof.

|

Stockholders of record at the close of business

on April 21, 2021, are entitled to receive notice of, and to vote at, the Annual Meeting and any adjournments thereof. Whether

or not you plan to attend the meeting, please sign, date and return the enclosed proxy card or voting instruction card in the envelope

provided, or submit your proxy by telephone or over the Internet in accordance with the instructions on the enclosed proxy card

or voting instruction card. If you attend the meeting, you may revoke your proxy and vote in person.

Thank you for your participation. We look forward to your continued support.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

Mark E. Schwarz

Chairman of the Board

and Executive Chairman

|

|

|

Important Notice Regarding the Availability of Proxy Materials for

the Stockholders Meeting to Be Held on June 8, 2021

The 2021 Proxy Statement and Annual Report to Stockholders for the year

ended December 31, 2020

are available at www.proxyvote.com.

|

WILHELMINA INTERNATIONAL, INC.

Two Lincoln Centre

5420 LBJ Freeway

Lockbox #25

Dallas, TX 75240

_________________________________

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 8, 2021

This Proxy Statement is furnished by the Board of

Directors (the “Board”) of Wilhelmina International, Inc., a Delaware corporation (the “Company,” “we,”

“our” or “us”), in connection with the Board’s solicitation of proxies for use at the Annual Meeting

of Stockholders (the “Annual Meeting”) to be held at the offices of our counsel, McGuire, Craddock & Strother,

P.C., 500 N. Akard Street, Suite 2200, Dallas, Texas 75201, at 4:00 p.m., local time, on Tuesday, June 8, 2021, or at any adjournment

or postponement thereof. This Proxy Statement is first being sent or given to stockholders beginning on or around April 27, 2021.

Questions

and Answers About the Annual Meeting and Voting

|

|

Q:

|

Why did I receive this Proxy Statement?

|

|

|

A:

|

The Board is soliciting your proxy to vote at the Annual Meeting because you were a stockholder

at the close of business on April 21, 2021, the record date for the Annual Meeting (the “Record Date”), and are entitled

to vote at the Annual Meeting. This Proxy Statement summarizes the information you need to know to vote at the Annual Meeting.

You do not need to attend the Annual Meeting to vote your shares.

|

|

|

Q:

|

What information is contained in this Proxy Statement?

|

|

|

A:

|

The information in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting,

the voting process, the background and compensation of our directors and executive officers, and certain other required information.

|

|

|

Q:

|

What should I do if I receive more than one set of voting materials?

|

|

|

A:

|

You may receive more than one set of voting materials, including multiple copies of this Proxy

Statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage

account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder

of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign,

date and return each proxy card and voting instruction card that you receive.

|

|

|

Q:

|

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

|

|

|

A:

|

If your shares are registered directly in your name with our transfer agent, Securities Transfer

Corporation (the “Transfer Agent”), you are considered, with respect to those shares, the “stockholder of record.”

This Proxy Statement, our 2020 Annual Report on Form 10-K (the “2020 Annual Report”), and a proxy card have been sent

directly to you by the Company.

|

If your shares are held in a stock brokerage

account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in street name. This

Proxy Statement and the 2020 Annual Report have been forwarded to you by your broker, bank or nominee who is considered, with respect

to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or nominee

how to vote your shares by using the voting instruction card included in the mailing or by following their instructions for voting

by telephone or the Internet. You may not vote these shares in person at the Annual Meeting unless you obtain a proxy from the

broker, bank or nominee that holds your shares giving you the right to vote the shares at the meeting.

|

|

Q:

|

What am I voting on at the Annual Meeting?

|

|

|

A:

|

You are voting on the following matters:

|

|

|

·

|

Election of seven directors to serve until the next Annual Meeting of Stockholders and until their

successors are duly elected and qualify;

|

|

|

·

|

An advisory resolution (the “Say-On-Pay Resolution”) approving the Company’s compensation of its executive

officers named in this Proxy Statement (the “Named Executive Officers”);

|

|

|

·

|

Ratification of the appointment of Baker Tilly US, LLP (“Baker Tilly”) as the Company’s independent registered

public accounting firm for fiscal year 2021; and

|

|

|

·

|

The transaction of such other business as may properly be brought before the Annual Meeting.

|

The Board recommends a vote “FOR”

the election of each of its director nominees and “FOR” each of the other proposals described in this Proxy Statement.

|

|

A:

|

You may vote using any of the following methods:

|

|

|

·

|

By proxy card or voting instruction card. Be sure to complete, sign and date the card and

return it in the prepaid envelope.

|

|

|

·

|

By telephone or the Internet. This is allowed if you are a beneficial owner of shares and

your broker, bank or nominee offers this alternative.

|

|

|

·

|

In person at the Annual Meeting. All stockholders of record may vote in person at the Annual

Meeting. You may also be represented by another person at the Annual Meeting by executing a proper proxy designating that person.

If you are a beneficial owner of shares, you must obtain a proxy from your broker, bank or nominee and present it to the inspector

of election with your ballot when you vote at the Annual Meeting.

|

|

|

Q:

|

What can I do if I change my mind after I vote my shares?

|

|

|

A:

|

If you are a stockholder of record, you may revoke your proxy at any time before it is voted at

the Annual Meeting by:

|

|

|

·

|

sending written notice of revocation to our Corporate Secretary;

|

|

|

·

|

submitting a new proxy dated later than the date of the revoked proxy; or

|

|

|

·

|

attending the Annual Meeting and voting in person.

|

If you are a beneficial owner of shares,

you may submit new voting instructions by contacting your broker, bank or nominee. You may also vote in person at the Annual Meeting

if you obtain a proxy from your broker, bank or nominee. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

|

|

Q:

|

What if I return a signed proxy card, but do not vote for the matters listed on the proxy card?

|

|

|

A:

|

If you return a signed proxy card without indicating your vote, your shares will be voted, in accordance

with the Board’s recommendation, “FOR” the election of each of its director nominees and “FOR” each

of the other proposals described in this Proxy Statement.

|

|

|

Q:

|

Can my broker vote my shares for me?

|

|

|

A:

|

Brokers and nominees who have record ownership of shares held in “street name” (i.e.,

for account holders who are the beneficial owners of the shares) have the discretion to vote such shares on routine matters, but

not on other matters. Brokers and nominees will have discretionary authority to vote on the ratification of auditors but will not

have discretionary authority to vote on the election of directors or any other proposal described in this Proxy Statement. Please

provide voting instructions to your broker or nominee so your vote can be counted.

|

|

|

Q:

|

Can my shares be voted if I do not return my proxy card or voting instruction card and do not attend the Annual Meeting?

|

|

|

A:

|

If you do not vote your shares held of record (registered directly in your name, not in the name

of a broker, bank or nominee), your shares will not be voted.

|

If your shares are held in street name

and you do not provide voting instructions to your broker, bank or nominee, your broker, bank or nominee may nonetheless submit

a proxy reflecting a “broker non-vote.” Broker non-votes will be considered present for purposes of determining a quorum

at the Annual Meeting but not for any other purpose. Therefore, broker non-votes will not affect the outcome of any other matters

considered at the Annual Meeting.

|

|

Q:

|

How are votes counted?

|

|

|

A:

|

For the election of directors, you may vote “FOR” all or some of the nominees or your

vote may be “WITHHELD” with respect to one or more of the nominees. For the other proposals described in this Proxy

Statement, you may vote “FOR” or “AGAINST” each proposal or you may “ABSTAIN” from voting on

any proposal.

|

|

|

Q:

|

What is the voting requirement to approve each of the proposals?

|

|

|

A:

|

In the election of directors, you may vote “FOR” all or some of the nominees or your

vote may be “WITHHELD” with respect to one or more of the nominees. You may not cumulate your votes. Thus, a stockholder

is not entitled to cumulate his votes and cast them all for any single nominee or to spread his votes, so cumulated, among more

than one nominee. Directors will be elected by a plurality of the votes cast at the Annual Meeting.

|

With respect to each other item of business,

you may vote “FOR,” “AGAINST” or “ABSTAIN.” For all matters to be brought before the meeting,

the affirmative vote of the holders of a majority of the outstanding shares entitled to vote and represented in person or

by proxy at the Annual Meeting (excluding broker non-votes) will decide the question. Therefore, if you “ABSTAIN” with

respect to any matter, the abstention has the same effect as a vote “AGAINST.”

|

|

Q:

|

How many votes do I have?

|

|

|

A:

|

You are entitled to one vote for each share of Common Stock of the Company that you hold. As of

the Record Date, there were 5,157,344 shares of Common Stock issued and outstanding.

|

|

|

Q:

|

What happens if a director nominee does not stand for election?

|

|

|

A:

|

If for any reason any nominee does not stand for election, any proxies we receive will be voted

in favor of the remainder of the nominees and may be voted for a substitute nominee in place of any nominee who does not stand.

We have no reason to expect that any nominee will not stand for election.

|

|

|

Q:

|

What happens if additional matters are presented at the Annual Meeting?

|

|

|

A:

|

Other than the items of business described in this Proxy Statement, we are not aware of any other

business to be brought before the Annual Meeting. If you grant a proxy, the person named as proxy holder will have the discretion

to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

|

|

|

Q:

|

How many shares must be present or represented to conduct business at the Annual Meeting?

|

|

|

A:

|

A majority of the 5,157,344 shares of our common stock issued and outstanding as of the Record

Date, represented in person or by proxy, constitutes a quorum at the Annual Meeting. If a quorum is not present, in person or by

proxy, the Annual Meeting may be postponed or adjourned from time to time until a quorum is obtained.

|

|

|

Q:

|

How can I attend and vote my shares in person at the Annual Meeting?

|

|

|

A:

|

You are entitled to attend the Annual Meeting only if you were a stockholder as of the close of

business on the Record Date, or you hold a valid proxy for the Annual Meeting. You should be prepared to present photo identification

for admittance. In addition, if you are a stockholder of record, your name will be verified against the list of stockholders of

record on the Record Date prior to your being admitted to the Annual Meeting. If you are not a stockholder of record but hold shares

through a broker, bank or nominee (i.e., in street name), you may be required to provide evidence of your ownership (such as your

most recent account statement prior to the Record Date, a copy of the voting instruction card provided by your broker, bank or

nominee, or other similar evidence of ownership) in order to be admitted to the Annual Meeting.

|

|

|

Q:

|

How can I vote my shares in person at the Annual Meeting?

|

|

|

A:

|

Shares held in your name as the stockholder of record may be voted in person at the Annual Meeting.

Shares held beneficially in street name may be voted in person at the Annual Meeting only if you obtain a proxy from the broker,

bank or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting,

we recommend that you also submit your proxy card or voting instruction card as described herein so that your vote will be counted

if you later decide not to attend the Annual Meeting.

|

|

|

Q:

|

What is the deadline for voting my shares?

|

|

|

A:

|

If you hold shares as the stockholder of record, your vote by proxy must be received before the

polls close at the Annual Meeting. If you hold shares beneficially in street name with a broker, bank or nominee, please follow

the voting instructions provided by your broker, bank or nominee.

|

|

|

Q:

|

Is my vote confidential?

|

|

|

A:

|

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled

in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except

(a) as necessary to meet applicable legal requirements, (b) to allow for the tabulation of votes and certification of the vote,

and (c) to facilitate a successful proxy solicitation. Occasionally, stockholders provide written comments on their proxy card,

which are then forwarded to our management.

|

|

|

Q:

|

Where can I find the voting results of the Annual Meeting?

|

|

|

A:

|

We intend to announce preliminary voting results at the Annual Meeting and publish final voting

results in a Current Report on Form 8-K to be filed with the U.S. Securities and Exchange Commission (the “SEC”) within

four business days after the Annual Meeting.

|

|

|

Q:

|

How may I obtain a copy of the 2020 Annual Report and other financial information?

|

|

|

A:

|

A copy of the 2020 Annual Report is enclosed. Stockholders may request another free copy of the 2020 Annual Report and other

financial information by contacting us at:

|

Wilhelmina International, Inc.

Two Lincoln Centre

5420 LBJ Freeway

Lockbox #25

Dallas, TX 75240

Attention: Corporate Secretary

Alternatively, current and prospective

investors can access the 2020 Annual Report and other financial information at www.wilhelmina.com/investor-relations/.

We will also furnish any exhibit to

the 2020 Annual Report if specifically requested. Our SEC filings are also available free of charge at the SEC’s website,

www.sec.gov.

|

|

Q:

|

What if I have questions for the Transfer Agent?

|

|

|

A:

|

Please contact the Transfer Agent, at the telephone number or address listed below, with questions

concerning stock certificates, transfer of ownership or other matters pertaining to your stock account.

|

Securities Transfer Corporation

2901 N. Dallas Parkway, Suite 380

Plano, Texas 75093

Phone: (469) 633-0101

|

|

Q:

|

Who can help answer my questions?

|

|

|

A:

|

If you have any questions about the Annual Meeting or how to vote or revoke your proxy, you should

contact us at:

|

Wilhelmina International, Inc.

Two Lincoln Centre

5420 LBJ Freeway

Lockbox #25

Dallas, TX 75240

Attention: Corporate Secretary

Proposals

to be voted on at the annual meeting

PROPOSAL

NO. 1 - ELECTION OF DIRECTORS

There are seven nominees for election to the Board

at the Annual Meeting to serve until the next Annual Meeting of Stockholders and until their successors are duly elected and qualify.

All of the nominees currently serve as directors of the Company. Proxies may not be voted with respect to more than seven individuals

in the election of directors at the Annual Meeting.

Except where authority to vote for a director

has been withheld, the proxies received pursuant to this solicitation will be voted “FOR” the nominees named below.

If for any reason any nominee does not stand for election, such proxies will be voted in favor of the remainder of the nominees

and may be voted for a substitute nominee in place of the nominee who did not stand. We have no reason to expect that any of the

nominees will not stand for election. The election of directors will be determined by a plurality of the shares voted at the Annual

Meeting.

The Board recommends a vote “FOR” election of each nominee

below.

Nominees

for Election to the Board

The following table sets forth information

regarding the nominees for election to the Board at the Annual Meeting.

|

Name

|

|

Age

|

|

Positions with the Company

|

|

Mark E. Schwarz

|

|

60

|

|

Director and Executive Chairman

|

|

Maya Burkenroad

|

|

34

|

|

Director

|

|

Clinton J. Coleman

|

|

43

|

|

Director

|

|

James A. Dvorak

|

|

51

|

|

Director

|

|

Alexander F. Mehr

|

|

42

|

|

Director

|

|

Mark E. Pape

|

|

70

|

|

Director

|

|

James C. Roddey

|

|

88

|

|

Director

|

Mark E. Schwarz

Mr. Schwarz has served as a director and Chairman

of the Board since 2004, and as Executive Chairman since 2012. Mr. Schwarz was the Company’s Chief Executive Officer

from 2007 to 2012. Since 1993, Mr. Schwarz has indirectly controlled Newcastle Partners, L.P. (“Newcastle LP”),

a private investment firm, and served as the Chairman, Chief Executive Officer and Portfolio Manager of its general partner, Newcastle

Capital Management, L.P. (“NCM”). Mr. Schwarz presently serves as Chairman of the boards of directors of Hallmark Financial

Services, Inc., a specialty property and casualty insurance company, and Rave Restaurant Group, Inc., an operator and franchisor

of pizza restaurants. Within the past five years, Mr. Schwarz has served as a director of SL Industries, Inc., a developer of power

systems used in a variety of aerospace, computer, datacom, industrial, medical, telecom, transportation and utility equipment applications.

He also serves as a director of various privately held companies. The Board believes that Mr. Schwarz should serve as a director

of the Company due to his extensive business and investment expertise, broad director experience and significant direct and indirect

shareholdings in the Company. (See, Security Ownership of Certain Beneficial Owners and Management.)

Maya Burkenroad

Ms. Burkenroad was appointed as a director on April

1, 2021, to fill a vacancy on the Board. Since 2019, Ms. Burkenroad has served as the Chief Operating Officer of Retail Ecommerce

Ventures, LLC, a tech-enabled ecommerce platform that specializes in acquiring and operating iconic retail brands, where she has

helped manage the acquisition and operations of more than six major American brands. She also serves as an officer of various of

its direct and indirect subsidiaries, including REV Alpha Holdings, LLC (“REVAH”). Previously, she assisted in the

launch and operation of MentorBox, a digital self-education startup founded in 2016. The Board believes that Ms. Burkenroad should

serve as a director of the Company due to her experience as a business executive and REVAH’s significant beneficial ownership

of common stock of the Company. (See, Security Ownership of Certain Beneficial Owners and Management.)

Clinton J. Coleman

Mr. Coleman has served as a director since

2011. He has since 2017 served as the Chairman and Chief Executive Officer of Novo Labs, Inc., a company focused on

the use of emerging technology to improve consumer interactions. Previously, he had since 2010 served as the Chief Executive Officer

of Bell Industries, Inc., a company primarily engaged in providing information technology services. Mr. Coleman

served as an investment professional with NCM from 2005 to 2017, including as a Managing Director (2012 to 2017) and Vice President

(2005 to 2012). Mr. Coleman is also a director of Rave Restaurant Group, Inc., and served as its interim Chief

Executive Officer from July 2016 to January 2017 and from June to November 2012, and served as its interim Chief Financial Officer

from July 2006 to January 2007. Prior to joining NCM, Mr. Coleman served as a portfolio analyst with Lockhart Capital

Management, L.P., an investment partnership, from 2003 to 2005. From 2002 to 2003, Mr. Coleman served as an associate

with Hunt Investment Group, L.P., a private investment group. Previously, Mr. Coleman was an associate director

with the Mergers & Acquisitions Group of UBS. The Board believes that Mr. Coleman should serve as a director of

the Company due to his experience in investment management and the management of publicly traded and privately held companies engaged

in a wide range of industries, as well as his significant transactional experience.

James A. Dvorak

Mr. Dvorak has served as a director since 2011. Since

2017, Mr. Dvorak has been Senior Vice-President - Investments at Hallmark Financial Services, Inc., a specialty property and casualty

insurance company. Mr. Dvorak served as an investment professional with NCM from 2008 to March, 2020, including as a Managing

Director (2012 to 2020) and Vice President (2008 to 2012). Mr. Dvorak served as a consultant and subsequently a Senior Investment

Analyst with Falcon Fund Management, a Dallas-based investment firm, from 2006 to 2007, and as a Vice President with Fagan Capital,

an investment firm located in Irving, Texas, from 1999 to 2006. Previously, Mr. Dvorak was with Koch Industries,

a diversified energy, chemicals and materials provider, as Chief Financial Officer of a business unit and as a board member of

a Koch affiliate. Mr. Dvorak has additional experience as a management consultant with Booz Allen & Hamilton

in Chicago, Illinois. The Board believes that Mr. Dvorak should serve as a director of the Company due to his experience as a business

executive, professional investor and management consultant, including expertise in strategic planning, business development and

financial and operational analysis.

Alexander F. Mehr

Mr. Mehr was appointed as a director on April 1,

2021, to fill a vacancy on the Board. Mr. Mehr was a co-founder of Retail Ecommerce Ventures, LLC, a tech-enabled ecommerce platform

that specializes in acquiring and operating iconic retail brands, and has served as its Chief Executive Officer since its formation

in 2019. He also serves as an officer of various of its direct and indirect subsidiaries, including REVAH. Previously, Mr. Mehr

was the co-founder and Chief Executive Officer of MentorBox, a digital self-education startup launched in 2016. He was also a co-founder

of Zoosk, an online dating platform, and served as its President from its formation in 2007 until 2014, thereafter remaining as

a director until its acquisition by Spark Networks in 2019. Prior to his entrepreneurial career, Mr. Mehr utilized his Ph.D. in

Mechanical Engineering in designing complex engineering systems, as well as risk and safety management of NASA’s space exploration

missions. The Board believes that Mr. Mehr should serve as a director of the Company due to his experience as a business executive

and REVAH’s significant beneficial ownership of common stock of the Company. (See, Security Ownership of Certain Beneficial

Owners and Management.)

Mark E. Pape

Mr. Pape has served as a director since 2011. He

has served as the Chairman of the boards of directors of H2Options, Inc., a water conservation design/installation firm, since

2009, and U.S. Rain Group, Inc., a private equity company investing in water conservation opportunities, since 2013. U.S.

Rain Group, Inc. acquired H2Options, Inc. in 2013. He is also currently a director of Hallmark Financial Services, Inc., a specialty

property and casualty insurance company. He served as the Chief Financial Officer of Oryon Technologies, Inc., a lighting technology

company, from 2010 to 2014, and as a director from May 2012 to January 2014. Oryon Technologies, Inc. filed a petition

under Chapter 11 of the federal Bankruptcy Code in May 2014. Mr. Pape served as a partner at Tatum LLC, an executive services

firm, from 2008 to 2009. From 2005 to 2007, he served as Executive Vice President and Chief Financial Officer at Affirmative

Insurance Holdings, Inc., a property/casualty insurance company specializing in non-standard automobile insurance, and served on

its board of directors and audit committee from 2004 to 2005. Mr. Pape served as the Chief Financial Officer of

HomeVestors of America, Inc., a franchisor of home acquisition services, during 2005; as President and Chief Executive Officer

of R.E. Technologies, Inc., a provider of software tools to the housing industry, from 2002 to 2005; as Senior Vice President and

Chief Financial Officer of LoanCity.com, a start-up e-commerce mortgage bank, from 1999 to 2001; as Vice President-Planning for

Torchmark Corporation, a life/health insurance holding company, from 1998 to 1999; as Senior Vice President and Chief Financial

Officer of United Dental Care, Inc., a dental benefits insurance company, from 1995 to 1997; and as Executive Vice President and

Chief Financial Officer of American Income Holding, Inc., a life insurance company, from 1991 to 1994. Previously, Mr. Pape was

engaged in investment banking from 1979 to 1991 with First City National Bank of Houston, Merrill Lynch Capital Markets Group,

the First Boston Corporation and then Bear, Stearns & Co. He began his career in 1974 as an auditor with KPMG LLP. He is a

certified public accountant licensed in Texas. The Board believes that Mr. Pape should serve as a director due to his leadership

and operational skills developed as a business executive, his background in finance and financial services, and his experience

as a director of both private and public companies.

James C. Roddey

Mr. Roddey has served as a director of the

Company since November 2013. He had previously served as a director from 2011 to September 2013 and has been a director of seven

publicly traded companies during his career. He has since 2016 been the sole member of Roddey Consulting LLC, a business

consulting firm. Mr. Roddey served as a director of Baker Tilly Virchow Krause, LLP, an accounting and business advisory firm,

from its acquisition of ParenteBeard, LLP in 2014 until 2016. He had previously served as Principal-Business Consulting Services

of the accounting and advisory firm of ParenteBeard and its predecessor, McCrory & McDowell LLC, since 2007. Mr. Roddey

was a partner at the Hawthorne Group, an investment and management company, from 2004 to 2007 and from 1978 to 2000. From

2000 to 2004, he served as the Chief Executive of Allegheny County, Pennsylvania. Mr. Roddey was a director of

SEEC, Inc., a software provider for the insurance and financial services industry, from 2005 to 2008. Earlier in his

career, he served as President and a director of Turner Communications, Inc. and Rollins Communication, Inc. and, while associated

with the Hawthorne Group, President and Chief Executive Officer of Pittsburgh Outdoor Advertising, Gateway Outdoor Advertising

and International Sports Marketing, among other companies. The Board believes that Mr. Roddey should serve as a director due to

his lengthy executive experience in a variety of industries through which he has developed significant managerial, operational

and financial expertise.

Family Relationships

There are no family relationships between any of

the Company’s directors and executive officers.

Arrangements Regarding Election of Directors

Effective April 1, 2021, Newcastle LP and REVAH

entered into a Mutual Support Agreement (the “MSA”) with respect to the election of directors to the Board. Pursuant

to the MSA, Newcastle LP and REVAH have agreed to use their commercially reasonable efforts (including the voting of all of their

shares) to cause the Board to at all times be comprised of seven directors which include (a) three persons designated by Newcastle

LP, and (b) two persons designated by REVAH (subject to reduction to one person if REVAH owns less than 15% of the outstanding

shares of the common stock of the Company at any time on or after March 31, 2022). Messrs. Schwarz, Coleman and Dvorak have been

elected to the Board as designees of Newcastle LP under the MSA. Mr. Mehr and Ms. Burkenroad have been elected to the Board as

designees of REVAH. The MSA will terminate upon the earlier of (i) the written agreement of the parties, or (ii) either Newcastle

LP or REVAH becoming the beneficial owner of less than 5% of the outstanding shares of the common stock of the Company.

PROPOSAL NO. 2 – ADVISORY RESOLUTION TO APPROVE EXECUTIVE COMPENSATION

Section 14A of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), and Rule 14a-21 promulgated by the SEC thereunder, require the Company to (i) at least

once every three years, present to the stockholders a non-binding, advisory vote on a resolution approving the compensation of

certain executive officers, and (ii) at least once every six years, present to the stockholders a non-binding, advisory vote on

the frequency of future resolutions to approve executive compensation. In accordance with the plurality vote at our 2019 Annual

Meeting of Stockholders, the Board has determined to provide the stockholders an opportunity to approve executive compensation

every year. Accordingly, at the 2021 Annual Meeting the Board will submit to the stockholders for a non-binding, advisory vote

the following Say-On-Pay Resolution:

“RESOLVED, that the stockholders

hereby approve the compensation paid to the Company’s executive officers as disclosed pursuant to Item 402 of Regulation

S-K under the heading ‘EXECUTIVE COMPENSATION’ in the Company’s 2021 Proxy Statement, including the compensation

tables and narrative discussion.”

The advisory vote on the Say-On-Pay Resolution is

intended to address the overall compensation of the Company’s executive officers rather than any specific element or amount

of compensation. This advisory vote on the Say-On-Pay Resolution is not binding on the Board or the Company. However, the Compensation

Committee will take into account the results of the advisory vote on the Say-On-Pay Resolution when considering future executive

compensation arrangements.

The Board recommends a vote “FOR” approval of the Say-On-Pay

Resolution.

PROPOSAL

NO. 3 - RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Baker Tilly to

serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021. Although

the selection of Baker Tilly does not require ratification, the Board has directed that the appointment of Baker Tilly be submitted

to stockholders for ratification due to the significance of their appointment to the Company. If stockholders do not ratify the

appointment of Baker Tilly as the Company’s independent registered public accounting firm, the Audit Committee will consider

the appointment of other certified public accountants. Representatives of Baker Tilly are not expected to be present at the Annual

Meeting, to be available to respond to appropriate questions or to have an opportunity to make a statement.

The Board recommends a vote “FOR”

ratifying the selection of Baker Tilly as the Company’s independent registered public accounting firm for fiscal year 2021.

Corporate

Governance

Board Leadership Structure

Our governing documents provide the Board

with flexibility to determine the appropriate leadership structure for the Board and the Company, including whether it is appropriate

to separate the roles of our Chairman of the Board and our Chief Executive Officer. In making these determinations, the Board considers

numerous factors, including the specific needs and strategic direction of the Company and the size and membership of the Board

at the time.

Mark E. Schwarz serves as the Executive Chairman

of the Company. In such capacity, he functions as both the chairman of the Board and an executive officer with responsibilities

for corporate strategy, capital allocation and business acquisitions. Mr. Schwarz is presently serving as the Company’s principal

executive officer on an interim basis pending the appointment of a new Chief Executive Officer. When appointed, the Chief Executive

Officer of the Company is not expected to be a director. The Board believes that this leadership structure is appropriate because

it permits Mr. Schwarz to provide Board leadership independent of operational management, while still providing the Company the

benefit of his business and investment expertise. As a result, the Board believes that all directors are able to objectively evaluate

the management and operations of the Company. The Board also believes that, as a result of his significant beneficial ownership

of Common Stock, Mr. Schwarz’s role as Executive Chairman enhances the focus of the Board on building stockholder value.

(See, Security Ownership of Certain Beneficial Owners and Management.)

Board Role in Risk Oversight

Senior management is responsible for assessing

and managing the Company’s various exposures to risk on a day-to-day basis, including the creation of appropriate risk management

programs and policies. The Board is responsible for overseeing management in the execution of its responsibilities and for assessing

the Company’s approach to risk management. The Board exercises these responsibilities periodically as part of its meetings,

at which the Board regularly discusses areas of material risk to the Company (including operational, financial, legal and regulatory,

strategic and reputational risks), and at meetings of the Audit Committee. In addition, an overall review of risk is inherent in

the Board’s consideration of the Company’s long-term strategies and in the transactions and other matters presented

to the Board, including capital expenditures, acquisitions and divestitures, and financial matters.

Director Independence

Annually, as well as in connection with the

election or appointment of a new director to the Board, the Board considers the Company’s business and other relationships

with each director. The Board determines whether directors are “independent” under Nasdaq’s listing

standards. The Board has determined that all directors except Mr. Schwarz are independent under Nasdaq’s listing

standards.

Meetings and Committees of

the Board of Directors

The Board met seven times during 2020 and

also approved various matters by unanimous written consent. Each of the directors attended at least 75% of the aggregate of (a)

the total number of meetings of the Board, and (b) the total number of meetings of all committees of the Board on which he served.

The Company has no policy with respect to directors attending the Annual Meeting of Stockholders. Messrs. Schwarz and Dvorak were

the only incumbent directors present at the Company’s 2020 Annual Meeting of Stockholders.

The Board currently has a separately-designated

Audit Committee and Compensation Committee, but does not have a separately-designated Nominating Committee. The Audit Committee

met four times during the fiscal year ended December 31, 2020. The Compensation Committee met once during fiscal 2020.

Audit Committee

The Audit Committee, among other things,

meets with our independent registered public accounting firm and management representatives, recommends to the Board appointment

of an independent registered public accounting firm, approves the scope of audits and other services to be performed by the independent

registered public accounting firm, considers whether the performance of any professional services by the independent registered

public accounting firm other than services provided in connection with the audit function could impair the independence of the

independent registered public accounting firm, and reviews the results of audits and the accounting principles applied in financial

reporting and financial and operational controls. The independent registered public accounting firm has unrestricted access to

the Audit Committee and vice versa.

The incumbent Audit Committee is comprised

of Mark E. Pape (chairman), James A. Dvorak and James C. Roddey, each of whom is independent under Nasdaq rules for audit committee

members. The Board has determined that Mr. Pape qualifies as an “audit committee financial expert,” as defined under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has adopted a written Charter of the

Audit Committee which is available at www.wilhelmina.com/investor-relations/.

Compensation Committee

The Compensation Committee determines policies

and procedures relating to compensation, employee stock options and other benefit plans of executive officers and other key employees.

Compensation is determined pursuant to discussions and analysis by the Compensation Committee based on factors that may include

a review of the individual’s performance, the scope of responsibility for the applicable position, the experience level necessary

for the applicable position, certain peer group compensation levels and the performance of the Company. The Executive Chairman

makes recommendations to the Compensation Committee regarding the amount and form of compensation for the Company’s executive

officers and other key employees and the Compensation Committee takes such recommendations into account in its review.

The incumbent Compensation Committee is comprised

of James C. Roddey (chairman), Mark E. Pape and Clinton J. Coleman, each of whom is independent under the listing standards of

Nasdaq. The Board has adopted a written Charter of the Compensation Committee, which is available at www.wilhelmina.com/investor-relations/.

Full Board Serving Function of Nominating Committee

The Company qualifies as a “controlled

company” under Nasdaq rules. In reliance on an exemption to Nasdaq rules for a controlled company, the Company does not maintain

a separate nominating committee or require that independent directors comprising a majority of the board select nominees for director.

The Company’s full Board currently

serves the function of a nominating committee. The Board believes it is appropriate for the Company not to have a nominating committee

at this time because, pursuant to the MSA, stockholders holding approximately 52% of our outstanding shares have agreed to use

their commercially reasonable efforts (including the voting of all of their shares) to cause the Board to at all times be comprised

of seven directors which currently include a total of five nominees directly designated by such holders. (See, Proposal No.

1 - Election of Directors – Arrangements Regarding Election of Directors.) Consequently, as a practical matter, the election

of directors to the Board will be controlled by these stockholders for the foreseeable future.

Director Nomination Process

Members of the Board who have been designated

by parties to the MSA identify prospective candidates to serve as directors, review candidates’ credentials and qualifications,

and interview prospective candidates, in accordance with the terms of the MSA. Subject to the terms of the MSA, the members of

the Board also consider and discuss other stockholder recommendations for director nominees. Recommendations for director nominees

may come from a wide variety of sources, including stockholders, business contacts, community leaders, other third-party sources

and members of management. The Board will initially evaluate any such prospective nominee on the basis of his or her resume and

other background information that has been made available to the Board and follow up with the prospective nominee. Except with

respect to nominations in accordance with the MSA, the Board does not anticipate that the Company will evaluate nominees differently

based on the source of their nomination. While the Board will consider candidates recommended by stockholders as discussed above,

it has not adopted formal procedures to be followed by stockholders for submitting such recommendations in light of the nomination

provisions of the MSA, which provides for identification and selection procedures with respect to all but two seats on the Board

at this time.

The Board seeks to attract director nominees

of personal integrity whose diversity of business background and experience will represent the interests of all stockholders. There

is no specific requirement for minimum qualifications or skills that candidates must possess. Director candidates are evaluated

based on a number of qualifications, including their judgment, leadership ability, expertise in the industry, experience developing

and analyzing business strategies, financial literacy and risk management skills.

Stockholder Communications

with the Board

The Board has established a process for stockholders

to send communications to the Board. Stockholders may communicate with the Board generally or a specific director at any time by

writing to the Company at Two Lincoln Centre, 5420 LBJ Freeway, Lockbox #25, Dallas, TX 75240, Attn: Corporate Secretary. The Corporate

Secretary reviews all messages received, and forwards any message that reasonably appears to be a communication from a stockholder

about a matter of stockholder interest that is intended for communication to the Board. Communications are sent as soon as practicable

to the director to whom they are addressed, or if addressed to the Board generally, to the Chairman of the Board. Because other

appropriate avenues of communication exist for matters that are not of stockholder interest, such as general business complaints

or employee grievances, communications that do not relate to matters of stockholder interest are not forwarded to the Board. The

Corporate Secretary has the right, but not the obligation, to forward such other communications to appropriate channels within

the Company.

Stockholder Proposals

If a stockholder wishes to submit a proposal

for inclusion in the Company’s proxy statement and form of proxy for the Company’s 2022 Annual Meeting of Stockholders,

the proposal must be received in proper form at the Company’s principal executive offices on or before December 28, 2021

in order to have the proposal included in the proxy materials of the Company for such meeting. If a stockholder wishes to submit

a proposal at the 2022 Annual Meeting of Stockholders outside the processes of Rule 14a-8 promulgated under the Exchange Act, the

stockholder must notify the Company in writing of such proposal on or before March 13, 2022 in order to have that proposal considered

at such meeting.

To be in proper form, a stockholder’s

notice must include information concerning the proposal. A stockholder who wishes to submit a proposal is encouraged to seek independent

counsel with regard to the SEC requirements. The Company may exclude any proposal that does not meet the SEC’s requirements

for submitting a proposal, and reserves the right to reject, rule out of order, or take other appropriate action with respect to

any proposal that does not comply with these and other applicable requirements. Notices of intention to submit proposals for or

at the Company’s 2022 Annual Meeting of Stockholders should be addressed to the Company at Two Lincoln Centre, 5420 LBJ Freeway,

Lockbox #25, Dallas, TX 75240, Attn: Corporate Secretary.

Code of Conduct and Ethics

The Board has adopted a Code of Business

Conduct and Ethics (the “Code of Ethics”) that sets forth legal and ethical standards of conduct applicable to all

directors, officers and employees of the Company. The Code of Ethics is available on the Company’s website at www.wilhelmina.com/investor-relations/.

Review, Approval or Ratification of Transactions with Related

Persons

The Board reviews all relationships and transactions

with the Company in which our directors or executive officers or their immediate family members are participants to determine whether

such persons have a direct or indirect material interest. The Board is primarily responsible for the development and

implementation of processes and controls to obtain information from the directors and executive officers with respect to related

party transactions and for then determining, based on the facts and circumstances, whether the Company or a related person has

a direct or indirect material interest in the transaction. In addition, the Audit Committee reviews and approves or

ratifies any related party transaction that is required to be disclosed pursuant to SEC or Nasdaq rules. In the course

of its review and approval or ratification of a related party transaction, the Audit Committee considers: (i) the nature of the

related person’s interest in the transaction, (ii) the material terms of the transaction, including, without limitation,

the amount and type of transaction, (iii) the importance of the transaction to the related person, (iv) the importance of the transaction

to the Company, (v) whether the transaction would impair the judgment of a director or executive officer to act in the best interest

of the Company, and (vi) any other matters the Audit Committee deems appropriate. Any member of the Board who is a related person

with respect to a transaction under review may not participate in the deliberations or vote respecting approval or ratification

of the transaction. (See, Related Party Transactions.)

Compensation of Directors

The Company’s current standard compensation

arrangement for non-employee directors permits each non-employee director to elect to receive either (a) an annual cash retainer

of $28,000, (b) options to purchase 100,000 shares of the Common Stock at the closing price on the date of grant, or (c) a combination

of cash retainer and stock options. During fiscal 2020, each non-employee director elected to receive all of his compensation in

cash. The Chairmen of the Audit Committee and the Compensation Committee each receive an additional annual cash retainer of $2,500,

and each member of the Audit Committee and Compensation Committee receive an additional annual cash retainer of $1,000. Commencing

in the third quarter of 2020, all directors agreed to a temporary 35% decrease from their standard compensation.

The following table sets forth information concerning

the compensation of the non-employee directors of the Company for the fiscal year ended December 31, 2020.

Name

|

Fees Earned or

Paid in Cash ($)

|

Option Awards ($)1

|

All Other

Compensation ($)

|

Total ($)

|

|

Clinton J. Coleman

|

23,100

|

---

|

---

|

23,100

|

|

James A. Dvorak

|

23,100

|

---

|

---

|

23,100

|

|

Horst-Dieter Esch

|

23,100

|

---

|

---

|

23,100

|

|

Mark E. Pape

|

26,600

|

---

|

---

|

26,600

|

|

James C. Roddey

|

26,600

|

---

|

---

|

26,600

|

|

Jeffrey R. Utz

|

25,100

|

---

|

---

|

25,100

|

|

|

1

|

As of December 31, 2020, no stock options were outstanding to any of the non-employee directors.

|

EXECUTIVE OFFICERS

The following table sets forth information

regarding the Company’s current executive officers.

|

Name

|

|

Age

|

|

Positions with the Company

|

|

Mark E. Schwarz

|

|

60

|

|

Director and Executive Chairman (principal executive officer)

|

|

James A. McCarthy

|

|

43

|

|

Chief Financial Officer (principal financial officer)

|

Mark E. Schwarz

For information on Mr. Schwarz, see “Proposal

No. 1 -Election of Directors – Nominees for Election to the Board.”

James A. McCarthy

Mr. McCarthy was appointed Chief Financial Officer

of the Company in 2016. Prior to joining the Company, Mr. McCarthy had since 2009 served as the Controller of Orchard Media, Inc.,

a music, video and film distribution company that was ultimately acquired by a subsidiary of Sony Corporation. Previously, he had

since 1999 been a Senior Manager at the international accounting firm of Ernst & Young LLP. Mr. McCarthy is a Certified Public

Accountant licensed in New York.

Summary Compensation Table

The following table summarizes the compensation

earned during the fiscal years ended December 31, 2020 and 2019, by each person who served as an executive officer of the Company

at any time during fiscal 2020 (the “Named Executive Officers”).

|

Name and

Principal Position

|

Year

|

Salary ($)

|

Bonus ($)

|

Option

Awards ($)

|

All Other

Compensation ($)

|

Total ($)

|

|

Mark E. Schwarz

Executive Chairman

|

2020

2019

|

123,750

150,000

|

---

---

|

---

---

|

---

---

|

123,750

150,000

|

|

William J. Wackermann1

Chief Executive Officer

|

2020

2019

|

41,154

600,000

|

---

40,000

|

---

---

|

---

---

|

41,154

640,000

|

|

James A. McCarthy

Chief Financial Officer

|

2020

2019

|

234,896

275,000

|

40,000

30,000

|

---

---

|

---

---

|

274,896

305,000

|

|

|

1

|

Mr. Wackermann’s employment terminated on January 26, 2020.

|

Employment Agreements

Mr. Wackermann entered into an Employment Agreement

with the Company effective January 26, 2016 which was amended and restated as of June 29, 2016 (as amended, the “Employment

Agreement”). Under the Employment Agreement, Mr. Wackermann was paid (a) a base annual salary of at least $500,000, and (b)

certain performance bonuses ranging from between 7.5% and 15% of earnings before interest, taxes, depreciation and amortization

(“EBITDA”) of the Company’s wholly owned subsidiaries in excess of certain thresholds. The calculation of EBITDA

included Mr. Wackermann’s base salary and other compensation related expense, but excluded the relevant bonus, for purposes

of determining whether an EBITDA threshold was met. In accordance with the Employment Agreement, Mr. Wackermann received two consecutive

annual grants of options to purchase 200,000 shares of the Company’s common stock at the fair market value on the date of

grant, which stock options were scheduled to vest in five equal annual installments and terminate ten years from the date of grant.

The term of the Employment Agreement was two (2)

years, subject to an annual one year renewal unless notice of non-renewal was provided by either party at least ninety (90) days

before the end of the applicable term. On October 28, 2019, the Company notified Mr. Wackermann that the Company elected not to

renew his Employment Agreement beyond its then expiration date of January 26, 2020, but offered to continue Mr. Wackermann’s

employment on an at-will basis with his then current position, compensation and other benefits. On December 26, 2019, Mr. Wackermann,

tendered his resignation as an officer of the Company, effective as of January 26, 2020. Pursuant to the Employment Agreement,

Mr. Wackermann was restricted from competing with the Company for a period of one year from the date of termination and is subject

to certain covenants of confidentiality and non-solicitation.

Mr. McCarthy has entered

into an employment letter with the Company confirming his at-will employment. The employment letter provides for a starting

base salary of $225,000 per year and a discretionary annual bonus targeted at 30% of base salary based on the achievement of financial,

strategic and/or personal goals to be set by the Board of Directors. Mr. McCarthy is eligible to participate in the Company’s

2015 Incentive Plan and is entitled to all other benefits offered by the Company to its employees. In accordance with

the employment letter, Mr. McCarthy was initially granted options to purchase 30,000 shares of the Company’s common stock

at an exercise price equal to the fair market value on the date of grant, which stock options vest in five equal annual installments

and terminate ten years from the date of grant. Subsequent grants are determined in the discretion of the Board of Directors. In

the event Mr. McCarthy’s employment with the Company is terminated without cause, he will be entitled to receive 60 days

of base salary. Pursuant to the employment letter, Mr. McCarthy is restricted from competing with the Company for a period of one

year from the date of termination and is subject to certain covenants of confidentiality and non-solicitation.

Except as described above, the Company has no plans

or arrangements that provide for payment to any Named Executive Officer in connection with the resignation, retirement or other

termination of such Named Executive Officer or a change in control of the Company.

Outstanding Equity Awards at Fiscal Year-End Table

The following table sets forth certain information

regarding equity awards held by the Named Executive Officers as of December 31, 2020, consisting solely of unexercised stock options.

|

Name

|

Number of Securities

Underlying Unexercised Options1

|

Option

Exercise

Price ($)

|

Option

Expiration Date

|

|

Exercisable (#)

|

Unexercisable (#)

|

|

Mark E. Schwarz

|

---

|

---

|

---

|

---

|

|

William J. Wackermann

|

---

|

---

|

---

|

---

|

|

James A. McCarthy

|

24,000

18,000

|

6,000

12,000

|

7.36

6.50

|

04/25/2026

05/09/2027

|

|

|

1

|

All outstanding options vest in five equal annual installments from the date of grant.

|

RELATED

PARTY TRANSACTIONS

The Company’s corporate headquarters are located

in the offices of NCM. Pursuant to a services agreement, NCM provides the Company the use of facilities and equipment, as well

as accounting, legal and administrative services, on a month-to-month basis for a fixed fee of $2,500 per month. The Company paid

$30,000 to NCM in each of fiscal 2020 and 2019 pursuant to the services agreement. Mr. Schwarz is the Chairman, Chief Executive

Officer and Portfolio Manager of NCM, which is the general partner of Newcastle LP.

INDEPENDENT AUDITORS

Montgomery Coscia Greilich LLP (“MCG”)

was previously the principal accountant to audit the financial statements of the Company. Effective June 1, 2019, MCG’s audit

practice was combined with Baker Tilly. In connection with such transaction, MCG declined to serve as the principal accountant

to audit the financial statements of the Company for the fiscal year ending December 31, 2019. During the two fiscal years ended

December 31, 2018, and the subsequent interim period preceding June 1, 2019, there were no (i) disagreements with MCG on any matter

of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements if

not resolved to MCG’s satisfaction would have caused MCG to make reference in connection with their opinion to the subject

matter of the disagreement, or (ii) “reportable events” within the meaning of Item 304(a)(1)(v) of Regulation S-K.

MCG’s audit reports on the Company’s consolidated financial statements as of and for the years ended December 31, 2018

and 2017 did not contain any adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit

scope or accounting principles. The Company provided MCG with a copy of the foregoing disclosures and requested that MCG furnish

to the Company a letter addressed to the SEC stating whether MCG agreed with such disclosures and, if not, stating the respects

in which it did not agree. A copy of MCG’s letter concurring with the foregoing disclosures was attached as Exhibit 16.1

to the Form 8-K filed by the Company on June 7, 2019.

On June 6, 2019, the Audit Committee of the Company

engaged Baker Tilly as the principal accountant to audit the Company’s financial statements for the fiscal year ending December

31, 2019. During the two fiscal years ended December 31, 2018, and through the subsequent interim period preceding such engagement,

the Company did not consult with Baker Tilly regarding either (i) the application of accounting principles to a specified transaction,

either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements,

or (ii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related

instructions to Item 304 of Regulation S-K), or a “reportable event” (as defined in Item 304(a)(1)(v) of Regulation

S-K).

The following table presents fees for professional

services rendered by Baker Tilly for the audit of the Company’s consolidated financial statements for the fiscal years ended

December 31, 2020 and 2019, respectively, as well as fees billed for other services rendered by Baker Tilly during each such period.

|

|

Fiscal 2020

|

Fiscal 2019

|

|

Audit Fees1

|

214,000

|

$223,500

|

|

Audit-Related Fees

|

---

|

---

|

|

Tax Fees

|

---

|

---

|

|

All Other Fees

|

---

|

---

|

|

|

1

|

Represents fees for audit of the financial statements contained in the Company’s Annual Report

on Form 10-K, review of financial statements included in its Quarterly Reports on Form 10-Q, and audit of the financial statements

of the Company’s 401(k) plan. A portion of the fees attributable to the indicated fiscal year were paid in the subsequent

fiscal year.

|

All services to be performed by the Company’s

independent registered public accounting firm must be approved in advance by the Audit Committee. Limited amounts of

services (other than audit, review or attest services) may be approved by one or more members of the Audit Committee pursuant to

authority delegated by the Audit Committee, provided each such approved service is reported to the full Audit Committee at its

next meeting. All of the services performed by Baker Tilly for the 2020 and 2019 fiscal years, respectively, were pre-approved

by the Audit Committee.

Audit

Committee Report

The Audit Committee of the Board is responsible

for providing independent, objective oversight of the Company’s accounting functions and internal controls. The Audit Committee

is currently composed of three directors and acts under a written charter approved and adopted by the Board. The Audit Committee

reviews its charter on an annual basis. Each of the members is independent as defined by all Nasdaq and SEC requirements. The Board

annually reviews the relevant definitions of independence for audit committee members and makes an annual determination of the

independence of Audit Committee members.

The Board has determined that Mr. Pape is

an “audit committee financial expert,” as defined by SEC rules and regulations. This designation does not impose any

duty, obligation or liability that is greater than is generally imposed on a member of the Audit Committee and the Board, and designation

as an audit committee financial expert does not affect the duty, obligation or liability of any member of the Audit Committee or

the Board.

The Audit Committee reviewed and discussed

with management the Company’s audited financial statements for the fiscal year ended December 31, 2020. It also discussed

with Baker Tilly the matters required to be discussed by Auditing Standard 1301, as amended, as adopted by the Public Company Accounting

Oversight Board (the “PCAOB”). In addition, the Audit Committee has received the written disclosures and the letter

from Baker Tilly required by applicable requirements of the PCAOB regarding Baker Tilly’s communications with the Audit Committee

concerning independence and the Audit Committee discussed with Baker Tilly that firm’s independence.

The Audit Committee is responsible for recommending

to the Board that the Company’s financial statements be included in the Company’s annual report. Management is responsible

for the preparation, presentation, and integrity of the Company’s financial statements, accounting and financial reporting

principles, internal controls and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations.

The Company’s independent auditor, Baker Tilly, is responsible for performing an independent audit of the consolidated financial

statements and expressing an opinion on the conformity of those financial statements to generally accepted accounting principles.

Based on the discussions with Baker Tilly

concerning the audit, the financial statement review, and other such matters deemed relevant and appropriate by the Audit Committee,

the Audit Committee recommended to the Board that the audited financial statements for the fiscal year ended December 31, 2020

be included in the Company’s 2020 Annual Report on Form 10-K for filing with the SEC.

Submitted to the Board by the undersigned

members of the Audit Committee.

|

|

Audit Committee

|

|

|

|

|

|

Mark E. Pape (Chairman)

|

|

|

James A. Dvorak

James C. Roddey

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of

the Record Date, concerning beneficial ownership of the Common Stock of the Company by (a) any person or group known to beneficially

own more than 5% of the Common Stock; (b) each current director and current executive officer of the Company; and (c) all current

directors and current executive officers as a group.

The information provided in the table is based on

the Company’s records, information filed with the SEC and other information provided to the Company. The number of shares

beneficially owned by each person or group is determined under SEC rules, and the information is not necessarily indicative of

ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the person or group has

sole or shared voting or investment power and includes any shares that the person or group has the right to acquire within 60 days

after the Record Date through the exercise of any stock option or other right. Unless otherwise indicated, (a) all persons have

sole voting and investment power (or share such powers with their spouse) with respect to the shares shown as beneficially owned

by them, (b) the mailing address for all persons is the same as that of the Company, and (c) the directors and current executive

officers have not pledged as security any of the shares beneficially owned by them.

|

Beneficial Owner

|

No. of Shares

Beneficially

Owned

|

Percent

Of Class

|

|

5% Beneficial Owners:

|

|

|

|

Newcastle Partners, L.P.1,2

Newcastle Capital Management, L.P.1

Newcastle Capital Group, L.L.C.1

NCM Services, Inc.1

Schwarz 2012 Family Trust1

Mark E. Schwarz1

|

2,430,725

|

47.1

|

|

REV Alpha Holdings, LLC2,3

Modell’s Sporting Goods Online, Inc.3

Retail Ecommerce Ventures, LLC3

Tai Lopez3

Alexander F. Mehr3

|

950,000

|

18.4

|

|

Ralph Bartel4

|

920,336

|

17.8

|

|

Lorex Investment AG5

Horst-Dieter Esch5

Peter Marty5

|

712,500

|

13.8

|

|

Directors and Current Executive Officers:

|

|

|

|

Mark E. Schwarz1,2

|

2,430,725

|

47.1

|

|

Maya Burkenroad

|

---

|

---

|

|

Clinton J. Coleman

|

---

|

---

|

|

James A. Dvorak

|

---

|

---

|

|

Alexander F. Mehr2,3

|

950,000

|

18.4

|

|

Mark E. Pape

|

---

|

---

|

|

James C. Roddey

|

---

|

---

|

|

James A. McCarthy6

|

42,000

|

*

|

|

All directors and executive officers

|

3,422,725

|

65.8

|

* Less than 1%.

|

|

1

|

All shares are held by Newcastle LP. The general partner of Newcastle LP is NCM, the general partner

of NCM is Newcastle Capital Group, L.L.C. (“NCG”), the sole member of NCG is NCM Services, Inc. (“NCMS”),

the sole shareholder of NCMS is the Schwarz 2012 Family Trust (“Schwarz Trust”) and the sole trustee of the Schwarz

Trust is Mark E. Schwarz. Accordingly, each of NCM, NCG, NCMS, the Schwarz Trust, and Mr. Schwarz may be deemed to beneficially

own the shares of Common Stock directly owned by Newcastle LP. Each of NCM, NCG, NCM Services, the Schwarz Trust, and Mr. Schwarz

disclaims beneficial ownership of the shares held by Newcastle LP except to the extent of their respective pecuniary interest therein.

|

|

|

2

|

Pursuant to the MSA, Newcastle LP and REVAH have agreed to vote their shares in a certain manner

with respect to the election of directors of the Company. (See, Proposal No. 1 - Election of Directors – Arrangements

Regarding Election of Directors.) Newcastle LP, on the one hand, and REVAH, on the other hand, each disclaim beneficial ownership

of shares held by the other.

|

|

|

3

|

As reported in Schedule 13D filed April 9, 2021. All shares are held by REVAH, which is a wholly-owned

subsidiary of Modell’s Sporting Goods Online, Inc., which is a majority-owned subsidiary of Retail Ecommerce Ventures, LLC,

which is controlled by Mr. Lopez and Mr. Mehr. Accordingly, each of Retail Ecommerce Ventures, LLC, Modell’s Sporting Goods

Online, Inc., Mr. Lopez and Mr. Alexander may be deemed to beneficially own the shares of Common Stock directly owned by REVAH.

Includes 712,500 shares which REVAH has the right to acquire from Lorex Investment AG (“Lorex”) on or within 60 days

after the Record Date. The address of REV Alpha Holdings, LLC is 1680 Michigan Ave., Suite 700, Miami Beach, Florida 33139.

|

|

|

4

|

As reported in Form 4 filed February 24, 2021. Mr. Bartel’s address is Casella postale 823,

6612 Ascona, Switzerland.

|

|

|

5

|

All shares are held by Lorex. Mr. Esch is the sole stockholder of Lorex and shares voting and dispositive

power over the shares held by Lorex with Peter Marty, its sole officer and director. Accordingly, each of Mr. Esch and Mr. Marty

may be deemed to beneficially own the shares of Common Stock directly owned by Lorex. The address of Lorex is c/o Treuhand –

u. Revisionsgesellschaft Mattig-Suter and Postner AG, Industriestrasse 22, Zug, CH-6302, Switzerland. The address of Mr. Esch is

Carretera Transpeninsular Km. 27.5, San Jose del Cabo, B.C.S. Mexico 23400. The address of Mr. Marty is c/o Mattig-Suter und Partner,

Bahnhofstrasse 28, Schwyz, CH-6431, Switzerland.

|

|

|

6

|

Consists solely of shares which may be acquired pursuant to stock options exercisable on or within

60 days after the Record Date.

|

Section 16(a) Beneficial

Ownership Reporting Compliance

The Company's executive officers, directors and

beneficial owners of more than 10% of the Common Stock are required to file reports of ownership and changes in ownership of the

Common Stock with the SEC. Based solely upon information provided to the Company by individual directors, executive officers and

beneficial owners, the Company believes that all such reports were timely filed during and with respect to the fiscal year ended

December 31, 2020.

Proxy

Solicitation

This solicitation of proxies is being made on behalf

of the Board and the cost of preparing, assembling and mailing this Proxy Statement is being paid by the Company. In addition to

solicitation by mail, Company directors, officers and employees (none of whom will receive any compensation therefor in addition

to their regular compensation) may solicit proxies by telephone or other means of communication. Arrangements will also be made

with brokerage firms and other custodians, nominees and fiduciaries that hold the voting securities of record for the forwarding

of solicitation materials to the beneficial owners thereof. The Company will reimburse such brokers, custodians, nominees and fiduciaries

for reasonable out-of-pocket expenses incurred by them in connection therewith.

Annual

Report

The 2020 Annual Report is being sent with this Proxy

Statement to each stockholder. The 2020 Annual Report is also available at www.wilhelmina.com/investor-relations/. However, the

2020 Annual Report is not to be regarded as part of the proxy soliciting materials.

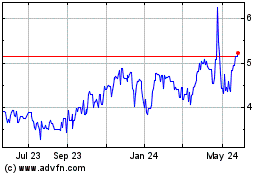

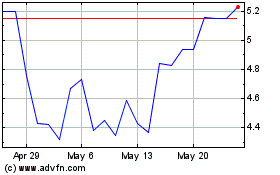

Wilhelmina (NASDAQ:WHLM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Wilhelmina (NASDAQ:WHLM)